- Home

- »

- Medical Devices

- »

-

Insulin Patch Pumps Market Size And Share Report, 2030GVR Report cover

![Insulin Patch Pumps Market Size, Share & Trends Report]()

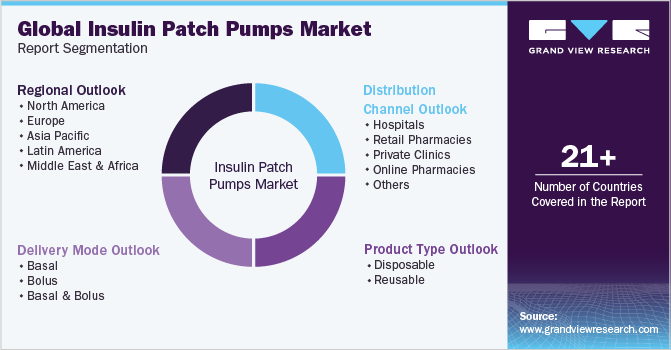

Insulin Patch Pumps Market Size, Share & Trends Analysis Report By Delivery Mode (Basal, Bolus, Basal & Bolus), By Product Type (Disposable, Reusable), By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-171-9

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global insulin patch pumps market size was estimated at USD 912.5 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.9% from 2023 to 2030. The high growth can primarily be attributed to factors such as technological advancements, the rising prevalence of diabetes, and increasing awareness regarding advanced patch pumps. For instance, according to the International Diabetes Federation, approximately 537 million adults were living with diabetes in 2022 and this number is expected to reach 643 million by 2030. Insulin patch pumps are the preferred choice among individuals with type 1 diabetes due to the absence of an insulin infusion set requirement. This convenience factor makes them particularly popular among older individuals and working people.

Insulin patch pumps are efficient devices as they are smaller than conventional insulin pumps, more discrete, and easier to use. These pumps are more affordable compared to conventional ones, which eventually generates more demand. Patch pumps are attached to the skin using an adhesive layer and due to the advanced technology, they require minimum monitoring. Typically, these pumps are seamlessly integrated with blood glucose or continuous glucose monitoring systems.

Technological advancements and the use of artificial intelligence in this field are expected to play a significant role in replacing traditional vial-syringe combinations. The increasing frequency of product launches along with collaborations between major market players and technology developers is also expected to boost the market competition. For instance, Tandem Diabetes Care is developing a t:sport insulin pump, which will be half the size of its t:slim X2. The availability of custom-made patch pumps is expected to increase the popularity of these devices during the forecast period. The discrete nature of the devices is one of the major factors increasing their adoption in the younger population.

The increasing prevalence of diabetes worldwide is expected to present lucrative opportunities for advanced diabetes management devices, including patch pumps. According to the International Diabetes Federation, the global diabetic population is expected to reach 783,700 by 2045, which includes a significant number of older people. The same source states that about 6 million Americans use insulin to help control their diabetes.

The COVID-19 pandemic has raised the risk of infection, serious consequences (such as kidney disease and ischemic heart disease), and mortality in populations with diabetes. However, one in five patients had difficulty finding blood glucose monitoring devices, and 20.0% had difficulty getting their insulin pumps filled on time, primarily because of financial limitations. Furthermore, there was a disruption in the supply chain due to the closure of manufacturing sites, shipping delays or shutdowns, and trade limitations or export bans on life-saving drugs such as insulin.

Product Type Insights

Based on product type, the insulin patch pumps market is segmented into disposable pumps and reusable pumps. The reusable insulin patch pump segment dominated the market in 2022 with a revenue share of 64.4% and is expected to maintain its dominance over the forecast period. This can be attributed to the increased adoption of these pumps and the high frequency of product launches.

Disposable insulin pumps are mechanical pumps and are also called simplified devices. The majority of these types of patch pumps have some disposable parts, while others are completely disposable. Currently, V-Go by Valeritas and PAQ by Ceour dominate the market as they have a strong presence in the U.S. as well as Europe. Such patch pumps provide consistent and adjustable insulin delivery, with fewer insulin injections.

Delivery Mode Insight

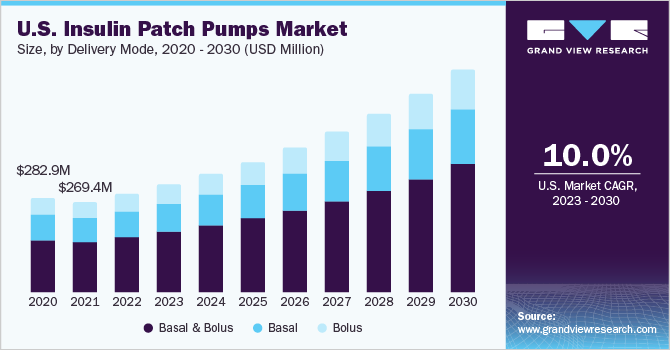

Based on delivery mode, the market is segmented into basal, bolus, and basal and bolus. The basal and bolus segment dominated the market in 2022 with a share of 56.2% and is expected to retain its position over the forecast period owing to the advanced features and the availability of a wide variety of products. Basal and bolus therapy helps normalize blood sugar levels without increasing the risk of hypoglycemia. Moreover, basal and bolus therapy includes an injection after each meal, which emulates the activity of the healthy pancreas. In addition, these therapies are used by both type 1 and type 2 diabetes patients, hence dominating the market. Based on the delivery mode, the market is segmented into basal, bolus, and basal and bolus.

The basal segment captured a significant share in 2022 and is anticipated to grow at a rapid pace over the forecast period. This high growth rate can primarily be attributed to increased adoption among type 1 diabetes patients. Basal insulin pump therapy acts on a slow-release mechanism, which is important for managing type 1 diabetes. All types of basal insulins are long-acting and mimic the natural function of the pancreas.

Distribution Channel Insights

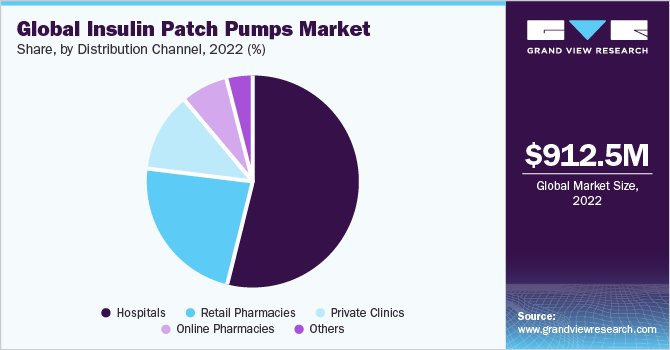

Based on distribution channel, the market is segmented into hospitals, retail pharmacies, private clinics, online pharmacies, and others. The hospital segment dominated the market in 2022 with a share of 53.7% owing to factors such as the increasing number of specialty hospital pharmacies and the expansion of the integrated delivery network.

Most first-time patch pump users tend to buy these from hospital pharmacies. Considering the recent shift in trend from traditional to automated insulin delivery solutions, the hospital pharmacy segment is expected to witness significant growth over the forecast period.

Regional Insights

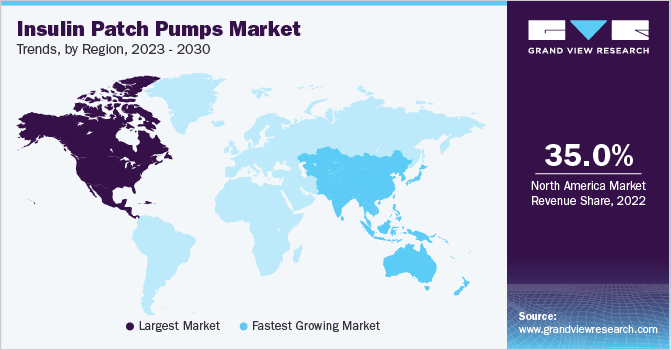

North America dominated the market with a revenue share of over 35.0% in 2022 owing to the availability of major brands of insulin patch pumps. Moreover, the rising frequency of Food and Drug Administration (FDA) approvals and increasing healthcare expenditure are aiding market growth in the region. For instance, in May 2023, The U.S. FDA approved the iLet Dosing Decision Software and the Beta Bionics iLet ACE Pump, intended for individuals six years of age and older who have type 1 diabetes.

Asia Pacific is expected to grow at the fastest CAGR over the forecast period due to factors such as the rapidly growing diabetic population and increasing awareness regarding advanced diabetes management solutions in the region. According to the International Diabetes Federation, India, and China account for the largest number of diabetes patients in the world. Most of the countries in this region are developing countries and the increase in obesity cases and growing socio-economic changes have fueled the occurrence of type I and type II diabetes. In addition, increasing product launches and technological advancements in the field of insulin patch pumps are expected to aid regional growth.

Key Companies & Market Share Insights

Key players focus on adopting new technologies, introducing advanced products, taking advantage of important cooperation activities, and exploring mergers & acquisitions to offer better services to their customers and strengthen their market presence. For instance, in May 2023, Medtronic plc finalized definitive agreements to proceed with the acquisition of EOFlow Co. Ltd., a producer of the EOPatch device. The EOPatch device represents a breakthrough in insulin delivery as it is a wearable, tubeless, and entirely disposable system. In November 2020, Terumo Corporation, a leading manufacturer of medical technology, received CE Mark for its MEDISAFE WITH insulin pump system. Some prominent players in the global insulin patch pumps market include:

-

Medtronic plc

-

F. Hoffmann-La Roche Ltd.

-

Insulet Corporation

-

CeQur

-

Terumo

-

Tandem Diabetes Care

-

Medtrum

-

Debiotech

Insulin Patch Pumps Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 998.6 million

Revenue forecast in 2030

USD 2,062.1 million

Growth rate

CAGR of 10.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, product type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Medtronic plc; F. Hoffmann-La Roche Ltd.; Insulet Corporation; CeQur; Terumo; Tandem Diabetes Care; Medtrum; Debiotech

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insulin Patch Pumps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global insulin patch pumps market report based on delivery mode, product type, distribution channel, and region:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Basal

-

Bolus

-

Basal & Bolus

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Retail Pharmacies

-

Private Clinics

-

Online Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global insulin patch pumps market size was estimated at USD 912.5 million in 2022 and is expected to reach USD 998.6 million in 2023.

b. The global insulin patch pumps market is expected to grow at a compound annual growth rate of 10.9% from 2023 to 2030 to reach USD 2,062.1 million by 2030.

b. North America dominated the insulin patch pumps market with a share of 38.8% in 2022. This is attributable to rising diabetes care awareness coupled with an increasing number of product launches.

b. Some key players operating in the insulin patch pumps market include Medtronic plc; F. Hoffmann-La Roche Ltd; Insulet Corporation; CeQur; Terumo; Tandem diabetes care; Medtrum; and Debiotech.

b. Key factors that are driving the insulin patch pumps market growth include increasing incidence of diabetes, rising diabetes-related healthcare expenditure, and innovative product launches.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."