- Home

- »

- Next Generation Technologies

- »

-

Integrated Workplace Management System Market Report 2030GVR Report cover

![Integrated Workplace Management System Market Size, Share & Trends Report]()

Integrated Workplace Management System Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Solution, Service), By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-321-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Integrated Workplace Management System Market Summary

The global integrated workplace management system market size was valued at USD 4.21 billion in 2022 and is projected to reach USD 11.46 billion by 2030, growing at a CAGR of 13.4% from 2023 to 2030. The continuous adoption of digital workplace solutions and automation of facility management processes are expected to drive market growth.

Key Market Trends & Insights

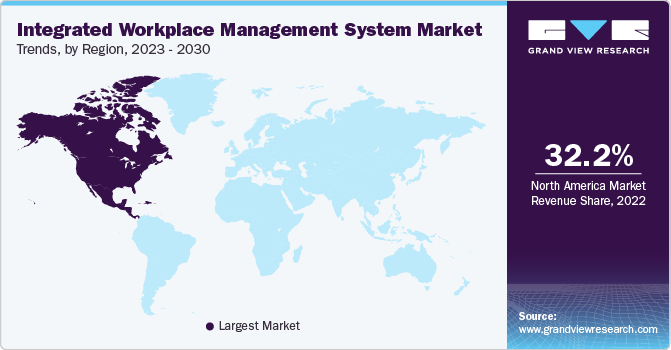

- North America dominated the market and accounted for the largest revenue share of 32.2% in 2022.

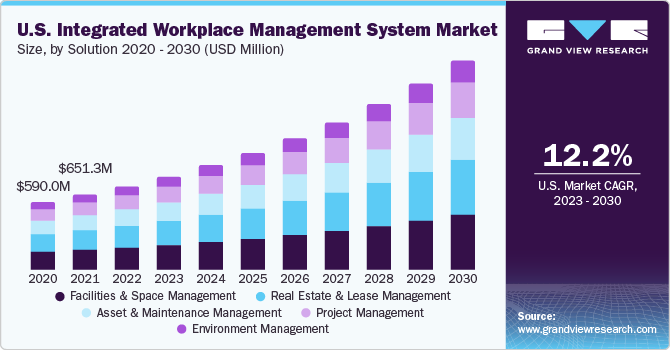

- The IWMS market in the U.S. is expected to grow at a significant CAGR over the forecast period.

- By deployment, the on-premise segment accounted for the largest revenue share of 51.2% in 2022.

- By offering, the solution segment accounted for the largest revenue share of 68.2% in 2022.

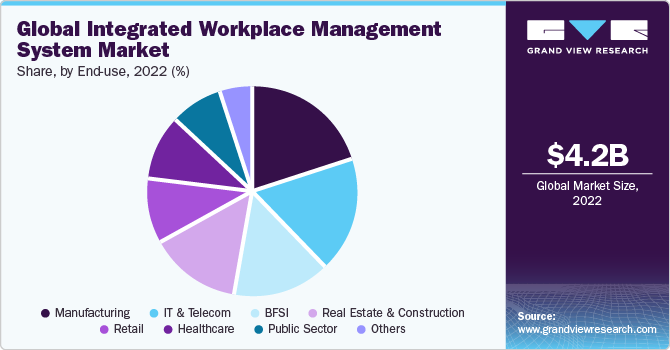

- By end use, the manufacturing segment accounted for the largest revenue share of 19.7% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 4.21 Billion

- 2030 Projected Market Size: USD 11.46 Billion

- CAGR (2023-2030): 13.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Organizations are increasingly shunning conventional approaches and switching to digital solutions for activities such as lease management, facilities and space management, asset and maintenance management, and project management. The rising demand for efficient and improved operational solutions, leading to the increased sophistication of solutions and services, is anticipated to drive the demand for integrated workplace management systems (IWMSs). Furthermore, advantages offered by these systems, such as integrated processes, real-time tracking, less energy consumption, disaster recovery, safety and security, and data center consolidation, are anticipated to drive the market over the forecast period.

Adopting technologies such as advanced analytics, advanced sensors, Software as a Service (SaaS), and mobility is gaining momentum globally, driving the demand for enterprise integration. This, in turn, is leading to the increased deployment of IWMS across organizations. Organizations across the globe need more transparency and insight into their facilities and corporate processes, as well as related data. Deployment of an IWMS offers organizations transparency across all relevant aspects by forming a structured and standardized data repository for all corporate processes. As organizations become more aware of the several benefits of IWMS, their demand is further anticipated to rise over the forecast period.

Intense competition across several industries has necessitated that businesses make quick and right decisions to stay competitive. Mergers and acquisitions, budget constraints, reorganizations, and other economic factors put pressure on businesses. This increases the demand for reliable, integrated management information to support decision-making processes. An IWMS supports strategic, tactical, and operational decision-making with analysis, reports, and dashboards and allows businesses to create specific analyses or output based on historical trends and future forecasts.

IWMS vendors are facing challenges in the wake of the COVID-19 pandemic. The pandemic compelled organizations across several industries to stop spending on new automation initiatives temporarily. Additionally, market players experienced a significant decline in their revenues in 2020, which put additional pressure on them to reduce costs. Moreover, the market will likely benefit from the potential increase in the demand for advanced IWMS solutions with social distancing benefits and risk management capabilities, best suited to new regulations and guidelines regarding the workforce safety, post the pandemic.

However, a lack of awareness about IWMS and its importance in organizations is anticipated to hamper market growth to a certain extent. Furthermore, myths such as high implementation costs and the requirement of extensive training for the implementation of IWMS are also restricting market growth. Several IWMS vendors license software and technologies from third-party providers. These third-party providers may not continue to partner on commercially reasonable terms. Thus, Software and technologies may need to be appropriately maintained or supported by the licensors, which may delay development.

The demand for corporate integration is growing as enhanced sensors, advanced analytics, Software as a Service (SaaS), and other technologies gain traction globally. As a result, the deployment of IWMS across companies has increased. Many companies need more insight into their services, corporate developments, and related data. COVID-19 remained crucial in regulating AI and cloud computing adoption to cope with work-from-home operations during the period. As such, vendors in the market were striving to introduce the latest solutions and services that could help their respective client organizations to manage their operations.

The market's expansion can be ascribed to boost demand for more effective solutions, which are essential to a higher level of sophistication in services and solutions. In addition, the increasing adoption of the Internet of Things (IoT) and big data across various industry verticals, such as BFSI, manufacturing, IT & telecom, and real estate, is also anticipated to drive market growth over the forecast period. Moreover, enterprises across the globe are focused on increasing their business operations to cater to a larger market, which is driving the need for integrated workplace management systems in enterprises. Enterprises are increasingly adopting the latest technologies, such as cloud computing and mobile computing, projected to drive the demand for cloud-based IWMS. The high level of scalability and flexibility, and cost advantages of cloud computing also encourage the migration to cloud platforms.

As the workforce continues to get tech-savvy, the demand for solutions based on the modern and latest technologies is also growing. Having realized that the work environment can significantly influence the employees' performance and engagement, organizations are aggressively deploying solutions based on the latest technologies, such as the Internet of Things (IoT) and artificial intelligence (AI), to improve work efficiency and enhance employee satisfaction. At the same time, IT professionals are increasingly collaborating with their facilities and real estate management colleagues to develop inspiring workplaces. Although cost containment has been the primary motivator for adopting an IWMS solution conventionally, the growing competitiveness and changing workforce dynamics are emerging as the latest drivers prompting organizations to deploy IWMS solutions.

Deployment Insights

Based on deployment, the market is segmented into on-premises and cloud. The on-premise segment accounted for the largest revenue share of 51.2% in 2022. On-premise is a secured deployment model, increasing its demand in the market. Furthermore, on-premise IWMS solutions are mostly adopted by large enterprises with established physical servers, sufficient budgets, and expert technicians. Moreover, on-premise deployment allows client organizations to scale functionalities and easily manage and upgrade the solutions. Furthermore, organizations across end-use industries such as BFSI and healthcare prefer the on-premises deployment of IWMS solutions, as security is a critical concern.

The cloud segment is estimated to register the fastest CAGR of 13.8% over the forecast period. The demand for cloud-based IWMS solutions has increased owing to its benefits, such as minimum Total Cost of Ownership (TCO), scalability, and flexibility.

Offering Insights

Based on offering, the market is segmented into, solution and non-solution. The solution segment accounted for the largest revenue share of 68.2% in 2022. The solution segment is sub-segmented into real estate & lease management, facilities & space management, asset & maintenance management, project management, and environment management. The facilities and space management segment dominated in 2022, accounting for over 28.5% of the market. This can be attributed to the growing demand for upgrades and maintenance of existing solutions, which helps increase the efficiency of decision-making processes. Moreover, facility and space management solutions help properly align administrative and infrastructural support functions to fulfill the core objective of businesses. Based on the solution, the market is segmented into real estate and lease management, facilities and space management, asset and maintenance management, project management, and environment management.

Amid the COVID-19 pandemic, work-from-home practices massively replaced desk jobs. In a work-from-home scenario, meeting room bookings and hot-desking functionality must be more streamlined and automated. This is anticipated to drive the demand for facilities and space management solutions for booking meeting rooms. Facilities and space management solutions allow businesses to track space utilization across all areas, resulting in savings across equipment maintenance and replacement costs by altering operational parameters such as lighting operational hours, set temperatures, and fresh-air intake. These factors are expected to boost the segment's growth over the forecast period.

The service segment is estimated to register the fastest CAGR of 14.1% over the forecast period. The solution segment is sub-segmented into professional services and managed services. The professional services segment dominated the market in 2022 and accounted for a share of over 67.1%. It can be attributed to the rising complexities in business operations and the growing adoption of IWMS solutions. IWMS vendors offer industry-oriented professional services, including consulting, software implementations, and training. Based on service, the market is segmented into professional services and managed services.

Vendors also offer training programs to client employees to help improve effectiveness and efficiency in handling IWMS solutions. For instance, Accruent, a provider of intelligent and cloud-based solutions, offers progressive training programs through its professional services, allowing clients to improve their employees' effectiveness. Furthermore, with every implementation, the company offers product and process training, including key application usage and function guidelines for each solution with industry and business needs. Moreover, the growing demand for third-party support and maintenance services, owing to cost-effectiveness and experienced and well-trained technicians, is anticipated to drive the growth of the professional services segment.

End Use Insights

Based on end use, the market is segmented into public sector, IT & telecom, manufacturing, BFSI, real estate & construction, retail, healthcare, and others. The manufacturing segment accounted for the largest revenue share of 19.7% in 2022. The industrial segment is sub segmented into pneumatic equipment, electronics/semiconductor, feed gas preparation, and others. Rapid technology implementation across the manufacturing vertical has significantly increased the degree of competitiveness among organizations. Thus, organizations are keen to adopt efficient workplace solutions in their manufacturing facilities. This is anticipated to drive the demand for IWMS solutions over the forecast period.

The public sector is estimated to register the fastest CAGR of 14.7% over the forecast period, owing to efficient management of spaces, adherence to regulatory compliance, and enhancement of operational efficiency and patient experience are among the key factors driving the adoption of IWMS in healthcare organizations.

The real estate and construction segment is anticipated to grow considerably over the forecast period. The rising demand for managing all major aspects of a real estate project by minimizing operational costs is anticipated to propel the demand for IWMS solutions within the real estate and construction segment. Furthermore, vendors in the market are capitalizing on this opportunity and introducing IWMS solutions tailored to the specific needs of companies operating in the real estate and construction vertical. For instance, in May 2020, Trimble Inc. launched ManhattanONE, a software suite for centralizing portfolio, workplace, building, and finance lease information, which enables data monitoring of real-estate data and facilitates the evidence-based decision-making process. The suite also addressed the back-to-work challenges posed by the COVID-19 pandemic.

Enterprise Size Insights

Based on enterprise size, the market is segmented into large enterprises and small & medium enterprises. The large enterprises segment accounted for the largest revenue share of 61.2% in 2022. Large enterprises implement IWMS solutions to simplify their complex work environments. Such enterprises demand robust monitoring solutions and automation capabilities for resource allocation and strategic decision-making tasks. The segment is expected to grow over the forecast period. Opening of offices post the COVID-19 pandemic, organizations adopted transitional measures such as workplace distancing to ensure no further spread of the viral disease resulting in increased demand for IWMS software to manage the floorspace and employee health efficiently. For instance, in June 2020, International Business Machines Corporation introduced a workplace management solution, Watson Works, incorporating Watson AI models. Watson Works offers various applications to address the potential workplace requirements post-pandemic, including facilities management, space allocation, prioritizing employee health, contact tracing & care management, and workplace re-entry.

The small & medium enterprises segment is estimated to register the fastest CAGR of 14.0% over the forecast period. Technological advancements, such as cloud computing and the Internet of Things (IoT), have made IWMS systems more accessible and affordable for SMEs. Cloud-based IWMS solutions eliminate the need for significant upfront investments in hardware and infrastructure, making them cost-effective and scalable for SMEs with limited budgets.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 32.2% in 2022. North America is at the forefront regarding deploying the latest and innovative technologies. The vendors have been innovative and competitive toward different technologies to boost productivity and enhance customer experience. Thus, the region has been a key player in adopting integrated workplace management systems (IWMS) in various industries and companies.

In the U.S., the demand for IWMS solutions is increasing due to growing developments in smart building projects for asset & maintenance management, space management, and real estate and lease management. Furthermore, innovative developments, increased industries, and technological advancements in industrial products are expected to boost market growth in the U.S.

Asia Pacific is expected to register the highest CAGR of 14.4% over the forecast period.Due to the increased usage of IoT, the Asia Pacific IWMS market is witnessing a boom in efficient technological products, prompting enterprises in the region to incorporate IWMS solutions to streamline operations. The adoption of IWMS systems in the Asia Pacific region is likely to grow as corporate and government networks expand, cloud services proliferate, and businesses and operations increase.

Cloud computing and IoT are becoming increasingly popular in China for various business uses. Simultaneously, the government encourages companies to use integrated workplace management systems for faster content delivery and high-speed network infrastructure through digitization. Furthermore, the rapid growth in the number of Small and Mid-Sized Businesses (SMBs) in India and their increased focus on incorporating new products and services to boost the business on regional and global levels are expected to advance the development of integrated workplace management systems in the country over the forecast period.

Key Companies & Market Share Insights

The integrated workplace management system market players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2023, ServiceChannel announced a strategic partnership with Accruent. The two operating companies under Fortive Corporation partnered to develop an Integrated Workplace Management System (IWMS) tailored for multi-site businesses. This comprehensive system automates crucial processes related to commercial real estate, assets, construction, leases, and facilities. By integrating ServiceChannel's facilities management platform with Accruent's real estate solutions, the partnership aims to enhance asset reliability, reduce costs, boost employee productivity, and improve operational efficiency.

Key Integrated Workplace Management System Companies:

- IBM Corporation

- SAP SE

- Trimble Inc.

- Nemetschek Group

- Accruent

- FM:Systems

- MRI Software LLC

- Planon

Recent Developments

-

In May 2023, Tango and Crestron Electronics announced an extended collaboration, strengthening their strategic partnership. Crestron has introduced Desk Touch, a sophisticated hardware solution for desk scheduling featuring a sleek touch interface. By integrating with Tango's desk booking and conference room scheduling platform, Tango Reserve, Desk Touch creates a user-friendly desk scheduling solution that promotes collaboration, improves desk utilization, and offers advanced workplace analytics. This joint effort in launching an integrated desk scheduling portfolio seamlessly continues Tango's existing strategic partnership.

-

In April 2023, Eptura launched a range of updates to its Archibus integrated workplace management system. These additions provide greater occupancy transparency and analysis options, allowing facility management teams to make better use of building operations data while on-site. These updates considerably improve Archibus' building information modeling viewer tool, viewer tool, allowing post-construction crews to operate their structures more effectively.

-

In October 2022, Thoma Bravo announced an merger of CONDECO GROUP LTD. The merger between Condeco and iOffice + SpaceIQ, backed by Thoma Bravo and JMI Equity, establishes a dominant global work tech company specializing in software solutions for modern workplaces. This strategic union brings together top-notch software offerings in asset management, integrated workplace management systems, and workplace experience solutions, paving the way for advancing next-generation workplace technology.

-

In January 2022, The Building People announced an acquisition of InfoNarus. The acquisition of InfoNarus aligns with The Building People's strategy of assisting clients in adopting emerging technology, integrating systems, and utilizing real-time building data to enhance workplace efficiency and productivity. The Building People takes a comprehensive approach to guide organizations toward the future of facilities by implementing a connected real estate model that integrates essential integrated workplace management systems across their clients' portfolio operations.

-

In January 2022, Tango announced an acquisition of Agilquest Corporation. The acquisition solidifies Tango's dominant position as the top real estate and facilities management industry player. By acquiring Agilquest Corporation, Tango is bridging the gap between the physical workspace and its occupants. This strategic move is aimed at addressing the evolving demands of hybrid work. With the combined entity, Tango will cater to more than 300 clients across 140 countries. In December, Tango had previously announced a partnership with Berkshire Partners.

Integrated Workplace Management System Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.74 billion

Revenue forecast in 2030

USD 11.46 billion

Growth Rate

CAGR of 13.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, enterprise size, end use, region

Regional scope

North America; Europe, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation; Archibus; FM:Systems; FM Solutions; Graco Inc.; MRI Software LLC; Planon; SAP SE; Trimble Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Integrated Workplace Management System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global integrated workplace management system market based on offering, deployment, enterprise size, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Real Estate & Lease Management

-

Facilities & Space Management

-

Asset & Maintenance Management

-

Project Management

-

Environment Management

-

-

Service

-

Professional Services

- Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Public Sector

-

IT & Telecom

-

Manufacturing

-

BFSI

-

Real Estate & Construction

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

- Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global integrated workplace management system market size was estimated at USD 4.21 billion in 2022 and is expected to reach USD 4.74 billion in 2023.

b. The global integrated workplace management system market is expected to grow at a compound annual growth rate of 13.4% from 2023 to 2030 to reach USD 11.46 billion by 2030.

b. North America dominated the integrated workplace management system market with a share of over 32% in 2022. This is attributable to the presence of key vendors of IWMS in the region.

b. Some key players operating in the integrated workplace management system market include IBM Corporation; Oracle Corporation; SAP SE; AssetWorks, LLC; MRI Software LLC; Indus Systems, Inc.; and Facilio Inc.

b. Key factors driving the integrated workplace management system market growth include increasing the requirement of improved and efficient operational solutions, leading to increased sophistication of solutions and services.

b. IWMS market vendors are facing challenges in the wake of the COVID-19 pandemic as the coronavirus outbreak has compelled organizations across industries to temporarily halt the spending on new automation initiatives.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.