- Home

- »

- Healthcare IT

- »

-

Infection Surveillance Solutions Market Size Report, 2030GVR Report cover

![Infection Surveillance Solutions Market Size, Share & Trends Report]()

Infection Surveillance Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Services, Software), By End-use (Long Term Care Facilities, Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-661-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

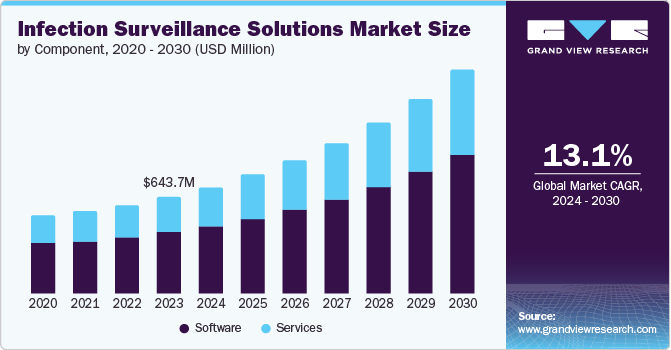

The global infection surveillance solutions market size was valued at USD 643.7 million in 2023 and is projected to grow at a CAGR of 13.1% from 2024 to 2030.The increasing rate of infectious diseases in the geriatric population, rise in healthcare expenditure, technological advancements, and initiatives towards infection control and measures drive the market growth. Also, the outbreak of endemics in different parts of the world drives the demand for infection surveillance solutions.

The primary reason for the market growth is the growing prevalence of (hospital-acquired infections) HAI’s worldwide. The occurrence of HAIs is high in patients when their immunity level is low. The poor hygiene in healthcare facilities also contributes to the HAIs. Furthermore, for healthcare facilities, HAIs are found to be the major reason for mortality which further fuels the adoption of technologies to improve infection control processes and strategies.

The proliferation of HAIs triggers several diseases for inbound patients. It has also been a primary source of infection in patients following treatments in clinics and hospitals. On the other hand, a surveillance system tracks, and monitors the infection levels and underscores the severity of a particular situation. Post, the outbreak of COVID-19 that lasted for nearly two and half years, a drastic need for an accurate and efficient surveillance system is realized at global levels that can effectively track, monitor, measure, and communicate the infection rate in patients. Besides, the increasing investments in research and innovation have further resulted in advanced technology that effectively solves the problem. Government initiatives and the increasing adoption in healthcare institutions is crucial for the deployment of these systems.

Component Insights

The software segment dominated with a market share of 63.4% in 2023. The use of web-based software provides real-time analysis and different configurations. Moreover, the participation of software companies in data collection, electronic health records, analytics, and tracking trends in epidemics has augmented demand for such systems. The need to prevent HAIs followed by the rise in digitalization methods in the healthcare industry has added to the segment growth. In addition, the urge for safe access to healthcare IT systems and countermeasures for data breaches and piracies are also evident.

The services segment is expected to be the fastest-growing segment with a CAGR of 13.5% during the forecast period. The infection surveillance service segment consists of maintenance service, training, consulting, and implementation services. The software complexities, product support, and equipment maintenance constitute major components in the service segment. The rapid adoption of technology and software result in an increasing need for digital services to function properly.

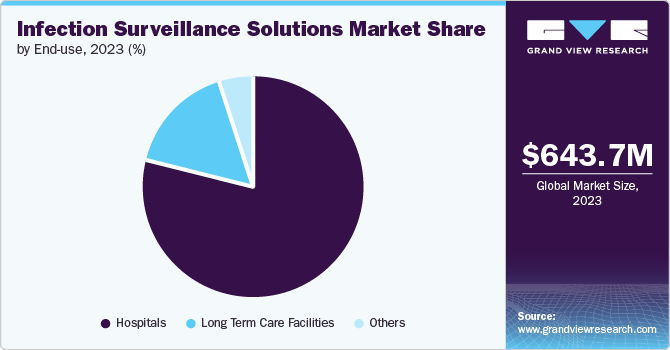

End-use Insights

The hospital segment dominated with a market share of 79.3% in 2023. High purchasing power by healthcare institutes, the growing need for tracking software, and the presence of skilled medical professionals are poised to contribute to the segment's growth. In addition, the increasing prevalence of infectious diseases is high in hospitals. Furthermore, government initiatives to improve the healthcare infrastructure have helped improve health conditions across the globe.

Long-term care facilities are expected to be the fastest-growing segment with a CAGR of 14.0% during the forecast period. The factors contributing to the segment growth include increasing awareness about the risk of spreading diseases, growing demand for long-term care facilities, and awareness about the benefits of these systems. Besides, the availability of skilled professionals and optimal treatment and care boost the segment's growth.

Regional Insights

North America infection surveillance solutions market accounted for a global share of 50.3% in 2023. This dominance can be attributed to factors such as an increasing healthcare infrastructure in the U.S., Canada, and Mexico, growing expenditure on healthcare, an increase in chronic diseases, and a rise in disposable income. In addition, the increasing mortality in hospitals due to widespread infections has further propelled the market growth.

U.S. Infection Surveillance Solutions Market Trends

The infection surveillance solutions in the U.S. is a dominating market in the North American region contributing to a share of 90.1% in 2023. The factors responsible for the dominance are the increasing cases of HAIs, technological advancements, and increasing awareness about the benefits of the systems. In addition, in the U.S., the Health and Human Services (HHS), governed by the cabinet-level department of the U.S. federal government, funds research activities in medical sciences.

Europe Infection Surveillance Solutions Market Trends

Europe's infection surveillance solutions market is fast-growing with a global share of 22.2% in 2023. The growth can be attributed to factors such as an increase in medical tourism, a rise in chronic diseases, and an outbreak of COVID-19 majorly played a role in influencing the market growth. In addition, the increasing population and prevalence of HAIs have led to an increase in the patient population contributing to the demand for infection surveillance systems.

UK infection surveillance solutions market is flourishing in Europe due to the increase in government initiatives to improve the healthcare infrastructure, and an increase in medical tourism has largely influenced the market growth. Moreover, the rise in social security and spending on public hygiene are major factors contributing to the adoption of disease monitoring and surveillance systems in the UK.

Asia Pacific Infection Surveillance Solutions Market Trends

The Asia Pacific infection surveillance solutions market is expected to grow steadily with a CAGR of 13.8% during the forecast period. The regional growth is influenced by high spending on containing endemics and efforts to create hygiene awareness. The contributions of NGOs and other governing bodies have made a significant impact in extracting positive outcomes in the healthcare sector. Besides, the technological benefits, increasing healthcare infrastructure and facilities are responsible for market growth.

China's infection surveillance solutions market is anticipated to grow high in the forecast period. It is one of the leading countries in disease monitoring and following effective measures. The rise in government funding and regulations is expected to supplement the measures in healthcare. Hence, there is a rise in the number of medical professionals associated with developments in the healthcare infrastructure.

Key Infection Surveillance Solutions Company Insights

Some key players in the global infection surveillance solutions market are Becton Dickinson and Company, Premier Inc., GOJO Industries, and others. Organizations focus on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Premier, Inc. is an American healthcare multinational company that offers a wide range of services to hospitals and healthcare providers. SafetySurveillor by Premier is a web-based infection tracking solution that digitally assists healthcare facilities in preventing HAIs.

-

Wolters Kluwer is a Dutch company and a global leader in information services and solutions. Their offerings include Sentri7 which is used in clinical surveillance and helps healthcare facilities to identify at-risk patients and improve patient outcomes.

Key Infection Surveillance Solutions Companies:

The following are the leading companies in the infection surveillance solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Becton Dickinson and Company

- Premier, Inc.

- Wolters Kluwer N.V.

- Baxter International Inc.

- Cerner Corporation (Oracle)

- Clinisys

- GOJO Industries

- Merative

- Truven Health Analytics

- Vigilanz Corporation

- RL Datix Ltd

Recent Developments

-

In May 2024, Premier Inc., announced its collaboration with AstraZeneca to use real-world data, Artificial Intelligence-powered technologies, and scalable solutions to enhance health outcomes and offer cost-effective solutions for patients.

-

In February 2024, PINC AI announced the collaboration between Applied Sciences a subsidiary of Premier, Inc., and Datavant a company, a pioneer in accumulating global health data. The collaboration is anticipated to shape the future of research in healthcare to improve patient outcomes.

Infection Surveillance Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 709.7 million

Revenue forecast in 2030

USD 1.48 billion

Growth Rate

CAGR of 13.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Becton Dickinson and Company; Premier, Inc.; Wolters Kluwer N.V.; Baxter International Inc.; Cerner Corporation (Oracle); Clinisys; GOJO Industries; Merative; Truven Health Analytics; Vigilanz Corporation; RL Datix Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infection Surveillance Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global infection surveillance solutions market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Long Term Care Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.