- Home

- »

- Medical Devices

- »

-

Laparoscopic Electrodes Market Size Report, 2030GVR Report cover

![Laparoscopic Electrodes Market Size, Share & Trends Report]()

Laparoscopic Electrodes Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Bariatric, General Surgeries), By Product (Monopolar, Bipolar Electrodes), By End User (Hospital, Ambulatory), And Segment Forecasts

- Report ID: GVR-4-68039-935-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

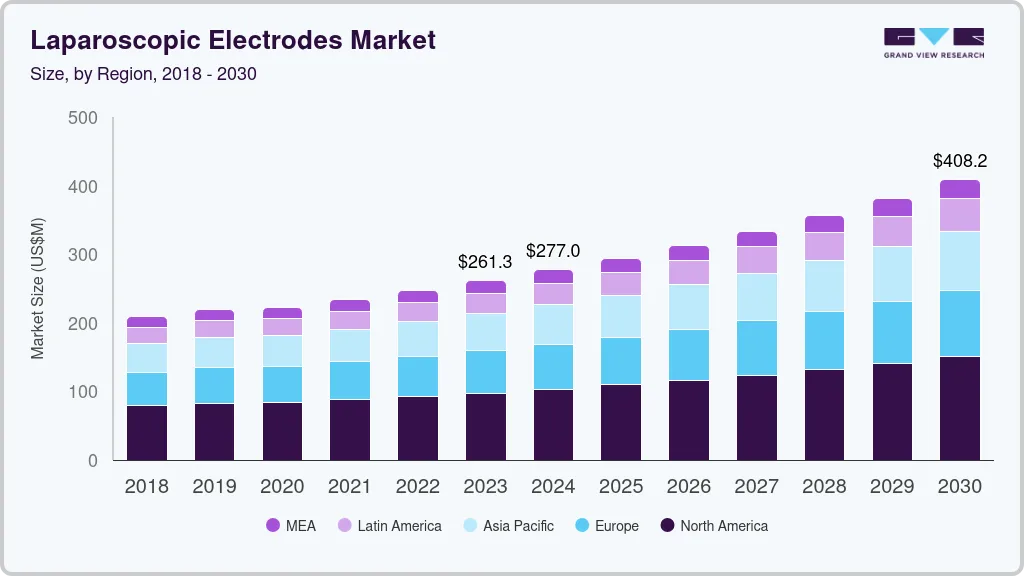

The global laparoscopic electrodes market size was valued at USD 261.3 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.6% from 2024 to 2030. Increasing preference for minimally invasive surgeries over the traditional methods, increasing prevalence of colorectal cancer, rise in the number of laparoscopic bariatric procedures, and other surgery-related technological advancements are among the major factors driving this market growth. In addition, the rapidly growing geriatric population in the Asia Pacific region, especially in countries, such as Japan, India, and China, and quick technological improvements are expected to boost the demand for laparoscopic electrodes over the forecast period.

The outbreak of the COVID-19 in the year 2020 negatively impacted the market. To allocate and direct medical supplies and capacity to the COVID-19 response, hospitals in the U.S and around the world postponed and delayed elective surgeries to varying degrees. Manufacturers have found it difficult to serve their surgeon customers since some hospitals restricted access to their facilities or changed access regulations. Almost all the companies are affected by reduced procedure volumes due to the pandemic, as all hospital resources are being diverted to fight the disease. As a result, they saw a decrease in procedural volumes in 2020, which is expected to stifle market growth.

However, the market is expected to rebound and grow over the forecast period, as most of the countries across the globe have started easing lockdown measures and resumed some of the elective procedures. Key players are planning to extend their businesses regionally and create new warehouses in other locations, as well as run their operations through numerous channels in the worst-affected areas. Companies are using a variety of tactics to deal with supply chain disruptions, including rerouting logistics, sourcing from extra partners, and air freight delivery. Local manufacturers have also benefited from the pandemic. These factors are expected to create lucrative opportunities for market growth.

The rapidly growing geriatric population in the Asia Pacific region, especially in countries with large untapped opportunities, such as Japan, India, and China, is expected to drive the market during the forecast period. Colorectal cancer is commonly diagnosed in people aged between 65 and 74 years as the risk of colorectal cancer increases with age. As per the World Bank, in 2019, more than 28% of the population in Japan was over the age of 65 years. Increased risk of colorectal and urinary bladder cancers has raised the demand for colorectal surgeries. In addition, the American Cancer Society (ACS) reported that, in 2019, the number of colorectal cancer cases in the U.S. increased to 101,420.

Thus, the growing geriatric population and increasing prevalence of colorectal cancer are expected to drive the demand for laparoscopic electrodes over the forecast period. The rising inclination towards minimally invasive surgical procedures and growing awareness about the safety and benefits of laparoscopic electrodes are majorly driving the market growth. Nowadays, minimally invasive surgical procedures are being increasingly adopted due to lower trauma associated with them. Small incisions decrease postoperative pain and facilitate speedy recovery, leading to the high adoption of these procedures, which is driving R&D in this field.

In addition, minimally invasive laparoscopic surgeries are being covered by health insurance providers in selected countries. For instance, Medicare now covers up to 75% of laparoscopic operations, as listed in the Medicare Benefits Schedule (MBS). These factors have led to the increased preference for minimally invasive surgeries by patients. As per the Journal of the Society of Laparoendoscopic Surgeons (JSLS), women who underwent single-site incision laparoscopic surgery tend to report less postoperative pain compared to traditional method laparoscopic surgery. Thus, the growing demand for single-incision laparoscopic surgery would in turn boost the market growth over the forecast period.

The U.S dominated the global market with the highest revenue share in 2021. This can be attributed to the increasing reliance on laparoscopic surgeries over open surgeries and raising awareness about the benefits of minimally invasive procedures. Furthermore, competition among prominent players, related to product innovation, will also impact the market. In addition, increasing healthcare expenditure in the U.S. may also favor the entry of both new and old players. For instance, as per the Centers for Medicare and Medicaid Services, U.S. healthcare spending increased by 4.6% and reached USD 3.8 trillion in 2019, accounting for approximately 17.7% of the GDP.

National Health spending is expected to grow at an annual rate of 5.4% from 2019 to 2028, to reach USD 6.2 trillion by the year 2028. Furthermore, several governments and non-government bodies increased their funding in healthcare sectors to support innovations and technological advancements in surgeries & other fields. For instance, healthcare finance by local and state governments had increased to 4.1% in 2017 from 3.8% in 2016. These factors are anticipated to boost the market growth. Moreover, the globally increasing incidence of obesity across all age groups is one of the major factors that can be attributed to the market growth over the forecast period.

Obesity is a major health concern, which leads to several associated diseases or complications, such as diabetes, Cardiovascular Diseases (CVDs), and cancer. For instance, as per the WHO, in 2016, more than 1.9 billion adults were overweight, out of which, around 650 million people were obese. These factors are expected to increase the demand for bariatric procedures. As the prevalence of obesity is increasing, the number of bariatric surgeries is also likely to increase, which is expected to directly drive the market for laparoscopic electrodes.

Product Insights

Based on the product, the market is categorized into monopolar and bipolar electrodes. The monopolar electrodes segment captured the largest market share of more than 53.00% in 2021. Increasing preference for minimally invasive surgeries, adoption of monopolar electrosurgery instruments by laparoscopic surgeons, and high prevalence of chronic conditions are some of the major factors responsible for the segment growth. Electrodes are an integral part of electrosurgical procedures. A wide range of these electrodes is available and is used based on certain variables, such as surgery objective and tissue types involved.

In addition, the frequent introduction of innovative monopolar hand instruments by key market players has augmented the segment growth. In October 2019, Apyx Medical Corp. (BOVIE MEDICAL) received the U.S. FDA approval to market Apyx Plasma/RF Handpiece, a single-use monopolar electrode for cutting, coagulation, and ablation of soft tissue. The device is an addition to the Renuvion product portfolio. Thus, the abovementioned factors are expected to fuel the market growth during the forecast period. The bipolar electrodes segment is expected to grow at the fastest CAGR from 2022 to 2030 owing to its growing applications in sensitive cases, including those pertaining to neurology, ophthalmology, and otolaryngology.

Moreover, the use of bipolar electrodes during electrosurgery significantly reduces the risk of patient burns. The rising frequency and incidence of diseases, such as colorectal cancer, are likely to fuel market expansion. For instance, colorectal cancer was the third-most frequent cancer in women and men, in 2020, according to the World Cancer Research Fund International, with around 1.90 million new cases reported. Colorectal cancer is most commonly treated with laparoscopic surgery. As a result, the rising prevalence of colorectal cancer is predicted to boost market growth over the forecast period.

End-user Insights

The end-user segment includes clinics, hospitals, and ambulatory surgical centers. The hospital segment dominated the market with a share of more than 61.80% in 2021. The growth of this segment can mainly be attributed to an increase in the number of patients suffering from various chronic diseases and the consequent rise in surgical procedures. In comparison to other healthcare settings, hospitals see a significantly higher inflow of patients for bariatric surgeries or other laparoscopic procedures, owing to the ease of handling any emergencies that may arise during surgical procedures and the availability of a wide range of treatment options in such facilities.

For instance, according to the American Society for Metabolic and Bariatric Surgery, in 2019 alone, 256,000 people in the U.S. underwent weight-loss surgery. Thus, the aforementioned factors are expected to drive the hospital segment. Moreover, hospitals are the primary health system in the majority of countries; therefore, the number of laparoscopic surgeries done at hospitals is relatively high than in other healthcare settings, such as Ambulatory Surgery Centers (ASCs) or clinics. Thus, the demand for laparoscopic electrodes in hospitals is comparatively high than in other end-use segments. The ASCs segment is expected to grow at the fastest CAGR during the forecast period.

This is due to an increase in the adoption of minimally invasive surgeries, a high preference for outpatient surgeries, and the cost-effectiveness of ambulatory surgical center-based laparoscopic procedures. Lower post-surgical complications in minimally invasive laparoscopic surgery, on the other hand, are predicted to boost the demand for ambulatory surgery facilities. In comparison to hospitals, they provide patients with various benefits, including same-day release and faster procedure times. Because laparoscopic operations are less invasive, most intra-abdominal surgeries can now be performed at ASCs. As a result of the factors discussed above, the ASCs segment is expected to rise rapidly over the forecast period.

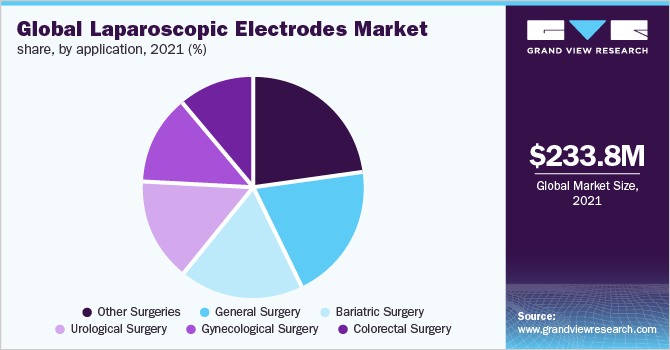

Application Insights

Based on applications, the global market has been further categorized into urological surgery, bariatric surgery, general surgery, gynecological surgery, colorectal surgery, and other surgeries. In 2021, the other surgeries segment dominated the market with a share of 23.03% of the global revenue. Cholecystectomy laparoscopy, appendectomy laparoscopy, thoracic laparoscopy, colon laparoscopy, and prostrate laparoscopy are among the most common procedures. Colon laparoscopy, for instance, is predicted to rise steadily as a result of ongoing innovation aimed at improving its success rate.

Thus, this segment is expected to witness a moderate growth rate over the forecast period. On other hand, the bariatric surgeries segment is expected to grow at the fastest CAGR during the forecast period owing to the increasing incidence of obesity in adults due to excessive intake of calories and changing lifestyle habits. For instance, according to the CDC, around 13.0% of the population (aged 18 years & above) are obese and 41.0 million children under the age of 5 years suffer from obesity.

Furthermore, the American Heart Association has estimated the total medical cost for bariatric surgery to reach up to USD 957.0 billion from USD 861.0 billion by 2030. Moreover, government support and increased awareness about unhealthy food/drinks & their impact on BMI are further expected to boost the demand for bariatric surgeries during the forecast period. Laparoscopic electrodes are among the essential requirements for bariatric surgeries and increasing demand for such surgeries is anticipated to fuel the segment growth.

Regional Insights

North America dominated the global market in 2021 and accounted for the maximum share of more than 37.00% of the global revenue. Increasing dependence on laparoscopic surgeries compared to open surgeries is a major factor driving the market. In addition, competition among prominent players, related to product innovation, will also impact the market. Furthermore, surgeons are now recommending laparoscopy over traditional surgeries, as it allows for rapid healing and positive outcome. In addition, increasing healthcare expenditure in the U.S. may also favor the entry of both new and old players. For instance, as per the Centers for Medicaid and Medicare Services, U.S. healthcare spending increased by 9.7% & reached USD 4.1 trillion in 2020, accounting for approximately 19.7% of the GDP.

Asia Pacific is expected to be the fastest-growing market during the forecast period owing to a rise in the number of advanced, well-equipped hospitals and high volumes of surgical procedures. Singapore and South Korea are some of the emerging economies in the Asia Pacific regional market. Advancing technology, increasing investments, improving reimbursement scenarios, and growing medical tourism is likely to drive the Asia Pacific regional market. Other driving factors for the country are affordable devices, an increase in mergers & acquisitions, and government initiatives to improve healthcare services. The government has made significant investments to provide basic health insurance to all citizens.

Key Companies & Market Share Insights

With the surge in demand for minimally invasive laparoscopic procedures, global manufacturers are enforcing higher product quality through mergers and acquisitions. Also, numerous market players are investing in R&D for developing innovative products. For instance, in 2017, Ethicon Inc., acquired Megadyne Medical to accelerate Ethicon’s advanced energy devices portfolio with Megadyne’s innovative portfolio of electrosurgical tools. In February 2019, CONMED Corp. announced the acquisition of Buffalo Filter LLC, a healthcare company specializing in surgical smoke evacuation technologies. Through this acquisition, the company will expand its General Surgery product portfolio by providing smoke-evacuation products, such as smoke evacuators, smoke evacuation pencils, and electrodes.

Furthermore, product launches, strategic acquisitions, and innovation are the major strategies adopted by companies to retain their market share. The market is currently consolidated with a few companies capturing the maximum share. However, recent market dynamics and increasing demand for innovative technologies are making way for a number of new entrants. The emergence of local players in developing countries, especially in China and India, is expected to increase the competition at the global level. Local players in these countries offer equipment at much lesser prices due to the availability of low-cost labor and raw materials. Some of the prominent players in the global laparoscopic electrodes market include:

-

Medtronic

-

Ethicon U.S., LLC. (Johnson and Johnson)

-

Olympus Corp.

-

CONMED Corp.

-

B. Braun Melsungen AG

-

Millennium Surgical Corp.

-

LiNA Medical ApS

-

AngioDynamics

-

Bovie Medical (Apyx Medical)

-

RUDOLF Medical

Laparoscopic Electrodes Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 277.0 million

Revenue forecast in 2030

USD 408.2 million

Growth rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; Mexico; Colombia; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Medtronic; Ethicon U.S., LLC. (Johnson & Johnson); Olympus Corp.; Conmed Corp.; B. Braun Melsungen AG; Millennium Surgical Corp.; LiNA Medical ApS; AngioDynamics; Bovie Medical (Apyx Medical); RUDOLF Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global laparoscopic electrodes market report on the basis of product, application, end-user, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Monopolar Electrodes

-

Bipolar Electrodes

-

-

Application Outlook (Revenue USD Million, 2018 - 2030)

-

Bariatric Surgery

-

Urological Surgery

-

Gynecological Surgery

-

General Surgery

-

Colorectal Surgery

-

Other Surgeries

-

-

End-user Outlook (Revenue USD Million, 2018 - 2030)

-

Hospital

-

Clinic

-

Ambulatory

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global laparoscopic electrodes market size was estimated at USD 233.79 million in 2021 and is expected to reach USD 246.95 million in 2022.

b. The global laparoscopic electrodes market is expected to grow at a compound annual growth rate of 6.48% from 2022 to 2030 to reach USD 408.20 million by 2030.

b. North America dominated the laparoscopic electrodes market with a share of 37.50% in 2021. This is attributable to the high adoption rate of advanced technology, the presence of skilled professionals, and huge investments by governments in the development of innovative medical devices in the region.

b. Some of the key players operating in the laparoscopic electrodes market include Medtronic, Ethicon US, LLC. (Johnson and Johnson), Olympus Corporation, CONMED Corporation, B. Braun Melsungen AG, Millennium Surgical Corp., LiNA Medical ApS, AngioDynamics, Bovie Medical (Apyx Medical), RUDOLF Medical

b. Key factors that are driving the laparoscopic electrodes market growth include the increasing adoption of minimally invasive surgeries over the traditional methods, the increasing prevalence of colorectal cancer, the increase in the number of laparoscopic bariatric procedures, and other surgery related technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.