- Home

- »

- Pharmaceuticals

- »

-

Influenza Vaccine Market Size, Share & Growth Report, 2030GVR Report cover

![Influenza Vaccine Market Size, Share & Trends Report]()

Influenza Vaccine Market (2024 - 2030) Size, Share & Trends Analysis Report By Vaccine Type (Inactivated, Live Attenuated), By Indication, By Age Group, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-019-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Influenza Vaccine Market Summary

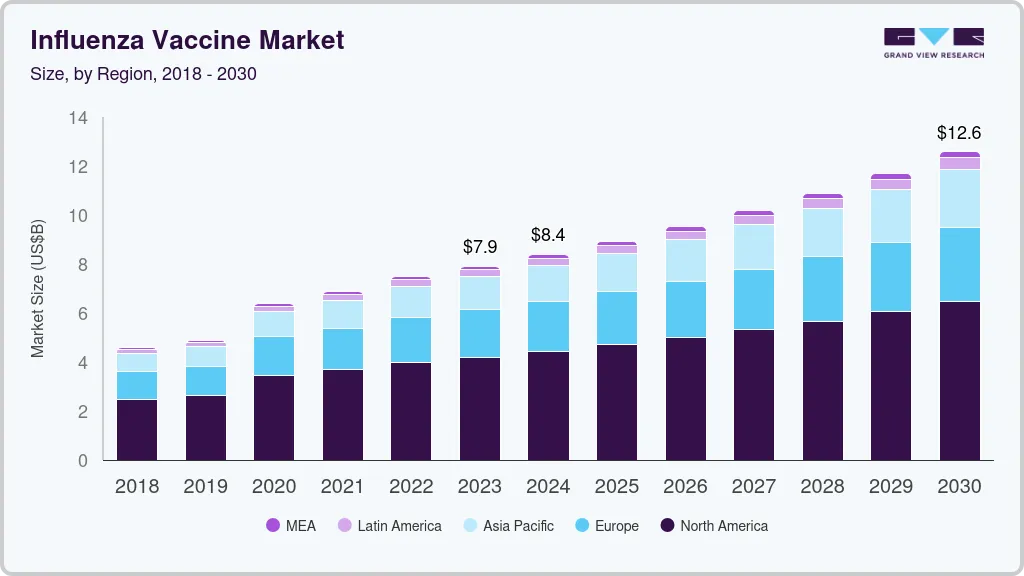

The global influenza vaccine market size was estimated at USD 7.91 billion in 2023 and is projected to reach USD 12.58 billion by 2030, growing at a CAGR of 6.9% from 2024 to 2030. Vaccine sales are expected to increase throughout the forecast period due to an increase in incidence of seasonal flu and increased recommendations for vaccination against the disease.

Key Market Trends & Insights

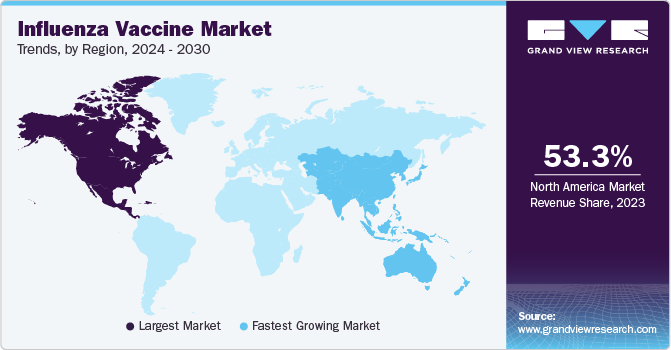

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Italy is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, Inactivated vaccines held the largest market share of 91.94% in 2023.

- By indication, the trivalent segment is expected to exhibit a growth rate of 5.0% over the forecasted period.

- By age group, The adult segment held the largest revenue share of 78.64% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.91 Billion

- 2030 Projected Market Size: USD 12.58 Billion

- CAGR (2024-2030): 6.9%

- North America: Largest market in 2023

According to CDC’s estimates published in October 2023, nearly one billion cases of seasonal influenza are reported globally, including around 3-5 million cases of chronic diseases. In addition, surge in surveillance and government support regarding vaccination at country and global levels for monitoring distribution, supply, and administration of vaccines is one of the growth-rendering factors for the market.

COVID-19 has increased the adoption of influenza vaccines across the globe. Key market players such as Sanofi; and GSK plc.; AstraZeneca and CSL Seqirus have witnessed significant growth in sale of influenza vaccines during the pandemic. An increase in R&D activities related to development of COVID-19-influenza combination vaccines is anticipated to increase vaccination against influenza illness globally. For instance, in November 2022, Pfizer, Inc. and BioNTech initiated a phase 1 clinical study of an mRNA-based combination vaccine candidate for COVID-19 and influenza.

According to CDC estimates, in 2022, there were around 25 million cases of illnesses, 280,000 hospitalizations, and around 17,000 deaths due to influenza in the U.S. Similarly, as per Public Health Agency of Canada, 34,413 cases were reported from August 2022 to December 2022 in the country and most of these cases were influenza A infections. Increasing prevalence and direct & indirect costs associated with it are increasing the shift toward vaccination against influenza disease.

Moreover, there are many licensed seasonal influenza vaccines suggested by CDC, WHO, and other regulatory bodies to combat the infection in the current market scenario. In addition, governments around the world recommend people get immunized to attain maximum protection against the flu. Moreover, in September 2022, the Advisory Committee on Immunization Practices (ACIP) recommended the influenza vaccines to all people aged above 6 months, especially people affected with acute COVID-19 disease.

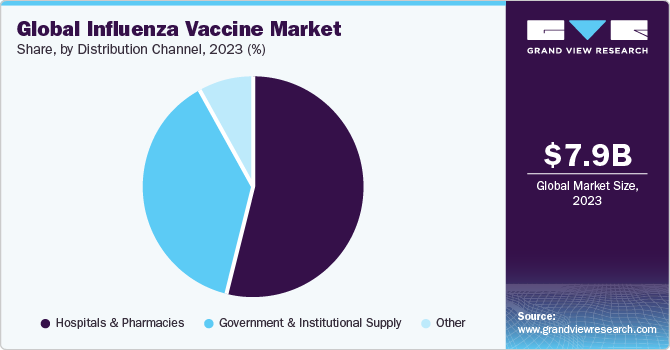

Distribution Channel Insights

Hospitals & pharmacies captured the largest revenue share of 54.00% in 2023. Large quantity of vaccine supply from hospitals is anticipated to generate lucrative revenue opportunities for the segment. Furthermore, high cases of flu and influenza leading to higher hospital admissions are also expected to propel segment demand forward. For instance, as of January 2023, around 40.76 million doses were distributed to U.S. pharmacies for adults of 18+ years, which is 1.4 million more doses than in January 2022. While U.S. physician medical offices received approximately 26.58 million in January 2023, accounting for 2.9 million fewer doses as compared to the previous year.

Government & institutional supply segment is expected to be the fastest-growing segment during the coming years. Ongoing vaccination and immunization programs and the inclusion of influenza vaccines in vaccination programs worldwide are responsible for high growth of this segment. For instance, in June 2022, the Government of New Zealand expanded access to free-of-cost flu vaccines for children and people with mental health issues. In addition, global health organizations such as WHO are procuring vaccines in large volumes to supply cost-effective vaccines to emerging economies and people with high unmet needs.

Market Dynamics

Investment by key market players to increase their footprint is driving the growth. Key market players are undertaking initiatives such as product development, collaboration, and geographic expansion to strengthen their market position. For instance, In February 2023, a team of researchers from the Chinese Academy of Sciences worked on a novel live-attenuated influenza vaccine. This technology is expected to be a promising way to decrease the influenza burden.

The threat of new entrants is likely to be moderate, owing to the high cost associated with development of novel vaccines as well as stringent regulations related to novel vaccine approvals. However, increasing research activities for development of multivalent vaccine by market leaders for influenza disease will increase the threat of new entrants. For instance, in January 2023, clinical trial results for mRNA vaccine codeveloped by the collaboration of GSK plc and CureVac were released. The vaccine is intended for influenza.

However, a major challenge in vaccines development for pharma companies is the wide range of harmful pathogens that could contaminate the solution and lead to loss of efficacy and safety during clinical trials, resulting in the vaccine being rejected. Inherent biological properties of organisms, stability, and lack of a singular manufacturing template for production are some obstacles in vaccine development, which may hamper market growth.

Regional Insights

North America led the market with a 53.35% share due to rapid launch of effective products along with technologically advanced vaccine production facilities across the region. Increasing prevalence of influenza infection in the U.S. & Canada and growing sales of influenza vaccines are also expected to fuel regional growth. According to WHO, about 37.2 million influenza flu cases were found in the U.S. in 2021. Furthermore, supportive government initiatives for vaccination and research activities are other factors propelling market growth. In June 2021, NIH launched the first-in-human phase I trial for assessing the immunogenicity and safety of investigational influenza vaccine.

Asia Pacific is anticipated to register the fastest growth rate throughout the forecast perioddue to healthcare reforms. Other factors contributing to market growth are increasing geriatric population, improving healthcare infrastructure, and entry of new players. In February 2023, SK Bioscience announced that it will invest USD 261 million to build a Songdo Global Research & Process Development Center for vaccine R&D. In addition, owing to the region’s large population, the rate of transmission is also higher. According to the Singapore Ministry of Health, the country has a higher burden of respiratory infections such as influenza than other diseases.

Vaccine Type Insights

Inactivated vaccines held the largest market share of 91.94% in 2023 and are anticipated to grow at the fastest rate during the forecast period. High prevalence of disease, surge in demand for effective vaccines, and presence of large number of manufacturers are contributing to high segment share of the market. Inactivated vaccines consist of viruses, bacteria, and other pathogens grown in culture and then killed to destroy disease-producing capacity. Key market players offer technologically advanced inactivated vaccines for protection against the condition. Inactivated vaccine given to children among age group 6-35 months produced a satisfactory antibody response even after a year of initial vaccination and later it reduced the chances of developing influenza A & B infection.

The live attenuated vaccine segment is anticipated to grow at a CAGR of 5.87% during the forecasted period. Live attenuated influenza vaccine is commercially accessible since 2003. However, it has not been able to gain widespread acceptance among end users. According to a research published in July 2022 by Springer Nature Limited, the usefulness of live attenuated vaccines has been overshadowed by safety concerns, minimal immunogenicity, and complex manufacturing techniques. The same study stated the development of a live attenuated influenza A vaccine through proteolysis-targeting chimeric (PROTAC) technology.

Indication Insights

The quadrivalent segment dominated the market with a share of 86.77% in 2023 and is expected to grow at the fastest growth rate over the forecast period. The growth is due to high efficacy against viral infections, cost-effectiveness, and easy availability in clinics & hospitals. In addition, higher preference for quadrivalent vaccines by medical professionals is also expected to support segment growth. In January 2023, the NHS England and the UK Health Security Agency (UKHSA) announced placing orders for influenza vaccines for 2022-2023 children’s program. The pharmacies and GP services are instructed to offer influenza vaccination to eligible candidates until March 31, 2023.

The trivalent segment is expected to exhibit a growth rate of 5.0% over the forecasted period due to limited protection against influenza virus and lower cost-efficiency than alternative vaccine type. Researchers conducted a study to assess the protection level of trivalent influenza vaccine on different age groups. According to an article published in October 2022, CDC’s observational data showcased that the trivalent Fluad adjuvanted vaccine offers better protection against influenza-related hospitalizations and emergency admission than standard-dose vaccinations.Trivalent-based Fluzone high-dose vaccination was 24% more effective than the standard dose vaccine in older adults. Hence, such studies assist regulatory bodies to form recommendations for influenza vaccines for older adults and stabilize demand for trivalent vaccines. In September 2022, the WHO recommended the composition of influenza vaccination for the upcoming 2023 influenza season.

Age Group Insights

The adult segment held the largest revenue share of 78.64% in 2023 owing to favorable efforts to increase immunization and high vaccine dose procurement by UNICEF, GAVI, and PAHO. Moreover, immunization coverage provision further led to surge in geriatric population getting immunized. In addition, vaccination for adults has become crucial to minimize hospitalizations and deaths caused by influenza. According to the CDC in the time period of 2022-2023, adults over 65 years of age recorded the highest rate of hospitalizations (187.3) per 100, 000 population in the U.S.

The pediatric segment is anticipated to grow lucratively over the forecast period owing to the high vaccinations provided to infants and newborns to protect them from the influenza disease. The CDC, WHO, and other regulatory bodies have implemented the immunization strategies such as provision of vaccines at an early age as well as to every child, globally. In addition, the surge in research activities to develop novel products and expansion of age indication of existing vaccines are anticipated to support segment growth.

Furthermore, the surge in population in countries like India and China created a higher demand for pediatric vaccines thereby propelling the segment growth. As per the CDC estimates, during the period of October 2022 to September 2023, 174 laboratory confirmed pediatric deaths were reported in the U.S. due to influenza. This is the third largest pediatric death that has been reported since the report began from 2004-2005 epidemic season.

Route Of Administration Insights

The injection segment held the largest revenue share of 92.09% in 2023. High growth of the segment accounted for a large number of intramuscular vaccine candidates available in market. Moreover, the availability of robust range of injectable products portfolio coupled with recent product approvals is catering to segment expansion. While the nasal spray segment is expected to exhibit the fastest growth rate over the forecasted period due to increasing adoption of nasal spray or intranasal vaccines at homecare settings, ease of self-administration, and ability of nasal spray to induce systemic as well as mucosal immunity.

In addition, ongoing efforts of researchers to investigate further opportunities and increasing funding in the intranasal flu vaccine is likely to support segment expansion. For instance, in February 2023, the Access to Advanced Health Institute announced receiving USD 9.9 million funding from Medical CBRN Defense Consortium to develop nasal spray-based RNA vaccine against influenza. This strategic initiative is expected to assist organizations in expanding their work on efficient and accessible RNA vaccines across the globe.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. Market players such as Pfizer Inc., Sanofi, GSK plc, and others are actively involved in development of novel influenza vaccines.

-

In October 2023, BioNTech SE and Pfizer Inc. announced positive results from a Phase 1 study of mRNA-based combination vaccine for influenza and COVID-19.

-

In May 2023, Novavax, Inc. announced positive results from a Phase 2 trial for three candidates: stand-alone influenza, COVID-19 combination, and high-dose COVID. These candidates showed robust immune responses, reassuring safety profiles, and reactogenicity comparable to authorized comparators, supporting their continued development.

-

In August 2022, Vaxess Technologies Inc. announced the launch of a phase I trial for the H1 influenza vaccine delivered by Vaxess’s MIMIX patch.

Key Influenza Vaccine Companies:

- GSK plc

- Pfizer Inc

- Vaxess Technologies Inc

- Merck & Co., Inc.

- Viatris Inc.

- OSIVAX

- AstraZeneca

- SINOVAC

- CSL Limited

- EMERGENT

- EMERGEX VACCINES

Influenza Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 8.39 billion

Revenue forecast in 2030

USD 12.58 billion

Growth rate

CAGR of 6.98% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Vaccine type, indication, age group, distribution channel, route of administration, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

GSK plc; AstraZeneca; SINOVAC; Pfizer Inc; Vaxess Technologies Inc; CSL Limited; EMERGENT; Merck & Co., Inc.; Viatris Inc.; OSIVAX; EMERGEX VACCINES

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Influenza Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global influenza vaccine market report based on vaccine type, indication, route of administration, age group, distribution channel, and regions:

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inactivated

-

Live Attenuated

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Quadrivalent

-

Trivalent

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adult

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injection

-

Nasal Spray

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Pharmacies

-

Government & Institutional Supply

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global influenza vaccine market size was estimated at USD 7.91 billion in 2023 and is expected to reach USD 8.39 billion in 2024.

b. The global influenza vaccine market is expected to grow at a compound annual growth rate of 6.98% from 2024 to 2030 and is expected to reach USD 12.58 billion by 2030.

b. The quadrivalent vaccine segment is expected to dominate the influenza vaccine market with a share of 86.77% in 2023 due to the high efficacy against viral infections, cost-effectiveness, easy availability, and higher preference for quadrivalent vaccines by medical professionals.

b. Some key players operating in the influenza vaccine market include Sanofi, GSK plc., AstraZeneca, CSL Limited, SINOVAC, Pfizer Inc, EMERGENT, and Abbott among others.

b. The rising incidence of influenza, increasing recommendations for vaccination, increasing awareness among people about vaccination against life-threaten diseases, and betterment in national immunization programs are the major factors driving the influenza vaccine market growth over the forecast period.

b. North America held the largest market share of 53.35% in 2023 and is expected to register a lucrative growth rate over the forecast period. It is attributable to the increasing prevalence of influenza, the presence of strong market players, and better healthcare policies in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.