- Home

- »

- Homecare & Decor

- »

-

Kids Furniture Market Size & Share Report, 2022-2030GVR Report cover

![Kids Furniture Market Size, Share & Trends Report]()

Kids Furniture Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Beds, Cots, & Cribs, Mattresses), By Material (Wood, Polymer, Metal), By Application (Commercial, Household), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-250-1

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Kids Furniture Market Summary

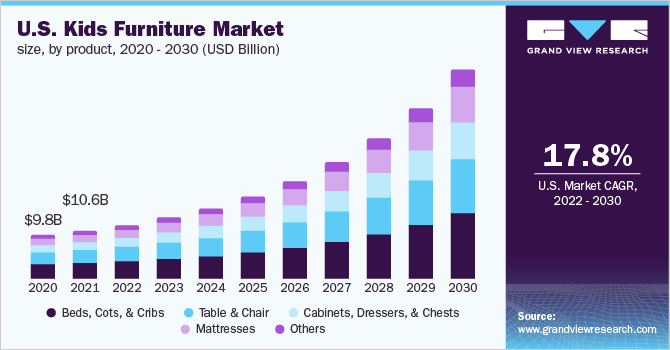

The global kids furniture market size was estimated at USD 38.82 billion in 2021 and is projected to reach USD 184.52 billion by 2030, growing at a CAGR of 18.9% from 2022 to 2030. Rising real estate prices are expected to impact the sizes of houses and children’s rooms, which is projected to create growth opportunities for companies offering compact, easy-to-move, and “assemblable” furniture for kids’ rooms.

Key Market Trends & Insights

- North America accounted for the largest revenue share of more than 30.0% in 2021.

- The Middle East and Africa region is anticipated to register the fastest CAGR of 22.8% from 2022 to 2030.

- In terms of application, the household segment dominated the global market with a revenue share of more than 65.0% in 2021.

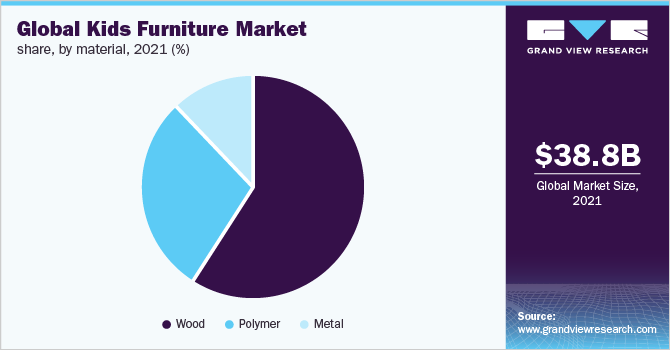

- In terms of material, the wood segment led the global market in 2021 with a share of over 55.0%.

- In terms of product, the beds, cots, and cribs segment dominated the global market with a revenue share of more than 30.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 38.82 Billion

- 2030 Projected Market Size: USD 184.52 Billion

- CAGR (2022-2030): 18.9%

- North America: Largest market in 2021

- Middle East and Africa: Fastest growing market

The outbreak of the COVID-19 pandemic led to worldwide lockdowns and school closures that resulted in an increase in demand for kids furniture, including chairs, tables, cabinets, dressers, and chests. Owing to the ongoing pandemic, children are now required to attend online classes, necessitating a separate study space in order to accommodate themselves comfortably for long school hours.Moreover, the worldwide population's per capita and disposable income is rising, particularly in developing nations, boosting the expansion of the kids furniture industry. Consumers with a high level of affordability spend wisely in order to increase their standard of living, resulting in the purchase of efficient and versatile consumer goods. This factor is expected to boost the growth of the market.

Furthermore, the demand rate is growing as the population grows, and at the same time, improving employment rates in emerging nations have enabled a large portion of the population to spend on both necessary and recreational items, which is expected to boost the growth of the market. For instance, according to the International Labour Organization, between 2017 and 2019, the number of working people in the Asia Pacific region increased to about 23 million.

With the rising home prices, consumers are increasingly investing in home improvement or home remodeling projects rather than buying new homes. The growing home values have doubled homeowner equity, indicating a trend of homeowners feeling richer and more disposed toward spending money on home improvement projects. This trend is likely to propel the demand for kids furniture in the foreseeable future.

Product Insights

The beds, cots, and cribs segment dominated the global market with a revenue share of more than 30.0% in 2021. The growth is attributed to its ease and convenient use for disinfecting and cleaning surfaces. Healthy sleep plays a quintessential role in the physical and emotional well-being of infants and young children, especially in the first two years, and assists in promoting growth, improving learning, and increasing the attention span of babies. Consequently, there is a significant rise in the demand for kids’ cribs, cots, and beds across the globe.

The mattresses product segment is expected to register the fastest CAGR of 20.4% from 2022 to 2030. Children tend to need more sleep than adults making mattresses a vital component of kids’ furniture. The rising concerns over timely sleep need by kids, coupled with the increasing concern regarding appropriate mattresses, are anticipated to drive the demand for kids mattresses in the foreseeable future.

Application Insights

The household application segment dominated the global market with a revenue share of more than 65.0% in 2021. With schools remaining shut due to the coronavirus pandemic and classes being conducted online, it is important to set up a comfortable classroom for the child at home to facilitate learning. This has been challenging, especially for those who live in a small home where the parents are also working from home.

The commercial application segment is expected to register the fastest CAGR of 21.4% from 2022 to 2030. Several parents continue to work in order to maintain their standard of living and also to provide better education for their children, which implies less quality time for their children. This has increased the number of daycare and crèche facilities in both schools as well as office compounds resulting in an increased demand for kids’ furniture in commercial spaces like crèche and daycare facilities.

Material Insights

The wood segment led the global market in 2021 with a share of over 55.0%. Among various materials, wood is highly preferred for furniture by consumers due to its various advantages. Wood is much stronger in load bearing for both chairs and tables, owing to which wood can support a heavier load without breaking down. Furthermore, wood can be repainted and re-polished after years of usage to bring the luster back.

The polymer segment is expected to register the fastest CAGR of 19.7% from 2022 to 2030. Compared to metal or wooden furniture, polymer furniture is more affordable. They are also stylish and comfortable to sit on, making them ideal for kids who are required to sit for hours doing homework or other in-home activities. Furthermore, they are not prone to breakage or cracks, making them safer to use for children. Plastic chairs are also lightweight, making them ideal for young kids. This is anticipated to continue over the next few years.

Regional Insights

In 2021, North America accounted for the largest revenue share of more than 30.0%. An increase in the working population in North America is a key contributing factor to the demand for kids’ furniture in day care. For instance, according to the U.S. Census Bureau, the youngest millennials reached their adulthood in 2020 and accounted for 28% of the U.S. population; they also accounted for 50% of the working population.

The Middle East and Africa region is anticipated to register the fastest CAGR of 22.8% from 2022 to 2030. Rapid investments in the construction sector in line with the development of smart city projects are expected to open new opportunities for players in the market over the coming years. Moreover, the growing per capita income in developing countries across the region will augment the product demand.

Key Companies & Market Share Insights

The market is highly competitive owing to the presence of a large number of international and regional players. With consumers shifting toward trendy design and multipurpose functions, many brands have been shifting their focus to cater to these demands and make products a significant portion of their business.

For instance, in July 2021, Aldi launched a new range of kids' garden furniture, which includes wooden benches, loungers, and tables. Similarly, in July 2021, Crate & Kids came up with a kids’ furniture line designed to meet the needs of millennial parents. These products feature trending designs, have multipurpose functions, available in gender-neutral styling and color, and are made sustainably. Some prominent players in the global kids furniture market include:

-

Williams Sonoma Inc.

-

Billion Dollar Baby Co.

-

Wayfair Inc.

-

Blu Dot

-

First Cry

-

KidKraft

-

Sorelle Furniture

-

Circu Magical Furniture

-

Crate and Barrel

-

Casa Kids

Kids Furniture Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 43.57 billion

Revenue forecast in 2030

USD 184.52 billion

Growth rate

CAGR of 18.9% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; U.K.; China; India; Brazil

Key companies profiled

Billion Dollar Baby Co.; Wayfair Inc.; Blu Dot; First Cry; KidKraft; Sorelle Furniture; Circu Magical Furniture; Crate and Barrel; Casa Kids

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global kids furniture market report on the basis of product, material, application, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Beds, Cots, & Cribs

-

Table & Chair

-

Cabinets, Dressers, & Chests

-

Mattresses

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wood

-

Polymer

-

Metal

-

-

Application Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Commercial

-

Household

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global kids furniture market size was estimated at USD 38.82 billion in 2021 and is expected to reach USD 43.57 billion in 2022.

b. The global kids furniture market is expected to grow at a compound annual growth rate of 18.9% from 2022 to 2030 to reach USD 184.52 billion by 2030

b. North America dominated the kids furniture market with a share of 33.7% in 2021. This is attributable to an increase in the number of childcare or daycare service providers. Moreover, the rise in on-site childcare services—supported by government initiatives to encourage working mothers—has also been contributing to the growth of the kids furniture market.

b. Some key players operating in the kids furniture market include Williams Sonoma Inc.; Billion Dollar Baby Co.; Wayfair Inc.; Blu Dot; First Cry; KidKraft; Sorelle Furniture; Circu Magical Furniture; Crate and Barrel; and Casa Kids.

b. Key factors that are driving the kids furniture market growth include a rise in the disposable income of parents and an increase in the birth rate.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.