- Home

- »

- Beauty & Personal Care

- »

-

Italy Sun Care Cosmetics Market Size, Industry Report, 2033GVR Report cover

![Italy Sun Care Cosmetics Market Size, Share & Trends Report]()

Italy Sun Care Cosmetics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Tinted Moisturizers, SPF Foundation, SPF Sunscreen), By Type (Conventional, Organic), By Distribution Channel (Hypermarkets & Supermarkets, E-commerce), And Segment Forecasts

- Report ID: GVR-4-68040-666-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Italy Sun Care Cosmetics Market Trends

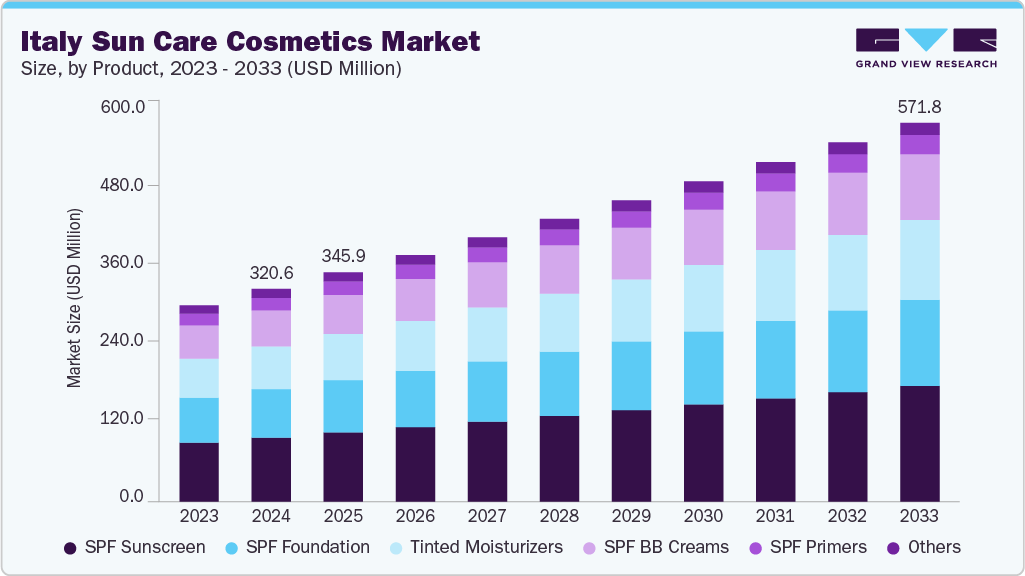

The Italy sun care cosmetics market size was estimated at USD 320.6 million in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2033. The Italian sun care cosmetics market is experiencing growth driven by several key factors. A heightened awareness of skin health and the harmful effects of UV exposure has led to increased demand for sun protection products. Consumers are increasingly seeking natural and organic formulations, favoring products that are both effective and environmentally friendly.

The country's Mediterranean climate and active outdoor lifestyle further contribute to the need for reliable sun care solutions. Italy sun care cosmetics market is also driven by strong dermatological endorsements and widespread public awareness campaigns emphasizing the importance of regular sun protection. The country’s vibrant outdoor culture and tourism sector significantly enhance demand throughout the year. Innovations in product formulations, offering lightweight and fast-absorbing textures, attract consumers seeking comfort and efficacy. Additionally, social media beauty trends play a crucial role in integrating sun care into daily skincare habits among Italian consumers in the sun care cosmetic industry. According to the Galaxus data published in July 2024, nearly 86% of the Italian respondents in a survey conducted out of 2,547 total respondents use sunscreen.

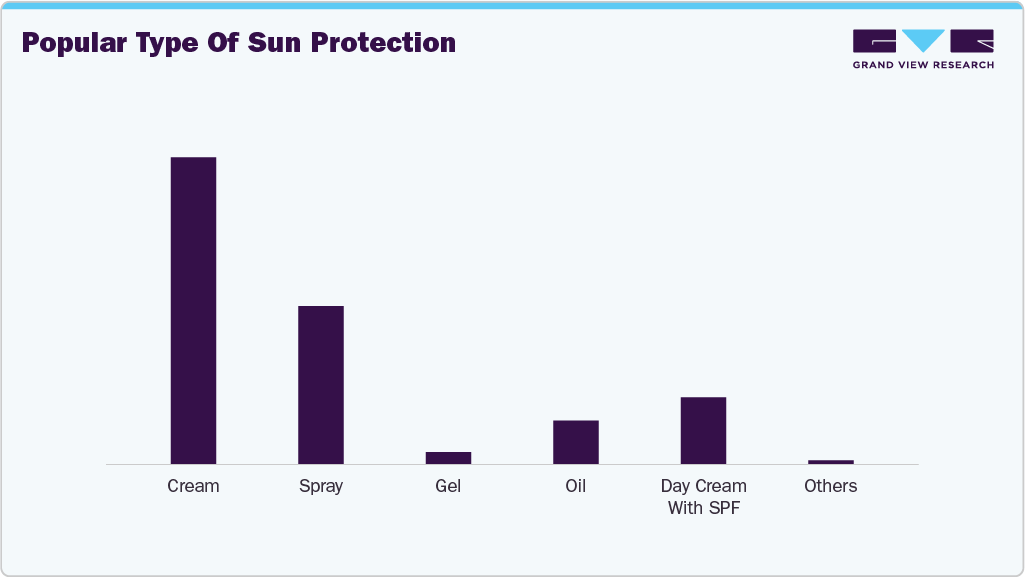

Consumer Insights & Surveys

Italian women are progressively embracing sunscreen and sun care products as essential parts of their daily skincare routines throughout the year, not just in the summer. There is a particular focus on protecting the face using SPF-infused creams, lotions, and serums that combine sun protection with skincare benefits. Growing awareness of sun-induced aging and skin health motivates regular use, especially among women aged 30 and above. Furthermore, Italian consumers prefer products with refined, lightweight textures that integrate smoothly with their beauty and makeup regimens.

Product Insights

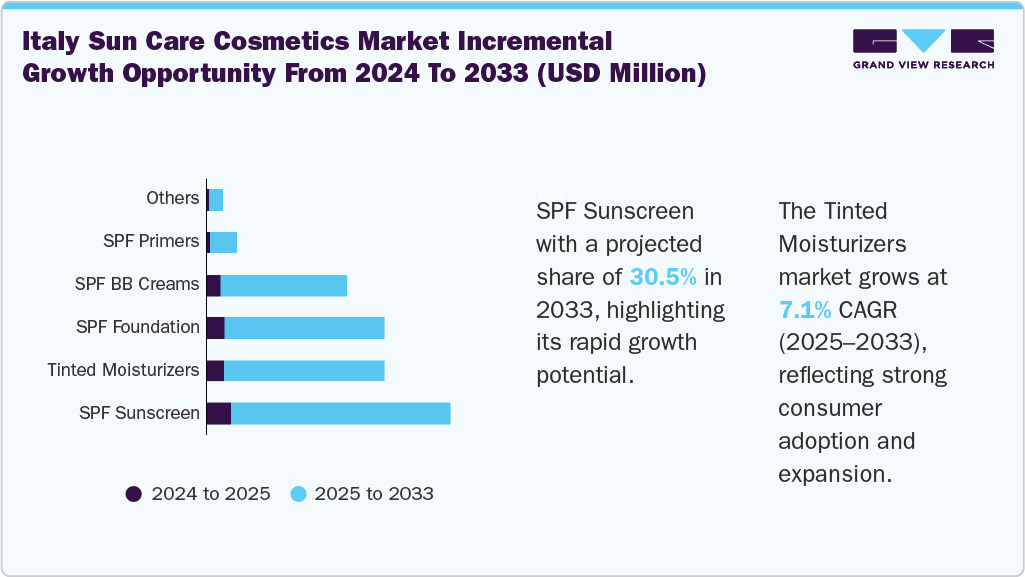

SPF sunscreen accounted for the largest revenue share of about 30.1% of the Italy sun care cosmetics market in 2024. The demand for SPF sunscreen in the Italian market is driven by increasing consumer awareness of the risks of UV exposure and skin aging. Growing preference for multi-functional products that combine sun protection with skincare benefits boosts market growth. Italy’s sunny climate and active outdoor lifestyle further elevate the need for reliable SPF solutions. According to the Galaxus data published in July 2024, about 63% of Italian consumers apply SPF sunscreen when sunbathing, whereas 33% use it during outdoor swimming. Additionally, rising availability through diverse retail channels, including e-commerce, enhances accessibility and adoption.

Demand for tinted moisturizers is projected to rise at a CAGR of 7.1% from 2025 to 2033. The demand for tinted moisturizers in Italy's sun care cosmetics market is fueled by a growing preference for multifunctional skincare products that combine sun protection with cosmetic benefits. Consumers are increasingly seeking lightweight, breathable formulations that provide a natural finish, aligning with the trend towards minimalistic beauty routines. The rising awareness of the harmful effects of UV exposure and the desire to prevent premature aging further drive the adoption of tinted moisturizers with SPF. Additionally, the availability of a wide range of shades to match various skin tones enhances the appeal of these products among Italian consumers. For instance, brands such as bareMinerals offer tinted moisturizer with SPF 30 for sun protection, and it is available in various shades to suit every skin complexion.

Type Insights

Conventional sun care cosmetics accounted for the largest revenue share of 84.3% of the Italy sun care cosmetics market in 2024. This type of sun care cosmetics market in Italy is driven by longstanding consumer trust in established brands known for proven efficacy and safety. Traditional product formats such as lotions and creams remain popular due to their familiarity and ease of use. Strong retail presence in pharmacies and specialty stores supports consistent availability. Moreover, ongoing consumer education about UV protection sustains steady demand for conventional sun care options.

The demand for organic sun care cosmetics is estimated to grow with the fastest CAGR of 7.0% over the forecast period. The organic sun care cosmetics market in Italy is propelled by a rising consumer preference for natural ingredients that are gentle on sensitive skin. Increasing environmental concerns encourage the use of eco-friendly and cruelty-free products. The demand for transparency in ingredient sourcing and certifications also boosts trust and adoption. For instance, COOLA LLC provides a sunscreen with SPF 50 that contains over 70% organic ingredients, featuring a non-greasy and fragrance-free formula. Additionally, the growing popularity of holistic wellness and clean beauty trends supports sustained market growth.

Distribution Channel Insights

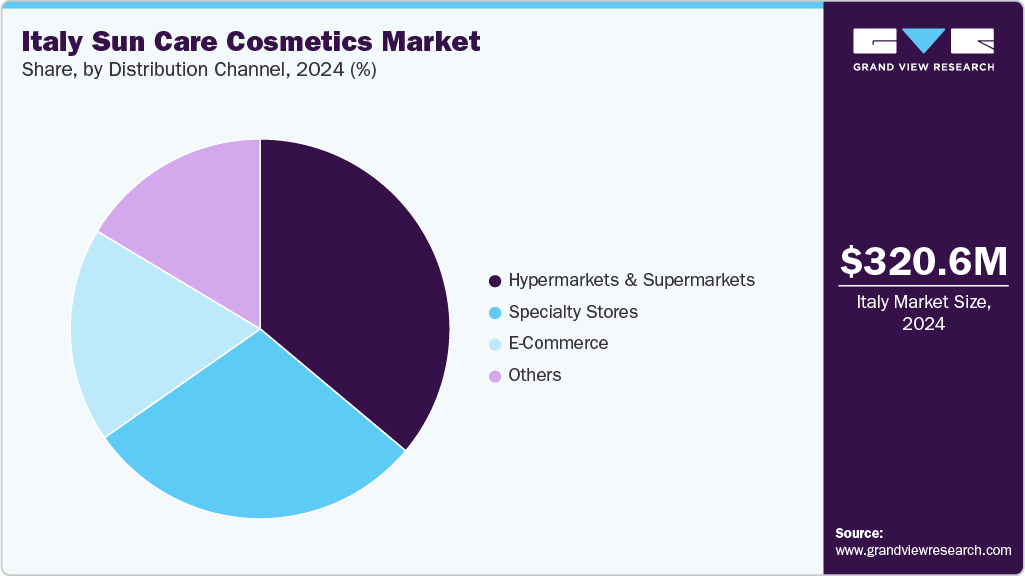

The sales of sun care cosmetics through hypermarkets and supermarkets accounted for a revenue share of about 36.1% in 2024. The growth of hypermarkets and supermarkets as a distribution channel for the sun care cosmetic industry in Italy is driven by their convenience and one-stop shopping experience. These outlets offer wide product assortments at competitive prices, attracting budget-conscious consumers. Their extensive presence in both urban and suburban areas enhances accessibility. Additionally, promotional activities and in-store displays help boost product visibility and impulse purchases.

E-commerce is expected to grow at the fastest CAGR of 7.2% from 2025 to 2033. The rise of e-commerce in Italy’s sun care cosmetics market is fueled by increasing internet penetration and smartphone usage. Online platforms provide consumers with the convenience of home delivery and access to a broader product range, including niche and international brands. Detailed product information and customer reviews support informed purchasing decisions. Moreover, targeted digital marketing and personalized recommendations enhance customer engagement and loyalty. According to the YouGov survey conducted in July 2024, about 10% Italian respondents consider quick delivery services for purchasing beauty & personal care products.

Key Italy Sun Care Companies Insights

The Italy sun care cosmetics market features a competitive landscape with both established brands and emerging players striving for prominence. Key companies are adapting to shifting consumer preferences by innovating product formulations and expanding their SPF and skincare ranges. Strategic partnerships, marketing campaigns, and brand differentiation are central to maintaining and growing market share. New entrants are leveraging clean beauty trends and digital platforms to gain traction in this evolving sector.

-

BioNike is a prominent Italian dermocosmetics brand specializing in sun care products, particularly through its DEFENCE SUN line. Renowned for its commitment to skin health, sustainability, and dermatological safety, BioNike offers a diverse range of sun protection solutions tailored to various skin types and needs.

-

Labo International Srl is a prominent Italian dermo-cosmetic company specializing in advanced skin care solutions, including sun protection products. Headquartered in Padova, Italy, Labo operates under the brand Labo Transdermic and offers a range of sun care products designed to provide high protection against UV radiation.

Key Italy Sun Care Cosmetics Companies:

- L’Oréal S.A.

- Johnson & Johnson Services, Inc.

- Beiersdorf AG

- Unilever

- NAOS

- Shiseido Co., Ltd.

- Pierre Fabre Laboratories.

- Clarins

- Cantabria Labs

- Labo International Srl.

Recent Developments

-

In June 2025, BioNike relaunched its Defence Sun sunscreen range, featuring triple protection against skin damage, enhanced environmental protection, and a marine-friendly formula. The products are packaged in 100% recyclable materials and support Worldrise, a non-profit dedicated to preserving marine ecosystems.

-

In July 2022, Marionnaud Parfumeries Italia S.r.l. collaborated with beauty tech company, Revieve, and launched an artificial intelligence (AI)-powered sun care app in Italy. The app is capable of detecting sun exposure concerns such as hyperpigmentation, melasma, and wrinkles to suggest tailored sun care routines, aiming to enhance awareness and reduce UV-related skin damage.

Italy Sun Care Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 345.9 million

Revenue forecast in 2033

USD 571.8 million

Growth rate

CAGR of 6.5% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country scope

Italy

Key companies profiled

L’Oréal S.A.; Johnson & Johnson Services, Inc.; Beiersdorf AG; Unilever; NAOS; Shiseido Co., Ltd.; Pierre Fabre Laboratories; Clarins; Cantabria Labs; Labo International Srl.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Italy Sun Care Cosmetics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Italy sun care cosmetics market report based on product, type, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Tinted Moisturizers

-

SPF Foundation

-

SPF BB Creams

-

SPF Primers

-

SPF Sunscreen

-

Others

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Conventional

-

Organic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-Commerce

-

Others

-

Frequently Asked Questions About This Report

b. The Italy sun care cosmetics market size was estimated at USD 320.6 million in 2024 and is expected to reach USD 345.9 million in 2025.

b. The Italy sun care cosmetics market is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033 to reach USD 571.8 million by 2033.

b. SPF sunscreen accounted for a revenue share of 30.1% in 2024, driven by growing preference for multi-functional products that combine sun protection with skincare benefits.

b. Some key players operating in the Italy sun care cosmetics market include L’Oréal S.A., Johnson & Johnson Services, Inc., Beiersdorf AG, Unilever, NAOS, and Shiseido Co., Ltd.

b. Key factors driving market growth in the Italy sun care cosmetics market include a Mediterranean climate encouraging frequent sun exposure, a strong cultural emphasis on skincare and beauty, and increasing adoption of high-SPF and anti-aging sun protection products. Growth is further supported by tourism-driven demand, seasonal product launches, and a shift toward sustainable and reef-safe formulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.