- Home

- »

- Medical Devices

- »

-

Interventional Cardiology Devices Market Size Report, 2033GVR Report cover

![Interventional Cardiology Devices Market Size, Share & Trends Report]()

Interventional Cardiology Devices Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Coronary Stents, PTCA Balloon Catheters, Intravascular Imaging Catheters & Pressure Guidewires, Accessory Devices), By Region, And Segment Forecasts

- Report ID: 978-1-68038-122-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Interventional Cardiology Devices Market Summary

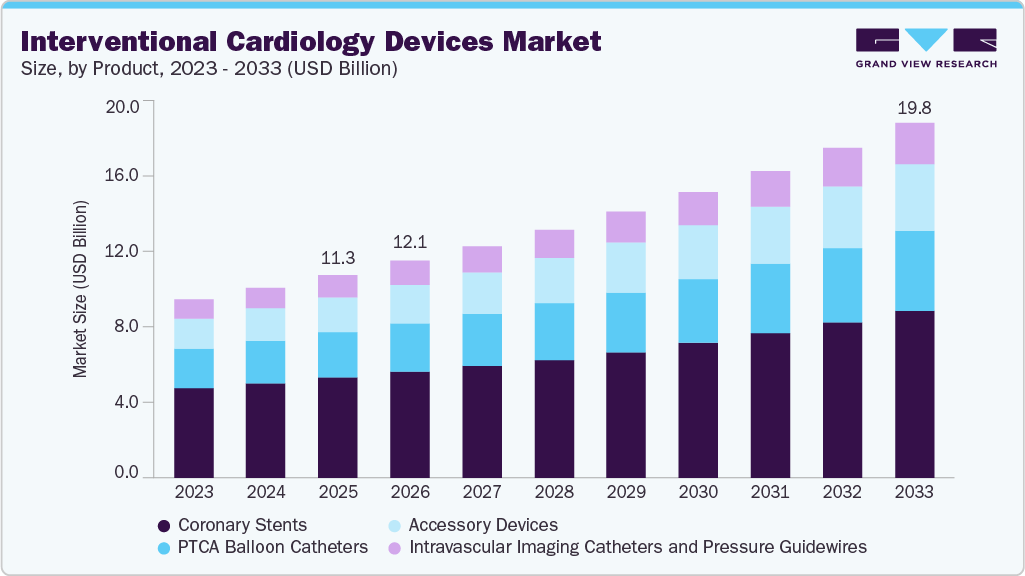

The global interventional cardiology devices market size was estimated at USD 11.28 billion in 2025 and is projected to reach USD 19.75 billion by 2033, growing at a CAGR of 7.30% from 2026 to 2033. The market growth is driven by the rising prevalence of cardiovascular diseases, demand for minimally invasive procedures, and advancements in technologies such as drug-eluting stents and bioresorbable vascular scaffolds.

Key Market Trends & Insights

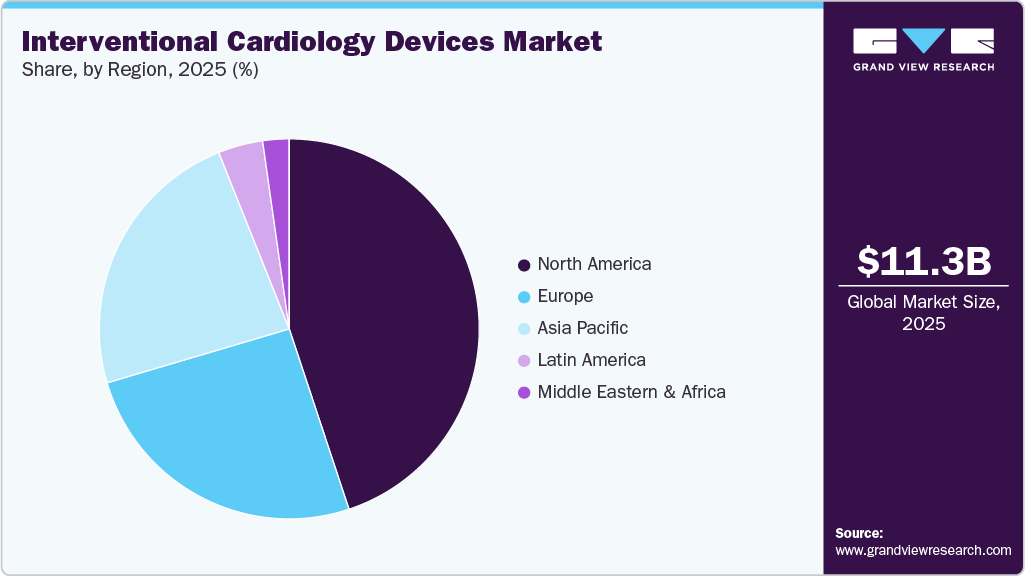

- The North America interventional cardiology devices market accounted for the largest global revenue share of 44.91% in 2025.

- The Asia Pacific interventional cardiology devices industry is anticipated to register the fastest CAGR from 2026 to 2033.

- By product, the coronary stents segment held the largest revenue share in 2025.

- In the coronary stents segment, DES held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.28 Billion

- 2033 Projected Market Size: USD 19.75 Billion

- CAGR (2026-2033): 7.30%

- North America: Largest Market in 2025

- Asia Pacific: Fastest Growing Market

The expanding elderly population, rising healthcare spending, and improved access to cardiac care in emerging markets also contribute to market expansion. In May 2025, Mentice secured a USD 642,000 order from a top 20 global MedTech company to expand its simulation-based training solutions for interventional cardiology. The order highlights the growing demand for advanced procedural training tools designed to enhance clinician proficiency and patient safety.

The rising prevalence of cardiovascular diseases is a primary driver of the interventional cardiology devices industry growth. Sedentary lifestyles, poor dietary habits, and increasing rates of obesity and diabetes have led to a global surge in coronary artery disease and other cardiac conditions. This growing disease burden has increased the demand for timely and effective interventions, boosting the adoption of stents, catheters, and other interventional tools.In October 2024, the CDC reported that heart disease continues to be the top cause of death in the U.S., responsible for more than 919,000 deaths in 2023, or roughly one-third of all fatalities. A person dies from cardiovascular disease every 34 seconds, and around 5% of adults are affected by coronary artery disease. Between 2020 and 2021, heart disease incurred a financial toll of USD 417.9 billion in healthcare costs, medications, and lost productivity.

Region/Country

Prevalence/Statistic

Notes (Market Relevance)

Global

612 million+ CVD cases (2025)

Major driver for interventional procedures and device demand

Annual CVD Deaths

20.5 million (2025 projection)

32% of all global deaths underscores the acute need for intervention

The shift toward minimally invasive procedures is also accelerating market growth. Interventional cardiology offers lower procedural risk, shorter hospital stays, and faster recovery times compared to traditional surgery. These benefits have made catheter-based treatments increasingly attractive to both patients and providers, particularly in high-volume centers and aging populations where surgical risk is a concern. Reflecting this momentum, in September 2023, the Society for Cardiovascular Angiography & Interventions (SCAI) hosted the 6th Annual SCAI Interface in Interventional Cardiology in Mumbai, India, bringing together global experts to highlight innovations and best practices in catheter-based cardiac care.

Technological innovation continues to transform the landscape of interventional cardiology. Advancements such as drug-eluting stents, bioresorbable scaffolds, and AI-assisted imaging have improved the precision, safety, and long-term outcomes of procedures. Companies investing in smart devices, image-guided navigation, and next-generation delivery systems are helping drive clinical adoption and market expansion.In May 2025, Cordis launched a global registry study to evaluate long-term outcomes of its SELUTION SLR drug-eluting balloon in up to 10,000 patients. The initiative includes global experts, including a Brazilian cardiologist, and aims to build robust clinical evidence for coronary interventions.

Interventional Cardiology Devices: Clinical, Technological, and Market Overview

Focus Area

Key Insights / Examples

Clinical Use Cases

- Acute coronary syndromes (STEMI/NSTEMI) interventions

- Chronic total occlusions (CTO) and complex coronary lesions

- Peripheral artery disease (PAD) procedures- Structural heart interventions: TAVR, MitraClip, valve repairs

Device & Technology Innovations

- Simulation & VR/AR training platforms (e.g., Mentice)

- Robotic-assisted catheter systems-

- AI-enabled imaging and decision support- Intravascular imaging integration: IVUS, OCT, FFR

Procedure Efficiency & Outcomes

- Shorter procedure times and fewer complications

- Higher procedural success in complex PCI

- Improved patient outcomes: reduced restenosis and thrombosis risk- Streamlined workflows in cath labs

Market Trends & Business Insights

- Leading vendors/startups: Concept Medical, Vesalio, Terumo, IMDS, Mentice

- Technology adoption: Drug-Eluting Stents (DES), Drug-Coated Balloons (DCB), thrombectomy systems

- Growth drivers: aging populations, CAD prevalence, supportive reimbursement policies

Emerging Directions

- Bioresorbable scaffolds and biodegradable devices- Miniaturized, catheter-based interventions-

- Personalized therapy using patient-specific imaging & AI modeling

- Expansion in emerging markets and remote interventional support

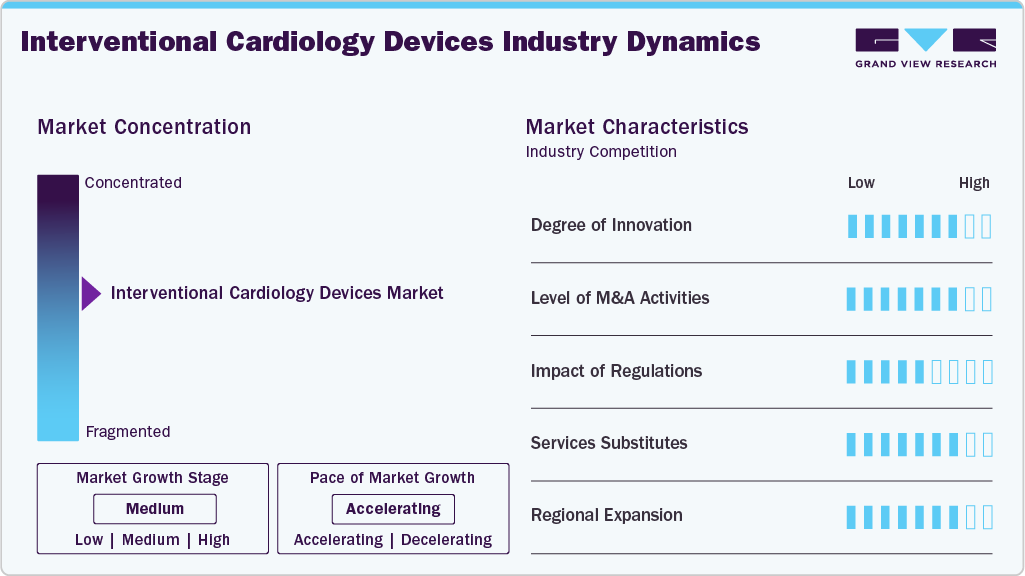

Market Concentration & Characteristics

The interventional cardiology devices market has witnessed significant innovation, driven by advancements in robotics, artificial intelligence, and data integration. Innovations in device miniaturization, precision-guided delivery systems, and AI-assisted imaging have enhanced procedural accuracy and patient outcomes. In October 2025, Terumo India launched the FineCross M3 Coronary Micro-Guide Catheter, enhancing percutaneous coronary intervention (PCI) procedures with improved crossing ability, enhanced guidewire support, and improved navigability for complex lesions. The launch strengthens Terumo India’s interventional cardiology portfolio, aiming to enhance procedural safety and clinical outcomes for patients with coronary artery disease.

The market is characterized by strong merger and acquisition activity as leading medtech companies aim to expand product portfolios, integrate complementary technologies, and accelerate go-to-market strategies. These consolidations are enabling companies to enhance R&D capabilities, reduce time-to-market for new devices, and gain access to emerging markets. In March 2025, Boston Scientific announced its acquisition of SoniVie Ltd., a private medical device firm in Israel, for approximately USD 360 million upfront, with potential additional payments, to expand its interventional cardiology portfolio with ultrasound-based renal denervation therapy for hypertension.

Regulatory frameworks play a pivotal role in shaping product development, market entry, and post-market performance for interventional cardiology devices. Regulatory bodies such as the FDA and EMA have established rigorous clinical and manufacturing standards, especially for high-risk Class III devices. Recent shifts toward expedited review pathways for breakthrough devices and harmonized international standards are supporting faster innovation. However, compliance with technical documentation, quality systems, and real-world evidence requirements remains critical for sustained market presence.

Manufacturers are actively expanding their product portfolios through continuous upgrades and the introduction of next-generation interventional tools. Innovations include improved stent platforms, next-gen drug delivery systems, robotic-assisted catheterization labs, and enhanced guidewire technologies. This focus on iterative improvements is aimed at addressing unmet clinical needs such as complex lesion management, reduced restenosis rates, and improved patient recovery times. Companies are also investing in platform-based ecosystems that integrate diagnostics, navigation, and therapeutic capabilities.

Global market leaders are strategically entering new geographic markets to capitalize on growing demand for advanced cardiac care, particularly in Asia-Pacific, Latin America, and the Middle East. Factors such as rising incidence of coronary artery disease, improving healthcare infrastructure, and supportive reimbursement policies are driving regional adoption. Companies are leveraging local partnerships, regulatory familiarity, and tailored product offerings to penetrate underserved markets and strengthen global distribution networks. in April 2022, New York-Presbyterian Hudson Valley Hospital announced the launch of an Interventional Cardiology Program.

Product Insights

The coronary stents segment dominated the interventional cardiology devices market, accounting for the largest share of 49.30% in 2025. This dominance is driven by the high prevalence of coronary artery disease, widespread use of stents in percutaneous coronary interventions, and continued advancements in stent technology including drug eluting and bioresorbable stents. The segment's growth is further supported by increasing procedure volumes, expanding clinical indications, and improved long term outcomes associated with newer generation stent platforms.In May 2023, Shockwave Medical launched its enhanced Shockwave C2+ Coronary IVL Catheter internationally for complex calcified coronary lesions. The company also began enrolling patients in EMPOWER CAD, the first all-female IVL study in interventional cardiology.

The accessory devices segment is anticipated to grow at the fastest CAGR during the forecast period,driven by the increasing complexity of interventional procedures and the growing need for supportive tools that enhance procedural safety and efficiency. These devices, including guidewires, catheters, introducers, and embolic protection systems, play a critical role in optimizing device delivery and improving clinical outcomes. Advancements in material science and device design, along with rising adoption of image-guided and robotic-assisted interventions, are further propelling demand within this segment. In October 2024, APT Medical launched its MDR-certified Anyreach PTCA Guidewire at EuroCTO 2024 in Istanbul, enhancing its PCI product portfolio. The guidewire was featured in a live complex CTO case, demonstrating strong performance in retrograde navigation for interventional cardiology.

Regional Insights

North America dominated the interventional cardiology devices market with a revenue share of 44.91% in 2025, owing to the high prevalence of cardiovascular diseases, advanced healthcare infrastructure, and early adoption of innovative technologies. Strong reimbursement frameworks, a high volume of interventional procedures, and the presence of leading market players further support regional growth.In July 2024, Cook Medical relaunched its Slip-Cath hydrophilic angiographic catheter in the U.S. and Canada after a product recall in 2016. The re-engineered device supports vascular imaging and interventions, including in cardiology. It features Beacon Tip technology and a hydrophilic coating for enhanced visibility and performance.

U.S. Interventional Cardiology Devices Market Trends

The U.S. interventional cardiology devices industry dominated North America in 2025, driven by a high burden of cardiovascular diseases, widespread availability of advanced treatment options, and robust investment in research and development. A well-established reimbursement system, high procedure volumes, and the presence of key industry players contribute to the country’s strong market position.In January 2025, the American Heart Association revealed that cardiovascular disease continued to be the top cause of death in the U.S., driven by rising rates of obesity, high blood pressure, and diabetes. With over 941,000 deaths in 2022 surpassing cancer and accidents it underscored the pressing need for better prevention strategies and expanded access to heart care.

The Canada interventional cardiology devices market is anticipated to register the fastest CAGR during the forecast period, supported by rising healthcare expenditure, increasing awareness of minimally invasive cardiac procedures, and expanding access to advanced cardiovascular care. Government initiatives aimed at improving healthcare infrastructure, along with growing demand for early diagnosis and treatment of heart diseases, are driving adoption. In December 2025: Surrey Memorial Hospital added two cardiac catheterization suites and two interventional radiology suites, enhancing local access to advanced heart and image-guided care and supporting timely, life-saving procedures.

Europe Interventional Cardiology Devices Market Trends

The Europe interventional cardiology devices industry is anticipated to grow significantly during the forecast period, due tothe rising incidence of cardiovascular diseases, increasing adoption of minimally invasive procedures, and strong presence of established medical device manufacturers. Supportive government policies, growing geriatric population, and expanding use of advanced imaging and navigation technologies in catheter-based interventions are also contributing to regional growth. In August 2022, Medtronic announced that it had received the European CE Mark approval for its Onyx Frontier Drug-Eluting Stent (DES). Also, Onyx Frontier had received U.S. FDA approval in May 2022. This DES offers significant improvements over the company’s previous generation Resolute Onyx DES family.

Germany interventional cardiology devices market is anticipated to register a considerable CAGR during the forecast period, driven by a high volume of cardiac procedures, strong clinical infrastructure, and continued investment in healthcare technology. The country’s emphasis on precision medicine and integration of digital tools in interventional cardiology is also enhancing procedural outcomes and driving market demand.In September 2024, Mentice AB and the German Society of Interventional Cardiology (AGIK) formed a three-year strategic partnership to enhance interventional cardiology training in Germany.

The UK interventional cardiology devices market is anticipated to grow considerably during the forecast period. The growth is attributable to rising prevalence of coronary artery disease, increasing adoption of minimally invasive treatments, and supportive government initiatives aimed at improving cardiovascular care. Strategic collaborations between healthcare providers and medtech companies are also fostering innovation and accelerating the introduction of advanced interventional solutions.In 2024, the British Heart Foundation reported that there were 68,078 deaths in the UK due to coronary heart disease. The NHS’s focus on cost-effective treatments and the availability of advanced stent technologies like drug-eluting stents help improve patient outcomes.

Asia Pacific Interventional Cardiology Devices Market Trends

The Asia Pacific interventional cardiology devices industry is expected to register the fastest CAGR over the forecast period. This is attributed to a rising burden of cardiovascular diseases, growing healthcare infrastructure, increasing adoption of advanced medical technologies, and expanding access to cardiac care in emerging economies. Rising healthcare expenditure, favorable government policies, and a surge in medical tourism further support regional market growth.A January 2024 study in Nature Communications introduced a drug-free stent coating made with recombinant humanized type III collagen, demonstrating improved endothelialization and reduced in-stent restenosis in animal models. This innovative coating exhibited anticoagulation and anti-inflammatory properties, positioning it as a promising alternative to traditional drug-eluting stents.

The China interventional cardiology devices market is anticipated to hold a considerable market share rate during the forecast period, owing toits large patient population, rapid urbanization, and government-driven healthcare reforms. Local manufacturing capabilities, increased investment in research and development, and growing uptake of minimally invasive procedures are also driving market expansion. In July 2024, MicroPort Scientific Corporation announced that its subsidiary, Shanghai MicroPort Medical, received NMPA approval for Firesorb, the world's first fully bioresorbable cardiac stent. Clinical studies show that Firesorb performs on par with permanent stents, with a 3-year target lesion failure rate of only 3.5% and a thrombosis rate of just 0.32%.

The interventional cardiology devices market in India accounted for significant market share, owing to the high incidence of cardiac disorders, increasing demand for cost-effective treatment options, and the availability of skilled interventional cardiologists. Rising awareness of early diagnosis and improvements in public and private healthcare infrastructure continue to support the country's growing market presence.In October 2025, Terumo India launched the FineCross M3 Coronary Micro-Guide Catheter, enhancing percutaneous coronary intervention (PCI) procedures by improving guidewire support, lesion crossing, and navigability in complex coronary artery disease cases. The device aims to increase procedural safety, efficiency, and clinical outcomes in India.

Latin America Interventional Cardiology Devices Market Trends

The Latin America interventional cardiology devices industry is anticipated to grow at the second-fastest CAGR over the forecast period, this is attributable to rising cardiovascular disease prevalence, increasing healthcare investments, and growing adoption of minimally invasive procedures. Efforts to modernize healthcare systems, along with the expansion of private healthcare facilities, are further contributing to market growth across the region.In September 2025, Concept Medical received ANVISA approval in Brazil for its MagicTouch Sirolimus-Coated Balloon (SCB) for coronary artery disease, marking the first metal-free, drug-delivery balloon cleared in the country and expanding access to safer, effective cardiovascular therapies.

The Brazil interventional cardiology devices market accounted for significant market share as it benefits from a large patient pool, improving access to advanced cardiac care, and growing government focus on reducing cardiovascular mortality. The presence of skilled healthcare professionals and expanding availability of interventional procedures in both public and private sectors support continued market development.In September 2023, MicroPort Endovastec announced the first clinical use of its Reewarm PTX Drug-Coated Balloon Catheter in Brazil for treating popliteal artery stenosis. The procedure, performed in São Paulo, marked the product’s Latin America debut following ANVISA approval in 2022.

MEA Interventional Cardiology Devices Market Trends

The MEA interventional cardiology devices industry holds a significant revenue share, due to a rising burden of lifestyle-related cardiovascular conditions, increasing awareness of interventional therapies, and expanding investments in healthcare infrastructure. Market growth is also supported by ongoing efforts to enhance cardiac care capacity and access in both urban and underserved areas.In May 2024, Bayer and digital health firm Huma launched a cardiovascular risk screening tool in Saudi Arabia, marking the initiative’s first global rollout beyond the U.S.

The UAE interventional cardiology devices market holds a significant market share due toits advanced healthcare system, high per capita healthcare spending, and early adoption of cutting-edge medical technologies. Strong government support for healthcare innovation, combined with the country’s positioning as a regional hub for medical tourism, further drives demand for interventional cardiology solutions.In September 2024, Translumina expanded its global footprint by launching direct operations in the UAE, aiming to strengthen its presence in the fast-growing MENA region. The move enhances access to its cardiovascular devices, including drug-eluting stents developed in collaboration with the German Heart Centre.

Key Interventional Cardiology Devices Company Insights

Key participants in the interventional cardiology devices market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Interventional Cardiology Devices Companies:

The following are the leading companies in the interventional cardiology devices market. These companies collectively hold the largest Market share and dictate industry trends.

- Abbott

- Medtronic

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Koninklijke Philips N.V.

- Terumo Corporation

- Alvimedica Medical Technologies Inc.

- Teleflex Incorporated

- B. Braun Melsungen AG

- Biosensors International Group, Ltd.

- Meril Life Sciences Pvt. Ltd.

- BIOTRONIK SE & Co. KG

- ACIST Medical Systems, Inc.

- Asahi Intecc Co., Ltd.

- Cook Medical LLC

- Medinol Ltd.

- Merit Medical Systems, Inc.

- NuMED, Inc.

- OpSens Inc.

- Zeon Medical Inc.

Recent Developments

-

In December 2025, the FDA cleared Vesalio’s enVast coronary mechanical thrombectomy system, introducing a stent-based approach for removing large coronary clots during primary PCI. The device, featuring proprietary Drop Zone technology, aims to improve clot capture and patient outcomes, marking Vesalio’s first regulatory approval in both the U.S. and Europe.

-

In December 2025, SCAI and CRT announced a partnership to advance interventional cardiology through joint education, advocacy, and research initiatives. The collaboration will include discounted CRT event registration for SCAI members, coordinated legislative activities, and development of registries and clinical trials to enhance physician training and patient care.

-

In September 2025, Interventional Medical Device Solutions (IMDS) began direct U.S. operations, naming Jason Bottiglieri as president. The shift from Biotronik distribution aims to enhance support and speed for complex percutaneous coronary interventions, providing physicians with direct access to IMDS’s PCI device portfolio.

-

In May 2025, Boston Scientific announced collaborations with Philips and Siemens to integrate its iLab Ultrasound Imaging System with their interventional X-ray platforms. These integrations aim to enhance intravascular imaging capabilities within cath labs, offering improved workflow and imaging accuracy.

-

In September 2024, Uppsala University launched a flexible stent to reduce complications in coronary artery surgery. The Infinity-Swedeheart study, involving 2,400 patients from 20 Swedish hospitals, compared this new stent to the conventional Resolute Onyx stent. This innovation has the potential to improve patient recovery and long-term outcomes in cardiac surgery.

-

In May 2024, Abbott launched the XIENCE Sierra Everolimus Eluting Coronary Stent System in India, enhancing treatment options for patients with blocked coronary arteries. This latest generation stent offers improved safety for complex cases and is part of Abbott's ongoing efforts to advance the angioplasty procedure, a minimally invasive method to restore blood flow to the heart using stents.

Interventional Cardiology Devices Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.06 billion

Revenue forecast in 2033

USD 19.75 billion

Growth rate

CAGR of 7.30% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Medtronic; Boston Scientific Corporation; Cardinal Health, Inc.; Koninklijke Philips N.V.; Terumo Corporation; Alvimedica Medical Technologies Inc.; Teleflex Incorporated; B. Braun Melsungen AG; Biosensors International Group, Ltd.; Meril Life Sciences Pvt. Ltd.; BIOTRONIK SE & Co. KG; ACIST Medical Systems, Inc.; Asahi Intecc Co., Ltd.; Cook Medical LLC; Medinol Ltd.; Merit Medical Systems, Inc.; NuMED, Inc.; OpSens Inc.; Zeon Medical Inc.; The Spectranetics Corporation; CID S.p.A.; Vascular Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Interventional Cardiology Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country-level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global Interventional cardiology devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Coronary Stents

-

DES

-

BMS

-

BRS

-

-

PTCA Balloon Catheters

-

Normal

-

Specialty

-

Drug-Coated

-

-

Intravascular Imaging Catheters and Pressure Guidewires

-

Accessory Devices

-

PTCA Guidewires

-

PTCA Guiding Catheters

-

Introducer Sheaths

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global interventional cardiology devices market size was estimated at USD 11.28 billion in 2025 and is expected to reach USD 12.06 billion in 2026.

b. The global interventional cardiology devices market is expected to grow at a compound annual growth rate of 7.30% from 2026 to 2033 to reach USD 19.75 billion by 2033.

b. Coronary stents held a significant share in the industry in 2025 with a revenue share of 49.30% due to the high prevalence of coronary artery disease, widespread use of stents in percutaneous coronary interventions, and continued advancements in stent technology, including drug-eluting and bioresorbable stents.

b. Some key players operating in the interventional cardiology devices market include Abbott; Medtronic; Boston Scientific Corporation; Cardinal Health, Inc.; Koninklijke Philips N.V.; Terumo Corporation; Alvimedica Medical Technologies Inc.; Teleflex Incorporated; B. Braun Melsungen AG; Biosensors International Group, Ltd.; Meril Life Sciences Pvt. Ltd.; BIOTRONIK SE & Co. KG; ACIST Medical Systems, Inc.; Asahi Intecc Co., Ltd.; Cook Medical LLC; Medinol Ltd.; Merit Medical Systems, Inc.; NuMED, Inc.; OpSens Inc.; Zeon Medical Inc.; The Spectranetics Corporation; CID S.p.A.; Vascular Solutions, Inc.

b. Key factors that are driving the market growth include the rising prevalence of cardiovascular diseases, increased demand for minimally invasive procedures, and advancements in technologies such as drug-eluting stents and bioresorbable vascular scaffolds.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.