- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Insulated Glass Market Size & Share, Industry Report, 2030GVR Report cover

![Insulated Glass Market Size, Share & Trends Report]()

Insulated Glass Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Residential Buildings, Commercial Buildings, Automotive), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-1-68038-319-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Insulated Glass Market Summary

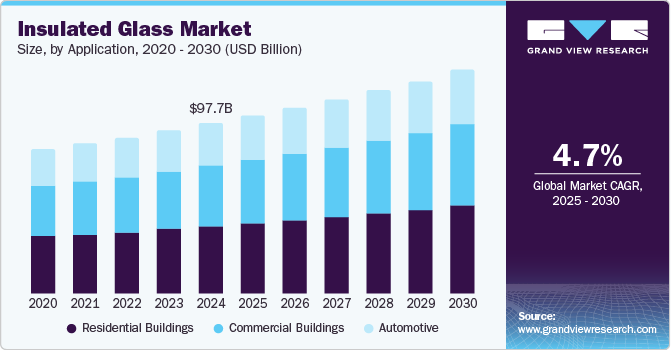

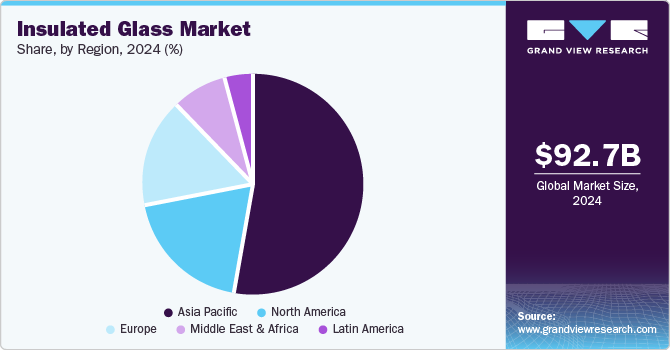

The global insulated glass market size was valued at USD 92.71 billion in 2024 and is projected to reach USD 121.7 billion by 2030, growing at a CAGR of 4.7% from 2025 to 2030. Government regulations and incentives drive market growth worldwide.

Key Market Trends & Insights

- Asia Pacific insulated glass market dominated the global market and accounted for the largest revenue share of 52.9% in 2024.

- The insulated glass market in China dominated the Asia Pacific insulated glass market with a share in 2024.

- By application, the residential buildings dominated the global insulated glass market and accounted for the largest revenue share of 54.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 92.71 Billion

- 2030 Projected Market Size: USD 121.7 Billion

- CAGR (2025-2030): 4.7%

- Asia Pacific: Largest market in 2024

Regulatory requirements for higher thermal insulation standards make insulated glass a crucial component for compliance, driving growth in energy-efficient building solutions. The rising awareness of environmental sustainability has prompted both consumers and builders to seek eco-friendly building materials. Insulated glass contributes to reducing carbon footprints by improving energy efficiency, making it a preferred choice in new constructions and renovations. Moreover, innovations in glass manufacturing and technology, such as the development of smart glass and improved acoustic insulation features, enhance insulated glass products' performance.

The increasing demand for energy-efficient building materials is also driven by urbanization and construction activities. Rapid urbanization and a boom in construction activities, especially in emerging economies, drive the demand for insulated glass. As cities expand, the need for energy-efficient building materials becomes more pronounced. Furthermore, the growing need for acoustic insulation also contributes to the demand for insulated glass, effectively reducing sound transmission.

The market growth in residential and commercial sectors is also a significant driver of the insulated glass market. Both sectors are witnessing a surge in demand for insulated glass due to ongoing construction projects and renovations aimed at improving energy efficiency and comfort levels within buildings. Government initiatives promoting energy conservation, such as the European Union’s “Renovation Wave” initiative and tax incentives in the U.S., are also contributing to the growth of the insulated glass market. As countries invest in infrastructure development, insulating glass becomes a vital solution for creating sustainable and efficient structures.

Application Insights

Residential buildings dominated the global insulated glass market and accounted for the largest revenue share of 54.8% in 2024, driven by the escalating demand for energy-efficient buildings. Homeowners seek to reduce energy costs and enhance comfort, making insulated glass a crucial component for minimizing heat transfer and improving thermal insulation. Government regulations, eco-friendly practices, and environmental awareness further fuel demand.

Commercial buildings are expected to register the fastest CAGR of 5.1% over the forecast period, owing to the demand for energy-efficient and sustainable buildings. Building owners and developers seek to reduce operating expenditures and enhance occupant comfort, making insulated glass a crucial component for thermal insulation and energy efficiency. Stringent building codes and green certifications further boost adoption.

Regional Insights

Asia Pacific insulated glass market dominated the global market and accounted for the largest revenue share of 52.9% in 2024. The region’s dominance is attributable to rapid urbanization, infrastructure development, and government initiatives promoting green building practices in countries such as China, India, and Japan. Growing economies, globalization, and liberalization reforms drive investment in infrastructure and energy-efficient materials, making insulated glass a preferred choice for residential and commercial applications.

China Insulated Glass Market Trends

The insulated glass market in China dominated the Asia Pacific insulated glass market with a share in 2024. The growing middle class, increasing disposable incomes, and strict energy regulations fuel demand for energy-efficient building materials. China’s recognized manufacturing base and global sustainability goals, including the UN’s 2050 zero carbon emission target, position the country as a key player in the market.

Europe Insulated Glass Market Trends

The European insulated glass market is expected to grow at a CAGR of 4.1% over the forecast period and is identified as a lucrative region in this industry. Insulated glass solutions effectively reduce heat transfer between interior and exterior building spaces, enhancing thermal comfort and energy efficiency. In response to the Russia-Ukraine conflict, European countries are seeking alternative energy sources, and insulated glass is playing a crucial role in reducing household energy consumption, thereby mitigating reliance on gas imports.

The insulated glass market in Germany is poised for significant growth over the forecast period, aided by the increasing demand for eco-friendly buildings and the government’s initiatives to reduce carbon emissions. Energy-efficient insulated glass minimizes heat transfer, meeting energy-saving goals. Smart glass technologies, improved acoustic insulation advancements, and a sustainability focus drive adoption.

North America Insulated Glass Market Trends

North America's insulated glass market held a significant share in the global market in 2024. Factors driving market growth in the region include increasing energy efficiency regulations, sustainable construction practices, and government initiatives promoting green building standards. The growing construction industry and residential/commercial projects also fuel demand. Favorable government initiatives and investments in sustainable growth and energy conservation further enhance the adoption of insulated glass solutions, solidifying North America’s leadership position in the market.

The insulated glass market in the U.S. is expected to grow significantly over the forecast period, driven by growing demand for energy-efficient buildings, strict building codes, and high energy costs. Smart glass and acoustic insulation developments, combined with environmental awareness and sustainability initiatives, position the U.S. market as a global leader in the insulated glass industry.

Key Insulated Glass Company Insights

Some of the key companies in the Insulated glass market include AGC Inc.; Central Glass Co., Ltd.; Glas Trösch Holding AG (Euroglas); fuyaogroup.com; and Glaston Corporation; among others. Key players in the insulated glass market are leveraging strategic initiatives such as mergers, acquisitions, and partnerships to expand their customer base.

-

AGC Inc. provides innovative solutions for energy efficiency and sustainability in construction, automotive, and electronics. Known for its advanced glass production technologies, AGC focuses on vacuum insulated glass, offering superior thermal insulation. Through research and development, strategic partnerships, and acquisitions, AGC establishes a strong global presence in eco-friendly building materials.

-

Nippon Sheet Glass Co., Ltd is a manufacturer of glass products for architectural, automotive, and technical applications. Well-known for high-quality insulated glass units, the company prioritizes innovation and sustainability through significant research and development investments. With a global presence in Asia, Europe, and North America, Nippon Sheet Glass is a key player in the insulated glass industry.

Key Insulated Glass Companies:

The following are the leading companies in the insulated glass market. These companies collectively hold the largest market share and dictate industry trends.

- AGC Inc.

- Central Glass Co., Ltd.

- Glas Trösch Holding AG (Euroglas)

- fuyaogroup.com

- Glaston Corporation

- Guardian Industries Holdings Site

- Nippon Sheet Glass Co., Ltd

- Compagnie de Saint-Gobain

- Şişecam

- Viracon

- Vitro

- Xinyi Glass Holdings Limited

Recent Developments

-

In September 2024, Vitro Architectural Glass’s VacuMax Vacuum Insulating Glass (VIG) received the 2024 Best of Products Award from The Architect’s Newspaper for its innovation, aesthetics, performance, and value.

-

In April 2024, AGC Inc. acquired its first EPD for domestically manufactured and sold architectural glass at its Kashima plant, marking a significant milestone.

-

In March 2024, Şişecam announced the completion of its largest glass production complex in Eskişehir, Turkey, with a consolidated capacity of approximately 1 million tons, following investments of USD 174 million.

Insulated Glass Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.87 billion

Revenue forecast in 2030

USD 121.7 billion

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa.

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

AGC Inc.; Central Glass Co., Ltd.; Glas Trösch Holding AG (Euroglas); fuyaogroup.com; Glaston Corporation; Guardian Industries Holdings Site; Nippon Sheet Glass Co., Ltd; Compagnie de Saint-Gobain; Şişecam; Viracon; Vitro; Xinyi Glass Holdings Limited

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulated Glass Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global insulated glass market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential Buildings

-

Commercial Buildings

-

Automotive

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Russia

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.