- Home

- »

- IT Services & Applications

- »

-

Inventory Management Software Market Size Report, 2033GVR Report cover

![Inventory Management Software Market Size, Share, & Trends Report]()

Inventory Management Software Market (2025 - 2033) Size, Share, & Trends Analysis Report By Component (Software, Services), By Application, By Deployment (On-Premises, Cloud), By Enterprise Size, By End Use (Retail, E-Commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-321-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Inventory Management Software Market Summary

The global inventory management software market size was estimated at USD 3.58 billion in 2024 and is projected to reach USD 7.14 billion by 2033, growing at a CAGR of 8.4% from 2025 to 2033. The rise in dropshipping and third-party logistics (3PL) drives the growth of the market.

Key Market Trends & Insights

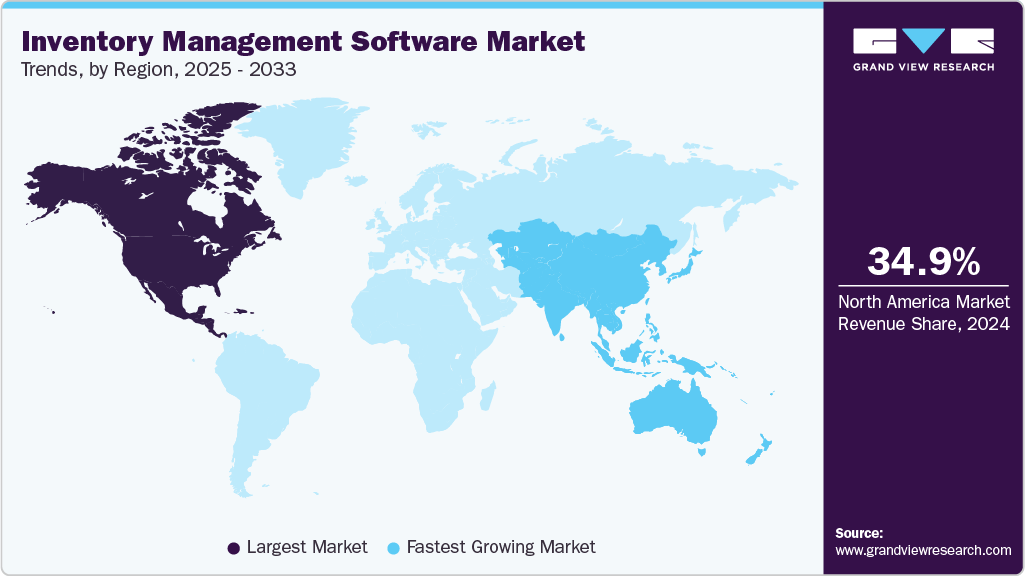

- North America held a 34.9% revenue share of the global inventory management software market.

- In the U.S., the increasing prevalence of multi-location and franchise-based business models is contributing to the growth of the market.

- By component, the software segment held the largest revenue share of 70.7% in 2024.

- By type, the order management segment held the largest revenue share in 2024.

- By deployment, the cloud segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.58 Billion

- 2033 Projected Market Size: USD 7.14 Billion

- CAGR (2025-2033): 8.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

E-commerce businesses require advanced applications to manage large, diverse inventories, ensure timely fulfillment, and maintain optimal stock levels to meet fluctuating customer demands. This drives demand for sophisticated inventory management systems that offer features such as automated reordering, demand forecasting, and integration with various sales channels. Consequently, as e-commerce continues to grow, so does the need for robust inventory management software, fueling market growth. According to the Indian Brand Equity Foundation (IBEF), India's e-commerce platforms achieved a significant milestone, hitting a GMV of USD 60 billion in fiscal year 2023, marking a 22% increase from the previous year. Similarly, the rising internet penetration will boost the adoption of inventory management software for streamlining various e-commerce tasks such as order management, inventory control, etc.

Inventory management software helps businesses efficiently track and manage their stock levels, orders, sales, and deliveries. It automates processes such as reordering, stock level monitoring, and demand forecasting, ensuring optimal inventory without overstocking or stockouts. The software provides real-time data and insights, enhancing decision-making and operational efficiency. It integrates with other business systems like ERP and sales platforms, streamlining workflows and improving accuracy. Key benefits include reduced operational costs, improved customer satisfaction, and better resource allocation, making it essential for businesses in retail, manufacturing, healthcare, and other industries.

Demand for inventory management software is expected to witness a rise due to changing supply chain models of product manufacturers and rapidly growing consumer demand, especially in the transport & logistics, e-commerce, and retail sectors. The need for manufacturers to streamline inventory management processes and curb costs globally is one of the key trends triggering market growth. Spiraling demand for the software may be attributed to its ability to optimize the supply chain and improve customer satisfaction.

The increasing adoption of mobile and handheld technologies for inventory control is propelling market growth. As retail operations become more decentralized and fast-paced, employees in warehouses, stores, and fulfillment centers are increasingly relying on mobile devices such as smartphones, tablets, and barcode scanners to perform inventory-related tasks. Inventory management software that integrates with these mobile technologies enables real-time stock updates, on-the-go inventory audits, and instant error corrections, which significantly improve accuracy and productivity. This mobile-first approach empowers retail staff to manage stock efficiently without being confined to desktops or back-office systems. It also facilitates quicker customer component store associates can instantly check stock levels, suggest alternatives, or initiate orders from other locations directly from the shop floor. As retail environments demand more agility and responsiveness, software solutions that support mobile inventory workflows are seeing a significant surge in demand.

The surge in subscription-based business models and recurring delivery components is pushing more businesses toward implementing robust inventory management solutions. Subscription commerce, such as meal kits, grooming products, and home essentials, relies heavily on predictable and consistent inventory replenishment cycles. Companies often rely on 3PL providers or drop shipping partners to meet recurring demand without overstocking or risking fulfillment delays. Inventory management software is essential in this model, as it enables forecasting of demand patterns, automates restocking processes, and ensures that inventory is available precisely when needed. The software helps balance inventory holding costs with customer expectations for timely, repeat deliveries. For businesses operating under tight margins, such as those in subscription boxes or consumables, this level of control is crucial to profitability and customer retention.

Furthermore, the expansion of global markets and cross-border commerce is contributing significantly to the growth of inventory management software, particularly for companies utilizing drop shipping and 3PL providers. Selling internationally introduces multiple layers of complexity different currencies, time zones, tax rules, shipping regulations, and supplier lead times. Businesses must have accurate and real-time control over inventory that is spread across various regions managed by different partners. Inventory management software addresses these challenges by offering multi-location inventory tracking, localized settings for tax and compliance, and integration with international shipping carriers. It also supports multi-currency transactions and language options, which are essential for global coordination. As more businesses go borderless to tap into new consumer markets, especially through e-commerce platforms, the need for software that can handle diverse inventory and fulfillment operations from a centralized system becomes essential.

Component Insights

The software segment dominated the market with a revenue share of 70.7% in 2024. The increasing digitization and automation of warehouse operations have propelled the demand for software-driven inventory solutions. Modern warehouses are becoming more complex and high-volume, requiring real-time coordination between inventory movement, labor management, and order fulfillment. Inventory management software is essential for automating warehouse processes like picking, packing, cycle counting, and slotting. It eliminates the need for manual data entry and enables seamless barcode and RFID scanning, which improves speed and reduces errors. Many software solutions now also offer 3D visualization of warehouse layouts, heatmaps for high-frequency zones, and labor optimization modules, allowing managers to make data-driven decisions that improve throughput and reduce operational costs. As warehouse automation becomes more prevalent through robotics and IoT-enabled systems, integrating these technologies with inventory software ensures cohesive and intelligent workflows.

The services segment is projected to be the fastest-growing segment from 2025 to 2033. Increasing demand for automation in order processing is driving the adoption of order management solutions. The global expansion of supply chains and the rise in cross-border trade have added layers of complexity to inventory management, further fueling the need for expert services. Multinational corporations must manage inventory across diverse geographical locations, each with its own regulations, tax structures, languages, and logistical challenges. Deploying inventory software in such scenarios demands careful localization, multi-currency and multi-language capabilities, and integration with region-specific carriers or suppliers. This level of customization and compliance cannot be handled through out-of-the-box solutions and requires specialized services. Service providers bridge this gap by offering localization support, compliance configuration, and tailored system architecture for international operations.

Application Insights

The order management segment dominated the market in 2024. The exponential rise of e-commerce and omnichannel retailing necessitates sophisticated order management systems to handle complex fulfillment processes, real-time inventory visibility, and seamless customer experiences. Technological advancements, such as AI and machine learning, enhance predictive analytics for demand forecasting and personalized customer service. Moreover, the integration of order management with existing ERP and CRM systems streamlines operations, reducing errors and improving efficiency. The increasing focus on supply chain optimization and the need for businesses to adapt to rapidly changing market dynamics further fuel demand for advanced order management applications.

The inventory control & tracking segment is projected to grow at a CAGR of 8.9% over the forecast period. Real-time data visibility is crucial for businesses to manage inventory levels efficiently. By having up-to-the-minute information on stock levels, companies can accurately forecast demand, replenish inventory promptly, and minimize stockouts. This helps in meeting customer demands promptly, enhancing customer satisfaction, and optimizing operational efficiency. Overall, real-time data empowers businesses to make proactive decisions and maintain a competitive edge in dynamic market environments. Regulatory requirements for accurate inventory reporting and data security also propel the demand for sophisticated tracking systems. Moreover, the push for supply chain optimization and cost reduction further fuels the adoption of advanced inventory control applications.

Deployment Insights

The cloud segment dominated the market in 2024. The segment growth is attributed to cloud applications offering scalability, allowing businesses to expand or reduce their inventory management capabilities as needed easily. This flexibility is particularly attractive to small and medium-sized enterprises (SMEs) looking to avoid large upfront investments in hardware and software infrastructure. Moreover, cloud-based systems provide accessibility from anywhere with an internet connection, enabling real-time inventory tracking and management on mobile devices, which is essential in today's fast-paced business environment.

The on-premises segment is expected to grow significantly over the forecast period. End use industries with stringent data security requirements, such as those in finance and healthcare sectors, prefer on-premise applications due to perceived greater control over data access and security protocols. Organizations prefer on-premise applications for their ability to customize and integrate deeply with existing IT infrastructure, providing a seamless operational fit. Despite the growing popularity of cloud-based applications, the on-premise segment continues to thrive due to these factors, catering specifically to enterprises prioritizing data control, compliance, and integration capabilities.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. Large enterprises drive significant growth in the market due to their complex operational needs and substantial inventory volumes. These enterprises typically require sophisticated applications that can handle extensive product lines, multiple warehouses, and global supply chains. Large enterprises prioritize efficiency gains and cost reductions, and the demand for comprehensive, customizable inventory management applications continues to grow, fostering innovation and competition within the market.

The small & medium enterprises segment is projected to be the fastest-growing segment from 2025 to 2033. Increasing affordability and accessibility of cloud-based applications enables SMEs to adopt sophisticated inventory management systems without significant upfront investment. The scalability offered by these applications allows SMEs to expand their capabilities as they grow. Furthermore, the rise of e-commerce and the need for efficient stock control and order fulfillment drive SMEs to implement robust inventory management tools.

End Use Insights

The manufacturing segment dominated the market with a revenue share of over 22.0% in 2024. The increasing complexity of supply chains and the need for real-time tracking and optimization of inventory levels are paramount. Advanced inventory management software helps manufacturers reduce waste, lower costs, and improve production efficiency by providing precise demand forecasting and automated reordering. The integration of technologies such as IoT and AI enhances visibility and predictive maintenance, ensuring smoother operations.

The e-commerce segment is projected to be the fastest-growing segment from 2025 to 2033. The integration of 3D printing (additive manufacturing) technologies with cloud platforms is driving market growth. Inventory management software provides the computational power and storage capacity needed for complex design files, real-time rendering, and remote access to 3D printing resources. This enables manufacturers to collaborate on design, streamline prototyping, and distribute manufacturing capabilities globally, enhancing efficiency and innovation.

Regional Insights

North America inventory management software industry emerged as the largest regional market globally, capturing a substantial market share of 34.9% in 2024. The presence of major industry players and continuous investments in R&D contribute to market expansion. The robust e-commerce sector demands sophisticated inventory applications to handle complex logistics and supply chain needs. Furthermore, regulatory requirements such as SOX and HIPAA ensure compliance and drive businesses to adopt advanced inventory management systems. The strong economic environment and the trend towards digital transformation across various industries also fuel growth in this region.

U.S. Inventory Management Software Market Trends

The U.S. inventory management software industry dominated the North American region in 2024. The exponential growth of e-commerce requires sophisticated inventory management to handle vast and diverse inventories, real-time tracking, and fulfillment demands, driving demand for advanced software applications. According to the U.S. Department of Commerce, U.S. retail e-commerce sales for the 1st quarter of FY24 were USD 289.2 billion, an increase of 2.1 percent from the 4th quarter of 2023.

Asia Pacific Inventory Management Software Market Trends

The Asia Pacific inventory management software industry is expected to be the fastest-growing segment, with a CAGR of 10.2% over the forecast period. The rapid industrialization and urbanization in the Asia Pacific region are driving substantial demand for efficient inventory management applications across diverse sectors such as manufacturing, retail, and logistics. As countries in the region undergo rapid economic development and urban expansion, there is an increasing need for businesses to manage their supply chains more effectively. Industrial growth is leading to larger-scale production and distribution networks, necessitating sophisticated inventory management software (IMS) to handle complex inventory tracking, stock optimization, and order fulfillment processes.

The inventory management software industry in China has been growing significantly during the forecast period. The explosive growth of e-commerce in China, driven by major players such as Alibaba and JD.com, has significantly increased the need for advanced inventory management applications. These e-commerce giants handle vast and complex inventories, with billions of products that need to be tracked, stocked, and delivered efficiently. The sheer volume and variety of products, coupled with high customer expectations for fast delivery and accuracy, necessitate sophisticated inventory management systems.

The Japan inventory management software industry is growing significantly from 2025 to 2033. Japan's strong technological infrastructure and high adoption of advanced technologies such as AI, IoT, and automation are key drivers for the growth of sophisticated inventory management applications. The country is known for its technological innovation and robust IT infrastructure, which facilitates the integration of cutting-edge technologies into business operations.

The inventory management software industry in India is expected to grow significantly from 2025 to 2033. The expansion of the organized retail sector in India, driven by rising consumer demand and increasing disposable incomes, necessitates efficient inventory management systems. As retail businesses scale up and diversify their product offerings, maintaining optimal stock levels becomes critical to prevent stockouts and overstocking, which can lead to significant financial losses. Efficient inventory management software enables retailers to track stock in real-time, forecast demand accurately, and streamline supply chain operations.

Europe Inventory Management Software Market Trends

The inventory management software industry in Europe is anticipated to register considerable growth from 2025 to 2033. Small and medium-sized enterprises (SMEs) in Europe are increasingly investing in digital transformation to enhance their competitiveness and agility in a rapidly evolving market. This transformation involves adopting advanced technologies, such as inventory management software, streamlining operations, reducing costs, and improving efficiency. By implementing inventory management applications, SMEs can automate and optimize stock control, ensuring they maintain the right inventory levels, minimize waste, and respond swiftly to market demands.

The inventory management software industry in the UK is growing significantly during the forecast period. Digital transformation across industries is a key driver for the adoption of sophisticated inventory management systems as businesses seek to leverage technology to enhance efficiency and competitiveness. This push for digitalization involves integrating advanced technologies such as AI, machine learning, and IoT into business processes to streamline operations, reduce costs, and improve decision-making.

The German inventory management software industry is growing significantly during the forecast period. Germany's robust industrial base, encompassing manufacturing, automotive, and engineering sectors, underscores the critical need for efficient inventory management applications. Germany's industrial strength necessitates sophisticated inventory management applications to optimize supply chains, improve operational efficiency, and maintain competitiveness in global markets.

The inventory management software industry in France is growing significantly during the forecast period. The adoption of Internet of Things (IoT) and RFID (Radio Frequency Identification) technologies in France is driving the demand for inventory management software that can leverage these technologies to enable real-time tracking of inventory, enhance inventory accuracy, and improve supply chain visibility.

Key Inventory Management Software Company Insights

Some of the key companies operating in the market include Epicor Software Corporation and SAP SE, among others, which are some of the leading players in the inventory management software industry.

-

Epicor Software Corporation is a global provider of enterprise resource planning (ERP) and inventory management software, serving businesses across industries such as manufacturing, distribution, retail, and automotive. Epicor’s inventory management software is a key component of its ERP solutions, providing businesses with real-time visibility, automated tracking, and advanced analytics for inventory control. The software enables companies to manage stock levels efficiently, reduce excess inventory, and optimize warehouse operations.

-

SAP SE is a global company specializing in enterprise software, cloud computing, and business process automation, offering advanced solutions for supply chain management (SCM), enterprise resource planning (ERP), and inventory management. SAP's inventory management capabilities are integrated within its SAP S/4HANA and SAP Extended Warehouse Management (EWM) solutions, enabling businesses to gain real-time visibility, automate inventory tracking, and improve stock control.

DataLogic and Archon Systemsare some of the emerging market participants in the target market.

-

Datalogic is a global technology company specializing in automatic data capture and industrial automation solutions. Datalogic’s inventory management solutions are designed to improve efficiency, accuracy, and real-time visibility in warehouses, retail stores, manufacturing facilities, and logistics operations. The company’s barcode scanners and mobile computers enable businesses to quickly and accurately scan products, track inventory movements, and reduce manual errors.

-

Archon Systems is a Canadian software company specializing in inventory management solutions for small and medium-sized businesses (SMBs). The company's flagship product, inFlow Inventory, is inventory management software designed to help businesses gain better control over their stock, sales, and supply chain. Offered as both a cloud-based and on-premise solution, inFlow Inventory enables users to manage inventory across multiple locations, automate reordering, generate detailed reports, and integrate with other business tools such as accounting and e-commerce platforms.

Key Inventory Management Software Companies:

The following are the leading companies in the inventory management software market. These companies collectively hold the largest market share and dictate industry trends.

- Acumatica, Inc.

- Archon Systems

- DataLogic

- Fishbowl

- Epicor Software Corporation

- IBM Corporation

- Intuit, Inc.

- Lightspeed Commerce Inc.

- Manhattan Associates

- Microsoft Corporation

- NCR Voyix Corporation

- Oracle Corporation

- Revel Systems

- SAP SE

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In April 2025, Orders in Seconds, Inc. (OIS) partnered with Fishbowl Inventory to deliver a seamless integration that enhances order management and warehouse operations. This collaboration combines OIS's advanced automated order management system with Fishbowl Inventory's warehouse management solutions, enabling businesses to improve efficiency, accuracy, and customer satisfaction. Both platforms also integrate smoothly with Intuit QuickBooks, offering wholesale distributors and CPG brands a centralized solution for managing sales, inventory, and finances.

-

In April 2025, Manhattan Associates partnered with Natura, a cosmetics and personal care company, to implement both Manhattan Active Warehouse Management and Manhattan Active Transportation Management. This collaboration aims to unify Natura’s supply chain operations and enhance operational efficiency. With a single, swift implementation, Natura can streamline its planning, execution, and real-time visibility across all supply chain processes. The Manhattan Active platform seamlessly integrates warehousing and transportation activities, optimizing storage, picking, shipping, and routing decisions using live data.

-

In May 2024, Epicor Software Corporation acquired Smart Software. This acquisition strengthens Epicor’s ability to enhance its ERP offerings with advanced AI applications across business operations in the make, move, and sell industries. These capabilities improve forecast accuracy, enable swift identification and resolution of inventory imbalances, predict future operational performance, and track actual results.

Inventory Management Software Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 3.74 billion

Revenue Forecast in 2033

USD 7.14 billion

Growth rate

CAGR of 8.4% from 2025 to 2033

Actual Data

2021 - 2024

Forecast Period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, application, deployment, enterprise size, end use, and region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Oracle Corportation; SAP SE; Microsoft Corporation; IBM Corporation; Manhattan Associates; Epicor; Zoho Corporation; Fishbowl; NetSuite; DataLogic; NCR Corporation; Intuit, Inc.; Acumatica, Inc.; Lightspeed; Revel Systems; Archon Systems

Customization Scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inventory Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global inventory management software market report based on component, application, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Software

-

Services

-

Professional Services

-

Managed Services

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Inventory Control & Tracking

-

Order Management

-

Scanning and Barcoding

-

Asset Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail

-

E-Commerce

-

Manufacturing

-

Healthcare

-

Logistics and Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global inventory management software market was valued at USD 3.58 billion in 2024 and is expected to reach USD 3.74 billion in 2025.

b. The global inventory management software market is expected to reach USD 7.14 billion by 2033, at a compound annual growth rate of 8.4%.

b. North America dominated the inventory management software market with a market share of 35.0% in 2024. The presence of major industry players and continuous investments in R&D contribute to market expansion.

b. The key players operating in inventory management software market include Oracle Corporation, Microsoft Corporation, IBM Corporation among others.

b. The inventory management software market is experiencing robust growth, driven by the need for businesses to optimize supply chains, reduce costs, and enhance operational efficiency. Rapid expansion across the e-commerce industry and rising supply chain disruptions will propel market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.