Japan Draught Beer Market Summary

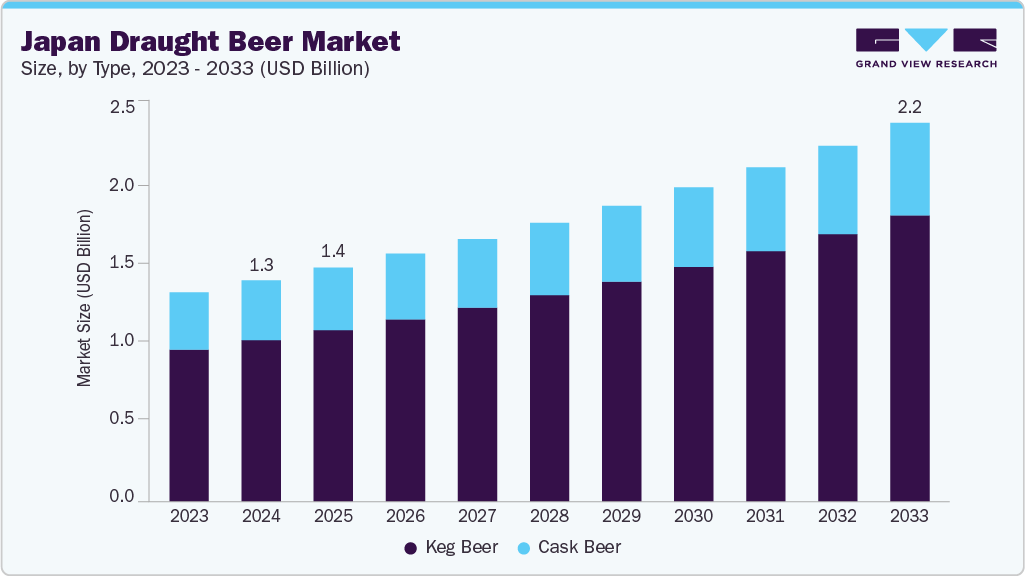

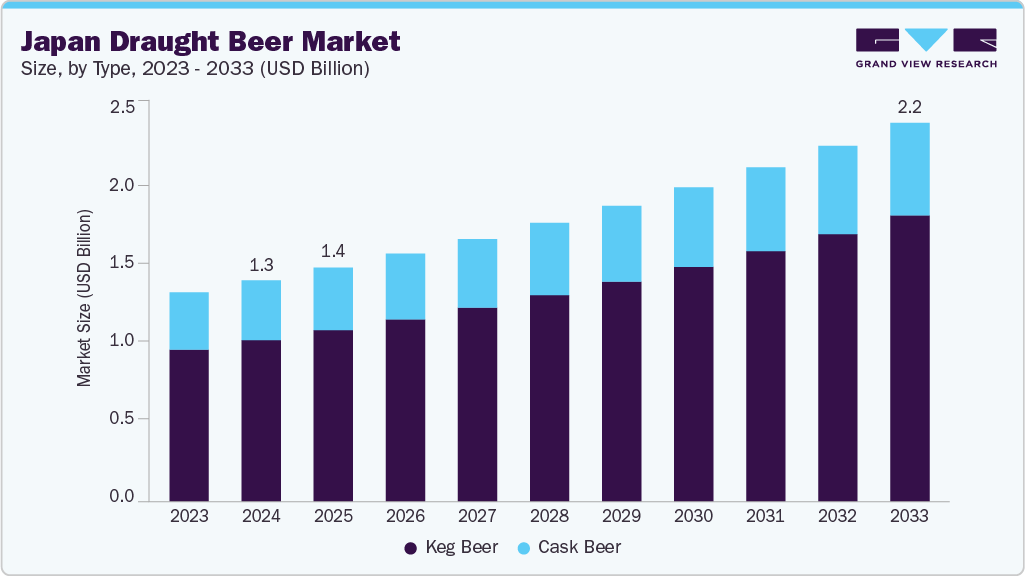

The Japan draught beer market size was estimated at USD 1.29 billion in 2024 and is projected to reach USD 2.21 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. There is a rising preference for fresh and flavorful drinking experiences, with draught beer often perceived as superior in taste and quality compared to bottled alternatives.

Key Market Trends & Insights

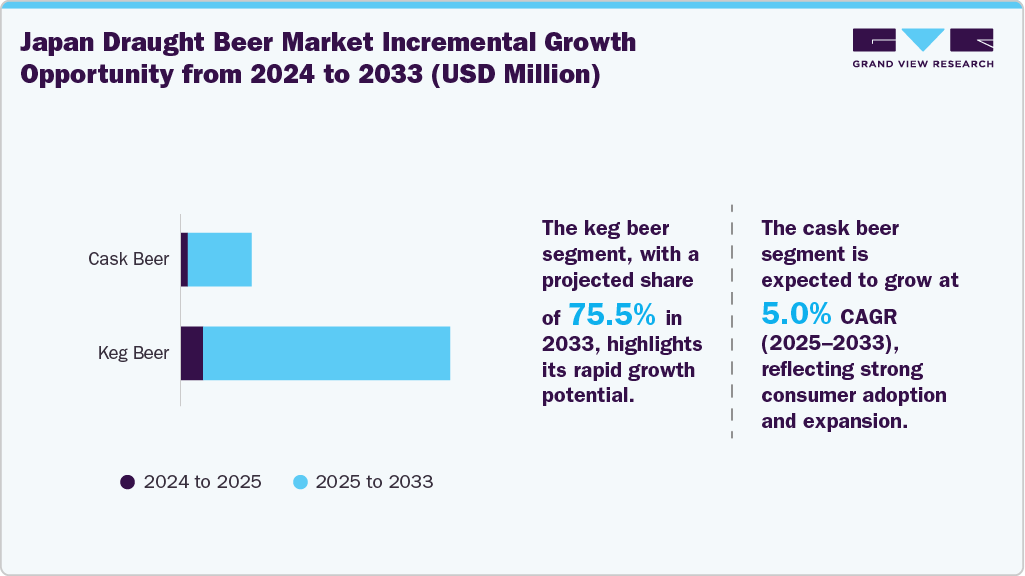

- By type, the keg draught beer segment held the highest market share of 73.0% in 2024.

- Based on category, the premium segment held the highest market share in 2024.

- Based on end use, the commercial use segment accounted for the largest share of 83.5% in 2024.

- Based on production, the macro breweries segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.29 Billion

- 2033 Projected Market Size: USD 2.21 Billion

- CAGR (2025-2033): 6.2%

This trend is especially prominent in social settings such as izakayas, restaurants, and bars, where on-tap beer is a staple of the dining experience. The rising disposable income among Japanese consumers has led to more frequent dining out and a greater willingness to spend on premium beverages. This economic change has increased the demand for higher-quality draught beer options, including super-premium and craft varieties. According to Kirin Holdings, in 2022, Japan's per capita beer consumption was 34.2 liters, equivalent to about 54.0 633ml bottles. Additionally, the growing popularity of social drinking culture-especially among younger demographics-has strengthened the role of beer in casual and celebratory gatherings, further boosting consumption.

Technological advancements in brewing and dispensing systems have also contributed. Improved keg systems and refrigeration technologies ensure consistent quality and freshness, making draught beer more appealing to consumers and hospitality providers. Moreover, expanding microbreweries and craft beer bars across Japan have introduced various flavors and styles, attracting beer enthusiasts seeking unique and artisanal experiences.

The Japanese market is also benefiting from health-conscious trends. Breweries are introducing reduced-alcohol and gluten-free draught options to cater to evolving consumer preferences. This diversification broadens the appeal of draught beer and aligns with Japan’s growing interest in wellness-oriented products.

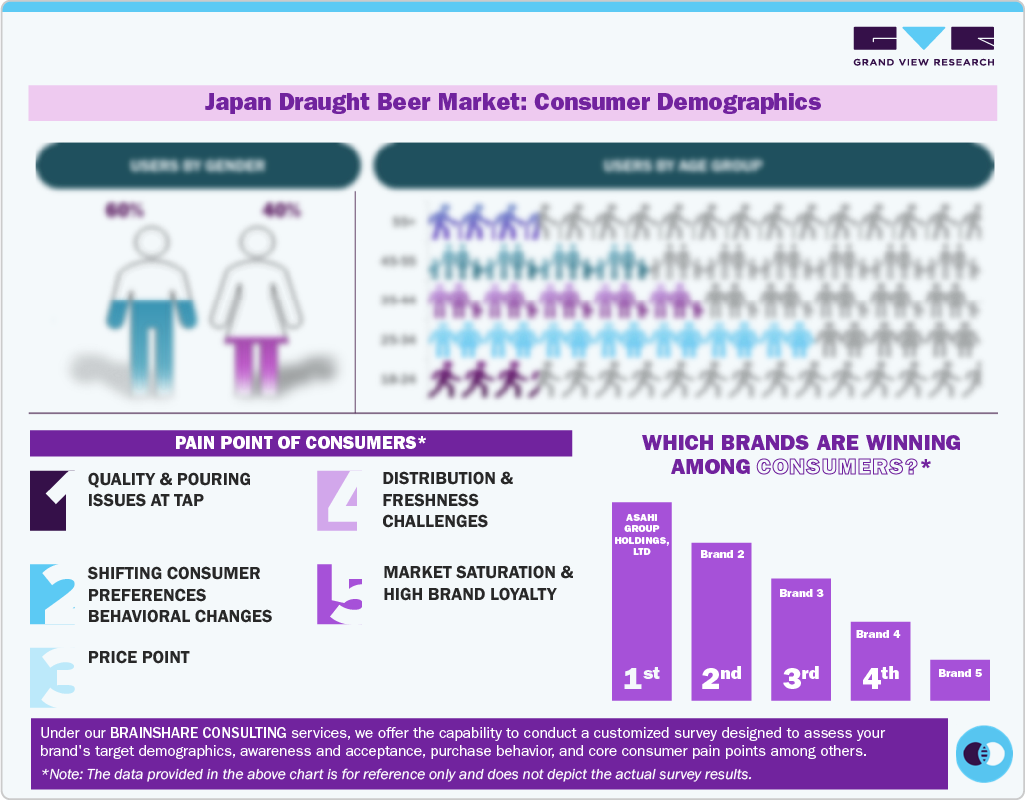

Consumer Insights

In Japan, a significant portion of the adult population consumes draught beer, particularly in social and on-premise settings such as izakayas, bars, and restaurants. As of 2025, Japan has a population of approximately 123 million, with 18-24 years: 6.9%, 25-34 years: 9.9% and 35-44 years: 11.2%. Several surveys suggest that 30-35% of these adults’ drink beer regularly, and among them, an estimated 60-70% prefer draught beer when consuming alcohol outside the home.

Men are the primary consumers, driven by cultural norms, workplace drinking, and traditional branding. However, female consumption is growing, supported by lighter, more flavorful draught options and gender-inclusive marketing. This shift is gradually diversifying Japan’s draught beer consumer base.

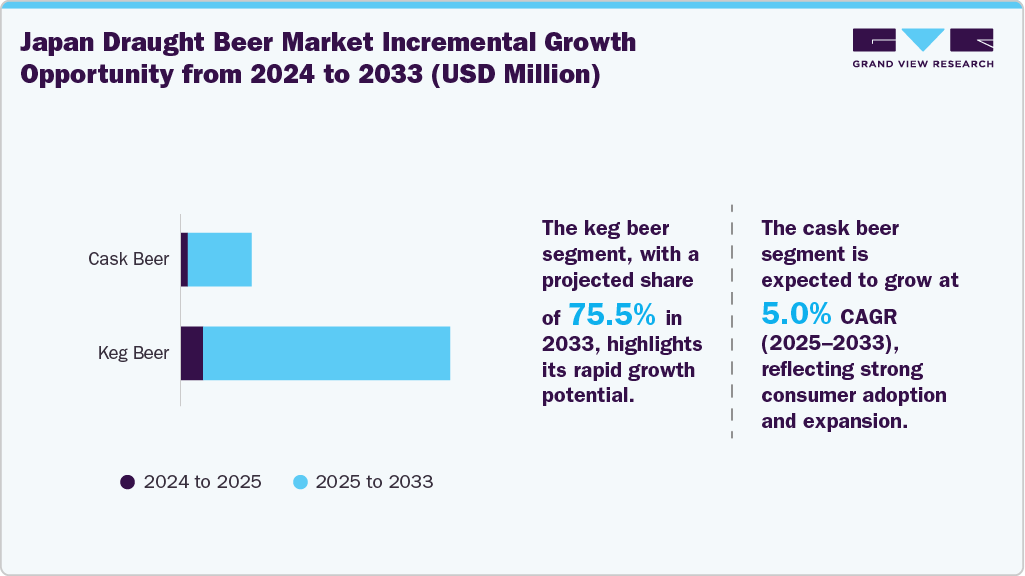

Type Insights

Keg draught beer dominated the Japanese industry and accounted for a share of 73.0% in 2024. This dominance is largely attributed to its efficiency in preserving freshness and flavor, making it the preferred choice. Keg systems offer consistent quality and are easier to store and dispense, aligning well with Japan's high beverage presentation and taste standards. Moreover, keg beer supports the growing demand for on-tap experiences, especially in urban centers where social drinking culture thrives. Its popularity is further reinforced by the rise of craft breweries and premium beer offerings, many of which rely on keg formats to deliver their products in optimal condition.

The cask draught beer is expected to grow significantly from 2025 to 2033, driven by a resurgence of interest in traditional brewing methods and artisanal experiences. Cask beer offers a more nuanced and unfiltered taste profile that appeals to beer enthusiasts seeking authenticity and craftsmanship. This growth is also supported by the expansion of microbreweries and craft beer bars, many of which are embracing cask conditioning to differentiate their offerings. As consumers become more adventurous and educated about beer styles, a rising appreciation for cask beer's subtle flavors and natural carbonation is rising.

Category Insights

Premium draught beer accounted for the largest share of 57.8% in 2024. This dominance reflects a strong consumer shift toward high-quality, flavorful beer experiences, particularly in urban centers and upscale hospitality venues. Japanese consumers are increasingly drawn to premium offerings that emphasize craftsmanship, refined taste profiles, and freshness-attributes that align well with the cultural appreciation for quality and presentation.

The regular segment is expected to grow significantly from 2025 to 2033, driven by a combination of affordability, familiarity, and evolving consumer preferences. While premium and craft beers dominate the spotlight, regular draught beer continues to appeal to a broad base of consumers who value consistency and accessibility. This segment benefits from its widespread availability in casual dining venues, izakayas, and convenience-focused establishments, making it a staple in everyday social drinking.

End Use Insights

In Japan, commercial use of draught beer accounted for the largest revenue share of 83.5% in 2024. This growth is attributed to the widespread presence of draught beer in hospitality venues, where it is a staple of the social drinking experience. These establishments rely heavily on draught beer for its freshness, consistent quality, and high profit margins, making it a preferred choice over bottled or canned alternatives.

The home use segment is expected to grow at the fastest CAGR from 2025 to 2033. Lifestyle changes have accelerated this trend, including the rise of remote work and a growing interest in home entertainment, which have made consumers more inclined to invest in home draught systems and mini-kegerators. Additionally, compact and user-friendly dispensing technologies have made it easier for consumers to enjoy fresh, tap-quality beer without visiting a bar or restaurant. Breweries are responding by offering smaller-format kegs, subscription services, and limited-edition brews tailored for home consumption. The appeal of freshness, flavor variety, and convenience drives adoption among younger, urban demographics who value quality and experience.

Production Insights

Draught beer manufactured through macro breweries accounted for the largest share, 89.8%, in 2024. Macro breweries excel in delivering consistent quality and wide availability, making their draught offerings the go-to choice for commercial venues. Their ability to produce large volumes at competitive prices also supports their dominance, especially in a market where freshness and reliability are key.

The microbreweries segment is expected to grow at the fastest CAGR of 8.5% from 2025 to 2033. A rising consumer appetite for authentic, small-batch brews that offer unique flavor profiles and local character drives this growth. As Japan’s beer culture evolves, more drinkers-especially younger and urban demographics-are gravitating toward craft experiences that emphasize quality over quantity. Expanding taprooms and brewpubs across major cities like Tokyo, Osaka, and Kyoto also contribute to this growth, creating vibrant spaces where microbreweries can showcase seasonal and experimental offerings. Additionally, the trend toward sustainable brewing practices and using locally sourced ingredients resonates strongly with eco-conscious consumers.

Key Japan Draught Beer Company Insights

Some of the key companies operating in Japan draught beer industry include ASAHI GROUP HOLDINGS, LTD., Kirin Holdings Company, Limited, SAPPORO BREWERIES LTD, SUNTORY HOLDINGS LIMITED, and others.

-

Asahi is known globally for its flagship beer, Asahi Super Dry, and operates across alcoholic beverages, non-alcoholic drinks, and food products. The company has pursued aggressive global expansion, notably acquiring brands such as Peroni and Carlton & United Breweries, and recently entering the U.S. market through Octopi Brewing.

Key Japan Draught Beer Companies:

- ASAHI GROUP HOLDINGS, LTD.

- Kirin Holdings Company, Limited

- SAPPORO BREWERIES LTD

- SUNTORY HOLDINGS LIMITED

Japan Draught Beer Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2033

|

USD 2.21 billion

|

|

Growth rate

|

CAGR of 6.2% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Type, category, end use, production

|

|

Key companies profiled

|

ASAHI GROUP HOLDINGS, LTD.; Kirin Holdings Company, Limited; SAPPORO BREWERIES LTD; SUNTORY HOLDINGS LIMITED

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Japan Draught Beer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan draught beer market report based on type, category, end use, and production.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Category Outlook (Revenue, USD Million, 2021 - 2033)

-

Super Premium

-

Premium

-

Regular

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Production Outlook (Revenue, USD Million, 2021 - 2033)

-

Macro Breweries

-

Microbreweries