- Home

- »

- Pharmaceuticals

- »

-

Intravenous Iron Drugs Market Size, Industry Report 2030GVR Report cover

![Intravenous Iron Drugs Market Size, Share, & Trends Report]()

Intravenous Iron Drugs Market (2025 - 2030) Size, Share, & Trends Analysis Report By Product (Iron Dextran, Iron Sucrose, Ferric Carboxymaltose), By Application (Chronic Kidney Disease), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-000-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Intravenous Iron Drugs Market Summary

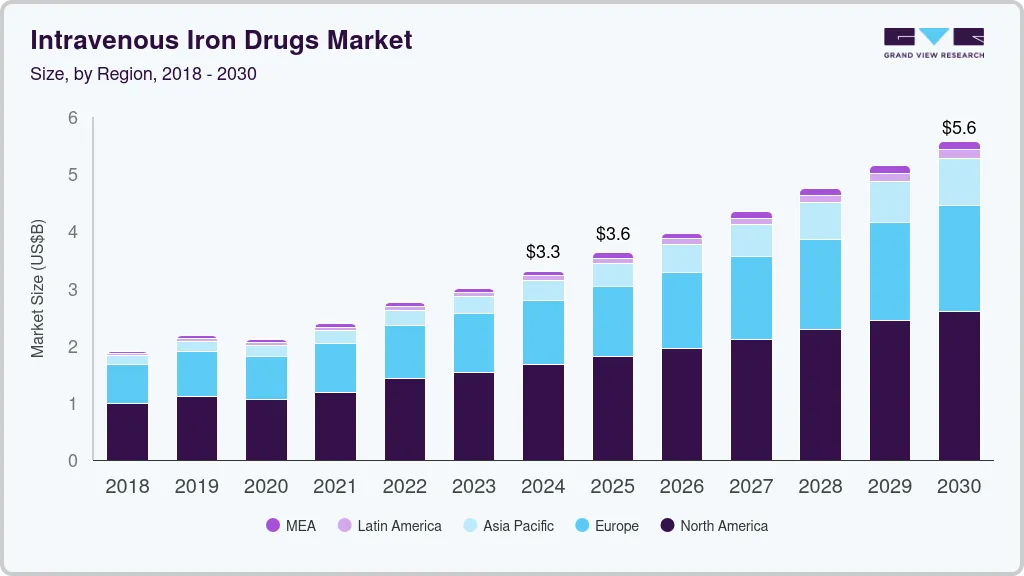

The global intravenous iron drugs market size was estimated at USD 3,302.1 million in 2024 and is projected to reach USD 5,578.2 million by 2030, growing at a CAGR of 9.1% from 2025 to 2030. One of the major factors for market growth is the increasing prevalence of chronic kidney disease, inflammatory bowel disease, and cancer, which are key target indications for IV iron usage.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, ferric carboxymaltose accounted for a revenue of USD 1,800.5 million in 2024.

- Ferric Carboxymaltose is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,302.1 Million

- 2030 Projected Market Size: USD 5,578.2 Million

- CAGR (2025-2030): 9.1%

- North America: Largest market in 2024

Advancements in drug delivery technologies, such as nanoparticle-based formulations, are improving iron absorption and reducing adverse effects. These formulations offer targeted delivery mechanisms, reducing frequent dosing and adverse reactions. Innovative infusion systems and biocompatible materials also improve the precision and reliability of Intravenous (IV) iron therapy administration, ensuring optimal patient treatment outcomes. Anemia is one of the most common blood disorders in recent times. According to the National Heart, Lung, & Blood Institute, an estimated 3 million individuals suffer from anemia in the U.S. According to the 2025 Edition of the WHO estimates, anemia affected approximately 30.7% of women aged 15 to 49 years and 35.5% of pregnant women in the same age group in 2023.

Furthermore, around 40% of children aged 6 to 59 months are estimated to suffer from anemia worldwide. These alarming figures highlight anemia as a persistent public health challenge, particularly in vulnerable populations such as pregnant women, where effective and rapid treatment is critical. In cases where oral iron supplements are insufficient or poorly tolerated, IV iron therapy becomes an essential treatment option, fueling global demand and market growth for IV iron drugs.

Their superior efficacy and safety primarily drive the adoption of IV iron drugs compared to oral treatments. IV formulations offer faster and more efficient iron absorption, fewer gastrointestinal adverse effects, and improved patient outcomes, which are particularly important for individuals who cannot tolerate or do not respond to oral therapy. According to a January 2025 report by MJH Life Sciences, modern FDA-approved IV iron formulations such as ferric carboxymaltose, ferumoxytol, and iron sucrose demonstrate enhanced safety profiles and effective iron delivery due to their stable carbohydrate shells and controlled release mechanisms. These advantages make IV iron therapy the preferred treatment for patients with gastrointestinal bleeding, inflammatory bowel disease, celiac disease, and those undergoing kidney dialysis, propelling the growth of the intravenous iron drugs industry.

Regulatory approvals for advanced IV iron therapies are expanding the intravenous iron drugs industry. In November 2022, CSL Vifor and Fresenius Kabi received approval in China for Ferinject, an IV iron treatment designed for patients who do not respond effectively to oral iron supplements. Such approvals not only broaden access to modern IV iron therapies in key markets but also underscore the growing recognition of their clinical value in managing Iron Deficiency Anemia (IDA), especially in cases where oral treatments are inadequate.

Pipeline Analysis

The following table presents a pipeline analysis of ongoing clinical trials involving IV iron drugs, targeting various conditions such as cancer, gastric cancer, Non-small Cell Lung Cancer (NSCLC), breast cancer, anemia, etc. These trials are sponsored by key players in the industry, hospitals, and renowned universities. The pipeline highlights the continued exploration of IV iron drugs in combination with innovative therapies, indicating a robust growth trajectory in the market during the forecast period.

As the global demand for advanced treatments rises, the market for IV iron drugs is expected to expand, driven by the growing prevalence of cancer, chronic kidney diseases, and conditions involving iron deficiency.

NCT Number

Conditions

Interventions

Sponsor

Completion Date

NCT06556134

Anemia of Chronic Kidney Disease

DRUG: Intravenous Iron Sucrose|DRUG: Oral Iron

Centre Hospitalier Hassan II - Fès

1/10/2024

NCT02632760

Anemia

DRUG: Ferric carboxymaltose|DRUG: Placebo

Bayside Health

11/27/2024

NCT03957057

Postpartum Anemia Nos|Iron-deficiency

DRUG: Iron Carboxymaltose|DRUG: Iron Isomaltoside|DRUG: Ferrous sulphate

University Medical Centre Ljubljana

6/15/2022

NCT06911034

Iron Deficiency Anemia (IDA)|Pregnancy

DRUG: Iron Carboxymaltose|DRUG: Iron Sucrose Injection

CMH Multan Institute of Medical Sciences

9/30/2024

NCT04253626

Pregnancy Related|Anemia, Iron Deficiency

DRUG: Ferumoxytol Injection [Feraheme]|DRUG: Ferrous Sulfate

Stanford University

7/1/2024

Source:- Clinicaltrials.gov.

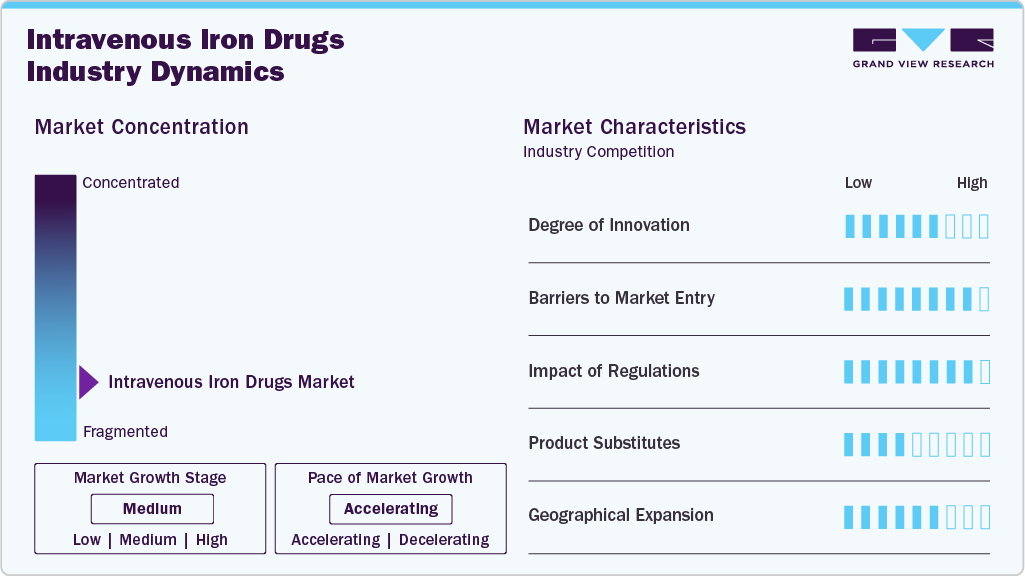

Market Concentration & Characteristics

The intravenous iron drugs industry is witnessing a moderate degree of innovation, marked by the development of next-generation formulations with improved safety, efficacy, and patient compliance. New compounds like ferric carboxymaltose and ferumoxytol feature stable carbohydrate shells and controlled iron release, reducing the risk of adverse reactions. Innovations also include high-dose, low-frequency dosing regimens that enhance treatment convenience. Moreover, research into nanoparticle-based delivery systems is creating new avenues for more targeted and efficient iron supplementation.

Stringent regulatory requirements and lengthy approval processes for new formulations. High research and development costs and the need for extensive clinical trials pose significant financial challenges. Established players maintain strong market positions through brand recognition and an existing distribution network.

Regulatory scrutiny significantly impacts market growth, as seen in the 2024 Class II FDA recall of Venofer (iron sucrose) due to potential glass delamination. Such recalls can erode patient and provider confidence, disrupt supply chains, and increase compliance costs for manufacturers. Strict safety and quality regulations, while essential, also extend time-to-market for new products. As a result, regulatory challenges can slow market expansion and create hurdles for existing players and new entrants.

The market faces increasing pressure from product substitutes, particularly with the recent approval and launch of several oral iron therapies in 2024 and 2025. A key example is ACCRUFeR (ferric maltol), approved by Health Canada in August 2024 and launched in March 2025, offering a convenient and non-invasive alternative for managing IDA. These oral formulations appeal to patients and providers due to ease of administration, lower costs, and fewer logistical requirements than IV therapies. As a result, they may limit the use of IV iron drugs, especially in cases of mild to moderate anemia.

The intravenous iron drugs industry is expanding significantly, particularly in emerging markets in Asia Pacific, Latin America, and the Middle East. This growth is driven by the increasing prevalence of anemia, improving healthcare infrastructure, and rising demand for effective treatments. Key market players focus on gaining regulatory approvals, optimizing pricing strategies, and strengthening reimbursement frameworks to enhance market access. Collaborations with local healthcare providers and government initiatives are key to penetrating these high-growth markets, while investments in regional manufacturing and distribution networks help address supply chain challenges and ensure consistent access to treatments.

Product Insights

The ferric carboxymaltose segment dominated the market with a revenue share of 50.25% in 2024 due to its increasing application, superior performance, fewer adverse effects, and reduced cost. Ferric Carboxymaltose (FCM) has greater efficacy with respect to improving hemoglobin levels and results in limited adverse events. Clinical studies, including a June 2022 report by NCBI, have demonstrated that FCM can help effectively treat moderate-to-severe anemia within 4 weeks, with fewer adverse events than other IV iron formulations. Its branded version, Ferinject, had obtained marketing authorization in 87 countries by March 2024 and has delivered consistent clinical value, backed by more than 25 million patient years of exposure. This robust clinical track record and global acceptance have solidified FCM’s dominant position in the market.

Others is expected to grow at the fastest CAGR over the forecast period. Some of the major players manufacturing these drugs are AMAG Pharmaceuticals, Inc.’s FeraHeme, Sanofi’s Ferrlecit, Pharmacosmos’ Monofer & Diafer, and Rockwell Medical’s TRIFERIC. Key players are increasing their market footprint by expanding the geographical presence of IV iron drugs globally. For instance, in January 2020, Pharmacosmos Therapeutics Inc. received U.S. FDA approval for its ferric derisomaltose injection for treating IDA in adult patients.

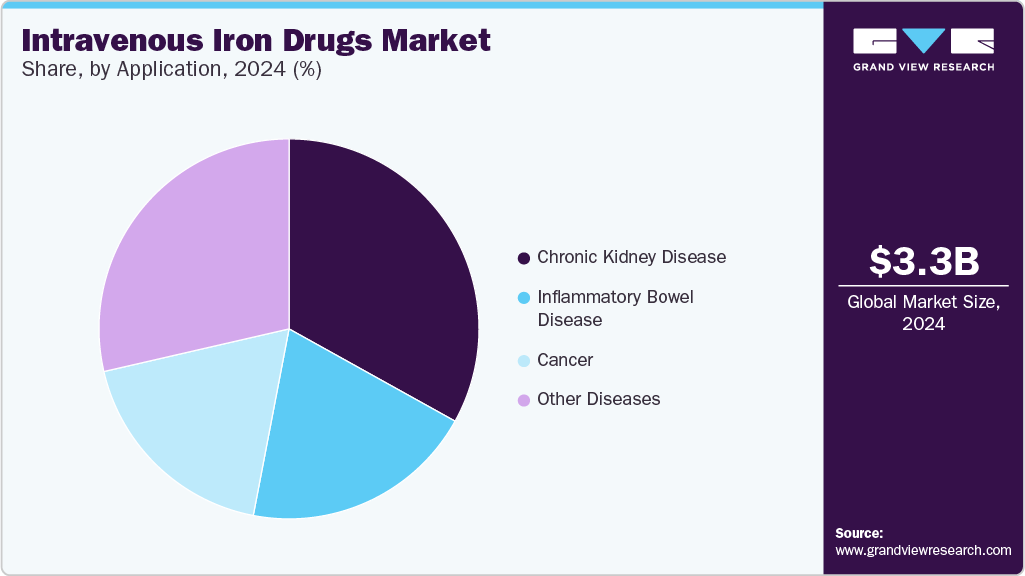

Application Insights

Chronic kidney diseases accounted for the largest market share of 33.08% in 2024 due to the wide use of IV products to treat CKD-induced anemia. One standard treatment for managing anemia in CKD patients is the administration of IV drugs. These medications are crucial because they provide the iron required for the synthesis of hemoglobin, thereby addressing one of the core problems of anemia in CKD. Moreover, effective anemia management in CKD patients can slow the progression of kidney disease and decrease hospitalization, contributing to the overall management of CKD.

Other diseases segment, which includes women’s health, celiac disease, and chronic heart failure, is expected to grow at a significant CAGR over the forecast period. Increasing recommendations for IV iron drugs in managing heart failure by government regulatory bodies are expected to fuel segment growth. For instance, the American College of Cardiology, American Heart Association, Heart Failure Society of America, and European Society of Cardiology Heart Failure, among others, recommend IV infusion for treating chronic heart failure & iron deficiency.

Regional Insights

North America intravenous iron drugs market accounted for the largest share of the global intravenous drugs industry, with a 50.09% share in 2024, primarily due to the increasing approvals and launch of new IV drugs in the U.S. In June 2023, Daiichi Sankyo and American Regent received FDA approval for INJECTAFER (ferric carboxymaltose injection) to treat iron deficiency in adults with heart failure classified as New York Heart Association classes II/III. This makes INJECTAFER the first and only IV therapy for this specific group aimed at improving their exercise capacity.

U.S. Intravenous Iron Drugs Market Trends

The intravenous iron drugs market in the U.S. held the largest share of the regional market, driven by the rising incidence of breast cancer. According to the National Breast Cancer Foundation, an estimated 316,950 women and 2,800 men are projected to be diagnosed with invasive breast cancer in the U.S. in 2025, with an additional 59,080 cases of noninvasive breast cancer. As treatment for breast cancer, especially in metastatic and early-stage cases, often leads to anemia due to chemotherapy or blood loss, IV iron therapy plays a critical supportive role in patient care. With over 4 million breast cancer survivors currently living in the U.S., the need for effective anemia management continues to grow, reinforcing the demand for IV iron drugs as an integral part of comprehensive cancer treatment regimens.

Europe Intravenous Iron Drugs Market Trends

The intravenous iron drugs market in Europe held the second-largest market share in 2024 and is expected to grow significantly in the coming years. This growth is attributable to several factors, including the presence of major market players, the development and commercialization of new drugs, the adoption of novel products, and the rising incidence of cancer across the region. A study published by the EU Science Hub in October 2023 highlighted the trend of increasing cancer cases and deaths in Europe.

The UK intravenous iron drugs market is driven by the high prevalence of IDA, which affects around 4 million people—3% of men and 8% of women. Growth is further supported by significant investments in oncology diagnostics, increasing demand for supportive therapies during cancer treatment, and the implementation of NHS cancer care programs. In addition, ongoing clinical trials and expanded access to biosimilars are enhancing the affordability and availability of IV iron therapies, contributing to broader adoption across patient groups.

The intravenous iron drugs market in Germany is driven by the rising prevalence of anemia among pregnant women, which is a key driving factor. According to an article published in April 2024, 47.2% of pregnant women in the country experienced anemia, with 15.3% specifically attributed to iron deficiency and 25.0% linked to acute bleeding. Furthermore, a separate 2023 analysis found that 23.7% of over 6 million pregnant women were anemic. These high rates of anemia, particularly during pregnancy when effective and rapid treatment is critical, fuel demand for IV iron therapies, which offer faster correction of iron levels and improved clinical outcomes compared to oral alternatives.

France intravenous iron drugs market held the highest share of the regional market, driven by the rising prevalence of chronic diseases such as CKD and IBD. According to a report by the French National Institute of Health and Medical Research, CKD affects approximately 10% of the French population, highlighting its status as a major health concern.

Asia Pacific Intravenous Iron Drugs Market Trends

The intravenous iron drugs market in Asia Pacific is anticipated to witness the fastest growth during the forecast period. This growth can be attributed to the increasing prevalence of chronic diseases such as CKD, IBD, and cancer. These conditions frequently result in IDA, necessitating IV therapy. Recent healthcare reports indicate a rising trend in the number of CKD and IBD cases across Asia Pacific, increasing the demand for effective anemia management solutions.

Japan intravenous iron drugs market held the largest share of the regional market, driven by the increasing prevalence of target diseases and a growing geriatric population, which leads to a higher incidence of various diseases, including those associated with anemia. This situation necessitates the use of IV iron therapy to manage anemia effectively.

The intravenous iron drugs market in China is growing rapidly, supported by a rising focus on improving healthcare R&D, aided by the development of novel technologies. The country invests heavily in biosimilar production and oncology R&D, further boosting market growth.

Latin America Intravenous Iron Drugs Market Trends

The intravenous iron drugs market in Latin America was identified as a lucrative region in this industry. Dynamic economies like Brazil and Mexico are experiencing a rise in R&D activities and rapid technological advancements, which is expected to drive market growth. Government spending, investments by major pharmaceutical and biopharmaceutical companies, and the presence of major academic research institutes are also among the key contributing factors.

Brazil intravenous iron drugs market held the highest share of the regional intravenous iron drugs industry, driven by the high prevalence of IDA, especially among women and children, and the rising incidence of chronic diseases like kidney disease and cancer, which increase anemia risk. In addition, advancements in IV iron formulations with improved safety and efficacy, expanding healthcare infrastructure, and growing awareness fuel market growth across the country.

Middle East & Africa Intravenous Iron Drugs Market Trends

The intravenous iron drugs market in the Middle East and Africa is experiencing growing demand for IV iron, particularly in Saudi Arabia and the UAE. Government-led cancer care initiatives, rising prevalence of iron deficiency and other chronic diseases, and infrastructure investments are key drivers.

Saudi Arabia intravenous iron drugs market is growing with the emerging recognition of iron deficiency as a potential risk factor for serious conditions like breast cancer, especially among premenopausal women. A recent studyin the Eastern Province found a high prevalence of iron deficiency in younger women undergoing breast cancer screening, with low iron levels linked to increased cancer risk. This study was published in PubMed in 2023. The growing awareness of iron deficiency’s impact on health will likely boost the demand for effective iron therapies, including IV options, to address anemia and support cancer care in the region.

Key Intravenous Iron Drugs Company Insights

Some major players in the intravenous iron drugs industry are Sanofi and AbbVie Inc., which dominate the market, leveraging brand recognition, regulatory approvals, and global distribution networks. Pricing strategies, supply chain efficiency, and product differentiation influence competitive dynamics. In addition, manufacturers in emerging markets, particularly in the U.S., are expanding their presence with new products. As healthcare systems prioritize affordable treatments, market competition is expected to intensify. Overall, the market is projected to grow significantly during the forecast period.

Key Intravenous Iron Drugs Companies:

The following are the leading companies in the intravenous iron drugs market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- AMAG Pharmaceuticals (Covis Pharma)

- Daiichi Sankyo Company, Ltd.

- Sanofi

- Vifor Pharma Management Ltd. (CSL)

- PHARMACOSMOS A/S

- Zydus Group

- Rockwell Medical, Inc.

Recent Developments

-

In March 2024, Cadila Pharmaceuticals announced the launch of Redshot FCM, fortified with the ferric carboxymallose formulation. This novel iron injection is designed for both adults and children with oral iron intolerance.

-

In July 2023, Evoqua Water Technologies (Evoqua) sold its hemodialysis concentrates business to Rockwell Medical, Inc. for an upfront cash payment of USD 11 million and two milestone payments of USD 2.5 million each 12 and 24 months after the transaction closed. Rockwell Medical financed this acquisition using its available cash. At the closure of the deal, Rockwell Medical had about USD 15.3 million in cash and cash equivalents.

-

In May 2023, Rockwell Medical, Inc. signed a long-term supply deal with Global Medical Supply Chain LLC to sell its hemodialysis concentrate products in the United Arab Emirates, expanding its geographical presence.

-

In March 2023, Pharmacosmos A/S announced that MonoVer (ferric derisomaltose) received national coverage in Japan and is being introduced in the third-largest pharmaceutical market in the world. When oral formulations are inefficient or cannot be used, or when there is a clinical need to deliver iron quickly, MonoVer, an IV iron drug, can be prescribed in Japan to treat Iron Deficiency Anemia (IDA).

Intravenous Iron Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.64 billion

Revenue forecast in 2030

USD 5.62 billion

Growth rate

CAGR of 9.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie Inc.; AMAG Pharmaceuticals (Covis Pharma); Daiichi Sankyo Company, Ltd.; Sanofi; Vifor Pharma Management Ltd. (CSL); PHARMACOSMOS A/S; Zydus Group; Rockwell Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intravenous Iron Drugs Market Report Segmentation

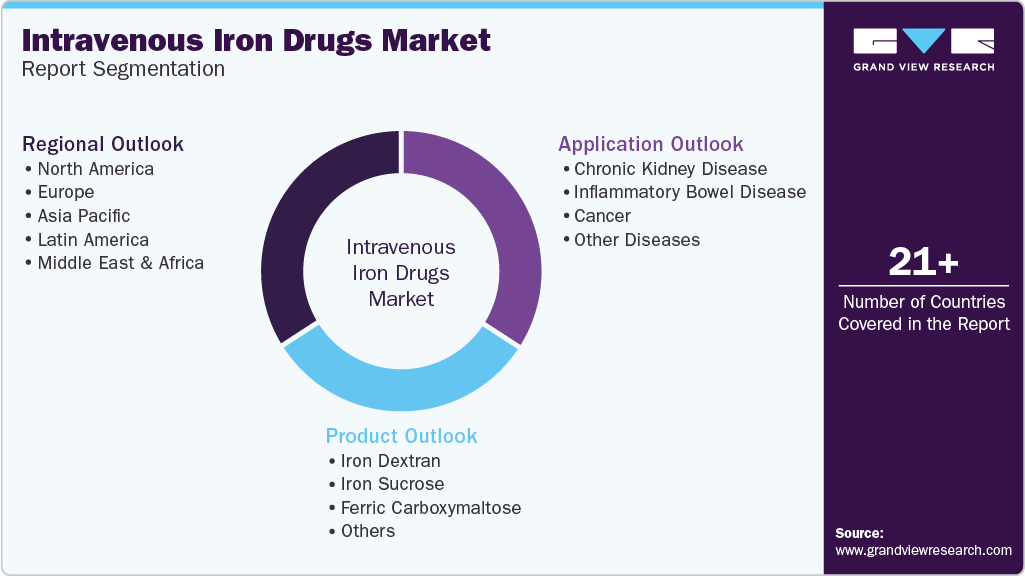

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global intravenous iron drugs market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Iron Dextran

-

Iron Sucrose

-

Ferric Carboxymaltose

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Inflammatory Bowel Disease

-

Cancer

-

Other Diseases

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Based on product, ferric carboxymaltose segment dominated the market with a revenue share of 50.25% in 2024 due to its increasing application, superior performance, fewer adverse effects, and reduced cost.

b. Key players operating in the market are AbbVie Inc., AMAG Pharmaceuticals (Covis Pharma), Daiichi Sankyo Company, Ltd., Sanofi, Vifor Pharma Management Ltd. (CSL), PHARMACOSMOS A/S

b. The growth of the Intravenous iron drugs market is primarily driven by the increasing prevalence of chronic kidney disease, inflammatory bowel disease, and cancer, which are key target indications for IV iron usage, is one of the major factors for market growth.

b. The global Intravenous iron drugs market size was estimated at USD 3.32 billion in 2024 and is expected to reach USD 3.64 billion in 2025.

b. The global Intravenous iron drugs market is projected to grow at a CAGR of 9.1% from 2025 to 2030 to reach USD 5.62 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.