Infectious Enteritis Treatment Market Trends

The global infectious enteritis treatment market size was valued at USD 453.46 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.09% from 2024 to 2030. The enduringly high prevalence of infectious enteritis, including conditions such as gastroenteritis and food poisoning, highlights the urgent necessity for the creation and accessibility of effective treatment solutions. As per the Middle East Journal of Digestive Diseases article, the estimated annual incidence of irritable bowel syndrome (IBS) stands at 38.5 cases per 10,000 individuals, with a reported prevalence ranging from 10% to 17% in the general population.

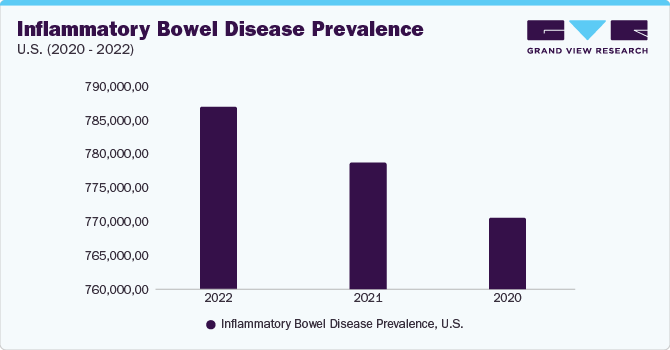

The aging population is a significant driver of the infectious enteritis treatment market, as they have weakened immune systems, rendering them more susceptible to infections like infectious enteritis, necessitating effective treatments. Moreover, aging populations typically have higher healthcare utilization rates, leading to more frequent doctor visits and diagnostic tests. This results in increased opportunities for the diagnosis and treatment of infectious enteritis.

Further, improvements in healthcare infrastructure, advanced diagnostic tools, ongoing pharmaceutical research and development initiatives, and rising concerns about antibiotic resistance collectively contribute to market expansion. These factors create a conducive business environment for pharmaceutical companies and healthcare providers to respond to the challenges of infectious enteritis, presenting promising growth prospects in this sector. For instance, in March 2021, Knight Therapeutics Inc. officially introduced IBSRELA (tenapanor) to the market as a pioneering treatment for irritable bowel syndrome with constipation (IBS-C) in adult patients.

During the COVID-19 pandemic, the heightened focus on hygiene and sanitation practices, as well as travel restrictions reduced the incidence of some enteric infections. On the other hand, the pandemic disrupted healthcare systems, causing delayed diagnosis and treatment for many patients. The pandemic disrupted healthcare systems, causing delays in diagnosis and treatment for many patients.

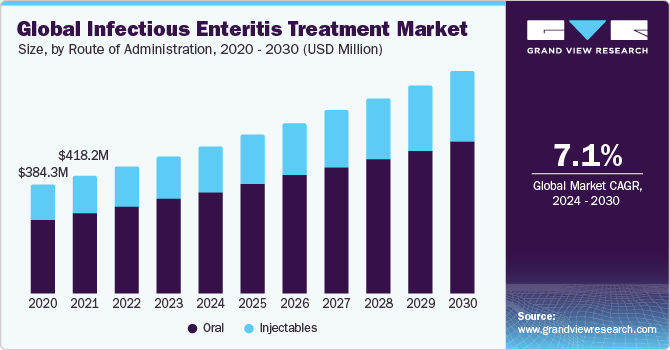

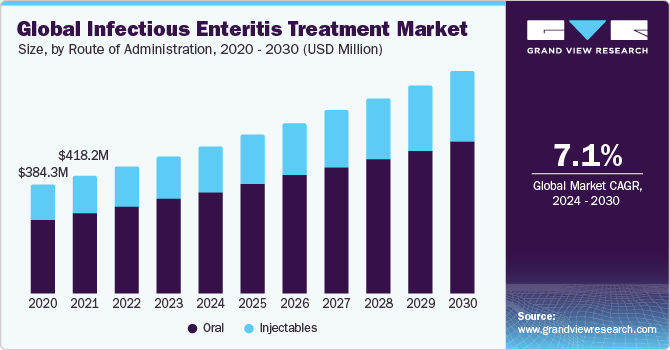

Route of Administration Insights

On the basis of route of administration, the market is segmented into oral, and injectables. The oral segment held the largest market share in 2023 due to their ease of administration, high patient compliance, and systemic effectiveness. Infectious enteritis often requires prompt treatment to alleviate symptoms and prevent complications, and oral medications provide a convenient and efficient way to achieve this. On the other hand, the injectables segment is expected to witness lucrative growth over the forecast period since they are highly effective for severe infectious enteritis or when oral administration is not feasible, such as in cases of vomiting or severe dehydration.

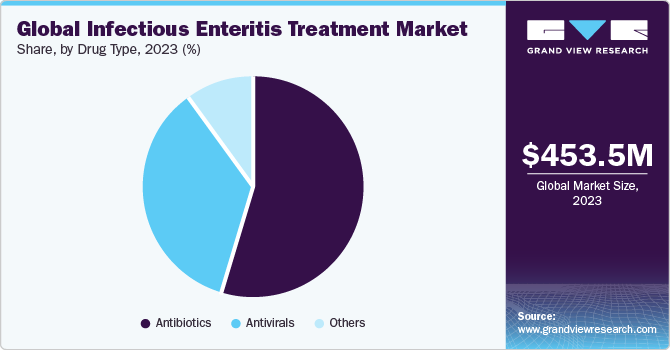

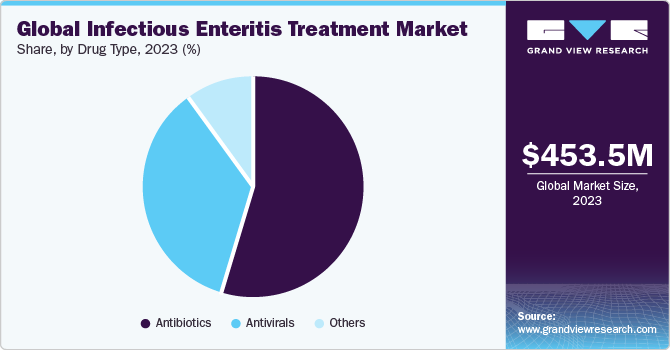

Drug Type Insights

Based on drug type, the market is segmented into antibiotics, antivirals, and others. The antibiotics segment dominated the market in 2023 due to its fundamental role in combating the underlying bacterial infections responsible for many cases of infectious enteritis.

Enteric pathogens, such as Salmonella, Shigella, and Campylobacter, are often bacterial in nature, and antibiotics effectively target and eliminate these pathogens. On the other hand, antivirals are expected to witness lucrative growth over the forecast period as they are designed to specifically target and inhibit the replication of the viruses, reducing the severity and duration of symptoms.

Regional Insights

North America dominated the market in 2023 due to a well-established healthcare infrastructure and advanced diagnostic capabilities, facilitating prompt diagnosis and treatment. Additionally, the region's robust pharmaceutical industry, coupled with substantial research and development activities, ensures a steady stream of innovative treatments that contribute to the overall market growth.

On the other hand, Asia Pacific is expected to witness lucrative growth over the forecast period. Theimprovements in healthcare infrastructure, rising disposable incomes, and increased healthcare awareness are driving higher healthcare utilization rates, leading to enhanced diagnosis and treatment of infectious enteritis cases, thereby contributing to the overall market growth in the region.

Key Infectious Enteritis Treatment Company Insights

Key players operating in the market are Johnson & Johnson, BioGaia, Bristol-Myers Squibb, GlaxoSmithKline plc, Mayne Pharma, Novartis AG, Pfizer Inc. and Teva Pharmaceuticals. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives. In April 2022, Ardelyx, Inc. secured FDA approval for IBSRELA, an NHE3 inhibitor developed for treating irritable bowel syndrome with constipation (IBS-C) in adults.