- Home

- »

- Display Technologies

- »

-

Interactive Whiteboard Market Size, Industry Report, 2030GVR Report cover

![Interactive Whiteboard Market Size, Share & Trends Report]()

Interactive Whiteboard Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Infrared, Resistive Membrane, Electromagnetic Pen, Capacitive), By Form Factor, By Projection Technique, By Screen Size, By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-396-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Interactive Whiteboard Market Summary

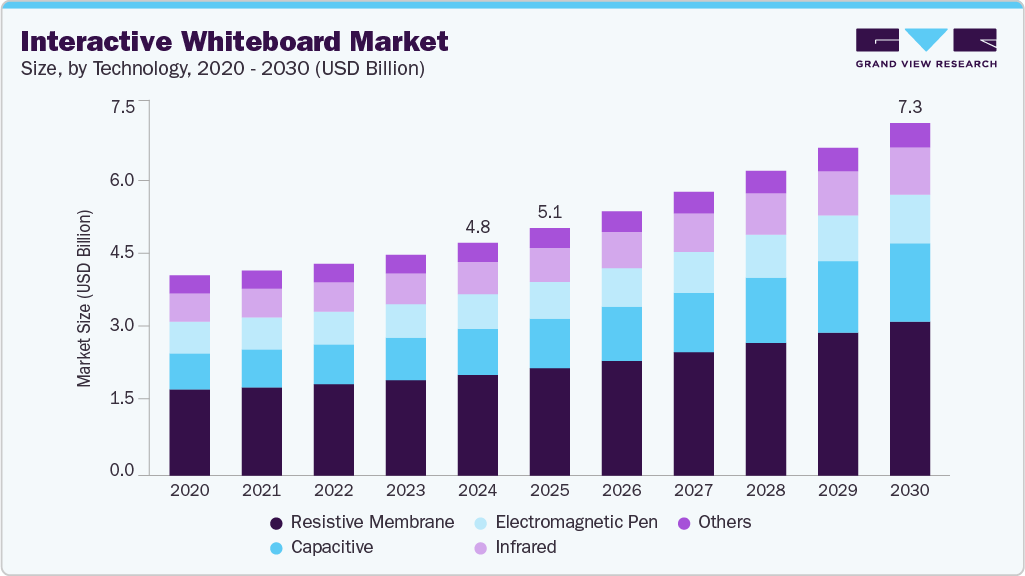

The global interactive whiteboard market size was estimated at USD 4.82 billion in 2024 and is projected to reach USD 7.30 billion by 2030, growing at a CAGR of 7.3% from 2025 to 2030, driven by rapid advancements in educational technology and the increasing emphasis on collaborative learning environments. Educational institutions worldwide are integrating digital tools into classrooms to enhance student engagement and improve learning outcomes.

Key Market Trends & Insights

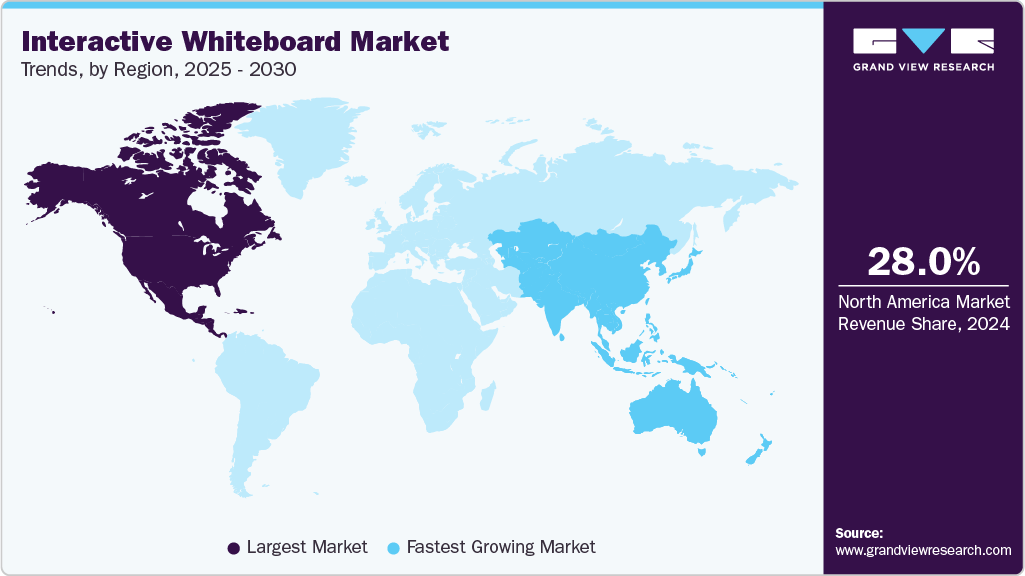

- North America dominated the global market and held a revenue share of over 28.0% in 2024.

- The interactive whiteboard market in the U.S. is expected to grow at a CAGR of 6.4% over the forecast period.

- By technology, the resistive membrane segment accounted for the revenue share of over 43.0% in 2024.

- By form factor, the portable segment accounted for the revenue share of over 53.0% in 2024.

- By projected technique, the front projection segment accounted for the revenue share of 62.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.82 Billion

- 2030 Projected Market Size: USD 7.30 Billion

- CAGR (2025-2030): 7.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Interactive whiteboards facilitate dynamic presentations, real-time collaboration, and multimedia content delivery, making them essential for K-12 and higher education. Government initiatives supporting digital education, especially in emerging economies, have further boosted the adoption of interactive whiteboards (IWBs). The increasing deployment of IWBs in corporate environments also contributes to market growth. As organizations embrace hybrid and remote work models, there is a rising need for tools that enable seamless communication and collaboration.Interactive whiteboards support real-time annotations, video conferencing integration, and multi-user participation, making them valuable assets for team meetings, brainstorming sessions, and training programs. The trend toward digital transformation in enterprises and a growing focus on employee engagement and productivity encourage investment in modern collaboration technologies like IWBs.

Technological advancements also play a key role in market expansion. Innovations such as cloud integration, multi-touch capabilities, AI-enabled features, and compatibility with a wide range of devices have made modern IWBs more versatile and user-friendly. These improvements enhance the user experience, making IWBs more appealing to educational and business users. Moreover, the declining cost of interactive display technologies has made IWBs more accessible to a broader customer base, further fueling market penetration.

Technology Insights

The resistive membrane segment dominated the market and accounted for the revenue share of over 43.0% in 2024, due to its cost-effectiveness and wide applicability in educational institutions and budget-conscious markets. Resistive membrane IWBs offer a more affordable alternative without significantly compromising essential functionality. This price advantage makes them particularly attractive in emerging economies, where public and private educational institutions often operate under tight budget constraints. The affordability of resistive technology enables broader adoption across schools and training centers seeking to modernize their teaching environments with interactive digital tools.

The capacitive segment is anticipated to be the fastest growing, with a CAGR of 9.5% during the forecast period, driven by the growing integration of modern touch interfaces that mimic the responsiveness of smartphones and tablets. As users become more accustomed to the intuitive gestures and fluid interaction offered by capacitive devices in their daily lives, there is a corresponding expectation for similar experiences in professional and educational settings. Capacitive IWBs meet this demand by supporting multi-user touch points, gesture-based control, and real-time writing with minimal lag, making them ideal for interactive group sessions, presentations, and creative tasks.

Form Factor Insights

The portable segment dominated the market and accounted for the revenue share of over 53.0% in 2024, driven by increasing demand for flexible and mobile collaboration solutions. Portable interactive whiteboards offer ease of relocation, making them ideal for dynamic work and learning environments. The rising adoption of hybrid work models, where businesses require adaptable tools that can be moved between meeting rooms, workspaces, and remote locations, drives growth. Portable whiteboards enable seamless collaboration in co-working spaces, corporate offices, and training centers, supporting the need for on-the-go interactivity.

The fixed segment is expected to grow at a significant CAGR over the forecast period due to the increasing investment in smart classroom infrastructure across educational institutions. Fixed interactive whiteboards, often mounted on walls or stands, provide a stable and permanent solution for digital learning, enabling features such as high-resolution touch interactivity, multimedia integration, and real-time annotation. Governments and private institutions are actively funding the modernization of classrooms, particularly in developed regions, further accelerating demand for fixed installations.

Projection Technique Insights

The front projection segment dominated the market and accounted for the revenue share of over 62.0% in 2024. Front projection interactive whiteboards integrate seamlessly with existing projector-based setups, allowing businesses to upgrade their conference rooms without replacing entire display systems. Compatibility with collaborative software, digital annotation tools, and video conferencing platforms further enhances their appeal for dynamic business presentations and team brainstorming sessions. In addition, advancements in interactive projection technologies, such as infrared and camera-based tracking systems, have improved accuracy and responsiveness, narrowing the performance gap with more expensive alternatives.

The rear projection segment is expected to grow significantly over the forecast period due to superior image quality and visibility, particularly in high-ambient light environments. Unlike front projection solutions that suffer from presenter shadows and glare, rear projection interactive whiteboards provide consistent, high-contrast images that remain visible even in brightly lit classrooms and boardrooms, making them particularly valuable for corporate and educational applications where presentation clarity is paramount.

Screen Size Insights

The 50 inch to 70 inch segment dominated the market and accounted for a significant share in 2024, driven by the declining cost of display panels and touch sensors, which have made 50-inch to 70-inch interactive whiteboards more accessible to budget-conscious buyers, including small businesses and schools in emerging markets. This affordability, combined with lower total cost of ownership compared to traditional projector-based systems, encourages wider adoption. Furthermore, the segment benefits from the growing trend of smart classroom and smart office initiatives, where interactive displays are central to creating engaging and collaborative environments.

The 71 inch to 90 inch segment is expected to grow at a significant CAGR over the forecast period, owing to the redesign of traditional boardrooms for hybrid collaboration and the creation of innovation hubs in enterprise environments. Modern workplaces prioritize larger interactive displays that simultaneously show detailed content, video conferencing feeds, and real-time annotations while accommodating multiple users. Moreover, multinational corporations are standardizing these sizes for regional headquarters and design centers, driving volume purchases across global office networks.

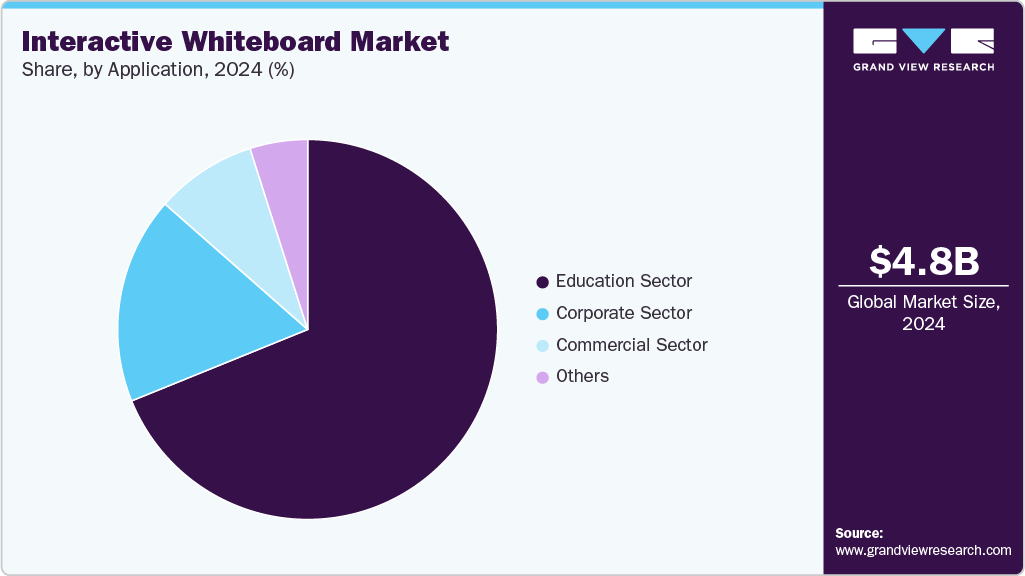

Application Insights

The education sector segment dominated the market and accounted for the revenue share of over 68.0% in 2024, driven by the global push for STEM education reform, where interactive whiteboards have become essential tools for demonstrating complex concepts through dynamic visualizations and hands-on activities. Governments across developed and emerging economies are allocating substantial portions of their education budgets to modernize classrooms, with interactive displays serving as centerpieces for these smart classroom initiatives.

The corporate sector segment is expected to grow at a significant CAGR over the forecast period due to the shift to hybrid work models, the digital transformation of meeting spaces, and the increasing value placed on visual collaboration tools. As organizations worldwide redesign their office layouts for post-pandemic work environments, interactive whiteboards have become critical infrastructure in huddle rooms, innovation hubs, and executive briefing centers. Large multinational corporations are standardizing these solutions across their global office networks, emphasizing models featuring seamless integration with Zoom Rooms, Microsoft Teams, and Webex platforms.

Regional Insights

North America dominated the market in 2024 and held a revenue share of over 28.0%, driven by the widespread integration of EdTech in both public and private education systems. Federal and state-level funding for digital learning infrastructure, along with the strong presence of leading EdTech companies, is encouraging schools and universities to adopt interactive solutions that support hybrid and remote learning environments. The growing culture of lifelong learning and professional upskilling supports demand in non-traditional educational settings.

U.S. Interactive Whiteboard Market Trends

The interactive whiteboard market in the U.S. is expected to grow significantly at a CAGR of 6.4% from 2025 to 2030, driven by the corporate sector's increasing reliance on interactive technologies to support remote collaboration, virtual training, and agile project management. The proliferation of hybrid work models has spurred investments in high-performance digital tools, including IWBs that integrate seamlessly with cloud platforms and conferencing software.

Europe Interactive Whiteboard Market Trends

The interactive whiteboard market in Europe is anticipated to grow considerably from 2025 to 2030. The European Union’s digital education action plan and smart classroom investments enable wider IWB deployment across member states. Moreover, multi-language support and content localization features in IWBs are enhancing accessibility and appeal in the culturally diverse European education landscape.

The UK interactive whiteboard market is expected to grow rapidly in the coming years. Government grants such as the EdTech Demonstrator Programme and the emphasis on personalized, data-driven learning tools further contribute to market growth. Moreover, the tech-savvy student demographic is accelerating the transition from traditional whiteboards to interactive digital interfaces.

The interactive whiteboard market in Germany held a substantial market share in 2024 due to the strategic commitment to modernizing public education through the DigitalPakt Schule initiative, which allocates funds to equip schools with digital infrastructure. The manufacturing sector also incorporates IWBs into vocational training programs and technical workshops, leveraging them as tools for simulation-based learning and employee reskilling.

Asia Pacific Interactive Whiteboard Market Trends

The interactive whiteboard market in Asia Pacific is expected to be the fastest-growing region, registering the highest CAGR of 9.6% from 2025 to 2030. Rapid urbanization and the expansion of smart city and smart education initiatives are key drivers of the IWB market growth. The region’s vast student population, increasing education spending, and government-backed digital inclusion efforts propel adoption in urban and rural settings.

The Japan interactive whiteboard market is expected to grow rapidly in the coming years, driven by a culture of technological adoption and innovation in education. Government reforms under the GIGA School Program aim to provide digital devices and connectivity to every student, creating fertile ground for IWB deployment. The use of IWBs in language instruction and technical subjects is gaining momentum, aided by the country’s emphasis on individualized and interactive pedagogy.

The interactive whiteboard market in China held a substantial market share in 2024, due to digitization policies and the central government’s commitment to closing the urban-rural education gap. Smart education pilots in provinces and the rise of large-scale online and blended learning platforms are accelerating demand.

Key Interactive Whiteboard Company Insights

BenQ, SMART Technologies ULC, Promethean Limited, Epson, Panasonic Corporation, and Boxlight are key players in the Interactive Whiteboard industry. These companies focus on various strategic initiatives, including new product development, partnerships, collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Promethean Limited collaborated with Google to launch the Promethean Chromebox OPS, a new compute device designed for seamless integration with Promethean’s interactive flat panel displays (IFPDs). This plug-and-play solution transforms large interactive touchscreens into ChromeOS-powered devices, providing educators with a streamlined, certified ChromeOS experience without the hassle of cables or additional setup steps when accessing digital content.

-

In February 2025, SMART Technologies launched three new products to enhance collaboration and connectivity across education, government, and business sectors. The lineup includes the SMART Board Mini interactive podium for dynamic engagement in classrooms and workplaces, the M Pro High Secure series TAA Interactive Display tailored for privacy-sensitive and government environments, and the SMART OneLaunch tool designed to streamline hybrid meetings.

-

In August 2024, BenQ introduced an interactive display lineup, the BenQ Board Essential RE04 series, designed specifically for the education sector with a strong focus on energy efficiency. Available in 65-, 75-, and 86-inch models, the RE04 series stands out as the most energy-efficient smart board certified by ENERGY STAR.

Key Interactive Whiteboard Companies:

The following are the leading companies in the interactive whiteboard market. These companies collectively hold the largest market share and dictate industry trends.

- BenQ

- Boxlight

- Cisco Systems, Inc.

- Epson

- Google LLC

- Hitachi, Ltd.

- Microsoft

- Newline Interactive

- Panasonic Corporation

- Promethean Limited

- Ricoh

- SAMSUNG

- Sharp Corporation

- SMART Technologies ULC

- ViewSonic Corporation

Interactive Whiteboard Market Report Scope

Report Attribute

Details

Market size in 2025

USD 5.12 billion

Revenue forecast in 2030

USD 7.30 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Technology, form factor, projection technique, screen size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

BenQ; Boxlight; Cisco Systems, Inc.; Epson; Google LLC; Hitachi, Ltd.; Microsoft; Newline Interactive; Panasonic Corporation; Promethean Limited; Ricoh; SAMSUNG; Sharp Corporation; SMART Technologies ULC; ViewSonic Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interactive Whiteboard Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global interactive whiteboard market report based on technology, form factor, projection technique, screen size, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrared

-

Resistive touch

-

Electromagnetic pen

-

Capacitive

-

Others

-

-

Form Factor Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed

-

Portable

-

-

Projection Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Front Projection

-

Rear Projection

-

-

Screen Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Less than 50 Inch

-

50 Inch to 70 Inch

-

71 Inch to 90 Inch

-

Greater than 90 Inch

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Education Sector

-

Corporate Sector

-

Commercial Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global interactive whiteboard market size was estimated at USD 4.82 billion in 2024 and is expected to reach USD 5.12 billion in 2025.

b. The global interactive whiteboard market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 7.30 billion by 2030.

b. Portable IWBs dominated the interactive whiteboard market, with a share of over 53.0% in 2024. This is attributable to increasing demand for flexible and mobile collaboration solutions. Portable interactive whiteboards offer ease of relocation, making them ideal for dynamic work and learning environments.

b. Some key players operating in the interactive whiteboard market include BenQ, Boxlight, Cisco Systems, Inc., Epson, Google LLC, Hitachi, Ltd., Microsoft, Newline Interactive, Panasonic Corporation, Promethean Limited, Ricoh, SAMSUNG, Sharp Corporation, SMART Technologies ULC, ViewSonic Corporation

b. The market growth can be attributed to driven by rapid advancements in educational technology and the increasing emphasis on collaborative learning environments. Educational institutions across the world are integrating digital tools into classrooms to enhance student engagement and improve learning outcomes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.