Japan Kombucha Market Summary

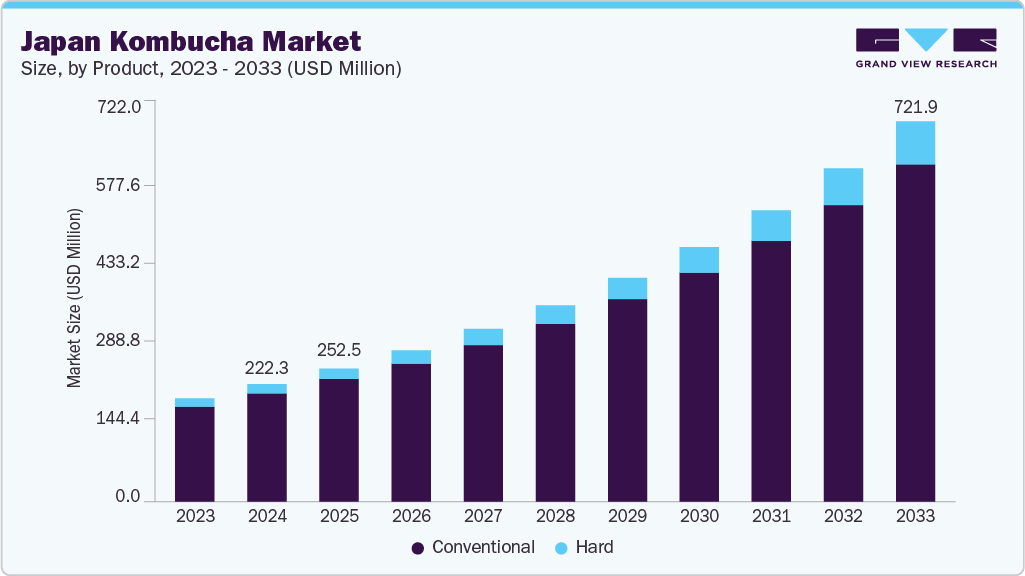

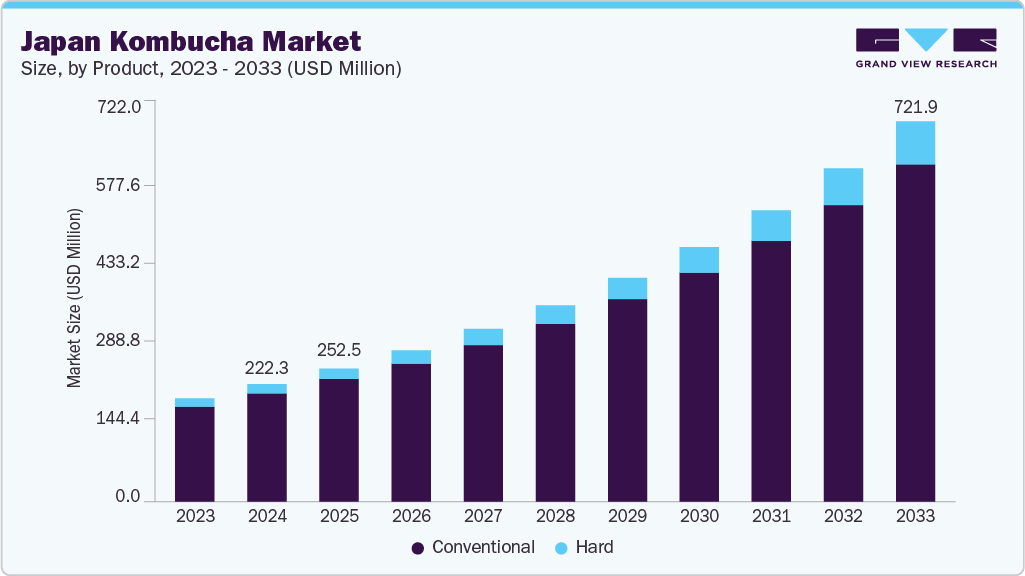

The Japan kombucha market size was estimated at USD 222.3 million in 2024 and is projected to reach USD 721.9 million by 2033, growing at a CAGR of 14.0% from 2025 to 2033. The market is driven by health conscious consumer shifts, innovative product lines, and benefits of fermented foods.

Key Market Trends & Insights

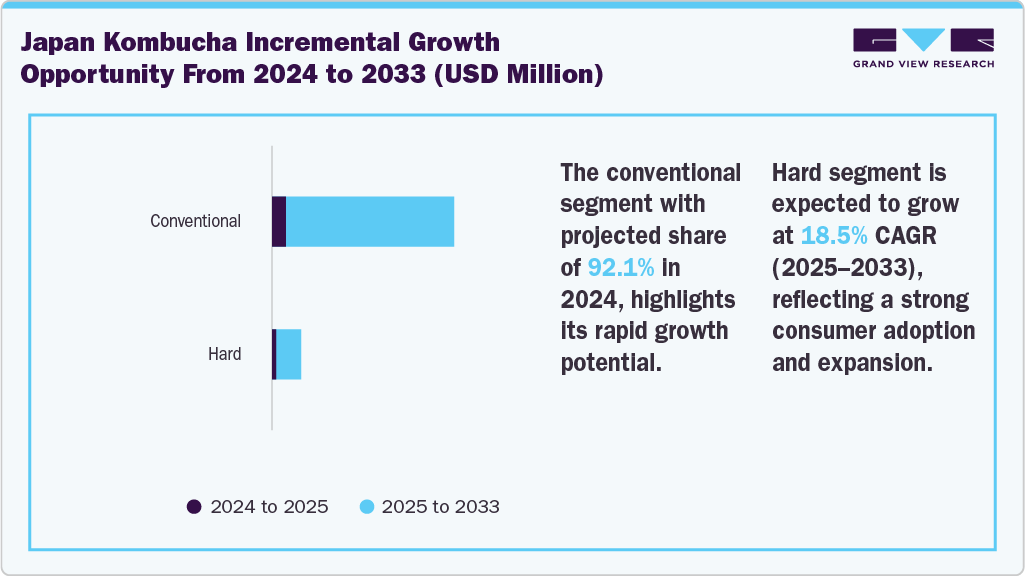

- By product, the conventional segment held the highest market share of 92.1% in 2024.

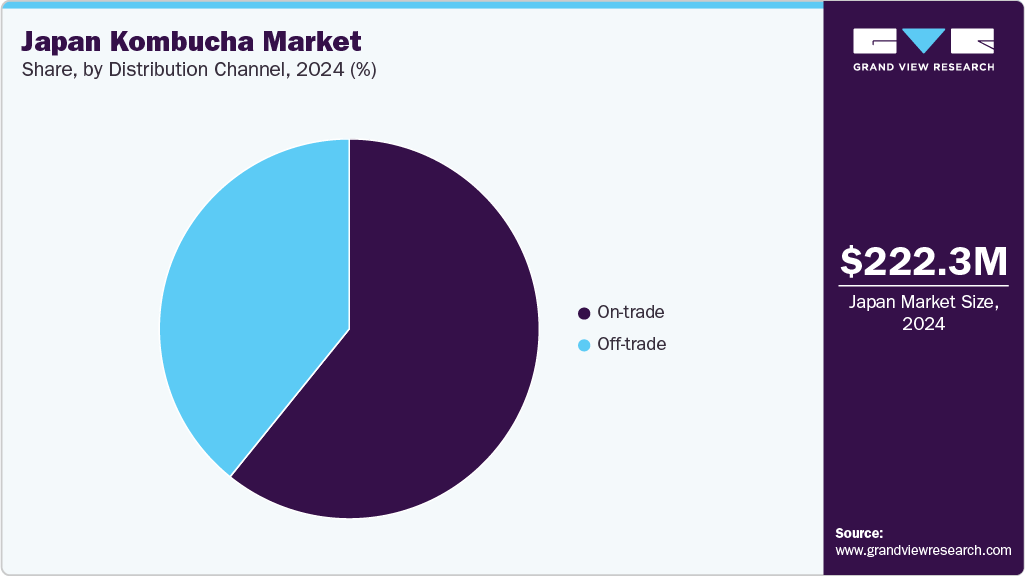

- By distribution channel, the on-trade segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 222.3 Million

- 2033 Projected Market Size: USD 721.9 Million

- CAGR (2025-2033): 14.0%

The growth of the kombucha market is predominantly driven by increasing health awareness among consumers, coupled with a rising demand for functional beverages and a shift toward fermented foods that support gut and immune health. This evolving consumer preference aligns with traditional dietary principles while integrating modern health consciousness, broadening kombucha’s appeal across diverse demographic segments.

Strategic marketing initiatives and expansion of distribution channels, including retail partnerships and e-commerce platforms, have significantly improved product accessibility. These efforts have been instrumental in accelerating market growth by reaching a wider consumer base and enhancing product availability across multiple touchpoints.

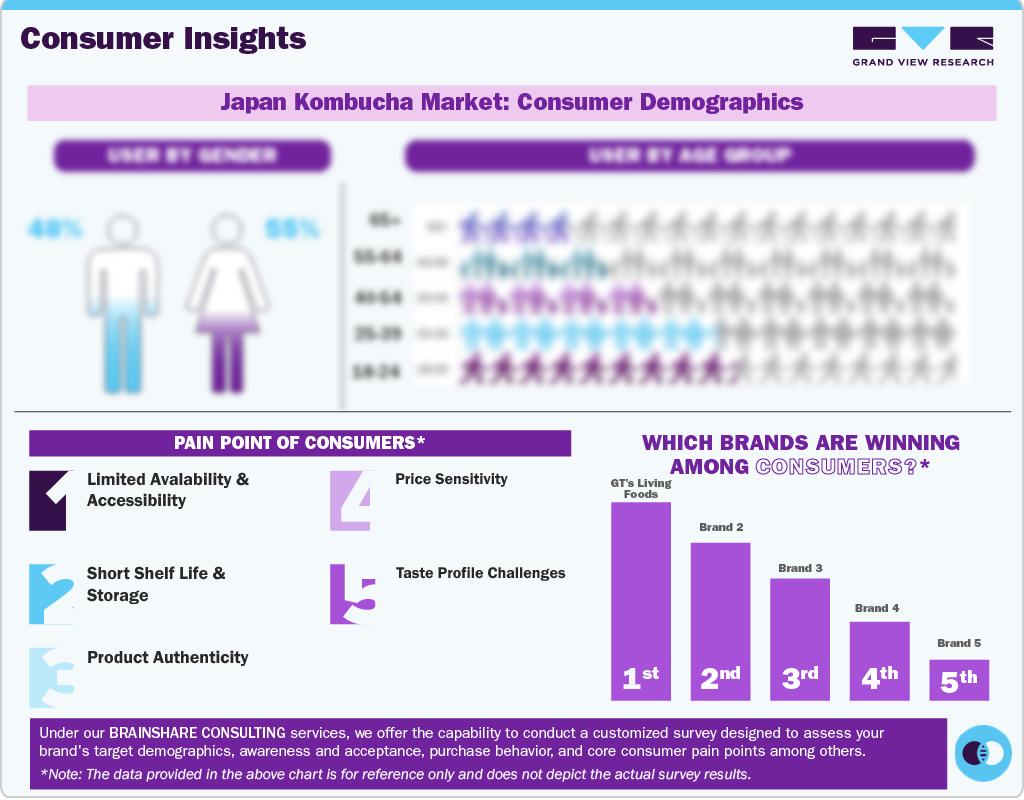

Consumer Insights

The Japan kombucha market has witnessed a significant transformation in recent years, driven primarily by a growing consumer focus on health and functional beverages. Consumers are becoming increasingly health-conscious, prompting a shift toward natural, fermented drinks perceived to offer digestive and immunity-related benefits. With its probiotic content and association with gut health, kombucha aligns well with traditional Japanese dietary values that emphasize balance and holistic well-being.

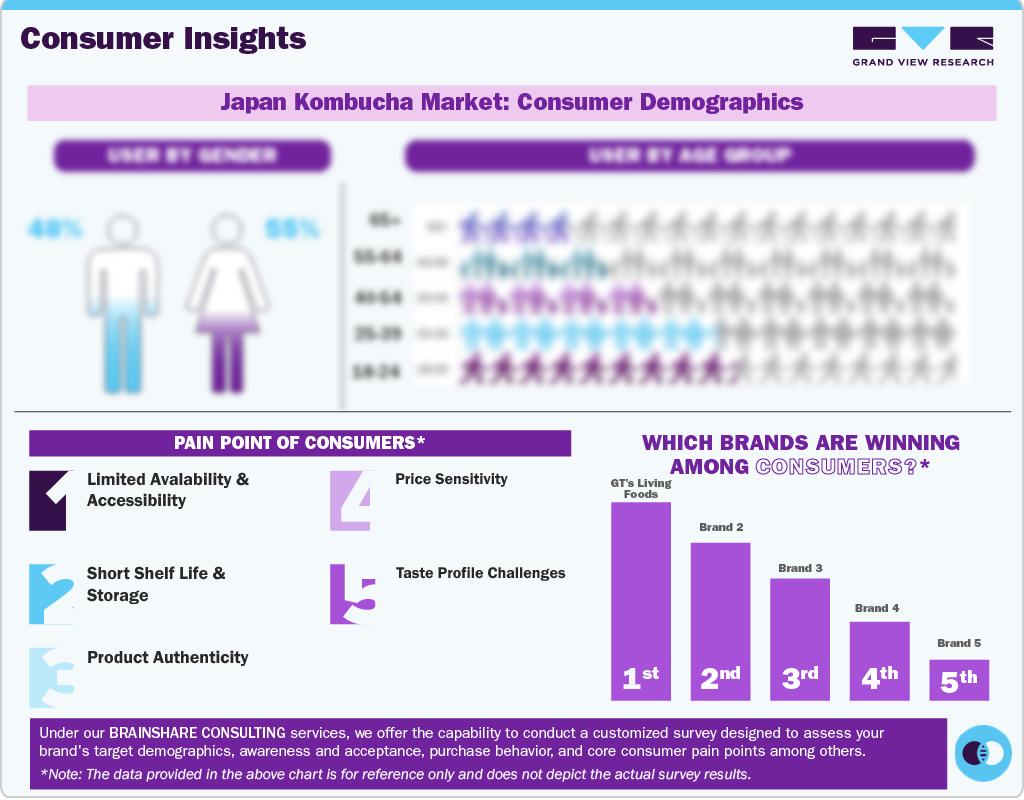

Consumer Demographics

Digital engagement is shaping kombucha consumption trends in Japan. Consumers are frequently exposed to information on the drink through social media influencers, wellness blogs, and strategic product placements within health-conscious lifestyle content. This digital exposure is particularly impactful among millennials and Gen Z, key drivers translating online discovery into retail purchases. These younger demographics are drawn to kombucha brands that align with sustainable values and modern aesthetics, reflecting a broader shift toward products embodying health and ethical considerations.

Product Insights

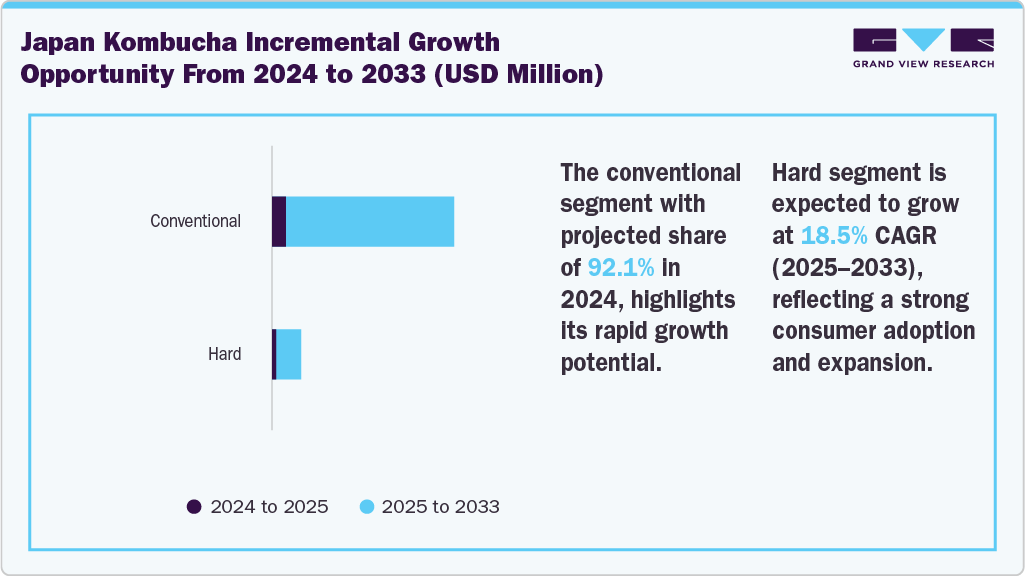

The conventional segment dominated the market with a revenue share of 92.1% in 2024. The segment is driven by consumer’s increasing health awareness and the introduction of innovative product offerings. In February 2024, ON-TAMA Co., Ltd. announced the introduction of TEAZEN's renowned Korean Kombucha brand in Japan. The launch highlighted TEAZEN's powdered Kombucha product line, which features lemon, raspberry, and Vin Chaud flavors. Concurrently, traditionally brewed kombucha, typically available in ready-to-drink bottled formats, continues to be favored by a growing demographic of health-conscious consumers who actively seek natural, probiotic-rich beverages.

The hard kombucha segment is expected to register the fastest CAGR of 18.5 % from 2025 and 2033. The market is primarily fueled by a rising consumer demand for low-sugar and low-calorie alcoholic alternatives. This trend is further amplified by consumers' increasing preference for products offering probiotic benefits and natural ingredients, which directly align with broader wellness trends. In addition, younger demographics are key drivers of this shift, as they actively seek beverage options that combine wellness advantages and social appeal.

Distribution Channel Insights

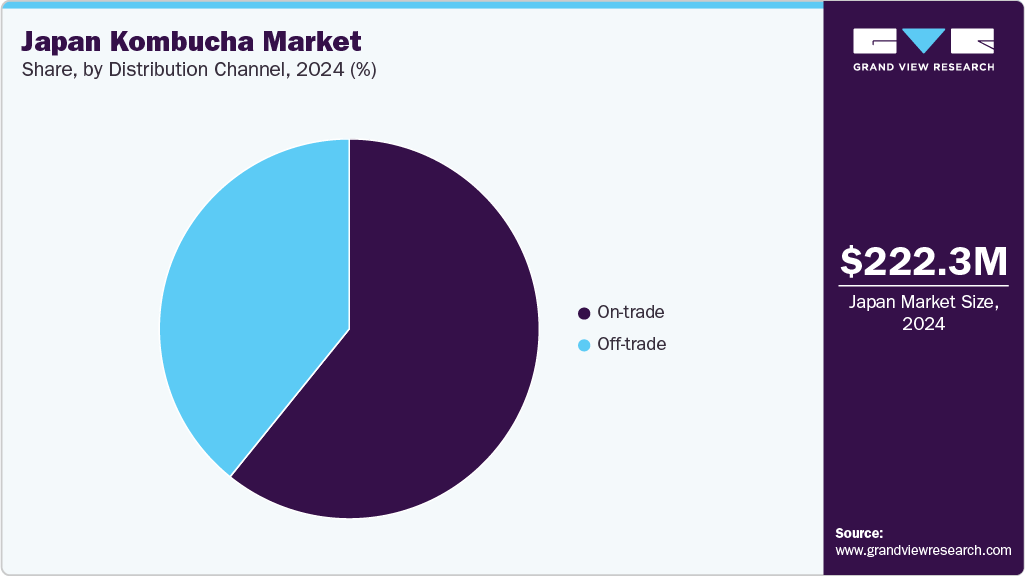

The on-trade segment accounted for a significant revenue share of the Japan kombucha market, driven by rising demand for functional beverages and growing preference for premium, experience-based consumption. Freshly brewed kombucha served in cafes, bars, and restaurants appeals to urban consumers seeking healthier, lifestyle-oriented alternatives.

The off-trade segment is anticipated to experience the fastest CAGR from 2025 to 2033.The market is driven by increasing health consciousness, greater product accessibility, and evolving consumer preferences. The shift toward at-home consumption, accelerated by the COVID-19 pandemic, has driven demand through supermarkets and convenience stores. Enhanced availability of ready-to-drink formats with innovative flavors and functional health claims strengthened the product’s retail appeal.

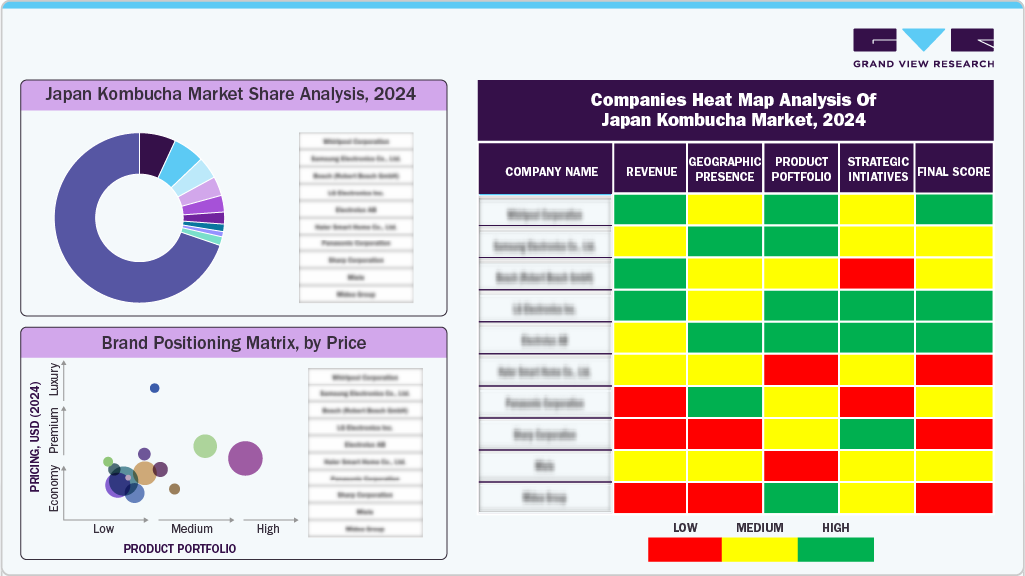

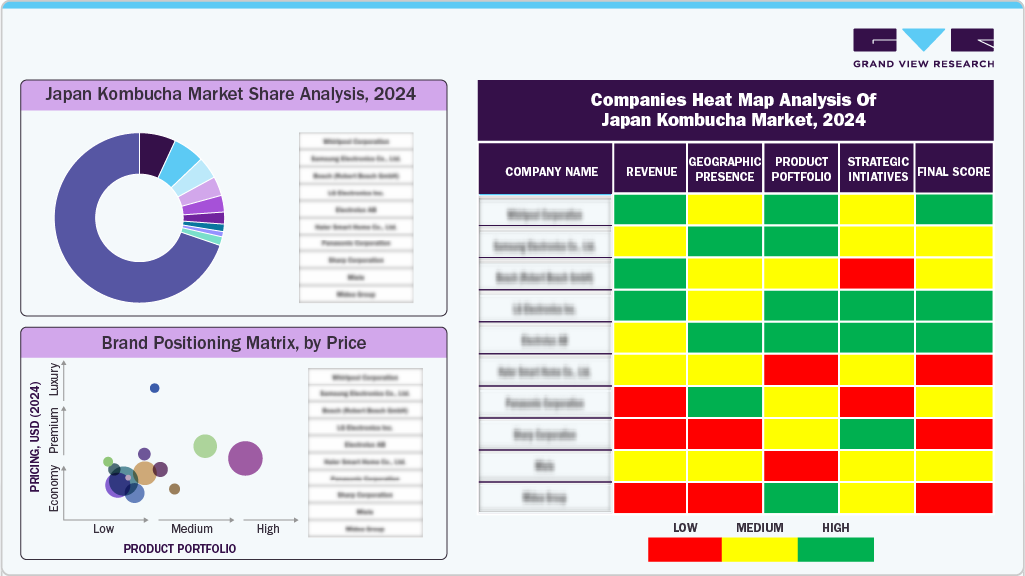

Key Japan Kombucha Company Insights

Some key players in the Japan kombucha market include OKS Company, GT's Living Foods and others.

- OKS Company (Ship Kombucha) produces high-quality, natural kombucha using carefully selected organic ingredients. Committed to reducing waste, the company sells wholesale in reusable barrels and encourages recycling. Focusing on innovation and global connectivity, it aims to create a positive, healthy environment through its unique, locally crafted beverages.

Key Japan Kombucha Companies:

- OKS Company [AF4] (Ship Kombucha)

- GT's Living Foods

- Kombucha Brewers Tokyo

Recent Developments

-

In May 2025, Tizen Co., Ltd. announced its participation in K-Con Japan 2025 to promote “K-Kombucha.” The company showcased various fermentation products and expanded its distribution to Costco and Japanese drug and convenience stores.

-

In March 2024, OKS Company (Ship Kombucha) launched a limited-time flavor, CACAO CHAI. This innovative product was created through collaboration with Dandelion Chocolate.

Japan Kombucha Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 252.5 million

|

|

Revenue forecast in 2033

|

USD 721.9 million

|

|

Growth rate

|

CAGR of 14.0% from 2025 to 2033

|

|

Actuals

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

OKS Company (Ship Kombucha), GT's Living Foods, and Kombucha Brewers Tokyo

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Japan Kombucha Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Japan kombucha market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)