- Home

- »

- Automotive & Transportation

- »

-

International Express Delivery Market, Industry Report, 2030GVR Report cover

![International Express Delivery Market Size, Share & Trends Report]()

International Express Delivery Market (2025 - 2030) Size, Share & Trends Analysis Report By Mode of Transport (Roadways, Airways, Railways, Waterways), By End-user, By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-580-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

International Express Delivery Market Summary

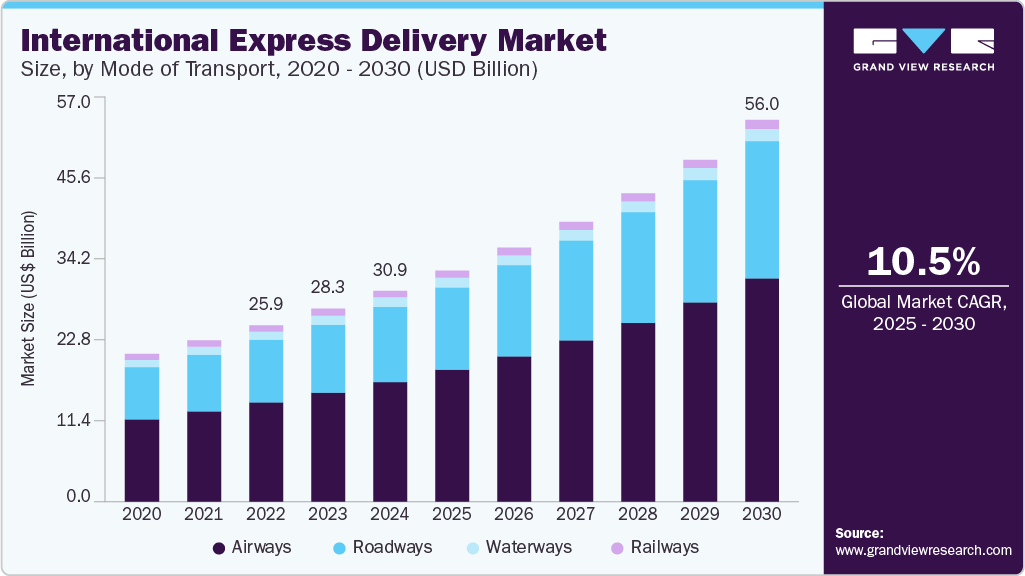

The global international express delivery market size was estimated at USD 30.96 billion in 2024 and is projected to reach USD 56.00 billion by 2030, growing at a CAGR of 10.5% from 2025 to 2030. Several key macroeconomic and sector-specific factors have driven the market.

Key Market Trends & Insights

- Asia Pacific leads the international express delivery market with a share of 44.66% in 2024.

- The international express delivery market in India held the highest revenue market share.

- Based on mode of transport, the airways segment accounted for the largest share of 56.7% in 2024 due to its unmatched speed and global reach.

- In terms of end user, B2C is expected to register the highest CAGR of 12.5% during the forecast period fueled by the exponential rise of cross-border e-commerce.

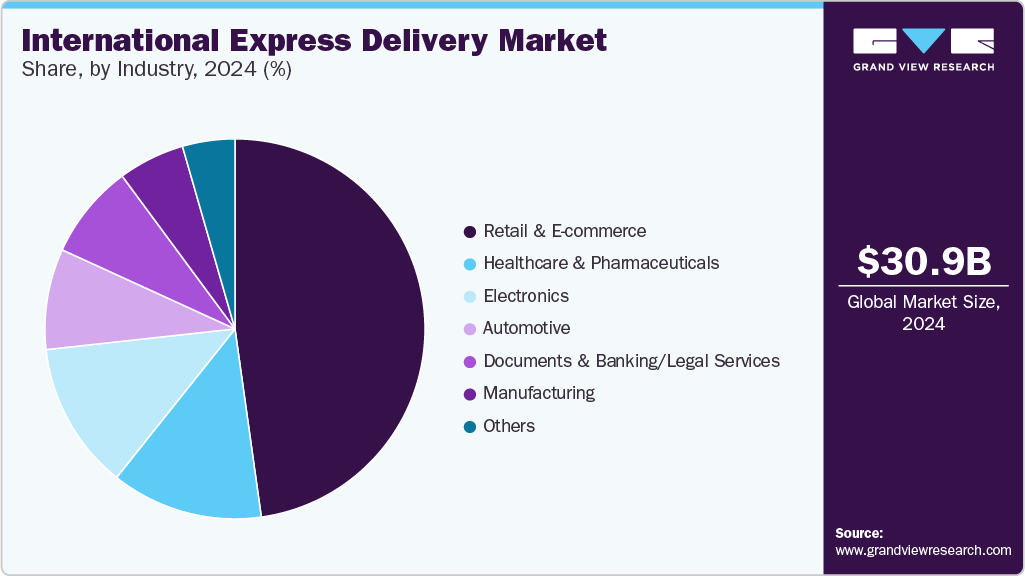

- Based on industry, the retail & E-commerce segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 30.96 billion

- 2030 Projected Market Size: USD 56.00 billion

- CAGR (2025-2030): 10.5%

- Asia Pacific: Largest market in 2024

The rise of cross-border e-commerce, increasing globalization of trade, and consumer demand for faster delivery times have collectively propelled market growth. Supply chain optimization strategies and growing import-export activities across both developed and emerging economies have also contributed to demand. Enhanced business-to-consumer (B2C) fulfillment expectations have intensified reliance on express logistics services, especially in the retail, pharmaceutical, and electronics sectors. Technological advancements have been rapidly integrated into the express delivery ecosystem. Innovations such as automated sorting systems, AI-powered route optimization, and real-time tracking solutions have been adopted to increase operational efficiency.

The use of drones and autonomous delivery vehicles is being explored to reduce last-mile delivery costs, while blockchain is being tested to enhance parcel traceability and data security. These technologies have enabled service providers to offer differentiated and value-added solutions in a competitive environment.

Incumbents and new entrants are investing significant capital into the sector. Major logistics companies are expanding their global networks through mergers, acquisitions, and infrastructure development. They are prioritizing investment in regional hubs, distribution centers, and IT platforms to support volume scalability. Venture capital firms are backing digital logistics startups, driving innovation in cross-border shipping platforms and last-mile fulfillment technologies. Companies are also forming strategic partnerships to streamline customs clearance and reduce delivery timeframes.

The market is subject to a complex regulatory framework that varies significantly across jurisdictions. Logistics providers must navigate customs regulations, trade tariffs, and import-export compliance requirements. Enhanced data protection and consumer rights policies, especially in the EU and North America, have imposed stricter operational standards. Sustainability regulations are being enforced more rigorously, compelling firms to report on emissions and adopt greener practices across their supply chains.

Despite robust growth drivers, several restraints continue to affect market expansion. High operational costs, including fuel surcharges, labor expenses, and cross-border compliance fees, have constrained profit margins. Infrastructure limitations in emerging markets have hindered service penetration and delivery reliability. Geopolitical tensions, trade restrictions, and supply chain disruptions caused by pandemics or climate events have introduced volatility. Furthermore, rising consumer expectations for free or low-cost shipping have pressured providers to maintain service levels while reducing costs.

Mode of Transport Insights

The airways segment accounted for the largest share of 56.7% in 2024 due to its unmatched speed and global reach. High-value, time-sensitive shipments, especially in sectors such as electronics, pharmaceuticals, and high-end retail, are increasingly being transported via air to meet tight delivery windows. Major express logistics providers are maintaining dedicated air fleets and securing capacity on commercial flights to ensure timely cross-border movement. The growing demand for next-day and two-day delivery services across international routes is reinforcing the dominance of the air transport segment.

The roadways segment is expected to grow significantly during the forecast period. Cross-border e-commerce growth and improved regional infrastructure enable more reliable and cost-effective ground transport options. Roadways are increasingly being leveraged for intra-regional deliveries, offering competitive transit times and greater flexibility for parcel consolidation. In addition, the push toward sustainability and carbon footprint reduction is prompting logistics providers to expand their fleets with electric and fuel-efficient vehicles, further accelerating growth in this segment.

End User Insights

The B2B segment held the largest market in 2024. This segment remains the dominant force, driven by the global movement of industrial goods, components, and critical documents across sectors such as manufacturing, pharmaceuticals, automotive, and aerospace. Enterprises rely heavily on time-definite express services to maintain just-in-time inventory systems, fulfill contractual delivery obligations, and manage high-value shipments with minimal risk. The consistent and high-volume nature of B2B transactions provides a stable revenue base for express logistics providers.

B2C is expected to register the highest CAGR of 12.5% during the forecast period fueled by the exponential rise of cross-border e-commerce. Consumers increasingly purchase products from international online retailers, expecting faster delivery times and enhanced visibility into the shipping process. This trend is compelling logistics companies to expand their delivery networks, invest in digital platforms, and tailor services to accommodate high volumes of smaller, individual shipments. The B2C segment is also being supported by growing internet penetration, mobile commerce, and the global reach of major e-commerce platforms, positioning it as a key driver of future market expansion.

Industry Insights

The retail & E-commerce segment dominated the market in 2024. Global consumers increasingly demand fast, reliable, and transparent delivery of goods purchased online, prompting e-commerce platforms and retailers to partner with express logistics providers for timely cross-border fulfillment. Seasonal peaks, promotional campaigns, and expanding omnichannel strategies further intensify this segment's reliance on express delivery solutions. To meet evolving consumer expectations, retailers also invest in express delivery partnerships that offer flexible delivery options, including same-day and time-slot services, enhancing customer satisfaction and brand loyalty.

The electronics segment is growing significantly, driven by high global demand for consumer electronics, semiconductors, and components. These products often require time-sensitive and secure transport due to their high value, sensitivity, and short product life cycles. With rapid product innovation and widespread globalization of manufacturing and distribution, electronics companies are increasingly turning to express delivery services to maintain supply chain continuity and meet tight go-to-market timelines. The growing adoption of connected devices, smart technologies, and electric components is expected to accelerate this segment's need for fast, traceable, and secure cross-border delivery solutions.

Regional Insights

Asia Pacific leads the international express delivery market with a share of 44.66% in 2024, with cross-border parcel flows driven by the region’s strong trade volumes and growing outbound demand from e-commerce exporters. Service providers are increasing direct international lanes and air freight capacity to handle high-volume shipments from manufacturing hubs in East and Southeast Asia. Regional integration and customs modernization enable faster international clearance processes, improving service reliability. Cross-border express services from Asia Pacific to Europe and North America are being prioritized through expanded transit hubs and digital freight forwarding platforms.

India International Express Delivery Market Trends

The international express delivery market in India held the highest revenue market share due to the rising SME participation in global marketplaces and increased exports of pharmaceuticals, apparel, and electronics. Carriers are enhancing their international air express networks through partnerships with integrators and commercial airlines to increase coverage across Europe, the Middle East, and North America. Regulatory streamlining under programs like Authorized Economic Operator (AEO) and ICEGATE integration is improving outbound shipment clearance. Infrastructure investments in Tier 1 airports and bonded logistics parks support scaling international express volumes.

China international express delivery market is defined by high-frequency parcel exports via dedicated air cargo lanes to North America, Europe, and emerging e-commerce destinations like Latin America. Leading platforms such as Alibaba and JD.com enable bulk international fulfillment through logistics subsidiaries and bonded warehouse networks. Peak seasons see extensive use of chartered flights and consolidation hubs to manage surges in outbound parcels. Advanced customs APIs and pre-clearance capabilities give Chinese exporters an edge in ensuring fast global deliveries under express terms.

North America International Express Delivery Market Trends

The international express delivery market in North America is driven by B2C and B2B flows across U.S.-Canada and U.S.-Mexico corridors, along with global trade links to Asia and Europe. Through cross-border zone optimization, express carriers enhance international transit capabilities, allowing faster customs pre-processing and outbound dispatch. Air express capacity is being expanded through dedicated terminals and sorting infrastructure at major airports like LAX, JFK, and Toronto Pearson. Increasing demand for cross-border returns management also leads to specialized express solutions tailored for international reverse logistics.

The U.S. international express delivery market centers on high-value outbound parcels such as medical equipment, IT hardware, and premium consumer goods destined for Europe and Asia. Express integrators invest in API-driven customs documentation and pre-lodgment systems to reduce border shipment dwell time. Coastal express hubs in Los Angeles, Miami, and New York are being equipped with automated international sorting and security screening systems to support higher throughput. The U.S. also sees a rise in express delivery for international repair-and-return cycles, especially in electronics and precision machinery.

Europe International Express Delivery Market Trends

The international express delivery market in Europe is characterized by high-volume outbound shipments to the U.S., China, and the Middle East markets, with a growing share in time-sensitive healthcare and industrial components. For global connectivity, pan-European express networks feed into major outbound gateways such as Amsterdam Schiphol, Frankfurt, and Paris CDG. Enhanced express lanes and fast-track customs corridors are being deployed to expedite cross-border parcel flow out of the EU. European express providers also develop international e-commerce support services, including multilingual return handling and export tax compliance.

The UK international express delivery market activity has shifted post-Brexit, with increased emphasis on efficient customs declaration systems and dual-channel routing for EU and non-EU shipments. Express delivery firms are integrating advanced export documentation tools and using bonded storage models to avoid shipment delays. Outbound volumes to North America and Asia, particularly in fashion, pharmaceuticals, and specialty food, are prioritized through London Heathrow and regional air express hubs. UK-based exporters are leveraging express carriers’ door-to-door capabilities to maintain competitiveness amid regulatory divergence from the EU.

The international express delivery market in Germany is shaped by strong outbound flows of high-tech equipment, machinery parts, and medical devices to North America, China, and Eastern Europe. Express providers are expanding freight corridors through Frankfurt and Leipzig, integrating airside handling with bonded customs systems to shorten export cycles. Industrial exporters increasingly use time-definite express options to deliver urgent parts and prototypes globally. Germany is also a leading adopter of digital export tracking and real-time customs updates, improving shipment transparency and compliance for international dispatches.

Key International Express Delivery Company Insights

Some key international express delivery companiesinclude FedEx, United Parcel Service, Inc. (UPS), and DHL Group. These companies focus on expanding their global networks, optimizing technology, and improving customer experience in the market. These companies invest heavily in infrastructure, including automated sorting hubs and digital freight forwarding platforms, to ensure faster and more efficient international transit. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, business expansions, new service launches, and partnerships, among others.

-

DHL has cemented its position as a global express delivery market leader by offering a wide range of tailored services that cater to both B2B and B2C segments. Its global express network ensures rapid, time-definite deliveries across major international routes, focusing on high-demand areas such as Asia Pacific, Europe, and North America.

-

FedEx’s international express delivery offerings are designed to provide fast, reliable, and cost-effective solutions for businesses and consumers worldwide. The company’s extensive global network enables it to offer time-sensitive services such as International Priority, which guarantees next-day or two-day delivery for shipments across major international routes. FedEx also provides International Economy services for cost-conscious shipments that do not require expedited delivery.

Key International Express DeliveryCompanies:

The following are the leading companies in the international express delivery market. These companies collectively hold the largest market share and dictate industry trends.

- DHL Group

- FedEx

- United Parcel Service, Inc. (UPS)

- SF Express

- CJ Logistics Corporation

- La Poste Group

- US Postal Service

- Correos Express

- Blue Dart Express Ltd.

- Aramex

Recent Developments

-

In February 2025, DHL eCommerce announced a strategic investment by acquiring a minority stake in AJEX Logistics Services, a parcel delivery firm based in Saudi Arabia. Combining DHL’s global expertise in international parcel logistics with AJEX’s regional presence, the partnership aims to enhance the availability of dependable, cost-effective, and environmentally responsible delivery solutions within the Saudi Arabian market.

-

In October 2024, United Parcel Service, Inc. (UPS) implemented network and infrastructure upgrades across Asia Pacific. A key enhancement includes a new air route via Sharjah International Airport (SHJ) in the UAE, enabling delivery of shipments from mainland China and South Korea to key markets such as Nigeria, Pakistan, Saudi Arabia, and South Africa within two business days. In addition, UPS has expanded its regional express capabilities, now offering next-day delivery from major Asia Pacific markets to Seoul, South Korea, and Bangkok to multiple destinations across the region.

International Express Delivery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 33.92 billion

Revenue forecast in 2030

USD 56.00 billion

Growth rate

CAGR of 10.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode of transport, end user, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

DHL Group; FedEx; United Parcel Service, Inc. (UPS); SF Express; CJ Logistics Corporation; La Poste Group; US Postal Service; Correos Express; Blue Dart Express Ltd.; Aramex

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

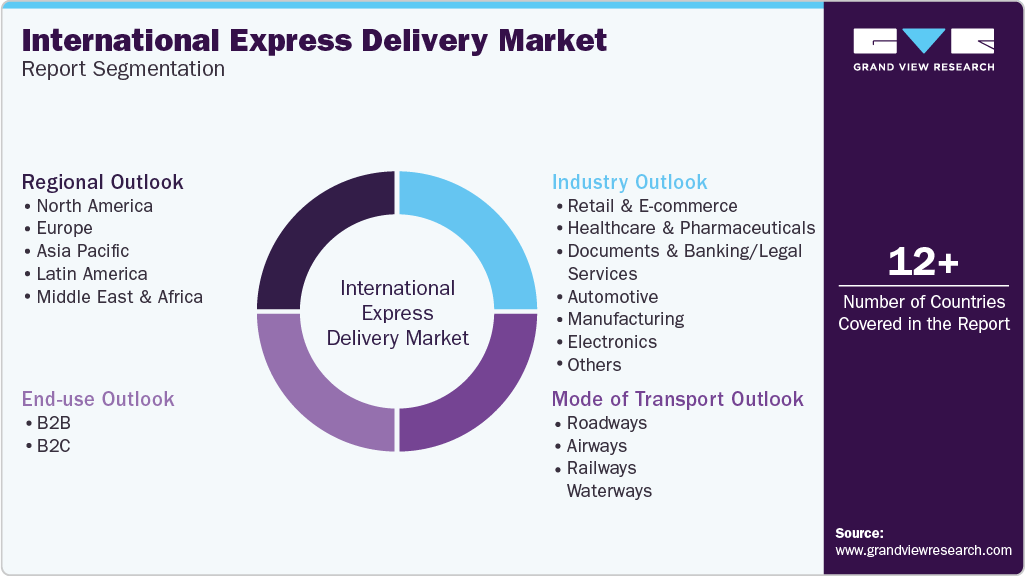

Global International Express Delivery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global international express delivery market report based on mode of transport, end user, industry, and region:

-

Mode of Transport Outlook (Revenue, USD Million, 2018 - 2030)

-

Roadways

-

Airways

-

Railways

-

Waterways

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & E-commerce

-

Healthcare & Pharmaceuticals

-

Documents & Banking/Legal Services

-

Automotive

-

Manufacturing

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global international express delivery market size was estimated at USD 30.96 billion in 2024 and is expected to reach USD 33.92 billion in 2025.

b. The global international express delivery market is expected to grow at a compound annual growth rate of 10.5% from 2025 to 2030 to reach USD 56.00 billion by 2030.

b. AsiaPacific dominated the international express delivery market with a share of 44.66% in 2024 with cross-border parcel flows driven by the region’s strong trade volumes and growing outbound demand from e-commerce exporters.

b. Some key players operating in the international express delivery market include DHL Group; FedEx; SF Express; CJ Logistics Corporation; La Poste Group; US Postal Service; Correos Express; Blue Dart Express Ltd.; Aramex

b. Key factors that are driving the market growth include the rise of cross-border e-commerce, increasing globalization of trade, and consumer demand for faster delivery times.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.