- Home

- »

- Communications Infrastructure

- »

-

Japan Cross-border E-commerce Market Size Report, 2030GVR Report cover

![Japan Cross-border E-commerce Market Size, Share & Trends Report]()

Japan Cross-border E-commerce Market (2023 - 2030) Size, Share & Trends Analysis Report By Platform (B2B, B2C, C2C), By Application (Food & Beverage, Personal Care, Furniture & Appliances, Toys, hobby & DIY), And Segment Forecasts

- Report ID: GVR-4-68039-115-9

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

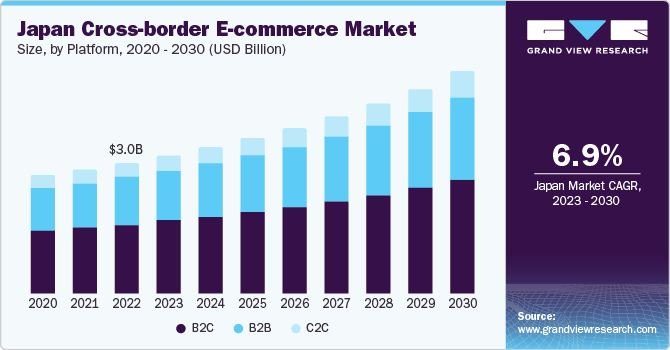

The Japan cross-border e-commerce market size was valued at USD 3.01 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Cross-border e-commerce is also known as international online trade and involves trading between businesses and consumers (B2C), two businesses (B2B), or two consumers (C2C). Cross-border e-commerce occurs when a consumer buys a product from an online seller in another country. Several reasons, such as varied product pricing and differentiation, quality, shipping options, and payment methods, enable consumers to buy products through cross-border e-commerce.

The market in Japan is anticipated to witness significant growth owing to several factors, such as the growth of the overall e-commerce industry, the availability of different payment methods, and strong online fraud prevention measures. Factors such as high urban population, internet penetration, and changing shopping behavior, coupled with rising awareness about e-commerce among Japanese consumers are anticipated to fuel the market growth over the forecast period.

For instance, according to the Japan Internet Stats and Telecommunications Report, the internet penetration rate in Japan in 2019 was 93.8%. According to industry experts in Japan, consumer behavior in Japan is changing rapidly. Consumers are increasingly inclined to buy globally recognized brand productsand often shop more online. These factors have paved the way for several payment providers and merchants to enter the Japanese market. More than 60% of consumers in Japan pay for products using credit cards. Apparel & fashion are anticipated to be the top buying category in Japan.

Established organizations and large enterprises are leaning towards online business due to lesser expenditure on communication and infrastructure. E-commerce offers organizations an easier reach for customers, and hence, the necessary exposure to business is also achieved. The increasing importance of online marketing tools such as Google and Facebook ads drive e-commerce. Marketing options these days are in abundance due to the popularity of social media applications; this, in turn, helps in escalating the market toward growth trajectories.

The COVID-19 pandemic had a significant impact on the Japanese cross-border e-commerce market. The pandemic led to an increased demand for online shopping as consumers sought safer and more convenient ways to make purchases. This shift towards digital channels benefited the cross-border e-commerce market, with Japanese consumers exploring international platforms to access a wider range of products. The pandemic also accelerated the digital transformation of retail, pushing traditional brick-and-mortar shoppers to embrace online shopping.

Platform Insights

On the basis of the platform, the market has been segmented into B2B, B2C, and C2C. The B2C segment accounted for the largest revenue share of 53.25% in 2022. This growth is attributed to the growing middle-class population and the intense use of social media, which boosts the demand for online purchasing of various products and services, positively impacting the Business-to-Consumer (B2C) segment growth. The internet has transformed the way people sell and buy goods and services. E-commerce or online retail is changing shopping experiences for customers.

Banks and other players in the market are allowing a safe and secure online platform to complete transactions via payment gateways. Market players focus on unique business model changes to enable sellers and consumers to transact online. Major retailers are trying to complement their traditional retailing with online commerce and tying up with other big e-commerce players.

The C2C segment is expected to expand at the fastest CAGR of 7.9% during the forecast period. Japan has a high internet penetration rate, with a significant portion of the population accessing online platforms. The presence of established e-commerce platforms and marketplaces in Japan, such as Mercari, Rakuma, and Yahoo! Auctions, has facilitated C2C cross-border transactions. These platforms provide a convenient and trusted infrastructure for individuals to sell and purchase products internationally.

Companies offer platforms where individual sellers from one country can sell products to different countries. It enables individuals to directly contact the buyer and ship the product, thus eliminating the need for intermediaries. However, the lack of trust is anticipated to inhibit the segment’s growth in the Japan cross-border e-commerce market over the next few years.

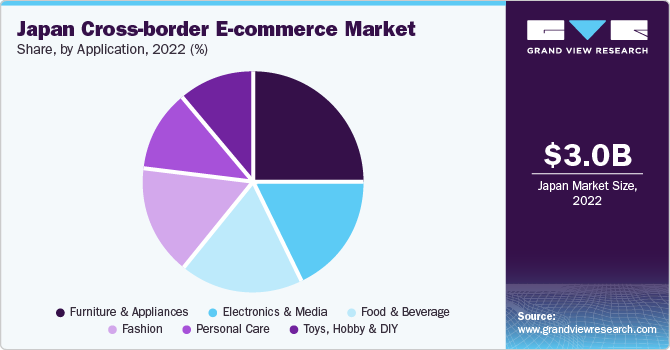

Application Insights

The furniture & appliances segment captured the highest revenue share of 25.2% in 2022. It is attributable to the rising presence of companies offering home furniture and appliances. The ongoing work-from-home situation has also positively affected segment growth. For instance, several companies have advised their employees to work from home. Due to social distancing, millions are turning towards the internet since social interactions are moving online and business-to-business communications are taking place digitally. E-commerce companies have witnessed a tremendous increase in demand for products such as power banks, routers, headsets, laptops, worktables, and chairs.

The toys, hobby & DIY segment is expected to expand at the fastest CAGR of 7.9% during the forecast period. Japan is renowned for its anime, manga, and gaming culture. This has resulted in a high demand for related merchandise, including action figures, collectible items, and hobby kits. The segment offers niche and specialized products catering to various interests and hobbies. It includes model kits, craft supplies, traditional Japanese toys, and DIY tools. Cross-border e-commerce allows sellers to reach a global audience and connect with consumers who have specific interests or niche hobbies.

The electronics and media segment held a considerable market share in 2022 and is expected to retain a high share for the next few years. Mobile phones are a major factor contributing to the market share of the electronics and media segment. Apple Inc.’s iPhones are hugely popular in Japan; thus, people use e-commerce websites to buy such premium phones from sellers outside the country.

Country Insights

The market is influenced by the increased customer preference towards products from foreign countries, owing to the unavailability of certain products in Japan, price benefits, and loyalty towards specific foreign brands. Additionally, the emergence of e-commerce portals as a key selling medium on account of improved internet connectivity, along with the presence of multiple applications on the Android and iOS platforms, is expected to remain a favorable factor for market growth.

In Japan, over 93% of the population uses the Internet, while 74% of Japanese individuals shop online. Localization is considered a key element to success as the population utilizes portals that are easily comprehended and are used in Japanese.

Key Companies & Market Share Insights

Industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in September 2022, Yuasa Battery, Inc. launched YBX automotive and marine batteries for North America’s battery market. The new YBX brand features next-generation battery innovation developed in collaboration with leading vehicle manufacturers, and can be readily installed. Yuasa's YBX batteries have been optimized for partial charge efficiency and built with lower self-discharge rates for expanded lifespans with advanced technology cars in consideration.

In October 2019, Amazon, Inc. announced the launch of Project Zero in Japan. The initiative aims to improve customers’ online shopping experience by identifying counterfeit or fake products using the company’s self-service counterfeit removal tools and eliminating such products and suspected entries. Project Zero by that time had already been implemented in the U.S. and Europe and proved very successful.

Key Japan Cross-Border E-Commerce Companies:

- Amazon.com, Inc.

- Rakuten Group, Inc.

- Kakaku.com, Inc.

- Yahoo! Japan

- Apple Inc.

- DMM.com

- Yodobashi Camera Co., Ltd.

Recent Developments

-

In May 2023, Mamenta, Inc. entered into a new partnership with Rakuten Group, Inc. The collaboration aims to assist e-commerce merchants on Rakuten Ichiba, the Rakuten-operated internet shopping mall. Mamenta has seamlessly integrated its technology suite into Rakuten Ichiba, enabling brands like Netflix, Harman International, McAfee, and others to connect data and manage inventory positions. This partnership empowers merchants on Rakuten Ichiba to enhance their operational efficiency and deliver an improved shopping experience to customers

-

In April 2022, Uniqlo, the Japanese apparel brand, unveiled a new feature on its e-commerce site to promote social responsibility. The Buy with Purpose feature will allow customers to support a cause through their purchases by having Uniqlo donate on their behalf to a designated organization. This feature will be accessible through the retailer's app and online website and will be specifically available for sustainably-manufactured styles, such as the company’s BlueCycle Jeans. By integrating this feature, Uniqlo encourages customers to make conscious choices and contribute to meaningful initiatives while enjoying their shopping experience

-

In April 2022, Tokyo-based Westlake Akishima, a prominent specialty stabilizer supplier for the PVC industry, launched an innovative e-commerce platform. Developed in collaboration with technology provider Agilis Chemicals, this platform aims to enhance the customer buying experience by providing a secure and convenient online purchasing process. With this platform, Westlake Akishima reinforces its commitment to delivering excellent service and streamlining the procurement process for its customers

Japan Cross-border E-commerce Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.09 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, application

Key companies profiled

Amazon.com, Inc.; Rakuten Group, Inc.; Kakaku.com, Inc.; Yahoo! Japan; Apple Inc.; DMM.com; Yodobashi Camera Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Japan Cross-border E-commerce Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the Japan cross-border e-commerce market report on the basis of platform, and application:

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

B2B

-

B2C

-

C2C

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverage

-

Personal Care

-

Furniture & Appliances

-

Toys, hobby & DIY

-

Electronics & Media

-

Fashion

-

Frequently Asked Questions About This Report

b. The Japan cross-border e-commerce market size was estimated at USD 3.01 billion in 2022 and is expected to reach USD 3.18 billion in 2023.

b. The Japan cross-border e-commerce market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 5.09 billion by 2030.

b. Furniture & Appliances dominated the Japan cross-border e-commerce market with a share of 25.2% in 2022. It is attributable to the rising presence of companies offering home furniture and appliances. The current ongoing work-from-home situation has also positively affected segment growth.

b. Some key players operating in the Japan cross-border e-commerce market include Amazon.com, Inc., Rakuten Group, Inc., Kakaku.com, Inc., Yahoo! Japan, Apple Inc., DMM, YODOBASHI CAMERA CO., LTD.

b. Factors such as high urban population, internet penetration, and changing shopping behavior coupled with rising awareness about e-commerce among consumers are anticipated to fuel the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.