- Home

- »

- Biotechnology

- »

-

Japan Next Generation Sequencing Market Size Report, 2033GVR Report cover

![Japan Next Generation Sequencing Market Size, Share & Trends Report]()

Japan Next Generation Sequencing Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Whole Genome Sequencing, Whole Exome Sequencing, Targeted Sequencing & Resequencing), By Product, By Application, By Workflow, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-156-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

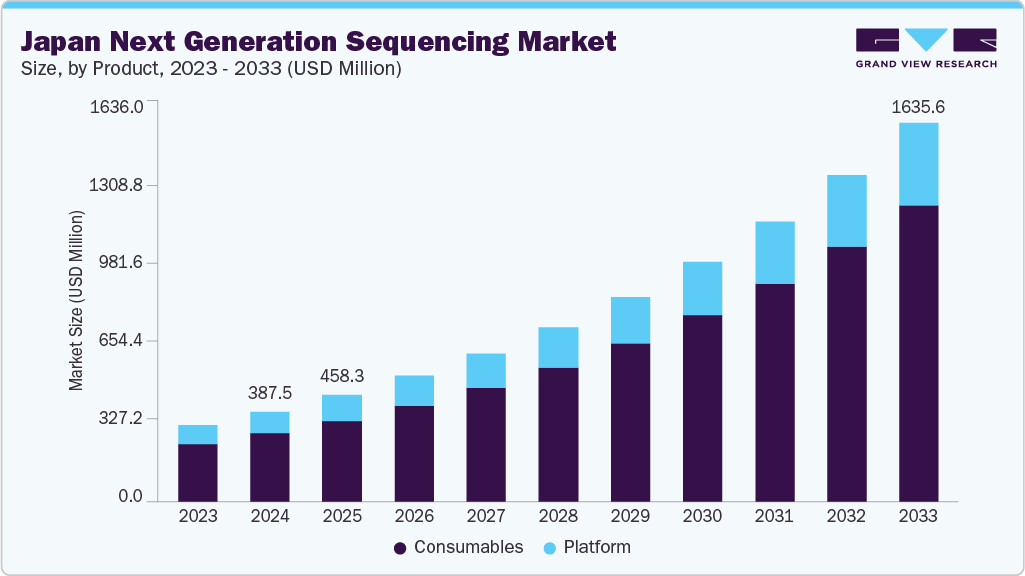

The Japan next-generation sequencing market size was valued at USD 387.5 million in 2024 and is projected to grow at a CAGR of 17.24% from 2024 to 2033. Key drivers of this growth include the declining costs associated with genetic sequencing and significant advancements in cloud computing and data integration technologies. Moreover, rising investments in cancer treatment and the broad application of next-generation sequencing (NGS) in cancer diagnosis and therapy are expected to propel market expansion further.

Rising Cancer Burden & Precision Medicine Initiatives

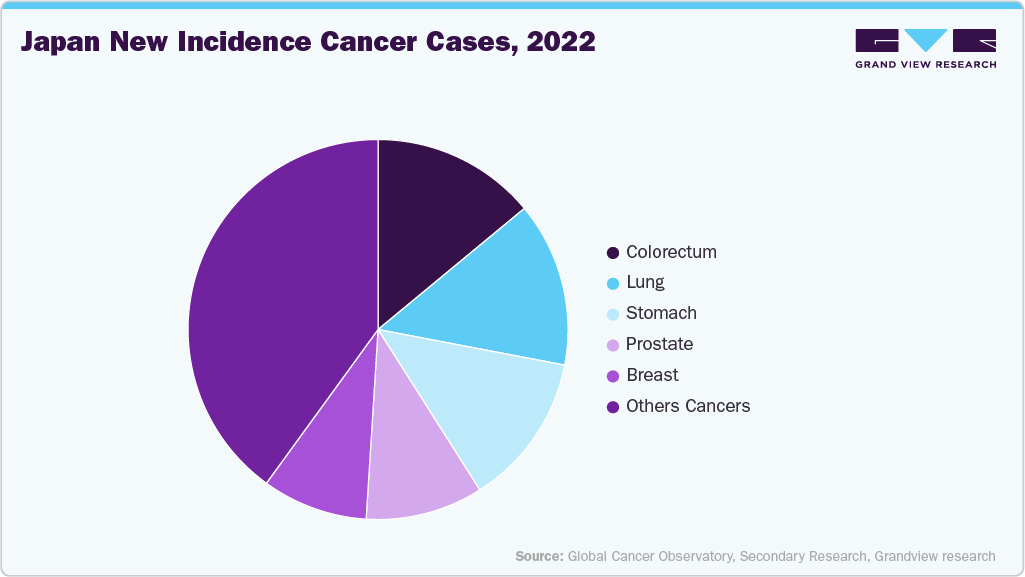

Japan faces some of the highest cancer rates and death rates worldwide, which continue to put a lot of pressure on its healthcare system. This increasing burden creates a strong need for advanced diagnostic tools that allow early detection, accurate characterizations of tumors, and improved treatment choices. Next-generation sequencing (NGS) has become a key technology in this effort, as it enables detailed genomic profiling of tumors, identification of actionable mutations, and monitoring of disease progression through liquid biopsies. The clinical usefulness of NGS in oncology is gaining recognition across Japan’s hospitals and cancer research centers, leading to broader adoption in routine cancer diagnostics.

Government-backed precision medicine initiatives further accelerate this trend by promoting the integration of NGS into mainstream clinical practice. National programs like the Cancer Genomic Medicine Program, established by Japan’s Ministry of Health, Labour and Welfare, have appointed specialized cancer genome medical centers across the country, ensuring equitable access to advanced sequencing-based diagnostics. Additionally, companion diagnostics for targeted therapies are increasingly gaining approval from Japan’s regulatory authorities, which boosts the clinical demand for NGS technologies. Since oncology remains the largest application area for NGS in Japan, the combined effect of rising cancer rates and supportive government precision medicine efforts is a strong driver of market growth.

Supportive Government Policies & Genomic Programs

The Japanese government has played a key role in increasing the use of next-generation sequencing (NGS) technologies by creating a supportive research and regulatory environment. National initiatives like the Japan Genomic Medicine Program and the Cancer Genomic Medicine Promotion Plan have allocated significant funding for large-scale genomic research, including population-based genome sequencing projects and clinical cancer genome studies. These programs aim to boost academic research and develop strong databases that form the basis for translational medicine, biomarker discovery, and new therapeutic development. By investing in infrastructure such as cancer genome sequencing centers and national biobanks, Japan enables researchers to access high-quality genomic data that speed up discoveries in disease mechanisms and personalized treatments.

The country’s regulatory framework has progressed to support faster and smoother integration of NGS into research and clinical workflows. The Pharmaceuticals and Medical Devices Agency (PMDA) has established clear approval pathways for NGS-based diagnostic panels and companion diagnostics, lowering barriers for academic groups and industry researchers to develop new assays and platforms. These supportive policies foster collaborations among universities, hospitals, and biotechnology companies, creating a thriving research ecosystem. The alignment of government funding, regulatory support, and institutional participation makes Japan one of the most research-intensive markets for NGS worldwide, establishing it as a hub for genomics-driven innovation in Asia.

Market Concentration & Characteristics

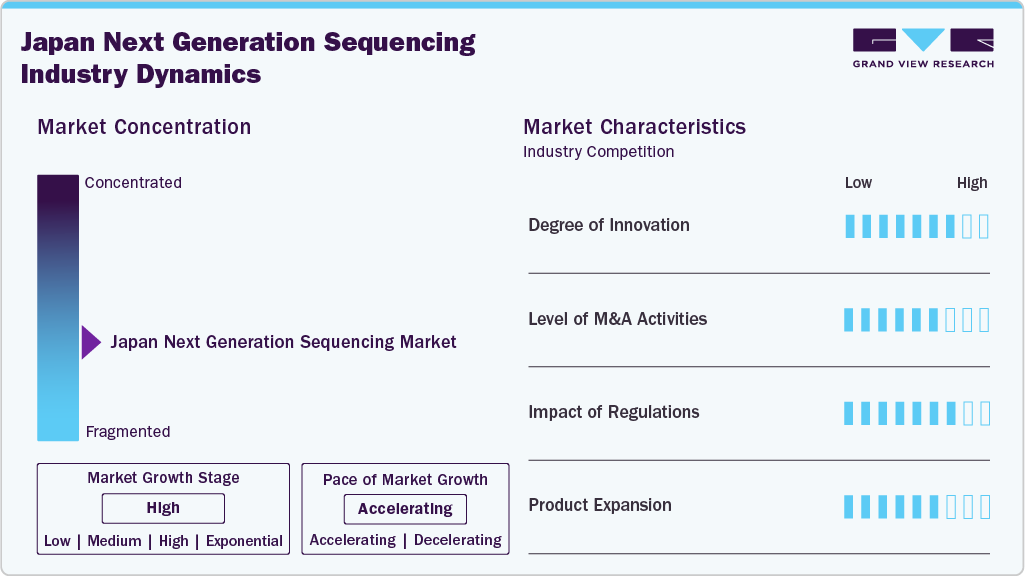

Japan's next-generation sequencing market is characterized by high innovation, with new technologies and instruments being developed and introduced regularly. For instance, in September 2023, Integra Biosciences launched a digital microfluidics platform in the United States, automating NGS sample preparation to enhance efficiency, reduce hands-on time, and improve lab workflow reproducibility.

Several key market players, such as Illumina Inc. and BGI, are actively involved in the Japanese market mergers and acquisitions (M&A). These strategic activities enable companies to expand their product and service portfolios, strengthen their market presence, and enhance technological capabilities. In parallel, the Japanese government supports numerous initiatives to evaluate the safety and efficacy of noninvasive prenatal testing (NIPT). As a result, healthcare providers across Japan have increasingly adopted integrated next-generation sequencing (NGS) technologies over the past few years, particularly in prenatal diagnostics.

Regulations in Japan play a crucial role in shaping the NGS market by ensuring safety, efficacy, and quality through strict oversight by the PMDA. While this builds trust, it also slows approvals and creates barriers for domestic innovation. Programs like Sakigake and Advanced Medical Care aim to streamline access for advanced diagnostics. In prenatal testing, certified facilities are required for NIPT to ensure ethical and clinical standards, though access remains uneven. Reimbursement is limited to approved tests and institutions, impacting broader adoption. Overall, regulations both support and constrain the market’s growth.

Leading players such as Illumina and BGI are actively broadening their portfolios through mergers and acquisitions and developing new sequencing platforms, panels, and informatics solutions. This expansion allows companies to address various clinical applications, including oncology, rare diseases, and noninvasive prenatal testing (NIPT). Moreover, partnerships with local healthcare providers and research institutions are helping tailor offerings to Japan’s specific regulatory and clinical requirements, further accelerating market penetration and user adoption.

Product Insights

The consumables segment held the largest revenue share in 2024 and is also expected to grow the fastest during the forecast period. This dominance is due to increased investments in developing advanced genomics techniques for prevention and detection, along with declining sequencing costs, which are fueling the growth of the NGS consumables market. Additionally, companies are launching consumables such as sample preparation kits and target enrichment panels.

The platforms segment is expected to witness significant market growth during the forecast period. NGS platforms enable the use of a wide range of techniques, allowing scientists to explore questions related to the transcriptome, genome, or epigenome. These applications make the platform a preferred option in agriculture, clinical diagnosis, research, and sustainable development.

Workflow Insights

The sequencing segment accounted for the largest revenue share, 63.75%, in 2024. This can be attributed to the availability of various platforms, such as iSeq, MiniSeq, MiSeq, NextSeq, HiSeq X, and NovaSeq series from Illumina and Ion Proton, PGM, and IonS5 system from Thermo Fisher Scientific for next-generation sequencing. Moreover, several players are providing sequencing services and platforms across the country.

The pre-sequencing segment of the Japan next-generation sequencing industry is expected to see strong growth during the forecast period. This increase is driven by the growing need for efficient sample preparation kits, library construction tools, and quality control solutions, which are vital for achieving accurate sequencing results. The rising use of NGS in clinical diagnostics, oncology research, and precision medicine is also boosting the demand for dependable pre-sequencing workflows in Japan.

Application Insights

The oncology segment accounted for the largest revenue share of 32.74% in 2024. This segment dominance can be due to the wide use of NGS in oncology, where gene mutations are sequenced to develop new cancer diagnostic & treatment methods. The NGS in oncology has also been aiding a better understanding of different tumor growth cell signaling pathways, which provides oncologists with insights for better diagnosis and management of various forms of cancer. With the reduction in the cost of whole genome sequencing, the application of NGS in oncology is anticipated to surge significantly in the forecasted period. For instance, in February 2025, Asia Pacific advanced precision oncology initiatives, leveraging genomics and NGS technologies to improve cancer treatment, reduce healthcare costs, and develop region-specific diagnostic solutions tailored to diverse populations.

The consumer genomics segment is expected to grow fastest during the forecast period, driven by increasing awareness of personal health, paternity testing, and genealogy. Several key market players are continually expanding their product offerings by launching new products, which will further accelerate segment growth. For example, in May 2022, PerkinElmer, Inc. expanded its genome testing services by adding ultrarapid whole genome sequencing to its portfolio. This will further aid in making informed clinical decisions and improve outcomes for patients in pediatric and neonatal intensive care units.

Technology Insights

The targeted sequencing and resequencing segment accounted for the largest revenue share, 48.38%, in 2024 within the Japan next-generation sequencing industry. This dominance is attributed to the widespread use of targeted approaches in oncology, rare disease diagnosis, and genetic testing, where cost efficiency and high accuracy are critical. Growing demand for gene panels, coupled with advancements in hybridization-based and amplicon-based enrichment methods, continues to strengthen the segment’s position in the Japanese market.

The whole genome sequencing (WGS) segment is anticipated to record the fastest growth in the Japan next-generation sequencing (NGS) market over the forecast period. The increasing use of WGS in identifying rare genetic variants, uncovering complex disease mechanisms, and supporting large-scale population genomics initiatives is driving this expansion. Moreover, declining sequencing costs, improvements in bioinformatics tools, and government-backed genomic research programs are expected to accelerate the adoption of WGS in both research and clinical applications across Japan.

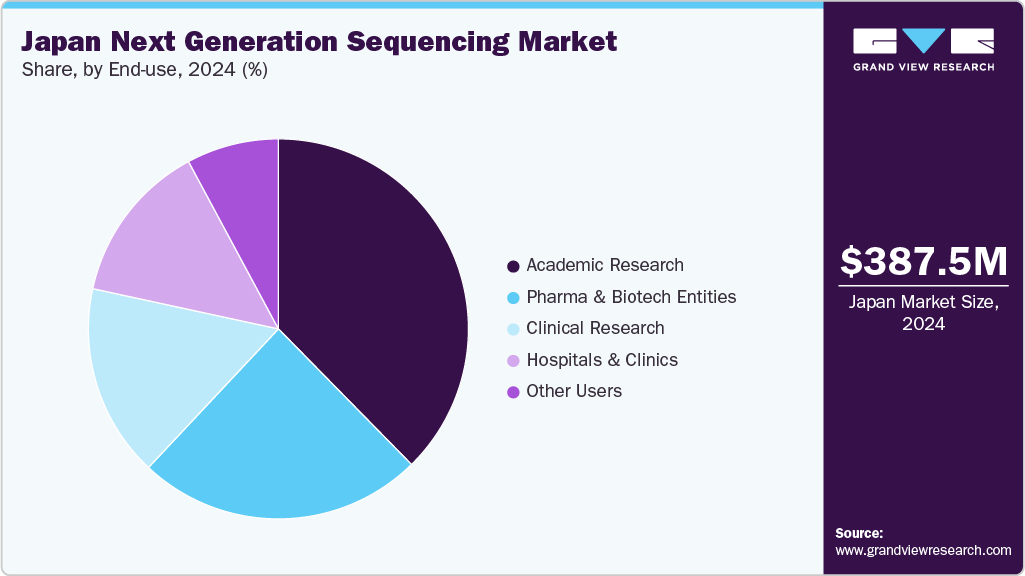

End Use Insights

The academic research segment accounted for the largest revenue share, 37.64%, in 2024. The segment's growth can be attributed to the availability of various institutes offering on-site bioinformatics courses and training programs that enhance knowledge about various sequencing data analysis solutions, which are expected to drive the segment's growth.

The clinical research segment is estimated to register the fastest CAGR over the forecast period. Implementation of NGS for studying tumor heterogeneity, the discovery of new cancer-related genes, and the identification of alterations related to tumorigenesis are expected to result in significant growth of this segment.

Key Japan Next Generation Sequencing Company Insights

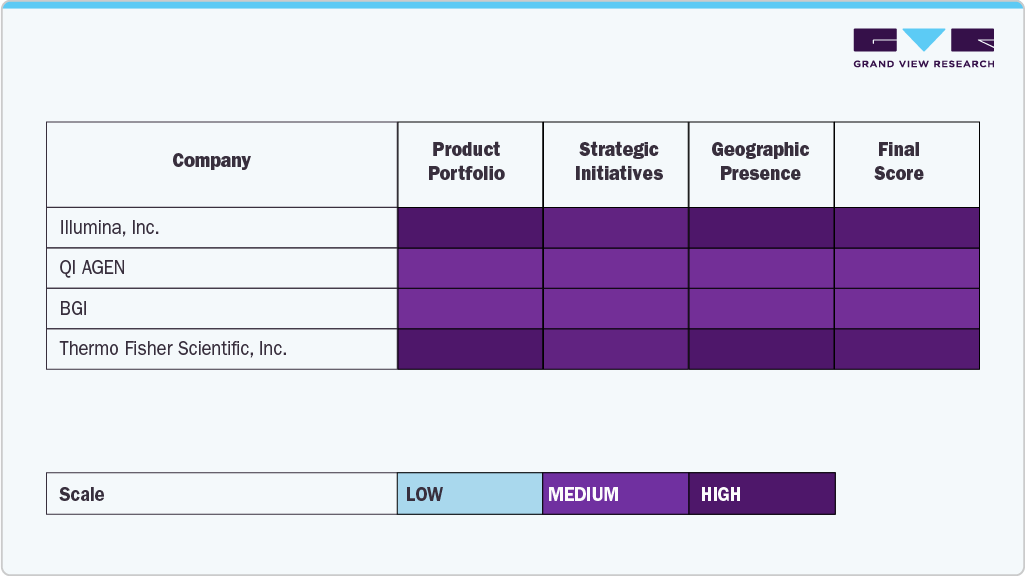

The Japan next-generation sequencing (NGS) industry is significantly shaped by global and regional players recognized for technological innovation, diverse product portfolios, and established presence in biotechnology and healthcare. Key companies such as Illumina, Inc., QIAGEN, Thermo Fisher Scientific, Inc., BGI, Pacific Biosciences, Bio-Rad Laboratories, Oxford Nanopore Technologies, Inc., Myriad Genetics, Inc., Agilent Technologies, Inc., and Eurofins Scientific have cemented their positions as leading providers of sequencing platforms, consumables, and analytical tools. Their technologies are widely adopted in applications such as clinical diagnostics, oncology, infectious disease research, precision medicine, and agricultural genomics, owing to their accuracy, scalability, and compliance with Japan’s regulatory and quality standards.

These companies continuously invest in R&D and product development, focusing on enhancing sequencing throughput, reducing costs, and improving data interpretation through advanced bioinformatics solutions. In particular, the integration of NGS into personalized medicine and clinical diagnostics is expanding the role of these players in addressing genetic disorders, cancer profiling, and rare disease research in Japan. Furthermore, Japan’s strong emphasis on regulatory compliance, ethical frameworks, and high-quality clinical outcomes supports the adoption of its solutions across both research and healthcare institutions.

Japan's research institutions and academic centers also work closely with these global leaders, fostering innovation and speeding up clinical translation. Strategic partnerships, public-private collaborations, and joint ventures are becoming more common, allowing these companies to improve their sequencing capabilities while gaining access to international genomic databases and expertise. Furthermore, the increasing demand for population genomics programs, biopharmaceutical research, and agricultural genomics promotes the development of customized sequencing solutions. As NGS adoption grows rapidly, these companies stay at the forefront by ensuring innovation, scalability, and reliability within Japan's quickly expanding sequencing ecosystem.

Key Japan Next Generation Sequencing Companies:

- Illumina, Inc

- QIAGEN

- Thermo Fisher Scientific, Inc

- BGI

- Pacific Biosciences

- Bio Rad Laboratories

- Oxford Nanopore Technologies, Inc

- Myriad Genetics. Inc.

- Agilent Technologies Inc

- Eurofins Scientific

Recent Developments

-

In May 2025, Illumina received MHLW approval in Japan for its TruSight Oncology Comprehensive genomic profiling test, enabling broader access to precision oncology through streamlined analysis of over 500 tumor genes.

-

In September 2023, Basepair partnered with Astride in Japan to distribute its bioinformatics platform, expanding NGS analysis access with user-friendly, low-code tools and strengthening genomics research capabilities across the region.

Japan NGS Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 458.3 million

Revenue forecast in 2033

USD 1.64 billion

Growth rate

CAGR of 17.24% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, workflow, end use, product, application

Key companies profiled

Illumina, Inc.; QIAGEN; Thermo Fisher Scientific, Inc; BGI; Pacific Biosciences; Bio Rad Laboratories; Oxford Nanopore Technologies, Inc; Myriad Genetics. Inc.; Agilent Technologies, Inc; Eurofins Scientific

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Japan Next Generation Sequencing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the Japan next generation sequencing market on the basis of technology, product, end use, workflow, and application:

-

Technology Outlook (Revenue in USD Million, 2021 - 2033)

-

Whole Genome Sequencing

-

Whole Exome Sequencing

-

Targeted Sequencing & Resequencing

-

DNA-based

-

RNA-based

-

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumables

-

Sample Preparation

-

Target Enrichment

-

-

Platforms

-

Sequencing

-

Data Analysis

-

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Oncology

-

Diagnostics and Screening

-

Oncology Screening

-

Sporadic Cancer

-

Inherited Cancer

-

-

Companion Diagnostics

-

Other Diagnostics

-

-

Research Studies

-

-

Clinical Investigation

-

Infectious Diseases

-

Inherited Diseases

-

Idiopathic Diseases

-

Non-Communicable/Other Diseases

-

-

Reproductive Health

-

NIPT

-

Aneuploidy

-

Microdeletions

-

-

PGT

-

Newborn Genetic Screening

-

Single Gene Analysis

-

-

HLA Typing/Immune System Monitoring

-

Metagenomics, Epidemiology & Drug Development

-

Agrigenomics & Forensics

-

Consumer Genomics

-

-

Workflow Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Sequencing

-

Nucleic Acid Extraction

-

Library Preparation

-

-

Sequencing

-

NGS Data Analysis

-

NGS Primary Data Analysis

-

NGS Secondary Data Analysis

-

NGS Tertiary Data Analysis

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharma & Biotech Entities

-

Other users

-

Frequently Asked Questions About This Report

b. The Japan next generation sequencing market size was estimated at USD 387.5 million in 2024 and is expected to reach USD 458.3 million in 2025.

b. The Japan next generation sequencing market is expected to grow at a compound annual growth rate of 17.24% from 2025 to 2033 to reach USD 1.64 billion by 2033.

b. Academic Research dominated the Japan next generation sequencing market with a share of 37.64% in 2024. This is attributable to rising number of clinical trials and research being done by academic research institutes pertaining to NGS.

b. Some key players operating in the Japan next generation sequencing market include Illumina, Inc, QIAGEN, Thermo Fisher Scientific, Inc, BGI, Pacific Biosciences, Bio Rad Laboratories, Oxford Nanopore Technologies, Inc, Myriad Genetics. Inc., Agilent Technologies, Inc, Eurofins Scientific

b. Key factors that are driving the market growth include exponentially decreasing costs for genetic sequencing along with the development of companion diagnostics and personalized medicine

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.