- Home

- »

- IT Services & Applications

- »

-

Infrastructure As Code Market Size, Industry Report, 2033GVR Report cover

![Infrastructure As Code Market Size, Share & Trends Report]()

Infrastructure As Code Market (2025 - 2033) Size, Share & Trends Analysis Report By Infrastructure Type (Mutable Infrastructure, Immutable Infrastructure), By Deployment (Cloud, On-premises), By Approach, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-408-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infrastructure As Code Market Summary

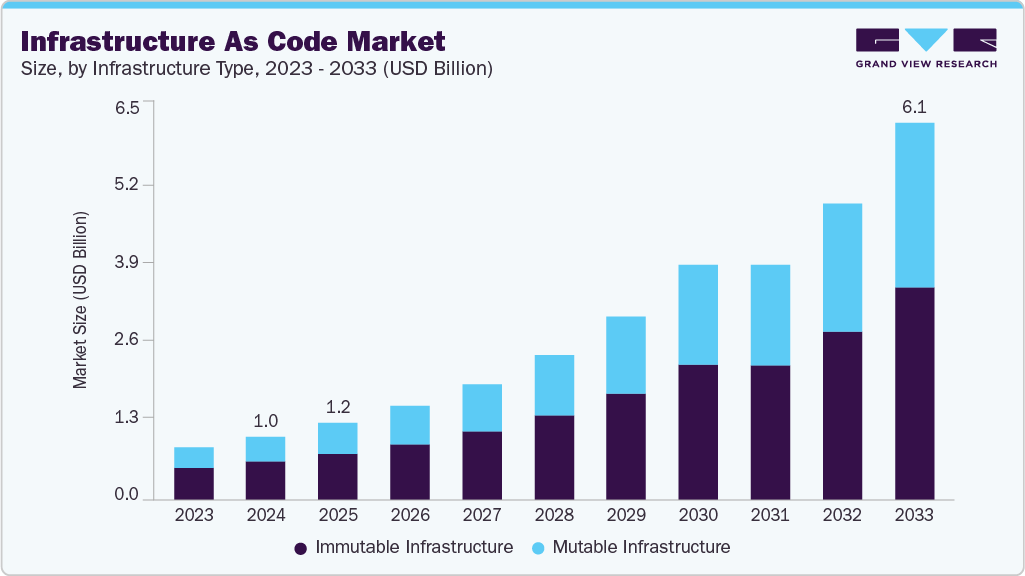

The global infrastructure as code market size was valued at USD 1.02 billion in 2024 and is projected to reach USD 6.14 billion by 2033, growing at a CAGR of 22.3% from 2025 to 2033. The growth is driven by the increasing adoption of cloud computing services, the rise of DevOps practices, and the need for cost efficiency in infrastructure management.

Key Market Trends & Insights

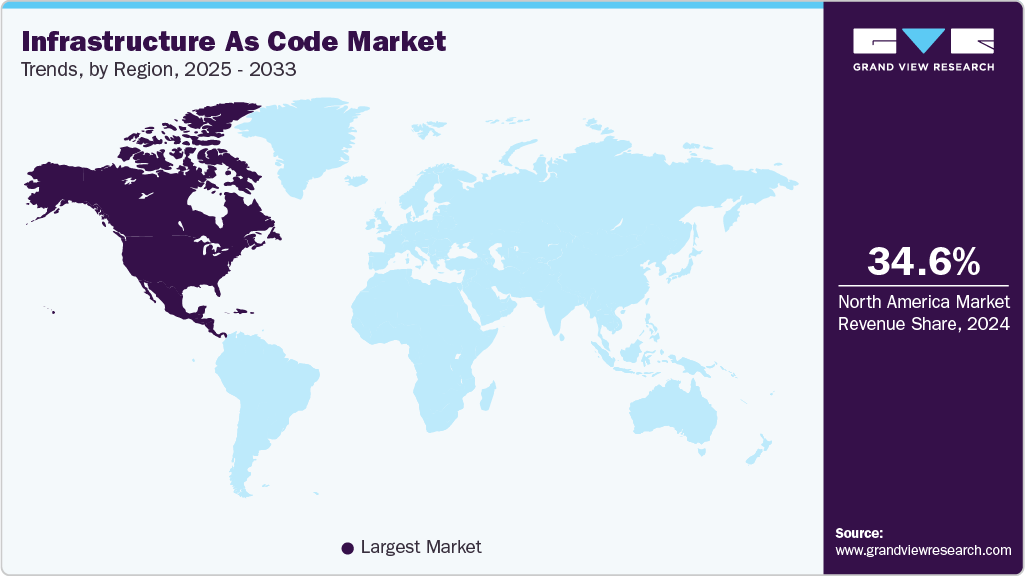

- North America dominated the global IaC market with the largest revenue share of 34.6% in 2024.

- The IaC market in the U.S. led the North American region and held the largest revenue share in 2024.

- By infrastructure type, immutable infrastructure led the market, holding the largest revenue share of 60.3% in 2024.

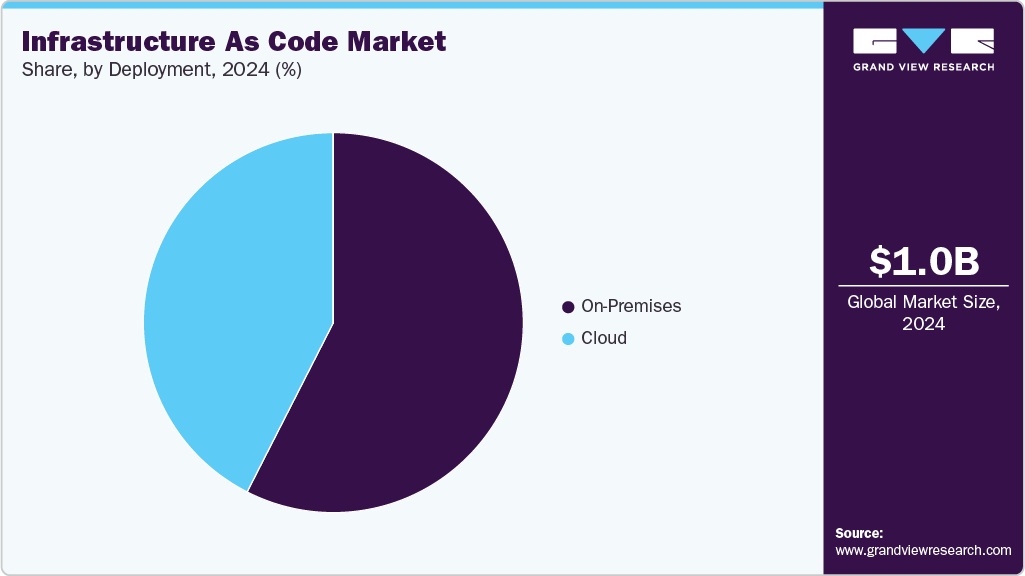

- By deployment, the Cloud segment is expected to grow at the fastest CAGR over the forecast period.

- By approach, the declarative segment held the dominant position in 2024.

- By end use, the IT & Telecom segment held the dominant position in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.02 Billion

- 2033 Projected Market Size: USD 6.14 Billion

- CAGR (2025-2033): 22.3%

- North America: Largest Market in 2024

Organizations are leveraging Infrastructure as code to automate and streamline infrastructure provisioning and management, which reduces manual intervention and enhances resource utilization. The demand for scalable, consistent, and reliable infrastructure solutions is also propelling the market forward, as infrastructure as code enables automated and error-free deployments. Additionally, the focus on security and compliance, as well as the broader digital transformation initiatives, is further fueling the adoption of Infrastructure as code tools.A key trend in the infrastructure as code is the integration with CI/CD pipelines, which facilitates faster and more efficient application development and deployment processes. This trend is complemented by the growing adoption of multi-cloud and hybrid cloud strategies, where IaC tools are crucial for managing and orchestrating infrastructure across diverse cloud environments. The rise of serverless computing is also influencing the market, with new IaC tools being developed to support serverless architectures effectively. Moreover, the incorporation of AI and machine learning into IaC tools is becoming more prevalent, optimizing infrastructure management through predictive analytics and automated decision-making.

Another significant trend is the increased focus on security within infrastructure as code practices, driven by the growing need to protect against cyber threats and ensure compliance with regulatory standards. This has led to the development of IaC tools with built-in security features and compliance checks. The market is also seeing a push toward standardization and the establishment of best practices, which aim to ensure the effective implementation and management of infrastructure as code solutions.

Additionally, the popularity of open-source IaC tools like Terraform and Ansible continues to rise, offering flexibility, community support, and cost-effectiveness. The overall trend toward greater automation and orchestration in infrastructure management is further driving the adoption of advanced IaC tools that offer comprehensive automation capabilities.

Infrastructure Type Insights

The immutable infrastructure segment dominated the market with a share of over 60.0% in 2024. Immutable infrastructure, which involves creating infrastructure components that are never modified after they are deployed, has gained significant traction due to its reliability, consistency, and security advantages. By eliminating configuration drift and ensuring that each deployment is identical to the last, immutable infrastructure reduces the potential for errors and security vulnerabilities, making it a preferred choice for many organizations. This approach aligns well with modern DevOps practices and continuous deployment models, further solidifying its dominant market position.

The mutable infrastructure segment is expected to register the highest CAGR over the forecast period. Mutable infrastructure, which allows for modifications and updates after deployment, is becoming increasingly attractive as it offers greater flexibility and adaptability to changing business requirements and environments. This flexibility is crucial for organizations that need to frequently update their systems and applications without completely redeploying their infrastructure. Advances in automation and orchestration tools are making it easier to manage mutable infrastructure effectively, thereby driving its rapid adoption and anticipated growth in the coming years.

Approach Insights

The declarative segment dominated the market in 2024. The declarative approach, favored for its simplicity and ease of use, allows users to specify the desired state of the infrastructure without detailing the steps to achieve that state. This method enhances consistency and reduces the likelihood of human errors, making it particularly attractive for organizations aiming for reliable and predictable infrastructure management. Additionally, declarative IaC tools, such as Terraform and CloudFormation, have gained widespread adoption due to their robustness and ability to integrate seamlessly with various cloud service providers.

The imperative segment is expected to register the highest CAGR over the forecast period. The imperative approach, which involves specifying the exact commands needed to achieve the desired infrastructure state, offers greater control and flexibility for complex and customized infrastructure configurations. As organizations increasingly seek more granular control over their infrastructure to optimize performance and efficiency, the demand for imperative IaC tools is expected to rise. The imperative approach's ability to handle intricate, bespoke infrastructure requirements and its potential to work in conjunction with automation and orchestration frameworks are key factors contributing to its anticipated growth.

End Use Insights

The IT & Telecom segment dominated the market in 2024. The dominance can be attributed to the high demand for scalable and efficient infrastructure management solutions within this sector, which is characterized by rapid technological advancements and the need for continuous service delivery. IT & Telecommunication companies rely heavily on IaC tools to automate infrastructure provisioning, manage complex network configurations, and ensure high availability and performance of their services. The ability to quickly adapt to changing business needs and technological landscapes makes IaC an indispensable tool for this sector, justifying its substantial market share.

The retail segment is expected to register the highest CAGR over the forecast period. The retail industry is increasingly embracing digital transformation, driven by the need to enhance customer experiences, streamline operations, and stay competitive in a dynamic market. Retailers are adopting infrastructure as code to support their e-commerce platforms, manage large-scale data centers, and implement omnichannel strategies efficiently. The growing emphasis on personalized customer interactions, real-time data analytics, and seamless supply chain operations necessitates robust and flexible infrastructure solutions, which IaC provides. As retailers continue to invest in advanced technologies to improve their digital capabilities, the adoption of IaC tools is expected to surge, leading to the highest growth rate in this segment.

Deployment Insights

The on-premises segment dominated the market in 2024. This significant share can be attributed to several factors. Many enterprises, especially those in regulated industries such as finance, healthcare, and government, prefer on-premise solutions due to stringent data security and compliance requirements. On-premise infrastructure as code solutions provide these organizations with greater control over their infrastructure and data, ensuring compliance with internal policies and regulatory standards. Additionally, businesses with substantial existing investments in on-premise infrastructure and legacy systems find it more practical to continue leveraging their current setups while incorporating IaC practices to enhance automation and efficiency.

The cloud segment is expected to register the highest CAGR over the forecast period. This projected growth is driven by the increasing adoption of cloud computing and the inherent advantages of cloud-based infrastructure as code solutions. Cloud IaC tools offer greater scalability, flexibility, and cost-efficiency, enabling organizations to rapidly adjust their infrastructure to meet changing demands without significant capital expenditure. Moreover, the growing trend towards multi-cloud and hybrid cloud strategies necessitates IaC solutions that can seamlessly manage and orchestrate resources across diverse cloud environments. The rise of digital transformation initiatives and the demand for agile, resilient, and innovative infrastructure further propel the shift towards cloud-based IaC deployments, making this segment a key growth area in the coming years.

Regional Insights

North America infrastructure as code industry dominated with a revenue share of over 34.6% in 2024. In North America, the market is experiencing robust growth driven by the rapid adoption of cloud computing and DevOps practices across various industries. The region's strong technological infrastructure, coupled with the presence of major cloud service providers and tech companies, fuels the demand for infrastructure as code solutions. Businesses are increasingly leveraging IaC to enhance automation, scalability, and security of their IT operations. The push towards digital transformation and the need for efficient infrastructure management in sectors like IT & Telecommunication, BFSI, and healthcare are key trends propelling the market forward.

U.S. Infrastructure As Code Market Trends

The infrastructure as code industry in the U.S. is expected to grow significantly due to the country's leadership in technology innovation and cloud service adoption. The high concentration of tech giants and start-ups in Silicon Valley and other tech hubs accelerates the implementation of infrastructure as code solutions. The U.S. government and defense sectors are also significant adopters of IaC, seeking to modernize their IT infrastructures for enhanced security and operational efficiency. The growing emphasis on cybersecurity and compliance with regulatory standards further drives the adoption of IaC tools that offer integrated security features and compliance checks.

Europe Infrastructure As Code Market Trends

The infrastructure as code market in Europe is expected to grow significantly over the forecast period, driven by a strong focus on regulatory compliance and data security, influenced by stringent regulations such as GDPR. European enterprises are increasingly adopting IaC to ensure consistent and secure infrastructure deployments that comply with these regulations. The region's significant investments in cloud infrastructure and digital transformation initiatives, particularly in countries such as Germany, the UK, and France, are boosting the adoption of infrastructure as code. The emphasis on sustainability and energy efficiency is also a notable trend, with businesses using IaC to optimize resource utilization and reduce environmental impact.

Asia Pacific Infrastructure As Code Market Trends

The infrastructure as code industry in the Asia Pacific region is anticipated to witness the fastest CAGR over the forecast period due to the expanding adoption of cloud services and digital transformation across emerging economies such as China, India, and Southeast Asian countries. The region's diverse and dynamic market landscape, along with increasing investments in IT infrastructure, drives the demand for infrastructure as code solutions. Businesses in sectors such as manufacturing, retail, and financial services are turning to IaC to enhance operational efficiency and competitiveness. The rising interest in AI, IoT, and smart city projects also contributes to the market's growth, as these initiatives require robust and scalable infrastructure management capabilities provided by IaC tools.

Key Infrastructure As Code Company Insights

Key players operating in the infrastructure as code market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth. Some key companies in the Infrastructure As Code market are HashiCorp, Inc. and Amazon Web Services, Inc.

-

HashiCorp, Inc. is a key player in the infrastructure as code market. HashiCorp, Inc. dominates the market through its flagship product, Terraform, which offers powerful multi-cloud provisioning, scalability, and automation capabilities. Its open-source model, strong enterprise adoption, and seamless integration across AWS, Azure, and Google Cloud make it the preferred choice for hybrid and multi-cloud infrastructure management.

-

Amazon Web Services, Inc. leads the IaC market with its robust native tool, CloudFormation, and deep integration across its extensive cloud ecosystem. Its comprehensive automation, reliability, and global cloud dominance enable enterprises to efficiently deploy, scale, and manage infrastructure, reinforcing AWS’s position in the IaC market.

Key Infrastructure As Code Companies:

The following are the leading companies in the infrastructure as code market. These companies collectively hold the largest market share and dictate industry trends.

- HashiCorp, Inc.

- Pulumi

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- IBM Corporation

- Hewlett Packard Enterprise Development LP

- Red Hat

- Perforce Software Inc.

- Oracle

Recent Developments

-

In September 2025, HashiCorp, Inc. announced Project Infragrap, a real-time infrastructure graph and agentic infrastructure automation capability, designed as a foundation for infrastructure that can observe, reason, and act. It shows a shift in IaC from provisioning to full-lifecycle, autonomous infrastructure operations. It also indicates IaC vendors are investing in “agentic” automation and observability of infrastructure, positioning IaC as a continuous control plane rather than just a one-time configuration tool.

-

In June 2025, HashiCorp, Inc., announced major new integrations and features for its infrastructure and security lifecycle management. The initiative includes integration with Red Hat Ansible Automation Platform and support for IBM Z mainframes, aimed at delivering a unified hybrid cloud control plane.

-

In February 2025, IBM Corporation acquired HashiCorp, Inc. for USD 6.4 billion. HashiCorp, Inc. is a major player in IaC and allows IBM Corporation to bolster its hybrid-cloud and multi-cloud automation stack, integrating infrastructure provisioning and security lifecycle management. It strengthens the IBM Corporation's position in the IaC market, and infrastructure automation is becoming a strategic enterprise layer.

Infrastructure As Code Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.23 billion

Revenue forecast in 2033

USD 6.14 billion

Growth rate

CAGR of 22.3% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Infrastructure type, deployment, approach, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

HashiCorp, Inc.; Pulumi; Amazon Web Services, Inc.; Microsoft; Google LLC; IBM Corporation; Hewlett Packard Enterprise Development LP; Red Hat; Perforce Software Inc.; Oracle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infrastructure As Code Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global infrastructure as code market report based on infrastructure type, deployment, approach, end use, and region:

-

Infrastructure Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Mutable Infrastructure

-

Immutable Infrastructure

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud

-

On-Premises

-

-

Approach Outlook (Revenue, USD Million, 2021 - 2033)

-

Imperative

-

Declarative

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Healthcare

-

BFSI

-

Retail

-

Government

-

IT & Telecom

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global infrastructure as code market size was estimated at USD 1.02 billion in 2024 and is expected to reach USD 1.23 billion in 2025.

b. The global infrastructure as code market is expected to grow at a compound annual growth rate of 22.3% from 2025 to 2033 to reach USD 6.14 billion by 2033.

b. North America dominated the infrastructure as code market with a share of 34.6% in 2024. This is attributable to strong technological infrastructure, coupled with the presence of major cloud service providers and tech companies.

b. Some key players operating in the infrastructure as code market include HashiCorp, Inc.; Pulumi; Amazon Web Services, Inc.; Microsoft; Google LLC; IBM Corporation; Hewlett Packard Enterprise Development LP; Red Hat; Perforce Software Inc.; and Oracle.

b. Key factors that are driving the market growth include the increasing adoption of cloud computing services, the rise of DevOps practices, and the need for cost efficiency in infrastructure management.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.