- Home

- »

- Next Generation Technologies

- »

-

Interactive Projector Market Size, Share, Trends Report, 2030GVR Report cover

![Interactive Projector Market Size, Share & Trends Report]()

Interactive Projector Market (2023 - 2030) Size, Share & Trends Analysis Report By Technology (DLP, 3LCD, LCoS), By Projection Distance, By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-800-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Interactive Projector Market Size & Trends

The global interactive projector market size was valued at USD 2.49 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 21.4% from 2023 to 2030 owing to the adoption of internet-based teaching in the education sector. Easy accessibility & availability and timesaving are the major factors driving the demand for e-learning. Students are opting for digital education to gain degrees and knowledge, paving the way for considerable market growth over the projected period. The growing importance of online training in corporate sectors is further anticipated to influence demand.

Adopting e-learning minimizes training costs and enhances employee productivity for companies. Cloud computing aids service providers in delivering online training to employees at affordable costs. These above-mentioned factors are further expected to propel the industry demand over the forecast period.

The rules and regulations for manufacturing projectors are different for all countries. The most common acceptable compliances include the Canadian Red Act (CRA), which regulates non-ionization emissions for public safety, and the Department of Health and Human Services (U.S.), which provides limits for radiation emissions from CRT monitors, optical drives, DVD-ROM, and laser printers.

The rapid consumerization of IT and mature sensor technology has declined the costs of sensors. Moreover, advancements in technology have introduced new suppliers, such as providers of software and sensors, in the market, maintaining a moderate bargaining power of a supplier.

Furthermore, the shift towards hybrid and remote learning models, accelerated by the COVID-19 pandemic, amplified the demand for interactive projectors. These projectors enable immersive and interactive experiences in virtual classrooms, supporting the needs of remote learners and facilitating effective distance education. With the widespread shift to remote learning and remote work during the pandemic, there has been an increased demand for interactive projectors as they enable interactive and collaborative experiences in virtual environments. Educational institutions and businesses have adopted interactive projectors to facilitate engaging remote learning and virtual meetings.

Technology Insights

Based on technology, the industry is segmented into 3LCD, Liquid-Crystal-on-Silicon (LCoS), and Digital Light Processing (DLP). The 3LCD segment held the highest market share of 56.5% in 2022. 3LCD projectors are known for their excellent color accuracy and brightness levels. The increasing technological advancements in projection technology have increased the use of projectors for various applications. For instance, Epson developed a 3LCD projector with 6,000 lumens of brightness and a laser projector with 25,000 lumens of brightness.

For instance, in October 2022, Sony Electronics launched the VPL-PHZ61 and VPL-PHZ51, the world's smallest WUXGA 3LCD laser projectors. These projectors offer exceptional operational features, impressive brightness, and versatile installation options, making them ideal for various industries such as corporate, education, museum, entertainment, and simulation.

A DLP projector uses optical micro-electro-mechanical technology to deliver sharp images without filters. It also has 3D capabilities. Recent advancements in DLP technology include the three-chip system used for stage productions, large venues, and award ceremonies. Some of the key DLP projector brands include Sharp Corporation (Japan), BenQ Corporation (Taiwan), and Optoma Corporation (Taiwan).

The Liquid-Crystal-On-Silicon (LCoS) segment is estimated to register the fastest CAGR of 23.7% over the forecast period. The growing popularity of LCoS-based interactive projectors can be attributed to their numerous benefits. LCoS technology provides sharper and more vibrant images with high contrast ratios, making the projected content visually appealing and engaging. LCoS projectors often have higher resolutions, allowing for detailed and clear visuals.

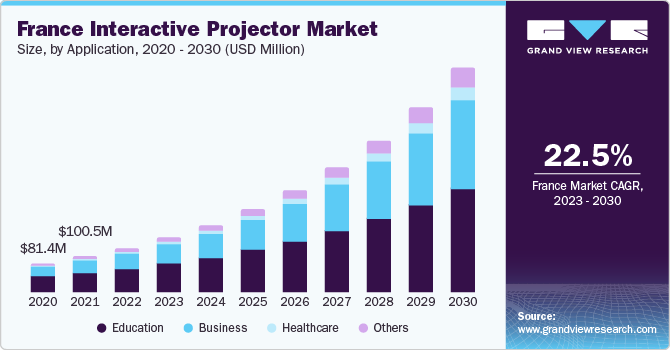

Application Insights

Based on applications, the industry is segmented into education, business, healthcare, and others. The education segment dominated the market with a market share of 46.1% in 2022. The growing need for energy-efficient and environment-friendly projectors in the education sector is anticipated to drive the interactive projector market. Furthermore, the growing expenditure on K-12 education in the U.S. will likely influence segment growth.

With the advent of IoT, there is a predominant increase in the penetration of interactive projection displays in the smart homes segment. The Common Core State Standards (CCSS) reshaped the U.S. education industry from fact-based instruction to teaching that fostered critical thinking.

The education segment growth is driven by various factors, including the FAITH project launched by the Turkey government, an initiative for providing tablets and interactive classrooms to all students. For instance, in September 2022, BenQ, a professional education display solutions provider, launched the next-generation Pro Series Interactive Flat Panel with innovative features such as the world's first Air Ioniser, Eyesafe® Certification, and Advanced ClassroomCare, which is certainly exciting. These advancements enhance the classroom experience by providing real-time collaboration and addressing important aspects such as air quality and eye safety.

The healthcare segment is anticipated to witness the fastest CAGR of 24.7% over the forecast period. Interactive projectors communicate information to patients, staff, and visitors. They are also used to provide information about insurance issues, health, and healthcare products & services to patients in a waiting room.

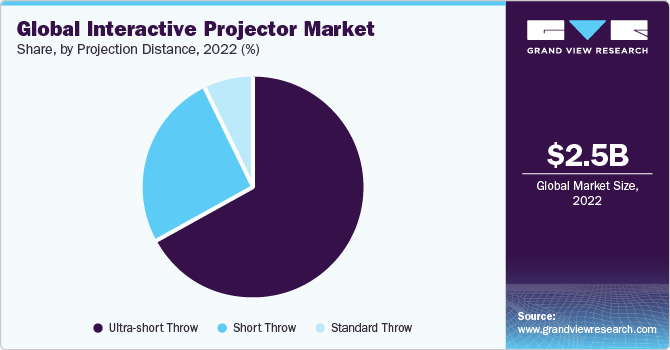

Projection Distance Insights

Based on projection distance, the industry is segmented into the standard throw, short throw, and ultra-short throw. The ultra-short-throw segment dominated the market with a revenue share of 66.7% in 2022 and is anticipated to retain its position over the forecast period. Ultra-short-throw projectors are designed to be placed close to the projection surface, typically just a few inches away. This design eliminates extensive mounting and allows for a larger projected image, even in limited spaces. It is particularly advantageous in classrooms and meeting rooms, where space is often limited. Interactive projectors, like infrared or laser sensors, use various technologies to detect and track user input. With an ultra-short-throw projection setup, users can interact with the projected content more accurately and comfortably without any noticeable input lag.

The short throw segment is estimated to register a significant CAGR of 18.5% over the forecast period. The increasing popularity of show throw projection distance drives the demand for longer throw distances. Projection mapping involves projecting dynamic visuals onto irregularly shaped surfaces or objects, creating mesmerizing visual effects. Longer throw distances enable projection mapping over larger areas, enhancing this technology's creative possibilities and impact in various industries, including entertainment, advertising, and art installations.

Regional Insights

North America accounted for the largest market share of 39.2% in 2022, majorly due to the rapid growth of cloud-based streaming services in the U.S. Developed economies, such as North America and Europe, are expected to witness significant growth due to bio-diverse cultures and increasing awareness among end-users. The prevailing large consumer base and increasing penetration of BYOD are the major factors driving the North American regional market.

On the other hand, Asia Pacific is projected to demonstrate growth at the fastest CAGR of 24.7% over the forecast period. The region is witnessing widespread adoption of digitalization across various industries. Interactive projectors play a vital role in this digital transformation, enabling businesses to deliver impactful presentations, interactive meetings, and collaborative workspaces. With the growing emphasis on interactive communication and collaboration, businesses invest in interactive projectors to enhance productivity and foster innovative work environments.

The industry players are likely to target the Asia Pacific region, owing to government initiatives such as the smart classroom policy in Thailand, which is spurring market demand in the region.

The Voluntary Control Council for Interference by Information Technology Equipment (Japan) controls the radiation emissions caused by personal computers and other duplicate products. The manufacturers must take the conformity verification test for their Information Technology Equipment products.

The rising government initiatives undertaken by emerging economies, such as Indonesia, Malaysia, and India, for modernizing education systems are expected to drive market demand over the forecast period. Indonesia introduced plans for an information and communication technology (ICT)-based learning movement to increase the technology-oriented workforce.

Key Companies & Market Share Insights

The market players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in June 2022, Philips projection introduced the Philips Screeneo U4, an ultra-short-throw projector designed to deliver an immersive 80" True Full HD picture from a remarkably close distance of only 12" (30.5cm).

Key Interactive Projector Companies:

- BenQ

- CASIO COMPUTER CO., LTD

- Dell Inc.

- Delta Electronics, Inc.

- Hitachi Digital Media Group

- Boxlight

- NEC Display Solutions

- Optoma

- Panasonic Holdings Corporation

- Seiko Epson Corporation

Recent Developments

-

In June 2023, Vivitek, a subsidiary of Delta, announced its presence at InfoComm 2023, where it will showcase its latest developments in projection technology and highlight the innovative NovoConnect solutions. With a strong track record of excellence and innovation, Vivitek remains at the forefront of projection technology, providing top-notch display solutions for various environments. Additionally, the company will showcase its Novo products, which offer advanced wireless presentation and collaboration capabilities, setting a new standard in this space.

-

In June 2023, JMGO, an innovator in smart projectors, is delighted to introduce the N1 Series, a lineup of triple-color laser gimbal projectors, now available on Amazon US and its global website. The N1 Series, which includes the N1 Pro, N1 Ultra, and N1 models, showcases JMGO's cutting-edge triple-color laser engine and incorporates an integrated gimbal design. This combination ensures an immersive cinematic experience that can be enjoyed anywhere and anytime.

-

In May 2023, ViewSonic India, a renowned global visual solutions provider, is excited to announce its participation in the highly anticipated What Hi-Fi 2023 event. The company will unveil and demonstrate its latest lineup of projectors, ranging from portable options to premium models with best-in-class performance. This event is a platform for industry professionals, experts, dealers, channel partners, audiophiles, and consumers to explore a comprehensive range of home theatre solutions and experience cutting-edge audiovisual technologies.

-

In January 2023, Samsung launched the Freestyle projector during CES 2022, featuring a portable circular design and the capability to project on various surfaces. With the integration of the Tizen operating system, it gained significant popularity among consumers. However, critics raised concerns about the value proposition of its price. Moreover, at CES 2023, Samsung introduced an upgraded version of the Freestyle projector, catering to users' evolving needs and expectations.

-

In January 2023, Sharp NEC Display Solutions Europe announced the release of the NEC PV800UL laser projector. This new installation projector and its counterpart, the PV710UL, offer a compact design and a range of built-in features to support versatile installations. With ProAssist support for easy control and geometric adjustment allows users to enjoy bright, high-quality visuals without spatial distortions. The NEC PV800UL projector is designed to meet the demands of flexible installations and provides an excellent viewing experience.

Interactive Projector Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.06 billion

Revenue forecast in 2030

USD 11.93 billion

Growth Rate

CAGR of 21.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, projection distance, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

BenQ; CASIO COMPUTER CO., LTD; Dell Inc.; Delta Electronics, Inc.; Hitachi Digital Media Group; Boxlight; NEC Display Solutions; Optoma; Panasonic Holdings Corporation; Seiko Epson Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interactive Projector Market Report Segmentation

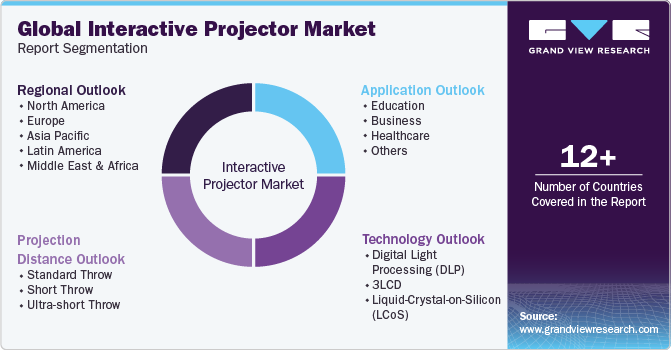

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global interactive projector market based on technology, projection distance, application, region:

-

Technology Outlook (Revenue in USD Million, 2017 - 2030)

-

Digital Light Processing (DLP)

-

3LCD

-

Liquid-Crystal-on-Silicon (LCoS)

-

-

Projection Distance Outlook (Revenue in USD Million, 2017 - 2030)

-

Standard throw

-

Short throw

-

Ultra-short throw

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Education

-

Business

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global interactive projector market size was estimated at USD 2.49 billion in 2022 and is expected to reach USD 3.06 billion in 2023.

b. The global interactive projector market is expected to grow at a compound annual growth rate of 21.4% from 2023 to 2030 to reach USD 11.93 billion by 2030.

b. North America dominated the interactive projector market with a share of 39.2% in 2022. This is attributable to the prevailing large consumer base and increasing penetration of BYOD.

b. Some key players operating in the interactive projector market include BenQ Corporation (Japan), Casio Computer Co., Ltd. (Japan), Dell Technologies, Inc. (U.S.), NEC Display Solutions, Ltd. (Japan), and Seiko Epson Corp. (Japan).

b. Key factors that are driving the market growth include increasing adoption of e-learning and increasing penetration of BYOD.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.