- Home

- »

- Medical Devices

- »

-

Laboratory Products And Services Outsourcing Market Report, 2030GVR Report cover

![Laboratory Products & Services Outsourcing Market Size, Share & Trends Report]()

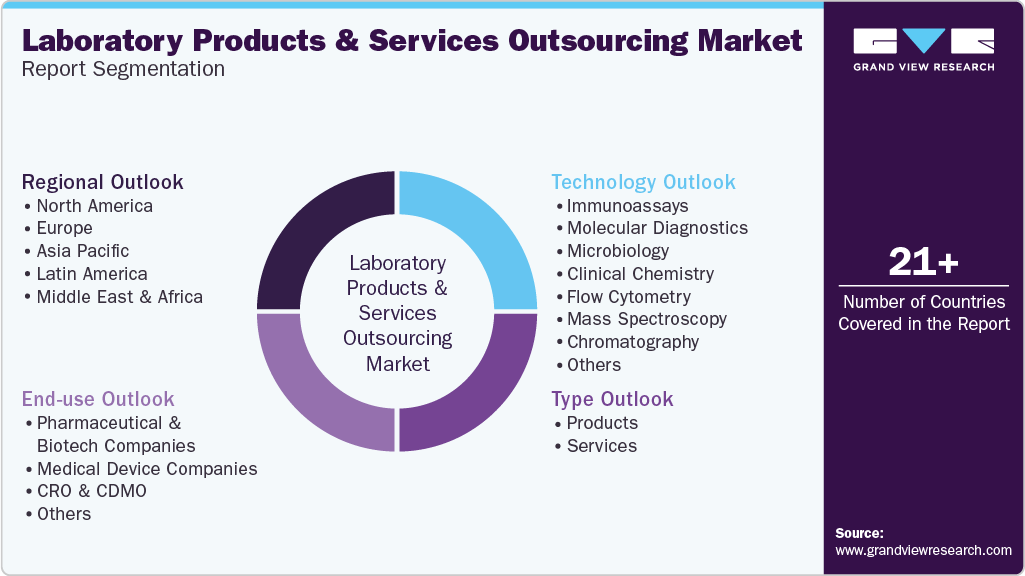

Laboratory Products & Services Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Products, Services), By Technology (Molecular Diagnostics, Immunoassays), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-264-5

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

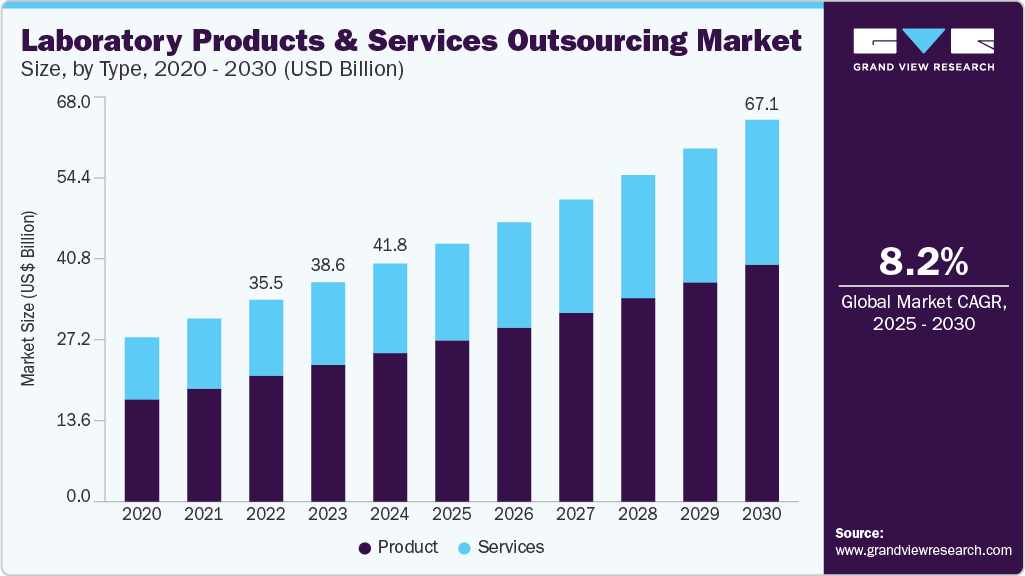

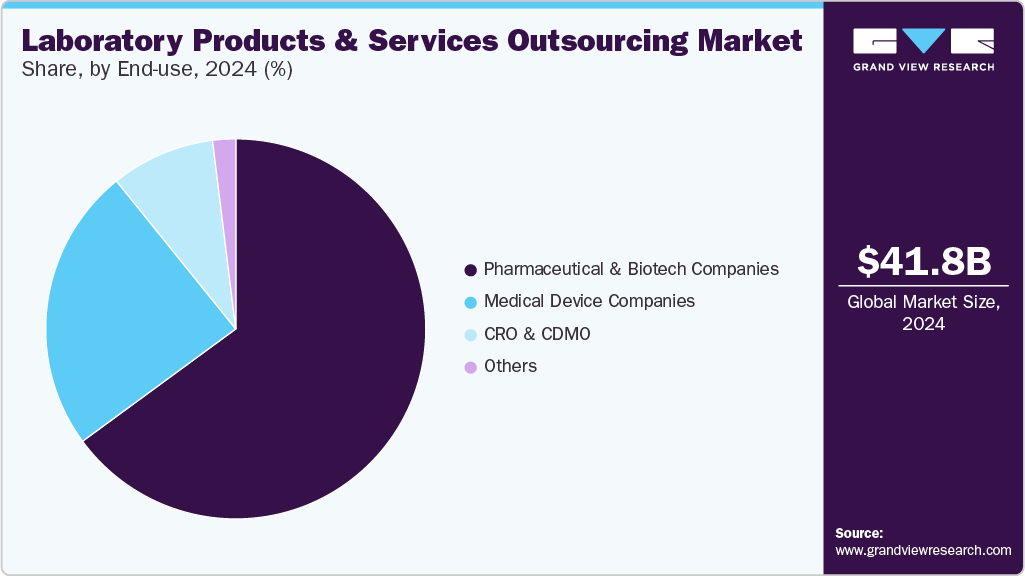

The global laboratory products and services outsourcing market size was valued at USD 41.81 billion in 2024 and is projected to grow at a CAGR of 8.17% from 2025 to 2030. Growth in the market can be attributed to the rising need to outsource product manufacturing and services to reduce the increasing cost pressure.

Key Highlights:

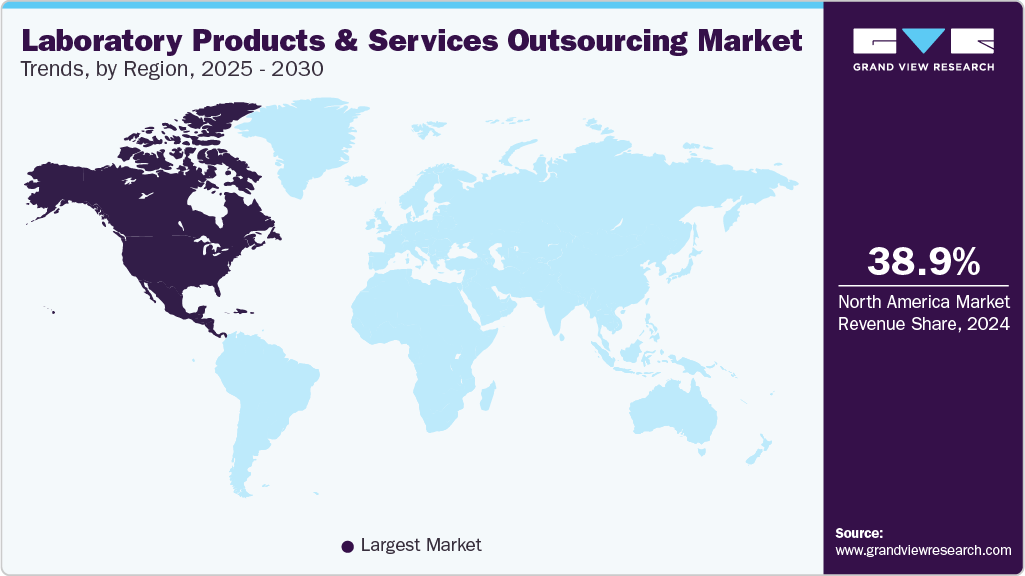

- North America held the largest market share of 38.99% in 2024

- The laboratory products and services outsourcing market in the U.S.is driven due to robust healthcare infrastructure

- In terms of type segment, product segment dominated the laboratory products and services outsourcing industry and accounted for 62.38% of global revenue in 2024

- In terms of technology segment, the molecular diagnostics segment accounted for the largest market share in 2024

- In terms of end use segment,the market is segregated into pharmaceutical & biotech companies, medical device companies, CRO & CDMO, and others

Moreover, a growing number of clinical trials, adoption of personalized medicine and novel therapeutics, rising R&D investment in the healthcare industry, and technological advancements in medical equipment are among the key factors driving market growth. A growing number of clinical trials is one of the factors driving market growth. For instance, in December 2024, according to the data published by WHO, the number of clinical trials registered worldwide has steadily increased from 1999 to 2022, with significant growth observed in high-income countries. Notably, the Western Pacific region, particularly China and Japan, has seen substantial increases in trial registrations. However, disparities persist, as low-income countries register significantly fewer trials, highlighting ongoing inequities in global clinical research.

Increasing adoption of personalized medicine and novel therapeutics is boosting the growth of the market. According to the Personalized Medicine at FDA article, in 2022, the U.S. Food and Drug Administration (FDA) granted 12 innovative personalized medicines, marking a significant milestone in expanding targeted treatments. This approval also included broadening the indications for numerous existing personalized therapies and introducing two novel siRNA therapies. Additionally, the FDA offered crucial guidance on the development of gene and cell-based therapies while simultaneously approving the use of five such therapies. Moreover, the FDA's approval of several new diagnostic indications in 2022 supported more precise and targeted treatment decisions for various health conditions, thereby driving the demand for laboratory products and services outsourcing.

Technological advancements such as automation and AI-based laboratory research are propelling the growth of the market. For instance, in April 2025, Precision for Medicine and PathAI entered into a collaboration agreement to integrate AI-powered digital pathology tools into clinical trials and biospecimen services. This partnership aims to enhance biomarker discovery and tissue analysis using advanced machine learning, improving quality control, patient stratification, and data reliability. PathAI’s proprietary tools, such as AISight, will be incorporated into Precision’s laboratory and clinical workflows, offering deeper insights into complex tissue biology and accelerating drug development. The collaboration delivers unique, customized services exclusive to Precision for Medicine.

Opportunity Analysis

The laboratory products and services outsourcing industry is expected to witness significant growth opportunities driven by the increasing demand for cost-effective and efficient laboratory operations across pharmaceutical, biotechnology, and academic research sectors. The growing complexity and volume of scientific research, especially in genomics, proteomics, and drug discovery, encourages institutions and companies to outsource laboratory services to specialized providers with advanced infrastructure and skilled personnel.

In addition, rising R&D expenditures globally are boosting demand for outsourced laboratory products and services. Outsourcing laboratory services allows companies to focus on innovation while reducing overhead and capital expenditures on in-house lab operations. Furthermore, the outsourcing of laboratory consumables procurement is growing as procurement services become more streamlined and tech-enabled.

Impact of U.S. Tariffs on the Global Laboratory Products and Services Outsourcing Market

The U.S. tariffs introduced in 2025 have severely affected the global market for laboratory products and services outsourcing. With import taxes between 20% and 25% on goods from major suppliers like China, Mexico, and Canada, the cost of important lab tools, such as testing machines, medical plastics, and electronic parts, has increased. These higher costs pressure lab budgets, causing delays in buying equipment and completing projects. Because the future of these tariffs is uncertain, suppliers are now looking at new markets, with countries like India and Mexico possibly becoming new centers for laboratory equipment exports.

Labs and service providers are rethinking how they manage their supply chains to deal with these problems. Some are considering moving production closer to home to avoid high tariffs, while others are putting money into making products within their own countries to rely less on imports. The increasing costs and supply chain issues are also changing how labs plan clinical trials and research, with some considering doing trials in new locations or using remote methods to save money. The U.S. tariffs are forcing the lab industry to change quickly, showing how important it is to plan smartly and have different options in today’s evolving trade environment.

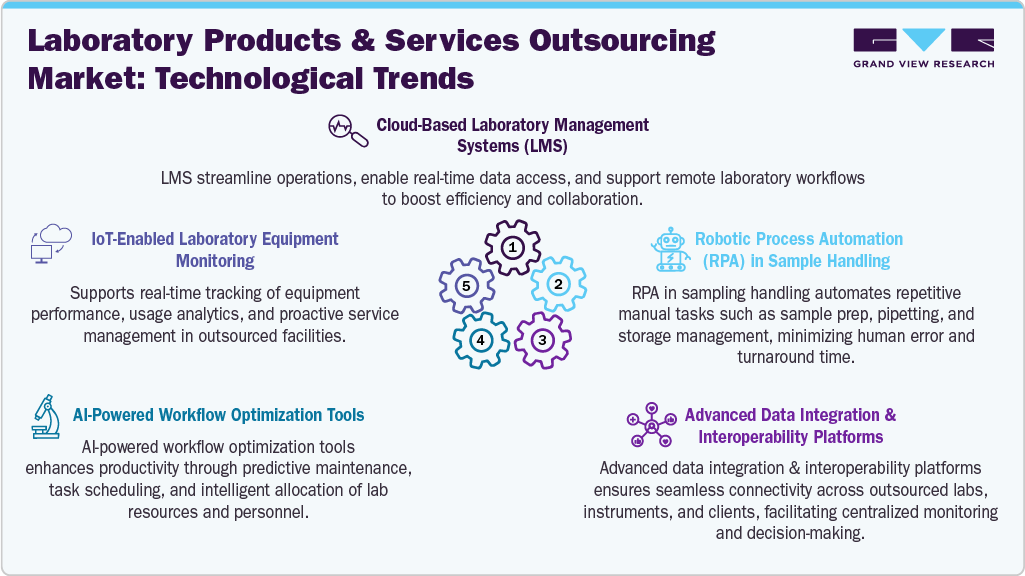

The market is experiencing rapid growth, driven by the integration of advanced technologies that enhance operational efficiency and data accuracy in laboratory environments. Cloud-based Laboratory Management Systems (LMS) offer centralized, real-time access to data, enabling seamless collaboration across geographically dispersed teams. Robotic Process Automation (RPA) further streamlines workflows by automating repetitive tasks such as sample handling, significantly improving throughput while minimizing human error. In addition, modern data-sharing frameworks facilitate easy interoperability between laboratory instruments, software platforms, and client-facing systems.

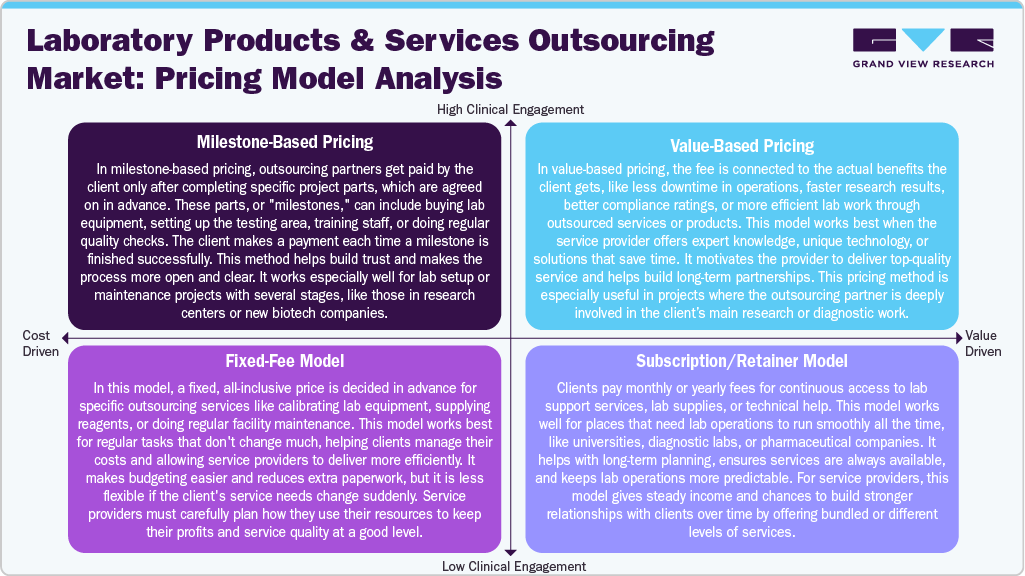

Cost-driven models like the Fixed-Fee and Milestone-Based Pricing are favored for standardized or phase-based tasks, offering predictability and clear deliverable, ideal for routine maintenance or staged lab setup. In contrast, Subscription/Retainer and Value-Based Pricing models cater to clients seeking long-term, high-value partnerships, often in environments demanding continuous support or outcome-oriented results, such as diagnostic labs or research-driven institutions. This pricing flexibility allows service providers to align with diverse client needs, from transactional engagements to collaborative, innovation-focused relationships.

Market Concentration & Characteristics

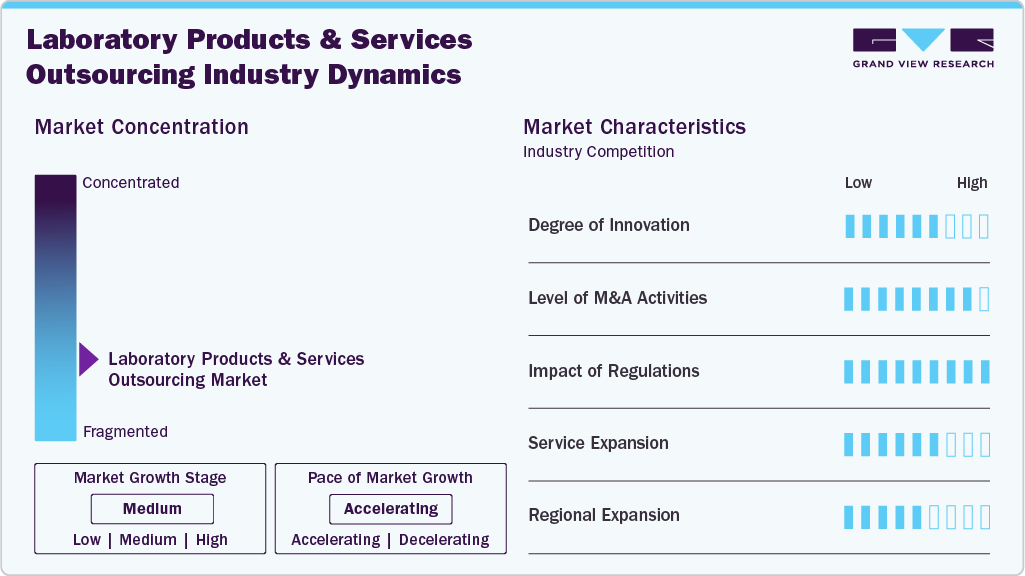

The laboratory products and services outsourcing industry growth stage is medium and anticipated to accelerate in growth. Key drivers include technological advancements, evolving regulatory landscapes, and the globalization and outsourcing of product processes. These factors offer distinct advantages, allowing organizations to access specialized capabilities and optimize operational efficiency.

The laboratory products and services outsourcing industry exhibits a high degree of innovation, with continuous advancements in technology and processes. These innovations drive efficiency and specialization, enabling providers to offer innovative solutions to meet evolving client needs and industry standards.

Regulations have a high impact on the market, influencing compliance requirements, quality standards, and market entry barriers. Adherence to regulatory frameworks shapes operational practices, service offerings, and strategic decisions, impacting market dynamics and competitiveness.

The level of M&A (mergers and acquisitions) activities in the market is high, with periodic consolidation and strategic partnerships reshaping the competitive landscape. M&A transactions are driven by expansion into new markets, diversification of service portfolios, and efforts to achieve economies of scale. For instance, in April 2025, Source BioScience UK Ltd, a prominent industry provider of histopathology diagnostics and genomic services, announced that it had successfully acquired Cambridge Clinical Laboratories (CCL), a leading provider of clinical, customized healthcare testing services based in Cambridge. The acquisition strengthens the company's clinical diagnostics portfolio by utilizing the CCL team's experience and the new, cutting-edge clinical lab facilities at Vision Park in Cambridge, offering expedited testing services for preclinical and clinical research.

Service expansion in the market is medium, with providers diversifying offerings to meet evolving client needs and market demands. This expansion includes the introduction of new testing methodologies, enhanced analytical capabilities, and expanded geographical coverage to cater to a broader client base. In addition, providers increasingly offer value-added services such as consulting, regulatory compliance support, and data analytics to differentiate themselves in the competitive landscape.

The market is experiencing significant regional expansion, with providers strategically expanding their presence to new geographic areas. This expansion allows them to tap into emerging markets, capitalize on the growing demand for laboratory services, and establish a broader client base. In addition, it facilitates closer proximity to clients, enabling faster response times and more personalized service delivery.

Type Insights

On the basis of the type segment, the market is segregated into products and services. Product segment dominated the laboratory products and services outsourcing industry and accounted for 62.38% of global revenue in 2024. The products segment includes equipment and disposables such as test tubes and pipettes, reagents, chemicals, and other essential supplies necessary for conducting experiments and analysis. Advancements in scientific research necessitate precise and efficient laboratory operations, fueling the need for general, analytical, clinical, support, and specialty equipment. This demand for advanced instrumentation and the requirement for precise chemical analysis and medical diagnostics contribute to the segment’s growth.

The service segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing complexity of drug development processes and the stringent regulatory requirements is driving the demand for specialized expertise and advanced analytical capabilities. Sub-categories such as ADME, PK, PD, Bioavailability, and Bioequivalence testing are essential for evaluating the safety and efficacy of pharmaceutical compounds, For instance, in May 2024, BioAgilytix entered into a partnership agreement with BBI Solutions OEM Limited (BBI) to integrate its bioanalytical testing services with BBI’s ability to produce high-quality antibody reagents for various testing purposes. This collaboration aims to enhance the efficiency of bioanalytical testing services for the pharmaceutical and biopharmaceutical industries.

Technology Insights

On the basis of the technology segment, the molecular diagnostics segment accounted for the largest market share in 2024. Advancements in molecular biology techniques and the adoption of personalized medicine approaches further boost the demand for molecular diagnostic services. Advancements in molecular diagnostics have revolutionized disease detection, offering rapid and precise results. For instance, in April 2024, Thermo Fisher Scientific launched the TSX Universal Series ULT Freezers, certified by ENERGY STAR. These freezers offer improved performance, tighter temperature control, and faster recovery times.

The immunoassays segment is projected to grow at the fastest CAGR over the forecast period. Immunoassays offer high sensitivity and specificity, making them valuable tools for disease diagnosis and drug development processes. Technological advancements like multiplexing and automation have revolutionized immunoassay platforms, enabling simultaneous analysis of multiple analytes in a single sample, reducing time and costs. Multiplex immunoassays, including Luminex bead-based platforms and protein microarrays, offer high analytical accuracy in biomedical research and clinical diagnostics. Emerging technologies like organ-on-a-chip further enhance multiplexing capabilities, allowing simultaneous analysis of biomarkers with high sensitivity and minimal user intervention.

End Use Insights

On the basis of the end use segment, the market is segregated into pharmaceutical & biotech companies, medical device companies, CRO & CDMO, and others. The pharmaceutical and biotech companies dominated in 2024. The growth of the segment is due to their intensive R&D activities, complex testing requirements, and strict regulatory demands. These companies consistently invest in advanced laboratory instruments, consumables, and support services to accelerate drug discovery, streamline clinical development, and ensure quality assurance across all phases. Their need for high-precision equipment, reliable testing environments, and continuous technical support drives significant demand, positioning them as the leading contributors to market growth.

The medical device companies’ segment is projected to grow at the fastest CAGR over the forecast period. The growth is mainly due to increasing innovation in diagnostic and therapeutic technologies, rising regulatory compliance requirements, and a growing reliance on laboratory services for product development and validation. As these companies expand their portfolios with more complex and specialized devices, the demand for advanced laboratory products and outsourced testing services is accelerating, particularly in areas such as biocompatibility testing, sterilization validation, and analytical support, further fueling segment growth.

Regional Insights

North America held the largest market share of 38.99% in 2024. Several factors, such as technological advancements, stringent regulatory requirements, and the increasing demand for specialized services, contribute to this positive outlook. In addition, the presence of leading pharmaceutical and biotechnology companies and a strong emphasis on research and development further propels market expansion. For instance, in March 2025, IQVIA Laboratories launched Site Lab Navigator, a cutting-edge platform designed to streamline laboratory operations in clinical trials through its innovative e-Requisition system. This digital solution enables investigator sites to manage lab requisitions and specimen handling electronically, replacing outdated paper-based processes.

U.S. Laboratory Products and Services Outsourcing Market Trends

The laboratory products and services outsourcing market in the U.S.is driven due to robust healthcare infrastructure, technological advancements, a highly skilled workforce, favorable regulatory frameworks, and the presence of leading pharmaceutical and biotechnology companies. In addition, the increasing demand for specialized laboratory services and the growing trend of outsourcing non-core functions among the healthcare industry have further solidified the U.S. dominance in the market. The country's strong academic and research institutions, collaborations between private and public sectors, and increasing focus on personalized medicine and clinical trials have also contributed significantly. Moreover, contract research organizations are expanding service offerings, attracting more outsourcing partnerships.

Europe Laboratory Products and Services Outsourcing Market Trends

The Laboratory products and services outsourcing market in Europe is expected to grow significantly due to technological advancements, evolving regulatory landscapes, and increasing demand for specialized services. European providers offer various laboratory solutions, including testing, research, and consulting services, with a strong focus on innovation and quality. Increased R&D investments in the pharmaceutical, biotechnology, and chemical sectors further support this growth.

The laboratory products and services outsourcing market in Germany held the largest share in 2024 in Europe, owing to several trends shaping the landscape. Importance of precision medicine and personalized healthcare solutions, driving demand for specialized laboratory services designed for individual patient needs. Moreover, advancements in digitalization and automation are revolutionizing laboratory processes, leading to increased efficiency, accuracy, and cost-effectiveness.

The laboratory products and services outsourcing market in the UK is anticipated to grow over the forecast period. Factors such as technological advancements, increasing demand for specialized services, and the need for cost-effective solutions will fuel market expansion. In addition, collaborations between outsourcing providers and healthcare organizations and a focus on innovation and quality will further fuel market expansion. With a strong healthcare infrastructure and a skilled workforce, the UK remains a key player in the global laboratory outsourcing landscape, positioned for continued growth and innovation in the coming years.

Asia Pacific Laboratory Products and Services Outsourcing Market Trends

The Asia Pacific market is expected to grow at a CAGR of 8.73% over the forecast period. The demand for outsourcing laboratory products and services in the Asia Pacific region is driven by cost advantages, access to a skilled workforce, growing healthcare needs, and expanding pharmaceutical and biotechnology sectors. Many companies are now outsourcing lab services to India and China to save costs, improve efficiency, and leverage regional skills, particularly clinical trials and R&D. Moreover, favorable government policies, a diverse patient base, and increasing investment in healthcare infrastructure contribute to the region’s attractiveness as a global hub for laboratory products and services outsourcing.

In Asia Pacific, the laboratory products and services outsourcing market in China held the largest share in 2024 due to high R&D infrastructure, integration of advanced technologies and availability of expertise is likely to boost the country’s market growth. Moreover, the availability of low-cost labor is one of the major factors for pharmaceutical firms across the globe to outsource laboratory products and services to China. In addition, strong government support for scientific research, increasing collaborations with global biotech and pharma companies, and the expansion of CRO networks are accelerating market development. China's robust supply chain and growing emphasis on quality standards strengthen its position as a leading hub for outsourced laboratory solutions.

The laboratory products and services outsourcing market in Japan is expected to grow over the forecast period due to rising product development costs, stimulating outsourcing to optimize expenses. Furthermore, continuous technological advancements in novel product development and evolving regulatory scenarios are likely to propel market demand. Moreover, an aging population and a growing focus on precision medicine in Japan are fueling demand for advanced laboratory testing and analytical services. The country is further witnessing increased partnerships between academic institutions and private laboratories, improving innovation and research capabilities. These factors contribute to the rising need for reliable and efficient outsourced laboratory services.

The laboratory products and services outsourcing market in India is anticipated to grow at the fastest CAGR over the forecast period, owing to its large talent pool, robust infrastructure, favorable regulatory environment, and increasing demand for advanced laboratory testing and pharmaceutical research.

Latin America Laboratory Products and Services Outsourcing Market Trends

The market in Latin America is anticipated to grow at a substantial pace over the forecast period. The growth in the region is attributed to increasing demand for outsourced laboratory services driven by the region's expanding healthcare sector, rising research & development investments, and growing adoption of advanced technologies. In addition, favorable government initiatives and regulatory reforms to promote innovation and attract foreign investment are expected to propel market growth.

The Brazil laboratory products and services outsourcing market is anticipated to grow at a significant CAGR over the forecast period. The country's large and diverse healthcare sector, rising demand for specialized laboratory services, increasing investments in research and development, and favorable government policies aimed at promoting innovation and attracting foreign investment are driving the market growth.

Key Laboratory Products And Services Outsourcing Company Insights

The major players operating across the market focus on adopting several strategic initiatives such as service launches, mergers & acquisitions/joint ventures, mergers, partnerships & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge, driving market growth. For instance, in August 2024, Quest Diagnostics, a leading provider of diagnostic information services, announced an agreement to acquire select assets of University Hospitals' outreach laboratory services in Ohio to expand access to its advanced diagnostic services across the state. These partnerships enhanced the company’s operational efficiency, maintained quality, and supported affordable healthcare.

Laboratory Products And Services Outsourcing Companies:

The following are the leading companies in the laboratory products and services outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific

- Charles River Laboratories

- Eurofins Scientific

- Labcorp

- Quest Diagnostics

- Parexel International Corporation

- Agilent Technologies

- PerkinElmer

- Bio-Rad Laboratories

- SGS SA

- Intertek Group plc

- WuXi AppTec, Inc

Recent Developments

-

In April 2025, Source BioScience UK Ltd. acquired Cambridge Clinical Laboratories (CCL), a clinical and personalized healthcare testing service provider. This strategic acquisition aimed to enhance the company’s diagnostic capabilities by integrating CCL's advanced laboratory infrastructure, expanding its end-to-end testing solutions across clinical and research domains.

-

In September 2023, Bio-Rad Laboratories, Inc., introduced its PTC Tempo 384 Thermal Cyclers and PTC Tempo 48/48. These innovative instruments are designed to facilitate PCR applications across various domains, including translational and basic research, process development, and quality control.

-

In July 2023, NAMSA acquired Clinical Research Institute, a German based full service Contract Research Organization (CRO). This initiative aimed to expanded company’s contract service offerings across Europe and other markets.

Laboratory Products And Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.32 billion

Revenue forecast in 2030

USD 67.12 billion

Growth rate

CAGR of 8.17% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific; Charles River Laboratories; Eurofins Scientific; Labcorp; Quest Diagnostics; Parexel International Corporation; Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; SGS SA; Intertek Group plc Inc; WuXi AppTec, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Products & Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory products and services outsourcing market report based on type, technology, end use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Equipment

-

General

-

Analytical

-

Clinical

-

Support

-

Specialty

-

-

Disposables

-

Others

-

-

Services

-

Pharmaceutical

-

Bioanalytical Testing

-

ADME

-

PK

-

PD

-

Bioavailability

-

Bioequivalence

-

Others

-

-

Method Development & Validation

-

Extractable & Leachable

-

Impurity Method

-

Technical Consulting

-

Others

-

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Others

-

-

Others

-

-

-

Medical Device

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Testing

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunoassays

-

Molecular Diagnostics

-

Microbiology

-

Clinical Chemistry

-

Flow Cytometry

-

Mass Spectroscopy

-

Chromatography

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotech Companies

-

Medical Device Companies

-

CRO & CDMO

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global laboratory products and services outsourcing market size was estimated at USD 41.81 billion in 2024 and is expected to reach USD 45.32 billion in 2025.

b. The global laboratory products and services outsourcing market is expected to grow at a compound annual growth rate of 8.17% from 2025 to 2030 to reach USD 67.12 billion by 2030.

b. North America region dominated the laboratory products and services outsourcing market with a share of 37.99% in 2024. This is attributable to high number of clinical trials, advanced healthcare infrastructure, stringent regulatory guidelines, and constant research and development initiatives.

b. Some key players operating in the laboratory products and services outsourcing market include Thermo Fisher Scientific, Charles River Laboratories, Eurofins Scientific, Labcorp, Quest Diagnostics, Parexel International Corporation, Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, SGS SA, Intertek Group plc Inc, WuXi AppTec, Inc.

b. Key factors that are driving the market growth include adoption of personalized medicine, increasing outsourcing trends among pharmaceutical companies, and surge in number of clinical trials among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.