- Home

- »

- Medical Devices

- »

-

Latin America Diabetes Devices Market, Industry Report, 2030GVR Report cover

![Latin America Diabetes Devices Market Size, Share & Trends Report]()

Latin America Diabetes Devices Market Size, Share & Trends Analysis Report By Type (Blood Glucose Monitoring Devices, Insulin Delivery Devices), By Distribution Channel, By End-use (Hospitals, Homecare), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-209-7

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The Latin America diabetes devices market size was valued at USD 17.21 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.52% from 2024 to 2030. The rising diabetic and geriatric population, widening knowledge about the various treatments available for the disease, and supportive national health programs for the government are the driving factors of the market. Furthermore, the market is also witnessing several R&D activities among the prominent players.

Latin America consists of countries with large populations, and the majority of these nations are undergoing economic transition. This region has a younger age distribution, with a growing population diagnosed with type I and type II diabetes. In 2021, annual mortality rates due to diabetes were 410,000. The increasing awareness of the disease in the region has led to a substantial rise in diagnosed cases, escalating the demand for glucose monitoring devices.

The region is witnessing a notable shift in its health landscape, with diabetes and other chronic diseases becoming prevalent. Major investments by key market players in the emerging economy and the presence of a large target population are factors expected to drive market growth. However, the low affordability of advanced technologies by end users may hinder market growth in the region.

CGM has become a popular alternative to portable finger-prick glucometers available in the market, offering convenience to diabetic patients. Sensors play a crucial role in CGM devices, opening new avenues to assess the effectiveness of individual patient therapeutic plans offline and stimulating the development of innovative online applications. The cost of CGM devices is decreasing with the advent of new technologies in the region. Additionally, factors like innovative product development and demographic changes, such as an aging population and higher obesity rates, are expected to drive market growth.

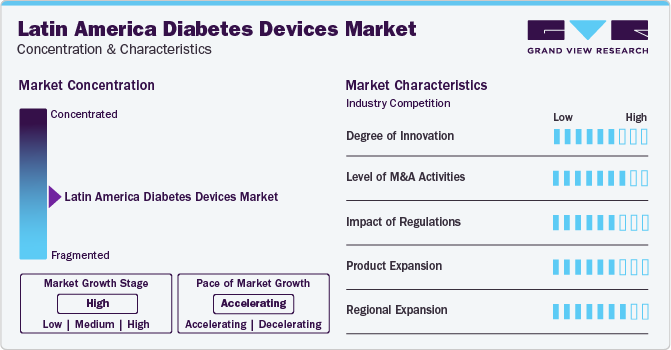

Market Concentration & Characteristics

The region is witnessing a moderate degree of innovation. However, several R&D activities are taking place in the market as the key players are investing more resources in this. The capacity of the manufacturers to invest in R&D activities to launch tailored products is likely to offer a competitive edge to the market players.

The diabetes devices market in Latin America is moderately competitive, with the presence of some major companies offering diabetes devices. Hence, major players in the market are adopting several strategies like mergers & acquisitions and partnerships & collaborations to stay competitive in the market. Several market players are acquiring smaller players to strengthen their market position. Several key players like Novo Nordisk and Medtronic are engaged in this growth strategy in this region. For instance, in August 2020 Medtronic acquired Companion Medical and added InPen to its diabetes device portfolio.

In several parts of Latin America, manufacturers are required to comply with premarket approval processes before marketing their applications. For instance, Manufacturers are required to comply with the regulations governed by the National Health Surveillance Agency (ANVISA) before the sale of any devices in Brazil. Another example is that foreign manufacturers are required to appoint a Mexican Registration Holder as a prerequisite to market devices in Mexico.

Technological advancements in diabetes devices, such as the introduction of advanced insulin pumps and pens, are propelling the demand for these products. Leading manufacturers are focusing on technological innovations and the development of advanced products to gain a substantial share of the market and further expand their product reach.

The diabetes devices market is highly competitive due to the presence of key market players such as Abbott Laboratories, BD, and LifeScan, Inc. The presence of these well-established players in the market having broad product portfolios and strong regional presence is likely to limit the regional expansion of new players.

Type Insights

The insulin delivery devices segment held the largest revenue share of 52% in 2023. This segment is further divided into pens, pumps, syringes, and jet injectors. The pens offer portability making it more convenient for the users. Syringes are the most common form of insulin delivery along with being the most cost effective. These have received greater recognition since COVID-19. Such factors are projected to boost the segment’s growth in the forecast period.

The BGM devices segment is expected to witness a fast CAGR over the forecast period. The availability of low-cost blood glucose monitoring devices and their accuracy in glucose level reading is a significant contributing factor to the segment’s growth. Furthermore, companies are initiating more product developments and launching more cost-effective, technologically advanced, easy-to-use products. This is expected to boost the demand for the blood glucose monitoring devices market.

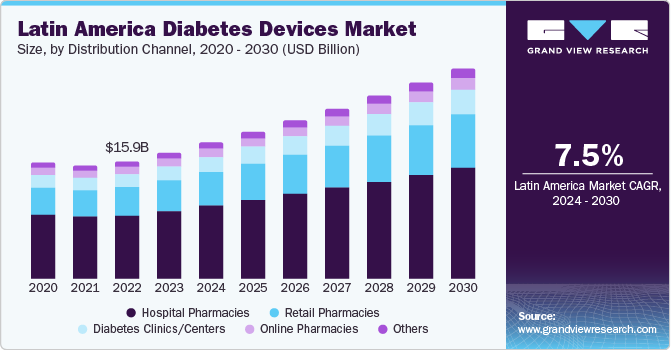

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share of 54% in 2023. Inpatient and outpatient pharmacies are the two types of pharmacies operating in hospitals. The use of CGM has increased widely in hospitals owing to the rising popularity of devices for outpatient continuous blood glucose level monitoring and the use of devices for ICU patients. Hence, these devices are increasingly being used in hospital settings and are majorly distributed by the pharmacies affiliated with these hospitals.

The retail pharmacies segment is expected to witness the fastest CAGR over the forecast period as they are considered the most accessible buying option for patients. Medication, self-monitoring glucose supplies (meter, testing strips, lancing device), insulin delivery equipment, and OTC products are some of the diabetes care products offered by retail pharmacies. With the trend of checking basic health parameters at home, this is expected to witness a high growth owing to the service deliveries.

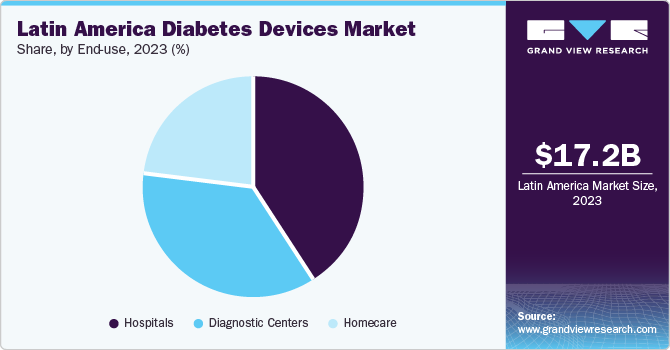

End-use Insights

The hospitals segment held the largest revenue share of 41% in 2023. Latin America’s hospitals have been proactive in adopting advanced diabetes devices and technologies to improve patient care and outcomes. This is due to the rising cases of diabetes in the region. Many hospitals and healthcare settings have increased the use of CGM devices for the identification of blood sugar levels in patients suffering from diabetes mellitus. This growth is projected to continue as hospitals keep addressing patient needs.

The diagnostic centers segment is expected to witness the fastest CAGR over the forecast period. Diagnostic centers in Latin America are witnessing the fastest growth owing to the growing prevalence of diabetes in the country and the increased demand for specialized healthcare services. The region has witnessed the initiation of many modern diagnostic centers that are equipped with the latest technologies and medical equipment to provide precise and effective treatment.

Country Insights

Latin America diabetes devices market is primarily driven by Brazil, Mexico, and Argentina. Growing investments by market players in the region, proximity to North America, and free-trade agreements with major countries such as the U.S., Canada, Japan, & several European countries are among the factors anticipated to boost the Latin America market during the forecast period.

Brazil Diabetes Devices Market Trends

Advanced devices and other home health applications for diabetes are in high demand in Brazil. People in Brazil primarily consider using devices manufactured in the U.S., Europe, and Canada. However, due to lower costs, there is a preference for domestic applications. Manufacturing costs in Brazil are lower compared to developed countries, attracting several market players for investment in the country. All applications must comply with Brazil’s Good Manufacturing Practices, which are similar to ISO 13485 and QSR. The Sistema Único de Saúde (SUS) provides financial support to private health institutions through financial grants and reimbursement for medical procedures, devices, and drugs after an agreement is made between the private entity and the Ministry of Health.

Mexico Diabetes Devices Market Trends

Mexico has become a significant destination for affordable medical device manufacturing, offering skilled yet affordable manufacturing labor, proximity to major markets, and impressive infrastructure capabilities. The presence of a major market player, Medtronic, in the country also represents lucrative growth opportunities. In Mexico, manufacturers need to comply with the rules governed by the Federal Commission for Protection from Sanitary Risks (COFEPRIS), which classifies devices into six different groups: diagnostic agents, medical equipment, orthotics, prosthetics, and functional aids, hygiene devices, surgical materials, and dental supplies. Reimbursement for care in Mexico only exists for patients with private healthcare insurance coverage.

Argentina Diabetes Devices Market Trends

Argentina’s medical device market offers excellent business opportunities as it virtually imports all medical applications. Despite stringent currency regulations, high inflation, and low foreign investment, the country is still an attractive destination for medical device manufacturers. This is due to the current high demand for imported essentials & specialized medical equipment, a reasonable regulatory approval timeline, and the country’s remarkable hospital capacity. Thus, the country represents lucrative growth opportunities for manufacturers of diabetes devices.

Key Latin America Diabetes Devices Company Insights

The Latin America diabetes care market houses several key companies such as Medtronic, BD, Abbott Diabetes Care, LifeScan, Inc., Roche Diabetes Care, and many more. These companies use several strategies like M&A activities, launches, investments, and expansion to keep their presence growing in the market region. Hence, these activities are expected to impact the market growth positively.

Key Latin America Diabetes Devices Companies:

- Medtronic PLC

- ARKRAY, Inc

- Abbott Diabetes Care

- BD

- Biocorp

- LifeScan Inc.

- Novo Nordisk

- Molex

- Phillips-Medisize

- GlucoModicum

- B Braun Melsungen AG

- Roche Diabetes Care

- Johnson & Johnson

- Tandem Diabetes Care, Inc.

- Senseonics, Inc.

Recent Developments

-

In October 2023, Philips-Medisize teamed up with GlucoModicum to design and commercialize a proprietary non-invasive, wearable device that removes technology and patient-care roadblocks in continuous glucose monitoring (CGM).

-

In October 2022, BD signed an agreement with Biocorp intending to use connected technology to track self-monitored drug adherence and outcomes such as biologics, by using Near Field Communication (NFC) technology

-

In June 2022, Abbott announced the development of a Novel Continuous Gloucose-Ketone Monitoring System which is one of a kind biowearable device. the device enables diabetic people to monitor glucose and ketones continuously in one sensor only

Latin America Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.58 billion

Revenue forecast in 2030

USD 28.72 billion

Growth rate

CAGR of 7.52 from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end-use, country

Regional scope

Latin America

Country scope

Brazil, Mexico, Argentina

Key companies profiled

Medtronic PLC.; ARKRAY, Inc.; Abbott Diabetes Care; BD; Biocorp; LifeScan Inc.; Novo Nordisk; Molex; Phillips-Medisize; GlucoModicum; B Braun Melsungen AG; Roche Diabetes Care; Johnson & Johnson; Tandem Diabetes Care, Inc; Senseonics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Latin America diabetes devices market report on the basis of type, distribution channel, end use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BGM Devices

-

Self-Monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

Insulin Delivery Devices

-

Pumps

-

Pens

-

Syringes

-

Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Frequently Asked Questions About This Report

b. The Latin America diabetes devices market size was estimated at USD 17.21 billion in 2023 and is expected to reach USD 18.58 billion in 2024.

b. The Latin America diabetes devices market is expected to grow at a compound annual growth rate of 7.52% from 2024 to 2030 to reach USD 28.72 billion by 2030.

b. Brazil dominated the Latin America diabetes devices market with a share of 34.39% in 2023. This is attributable to growing prevalence of diabetes devices, rising demand for the glucose monitoring devices, insulin pumps, and other related products. The Brazilian government has also taken steps to improve diabetes care, which has further boosted the market. Some of the key players in the market include Abbott Laboratories, Roche Diagnostics, and Medtronic.

b. Some key players operating in the Latin America diabetes devices market include TAbbott Laboratories, Roche Diagnostics, Medtronic Inc., Becton, Dickinson and Company, Dexcom Inc., Johnson & Johnson, Sanofi S.A., Novo Nordisk A/S, and Insulet Corporation.

b. Key factors that are driving the market growth include increasing prevalence of diabetes in the region, which is leading to a greater demand for diabetes management products. Additionally, the rising geriatric population in the region is also contributing to market growth, as older adults are more likely to develop diabetes. Also, increasing adoption of technologically advanced diabetes devices in the region. Manufacturers are introducing products with new features such as continuous glucose monitoring systems (CGMs), which are gaining popularity among patients.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."