- Home

- »

- Automotive & Transportation

- »

-

Internet of Things in Warehouse Management Market Report, 2025GVR Report cover

![Internet of Things in Warehouse Management Market Size, Share & Trends Report]()

Internet of Things in Warehouse Management Market Size, Share & Trends Analysis Report By Solution (Warehouse Automation, Workforce Management, Inventory Management, EDI, Tracking), By Device, By Service, And Segment Forecasts, 2018 - 2025

- Report ID: GVR-1-68038-753-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2015

- Forecast Period: 2016 - 2025

- Industry: Technology

Industry Insights

The global Internet of Things in warehouse management market was valued at USD 2.27 billion in 2015, owing to the increasing penetration of connected devices across the globe. The telecommunication industry has undergone significant advancements over the past few years. The increasing need of applications for connected devices across various sectors is expected to increase the efficiency of the warehouse.

The growing number of machine-to-machine applications, including video surveillance, smart meters, transportation, health monitoring, and asset tracking, is anticipated to drive the connected device market demand. The IoT-enabled applications are anticipated to revolutionize the digital consumer experience. Additionally, the increasing telematics-related regulations by various governments are expected to propel the demand for connected trucks and enhance the productivities of the warehouse operations.

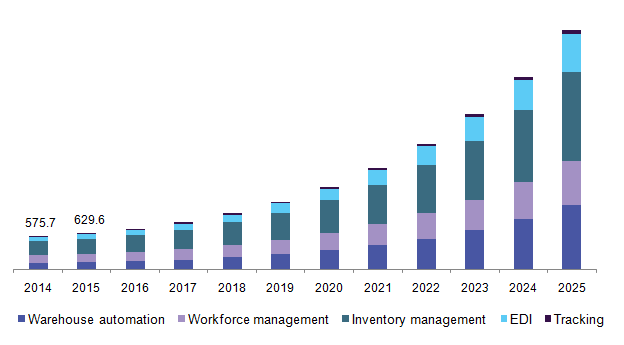

U.S. IoT in warehouse management market, by solution, 2014 - 2025 (USD Million)

The growing automation in warehouse is changing the traditional industry operations, enabling companies to maximize their throughput. Order accuracy can beachieved through automated Materials Handling (MH) equipment, robotics applications, and high-speed conveyor systems.

Solution Insights

Based on the solution, the industry has been segmented into warehouse automation, workforce management, inventory management, electronic data interchange (EDI), and tracking. The warehouse automation solution is anticipated to witness high growth rate over the forecast period.

The automated warehousing systems increase the storage capacity by 400% compared to the traditional forklift operations. Additionally, automation also helps to reduce the storage space in the warehouse that can be used for other activities such as packagingand value-added services.

The inefficiencies of picking &put away increase the overall storage operation cost. The adoption of workforce management application is anticipated to reduce labor cost. The functions of workforce management include picking optimization and workforce forecast.

Device Insights

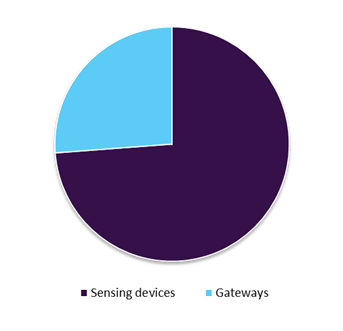

Based on the device, the industry has been segmented into sensing devices and gateways.Thegateway is expected to have high growth rate over the projected period. The rapid proliferation of RFID technology is likely to spur the industry demand.Operators across the globe are using RFID readers, barcode scanners, and other handheld devices to streamline shipping and inventory management.

The RF tags,attached to pallets, provide information and location of the product. Furthermore, the integration of RFID and warehouse management systems is expected to further influence the sensing device market demand.

Service Insights

Based on the service, the industry has been segmented into 3PL and usage-based insurance. IoT enables organizations to target untapped market segments by offering new services to attract customers. The increasing movement of companies toward service-oriented models is expected to drive the 3PL service market.

IoT in warehouse management market, by device, 2015 (USD Million)

The usage-based insurance is anticipated to portray high growth rate over the forecast period. The growing adoption of telematics solutions in trucks and the increasing penetration of connected trucks are expected to drive the usage-based insurance service.

Regional Insights

North America held a significant market share of over 43.71% in 2015 and is expected to be one of the most influential markets across the globe. The prevailing high labor costs and growing penetration of automation are the key factors driving the North American regional market.Furthermore, the growing adoption of connected trucks is anticipated to drive the market demand across the region. Driver assistance systems, infotainment, and safety applications are all the major applicationsof the connected trucks.

Internet of Things in Warehouse Management Market Share Insight

Some of the major industry players include Argos Software (U.S.), Eurotech S.P.A. (Italy), GT Nexus (U.S.), and IBM Corporation (U.S.). The service providers create value to the customers by having better communication between the sensor technology and the network layer. Machine-to-Machine communication includes industrial instrumentation and application software. Service providers aim to reduce the costs of operations and deploy new services toattract customers.

Report Scope

Attribute

Details

Base year for estimation

2015

Actual estimates/Historical data

2014 - 2015

Forecast period

2016 - 2025

Market representation

Revenue in USD Millionand CAGR from 2016 to 2025

Regional scope

North America, Europe, Asia Pacific, South America,and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France,Japan, China, India, Singapore, and Brazil

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope(equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional,and country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global Internet of Things (IoT) in Warehouse Management Market based onsolution, device, service, and region:

-

Solution Outlook (Revenue, USD Million; 2014 - 2025)

-

Warehouse automation

-

Workforce management

-

Inventory management

-

Electronic data interchange (EDI)

-

Tracking

-

-

Device Outlook (Revenue, USD Million; 2014 - 2025)

-

Sensing devices

-

Gateways

-

-

Service Outlook (Revenue, USD Million; 2014 - 2025)

-

Usage-based insurance

-

3PL

-

-

Regional Outlook (Revenue, USD Million; 2014 - 2025)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

-

South America

-

Brazil

-

-

The Middle East and Africa (MEA)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."