- Home

- »

- Next Generation Technologies

- »

-

Infrastructure Asset Management Market Size Report, 2030GVR Report cover

![Infrastructure Asset Management Market Size, Share & Trends Report]()

Infrastructure Asset Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By Component, By Service Type (Strategic, Operational, Tactical), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-948-7

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Infrastructure Asset Management Market Summary

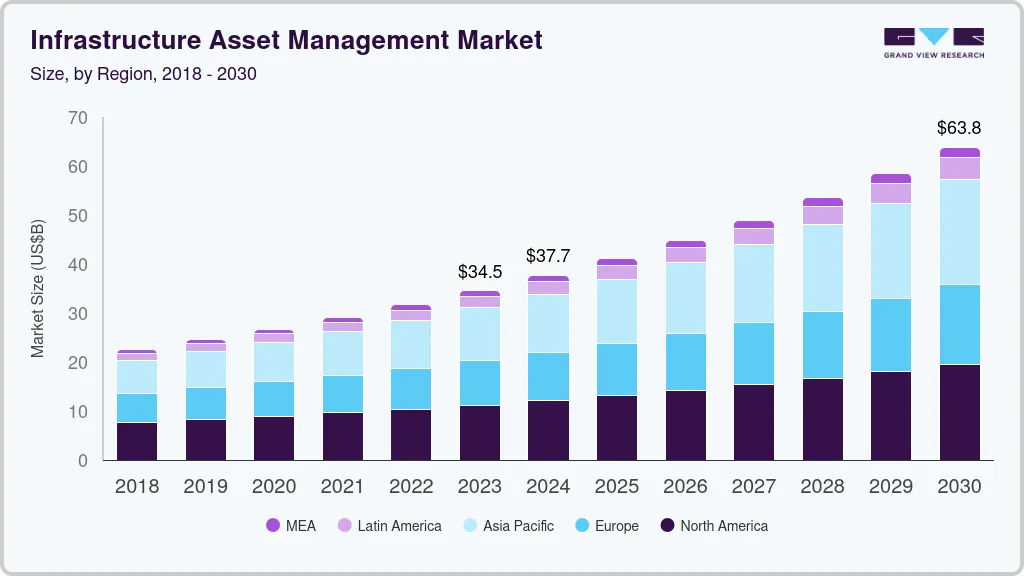

The global infrastructure asset management market size was estimated at USD 34.55 billion in 2023 and is expected to grow at a CAGR of 9.2% from 2024 to 2030. The market has witnessed considerable growth owing to the rapid adoption of infrastructure asset management (IAM) services to reduce infrastructure procurement and maintenance costs.

Key Market Trends & Insights

- North America dominated the global infrastructure asset management market with the largest revenue share of 33.6% in 2022.

- The infrastructure asset management market in the U.S led the North America market and held the largest revenue share in 2022.

- By application, the transportation segment led the market, holding the largest revenue share of 30.1% in 2022.

- By service, the strategic asset management segment is expected to grow at the fastest CAGR from 2023 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 34.55 Billion

- 2030 Projected Market Size: USD 63.82 Billion

- CAGR (2024-2030): 9.2%

- North America: Largest market in 2022

The development of advanced wireless technologies and protocols such as High-Speed Downlink Packet Access (HSDPA) is expected to enable a rise in the adoption of technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT), further driving the market growth.

Companies in the IAM industry are implementing a dual-track strategy called as Design-Build and Build-Operate-Transfer strategy. The design and construction are done by local start-ups while large corporations provide operation and maintenance software. Risks associated with aging infrastructure are a major driver for the market. Various industries such as manufacturing and oil & gas utilities require assets such as land, buildings, and machinery to obtain long-term service life.

Such industries need a large amount of capital to operate as the old designs cannot be modified or upgraded frequently. Hence, these industries deploy IAM solutions to enable efficient use of existing facilities and also ensure superior maintenance post-deployment. For instance, as per the study conducted by the U.S. Department of Energy, nearly 75% of transmission lines and transformers are more than 25 years old. In Europe, governments are facing challenges with water and wastewater infrastructure. The European region faces a wastage of more than three billion liters of water mostly due to leakage in distribution systems.

Moreover, decreasing return on assets for U.S. companies is anticipated to drive market growth over the forecast period. As companies opt for IAM to gain maximum return on assets, the asset management processes can closely relate to achieving quality enhancements and organizational productivity.

Government initiatives reveal lucrative opportunities for developing economies in the near future. Huge investments by companies for the development of solar energy infrastructure also enhance the growth of the infrastructure segment. Also, the growing awareness of energy conservation leads to the high adoption rate of IAM solutions for energy infrastructure. Moreover, governments around the world are making significant investments in the development of Smart Cities and emphasizing greater safety in public-owned structures.

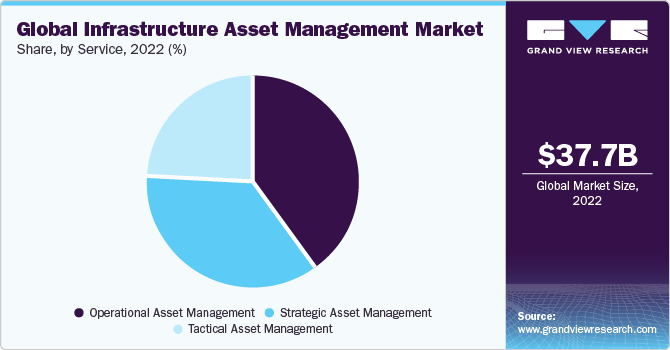

Service Insights

The operational asset management segment held the largest revenue share of 39.5% in 2022 and is expected to expand at the fastest CAGR of 9.7% over the forecast period owing to the wide usage in energy sectors. Changing dynamics in the energy sector are enabling the companies to look ahead for ways to cut down on energy costs, which is responsible for the segment growth.

The strategic asset management segment is expected to witness a significant growth over the forecast period owing to the rise in popularity and involvement of planning, design, development, and maintenance of infrastructure. The rise in popularity of risk assessment accepted under SAM services is anticipated to drive the growth.

Application Insights

The transportation segment accounted for the largest revenue share of 30.1% in 2022. Factors such as government investments in enhancing transportation activities for citizens and the integration of location-based services in transportation systems are driving the growth of the transportation segment.

The energy infrastructure segment is expected to expand at the fastest CAGR of 11.1% during the forecast period. Energy applications are gaining traction since several countries are now embracing concepts such as SMART cities wherein IAM services are fully used for developing and management of energy infrastructure. At present, government initiatives aligned with the availability of fund investors for SMART city projects are opportunistic for the market demand.

The water and waste segment is expected to grow significantly owing to the concerns about global warming. Stringent government policies for implementing waste and water management across various cities are anticipated to influence growth. Also, several nations are aiming to fix and renew their existing and new construction for public water infrastructure.

Regional Insights

North America dominated the infrastructure asset management market and accounted for the largest revenue share of 33.6% in 2022 owing to the rise in the need to augment asset utilization simultaneously minimizing the operational costs. Also, some of the factors such as aging infrastructure and an increase in private sector investments and public-private partnerships (PPPs) in infrastructure projects are fueling the market growth in the region.

Asia Pacific is expected to expand at the fastest CAGR of 10.1% during the forecast period, attributed to the major growth opportunities in the aviation industry. Regional spending on infrastructure has gained traction in recent years, opening new opportunities for market players. For instance, in India, the government planned to develop more than 100 smart cities by 2020, led by efficient telecommunications infrastructure that bodes well for market development. However, the pandemic hindered the progress of this mission, and it is expected to be completed by 2024. According to a report published in March 2023 by The Parliamentary Standing Committee, out of 7,821 projects, over 68% have been completed.

Component Insights

The services segment accounted for the largest revenue share of 65.0% in 2022 and is expected to expand at the fastest CAGR of 9.2% over the forecast period. Services are cost-effective as support and maintenance are included in the service package itself. The companies operating in the services sector are putting a high emphasis on providing training facilities subjective to the services workforce for the IAM system.

The solution segment is expected to witness significant growth over the forecast period. Solutions for infrastructure asset management are gaining traction as they are becoming popular due to their features such as systematic and often combined approaches for the management of varied infrastructure in various sectors such as energy, water, and waste. Customization is a major feature provided in IAM solutions.

Key Companies & Market Share Insights

The rapid adoption of IAM services results in minimizing the procurement and maintenance costs of infrastructure. Moreover, IAM services also offer security for infrastructure for airports, government buildings, and sports complexes.

Many companies are gaining long-term contracts based on their strategic initiatives and extended geographical presence. For instance, in March 2022, Aptean, a worldwide supplier of essential enterprise software solutions announced the release of Aptean EAM. This innovative solution is a cloud-based Enterprise Asset Management (EAM) software designed specifically for manufacturing and other businesses relying on intricate equipment to facilitate production. This launch showcases Aptean's commitment to delivering cutting-edge software solutions to empower businesses in optimizing their asset management processes.

Key Infrastructure Asset Management Companies:

- WSP

- RPS Group

- Brookfield Asset Management

- Macquarie Group Limited

- SIMCO Technologies

- Pitney Bowes Inc.

- Atkins.

- AABASOFT TECHNOLOGIES INDIA PRIVATE LIMITED.

- ThomasLloyd

- EverStream Capital Management.

Recent Developments

-

In June 2023, Macquarie Asset Management (MAM) and Coastal Waste & Recycling (Coastal) announced the completion of the recapitalization of Coastal. As a result, MAM, through one of its funds, has become the primary owner of Coastal. This strategic investment by MAM is expected to expedite Coastal's growth and further establish its prominent position as one of the top privately owned integrated solid waste and recycling businesses in the Southeast region.

-

In April 2023, Siemens Digital Industries Software and IBM announced an extension of their longstanding partnership. The focus of their collaboration is the creation of a combined software solution that integrates their respective offerings in systems engineering, service lifecycle management, and asset management.

-

In September 2022, WSP announced the acquisition of John Wood Group plc's Environment & Infrastructure Business. This strategic move facilitated the combination of their strengths, enabling them to provide clients with an extended range of exceptional multidisciplinary services. By joining forces, WSP and John Wood Group can deliver innovative solutions and enhanced value to their clientele.

Infrastructure Asset Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.67 billion

Revenue forecast in 2030

USD 63.82 billion

Growth Rate

CAGR of 9.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, service, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

WSP; RPS Group; Brookfield Asset Management; Macquarie Group Limited; SIMCO Technologies; Pitney Bowes Inc.; Atkins.; AABASOFT TECHNOLOGIES INDIA PRIVATE LIMITED.; ThomasLloyd; EverStream Capital Management

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Infrastructure Asset Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global infrastructure asset management market report based on component, service, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Strategic asset management

-

Operational asset management

-

Tactical asset management

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation infrastructure

-

Energy infrastructure

-

Water & waste infrastructure

-

Critical infrastructure

-

Mining

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global infrastructure asset management market size was estimated at USD 37.65 billion in 2022 and is expected to reach USD 41.01 billion in 2023.

b. The global infrastructure asset management market is expected to grow at a compound annual growth rate of 8.9% from 2023 to 2030 to reach USD 74.53 billion by 2030.

b. North America dominated the infrastructure asset management market with a share of 33.6% in 2022. This is attributable to the rising need to augment asset utilization simultaneously minimizing the operational costs.

b. Some key players operating in the infrastructure asset management market include WSP, RPS Group, Brookfield Asset Management, Macquarie Group Limited, SIMCO Technologies, Pitney Bowes Inc., Atkins., AABASOFT TECHNOLOGIES INDIA PRIVATE LIMITED., ThomasLloyd, and EverStream Capital Management.

b. Key factors that are driving the infrastructure asset management market growth include aging infrastructure, regulatory compliance, regulatory complaints, remote monitoring, IoT, increasing urbanization, and technological advancement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.