- Home

- »

- Biotechnology

- »

-

Latin America Digital Biology Market, Industry Report, 2030GVR Report cover

![Latin America Digital Biology Market Size, Share & Trends Report]()

Latin America Digital Biology Market Size, Share & Trends Analysis Report By Application (Cellular & Biological Simulation), By Tools (Databases), By Services, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-242-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Latin America Digital Biology Market Trends

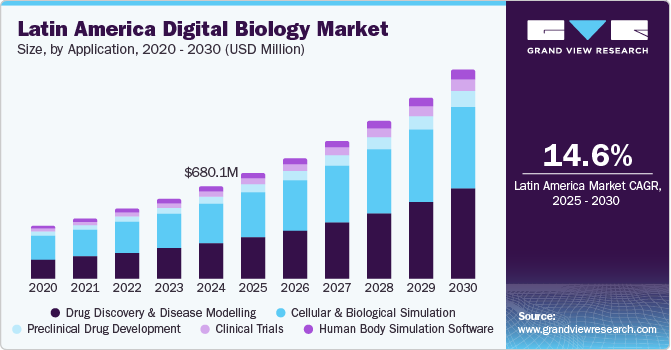

The Latin America digital biology market size was estimated at USD 680.1 million in 2024 and is projected to grow at a CAGR of 14.6% from 2025 to 2030. Innovations in genome sequencing, data analysis, and computational biology tools have enhanced the efficiency of biological research, prompting widespread adoption of digital biology technologies. In this context, companies such as Genedata AG and DUNA Bioinformatics are at the forefront, developing improved computational tools that facilitate the analysis of large datasets.

The market’s expansion is further supported by increased utilization of bioinformatics tools across educational institutions and research organizations, particularly in Brazil and Mexico. Brazilian universities are leveraging advanced software tools to process vast biological datasets, which elevates their research capabilities and stimulates demand for digital biology solutions. The collaborative efforts between academic entities and commercial organizations are fostering an environment ripe for innovation, specifically in bioinformatics applications that enhance research outcomes.

Government initiatives and funding also play a crucial role in driving the digital biology market in Latin America. For instance, the Hevolution Foundation’s commitment of up to USD 5 million through the Geroscience in Latin America program aims to support 20 to 25 aging biology projects over four years, thus enhancing the region’s biomedical research capacity. Similarly, the Pew Charitable Trusts’ funding for 10 postdoctoral fellows from various Latin American countries reflects a concerted effort to nurture emerging scientific talent and strengthen the biomedical research community.

Furthermore, the collaboration between regional scientists and global research institutions, such as the Max Planck Institutes, underscores the growing institutional support for scientific initiatives. In 2023, over 700 Latin American scientists participated in 200 active research projects in collaboration with the Max Planck Society. This interconnectedness highlights a robust commitment to scientific advancement and innovation in digital biology, positioning Latin America as an emerging hub for cutting-edge biomedical research and technology.

Application Insights

Cellular & biological simulation led the market with a revenue share of 42.4% in 2024, driven by the rise in computational methods for structural and functional genomics. These simulations enable researchers to efficiently analyze gene sequencing, protein interactions, and cellular behavior, thereby minimizing the reliance on expensive and time-intensive experimental trials, ultimately enhancing research efficiency and outcomes.

Drug discovery & disease modelling is expected to grow at the fastest CAGR of 16.4% over the forecast period. As pharmaceutical companies aim to reduce clinical trial failures and lower R&D costs, the demand for drug discovery and disease modelling is growing. Advanced modeling techniques provide improved predictions of drug efficacy and safety, facilitating the more rapid development of therapeutics specifically tailored to address prevalent diseases in the region.

Tools Insights

Databases dominated the market and accounted for a share of 37.4% in 2024 due to the increasing need for efficient data management and analysis in biological research. As researchers generate expansive datasets, robust databases become essential for the organization, retrieval, and analysis of complex biological information. This capability enhances research productivity and facilitates collaboration across institutions, thereby driving the demand for sophisticated database solutions that support the growing volume and complexity of biological data.

Software & services are expected to grow at the fastest CAGR of 14.9% over the forecast period. Researchers are increasingly depending on sophisticated software tools for data analysis and simulations. These advanced solutions streamline research workflows, improve the accuracy of biological modeling, and foster collaboration among researchers. The widespread adoption of such tools across both academic and industrial sectors in Latin America highlights the critical role of software and services in advancing digital biology initiatives.

Services Insights

Contract services held the largest market share of 51.1% in 2024, fueled by increasing outsourcing by pharmaceutical and biotech companies. This shift allows organizations to access specialized expertise and cutting-edge technologies without incurring large overhead costs. By outsourcing, companies can expedite their research timelines and enhance operational efficiency, reflecting a strategic approach to resource allocation within the competitive landscape of digital biology.

In-house services are expected to register the fastest CAGR of 14.8% over the forecast period. Digital biology tools aid in maintaining control over organizations’ research processes. By developing internal capabilities, companies can boost their innovation potential, streamline operations, and ensure compliance with specific regulatory standards. This focus on enhancing in-house expertise improves research outcomes and solidifies the organizations’ capacity to meet evolving market demands effectively.

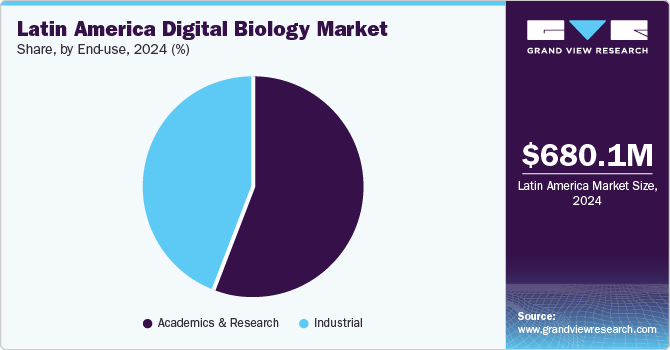

End Use Insights

Academics & research dominated the market and accounted for a share of 56.0% in 2024. The growing focus on expanding knowledge in areas such as genomics, proteomics, and bioinformatics significantly propels investment in these advanced technologies. This investment enhances collaborative efforts among researchers and leads to improved educational outcomes, positioning the region as a competitive player in the global landscape of scientific advancement.

The industrial segment is projected to grow at the fastest CAGR of 16.5% over the forecast period. Companies are effectively leveraging sophisticated technologies to optimize production efficiency, improve product quality, and expedite the time-to-market for new biologics. This trend reflects a broader acknowledgment of the pivotal role that digital biology is playing in enhancing operational capabilities and driving innovation within industrial applications, ultimately positioning businesses for greater market success.

Regional Insights

Brazil digital biology market dominated the Latin America market with a revenue share of 25.3% in 2024. The country is spearheading substantial investments in biotechnology research while emphasizing digital health solutions. Its large population offers a significant user base for digital biology applications, complemented by numerous research institutions and universities that promote innovation in the sector. For instance, Brazil is projected to have around 185.4 million mobile internet users by 2026, facilitating greater access to digital health technologies.

The digital biology market in Argentina is expected to register lucrative growth over the forecast period, supported by increasing investments in biotechnology and life sciences. The government is implementing initiatives to strengthen research capabilities and encourage collaboration between academic institutions and private enterprises. The rising prevalence of chronic diseases underscores the need for innovative diagnostic and treatment solutions, thereby boosting demand for digital biology tools. With over 40 biotechnology companies actively developing healthcare digital solutions, Argentina demonstrates a vibrant ecosystem for advancements in this field.

Key Latin America Digital Biology Company Insights

Some key companies operating in the market include DNA GTx Bioinformatics; Precigen; Dassault Systèmes; Genedata AG; and Simulations Plus. Strategic initiatives focus on partnerships to enhance research, expand product offerings, and leverage AI and computational biology, supported by favorable government policies to drive regional market growth.

-

Dassault Systèmes offers sophisticated software solutions for life sciences, emphasizing simulation and modeling to optimize drug discovery and development while enhancing collaboration among researchers.

-

Genedata AG focuses on life sciences software solutions for data integration, analysis, and management, facilitating efficient processing of large biological datasets to accelerate therapeutic development.

Key Latin America Digital Biology Companies:

- DNA GTx Bioinformatics

- Precigen

- Dassault Systèmes

- Genedata AG

- Simulations Plus

Recent Developments

-

In October 2024, Dassault Systèmes published the pioneering “ENRICHMENT Playbook” after a five-year collaboration with the FDA, guiding the medical device industry in utilizing virtual twins to streamline clinical trials.

-

In October 2024, Clarivate announced the agenda for the 2nd annual Summit LATAM in Milan, focusing on AI, strategic partnerships, and innovation to reshape the pharmaceutical landscape in Latin America.

-

In September 2024, QIAGEN collaborated with Bio-Manguinhos/Fiocruz to improve malaria and dengue detection in Brazil’s national blood donation program.

Latin America Digital Biology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 778.9 million

Revenue forecast in 2030

USD 1.5 billion

Growth rate

CAGR of 14.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, tools, services, end use, region

Regional scope

Latin America

Country scope

Brazil, Argentina, Chile, Colombia, Cuba, Uruguay, Peru, Venezuela, Costa Rica, Ecuador, Panama, Guatemala, Dominican Republic (República Dominicana)

Key companies profiled

DNA GTx Bioinformatics; Precigen; Dassault Systèmes; Genedata AG; Simulations Plus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Digital Biology Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America digital biology market report based on application, tools, services, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cellular & Biological Simulation

-

Computational Genomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Computational Proteomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Pharmacogenomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Transcriptomics and Metabolomics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Drug Discovery & Disease Modelling

-

Target Identification

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Target Validation

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Lead Discovery

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Lead Optimization

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Preclinical Drug Development

-

Pharmacokinetics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Pharmacodynamics

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

-

Clinical Trials

-

Phase I

-

Phase II

-

Phase III

-

-

Human Body Simulation Software

-

-

Tools Outlook (Revenue, USD Million, 2018 - 2030)

-

Databases

-

Infrastructure/Hardware

-

Software & Services

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house Services

-

Contract Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academics & Research

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

Cuba

-

Uruguay

-

Peru

-

Venezuela

-

Costa Rica

-

Ecuador

-

Panama

-

Guatemala

-

Dominican Republic (República Dominicana)

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."