- Home

- »

- IT Services & Applications

- »

-

Inspection Management Software Market Size Report, 2030GVR Report cover

![Inspection Management Software Market Size, Share & Trends Report]()

Inspection Management Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment Type, By Enterprise Size, By Features, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-585-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Inspection Management Software Market Summary

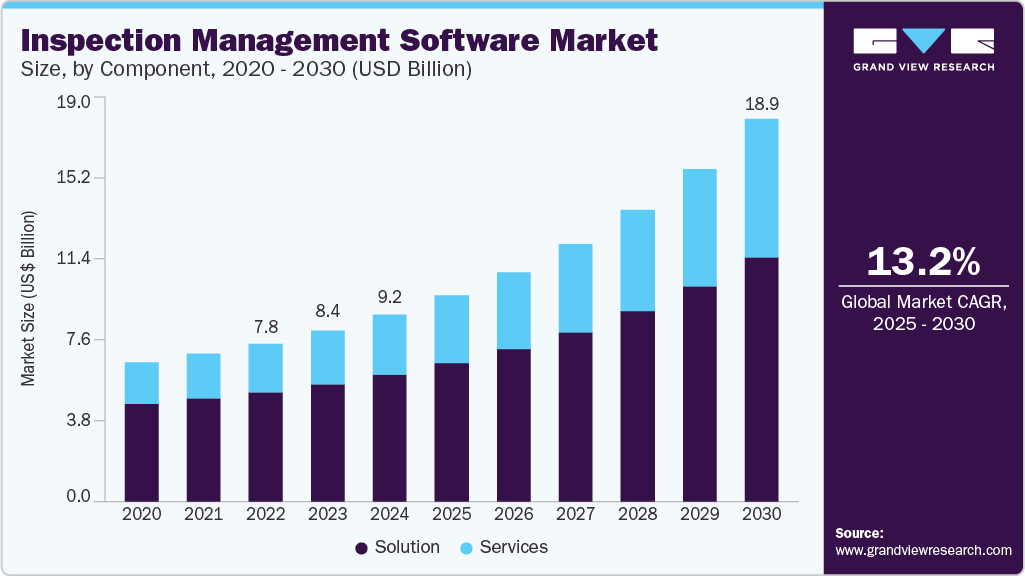

The global inspection management software market size was estimated at USD 9.20 billion in 2024 and is expected to reach USD 18.86 billion by 2030, growing at a CAGR of 13.2% from 2025 to 2030. The adoption of mobile and cloud-based inspection platforms is driving the growth.

Key Market Trends & Insights

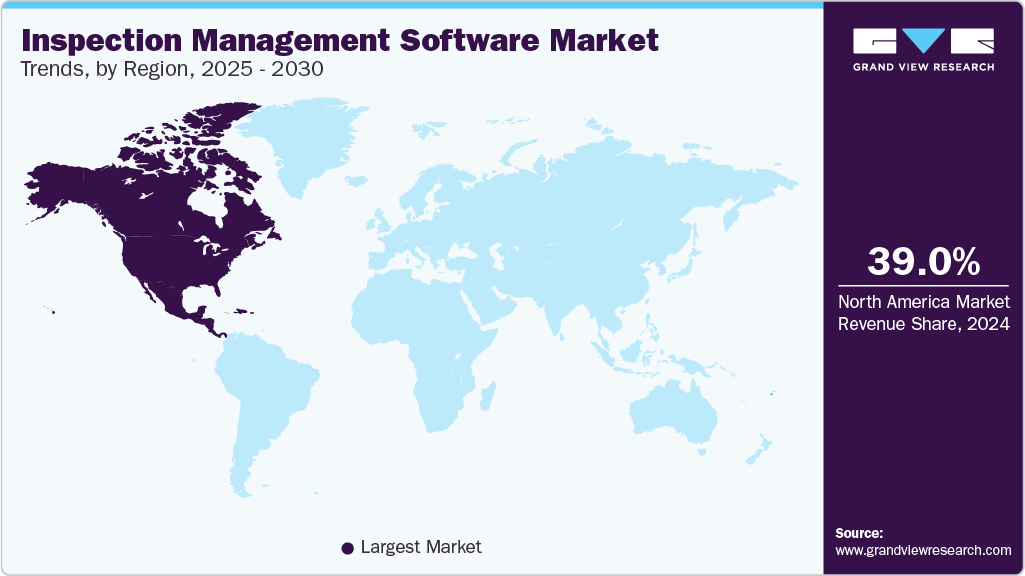

- North America inspection management software industry held the major share of over 39.0% in 2024.

- The inspection management software market in the U.S. is projected to grow during the forecast period.

- In terms of component, the solution segment accounted for the largest market share of over 67.0% in 2024.

- In terms of deployment type, the on-premises segment accounted for a revenue share of over 55.0% in 2024.

- In terms of enterprise size, the large enterprises segment accounted for a revenue share of over 66.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 9.20 Billion

- 2030 Projected Market Size: USD 18.86 Billion

- CAGR (2025-2030): 13.2%

- North America: Largest market in 2024

Modern inspection management solutions offer field inspectors the ability to capture data on mobile devices, even in remote locations, and synchronize it with cloud systems for centralized analysis. This mobile-first approach is especially valuable for industries with dispersed assets or field operations, such as utilities and logistics. Cloud-based platforms also offer scalability, ease of deployment, and integration with other enterprise systems like ERP and EAM software, which increases their appeal to businesses seeking digital agility.The rise of Industry 4.0 and smart manufacturing initiatives is further accelerating the adoption of digital inspection tools. Manufacturers are increasingly investing in automation, real-time monitoring, and interconnected systems to optimize productivity and minimize downtime. Inspection management software complements this transformation by providing real-time visibility into product quality, equipment condition, and compliance metrics. Integration with sensors, IoT devices, and manufacturing execution systems (MES) enables automated inspection data capture and analysis, reducing reliance on manual checks and enabling predictive quality control.

Increasing volume of audits and third-party assessments across regulated industries is driving market growth. Whether certification bodies conduct internal audits or compliance audits, businesses are under constant scrutiny to demonstrate traceability, data accuracy, and corrective actions. Inspection software facilitates audit readiness by maintaining detailed digital records, providing instant access to inspection histories, and ensuring that all processes are documented and standardized. This not only simplifies audits but also strengthens transparency and trust among stakeholders.

Additionally, there is growing pressure on companies to digitally standardize and harmonize inspection processes across different departments, plants, and subsidiaries. Inconsistent practices can lead to gaps in compliance, increased operational risk, and inefficient communication. Inspection management software provides customizable checklists, templates, and automated workflows, allowing organizations to enforce uniform standards and practices company-wide. This standardization ensures consistency, improves training and onboarding for new inspectors, and facilitates benchmarking across business units.

Furthermore, customer expectations for high-quality, defect-free products are at an all-time high, particularly in consumer-facing industries like electronics, automotive, and food & beverage. Any lapse in product quality or safety can result in recalls, reputational damage, and financial loss. Inspection management software supports quality assurance programs by enabling real-time defect detection, root cause analysis, and corrective action tracking. As customer scrutiny intensifies and product complexity increases, these tools become essential for delivering reliable, high-quality outputs consistently.

Component Insights

The solution segment accounted for the largest market share of over 67.0% in 2024. The increasing emphasis on mobile-first and cloud-enabled solutions has further boosted the demand for advanced inspection software. Solutions that support mobile data entry and cloud synchronization allow field inspectors to capture information in real time, even from remote or hazardous locations. This improves data accuracy, reduces time lags, and ensures central visibility for supervisory teams. As more organizations embrace hybrid work environments and geographically dispersed operations, mobile-capable inspection solutions have become critical tools for maintaining oversight and responsiveness.

The services segment is anticipated to grow at the fastest CAGR during the forecast period. The growing popularity of Software-as-a-Service (SaaS) delivery models is driving segment growth. Many organizations are opting for subscription-based platforms that bundle software and services into a single package. In these cases, vendors or third-party partners provide not only the technology but also end-to-end support, including data migration, onboarding, and user assistance. This arrangement lowers the barrier to entry for small and mid-sized companies that may not have dedicated IT departments, while also offering large enterprises the flexibility to outsource software management functions.

Deployment Type Insights

The on-premises segment dominated the market and accounted for a revenue share of over 55.0% in 2024. The long-term cost predictability associated with on-premises deployments is also a compelling driver for some organizations. Although the initial capital investment may be higher due to hardware and setup costs, on-premises solutions often eliminate recurring subscription fees tied to cloud-based models. For organizations planning to use the software over a long horizon or with a large user base, owning the infrastructure can prove cost-effective in the long run, especially if the internal IT team can manage and maintain the system efficiently.

The cloud segment is expected to register the fastest CAGR from 2025 to 2030. Cloud-based inspection management software also supports improved collaboration and centralized data management. By consolidating inspection data on a unified platform, organizations can break down silos between teams and locations. This fosters better communication, shared insights, and consistent inspection practices. Supervisors, quality managers, and auditors can access the same real-time data, generate consolidated reports, and track performance trends from a single dashboard, enhancing decision-making and quality control.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for a revenue share of over 66.0% in 2024 in the inspection management software industry. The growing use of advanced technologies such as IoT, AI, and machine learning is also influencing large enterprises to adopt inspection management platforms capable of integrating with these innovations. Many modern inspection solutions support connectivity with IoT-enabled devices and sensors that collect real-time data from equipment, production lines, and infrastructure. This data can feed into AI-powered analytics engines to identify anomalies, predict failures, and recommend preventive actions. Large enterprises, especially in industries such as oil & gas, manufacturing, and utilities, are leveraging these capabilities to move toward predictive maintenance and smarter asset inspections.

The small and medium enterprises (SMEs) segment is expected to register the fastest CAGR from 2025 to 2030. The increasing adoption of mobile technology and remote work capabilities has made inspection software more attractive to SMEs. Mobile-friendly platforms enable field teams to perform inspections using smartphones or tablets, even in remote or off-site locations. This mobility is especially beneficial for construction firms, equipment service providers, or field-based operations, where on-the-go access to inspection forms, images, and updates is essential. SMEs can use these capabilities to improve response times, maintain service quality, and reduce paperwork.

Features Insights

The real-time reporting segment dominated the market and accounted for a revenue share of over 45.0% in 2024 in the inspection management software industry. The demand for improved collaboration and communication also contributes to the rise of real-time reporting in inspection management. In large organizations or across distributed teams, having a centralized platform that provides real-time access to inspection results ensures that all stakeholders, whether they are on the shop floor, in the field, or in a remote office, are on the same page. This level of transparency improves collaboration, as different teams, such as quality control, safety, and operations, can quickly share insights and coordinate responses to identified issues. It also ensures that management is constantly updated on key performance indicators (KPIs) and operational metrics, facilitating better strategic alignment across departments.

The automated workflows segment is expected to register the fastest CAGR from 2025 to 2030. The demand for improved compliance and audit readiness is another major driver behind the growth of automated workflows in inspection management. Industries that are subject to strict regulatory standards, such as food safety, pharmaceuticals, or oil and gas, must ensure that inspections are consistently performed, documented, and tracked. Automated workflows can ensure that these inspections follow exact procedures and are documented in compliance with industry regulations. The automation of this process also ensures that all required actions are taken within the required timeframes, reducing the risk of non-compliance and associated penalties. Moreover, automated reports provide an easy-to-access digital trail of all inspections, which is crucial during audits or regulatory inspections.

End Use Insights

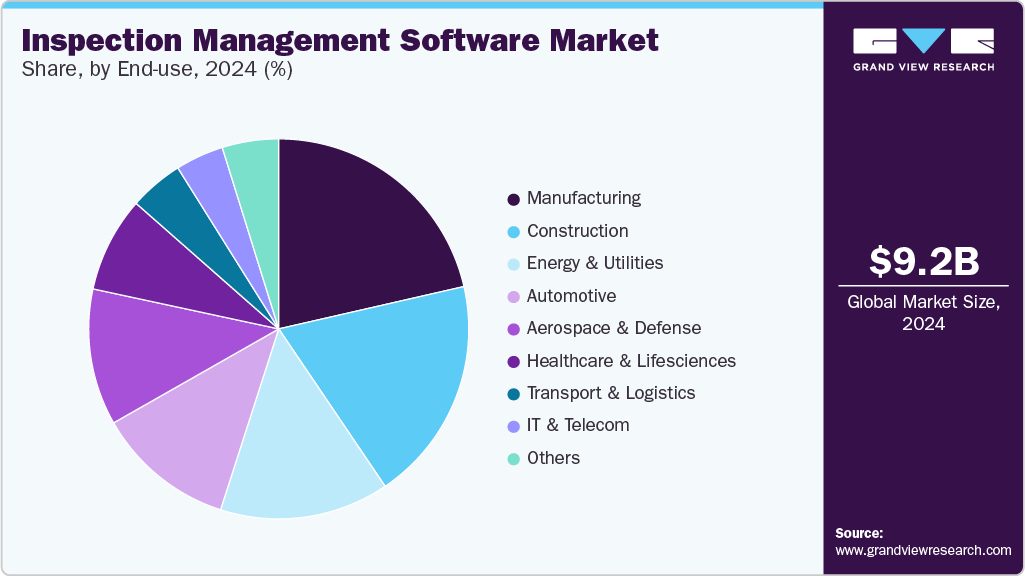

The manufacturing segment accounted for the largest market share of over 21.0% in 2024 in the inspection management software industry. The rise of Industry 4.0 and the increasing use of smart manufacturing technologies also serve as a major driver for the growth of inspection management software in the manufacturing sector. The integration of Internet of Things (IoT) sensors, connected machines, and advanced analytics into manufacturing processes has revolutionized the way inspections are performed. IoT-enabled devices can monitor equipment conditions in real-time and automatically trigger inspections when certain thresholds or anomalies are detected. Inspection management software integrates with these smart technologies, facilitating automated data collection and real-time reporting. This enables manufacturers to identify problems early and take corrective actions before they lead to costly downtime or production delays.

The construction segment is anticipated to register the fastest CAGR during the forecast period. The increasing use of mobile devices in the construction sector is fueling the demand for inspection management software. Construction teams, especially field inspectors, rely heavily on mobile devices to perform inspections, capture data, and communicate with other team members. Inspection management software that is mobile-friendly allows inspectors to access checklists, take photos, and record data directly on their devices, reducing the time spent on manual data entry and paperwork. Mobile-enabled inspection solutions also allow for better communication between on-site and off-site teams, as data can be instantly shared with project managers and other stakeholders, improving coordination and decision-making.

Regional Insights

North America inspection management software industry held the major share of over 39.0% in 2024. The adoption of digital transformation and the increasing shift toward automation in industries across North America are driving market growth. Many businesses in the region are modernizing their operations by replacing manual inspection processes with digital solutions. Traditional inspection methods often rely on paper-based forms, which can be prone to errors, delays, and data loss. Inspection management software offers an efficient way to automate the entire inspection process, from scheduling and tracking to data collection and reporting. By digitizing inspections, organizations can improve data accuracy, eliminate paperwork, and reduce the time spent on manual tasks, leading to higher productivity and reduced operational costs. This trend toward automation is accelerating the adoption of inspection management software in various sectors, including manufacturing, construction, and energy.

U.S. Inspection Management Software Market Trends

The inspection management software market in the U.S. is projected to grow during the forecast period. The growing importance of predictive maintenance is contributing to the increasing use of inspection management software in the U.S. Industries such as manufacturing, energy, and transportation are investing heavily in predictive maintenance solutions to reduce downtime, extend the lifespan of equipment, and minimize repair costs. Inspection management software that integrates with IoT devices, sensors, and AI can help monitor the condition of machinery and infrastructure in real-time. This allows for predictive inspections based on data collected from equipment, which can identify potential issues before they lead to failures. By adopting predictive maintenance strategies, companies can optimize their asset management, reduce unplanned maintenance costs, and ensure that equipment operates at peak efficiency.

Europe Inspection Management Software Market Trends

The inspection management software market in Europe is expected to register a CAGR of 13.4% during the forecast period. The growing need for digital documentation is another driver for the inspection management software market in Europe. As industries become more digitized, there is an increasing demand for electronic documentation to replace paper-based systems. In sectors like healthcare, construction, and manufacturing, paper-based inspection records can be cumbersome, difficult to manage, and prone to errors or loss. Digital documentation enables organizations to store inspection data securely, access it easily, and ensure that records are accurate and up to date. By providing a centralized, digital system for inspections, inspection management software helps companies maintain detailed, organized records that are easy to retrieve during audits or regulatory inspections. This shift toward digital documentation is particularly valuable in industries where traceability and transparency are essential for compliance and quality assurance.

Germany inspection management software industry is expected to grow during the forecast period. The growing investment in smart infrastructure and construction projects is another important factor. Germany is modernizing its transportation, energy, and public infrastructure, and these projects demand strict adherence to safety and quality standards. Inspection management software enables engineers, contractors, and regulators to monitor compliance throughout construction lifecycles. With cloud-based platforms, inspections can be conducted and documented in real time on-site, improving transparency, accountability, and communication across stakeholders. This trend is particularly evident in the push for energy-efficient buildings and infrastructure upgrades aligned with Germany’s climate goals and EU Green Deal targets.

Asia Pacific Inspection Management Software Market Trends

The inspection management software market in Asia Pacific is expected to register the fastest CAGR of 15.0% from 2025 to 2030. The expansion of large infrastructure and urban development projects across the region is fueling the need for comprehensive inspection solutions. Nations like India, Indonesia, and Vietnam are investing heavily in construction, transportation, and smart city projects, which require continuous safety and quality inspections. Inspection management software supports these projects by providing digital tools for site inspections, project monitoring, and incident tracking. This enhances coordination among stakeholders, ensures regulatory compliance, and accelerates project delivery timelines, making such software an essential component in infrastructure development.

China inspection management software industry is projected to grow during the forecast period. The growth of the export-oriented manufacturing base also accelerates adoption. Chinese manufacturers serving overseas markets must adhere to complex and varying compliance standards depending on the destination country. Inspection management software provides flexibility to customize inspection protocols for different standards, ensuring smooth certification processes and fewer rejected shipments. This adaptability is especially important as trade partners increasingly demand transparency and traceability across the entire production and supply chain.

Key Inspection Management Software Companies Insights

Key players operating in the inspection management software market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Inspection Management Software Companies:

The following are the leading companies in the inspection management software market. These companies collectively hold the largest market share and dictate industry trends.

- Dassault Systèmes SE

- Hexagon AB

- Oracle Corporation

- Wolters Kluwer N.V.

- Autodesk Inc.

- Ideagen PLC

- Zoho Corporation Pvt. Ltd.

- Intelex Technologies Inc.

- ComplianceQuest

- Penta Technologies, Inc.

- SafetyCulture

- InspectAll

- Benchmark ESG

- TIC Systems

- Inspection Express

Recent Developments

-

In April 2025, Navarik, a division of Vela Software Group, acquired TIC Systems. The flagship product of TIC Systems, the Inspection Management System (IMS), is built to enhance inspection workflows by centralizing key functions such as inspection reporting, lab test results, billing, and invoicing. This strategic acquisition strengthens Navarik’s position in the commodity trading sector. It paves the way for innovation and continuous improvement in testing, inspection, and certification, ultimately delivering long-term value to customers.

-

In November 2023, Inspection Express, a provider of inspection management software, partnered with Console Cloud, a cloud-based property management solutions provider, to deliver a fully integrated experience for real estate professionals. This collaboration enhances inspection workflows by enabling greater efficiency, accuracy, and real-time collaboration. The partnership highlights both companies' dedication to innovation and their shared commitment to providing exceptional value to clients.

Inspection Management Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.16 billion

Revenue forecast in 2030

USD 18.86 billion

Growth rate

CAGR of 13.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment type, enterprise size, features, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Dassault Systèmes SE; Hexagon AB; Oracle Corporation; Wolters Kluwer N.V.; Autodesk Inc.; Ideagen PLC; Zoho Corporation Pvt. Ltd.; Intelex Technologies Inc.; ComplianceQuest; Penta Technologies, Inc.; SafetyCulture; InspectAll; Benchmark ESG; TIC Systems; Inspection Express

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inspection Management Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inspection management software market report based on component, deployment type, features, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Features Outlook (Revenue, USD Billion, 2018 - 2030)

-

Real-Time Reporting

-

Automated Workflows

-

Integration Capabilities

-

Mobile Accessibility

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Manufacturing

-

Energy and Utilities

-

Transport and Logistics

-

Aerospace and Defense

-

Construction

-

IT and Telecom

-

Healthcare and Lifesciences

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inspection management software market size was estimated at USD 9.20 billion in 2024 and is expected to reach USD 10.16 billion in 2025.

b. The global inspection management software market is expected to grow at a compound annual growth rate of 13.2% from 2025 to 2030 to reach USD 18.86 billion by 2030.

b. The solution segment accounted for the largest market share of over 67.0% in 2024 in the inspection management software market. The increasing emphasis on mobile-first and cloud-enabled solutions has further boosted the demand for advanced inspection software.

b. Dassault Systèmes SE, Hexagon AB, Oracle Corporation, Wolters Kluwer N.V., Autodesk Inc., Ideagen PLC, Zoho Corporation Pvt. Ltd., Intelex Technologies Inc., ComplianceQuest, Penta Technologies, Inc., SafetyCulture, InspectAll, Benchmark ESG, TIC Systems, Inspection Express

b. Factors such the adoption of mobile and cloud-based inspection platforms and increasing volume of audits and third-party assessments across regulated industries are anticipated to accelerate the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.