- Home

- »

- Medical Devices

- »

-

Insulin Delivery Devices Market Size & Share Report, 2030GVR Report cover

![Insulin Delivery Devices Market Size, Share & Trends Report]()

Insulin Delivery Devices Market Size, Share & Trends Analysis Report By Product (Insulin Syringes, Insulin Pens, Insulin Pumps, Insulin Injectors), By End Use (Hospitals, Homecare), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-991-3

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry: Healthcare

Report Overview

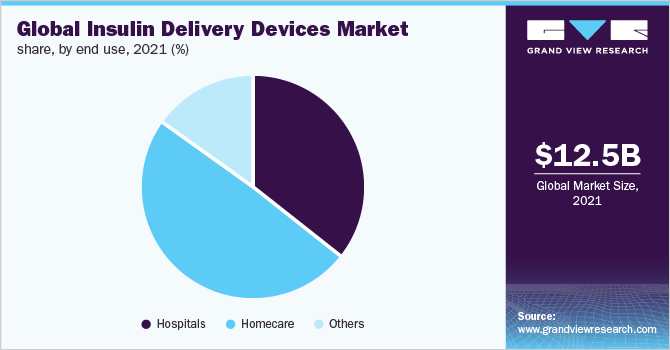

The global insulin delivery devices market size was valued at USD 12.5 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030. Insulin delivery devices including syringes, pens, pumps, and jet injectors are used to deliver insulin to diabetic patients. One of the foremost factors contributing to the growth of the market is the surging number of diabetics due to aging, obesity, and unhealthy lifestyles. Obesity is believed to be a major factor leading to the development of diabetes in individuals. According to the WHO, in 2014, over 1.9 billion people were identified to be overweight, of which, around 600 million people were obese.

Risk factors, such as obesity and being overweight are highly linked to the incidence of diabetes, which is rising by epidemic proportions, thus rendering a high prevalence of diabetes. Consequently, the large population afflicted with diabetes is driving the market for insulin delivery devices. In addition, the high demand for advanced insulin delivery devices is supporting the adoption of recently launched innovative pen devices and portable pumps, which is estimated to boost the market growth. However, stringent government rules and regulations governing the product approval process and the high cost of insulin analogs in diabetes care management could hinder the market growth.

The outbreak of COVID-19 led to dramatic turmoil in the market for insulin delivery devices. Nearly 40% of the global Covid 19 facilities reported the admissions of people with diabetes. However, ~45% of those patients, didn’t receive routine medical care due to the fear of the virus spreading. One in every 5 patients, experienced the reduced availability of blood glucose monitoring devices and ~20% experienced the delaying of refilling of insulin pumps, mainly due to financial constraints. Disruption in the supply chain due to closure of manufacturing sites, shipping delays or shutdowns, and trade limitations or export bans on life-saving drugs such as Insulin.

China imposed a ban on life-saving drugs to export in the U.S., in March 2020. This led to the reduction in raw material supply for the manufacturing of insulin in the U.S. On the other hand, the market players like Eli Lilly, Sanofi, and Novo Nordisk, disapproved the shortage claims and fulfilled the market needs, by increasing manufacturing levels. But, the lack of reimbursement from the government, insurance losses, economic setbacks experienced by buyers, and the high cost of insulin, have led to the decline in the market for insulin delivery devices. It is said to grow at a steady rate by mid-2022.

Product Insights

The insulin pens segment held the largest revenue share of 36.5% in 2021 owing to its advantages over other products. Factors such as its high adoption rate, user-friendly design, and rising popularity among consumers contributed to the largest revenue share of this segment. The growing focus of manufacturers on promoting innovation and advancements is another major factor yielding the high share. For instance, in January 2014, Novo Nordisk launched a new device, NovoPen Echo in the U.S. This is the first device of its kind, available in the U.S., with a memory function and half-unit dosage features. Thus, product advancements are expected to propel the demand for insulin pens in the near future.

End-use Insights

The home care segment dominated the insulin delivery devices market and accounted for the largest revenue share of 48.9% in 2021. It is anticipated that the home care segment will maintain its position in the market for insulin delivery devices during the forecast period. The key factors resulting in significant growth of the segment are increasing awareness of diabetes care and the growing adoption of insulin delivery devices amongst patients for home use.

The use of insulin devices at home saves on visiting costs, hospital or clinic fees, and waiting time. The advanced devices, including pumps, pens, and injectors, are small in size, highly portable, and can be used anywhere at any time. Thus, greater access to these devices and their higher user-friendliness has made insulin users opt for self-care diabetes management options.

Regional Insights

North America dominated the market for insulin delivery devices and accounted for the largest revenue share of 37.5% in 2021. The rising diabetic population and the accessibility of technologically advanced devices are the factors contributing to the high market growth in North America. According to statistics by the CDC in 2016, around 29 million people in the U.S. are still suffering from diabetes, among them 21.0 million patients were diagnosed, whereas 8.1 million patients remained undiagnosed. Also, according to the Canadian Diabetes Association, the prevalence of diabetes is growing in Canada and it is estimated to reach around 5 million by 2025. Thus, the large patient base suffering from diabetes and its growing prevalence is expected to boost the growth in this region.

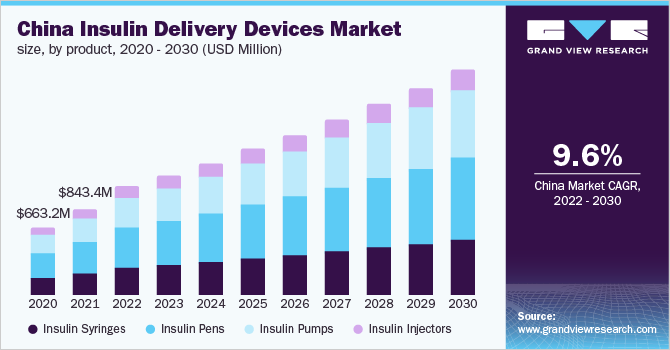

In Asia Pacific, the market for insulin delivery devices is expected to grow fast over the forecast period. Developing economies, such as China and India, are expected to witness the highest growth during the study period due to the presence of a large population base suffering from diabetes and its rising awareness amongst individuals. In addition, global vendors are expanding their business in Asia Pacific and providing high-end products for diabetes care, which is the major factor contributing to the growth.

Key Companies & Market Share Insights

The market for insulin delivery devices is ruled by three major players, namely, Novo Nordisk, Eli Lilly, and Sanofi. These leaders are constantly adopting developmental strategies such as collaborations, acquisitions, partnerships, mergers, marketing agreements, and new product launches to strengthen their portfolios. For instance, Eli Lilly developed a biosimilar version of insulin glargine, Rezvoglar KwikPen, that received FDA approval in December 2021. Also, in November 2021, Sanofi partnered with Roche, to increase the adoption of disposable insulin pens. Further, these players are collaborating with local players to improve their market reach. Some of the prominent players in the insulin delivery devices market include:

-

Novo Nordisk A/S

-

Sanofi

-

Eli Lilly and Company

-

Biocon Ltd.

-

Ypsomed AG

-

Wockhardt Ltd.

-

Medtronic

-

Abbott Laboratories

-

F. Hoffmann-La Roche, Ltd.

Recent Developments

-

In 2023, Novo Nordisk entered negotiations of acquiring BIOCORP, which specialized in the design and development of medical devices. This was done for the development of FlexTouch Pen with Mallya, an add-on Bluetooth device.

-

In 2023, Lilly and IABL, the largest healthcare provider collaborated to provide high-quality and affordable insulin in Bangladesh.

-

In 2022, Medtronic, a global leader, launched the world’s first infusion set for insulin pumps labeled for up to 7-day wear. It reduces insulin loss, maintains the flow and provides stability to the wear time.

-

In 2021, Lilly collaborated with several technological companies internationally to provide connected insulin pen solutions for diabetic patients.

-

In 2021, Biocon and Viatris announced the launch of SEMGLEE®, an insulin injection to help control high blood sugar in adult and pediatric patients with type 1 diabetes and adults with type 2 diabetes.

Insulin Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 15.6 billion

Revenue forecast in 2030

USD 27.7 billion

Growth Rate

CAGR of 7.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Brazil; Mexico; South Africa

Key companies profiled

Novo Nordisk A/S; Sanofi; Eli Lilly and Company; Biocon Ltd.; Ypsomed AG; Wockhardt Ltd.; Medtronic; Abbott Laboratories; F. Hoffmann-La Roche, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulin delivery devices market based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulin syringes

-

Insulin pens

-

Insulin pumps

-

Insulin injectors

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global insulin delivery devices market size was estimated at USD 12.5 billion in 2021 and is expected to reach USD 15.6 billion in 2022.

b. The global insulin delivery devices market is expected to grow at a compound annual growth rate of 7.4% from 2022 to 2030 to reach USD 27.7 billion by 2030.

b. North America dominated the insulin delivery devices market with a share of 37.5% in 2021. This is attributable to the rising diabetic population and the accessibility of technologically advanced devices.

b. Some key players operating in the insulin delivery devices market include Novo Nordisk A/S, Sanofi, Eli Lilly and Company, Biocon Ltd., Ypsomed AG, Wockhardt Ltd, Medtronic, Abbott Laboratories, F. Hoffmann-La Roche, Ltd.

b. Key factors that are driving the insulin delivery devices market growth include to surging number of diabetics due to aging, obesity, and unhealthy lifestyles

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."