- Home

- »

- Medical Devices

- »

-

Intravascular Stents Market Size, Share, Growth Report 2030GVR Report cover

![Intravascular Stents Market Size, Share & Trends Report]()

Intravascular Stents Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Drug Eluting Stents, Bare Metal Stents), By Mode of Delivery, By Product, By End-Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-125-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

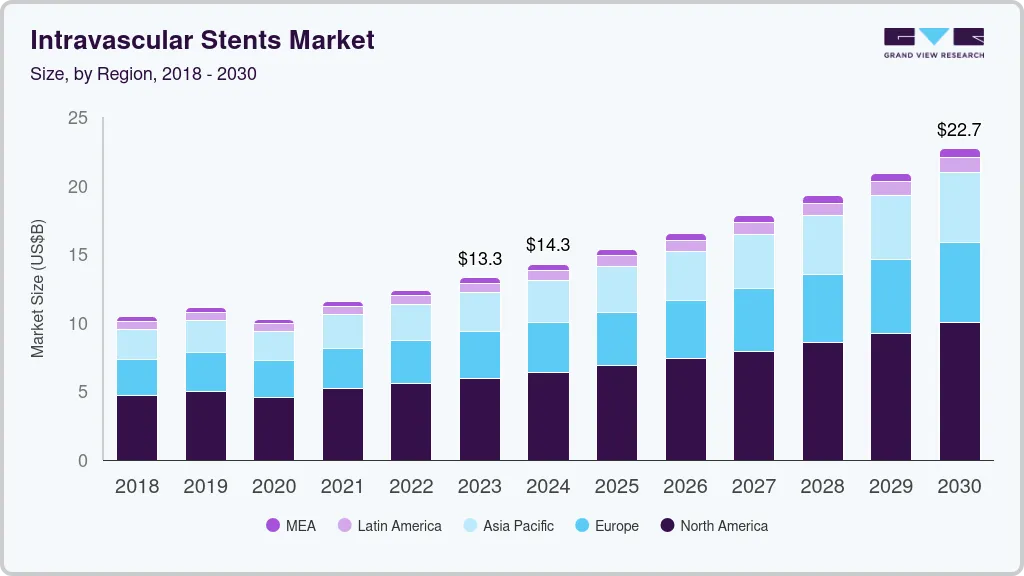

The global intravascular stents market size was valued at USD 13.26 billion in 2023 and is expected to reach USD 22.69 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. The market for intravascular stents is expected to experience substantial growth, propelled by various factors. These factors include the increasing prevalence of coronary artery diseases and peripheral diseases, a growing elderly population, and the introduction of advanced product offerings. Conditions like coronary artery disease (CAD), peripheral arterial disease (PAD), atherosclerosis, and deep vein thrombosis are becoming more widespread, leading to significant demand for intravascular stents. According to a journal from the American Heart Association published in June 2023, more than 12 million Americans and around 200 million people globally are affected by PAD.

In addition, cardiovascular diseases (CVDs) have emerged as a significant public health concern worldwide, primarily driven by various risk factors such as high blood pressure, unhealthy diets, diabetes, and stress. The sharp increase in CVD-related deaths underscores the urgent need for effective preventive, diagnostic, and treatment measures.

The COVID-19 pandemic significantly impacted surgical procedures and patient care, leading to delays in diagnosing and treating cardiovascular diseases, and affecting the coronary stent market. According to a research study published in the National Library of Medicine in March 2022, there was a 52.7% decrease in adult cardiac surgery volume and a 65.5% reduction in elective cases during the period between February 2020 and January 2021. This study highlights the adverse effects of the COVID-19 pandemic on cardiac surgical procedures. However, with the decline in COVID-19 cases, the market started to recover, leading to increased heart surgeries. The reduction in COVID-19 cases resulted in more heart surgeries, leading to increased adoption of intravascular stents.

Furthermore, the market's growth was also driven by various companies developing new products. The emphasis on introducing new products and obtaining regulatory approvals is anticipated to enhance the accessibility of advanced options, stimulate greater adoption of intravascular stents, and contribute to the growth of the market.

Moreover, the increasing elderly population worldwide and advancements in stent technology and materials are key factors projected to significantly impact the intravascular stent market's growth. The older population, particularly individuals aged 65 and above, is more susceptible to chronic diseases like CVDs, which often require surgical interventions like stent implantation to treat arterial obstructions caused by plaque buildup. According to a report by the Asian Pacific Observatory on Health Systems and Policies in November 2022, the Asia-Pacific region is expected to have about one-fourth of its population aged 60 years or older by 2050, attributed to decreasing mortality rates and increased longevity. This demographic shift will likely increase the burden of CVDs, driving demand for effective and advanced treatment procedures, including intravascular stent implantation, and contributing to market growth.

Key market players play a vital role in driving the adoption of technological advancements in the intravascular stent market. These companies actively integrate such innovations into their product offerings to enhance patient outcomes and expand access to advanced treatment options. A noteworthy example is Cordis, a prominent player in the intravascular market, which obtained US FDA approval in March 2022 for its Smart Radianz Vascular Stent System. This self-expanding stent is specifically designed for radial peripheral procedures, addressing the specific needs of both physicians and patients. The introduction of specialized and advanced products like the Smart Radianz Vascular Stent System reinforces the market position and competitiveness of these companies.

Furthermore, strategic collaborations and partnerships enable market players to enter untapped market segments and extend their reach to new geographical regions, thereby contributing to overall market growth. Through continuous innovation and collaborative efforts, these companies drive the widespread adoption of cutting-edge technologies, further enhancing the intravascular stent market.

Type Insights

The drug-eluting stents (DES) segment held the largest market share of 58.22% in 2022, categorized by type. DES has proven to be effective in reducing restenosis rates compared to bare metal stents (BMS). The ability of DES to lower the incidence of major adverse cardiac events (MACE) has been a key driver in their widespread adoption. The drug coating on the stent helps prevent stent thrombosis, reducing the risk of blood clot formation within the stent. This leads to a decrease in heart attacks, strokes, and other cardiovascular events, resulting in improved patient safety and overall survival rates. For example, in May 2022, Medtronic plc received approval from the US FDA for the Onyx Frontier DES. This innovative stent, part of the Resolute DES family, shares the same advanced stent platform as the Resolute Onyx DES but incorporates a novel delivery mechanism designed to enhance acute performance, particularly in challenging cases. This advancement aims to improve patient outcomes and offer better treatment options for individuals with complex conditions.

The bioabsorbable stent segment is predicted to grow substantially in the forecast period. These stents represent a groundbreaking advancement in the field of interventional cardiology. Their gradual dissolution in the body eliminates long-term risks associated with permanent stents, such as in-stent restenosis and late-stent thrombosis, thus reducing the likelihood of adverse events. Unlike permanent stents, bioabsorbable stents allow the artery to maintain natural flexibility and movement, improving patient outcomes. The need to overcome the limitations of permanent stents has been the primary driving force behind the development and adoption of bioabsorbable stents. A study published in the Catheterization and Cardiovascular Intervention journal in May 2020, titled "Safety and Efficacy of Bioabsorbable Polymer Everolimus-Eluting Stent versus Durable Polymer Drug-Eluting Stents in High-Risk Patients Undergoing PCI: TWILIGHT-SYNERGY," reveals that bioabsorbable polymer (BP) DES demonstrate superior safety and efficacy compared to durable polymer (DP) DES in high-risk patients undergoing percutaneous coronary intervention (PCI). These research findings indicate that polymer-based bioabsorbable stents are expected to exhibit a high level of safety and efficacy, which is likely to drive growth in this segment over the forecast period.

Mode of Delivery Insights

In 2022, the balloon-expanding stents segment held the largest market share at 53.91%. These stents offer a notable advantage by enabling precise and controlled expansion within the affected blood vessel. This characteristic ensures optimal scaffolding of the vessel, resulting in improved blood flow and a reduced risk of re-narrowing or restenosis. Furthermore, their suitability for application in intricate anatomical locations allows effective treatment, even in challenging cases. The increasing preference for minimally invasive procedures has significantly contributed to the growth of this segment. Furthermore, the increasing preference for minimally invasive procedures has significantly contributed to the growth of the self-expanding stents segment. In June 2021, Cardiovascular Systems, Inc. announced the availability of the complete range of OrbusNeich JADE over-the-wire balloon catheters for percutaneous transluminal angioplasty (PTA) procedures in the U.S. Thus, such development has further fueled the adoption of balloon-expanding stents and contributed to the segment's growth in the market.

The self-expanding stents segment is anticipated to witness significant growth in the market during the forecast period. These stents are engineered using materials like nitinol, which possess shape memory properties and can automatically expand to fit the vessel walls. This inherent flexibility enables the stent to adapt to challenging lesions or narrow arteries, effectively providing support and restoring blood flow. Additionally, ongoing advancements in stent technologies, including improved designs and materials, contribute to the market's expansion. Self-expanding stents, in particular, offer advantages such as enhanced flexibility, conformability, and reduced risk of recoil or collapse after deployment. These benefits drive their increasing adoption and contribute to their market growth. For instance, In September 2022, Wallaby/Phenox, a prominent market player, introduced the Pegasus HPC stent system. This cutting-edge solution extends the benefits of surface modification to a wider range of patients who undergo stent-assisted coiling procedures, suffer from intracranial atherosclerotic disease (ICAD), or face dissections. The surface modification effectively minimizes thrombogenic complications, caters to multiple indications, and offers the advantages of traditional laser-cut, open-cell stents while emphasizing improving patient safety.

Product Insights

The coronary stents segment accounted for the largest share of 77.46% of the market in 2022. The increasing prevalence of CADs, which occur when plaque accumulates in the arteries, has led to a growing demand for percutaneous coronary intervention treatments involving stents. This surge in demand is expected to be the primary driver fueling the expansion of the coronary stent market. Moreover, there is a notable trend among companies to introduce innovative and advanced drug-eluting stent systems, which is expected to significantly influence the growth of the coronary stent segment. In June 2021, Abbott obtained regulatory approval to label its XIENCE family of drug-eluting stents for dual-antiplatelet therapy in the U.S., with a specific focus on patients with high bleeding risk (HBR) for a month. This regulatory clearance enables the utilization of XIENCE stents in high-risk patients prone to bleeding complications, thereby making a valuable contribution to improving patient care and enhancing treatment outcomes.

The peripheral stent segment is projected to experience significant growth during the forecast period. Due to the increasing prevalence of peripheral diseases, the growing geriatric population, and the introduction of advanced products. For instance, a study published in Circulation Research in June 2021 indicated that PAD is estimated to affect approximately 8.5 million adults in the U.S., with a prevalence of 7%. Consequently, the rising incidence of PAD is expected to drive demand for peripheral stents, propelling the market growth. Additionally, the market is expected to receive a boost from the increasing number of approvals by the U.S. FDA and the launch of new products by key players. In July 2022, BIOTRONIK obtained FDA approval for its innovative Pulsar-18 T3 peripheral self-expanding stent system, enhancing the endovascular treatment implantation procedure. These developments signify growing interest and investment in the peripheral stent market, further contributing to its expansion.

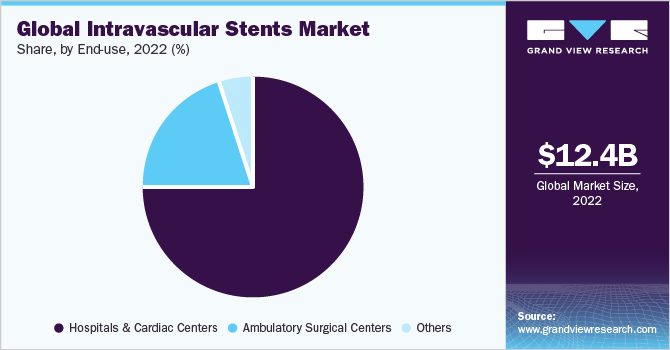

End Use Insights

In 2022, the hospital & cardiac centers segment held a significant market share of 74.55%, primarily driven by the increasing prevalence of CVDs and the growing elderly population. Moreover, the market witnessed further growth due to the rising popularity of minimally invasive procedures. As per the World Health Organization (WHO), cardiovascular diseases (CVDs) continue to be the leading cause of death worldwide, resulting in an estimated 17.9 million fatalities each year. This category of diseases encompasses various heart and blood vessel conditions such as coronary artery disease (CAD), heart attacks, stroke, and peripheral arterial disease (PAD). Hospitals and cardiac centers play a vital role in specialized medical care for diagnosing and treating CVDs, including conditions related to PAD and CAD.

The ambulatory care centers segment is expected to experience substantial market growth during the forecast period. Ambulatory care centers have emerged as significant drivers in the adoption and utilization of intravascular stents. These centers offer efficient and cost-effective alternatives to conventional hospital settings, catering to a wide range of outpatient procedures, including intravascular stent placements.

Regional Insights

North America accounted for the largest share of 43.79% in 2022 due to several factors, including an increasing prevalence of chronic diseases, a growing elderly population, the strong presence of industry players in the region, well-developed healthcare infrastructure, and heightened awareness among the public and healthcare stakeholders regarding available technologies.

Moreover, the active involvement of key market players and research institutions in the region, focusing on innovative stent development for various medical conditions, is predicted to boost market growth. For instance, in October 2021, Boston Scientific Corporation presented positive results from a clinical trial for their Eluvia drug-eluting vascular stent system during the Vascular InterVentional Advances (VIVA) meeting in Las Vegas. The trial, known as EMINENT, involved 775 patients and demonstrated that the Eluvia stent performed better than self-expanding bare metal stents (BMS) in treating patients with peripheral arterial disease (PAD) and superficial femoral artery (SFA) lesions up to 210 mm in length. This groundbreaking trial is expected to drive the utilization of intravascular stents in the region, fostering further advancements in the field.

The Asia Pacific region is expected to experience substantial market growth in the intravascular stent market due to several contributing factors. Sedentary lifestyles, unhealthy dietary habits, and an aging population are leading to an increased incidence of conditions like PAD, creating a higher demand for effective treatment options such as intravascular stents.

Moreover, countries with large populations, such as China and India, experience a significant prevalence of CVDs, making the intravascular stent market a crucial segment in the region. The increasing elderly population and the development of new products in this area contribute to the growth of the intravascular stent market. This high prevalence of CAD leads to an increasing number of cardiology intervention procedures in the region, consequently driving the market growth of Intravascular stents.

Key Companies & Market Share Insights

Key players are introducing advanced products at affordable prices to increase their market share and implementing strategic initiatives, such as acquisitions, mergers, and collaborations, to maximize their market dominance.

For instance, In April 2022, Translumina, a prominent manufacturer of cardiovascular medical devices for interventional cardiology, introduced VIVO ISAR, its dual drug polymer-free coated stent (DDCS), in multiple international markets, including Europe. This strategic launch signifies Translumina's commitment to innovation and expanding its product offerings to cater to the needs of healthcare professionals and patients globally. Some of the key players in the global intravascular stents market include:

-

Boston Scientific Inc.

-

Medtronic

-

Terumo Medical

-

Abbott

-

Biotronik

-

Lifetech

-

iVascular SLU

-

Stryker

-

Cook Medical

-

Microport Scientific Corporation

-

Stentys S.A.

-

Hellman & Friedman (Cordis Inc.)

-

B Braun Melsungen AG

Intravascular Stents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14.26 billion

Revenue forecast in 2030

USD 22.69 billion

Growth rate

CAGR of 8.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mode of delivery, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Boston Scientific Inc.; Medtronic; Terumo Medical; Abbott; Biotronik; Lifetech; iVascular SLU; Stryker; Cook Medical; Microport Scientific Corporation; Stentys S.A.; Hellman & Friedman (Cordis Inc.); B Braun Melsungen AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Intravascular Stents Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented global intravascular stents market report on the basis of type, mode of delivery, product, end-use and region.

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Eluting Stents (DES)

-

Bare Metal Stents (BMS)

-

Bioabsorbable Stents

-

-

Mode of Delivery Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Self-expanding Stents

-

Balloon-expandable Stents

-

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Coronary Stents

-

Peripheral Stents

-

Iliac Artery Stents

-

Femoral Artery Stents

-

Carotid Artery Stents

-

Renal Artery Stents

-

Other Peripheral Stents

-

-

Neurovascular Stents

-

Intracranial Stents

-

Flow Diverters

-

-

-

End Use Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Cardiac Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global intravascular stents market size was estimated at USD 12.37 billion in 2022 and is expected to reach USD 13.27 billion by 2023.

b. The global intravascular stents market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 22.69 billion by 2030.

b. North America emerged as the leading market region in 2022, holding the largest share of 43.79%. The region's robust healthcare infrastructure, advanced medical facilities, and skilled healthcare professionals contribute to the easy accessibility of peripheral vascular stents for patients in the region.

b. Key market players include Boston Scientific Inc., Medtronic, Terumo Medical, Abbott, Biotronik, Lifetech, iVascular SLU, Stryker, Cook Medical, Microport Scientific Corporation, Stentys S.A., Hellman & Friedman (Cordis Inc.), B Braun Melsungen AG

b. The growth of the market can be attributed to the increasing prevalence of peripheral vascular diseases (PVDs) and coronary artery diseases (CAD).

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.