- Home

- »

- Medical Devices

- »

-

Intravenous Solutions Market Size, Industry Report, 2033GVR Report cover

![Intravenous Solutions Market Size, Share & Trends Report]()

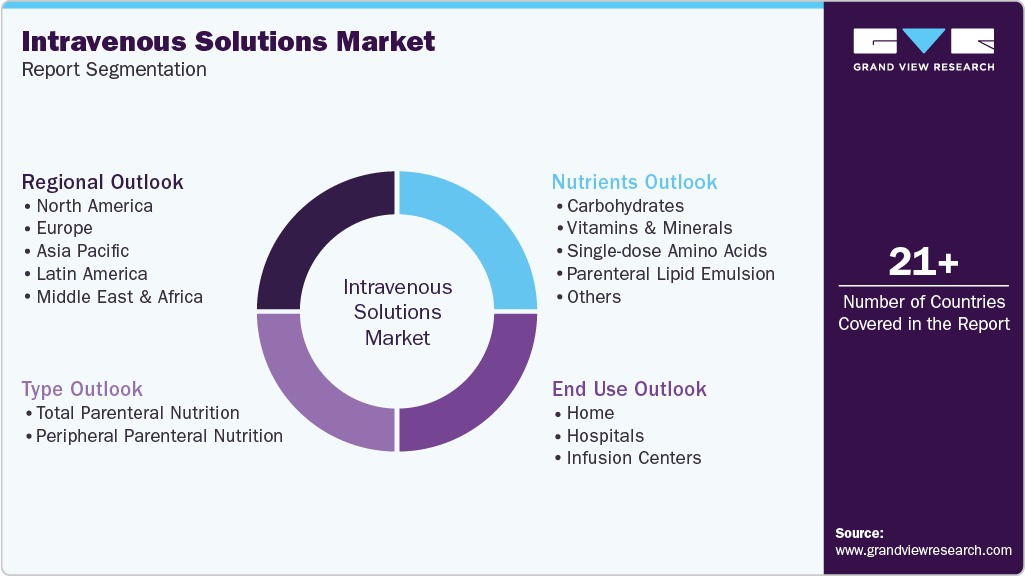

Intravenous Solutions Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (TPN, PPN), By Nutrients (Carbohydrates, Vitamins & Minerals, Single-dose Amino Acids), By End Use (Home, Hospitals, Infusion Centers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-137-5

- Number of Report Pages: 190

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Intravenous Solutions Market Summary

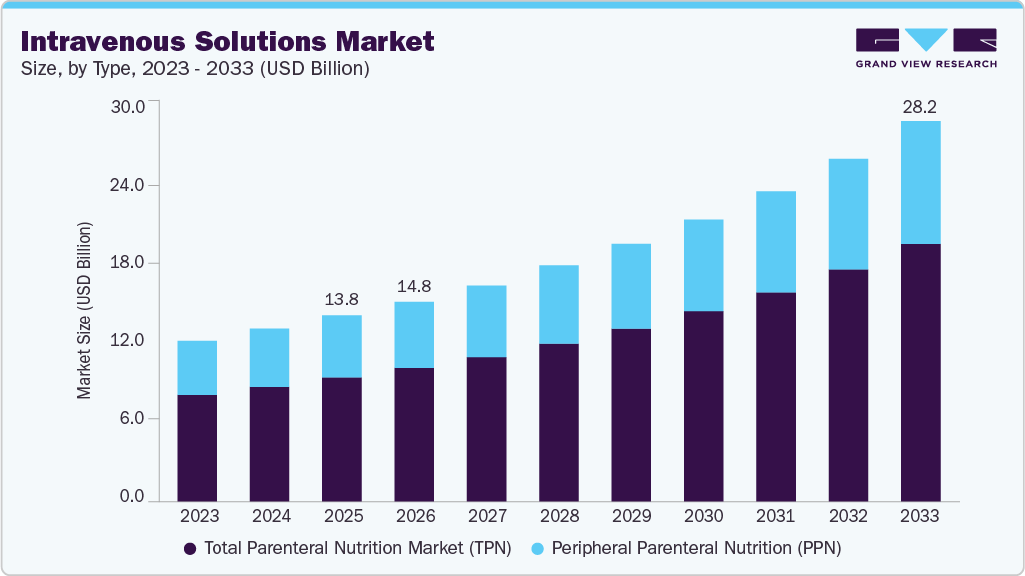

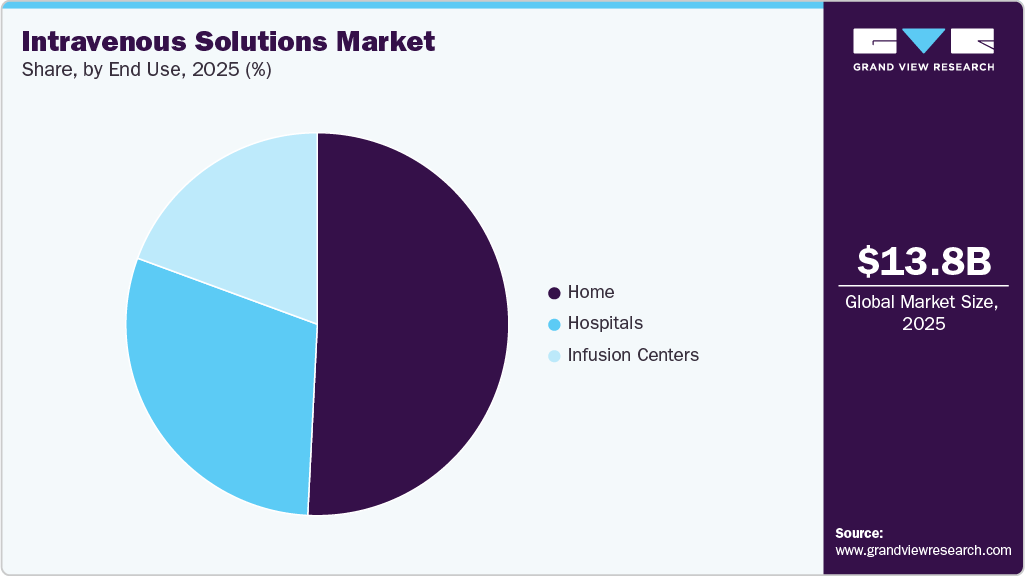

The global intravenous solutions market size was estimated at USD 13.8 billion in 2025 and is projected to reach USD 28.2 billion by 2033, growing at a CAGR of 9.57% from 2026 to 2033. This growth is attributed to the increasing prevalence of diseases, such as neurological diseases, gastrointestinal diseases, and cancer.

Key Market Trends & Insights

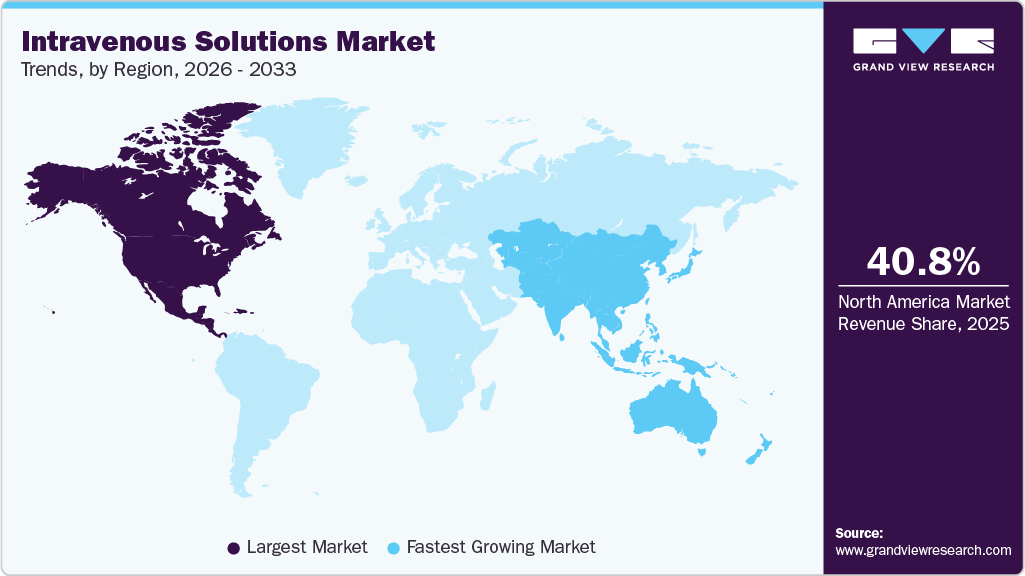

- North America dominated the market for intravenous (IV) solutions with a share of 40.8% in 2025.

- Asia Pacific is estimated to be the fastest-growing region over the forecast period.

- Based on type, the total parenteral nutrition segment held the largest market share of 66.6% in 2025.

- Based on nutrients, single dose amino acids held the dominant market share in 2025.

- Based on end use, the home segment held the dominant market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 13.8 Billion

- 2033 Projected Market Size: USD 28.2 Billion

- CAGR (2026-2033): 9.57%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

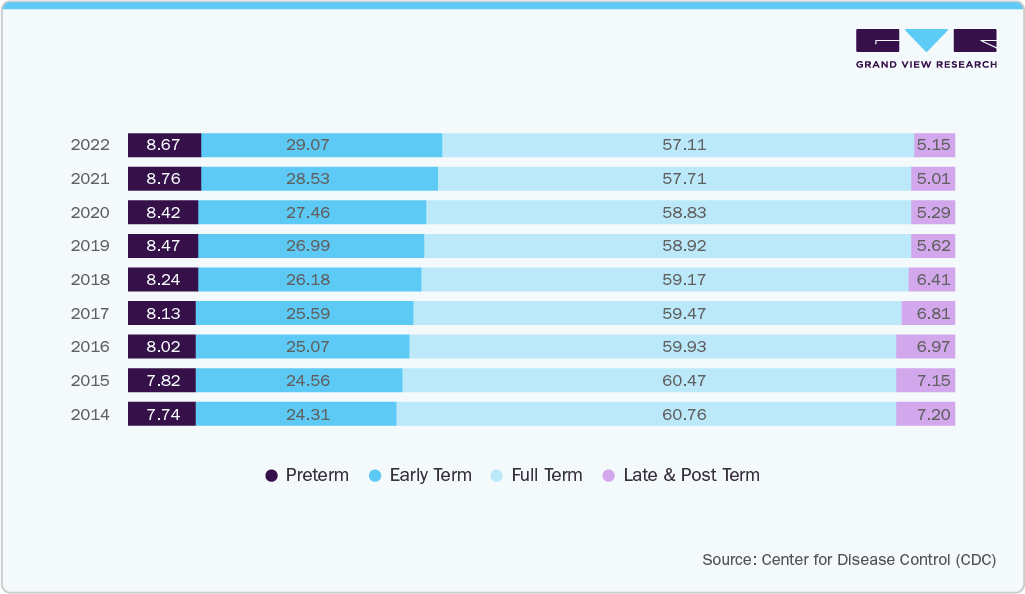

IV solutions provide essential nutrients and are a main source of energy. The rising rate of premature births in developed countries such as the U.S. and the UK are further fueling the demand for intravenous (IV) solutions, as these nations have advanced neonatal care infrastructure that relies heavily on IV therapy. In these countries, factors such as increasing maternal age, higher rates of assisted reproductive technologies (ART), and chronic maternal conditions such as diabetes and hypertension have contributed to a growing number of preterm deliveries. For instance, according to Tommy's, the premature birth rate in England and Wales rose to 7.9% in 2022, up from 7.5% in 2021, marking two consecutive years of increase. Over 53,000 babies were born prematurely in 2022.

The below table shows the percent distribution of singleton births, by gestational age: U.S., 2014 - 2022.

Malnutrition is one of the major drivers of the IV solutions market. According to the WHO, in 2022, 2.5 billion adults were overweight, with 890 million living with obesity, while 390 million were underweight. Globally, 149 million children under 5 were stunted, 45 million were wasted, and 37 million were overweight or obese. This high prevalence of malnutrition globally contributes to market growth. According to UNICEF, poor nutrition in the first 1,000 days of an infant’s life may lead to impaired cognitive ability and stunted growth. Starch, minerals, vitamins, amino acids, lipids, and other key substances must be present in an infant’s diet. These essential nutrients can be administered through parenteral nutrition, which is expected to boost the market. A high number of malnourished children and premature neonates that require these nutrients is expected to further propel the market.

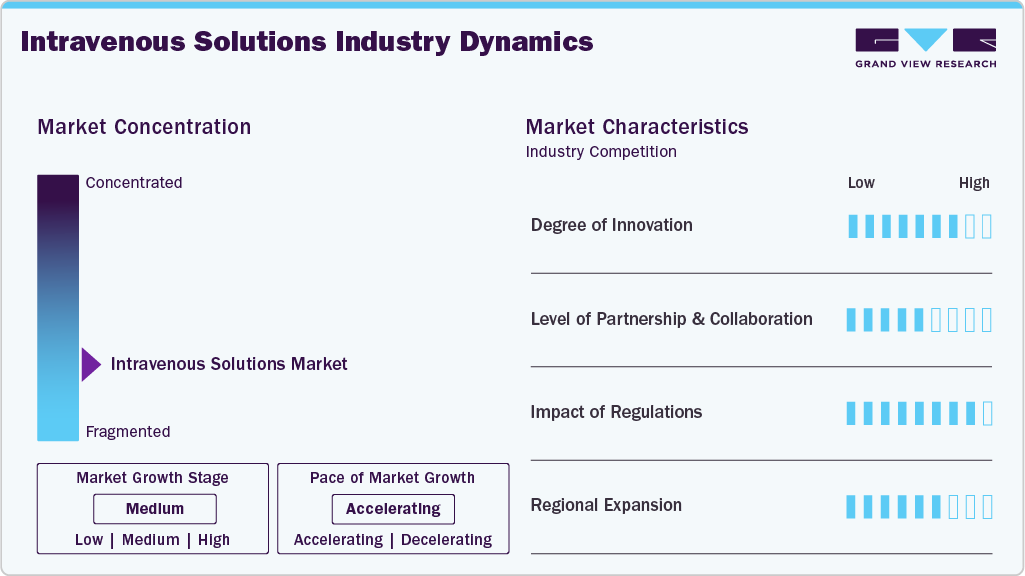

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, impact of regulations, level of partnerships & collaborations activities, degree of innovation, and regional expansion.

The IV solutions market is witnessing steady innovation focused on improving fluid composition, stability, and compatibility with advanced therapies. Manufacturers are developing customized electrolyte and nutrient formulations, ready-to-administer sterile solutions, and additive-free products to enhance safety and clinical efficiency. For instance, in May 2024, B. Braun Medical launched its new line of Levetiracetam in Sodium Chloride Injection products, expanding its anticonvulsant portfolio with three different concentrations of Levetiracetam.

The IV solutions market shows a moderate level of partnerships and collaborations, primarily aimed at enhancing product formulation, quality, and clinical performance. Manufacturers are partnering with hospitals, research institutions, and pharmaceutical companies to develop advanced electrolyte blends, parenteral nutrition solutions, and therapy-specific formulations that improve patient outcomes and meet evolving clinical requirements. For instance, in December 2023, Fresenius Kabi entered into a multiyear supply and service agreement with the Mayo Clinic. Under this agreement, the Mayo Clinic is expected to purchase 10,000 Ivenix large-volume infusion pumps for its hospitals and clinics across Minnesota, Arizona, and Florida.

Regulations have a significant impact on the IV solutions market, as manufacturers must comply with stringent quality, sterility, and safety standards set by agencies such as the U.S. FDA, EMA, and WHO. These regulations govern formulation purity, labeling accuracy, contamination control, and manufacturing practices under Good Manufacturing Practices (GMP). Compliance ensures patient safety and product efficacy but also increases production complexity and costs, driving continuous investment in advanced manufacturing and quality assurance systems.

The IV solutions market is witnessing moderate expansion as companies focus on optimizing formulation quality, improving sterility standards, and meeting rising clinical demand for reliable fluid and electrolyte therapies.

Type Insights

Based on type, the market is categorized into Total Parenteral Nutrition (TPN) and Peripheral Parenteral Nutrition (PPN). In 2025, the TPN segment dominated the market with a revenue share of 66.56%. TPN solutions are more highly concentrated than PPN solutions and are used predominantly in Surgical Intensive Care Units (ICU). According to the Society of Critical Care Medicine, more than 5 million patients are admitted annually to ICUs within the U.S.

The Peripheral Parenteral Nutrition (PPN) segment is expected to experience significant growth from 2026 to 2033. According to MDPI, various benefits were observed in colorectal surgery patients undergoing early PPN. PPN supplementation and adherence to Enhanced Recovery after Surgery (ERAS) programs can reduce postoperative complications. Moreover, the patients receiving PPN had a lower risk of complications than those receiving conventional fluid therapy. PPN also decreases the likelihood of complications worsening or major complications developing.

Nutrients Insights

Based on nutrients, the single-dose amino acids segment held the largest share of the IV solutions market in 2025, driven by their critical role in parenteral nutrition for patients unable to meet protein requirements. The segment’s dominance is supported by rising demand in clinical nutrition, especially among surgical, critical care, and malnourished patients, along with increasing adoption of customized amino acid formulations to improve metabolic support and recovery outcomes.

The vitamins and minerals segment is expected to register a CAGR of 11.0% from 2026 to 2033. Vitamins are vital for blood clotting, RBC formation, and maintaining mucus membranes. Deficiencies lead to anemia, beriberi, pellagra, and chronic mental conditions. Treatment involves parenteral or enteral nutrition. Minerals are essential organic chemicals that regulate metabolic pathways, including β-carotene, sodium chloride, magnesium, potassium, and phosphorous. Deficiency weakens the immune system & bones and causes fatigue due to poor mineral absorption. PN can be used for treatment in such cases.

End Use Insights

Based on end use, the home segment held the dominant market share in 2025 and is expected to grow at the fastest CAGR during the forecast period, due to the rising preference for home-based healthcare among patients with chronic conditions. Many individuals requiring long-term IV therapy, such as those undergoing chemotherapy, antibiotic treatment for infections, or hydration therapy for conditions such as dysphagia, prefer receiving treatment at home rather than in hospitals or clinics. This shift is largely driven by the desire to avoid frequent hospital visits, reduce the risk of hospital-acquired infections, and maintain a higher quality of life.

The hospitals segment holds a significant share in the market, due to the increasing demand for IV therapy in critical care and inpatient settings. Hospitals handle a large volume of patients requiring fluid replacement, electrolyte balancing, and parenteral nutrition, making IV solutions an important component of patient management.

Regional Insights

North America intravenous solutions industry dominated the global market in 2025 in terms of revenue share. The increasing prevalence of chronic diseases and an aging population. In the U.S. & Canada, the rising incidence of conditions such as diabetes, cancer, and kidney diseases necessitate the use of IV therapies for effective management. Furthermore, a growing number of strategic developments in the country pertaining to IV fluids and its ancillary services are anticipated to propel market growth. For instance, in August 2022, Assure Infusions announced the building of a robotic manufacturing facility in Bartow. The facility is expected to be operational by the end of 2023 and will mitigate the demand-supply gap for IV fluids in the country.

U.S. Intravenous Solutions Market Trends

The intravenous (IV) solutions industry in the U.S. dominated the North American market owing to the increasing number of disabilities & malnutrition cases due to the rising incidence of chronic medical conditions and the growing geriatric population are among the factors leading to a rise in the demand for intravenous parenteral nutrition products. The growing incidence of cardiovascular diseases has increased the prevalence of myocardial ischemia-reperfusion injury, propelling the demand for parenteral nutrition in the country for managing these injuries.

Europe Intravenous Solutions Market Trends

The intravenous (IV) solutions industry in Europe is driven by an increasing demand for parenteral nutrition, hydration therapy, and drug administration in hospitals and homecare settings. One of the major factors contributing to this growth is the region’s aging population, which has led to a higher prevalence of chronic conditions such as cancer, kidney diseases, and gastrointestinal disorders that require IV therapy. According to the Eurostat data, in 2024, the geriatric population base in Europe reached approximately 21% of the total population, reflecting a steady upward trend. The median age has risen from 38.4 years in 2001 to 44.4 years in 2023, indicating an ongoing demographic shift toward older age groups.

The UK intravenous solutions industry is one of the key markets in the European region. The presence of advanced healthcare facilities & research centers and the fact that it is a manufacturing & services economy indicate its well-developed healthcare system. The country has a large proportion of geriatric population and a high prevalence of chronic diseases. In 2024, Age UK reports that there are 22 million individuals over the age of 50 in England, which represents two out of five people in the total population. This demographic is experiencing rapid growth, with projections indicating a 19.3% increase in the population aged 50 and above between 2024 and 2044, which is around an additional 4.3 million people.

The intravenous solutions industry in Germany is significantly influenced by the country's aging population and the increasing burden of chronic diseases. Conditions such as dementia, diabetes, and cardiovascular diseases require long-term intravenous therapies, which has led to an increased demand for reliable and advanced IV solutions. Germany's sophisticated healthcare infrastructure, including well-equipped hospitals and clinics, supports the adoption of cutting-edge IV technologies. This infrastructure enables the efficient delivery of intravenous therapies, enhancing patient care standards and contributing to market growth.

Asia Pacific Intravenous Solutions Market Trends

The intravenous solutions industry in Asia Pacific is expected to grow significantly over the forecast period. The growing prevalence of chronic diseases due to unhealthy eating habits and rising demand for cost-effective care treatment are some of the factors expected to drive market growth. Moreover, increasing population, poverty, and low awareness about nutrition are leading to malnutrition, which is one of the key factors boosting market demand. Significant unmet healthcare needs, high out-of-pocket healthcare spending, and rapidly growing purchasing power to access various technologically advanced healthcare services are expected to boost the market over the forecast period

The Japan intravenous solutions industry growth is driven by the increasing healthcare expenditure and rising prevalence of chronic diseases, leading to various government initiatives being undertaken to control individual healthcare spending. Moreover, Japan has an aging population, which is further expected to increase the demand for IV solutions in the country. For instance, in September 2024, Japan's elderly population (65+) reached a record 36.25 million, 29.3% of the total, according to the Ministry of Internal Affairs and Communications.

China intravenous solutions industry is a rapidly emerging market owing to a large patient pool, a rising elderly population, which is boosting the demand for high-quality medical facilities, and increasing prevalence of chronic diseases. The rate of undernutrition is also high in this country. According to an Elsevier article in April 2023, diabetes prevalence in China is expected to increase from 8.2% to 9.7% from 2020 to 2030.

Latin America Intravenous Solutions Market Trends

The IV solutions industry in Latin America is driven by the rising geriatric population and increasing prevalence of chronic diseases. ECLAC reports that Latin America and the Caribbean face rapid population aging. In 2022, 88.6 million people were aged 60+, representing 13.4% of the population. By 2050, this will rise to 25.1% (193 million).

Middle East & Africa Intravenous Solutions Market Trends

The Middle East & Africa IV solutions industry growth is driven by the increasing prevalence of dehydration-related conditions, chronic diseases, and surgical procedures across the region. In addition, the expanding healthcare infrastructure, especially in major cities, allows better access to IV therapy in hospitals and outpatient settings.

Key Intravenous Solutions Company Insights

New product developments, geographic expansions, acquisitions, and collaborations are the key strategic undertakings influencing the industry dynamics. For instance, in June 2023, Vifor Pharma received FDA approval for Injectafer. Injectafer is the only IV replacement therapy for adult patients suffering from heart failure & iron deficiency.

Key Intravenous Solutions Companies:

The following are the leading companies in the intravenous solutions market. These companies collectively hold the largest market share and dictate industry trends.

- Fresenius Kabi AG

- B. Braun SE

- Baxter

- Otsuka Pharmaceutical Co., Ltd.

- Pfizer, Inc.

- JW Life Science

- Vifor Pharma

- ICU Medical, Inc.

Recent Developments

-

In November 2024, Otsuka Pharmaceutical Factory, a division of Otsuka Pharmaceutical Co., Ltd., formed a joint venture with ICU Medical, Inc. This partnership aims to enhance the supply of intravenous (IV) solutions in North America, creating one of the largest global IV solutions manufacturing networks with an estimated annual production of 1.4 billion units.

-

In April 2024, Baxter announced the further expansion of its pharmaceutical’s portfolio with the launch of five injectable products in the U.S., including IV solutions.

-

In March 2024, Health Canada approved Ferinject (ferric carboxymaltose) for treating iron deficiency anemia in adults and children and iron deficiency in adult heart failure patients. This approval provides a new treatment option to address iron deficiency, a condition that can significantly impact overall health and well-being.

"The approval by Health Canada marks an important step forward for the treatment of iron deficiency anemia as well as iron deficiency in heart failure and supports our promise to patients and public health. We are confident that our now approved IV iron therapy can make a meaningful contribution to achieve key therapeutic goals in the treatment of these patients."

- Dr. Vinicius Gomes de Lima, Head of Global Medical Affairs, CSL Vifor.

-

In May 2023, Otsuka Pharmaceutical Co., Ltd. acquired additional equity in its subsidiary- Otsuka Pharmaceutical India (OPI). Through the following mergers & acquisitions, OPI is now a wholly owned subsidiary of Otsuka Pharmaceutical

Intravenous Solutions Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 14.8 billion

Revenue forecast in 2033

USD 28.2 billion

Growth rate

CAGR of 9.57% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Market value in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, nutrient, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Fresenius Kabi AG; B. Braun SE; Baxter; Otsuka Pharmaceutical Co., Ltd.; Pfizer, Inc.; JW Life Science; Vifor Pharma; ICU Medical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Intravenous Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global intravenous solutions market report based on type, nutrient, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Total Parenteral Nutrition

-

Peripheral Parenteral Nutrition

-

-

Nutrients Outlook (Revenue, USD Million, 2021 - 2033)

-

Carbohydrates

-

Vitamins & Minerals

-

Single-dose Amino Acids

-

Parenteral Lipid Emulsion

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Home

-

Hospitals

-

Infusion Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global intravenous solutions market size was estimated at USD 13.8 billion in 2025 and is expected to reach USD 14.8 billion in 2026.

b. The global intravenous solutions market is expected to grow at a compound annual growth rate of 9.57% from 2026 to 2033 to reach USD 28.2 billion by 2033.

b. The total parenteral nutrition segment dominated the intravenous solutions market with a share of 66.56% in 2025. This is attributable to rising the growing applications in the geriatric and pediatric population coupled with its requirement in the management of chronic diseases such as cancer and ulcerative colitis.

b. Some key players operating in the intravenous solutions market include Fresenius Kabi AG; B. Braun SE; Baxter; Otsuka Pharmaceutical Co., Ltd.; Pfizer, Inc.; JW Life Science; Vifor Pharma; ICU Medical, Inc.

b. Key factors that are driving the intravenous solutions market growth include increasing natality rate, risk of malnutrition, rising geriatric population base, and increasing incidence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.