- Home

- »

- Pharmaceuticals

- »

-

Latin America And Caribbean Hemp-Derived Cannabidiol Market Report, 2030GVR Report cover

![Latin America And Caribbean Hemp-Derived Cannabidiol Market Size, Share & Trends Report]()

Latin America And Caribbean Hemp-Derived Cannabidiol Market Size, Share & Trends Analysis Report By Product (Personal Care And Cosmetics, Nutraceuticals), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-922-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

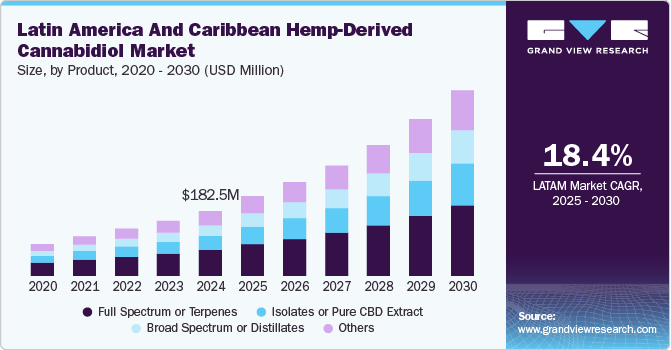

The Latin America and Caribbean hemp-derived cannabidiol market size was estimated at USD 182.45 million in 2024 and is projected to grow at a CAGR of 18.4% from 2025 to 2030. Latin America and the Caribbean region have been key regions for cannabis, and the low cost of labor & high potential of agricultural benefits from farming have been key drivers propelling growth in the region. The region has vast agricultural potential, owing to which hemp farming can be cost-effective. Similar quantities of hemp-derived products cost less than contemporary products grown outside. This is due to the low labor cost and lower construction costs in the region. For instance, Colombia has over 3,000 licenses granted for its processing and cultivation and more than 57,000 hectares of legal cannabis crops.

Many countries in the region have a basic implementation of the legal use of CBD oil for medicinal purposes; patients receive medical prescriptions for the use of hemp-derived CBD oil and then import products from the countries or companies having distribution channels to purchase CBD products. For instance, in June 2022, the board of Agência Nacional de Vigilância Sanitária (ANVISA) authorized the importation of cannabis plant derivatives, specifically the extract in its raw form. This extract can subsequently be purified to produce pharmaceutical-grade CBD for use in formulating cannabis products within Brazil. This new legislation marks that importation is no longer restricted to Ingredient Active Pharmaceuticals (“IFA”).

The growing legalization of cannabis for medical and recreational purposes in various countries in this region fuels the market growth. For instance,

-

In December 2013, Uruguay became the first country in the globe to legalize the cultivation, distribution, and sale of cannabis for recreational and medical purposes.

-

In June 2021, the Supreme Court of Mexico decriminalized the use of cannabis for recreational purposes.

-

In Colombia, industrial hemp and medical cannabis were legalized in 2021 and 2016, respectively.

In April 2023, the Hemp Fair Brasil 2023 was held in São Paulo, South America. This event aims to be the largest cannabis fair in Brazil, organized to receive visitors in person and online. More than 20,000 attendees are anticipated to explore the exhibitor booths and participate in various concurrent events. Organized by the Brazilian Association of Cannabis Industries (ABICANN) and produced by the Comunicar Bem agency, the Hemp Fair Brasil features a support initiative with over 110 exhibitor stands. These are open to companies and social organizations looking to provide or obtain solutions related to cannabis raw materials and inputs. Thus, the organization of events in these regions fuels market growth.

Favorable government initiatives and growing investments in these regions propel the market growth. For instance, in May 2024, The Ministry of Commerce, Industry, and Tourism of Colombia invested USD 1.28 million and introduced a program aimed at capitalizing on the potential of the hemp and cannabis industry to produce a wide range of products, including medicinal and agricultural bio-inputs products.

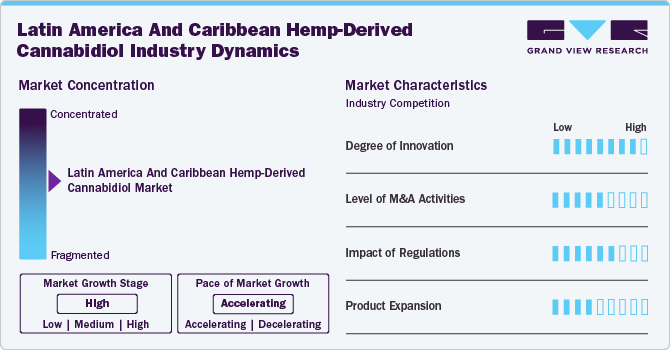

Market Concentration & Characteristics

The market is characterized by a high degree of innovation owing to rising product demand due to its health benefits without intoxication, increased R&D activities on the use of CBD and its medicinal properties, and growing preference for cannabis extracts such as tinctures and oils.

The market is characterized by a medium level of merger and acquisition (M&A) activity. facilitating access to complementary technologies and distribution channels to capture a larger market share. For instance, in October 2024, MedCana, a Texas-based cannabis company, acquired seven cannabis companies in Colombia, which are as follows,

-

Cannehealth Business

-

Cannabicolombia Group

-

Remedium

-

Organic Leaves

-

Vital Cannabis

-

Royal Cannabis

-

Elemental Genetics

The ease of regulations and the establishment of a robust framework for using CBD fuels market growth. For instance, in Brazil, the manufacturing and sale of cannabis-based medicines are permitted. Manufacturers must obtain a Certificate of Good Manufacturing Practice from ANVISA to produce and sell these products. In addition, they must secure special authorization and operating permits and provide technical documentation on product quality to comply with ANVISA's prior requirements. Once authorized by ANVISA, manufacturers are able to distribute their products to pharmacies nationwide.

Several market players are expanding their business by launching new solutions in the market to expand their product portfolio. For instance, in September 2021, Aurora Cannabis Inc. launched Bidiol, Uruguay's first medical cannabis oil. It is available in concentrations of 3% and 10%.

Product Insights

The full spectrum or terpenes segment led the market with the largest revenue share of 41.0% in 2024. The full spectrum products or terpenes-containing products have anti-inflammatory properties due to which it is highly preferred over products containing only CBD. It has better medical properties, which is a key factor for a large market share. For instance, in April 2024, Sannabis, Inc., a Colombia-based cannabis company, launched Sannabis NO LICK Terpene Spray to enhance the entourage effect when added directly to cannabis products.

The broad spectrum or distillates segment is expected to grow at the fastest CAGR over the forecast period. Since these broad-spectrum or distillates do not contain a detectable amount of THC, they are procured by various businesses on a wholesale basis. They usually contain three or more cannabinoids in a limited range. They are used to produce soft gels, fruit chews, gummies, topical ointments, formulated oil drops, and other oil-soluble products. Furthermore, favorable regulations for importing and exporting CBD isolates and distillates fuel the market growth. For instance, in November 2021, Avicanna Inc., a biopharmaceutical company, expanded its medical cannabis products brand Rho Phyto in the Caribbean region with initial export to Bryden Stokes Limited, a distribution partner in Barbados.

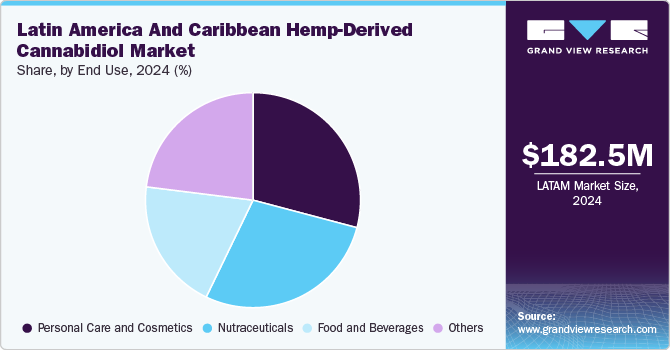

End Use Insights

Based on end use, the personal care and cosmetics segment led the market with the largest revenue share of 29.1% in 2024. The segment's growth is attributed to the recent legalization of the use of CBD products in a medical capacity and the consumers' growing adoption of hemp-derived CBD-based products. Hemp has become a vastly used ingredient in cosmetic and personal care products, resulting in the popularity and demand for hemp-derived products. The growing market caters to a selected income group, but the ever-increasing consumer base and various strategies implemented by market players in the region drive segment growth. For instance, in September 2023, Aurora Cannabis Inc., the Canadian cannabis company, partnered with Herbarium, the herbal medicine company in Brazil, to expand its hemp-derived CBD portfolio into Brazil.

The food and beverages segment is expected to grow at the fastest CAGR over the forecast period. There is an increasing consumer interest in cannabis-infused food and beverages as more individuals become aware of the health benefits associated with CBD. This trend is mainly observed among the younger population seeking alternative wellness products. According to the Colombian Association of Cannabis Industries, the cost of raw products grown in the LATAM and Caribbean is three times less than its North American counterpart. The region has begun to see its potential to become a main hub for hemp farming, which fuels the segment growth.

Regional Insights

Mexico Hemp-Derived Cannabidiol Market Trends

Mexico dominated the Latin America and Caribbean hemp-derived CBD market with the largest revenue share of 29.5% in 2024. The Mexican law permits the sale of CBD products as supplements with THC content below 1%. In 2018, the country allowed the import and distribution of CBD products to retailers and pharmacies nationwide. The Mexican government has approved Manna Health to sell, buy, lease, supply, import, or export any products related to health and wellness. Moreover, CBD Life is the sole provider of CBD-infused edibles such as gummies, energy drinks, and a line of infused teas in the country. Such factors boost the country's market growth.

Key Latin America And Caribbean Hemp-Derived Cannabidiol Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Latin America And Caribbean Hemp-Derived Cannabidiol Companies:

- Khiron Life Sciences Corp

- CBD Life

- Remederi

- Pharmin

- Elixinol

- Isodiol International Inc.

- LEEF Organics

- CBD Skincare Company

- ENDOCA

Recent Developments

-

In January 2024, Ease Labs Pharma, a cannabis pharmaceutical company in Brazil, received approval from the Brazilian Health Regulatory Agency for its Cannabis sativa Extract locally, a full-spectrum extract containing up to 0.2% THC, 750mg (25mg/mL) of CBD, and other cannabinoids.

-

In July 2023, Barbados’ cannabis authority partnered with GrowerIQ, a cannabis technology company, to track and report all production of cannabis on the island.

Latin America And Caribbean Hemp-Derived Cannabidiol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 225.52 million

Revenue forecast in 2030

USD 524.39 million

Growth rate

CAGR of 18.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

Latin America

Country scope

Brazil; Mexico; Colombia; Peru; Puerto Rico; Aruba; Barbados; Jamaica; Bermuda

Key companies profiled

Khiron Life Sciences Corp; CBD Life; Remederi; Pharmin; Elixinol; Isodiol International Inc.; LEEF Organics; CBD Skincare Company; ENDOCA

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America And Caribbean Hemp-Derived Cannabidiol Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the Latin America and Caribbean hemp-derived Cannabidiol market report based on product, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Isolates or Pure CBD Extract

-

Broad Spectrum or Distillates

-

Full Spectrum or Terpenes

-

Others

-

-

End Use Outlook (Revenue USD Million, 2018 - 2030)

-

Personal Care and Cosmetics

-

Food and Beverages

-

Nutraceuticals

-

Others

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

Latin America

-

Brazil

-

Mexico

-

Colombia

-

Peru

-

Puerto Rico

-

Aruba

-

Barbados

-

Jamaica

-

Bermuda

-

Frequently Asked Questions About This Report

b. The Latin America and Caribbean hemp-derived cannabidiol market size was estimated at USD 182.45 million in 2024 and is expected to reach USD 225.52 million in 2025.

b. The Latin America and Caribbean hemp-derived cannabidiol market is expected to grow at a compound annual growth rate of 18.4% from 2025 to 2030 to reach USD 524.39 million by 2030.

b. Full-spectrum or terpenes dominated the Latin America and Caribbean hemp-derived cannabidiol market with a revenue share of 40.0% in 2024. The full spectrum products or terpenes-containing products have anti-inflammatory properties due to which it is highly preferred over products containing only CBD. It has better medical properties, a key factor in its large market share.

b. Some key players operating in the Latin America and Caribbean hemp-derived cannabidiol market include Khiron Life Sciences Corp, CBD Life, Remederi, Pharmin, Elixinol, Isodiol International Inc., LEEF Organics, CBD Skincare Company, and ENDOCA.

b. Factors such as rising product demand due to its health benefits without intoxication, increased R&D activities on the use of CBD and its medicinal properties, and growing preference for cannabis extracts such as tinctures and oils drive the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."