- Home

- »

- Food Additives & Nutricosmetics

- »

-

Lactulose Market Size And Share, Industry Report, 2030GVR Report cover

![Lactulose Market Size, Share & Trends Report]()

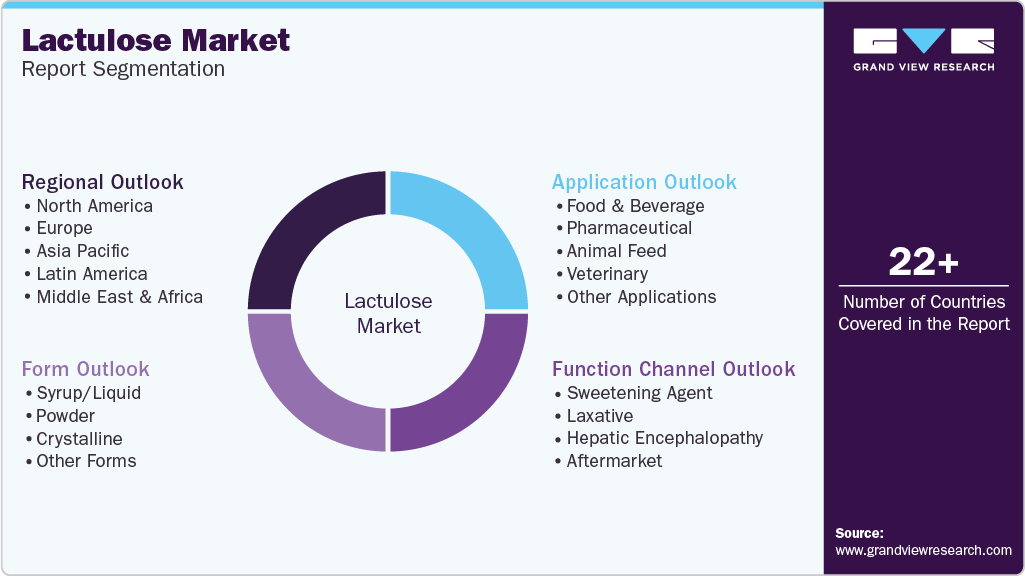

Lactulose Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Syrup/Liquid, Powder, Crystalline), Function (Sweetening Agent, Laxative, Hepatic Encephalopathy), By Application (Food & Beverage, Pharmaceutical), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-591-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lactulose Market Size & Trends

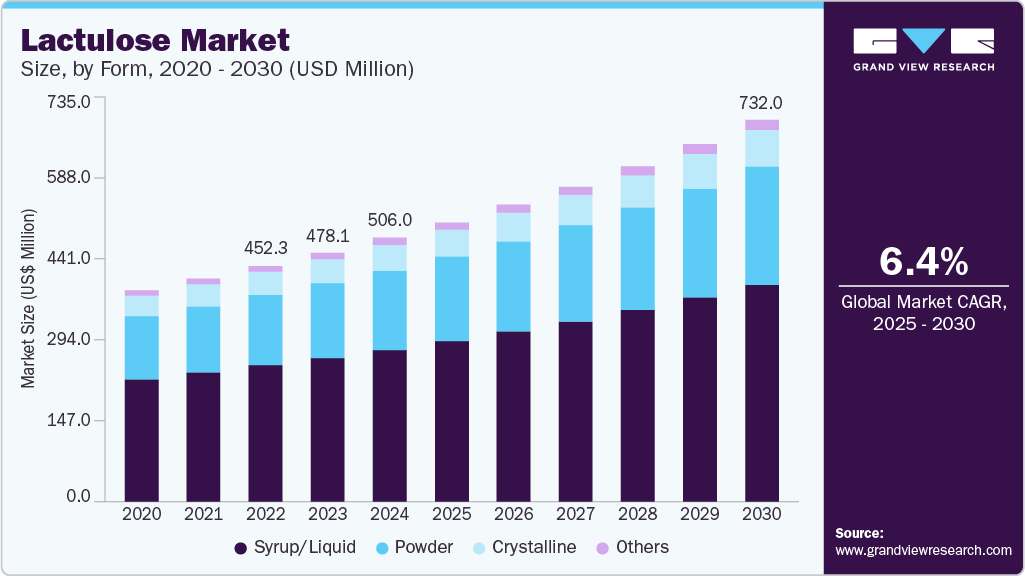

The global lactulose market size was estimated at USD 506.0 million in 2024 and is expected to expand at a CAGR of 6.4% from 2025 to 2030. The lactulose market is growing due to rising demand for digestive health solutions and increasing cases of constipation and liver-related issues.

Key Highlights:

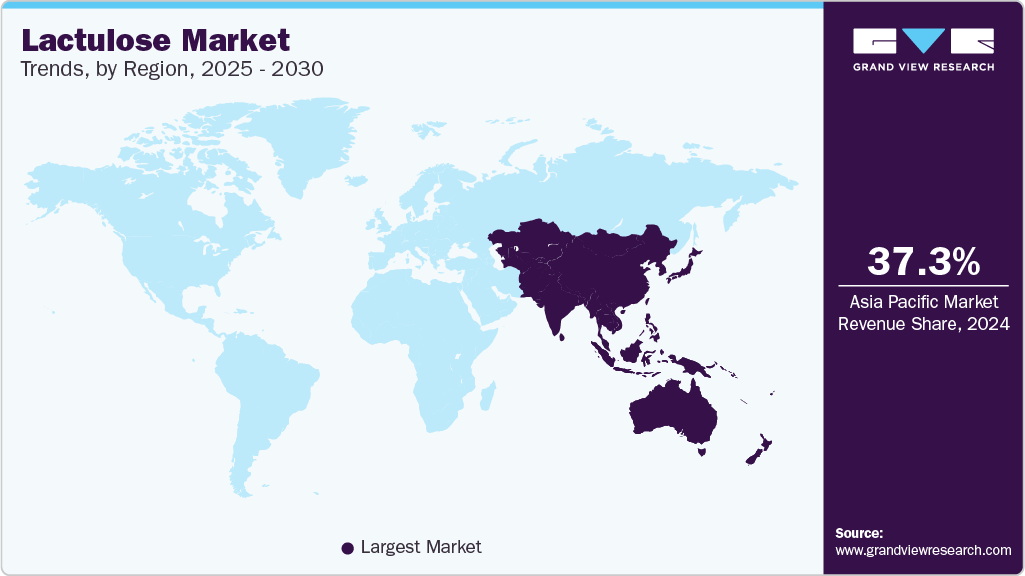

- Asia Pacific lactulose market dominated with a revenue share of 37.3% in 2024.

- The U.S. lactulose market is characterized by advanced medical facilities and a high diagnosis rate

- By form, the syrup/liquid segment led the market and accounted for the largest revenue share of 57.6% in 2024.

- By function, the laxative segment dominated the market and accounted for the largest revenue share of 69.8% in 2024.

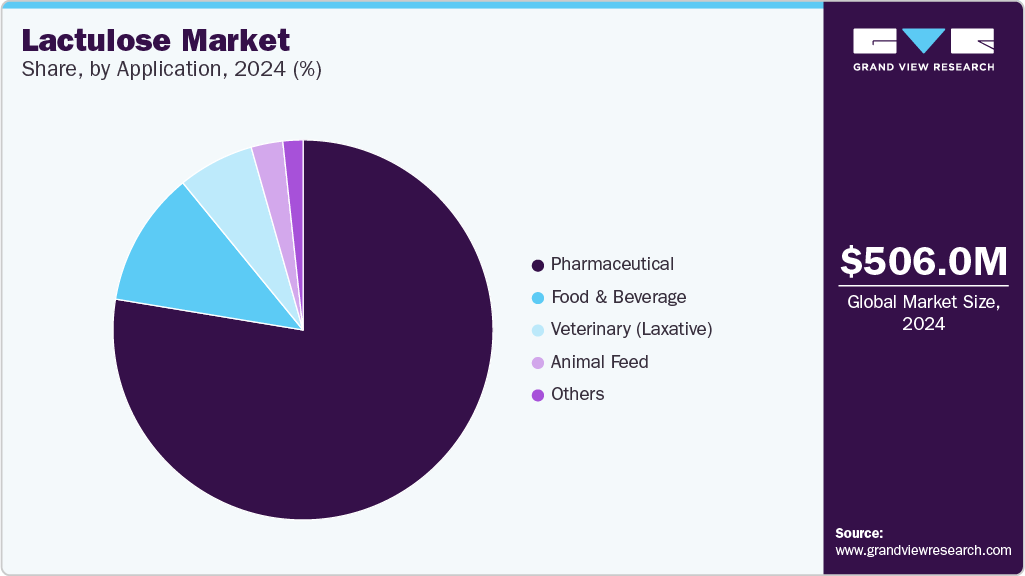

- By application, the pharmaceuticals segment dominated the market and accounted for the largest revenue share of 77.6% in 2024.

Its role as a safe and effective treatment, especially for laxative and hepatic uses, supports this trend. Growing awareness about gut health and the benefits of prebiotics also adds to its demand. As people seek better health management, lactulose continues to see steady use in both medical and nutritional areas.

The increasing awareness of gut health and its impact on overall well-being has driven the demand for prebiotic ingredients like lactulose. As a non-digestible sugar, lactulose reaches the colon intact, where it serves as food for beneficial gut bacteria, such as bifidobacteria and lactobacilli. With the rise in digestive disorders like irritable bowel syndrome (IBS), bloating, and constipation, consumers are actively seeking functional foods and supplements that support gut microbiota balance.

Companies have responded by incorporating prebiotic ingredients into their products, including fermented dairy, functional beverages, and dietary supplements. For instance, lactulose has been added to probiotic yogurt formulations in Japan to enhance the effectiveness of live cultures, leading to better digestion and nutrient absorption. The global functional food market, valued at over USD 200 billion, is expanding rapidly due to the growing demand for natural solutions to improve gut health, making lactulose an attractive ingredient for manufacturers.

Lactulose plays a critical role in the treatment of hepatic encephalopathy (HE), a severe neurological condition caused by liver failure, where toxins like ammonia accumulate in the blood and affect brain function. Patients with cirrhosis, a major cause of HE, rely on lactulose to reduce ammonia levels by promoting its excretion through frequent bowel movements. The World Journal of Hepatology highlights lactulose as a first-line treatment for HE, often prescribed alongside antibiotics like rifaximin. For example, in the United States, where over 4.5 million adults suffer from chronic liver disease, hospitals frequently administer lactulose to prevent HE-related complications, such as confusion and coma.

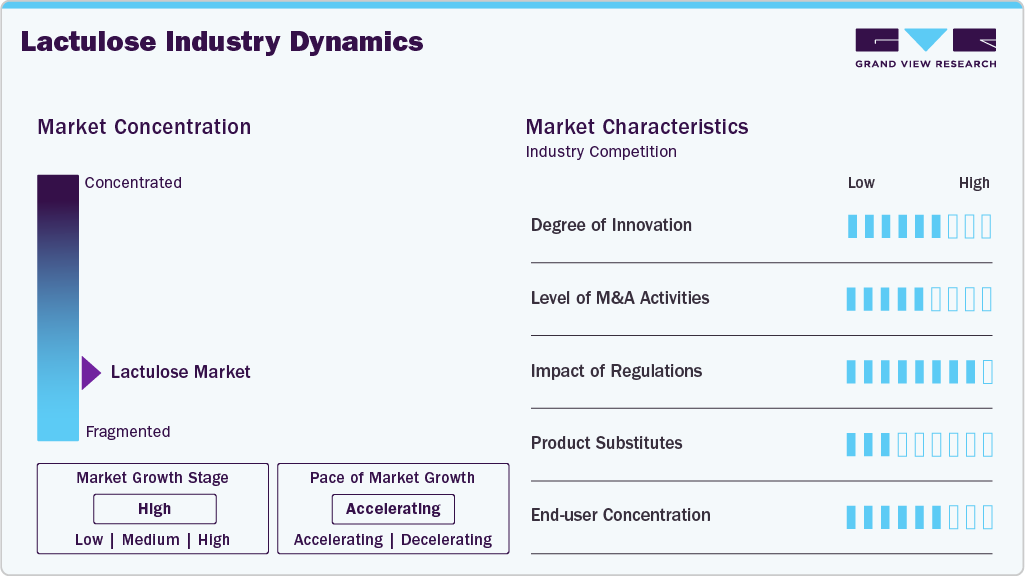

The lactulose market is fragmented, with several global and regional players competing. Dominated by pharmaceutical and nutraceutical sectors, the market sees steady demand growth, driven by rising gastrointestinal disorders and increased awareness of gut health and prebiotic benefit.

Market Concentration & Characteristics

The market is fragmented, with global players such as Abbott, Fresenius, Morinaga Milk Industry Co., Ltd., Illovo, and Daiichi Sankyo holding significant shares due to strong distribution networks and brand trust. However, regional players and emerging brands are entering the space with competitively priced alternatives, especially in developing countries, leading to healthy competition and innovation.

The lactulose market is characterized by its strong alignment with the pharmaceutical and nutraceutical sectors, as it is primarily used as a synthetic disaccharide for treating constipation and hepatic encephalopathy. Derived from lactose, lactulose functions as a non-digestible sugar that promotes colonic acidification and osmotic effects, stimulating bowel movements. The market is heavily prescription-driven, particularly in developed regions like North America, Europe, and Japan, where healthcare systems actively support therapeutic use of lactulose-based formulations.

Form Insights

The syrup/liquid segment led the market and accounted for the largest revenue share of 57.6% in 2024. This dominance is largely due to its extensive use in the pharmaceutical industry, particularly for the treatment of constipation and hepatic encephalopathy. Lactulose syrup is a widely prescribed laxative, especially for elderly patients, children, and individuals with chronic digestive issues. For example, in countries with aging populations such as Japan, Germany, and the United States, the demand for gentle, effective laxatives has increased significantly.

The powder segment is expected to grow fastest with a CAGR of 6.9% from 2025-2030 during the forecast period. The growth of this segment is driven primarily by its suitability for industrial and bulk applications, especially in nutraceuticals, functional foods, and dietary supplements. Unlike the syrup form, lactulose powder is favored in the food and beverage industry, where manufacturers require ingredients with longer shelf life, higher stability, and easy integration into powdered formulations like infant nutrition products, prebiotic drinks, and supplement capsules.

Function Insights

The laxative segment dominated the market and accounted for the largest revenue share of 69.8% in 2024. This dominance is due to its long-standing and widespread use in treating constipation, especially in chronic and age-related cases. Lactulose is a non-absorbable sugar that draws water into the colon, softening stools and stimulating bowel movements. It is preferred over harsher laxatives because of its gentle action and safety, even for infants, pregnant women, and the elderly.

The sweetening agents segment is expected to grow fastest with a CAGR of 7.3% during the forecast period. Although this is a relatively small segment, it plays a specific and valuable role in health-focused food and beverage applications. Lactulose is a low-calorie sweetener with prebiotic properties, making it attractive for functional foods, diabetic-friendly products, and infant nutrition. It provides mild sweetness while promoting gut health by stimulating the growth of beneficial bacteria like Bifidobacteria in the colon.

Applications Insights

The pharmaceuticals segment dominated the market and accounted for the largest revenue share of 77.6% in 2024. This segment is primarily driven by the two major therapeutic uses of lactulose: as a laxative and in the treatment of hepatic encephalopathy (HE). Lactulose’s role as a laxative is well-established, widely prescribed, and available over-the-counter for treating chronic constipation, particularly in the elderly, pregnant women, and children due to its gentle, non-irritating mechanism. Its effectiveness, safety profile, and ability to restore healthy bowel movements have made it a staple in both home and hospital settings.

Animal feed is expected to grow the fastest with a CAGR of 8.0% during the forecast period. Lactulose is used as a dietary supplement and functional additive in animal feed, especially for young livestock like calves and piglets, where it promotes the development of beneficial gut bacteria, improving digestion and nutrient absorption. Its prebiotic effect helps maintain gut flora balance, reduce pathogenic bacteria, and enhance immune response, which is crucial in high-density farming environments.

Regional Insights

Asia Pacific lactulose market dominated with a revenue share of 37.3% in 2024. This growth is largely driven by the sheer population size, urbanization, and rising awareness of gut and liver health. Countries like China, India, and Japan are the primary growth hubs due to large aging populations, expanding middle-class healthcare spending, and a rise in lifestyle-related digestive disorders.

China Lactulose Market Trends

China lactulose marketis driven primarily by the increasing prevalence of gastrointestinal disorders, particularly chronic constipation and hepatic conditions like hepatic encephalopathy. China's aging population, which is expected to exceed 400 million aged 60+ by 2035, is particularly prone to such conditions, boosting demand for effective and safe laxatives such as lactulose. Growing health awareness and an expanding middle-class population are fueling demand for digestive health supplements, functional foods, and OTC pharmaceuticals.

Europe Lactulose Market Trends

The growth of Europe lactulose market is driven by the region’s aging population - by 2030, over 25% of the EU population will be aged 65 or older, leading to a higher incidence of chronic constipation and hepatic encephalopathy (HE). Countries like Germany, France, Italy, and the UK are leading consumers due to well-established healthcare systems and high pharmaceutical usage. Lactulose is widely used as an over-the-counter laxative and is included in several national clinical guidelines for treating HE. The European Food Safety Authority (EFSA) has approved lactulose as a prebiotic ingredient, boosting its use in functional foods and infant nutrition, particularly in markets like the Netherlands and Scandinavia, where digestive health products are popular.

North America Lactulose Market Trends

The North America lactulose market also sees strong demand in pediatric care, with liquid formulations like 10g/15ml syrup commonly used for children due to their mild effect and sweet taste. In Canada, the rise in digestive health supplements has made lactulose a notable prebiotic in food and nutraceuticals. Meanwhile, Mexico’s expanding generic drug industry and improvements in healthcare coverage are driving accessibility. North America also leads in veterinary use, with lactulose being prescribed for cats and dogs suffering from constipation or liver issues. Increasing consumer awareness, insurance reimbursements, and high per capita healthcare expenditure make this region highly lucrative for both domestic manufacturers and exporters of lactulose-based products.

The U.S. lactulose market is characterized by advanced medical facilities and a high diagnosis rate, which supports the consistent usage of lactulose. Additionally, a growing emphasis on gut health, prebiotic supplementation, and functional foods contributes to the compound's popularity in over-the-counter products and food applications. Increased cases of chronic constipation due to sedentary lifestyles and poor dietary habits also support the drug’s widespread usage.

Latin America Lactulose Market Trends

Latin America lactulose market’s growth is driven by rising healthcare awareness, increasing access to pharmaceutical products, and expanding food supplement use across countries like Brazil, Argentina. Brazil is the largest contributor in the region, backed by its well-established dairy and pharmaceutical sectors. With a population exceeding 200 million, increasing digestive health issues, and a growing focus on geriatric and pediatric care are fueling lactulose demand. The country also serves as a hub for whey-based product innovation, offering scope for lactulose manufacturing from dairy by-products.

Middle East & Africa Lactulose Market Trends

The Middle East & Africa lactulose market is the smallest regional market, supported by improving healthcare systems, increasing pharmaceutical imports, and greater awareness of digestive and liver health. Saudi Arabia and the United Arab Emirates lead demand due to their high healthcare expenditure and better access to medications like lactulose, commonly prescribed for constipation and hepatic encephalopathy. These countries also show rising demand in veterinary applications, especially in livestock health, due to large-scale farming operations.

Key Lactulose Company Insights

Some key players operating in the market include Abbott and Fresenius Kabi.

-

Abbott, a U.S.-based global healthcare company, operates in diagnostics, medical devices, nutrition, and branded generics. It is a Fortune 500 company with a massive international presence and strong consumer trust. Its nutrition division includes globally recognized brands like Ensure and Similac. In pharmaceuticals, Abbott offers various therapeutic products, including gastrointestinal drugs. Abbott manufactures and markets lactulose syrup formulations under different brand names used in the treatment of chronic constipation and hepatic encephalopathy. The company’s robust distribution channels and R&D support ensure widespread accessibility and high standards. Abbott's lactulose is a part of its larger gastrointestinal and liver health treatment portfolio.

-

Fresenius Kabi is a global healthcare company headquartered in Germany, focusing on lifesaving medicines and technologies for infusion, transfusion, and clinical nutrition. It serves hospitals and outpatient care with a wide range of injectable drugs, infusion therapies, and nutritional products. The company operates across over 100 countries and is a subsidiary of Fresenius SE & Co. KGaA. In the lactulose space, Fresenius Kabi manufactures oral liquid formulations used for treating chronic constipation and hepatic encephalopathy. These products are widely distributed in global pharmaceutical markets and are recognized for their consistent quality, regulatory compliance, and therapeutic reliability in digestive and liver-related disorders.

Illovo and Biofac, are some of the emerging market participants in the market.

-

Illovo Sugar Africa, a subsidiary of Associated British Foods, is the largest sugar producer in Africa. Headquartered in South Africa, the company operates sugar mills and refineries across several African nations. Besides sugar, Illovo manufactures downstream products like ethanol, furfural, and specialty health ingredients. One such specialty is lactulose, derived from lactose-rich substrates through fermentation. Illovo supplies this lactulose to pharmaceutical and nutraceutical companies for use in laxative formulations and prebiotic health products. With its strong agribusiness integration and production capacity, Illovo is a key regional supplier of lactulose ingredients in bulk, particularly within the African and European markets.

-

Biofac is a Danish pharmaceutical company specializing in fermentation-based and bioactive products for pharmaceutical, nutraceutical, and veterinary applications. It is known for its high-purity ingredients and advanced production technologies. Biofac’s product portfolio includes vitamins, amino acids, and specialty carbohydrates like lactulose. The company produces lactulose in both syrup and crystalline forms, serving global pharmaceutical manufacturers who formulate laxatives, hepatic therapies, and gut health products. Biofac’s emphasis on quality, traceability, and regulatory compliance makes it a preferred supplier in Europe and other regulated markets. Its lactulose offerings are positioned for high-value segments, including both human and veterinary health solutions.

Key Lactulose Companies:

The following are the leading companies in the lactulose market. These companies collectively hold the largest market share and dictate industry trends.

- Fresenius Kabi

- Orion Lifescience

- Morinaga Milk Industry Co., Ltd.

- Abbott

- Illovo

- Biofac

- Daiichi Sankyo

- Inalco SpA

- Casca Remedies

- Enrich Pharma

Recent Developments

-

In March 2025, Cadila Pharmaceuticals launched Cadilose, a lactulose-based solution targeting constipation and hepatic encephalopathy (HE). Cadilose acts as an osmotic laxative and prebiotic, improving bowel movement and supporting gut health. It reduces colonic pH and ammonia absorption, addressing cognitive symptoms of HE. This launch reinforces Cadila’s focus on innovative GI care.

Lactulose Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 536.2 million

Revenue forecast in 2030

USD 732.0 million

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, function, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

Fresenius Kabi; Orion Lifescience; Morinaga Milk Industry Co., Ltd.; Abbott; Illovo; Biofac; Daiichi Sankyo; Inalco SpA; Casca Remedies; Enrich Pharma

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lactulose Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lactulose market report based on form, function, application, and region.

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Syrup/Liquid

-

Powder

-

Crystalline

-

Other Forms

-

-

Function Channel Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Sweetening Agent

-

Laxative

-

Hepatic Encephalopathy

-

Aftermarket

-

-

Lactulose Applications Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Animal Feed

-

Veterinary

-

Other Applications

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lactulose market size was estimated at USD 506.0 million in 2024 and is expected to reach USD 536.2 million in 2025.

b. The global lactulose market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 732.0 million by 2030.

b. Asia Pacific dominated the lactulose market with a share of 37.3% in 2024. This growth is largely driven by the sheer population size, urbanization, and rising awareness of gut and liver health. Countries like China, India, and Japan are the primary growth hubs due to large aging populations, expanding middle-class healthcare spending, and a rise in lifestyle-related digestive disorders.

b. Some key players operating the lactulose market include Fresenius Kabi, Orion Lifescience, Morinaga Milk Industry Co., Ltd., Abbott, Illovo, Biofac, Daiichi Sankyo, Inalco SpA, Casca Remedies, and Enrich Pharma.

b. The lactulose market is growing due to rising demand for digestive health solutions and increasing cases of constipation and liver-related issues. Its role as a safe and effective treatment, especially for laxative and hepatic uses, supports this trend. Growing awareness about gut health and the benefits of prebiotics also adds to its demand. As people seek better health management, lactulose continues to see steady use in both medical and nutritional areas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.