- Home

- »

- Automotive & Transportation

- »

-

Last Mile Delivery Market Size, Share & Growth Report, 2030GVR Report cover

![Last Mile Delivery Market Size, Share & Trends Report]()

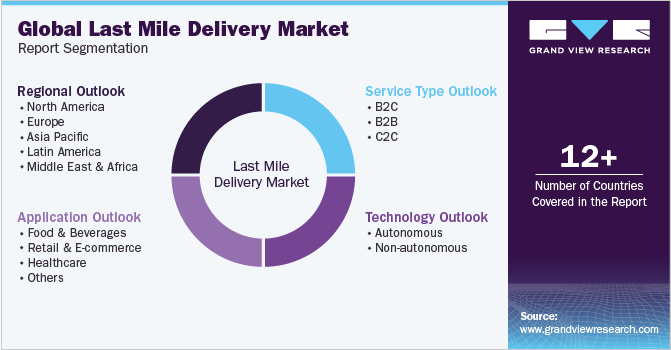

Last Mile Delivery Market (2023 - 2030) Size, Share & Trends Analysis Report By Service Type (B2C, B2B, C2C), By Technology (Autonomous, Non-Autonomous), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-110-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Last Mile Delivery Market Summary

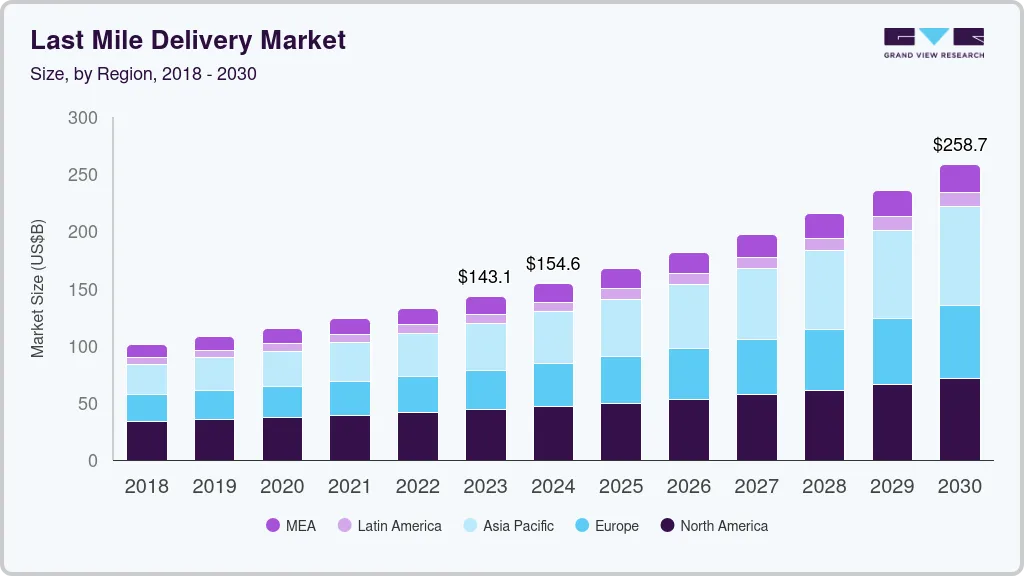

The global last mile delivery market size was estimated at USD 132.71 billion in 2022 and is anticipated to reach USD 258.68 billion by 2030, growing at a CAGR of 8.8 from 2023 to 2030. Key drivers propelling the market growth include rising consumer expectations for same-day or next-day deliveries, the imperative for real-time tracking and visibility, the ascent of on-demand services, and the challenges posed by urban congestion and sustainability considerations.

Key Market Trends & Insights

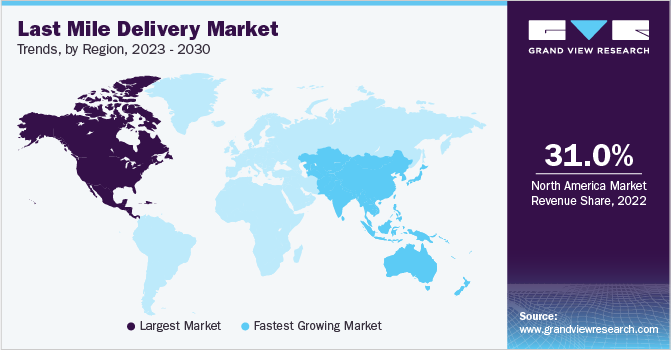

- North America led the overall market in 2022 with more than 31.0% of the market share.

- Asia Pacific is expected to expand notably with a CAGR of 11.1% during the forecast period.

- By service type, the B2C segment led the market and accounted for more than 70.0% share of the global revenue in 2022.

- By technology, non-autonomous segment led the market and accounted for around 98.0% share of the global revenue in 2022.

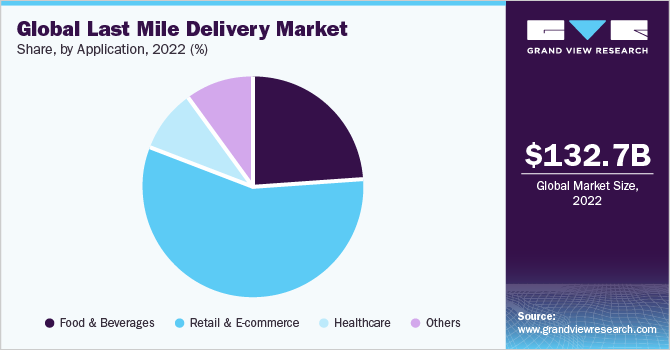

- By application, retail & e-commerce segment led the market and accounted for more than 57.0% share of the global revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 132.71 Billion

- 2030 Projected Market Size: USD 258.68 Billion

- CAGR (2023-2030): 8.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The concept pertains to the final phase of the logistics process, involving transporting goods from a distribution center or local hub to the ultimate destination, typically the customer's doorstep or a retail store. This stage holds paramount significance as it represents the last interaction point with the customer and has a substantial impact on overall customer experience and satisfaction. In recent times, the market has gained exceptional prominence due to the surge in e-commerce and the escalating demand for prompt and reliable services. Businesses, retailers, and logistics companies are heavily investing in streamlining their last-mile operations to ensure punctual and efficient deliveries. This drive for optimization has given rise to a multitude of innovative methods and cutting-edge technologies.

The market is projected to evolve as companies discover more cost-effective and environment-friendly solutions to meet the ever-growing demands of contemporary consumers. Technological advancements such as autonomous vehicles and drones are being actively explored in this pursuit, heralding a transformation in the last-mile delivery landscape.

COVID-19 Impact on the Last Mile Delivery Market

The market for Last Mile Delivery witnessed a significant impact from the COVID-19 pandemic. As countries implemented lockdowns and restrictions to contain the virus, online shopping and e-commerce activities surged. This sudden surge in demand for home deliveries put immense pressure on last-mile services, compelling them to swiftly adapt to changing consumer behavior and delivery requirements. The closure or limitations of physical retail stores further fueled the demand for last-mile delivery, driving substantial growth in e-commerce sales.

However, amidst this market growth, certain factors negatively affected the industry. Last-mile delivery providers faced a considerable increase in workload, leading to delivery delays in some regions due to workforce limitations and transport disruptions. Delivery personnel encountered health and safety risks while frequently interacting with multiple customers daily, prompting companies to implement strict safety protocols and provide personal protective equipment (PPE) to mitigate these concerns.

Despite the challenges, the COVID-19 pandemic also presented opportunities for the Last Mile Delivery space. The accelerated shift towards e-commerce and technology adoption during the pandemic is expected to have a lasting impact on the industry beyond the pandemic period. As a result, companies are prioritizing enhancing their last-mile delivery capabilities to meet evolving customer expectations and preferences in the post-pandemic business landscape.

Service Type Insights

The B2C segment led the market and accounted for more than 70.0% share of the global revenue in 2022. Based on service type, the market is bifurcated into B2C, B2B, and C2C. The expansion of the B2C (Business-to-Consumer) segment can be attributed to the significant shift in consumer behavior toward online shopping and the increased prevalence of e-commerce platforms. Consequently, businesses have recognized the need to offer highly efficient and customer-centric services, thereby bolstering the growth of the B2C segment. This trend will persist as companies acknowledge the importance of providing seamless, convenient, and customer-oriented service experiences.

To address the evolving preferences of modern consumers in the digital era, prudent investments in streamlined last-mile logistics and the strategic utilization of technology will remain crucial. In tandem with this development, several companies have adopted direct-to-consumer (D2C) business models, circumventing traditional retail channels. This strategic shift underscores the significance of the B2C service type as an integral mechanism for establishing direct connections with end consumers. As businesses continue to embrace these approaches, the B2C last-mile delivery sector is poised for continued growth and prominence in the dynamic landscape of contemporary commerce.

The C2C segment is anticipated to witness a CAGR of 11.4% throughout the forecast period. The adoption of C2C (Consumer-to-Consumer) last-mile delivery service type is on the rise, reflecting an increasing trend where individual consumers utilize the services to facilitate direct deliveries between themselves. In this model, individuals, without the intermediation of traditional businesses or retailers, deliver goods to other consumers. The proliferation of peer-to-peer marketplaces and online platforms has significantly facilitated the growth of the C2C service type.

These platforms serve as intermediaries, connecting individuals seeking to send or receive goods, thereby establishing a decentralized network for the execution of such deliveries. As C2C last-mile delivery gains momentum, it brings forth both opportunities and challenges. On the one hand, it offers notable advantages, including potential cost savings, heightened flexibility, and a sense of community engagement. On the other hand, concerns may arise in terms of ensuring reliability, security, and accountability within the peer-to-peer delivery model.

Technology Insights

The non-autonomous segment led the market and accounted for around 98.0% share of the global revenue in 2022. In terms of technology, the market is bifurcated into autonomous & non-autonomous. Non-autonomous technology has witnessed substantial adoption in the market, which is attributed to several notable factors. Despite the considerable attention garnered by autonomous delivery technologies such as drones and self-driving vehicles, non-autonomous methods dominate the last-mile delivery landscape. This prominence can be attributed to the cost-effectiveness, adaptability, flexibility, and other favorable attributes of non-autonomous last-mile solutions.

Specifically, non-autonomous vehicles and methods offer higher cost efficiency, especially for transportation over short to medium distances. In contrast, the initial expenses associated with implementing autonomous technologies can be prohibitively high, rendering non-autonomous options more appealing, particularly for businesses constrained by budgetary considerations. Furthermore, the longevity of non-autonomous technology practices underscores their proven success in implementation and operation, contributing to a heightened sense of trust and confidence among both companies and customers. This established track record enhances the reliability and dependability of non-autonomous methods, further reinforcing their enduring appeal in the dynamic domain of last-mile delivery.

The autonomous segment is anticipated to expand at a considerable CAGR of 17.6% during the forecast period. The logistics industry is undergoing significant transformation as technological advancements pave the way for adopting autonomous solutions, such as drones and self-driving vehicles. This adoption is expected to witness accelerated growth, facilitated by ongoing enhancements in autonomous technologies.

These bolster their capabilities, reliability, and safety, rendering them increasingly viable for real-world deployment in last-mile delivery operations. The continuous progression of this technology is likely to shape the future of last-mile delivery, with both autonomous and non-autonomous methods playing complementary roles, offering a comprehensive and adaptable solution to meet the evolving needs of businesses and consumers alike.

Furthermore, consumer familiarity with autonomous technologies across different aspects of their lives is anticipated to foster greater acceptance of autonomous technology, subsequently fueling the growth of this market segment. This rising consumer acceptance, combined with the operational efficiencies and transformative potential offered by autonomous solutions, contributes to the positive outlook for the market's expansion. As businesses and consumers embrace the prospects presented by autonomous technology, it is poised to reshape the dynamics of last-mile logistics, elevating efficiency, enhancing customer experiences, and opening new avenues for progress in the industry.

Application Insights

The retail & e-commerce segment led the market and accounted for more than 57.0% share of the global revenue in 2022. The market is bifurcated in terms of application into retail & e-commerce, healthcare, food & beverages, and others. The Last Mile Delivery market holds immense significance in both the retail and e-commerce sectors, facilitating the timely and efficient transportation of goods from distribution centers or fulfillment centers to the final destination - the customers' doorstep.

The predominant role of last-mile services in these applications can be attributed to various key drivers that address the distinct requirements of retail and e-commerce operations. Notably, the relentless pursuit of customer satisfaction, the imperative to maintain competitiveness, and the ongoing growth of online shopping significantly contribute to the dominance of the retail and e-commerce sector.

In the retail sector, last-mile delivery plays a pivotal role for brick-and-mortar retailers seeking to expand their market reach and offer online shopping options to their clientele. The ascent of omnichannel retailing has fueled the adoption of last-mile delivery, which strives to provide seamless shopping experiences, affording customers the convenience of placing orders online and receiving their purchases promptly at their preferred location. Similarly, in the e-commerce sector, last-mile delivery serves as a critical component within the entire supply chain, directly influencing customer satisfaction and repeat business. As e-commerce continues its flourishing trajectory, it emerges as a central focus for companies endeavoring to distinguish themselves in the fiercely competitive online marketplace.

The food & beverages segment is anticipated to expand at a considerable CAGR of 11.0% through the forecast period. The food and beverage industry experiences significant growth due to the need to efficiently transport perishable goods from establishments to consumers' doorsteps. This expansion is driven by the rising popularity of food delivery services due to changing consumer preferences, convenience, and the impact of COVID-19, emphasizing contactless delivery options.

Additionally, the growth of cloud kitchens and food delivery platforms optimizes operations, enticing customers and fueling demand for efficient services. Technological advancements in real-time tracking, route optimization, and mobile applications further enhance capabilities and visibility, supporting this sector's high growth in demand for last-mile delivery services. As consumer demand for convenience persists, the market is primed for continued expansion in the food & beverage application segment.

Regional Insights

North America led the overall market in 2022 with more than 31.0% of the market share. North America emerged as the dominant player in the market owing to several key factors contributing to its supremacy in the evolving logistics landscape. Firstly, the region experienced a significant upsurge in e-commerce activities, with a growing number of consumers favoring online shopping for its convenience and product variety. This bolstered the demand for efficient last-mile delivery services, elevating the region's prominence. North America's robust technological infrastructure was pivotal in supporting last-mile delivery growth.

The widespread implementation of advanced logistics technologies, including real-time tracking systems, route optimization algorithms, and automated delivery solutions, enhanced the efficiency and visibility of last-mile operations. The combined impact of these drivers solidified North America's leadership in the last-mile delivery market in 2022, reaffirming the region's commitment to addressing the evolving needs of modern consumers in the digital era. As e-commerce continues to expand and logistics technologies advance, North America is poised to maintain its influential role in shaping the future of last-mile delivery.

Asia Pacific is expected to expand notably with a CAGR of 11.1% during the forecast period, due to the region’s robust growth and its transformation into a leading force in the rapidly evolving logistics landscape. The Asia Pacific region's dominance in the last-mile delivery market can be attributed to several key drivers. The region is experiencing significant growth in e-commerce activities, driven by a rising middle-class population, increasing smartphone penetration, and growing internet connectivity, leading to a surge in online shopping and demand for efficient deliveries.

This combined impact has solidified the region's position as a dominant player in the last-mile delivery market, which is poised for continued growth and influence. As the e-commerce sector continues to thrive and technological innovations advance, the Asia Pacific region is expected to maintain its leadership role in shaping the trajectory of the last-mile delivery industry.

Key Companies & Market Share Insights

The last-mile delivery market boasts a dynamic and fiercely competitive landscape, with numerous players offering diverse delivery solutions to cater to the increasing demands of consumers and businesses. This landscape encompasses established logistics providers, prominent e-commerce giants, innovative startups, and technology companies. Key players bolster their market presence and expand their market share by employing various development strategies, such as product launches and mergers & acquisitions. Furthermore, they continuously introduce new features to enhance the customer experience, further intensifying the competition within the last-mile delivery market.

In June 2023, Amazon announced its plans to enlist small businesses as part of its initiative to enhance last-mile delivery operations. This project, spanning 23 states in the U.S., would involve diverse small businesses, such as clothing stores, florists, and bodegas. Amazon approximates that a small business could earn up to USD 27,000 per year by undertaking delivery responsibilities. The anticipated average delivery volume for these companies has been set at around 30 packages daily. This delivery commitment includes weekends but excludes major holidays, and the estimated earnings for each package delivered amount to approximately USD 2.50. Some of the key players operating in the global last mile delivery market include:

-

A1 Express Services Inc.

-

Deutsche Post AG (DHL GROUP)

-

Power Link Expedite

-

United Parcel Service, Inc. (UPS)

-

FedEx

-

XPO Logistics, Inc.

-

Amazon.com

-

Kerry Logistics Network Limited

-

Drone Delivery Canada Corp.

-

A2Z Drone Delivery, LLC

Last Mile Delivery Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 143.10 billion

Revenue Forecast in 2030

USD 258.68 billion

Growth Rate

CAGR of 8.8% from 2023 to 2030

Historic year

2017 - 2021

Base year for estimation

2022

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Service type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; India; South Korea; Australia; China; Japan; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

A1 Express Services Inc.; Deutsche Post AG (DHL GROUP); Power Link Expedite; United Parcel Service, Inc. (UPS); FedEx; XPO Logistics, Inc.; Amazon.com; Kerry Logistics Network Limited; Drone Delivery Canada Corp.; A2Z Drone Delivery, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Last Mile Delivery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global last mile delivery market report based on service type, technology, application, and region.

-

Service Type Outlook (Revenue, USD Million, 2017 - 2030)

-

B2C

-

B2B

-

C2C

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Autonomous

-

Non-autonomous

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Food & Beverages

-

Retail & E-commerce

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global last mile delivery market size was estimated at USD 132.71 billion in 2022 and is expected to reach USD 143.10 billion in 2023.

b. The global last mile delivery market is expected to grow at a compound annual growth rate of 8.8% from 2023 to 2030 to reach USD 258.68 billion by 2030.

b. North America dominated the last mile delivery market with a share of more than 31.1% in 2022. The region experienced a significant upsurge in e-commerce activities, with a growing number of consumers favoring online shopping for its convenience and product variety which is expected to continue the market dominance across the region.

b. Some key players operating in the last mile delivery market include A1 Express Services Inc, Deutsche Post AG (DHL GROUP), Power Link Expedite, United Parcel Service, Inc. (UPS), FedEx, XPO Logistics, Inc, Amazon.com, and Kerry Logistics Network Limited, among others.

b. Key drivers propelling the last mile delivery market growth include the consumers' rising expectations for same-day or next-day deliveries, the imperative for real-time tracking and visibility, and the ascent of on-demand services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.