- Home

- »

- Electronic & Electrical

- »

-

Large Cooking Appliance Market Size, Industry Report, 2030GVR Report cover

![Large Cooking Appliance Market Size, Share & Trends Report]()

Large Cooking Appliance Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cooktops, Ovens, Specialized Appliances), By Application (Household, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-104-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Large Cooking Appliance Market Trends

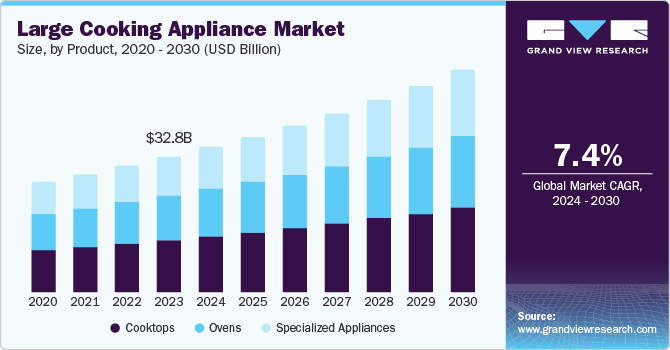

The global large cooking appliance market size was valued at USD 32.79 billion in 2023 and is expected to expand at a CAGR of 7.4% from 2024 to 2030. The rising standard of living and increasing consumer preference for modular kitchens are significant contributors. The rapid depletion of natural resources such as LPG and wood has also led to a higher demand for specialized and energy-efficient cooking appliances. Urbanization is another crucial driver, as more people move to urban areas, leading to smaller households and a greater need for compact and efficient cooking solutions.

The growing number of nuclear families and working women has increased the demand for convenient and smart cooking appliances. Furthermore, the trend towards eco-friendly and energy-saving alternatives also propels market growth. Moreover, the rise in disposable incomes, particularly in emerging economies, enables more consumers to invest in high-end and premium cooking appliances. The growing awareness of health and wellness also influences market growth as consumers look for appliances that support healthier cooking methods, such as ovens and cooktops.

The expansion of the e-commerce sector has made it easier for consumers to access a wide range of cooking appliances, often at competitive prices and with convenient delivery options. Furthermore, continuous technological advancements and innovations in cooking appliances, such as induction and multi-functional appliances further drive market growth.

Product Insights

The cooktops segment dominated the market with the largest revenue share of 38.2% in 2023. Cooktops are essential in residential and commercial kitchens, offering versatility and efficiency. The increasing trend of modular kitchens and the preference for sleek, built-in appliances have significantly boosted the demand for cooktops. Technological advancements, such as induction and smart cooktops, have made these appliances more appealing to consumers. The growing awareness of energy efficiency and the shift towards eco-friendly cooking solutions also contribute to the popularity of cooktops.

The specialized appliances segment is expected to grow at the fastest CAGR of 7.8% over the forecast period. There is a rising demand for appliances that cater to specific cooking needs and preferences, such as air fryers, sous-vide machines, and multi-cookers. These appliances offer convenience and versatility, appealing to consumers experimenting with different cooking techniques and recipes.

The increasing focus on health and wellness also drives the demand for specialized appliances that promote healthier cooking methods. For instance, steam ovens and air fryers are gaining popularity as they allow for cooking with less oil and preserving more nutrients in food.

Technological advancements are also crucial to this segment’s growth. Innovations such as smart connectivity, precise temperature control, and user-friendly interfaces are making specialized appliances more attractive to consumers. Furthermore, the growing trend of home cooking and the influence of cooking shows and social media encourage consumers to invest in these specialized appliances.

Application Insights

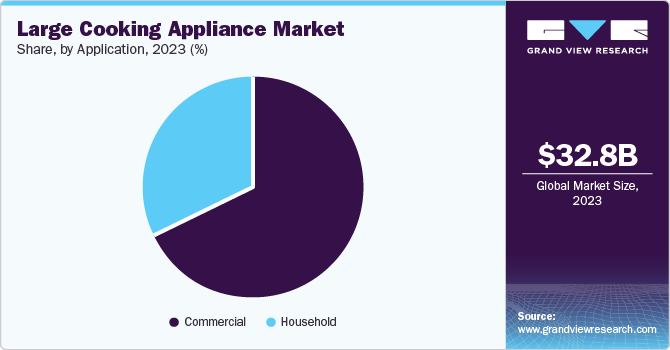

The commercial segment dominated the market with the largest revenue share in 2023. This dominance is driven by the robust demand from the hospitality industry, including restaurants, hotels, and catering services, which require high-capacity and durable cooking appliances to meet their operational needs. The growth in the food service industry, coupled with the increasing number of dining establishments and the trend towards eating out, has significantly boosted the demand for commercial cooking appliances. Additionally, advancements in technology, such as energy-efficient and smart appliances, are further propelling the growth of this segment.

The household segment is expected to grow significantly over the forecast period. This growth is fueled by several factors, including the rising trend of home cooking and the increasing popularity of cooking as a hobby, influenced by cooking shows and social media. The shift towards healthier eating habits and the demand for appliances that support these preferences, such as air fryers and steam ovens, are also contributing to the growth of the household segment. Furthermore, the increasing adoption of smart home technologies and the availability of a wide range of innovative and user-friendly cooking appliances are expected to drive the growth of this segment. The rise in disposable incomes, particularly in emerging economies, enables more households to invest in high-quality, advanced cooking appliances.

Regional Insights

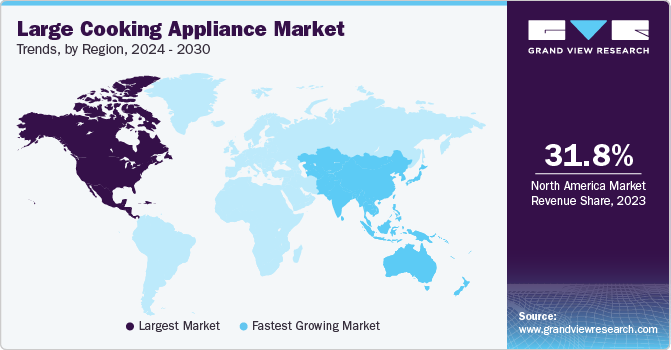

North America’s large cooking appliances market dominated the global market with revenue share of 31.8% in 2023. The region’s high disposable income levels and the strong preference for advanced and energy-efficient appliances play a crucial role. Furthermore, widespread adoption of smart home technologies and increasing trend of kitchen remodeling and renovation projects is expected to drive the demand for large cooking appliances in North America.

U.S. Large Cooking Appliances Market Trends

The U.S. large cooking appliances market is expected to grow significantly over the forecast period owing to the presence of key industry players and continued innovative products tailored to meet needs of consumers. Furthermore, the increasing awareness of energy conservation and the availability of eco-friendly appliances are also contributing to the market’s growth.

Europe Large Cooking Appliances Market Trends

Europe's large cooking appliances market was identified as a lucrative region in 2023. The region’s strong economic stability and high disposable income levels enable consumers to invest in advanced and premium cooking appliances. Furthermore, the growing trend of smart home and high adoption of smart home appliances are significantly driving market growth.

The UK's large cooking appliances market is expected to grow significantly over the forecast period. The demand for energy-efficient and eco-friendly appliances is rising, influenced by stringent environmental regulations and a growing awareness of sustainability among consumers. Furthermore, well-established brands and continuous technological innovations contribute to its attractiveness.

Asia Pacific Large Cooking Appliances Market Trends

Asia Pacific large cooking appliances market is expected to grow at the fastest CAGR of 7.9% over the forecast period. Rising disposable incomes in the region have increased consumer spending on high-quality, advanced cooking appliances. Urbanization and modern lifestyles also contribute to this trend, as more people seek convenient and efficient cooking solutions, such as smart and modular kitchen appliances. Technological advancements, including smart features, energy efficiency, and connectivity, attract consumers who desire the latest kitchen convenience.

India’s large cooking appliances market is expected to grow significantly in the coming years. The expansion of e-commerce platforms has made it easier for consumers to access a wide range of cooking appliances, often with competitive pricing and convenient delivery options. Furthermore, supportive government policies and initiatives promoting energy-efficient appliances encourage consumers to upgrade their old cooking appliances to more efficient models. These factors collectively contribute to the robust growth of the market. For instance, The Bureau of Energy Efficiency (BEE) has implemented an energy efficiency-labeling program for appliances, including large cooking appliances like ovens and microwaves. This help consumers make informed choices and encourages manufacturer to produce more energy-efficient products.

Key Large Cooking Appliance Company Insights

Some key companies in the large cooking appliances market include Whirlpool Corporation, Samsung Electronics Co. Ltd, Hitachi Appliances Inc., Morphy Richards, Haier Group Corporation, Koninklijke Philips N.V., Robert Bosch GmbH, and others. . Companies are focusing on launching new designs and increasing product ranges. Moreover, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Samsung Electronics Co. Ltd., a global leader in consumer electronics, has made a significant strides in the large cooking appliances market. Samsung offers a wide range of products including cooktops, ovens, and specialized kitchen equipment. The company advantages advanced technology to create energy-efficient and smart appliances that cater to modern kitchen needs.

Key Large Cooking Appliances Companies:

The following are the leading companies in the large cooking appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics Co. Ltd.

- LG Electronics Inc.

- Morphy Richards

- Whirpool Corporation

- Hitachi Appliances Inc.

- AB Electrolux

- Haeir Group Corporation

- Robert Bosch GmbH

- Koninklijke Philips N.V

- Hitachi Appliances Inc.

Recent Developments

-

In April 2024, SAMSUNG, a prominent company in the consumer electronics industry, demonstrated its latest portfolio additions empowered by Artificial intelligence technology, including a Smart AI induction cooktop (80cm).

-

In May 2024, Toshiba, a key market participant in smart kitchen appliances, unveiled an addition to its W3 series offerings, the Air Fry Microwave Oven (MW3-AC26SF), equipped with a combination of ChefDefrost and OriginInverter technology.

-

In January 2024, TTK Prestige, an established brand in the home and kitchen appliances market, unveiled a range of offerings, including Tri-ply Flip-on Cooker, Induction Cooktop V3, Endura Pro Mixer Grinder, Svachh Neo Gas Stove, Hard Anodised Non-Stick cookware and others, for its customers and modern homemakers,

Large Cooking Appliance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 35.16 billion

Revenue forecast in 2030

USD 53.91 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and UAE

Key companies profiled

Samsung Electronics Co. Ltd.; LG Electronics Inc.; Morphy Richards; Whirpool Corporation; Hitachi Appliances Inc.; AB Electrolux; Haeir Group Corporation; Robert Bosch GmbH; Koninklijke Philips N.V; Hitachi Appliances Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Large Cooking Appliance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global large cooking appliance market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cooktops

-

Ovens

-

Specialized Appliances

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.