- Home

- »

- Medical Devices

- »

-

Joint Replacement Market Size & Share Report, 2021-2028GVR Report cover

![Joint Replacement Market Size, Share & Trends Report]()

Joint Replacement Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Knees, Hips, Extremities), By Fixation Type, By End-use (Hospitals, Orthopedic Clinics), By Procedure, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-293-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Joint Replacement Market Summary

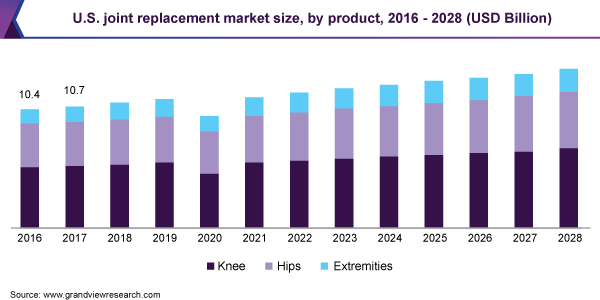

The global joint replacement market size was valued at USD 17.1 billion in 2020 and is expected to reach USD 25.4 billion by 2028, expanding at a compound annual growth rate (CAGR) of 3.4% from 2021 to 2028. The increase in the prevalence of orthopedic disorders, osteoporosis, Osteoarthritis (OA), and lower extremity conditions are some factors driving the market for joint replacement.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of over 62.9% in 2020.

- By product, the knee segment dominated the market and held the largest revenue share of over 46.0% in 2020.

- By fixation type, the cemented segment dominated the market and held the largest revenue share of over 49.0% in 2020.

- By procedure, the total replacement segment dominated the market and held the largest revenue share of over 64.0% in 2020.

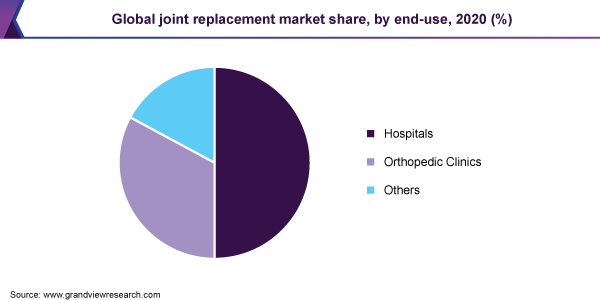

- By end-use, the hospitals segment dominated the market and held the largest revenue share of over 50.0% in 2020

Market Size & Forecast

- 2020 Market Size: USD 17.1 Billion

- 2028 Projected Market Size: USD 25.4 Billion

- CAGR (2021-2028): 3.4%

- North America: Largest market in 2020

- Asia Pacific: Fastest growing market

According to Arthritis Foundation, it was estimated that over 78 million people in the U.S. who are 18 years of age or above are anticipated to be diagnosed with arthritis by 2040. Rheumatoid arthritis is also another form, which affects the joints of the body and leads to muscle pain. Thus, increasing incidence of these chronic diseases leads to high demand for surgical interventions, which thereby impels the growth of the market for joint replacement.

With the first wave of COVID-19, many countries made the required decision to abandon all non-emergency surgical procedures to free up caregivers for patients with COVID-19. As stated by a new study circulated in the Annals of Surgery, the charge of halting major elective surgery all through the COVID-19 is projected to be USD 22.3 billion in the U.S. Widespread surgical restrictions and cancellation resulted in monumental revenue losses for the orthopedic companies. However, during the 3rd quarter, the market for joint replacement started recovering and began working rapidly through a significant backlog of postponed surgeries. Therefore, in the coming years, it is estimated that the market for joint replacement will recover rapidly after the resumption of surgical procedures at full force.

The industry players also reported a decline in sales in 2020. For instance, Stryker’s net revenue decreased by 9.1% from last year and Zimmer Biomet’s revenue decreased by around 11.8% in 2020 from 2019. The pandemic took a significant toll on knee replacement sales due to the procedure’s less urgent nature compared to hip replacement. The extremities segment maintained steady growth due to its more rapid underlying growth.

Joint Replacement Market: impacted by the suspension, delay of elective surgeries due to COVID 19

Pandemic Impact

Post COVID Outlook

The earlier projections depicting 3.60% YoY growth was countered by the pandemic resulting in the difference of USD ~3.1 billion revenue in the earlier and recent estimations

Gradual market recovery is anticipated in 2021 with YOY growth of 17.5% from 2020 and a CAGR of over 4.5% (2022- 2028) owing to, resumption of elective surgeries, backlog, and increased target population

Pandemic-related losses for joint replacement sales moderated in the APAC region compared to other international markets. While the U.S. market also took its share of losses but a robust third-quarter recovery helped offset steeper full-year declines.

More sturdy orthopedic procedure volumes are expected in the 2nd half of 2021 and more robust stabilized revenues for device companies in 2022.

By 2021, many companies reported recovery in sales with positive projections for the future. For example, Stryker's orthopedics segment revenue reported double-digit growth of 21.4% in 2021 Q1 as compared to 2020 Q1.

Moreover, technological advancements in the field of knees and hips and especially extremities are further boosting the revenue. For instance, in September 2020 Stryker Corporation released the smart robotic system, Mako Total Hip 4.0. The system allows surgeons and physicians to plan the patient’s implant position while taking into consideration, the changes in pelvic tilt in the patient’s standing, sitting, and supine poses. In September 2020, Smith+Nephew acquired the extremity orthopedic business of Integra Lifesciences to increase its penetration in this segment.

Product Insights

The knee segment dominated the market for joint replacement and held the largest revenue share of over 46.0% in 2020. The segment is majorly driven by the growing geriatric populace giving an upsurge to old-age disorders such as osteoporosis, arthritis. Additionally, increasing technological advancements such as minimally invasive surgeries accompanied by the existence of improved implant materials are likely to boost the growth of the segment.

The extremities segment is expected to grow fast over the forecast period. The field of extremity surgery and implants has been observing several technological innovations, for example, mobile-bearing ankles, reverse shoulder implants, and the advent of new and safer implant materials. Moreover, new product launches by industry players such as Exactech, Lima and Middata for shoulder replacement are further bolstering segment growth.

Fixation Type Insights

The cemented segment dominated the market for joint replacement and held the largest revenue share of over 49.0% in 2020. Cemented fixation was found to be the best fit in older patients while cementless fixation is the best fit for younger patients. Cemented fixation has good survivorship and low revision rates as compared to other types, thus increasing the demand.

Moreover, the cost-effectivity of cemented THA is propelling its growth. The vendors offer various innovative cemented implant designs to provide more comfort to the patient. For instance, Zimmer’s product The Legacy LPS-Flex Fixed Bearing total knee offers an increased flexion and posterior stabilization to the patient.

Procedure Insights

The total replacement segment dominated the market for joint replacement and held the largest revenue share of over 64.0% in 2020. According to the Arthritis Foundation report, the number of total hip replacements in the U.S. is projected to reach 635,000 per year by 2020. Moreover, total knee replacement is projected to reach 1.28 million procedures per year. In November 2019, THINK Surgical, Inc. received U.S. FDA clearance for TSolution One Total Knee Application for practice in total knee arthroplasty in the U.S.

The others segment includes revision and resurfacing replacement. Total replacement surgery is most effective but over time if it fails to owe to numerous reasons, then revision replacement is done. Revision replacements have the similar goal to relieve discomfort and recover the function of the organ. According to the Arthritis Foundation report, revision total knees and revision total hips are expected to reach 120,000 and 72,000 procedures per year respectively by 2030.

End-use Insights

The hospitals segment dominated the market for joint replacement and held the largest revenue share of over 50.0% in 2020 owing to the presence of advanced treatment options and the increased number of patient footfall under these facilities. Hospitals are easily accessible as they are present in most locations, and hence, most of the patients prefer hospitals over other settings. Moreover, the availability of favorable reimbursement policies through Medicare and Blue Cross Blue Shield is further fostering segment growth.

The orthopedic clinics segment is expected to show the fastest growth over the forecast period owing to an increase in the number of sports injuries, trauma accidents, and other chronic diseases. Factors such as shorter stay duration, reduced wait times, and personalized care have increased the demand for these clinics. Furthermore, orthopedic clinics can provide cost-effective services and procedures, owing to their low-cost structure as compared to hospitals. Such factors are expected to propel this segment over the coming years. Since the number of patients preferring orthopedic clinicians has increased, there has been a significant rise in the number of such clinics.

Regional Insights

North America dominated the market for joint replacement and accounted for the largest revenue share of over 62.9% in 2020. An increase in factors, such as the prevalence of osteoarthritis, geriatric population, availability of insurance coverage, and a number of trauma and accident cases, is projected to drive the demand for joint replacements in North America. For instance, according to the American Joint Replacement Registry (AJRR), in 2019, around 1.5 million hip and knee arthroplasty surgeries were recorded in the registry. Thus, supports the growth of the market for joint replacement. The growing prevalence of orthopedic diseases, coupled with the rapid adoption of innovative products, is likely to fuel the market for joint replacement in the region.

In Asia Pacific, the market for joint replacement is anticipated to show the fastest growth over the forecast period owing to rising spending in healthcare, quickly evolving healthcare infrastructure and growing medical tourism in the region. As per The Asian Federation of Osteoporosis Societies (AFOS), a total of 1.2 million hip fractures occurred in 2019, which is expected to reach 2.6 million by 2050. Other factors, such as the growing elderly population, increasing healthcare spending in developing Asian economies, and the increasing overall prevalence of osteoarthritis, osteoporosis, bone injuries, diabetes, and obesity, are expected to contribute to the joint replacement market over the coming years.

Key Companies & Market Share Insights

The market for joint replacement is fragmented with many big and small industry players. Key players are adopting business strategies including diverse product offerings, regional expansion, partnerships, and new product launches to gain market share. For instance, in January 2021, De Puy Synthes’s VELYS Robotic-Assisted Solution intended for practice with the ATTUNE Total Knee System has received 510(k) clearance from the U.S. FDA. In January 2021, Stryker acquired OrthoSensor, Inc., a frontrunner in the digital evolution for total joint replacement. This acquisition has strengthened its position in the market. Some of the prominent players in the joint replacement market include:

-

Johnson & Johnson Services, Inc. (DePuy Synthes)

-

Stryker

-

Zimmer Biomet

-

Smith+Nephew

-

DJO, LLC

-

Arthrex, Inc.

-

Exactech, Inc.

-

Conformis

-

MicroPort Orthopedics

-

Corin Group

Joint Replacement Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 20.1 billion

Revenue forecast in 2028

USD 25.4 billion

Growth rate

CAGR of 3.4% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, fixation type, end-use, procedure, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Japan; India; China; Brazil; Mexico; Argentina; South Africa; Saudi Arabia

Key companies profiled

Johnson & Johnson Services, Inc. (DePuy Synthes); Stryker; Zimmer Biomet; Smith+Nephew; DJO, LLC.; Arthrex, Inc.; Exactech, Inc.; Conformis; MicroPort Orthopedics; Corin Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global joint replacement market report on the basis of product, fixation type, end-use, procedure, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Knees

-

Hips

-

Extremities

-

Upper

-

Lower

-

-

-

Fixation Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Cemented

-

Cementless

-

Hybrid

-

Reverse Hybrid

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Orthopedic Clinics

-

Others

-

-

Procedure Outlook (Revenue, USD Million, 2016 - 2028)

-

Total Replacement

-

Partial Replacement

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global Joint Replacement market size was estimated at USD 17.1 billion in 2020 and is expected to reach USD 20.1 billion in 2021.

b. The global Joint Replacement market is expected to grow at a compound annual growth rate of 3.37% from 2021 to 2028 to reach USD 25.4 billion by 2028.

b. North America dominated the market with a share of over 62.9% in 2020. An increase in factors, such as the prevalence of osteoarthritis, geriatric population, availability of insurance coverage, and the number of trauma & accident cases, is projected to drive the demand for joint replacements in North America.

b. Some key players operating in the Joint Replacement market include Johnson & Johnson Services, Inc. (DePuy Synthes), Stryker, Zimmer Biomet, Smith+Nephew, DJO, LLC., Arthrex, Inc., Exactech, Inc., Conformis, MicroPort Orthopedics, and Corin Group.

b. Key factors that are driving the market growth include an increase in the prevalence of orthopedic disorders, osteoporosis, osteoarthritis (OA), and lower extremity conditions and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.