- Home

- »

- Medical Devices

- »

-

Infant Incubators And Warmers Market Size Report, 2033GVR Report cover

![Infant Incubators And Warmers Market Size, Share & Trends Report]()

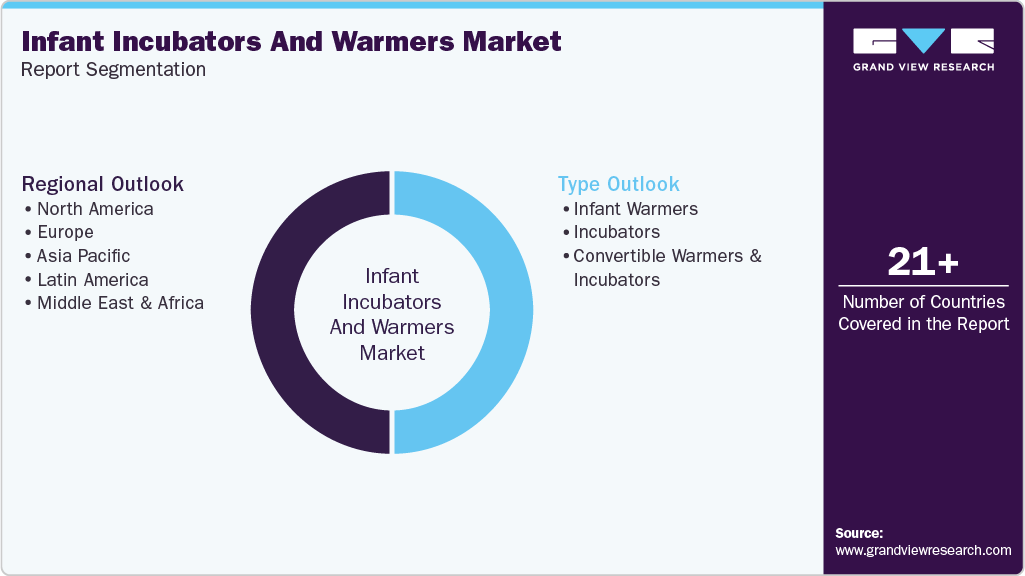

Infant Incubators And Warmers Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Infant Warmers, Incubators, Convertible Warmers & Incubators), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68040-701-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Infant Incubators And Warmers Market Summary

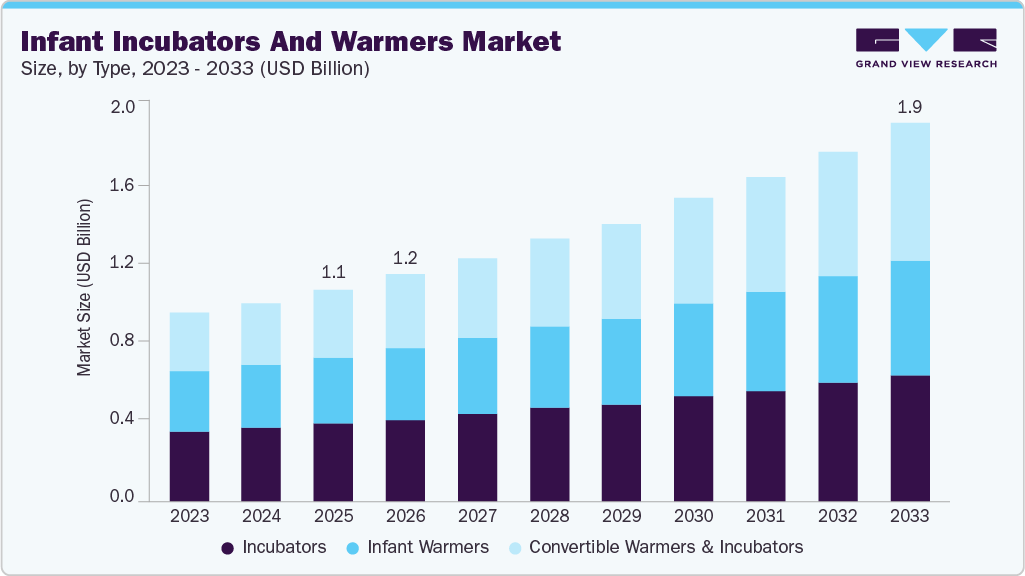

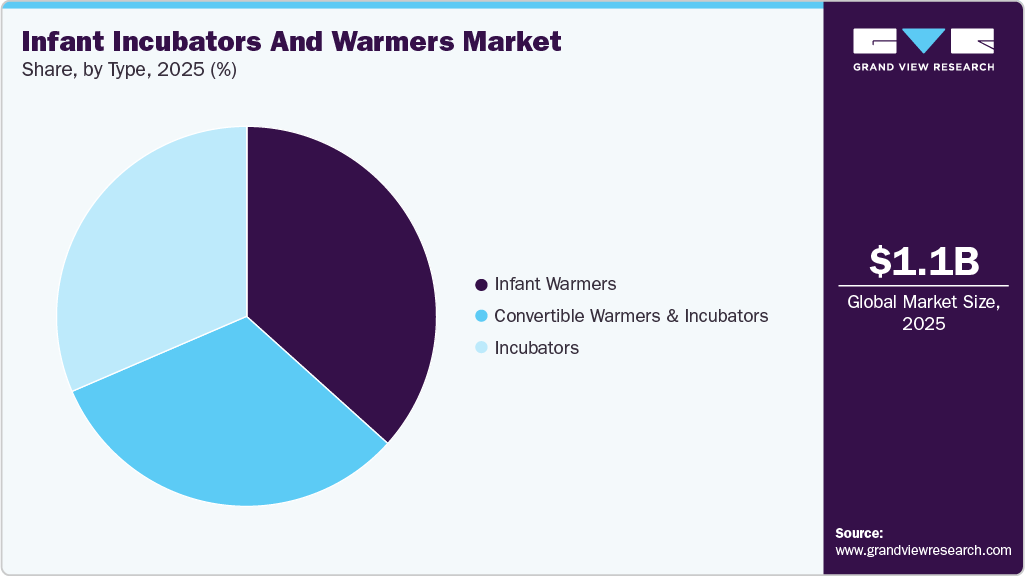

The global infant incubators and warmers market size was estimated at USD 1.10 billion in 2025 and is expected to reach USD 1.95 billion by 2033, growing at a CAGR of 7.59% 2026 to 2033. The demand in the market is expected to reach USD 1.95 billion in 2033.

Key Market Trends & Insights

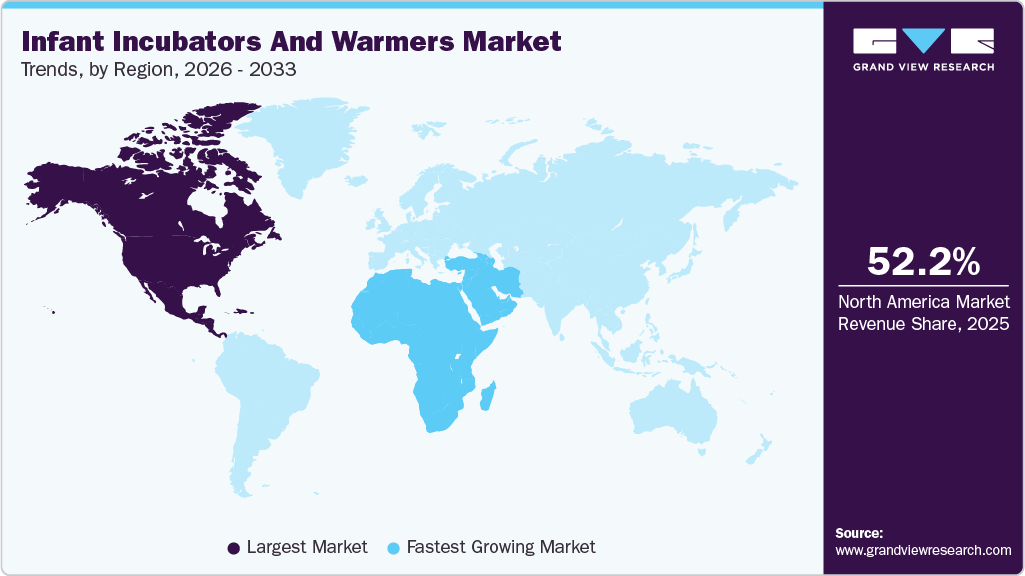

- Asia Pacific infant incubators and warmers market dominated the global market in 2025 and accounted for the largest revenue share of 52.23%.

- The India infant incubators and warmers market is anticipated to register the fastest growth rate during the forecast period.

- In terms of the type segment, the incubator segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.10 Billion

- 2033 Projected Market Size: USD 1.95 Billion

- CAGR (2026-2033): 7.59%

- Asia Pacific: Largest market in 2025

- MEA: Fastest growing market

The significant number of newborn deaths and preterm births, along with the availability of financial assistance for equipment research & procurement, is expected to boost market growth. Moreover, product innovations by manufacturers are increasing treatment efficiency and affordability, which is expected to reduce treatment costs. Furthermore, community-led initiatives have played a crucial role in enhancing infant care services and expanding access to essential medical equipment. In December 2023, the fundraising efforts led by a former Mayor of Thurrock made a meaningful contribution to improving newborn care capacity at Basildon Hospital. During this initiative, Cllr Susan Little, who was serving as Mayor of Thurrock at the time, together with former Mayor Cllr James Halden, formally presented Basildon’s Neonatal Intensive Care Unit (NICU) with funds that enabled the purchase of a USD 48,097.7 portable incubator. This advanced equipment was intended to support the safe and efficient transport of premature and critically ill infants within the unit.

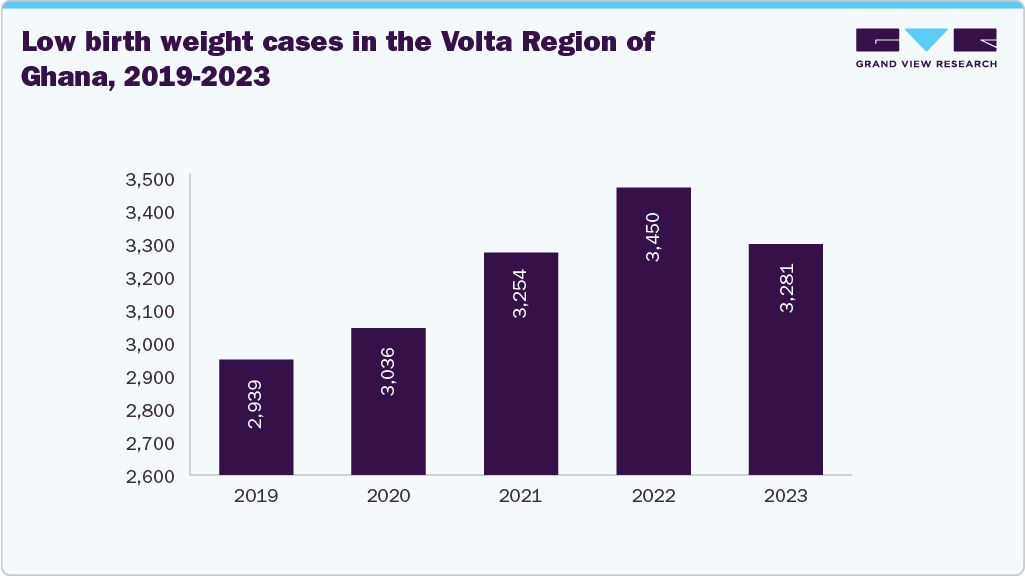

The children born at less than 37 weeks of gestational age are preterm infants, and children born with less than 2.5 kg are Low Birth Weight (LBW) infants. The number of preterm births is constantly rising, which is increasing the demand for care devices. According to the World Health Organization, approximately 13.4 million babies were born preterm in 2020, accounting for nearly one in ten live births. The burden of preterm births is particularly high in low- and middle-income countries, where access to advanced newborn care is often limited. In addition, Low birth weight remains another critical concern in neonatal health. The World Health Organization's 2024 report states that 15-20% of babies globally are born with low birth weight, which means over 20 million infants each year weigh less than 2,500 grams. This condition is strongly associated with increased risks of neonatal morbidity and mortality.

Government and NGO interventions continue to play a crucial role in shaping the growth of the infant incubators and warmers market. Over the past several years, national health programs and international aid efforts have significantly expanded infant care capacity, particularly in regions burdened with high rates of preterm and low birth-weight births. In India, for instance, the government has steadily scaled up its network of Special Newborn Care Units (SNCUs). According to a UNICEF report published in 2024, the number of Special Newborn Care Units (SNCUs) in India increased from 712 in 2017 to 1,054 units by 2024, reflecting a determined effort to enhance newborn survival rates.

Furthermore, NGOs have contributed significantly to bridging gaps in neonatal healthcare infrastructure, particularly in low-resource settings. Organizations such as UNICEF, PATH, and Save the Children have collaborated with governments to provide critical equipment, training, and technical support. For instance, UNICEF has been actively involved in supporting the development and piloting of affordable and portable thermal care technologies designed to help maintain body temperature in premature and low-birth-weight infants, particularly in low-resource and emergency settings. Such efforts have enabled smaller healthcare facilities, especially in rural regions, to maintain the thermal regulation crucial for the survival of preterm and low-birth-weight infants.

In addition, initiatives such as India’s Newborn Action Plan (INAP) have prioritized reducing newborn mortality by focusing on expanding facility-based newborn care and improving quality standards across healthcare systems. Similarly, the Baby-Friendly Hospital Initiative (BFHI), supported by WHO and UNICEF, has encouraged hospitals globally to adopt evidence-based practices that enhance maternal and newborn care, including early initiation of breastfeeding and maintaining thermal protection for newborns, which in turn drives demand for advanced infant equipment such as incubators and warmers.

Rising technological advancements are boosting the growth of the market. Over recent years, manufacturers have focused on developing devices with enhanced precision, safety, and usability to support the complex requirements of infant care. Among emerging innovations, infant phototherapy incubators are gaining prominence by combining high-intensity phototherapy for treating newborn jaundice with precise thermal and humidity regulation in a single, integrated system. These devices enable clinicians to manage hyperbilirubinemia effectively and maintain a controlled environment, minimizing the need to transfer delicate infants between separate units.

Manufacturers are responding to this trend by developing compact incubators and warmers that feature simplified controls, battery-powered operation, and remote monitoring capabilities. These devices are designed to be intuitive for caregivers and ensure clinical standards of care. The shift toward home-based newborn care also aligns with broader healthcare goals of decentralization and personalized medicine, creating a favorable market landscape for companies offering technologically advanced and affordable solutions.

For instance, mOm incubators aims to transform neonatal care by ensuring every newborn receives the best possible start through innovative, flexible incubation technology. In the UK, around 600,000 babies are born annually, and up to 16% require NICU care, often resulting in stressful separation from parents and added pressure on the healthcare system. The mOm Essential Incubator addresses this challenge by offering a portable, first-of-its-kind neonatal incubator that can be used anywhere in a hospital, enabling babies born from 30 weeks of gestation onward to stay closer to their families. This covers nearly 90% of infants who typically need NICU support. By supporting Family Integrated Care, the device promotes parent-infant bonding, reduces emotional strain, and helps stabilize infants earlier, lowering the risk of complications such as respiratory distress and hypoglycemia.

Moreover, as healthcare providers and policymakers increasingly focus on community-based care models, the market for infant incubators and warmers is poised to benefit from this evolving care paradigm. This shift presents new growth opportunities in both developed and emerging regions.

In addition, the FDA in January 2025 confirmed that all newly manufactured neonatal incubators in the U.S. are safe for immediate clinical use, resolving earlier concerns about harmful airborne chemicals inside the devices. After first warning healthcare providers in February 2023 about potential exposure to volatile chemicals such as formaldehyde and cyclohexanone, the agency worked closely with manufacturers-reviewing test data and assessing possible health risks for vulnerable newborns. The evaluation found no dangerous chemical levels, meaning incubators no longer require a week-long pre-use ventilation period. GE HealthCare also adopted additional steps to reduce formaldehyde levels in its incubators before distribution.

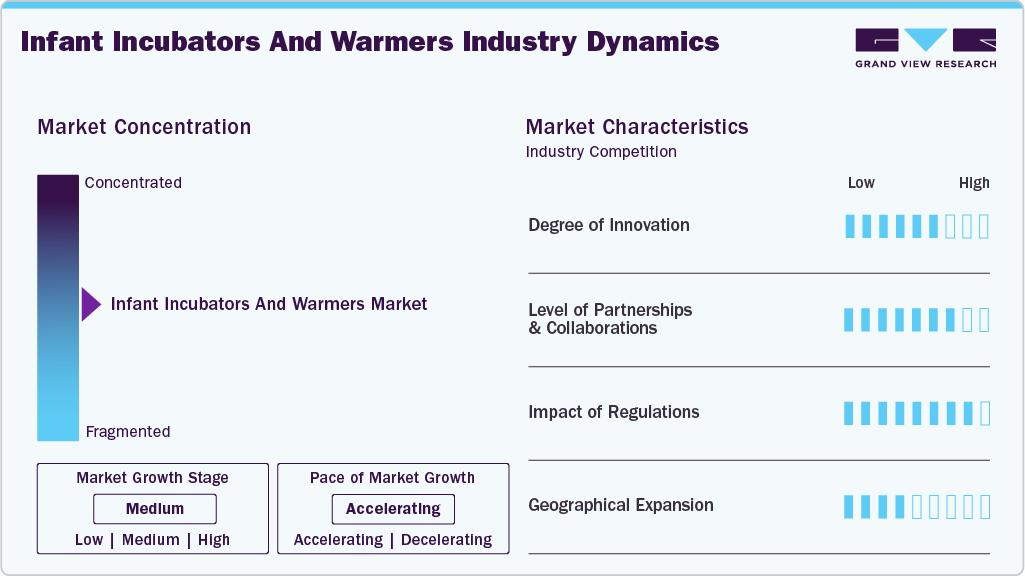

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry is fragmented, with many services and end users entering the market. There is a high degree of innovation, high level of partnerships and collaboration activities, moderate impact of regulations, and moderate geographical expansion of industry.

The industry is experiencing a high degree of innovation. Manufacturers have focused on developing devices with enhanced precision, safety, and usability to support the complex requirements of infant care. For instance, the integration of servo-controlled temperature and humidity systems in incubators, such as the Dräger Babyleo TN500, has significantly improved the ability to maintain stable thermal environments for preterm and low-birth-weight infants, reducing the risk of complications such as hypothermia. The device offers advanced features such as automated humidity regulation, precise temperature control, and gentle heating, helping protect neonates’ subtle physiology while supporting neurodevelopment.

Several key players are actively engaging in partnerships and collaborations to foster growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, in January 2023, GE HealthCare and Windsor Regional Hospital entered into a significant 15-year Managed Equipment Service agreement. This partnership aims to enhance patient outcomes, improve staff wellbeing, and provide innovative technology solutions across various medical departments.

The regulatory framework for the industry involves compliance with industry-specific guidelines and standards to ensure accuracy and consistency. For instance, Germany’s regulatory system for infant incubators & warmers is governed by the EU Medical Device Regulation (MDR 2017/745), directly applicable since May 2021, and implemented nationally via the Medical Devices Implementation Act (MPDG). Oversight is managed by the Federal Institute for Drugs and Medical Devices (BfArM) alongside appointed Notified Bodies, which review higher-risk devices. Germany has introduced the DMIDS platform for device registration, post-market surveillance, and vigilance data exchange, and follows risk-based market surveillance informed by national administrative regulations.

Geographical expansion helps companies to increase their presence to maintain or strengthen their market presence. Companies such as mOm Incubators Ltd, and GE HealthCare have strategically entered new markets to enhance their reach and capitalize on emerging opportunities. For instance, in August 2022, GE Healthcare launched a new manufacturing facility in Bengaluru, India, under the government's Production Linked Incentive (PLI) Scheme. This initiative aims to enhance local manufacturing capabilities and support the country's healthcare ecosystem.

Type Insights

Based on type, the incubator segment held the majority share of 36.66% in 2025. Growth in the segment is attributed to the rising prevalence of preterm and low-birth-weight births globally. In addition, increasing government initiatives and international programs aimed at reducing neonatal mortality rates are boosting investments in healthcare infrastructure, thereby expanding the demand for advanced incubators in hospitals and newborn intensive care units. Moreover, recent regulatory developments have addressed safety concerns related to neonatal incubators. In January 2025, the U.S. FDA clarified that newly manufactured neonatal incubators are safe for immediate clinical use, addressing prior concerns about potential exposure to airborne chemicals.

The convertible warmers & incubators segment is expected to grow at the fastest CAGR during the forecast period. This growth is primarily driven by the increasing demand for versatile and efficient equipment capable of addressing varying clinical needs. These devices are designed to function both as open radiant warmers and as closed incubators, allowing seamless transitions between modes depending on the infant’s condition and required level of care. Such flexibility is highly valued in neonatal intensive care units (NICUs), where infants initially require immediate resuscitation and thermal stabilization in an open environment, followed by the protective and controlled conditions of a closed incubator. This dual functionality minimizes the need for transferring fragile neonates between separate devices, thereby reducing handling risks, thermal fluctuations, and the potential for infection.

Regional Insights

Asia Pacific infant incubators and warmers market dominated the market with largest revenue share of over 52.23% in 2025. Thailand, South Korea, and India are some of the emerging countries in the Asia Pacific market. Technological advancements and an increasing number of preterm births are anticipated to promote the growth of fetal and infant incubators and warmers. Governments in countries such as India and China are investing heavily in healthcare infrastructure to improve neonatal care facilities. For instance, in October 2024, the Indian Government upgraded its All-India Institute of Medical Sciences (AIIMS)-Patna neonatal intensive care unit (NICU) from an existing 8-bed facility to a 24-bed facility.

Japan infant incubators and warmers market held significant revenue share in 2025. Factors such as the availability of advanced products, growing awareness about neonatal & prenatal care, and the presence of well-established companies are expected to boost market growth. While Japan has one of the lowest neonatal mortality rates globally, the rising average maternal age, increased prevalence of assisted reproductive technologies (ART), and high demand for precision neonatal care are key drivers of device adoption. For instance, according to the UN Inter-agency Group for Child Mortality Estimation (IGME), the neonatal mortality rate in Japan was 0.8 per 1,000 live births. Moreover, the advancements in infant incubators & warmers in the region are expected to drive market growth.

India infant incubators and warmers market is driven by the growing awareness about neonatal & prenatal care, the high prevalence of preterm births, and government initiatives to provide better care for neonatal infants. According to the National Health Portal in India, nearly 3.3 million babies are born prematurely, accounting for 13% of births. In addition, the neonatal mortality rate was 17.3 in 2023. In addition, several factors in maternity are expected to increase the demand for NICUs, such as ages younger than 16 years or older than 40 years, diabetes, drug abuse, Sexually Transmitted Diseases (STDs), and multiple pregnancies. These factors are anticipated to drive the demand for prenatal and infant incubators & warmers.

North America Infant Incubators And Warmers Market Trends

The market is expected to register a significant CAGR over the forecast period. The market is driven by advanced healthcare infrastructure, increasing premature birth rates, and widespread adoption of neonatal intensive care technologies. For instance, the preterm birth rate in the U.S. grew 12% from 2014 to 2022 to 8.67%, intensifying the demand for high-performance devices such as infant warmers, incubators, and hybrid convertible systems that offer flexible and continuous thermoregulation. Furthermore, government programs such as Medicaid and the NICHD (National Institute of Child Health and Human Development) have supported investments in NICU upgrades, contributing to sustained demand. The growing use of evidence-based neonatal care protocols ensures standardized deployment of such devices across various hospital tiers, from regional NICUs to community hospitals.

The U.S. infant incubators and warmers market is highly advanced, supported by a robust neonatal care infrastructure, steady innovation from leading manufacturers, and a continued focus on reducing neonatal mortality and morbidity. In addition, the increasing number of preterm births in the country contributes to market growth. For instance, according to the CDC, in 2022, preterm birth affected about 1 of every 10 infants born in the country, with an overall prevalence of 10.4%. Furthermore, government programs such as Title V Maternal and Child Health Services Block Grant, Medicaid NICU reimbursements, and NIH-funded neonatal innovation programs help support widespread deployment.

Europe Infant Incubators And Warmers Market Trends

The market is expected to witness high growth due to the increasing frequency of acquired infections among newborn babies, the growing number of hospitals, a major patient population suffering from low birth weight, and the growing number of preterm babies. For instance, according to the European Commission, about 500,000 babies are born prematurely yearly in Europe. As these babies require extra care, the rising number of preterm births is expected to propel market growth. Improved awareness about neonatal health and better access to healthcare facilities also increase the demand for quality infant incubators & warmers.

UK infant incubators and warmers market is expected to grow significantly over the forecast period due to the rising preterm birth rates, and a continued focus on improving neonatal care outcomes across NHS trusts. Moreover, in alignment with the Long-Term Plan, NHS England’s Neonatal Transformation Programme emphasizes capacity building in Level 2 and Level 3 neonatal units, with targeted investments in medical technologies, better staffing, and digital infrastructure. These initiatives are increasing the procurement of advanced incubators that offer intelligent humidity and temperature control, minimal handling, and compatibility with digital neonatal records. For instance, in August 2023, the Department of Health, Wrightington, Wigan & Leigh Teaching Hospitals NHS Foundation Trust purchased neonatal incubators from Drägerwerk AG & Co. KGaA worth USD 48,613.2 (GBP 35,375.14).

Italy infant incubators and warmers market is influenced by robust healthcare infrastructure, increasing focus on maternal and neonatal health, and strong Servizio Sanitario Nazionale (SSN), Italy's universal public healthcare system. Italy's preterm birth rate is 7.25% and has a relatively low infant and neonatal mortality rate of 2.34 and 1.62 per 1,000 births, respectively. Italian healthcare authorities prioritize early detection of high-risk pregnancies, thereby increasing the need for advanced thermal regulation devices to manage preterm infants.

Latin America Infant Incubators And Warmers Market Trends

The market is anticipated to grow significantly due to the growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries, such as the U.S., Canada, Japan, & several European countries, are factors anticipated to boost market growth in Latin America during the forecast period. Supportive government regulations to commercialize medical equipment and devices in the region are expected to propel market growth. For instance, Latin American countries require the U.S. FDA or CE mark approval to file marketing approvals. However, hospitals’ low affordability of advanced technologies is likely to hinder growth in Latin America.

Brazil infant incubators and warmers market held the largest market share in 2025 due to the availability of various products in the local market, increasing occurrence of preterm births & cesarean deliveries, and government initiatives to reduce the infant mortality rate. According to a study published in the PubMed Central Journal in May 2023, the prevalence of preterm birth in 2011-2021 was 11.1%. This prevalence fuels strong demand for infant warmers, incubators, and convertible hybrid systems.

Middle East And Africa Infant Incubators and Warmers Market Trends

The market is anticipated to grow significantly due to the increasing prevalence of preterm births in Africa. Preterm newborns are found to be prone to infections and diseases. For instance, according to data published in the Lancet Journal in October 2023, most preterm births (approximately 65% of global preterm births) occur in Africa and South Asia. Furthermore, regional governments are upgrading their hospitals with the inauguration of new facilities dedicated to neonatal care. For instance, in November 2022, Partners in Health (PIH) opened a newly renovated Neonatal Intensive Care Unit (NICU) in the District Hospital, Kirehe, Rwanda.

South Africa infant incubators and warmers market is witnessing an increase in the number of preterm births, with a rate of 59%, mainly at the district hospitals and community health centers. In addition, South Africa accounts for one of the highest neonatal mortality rates globally. According to UNICEF data, the neonatal mortality rate in South Africa in 2023 was 11.7 deaths per 1,000 live births. This high neonatal mortality rate is attributed to the poor intrapartum and neonatal care in the district hospitals in the country.

Key Infant Incubators and Warmers Company Insights

The market is slightly consolidated, with the presence of many global-level infant incubators and warmers providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Infant Incubators And Warmers Companies:

The following are the leading companies in the infant incubators and warmers market. These companies collectively hold the largest market share and dictate industry trends.

- Atom Medical USA, LLC (subsidiary of Atom Medical Corporation)

- Drägerwerk AG & Co. KGaA

- GE HealthCare

- nice Neotech Medical Systems Pvt. Ltd.

- LEEX LLC

- International Biomedical Ltd.

- mOm Incubators Ltd

- Zimed Healthcare Inc

- DIAMEDICAL USA EQUIPMENT LLC

- Médipréma’s Group

- Apothecaries Sundries Mfg. Pvt. Ltd. (ASCO)

Recent Developments

-

In June 2025, AquaWomb launched a new startup emerging from a collaboration between researchers at TU/e, Máxima Medical Center, and The Gate, building on the Horizon “Perinatal Life Support” study. The company aims to revolutionize neonatal care by developing a liquid-filled incubator designed to mimic the natural environment of the womb.

-

In October 2024, Drager introduced the BabyRoo TN 300 open warmer for neonatal patients in India. This device features advanced thermoregulation capabilities and integrated technologies to enhance neonatal care.

-

In June 2023, Drager launched the Babyroo TN300 open warmer, designed for neonatal care and offering advanced thermoregulation and lung protection from birth.

-

In February 2023, Mediprema group launched Médirunner, an internal transfer trolley with an incubator for transporting neonates from different hospital departments.

Infant Incubators And Warmers Market Report Scope

Report Attribute

Details

Market size in 2026

USD 1.17 billion

Revenue forecast in 2033

USD 1.95 billion

Growth Rate

CAGR of 7.59% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Atom Medical USA, LLC (subsidiary of Atom Medical Corporation); Drägerwerk AG & Co. KGaA; GE HealthCare; nice Neotech Medical Systems Pvt. Ltd.; LEEX LLC; International Biomedical Ltd.; mOm Incubators Ltd; Zimed Healthcare Inc.; DIAMEDICAL USA EQUIPMENT LLC; Médipréma’s Group; Apothecaries Sundries Mfg. Pvt. Ltd. (ASCO)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infant Incubators And Warmers Market Trends Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global infant incubators and warmers market report based on type and regions.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Infant Warmers

-

Value

-

Performance

-

Premium

-

-

Incubators

-

Value

-

Performance

-

Premium

-

-

Convertible Warmers & Incubators

-

Value

-

Performance

-

Premium

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global infant incubators and warmers market size was estimated at USD 1.10 billion in 2025 and is expected to reach USD 1.17 billion in 2026.

b. The global infant incubators and warmers market is expected to grow at a CAGR of 7.59% during the forecast period and is expected to reach USD 1.95 billion in 2033.

b. The incubator segment held the majority share of 36.66% in 2025. This is attributed to the rising prevalence of preterm and low-birth-weight births globally. In addition, increasing government initiatives and international programs to reduce neonatal mortality rates are boosting investments in healthcare infrastructure, thereby expanding the demand for advanced incubators in hospitals and newborn intensive care units.

b. Key players in the market include Atom Medical USA, LLC (subsidiary of Atom Medical Corporation), Drägerwerk AG & Co. KGaA, GE HealthCare, nice Neotech Medical Systems Pvt. Ltd., LEEX LLC, International Biomedical Ltd., mOm Incubators Ltd, Zimed Healthcare Inc., DIAMEDICAL.

b. The factors driving the market include the significant number of newborn deaths and preterm births, along with the availability of financial assistance for equipment research & procurement. Moreover, product innovations by manufacturers are increasing treatment efficiency and affordability, which is expected to reduce treatment costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.