- Home

- »

- Advanced Interior Materials

- »

-

Structural Steel Market Size, Share & Trends Report, 2030GVR Report cover

![Structural Steel Market Size, Share & Trend Report]()

Structural Steel Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Angles, Channels, Rounds), By Application (Non-residential (Industrial, Commercial, Institutional), Residential), By Region, And Segment Forecasts

- Report ID: 978-1-68038-503-8

- Number of Report Pages: 123

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Structural Steel Market Summary

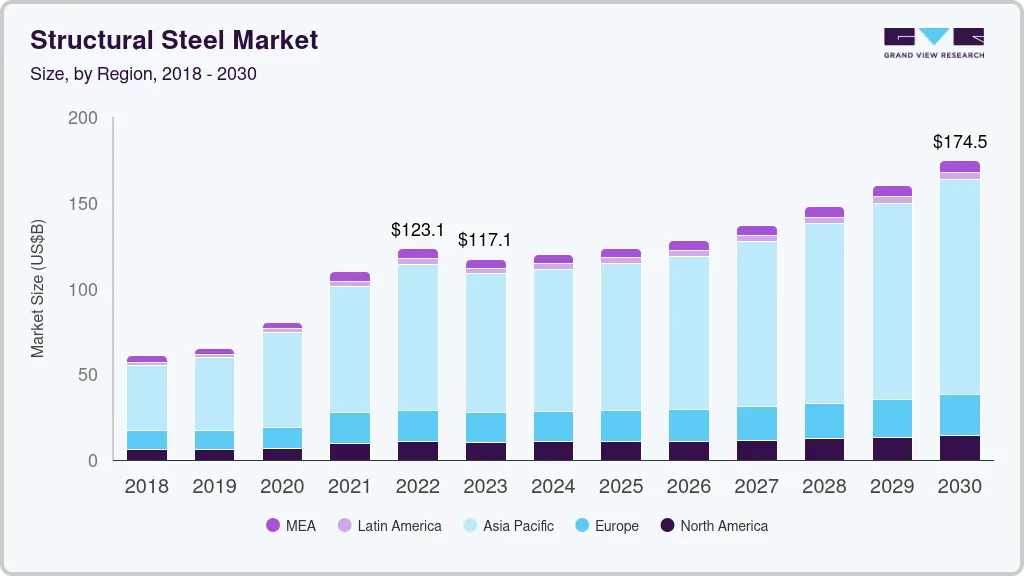

The global structural steel market size was estimated at USD 110.74 billion in 2023 and is projected to reach USD 174.51 billion by 2030, growing at a CAGR of 4.5% from 2024 to 2030. Infrastructural developments, in both developing as well as developed countries, are anticipated to remain the primary factors driving the demand for structural steel.

Key Market Trends & Insights

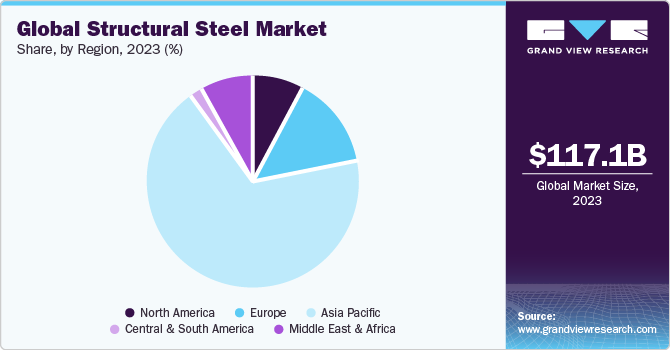

- Asia Pacific held the largest revenue share of about 69.0% of the global market in 2023

- North America is anticipated to register a CAGR of 4.7%, in terms of revenue, over the forecast period.

- Based on product, angles (L shape) segment accounted for the highest revenue share of over 30.0% in 2023.

- Based on application, the non-residential segment held the largest revenue share of 52.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 110.74 Billion

- 2030 Projected Market Size: USD 174.51 Billion

- CAGR (2024-2030): 4.5%

- Asia Pacific: Largest market in 2023

The growing housing needs, as a result of the increasing population across the globe, are also among the key factors driving product demand. As per the projections estimated by the United Nations, the global population will reach 11.2 billion by 2100, which, in turn, is anticipated to bolster housing demand, thus, boosting consumption for structural steel.

Structural steel is considered a green construction material due to its recyclability and thus, a rising number of green buildings is anticipated to propel market growth in the coming years. According to the World Green Building Council, LEED-certified buildings use 11% less water and 25% less energy in the U.S. Green buildings help reduce harmful impacts on the environment, hence, focus on their construction is increasing in the country. California holds the major share in the overall green buildings segment in the U.S., in terms of area, and the state is expected to achieve zero net energy by 2030.

The U.S. construction industry was impacted in 2020 on account of the COVID-19 pandemic. The country is putting efforts toward reaching stable economic growth through several investments. For instance, the overall construction activities in the U.S. is estimated to have grown by 6.1% in 2023. The major growth was witnessed in the manufacturing segment for nearly 37.0%, followed by commercial and residential with over 22.0% and 13.0%, respectively.

Increasing construction of high-rise buildings is another key driving factor for the structural steel market. The product possesses a high strength-to-weight ratio, allowing it to bear heavy loads and resist compression, tension, and bending forces, making it an ideal material ideal for supporting the weight of tall buildings and transferring the load to the foundation. There are 97 under-construction tall buildings in the world, of which 1 is above 600m, 25 are above 400m, and the remaining above 300m. The majority of these buildings are in Asia.

The market however faces restrictions from the supply aspect. Steel commodities have experienced daily price swings in most countries along with fluctuations in the prices of raw materials such as iron, coal, and scrap. Any disruption in demand-supply leads to extreme volatility in the prices. Production costs also influence prices and storage capacity, which directly impact the costs of structural steel.

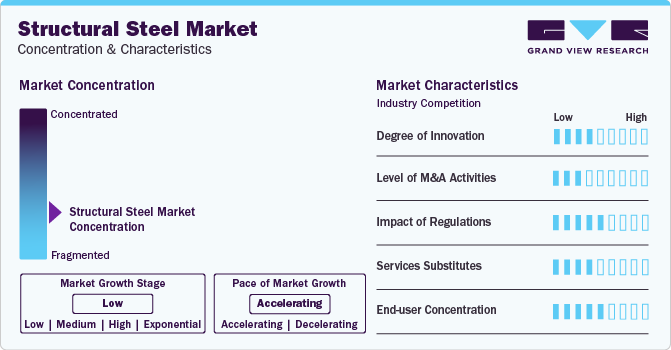

Market Concentration & Characteristics

The structural steel market is fragmented and is characterized by the presence of numerous players located across regions. Key players cater to the export markets as well, while mid- to small-scale players cater mainly to domestic demand.

The market is characterized by a moderate degree of innovation to optimize the production process and produce aesthetic products. Manufacturers have been focusing on developing and innovating new products by improving their production process in order to cater to the voluminous building & construction segment.

The market observed a low level of merger and acquisition (M&A) activity owing to challenges such as liquidity and cash flow. Also, various players await a full-swing of revival of construction activity to expand their geographic reach through strategic moves such as M&As.

The market is also subject to moderate levels of regulatory scrutiny. Various regulatory authorities across the world provide standards and guidelines for proper safety measures and waste disposal mechanisms. End user concentration is a significant factor in the market, and in order to minimize logistics costs, manufacturers are located in close vicinity to cities where construction activity is an ongoing process.

Product Insights

Based on product, angles (L shape) accounted for the highest revenue share of over 30.0% in 2023. Steel Angles are available both as "equal angles" where both legs are of the same size, and "unequal angles", that have legs of different sizes. Infrastructural spending in key developing countries such as India and Indonesia are anticipated to cater to growth in this segment.

Application Insights

Based on application, the non-residential held the largest revenue share of 52.0% in 2023, of the global market. It is estimated to expand further at the fastest CAGR over the forecast period owing to the increasing spending on manufacturing plants, airports, commercial centers, healthcare facilities, and malls. The segment is further divided into industrial, commercial, offices, and institutional.

The others sub-segment (including industrial & infrastructure) accounts for the maximum share, which consists of the non-residential segment. Structural steel is majorly used in industrial buildings due to its extreme strength, which is beneficial not only for structural integrity but also for subsiding the potential impact of repairs. It is also ideal for building large bridges owing to its high durability and excellent strength-to-weight ratio, which ensures withstanding the weight of cars and pedestrians.

The residential application segment accounted for the second-highest revenue share in 2023. The product is widely utilized in housing and residential buildings. Its exceptional flexibility and adaptability make it suitable for modular construction, allowing for easy disassembly and relocation while maintaining the building's asset value. This versatile material can be employed in various residential building types, ranging from single-family houses to large mixed-use structures. Moreover, it also provides environmental benefits as it is 100% recyclable with no degradation.

Regional Insights

Asia Pacific held the largest revenue share of about 69.0% of the global market in 2023 and is anticipated to maintain its dominance at the fastest CAGR in the forecast period. Increased investments in the housing and commercial sectors of the developing economies, such as China and India, are anticipated to prove fruitful for market growth.

Furthermore, Southeast Asia is one of the emerging regions in the global market. There is a need for huge investments to reduce the infrastructure gap in this region. From 2000, Japan has financed projects worth USD 230 billion, while China invested around USD 155 billion for the improvement of infrastructure in the Southeast Asian region. Such investments are expected to augment the product demand over the coming years.

North America is anticipated to register a CAGR of 4.7%, in terms of revenue, over the forecast period. The region suffered a heavy economic loss, especially in the U.S. and Mexico, due to the COVID-19 pandemic. The aging of infrastructure is expected to remain a key factor for rising product demand in the region.

Middle East & Africa is expected to grow at a considerable CAGR over the forecast period. The region is anticipated to witness a plethora of projects in the coming years, which is expected to augment market growth. Some of the projects include Abrahamic Family House, Abu Dhabi; URB: The Loop, Dubai; Baynouna Solar Park, Jordan; Mega Urban Housing Project, South Africa; Wind Power Project, Egypt; and Bridge on Lake Victoria, Tanzania.

Key Companies & Market Share Insights

The market is fragmented with the presence of various small- and large-scale companies operating in different parts of the world. Companies focus on acquisitions and capacity expansions to broaden their presence worldwide.

Some of the key players operating in the market include ArcelorMittal, Gerdau S.A., and Baosteel Group.

-

ArcelorMittal has several business segments, namely - NAFTA, Brazil, Europe, ACIS, and mining. The NAFTA segment produces flat products such as slab, hot-rolled coil, cold-rolled coil, coated steel, and plate. The products are sold to industries such as automotive, energy, construction, packaging, and appliances. The Brazil segment produces flat products and long products. Flat products include slabs, hot-rolled coils, cold-rolled coils, and coated steel, while long products include wire rods, sections, bars & rebar, billets, blooms, and wire drawing. The Europe segment produces hot-rolled coils, cold-rolled coils, coated products, tinplate, plates, and slabs. The ACIS segment produces flat, long, and tubular products.

-

Gerdau S.A. specializes in manufacturing billets, blooms, slabs, wire rods, rebar, heavy slabs, hot- and cold-rolled coils, and seamless tubes. The company offers its products to various end-use industries such as metallurgy, farming & livestock, construction, automotive, petrochemical, railway, and marine industries.

-

Baosteel Group manufactures various iron and steel products. It operates under major product categories including stainless steel, carbon steel, and special steel. It has a presence in 40 countries across Asia Pacific, North & South America, Africa, and Europe.

HBIS Group and Anyang Iron & Steel Group Co., Ltd. are some of the emerging market participants.

-

HBIS Group specializes in manufacturing bars, wires, profiles, hot-rolled strips, hot- & cold-rolled plates, galvanized plates, pipes, vanadium-nitrogen alloys, and twisted ribbed steel bars. The company also manufactures coke, industrial gas, and chemical products. It offers its products for various applications such as automotive, nuclear power, marine engineering, bridges, construction, and home appliances.

-

Anyang Iron & Steel Group Co., Ltd. operations include coking, sintering, smelting, rolling, and scientific research & development; it exports its products to Germany, the UK, Japan, South Korea, and South Africa. It also specializes in manufacturing high-speed wire rods, structural steel, galvanized steel, cold-rolled steel, heavy section, color coated steel, seamless pipes, pipe fittings, and hot-rolled steel products.

Key Structural Steel Companies:

- Arcelor Mittal S.A.

- Baogang Group

- Evraz plc

- Gerdau S.A

- Nippon Steel Corporation

- JSW Steel Limited

- Tata Steel Limited

- SAIL

Recent Developments

-

In August 2023, Hybar LLC, a metal scrap recycling company commenced the construction of its steel rebar mill project in Arkansas, U.S. Machinery is being supplied by SMS group GmbH, and will utilize steel scrap as feedstock.

-

In March 2023, JSPL announced its plans to produce the first-ever fire-resistant steel structures in India at its facility located in Raigarh, Chhattisgarh, India.

Structural Steel Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 117.12 billion

Revenue forecast in 2030

USD 174.51 billion

Growth Rate

CAGR of 4.5% from 2023 to 2030

Market size volume in 2023

129,348.2 kilotons

Volume forecast in 2030

193,616.8 kilotons

Growth Rate

CAGR of 5.5 % from 2023 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application and region

Regional scope

North America, Europe, Asia Pacific, Central & South Africa, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Spain, Russia, Turkey, Poland, China, Japan, Taiwan, India, Hong Kong, Thailand, Malaysia, Singapore, Vietnam, Philippines, Australia, New Zealand, Indonesia, Brazil, Chile, Colombia, UAE, Saudi Arabia, Iran, South Africa

Key companies profiled

Arcelor Mittal S.A., Baogang Group, Evraz plc, Gerdau S.A, Nippon Steel Corporation, JSW Steel Limited, Tata Steel Limited, SAIL, Wuhan Iron & Steel (Group) Corp, Hebei Steel Group, Baosteel Group Corporation, Bohai Steel Group Co. Ltd., andAnshan Iron & Steel Group Co., Ltd. among others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

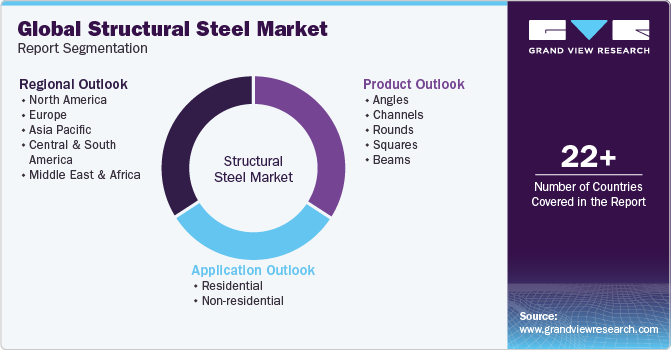

Global Structural Steel Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global structural steel market report on the basis of product, application and region.

-

Product Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

Angles

-

Channels

-

Rounds

-

Squares

-

Beams

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

Residential

-

Non-residential

-

Institutional

-

Commercial

-

Offices

-

Others

-

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Russia

-

Turkey

-

Poland

-

-

Asia Pacific

-

China

-

Japan

-

Taiwan

-

Hong Kong

-

Thailand

-

Malaysia

-

Singapore

-

Indonesia

-

Vietnam

-

Philippines

-

India

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Chile

-

Colombia

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Iran

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global structural steel market size was estimated at USD 105.57 billion in 2022 and is expected to reach USD 110.74 billion in 2023.

b. The global structural steel market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 162.46 billion by 2030.

b. Based on the application segment, non-residential held the largest revenue share of more than 54.0% in 2022 owing to increasing demand for high-quality construction material in industrial, commercial, offices, and institutional buildings.

b. Some of the key players operating in the structural steel market include ArcelorMittal, Baosteel Group, Evraz plc, Gerdau S.A., JSW Steel, POSCO, Nippon Steel Corporation, Tata Steel, and SAIL.

b. Growing efforts towards infrastructural developments coupled with rising spending in the residential sector across various countries are anticipated to augment structural steel market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.