- Home

- »

- Biotechnology

- »

-

Computational Biology Market Size & Share Report 2030GVR Report cover

![Computational Biology Market Size, Share & Trends Report]()

Computational Biology Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Database, Infrastructure & Hardware, Software Platform), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-212-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global computational biology market size was valued at USD 5.57 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.2% during 2024-2030. The growing advancements in genomics and bioinformatics, increasing demand for personalized medicine, drug discovery and development, and the need for efficient data analysis in the life sciences are driving the growth of the market for computational biology. In addition, the rising application of artificial intelligence & machine learning to computational biology is anticipated to boost the market.

The COVID-19 pandemic accelerated the adoption of computational biology solutions, specifically in vaccine discovery & development and virus genomics research. High-performance computing and machine learning techniques contributed to analyzing gigantic datasets, recognizing potential drugs, and understanding the genetic map of viruses. Thus, the computational biology field has played an important role in the COVID-19 pandemic response efforts and is expected to witness continued expansion in post-pandemic research in life sciences.

There is an increasing adoption of AI innovation in the healthcare sector which includes medicine, pharmacology, and biotechnology, where it is majorly transforming drug discovery & development. According to the news article, published in January 2023, the drug discovery & development cost for a drug averages nearly USD 1.3 billion, giving a significant opportunity for AI-based technology in drug discovery. Moreover, according to a research paper, released by Nature, in February 2022, the adoption of AI into drug discovery & drug development has increased the pipeline almost nearly to 40% yearly. Furthermore, as per an interview with one of the healthcare investors, various drug-developing organizations are utilizing AI technology in multiple ways which include machine learning algorithms to identify & validate the potential of various drugs by predicting their effectiveness and safety. AI technology is further used in optimizing the design of drugs according to its effectiveness. Thus, the adoption of AI and ML in drug development promising opportunity and is anticipated to fuel the process of drug discovery, thereby, accelerating the market growth of computational biology over the forecast period.

Furthermore, in May 2022, a Germany-based company CureVac, and a Belgium-based company myNEO collaborated to work on specific cancer antigens in order to identify & develop new mRNA immunotherapies for the vaccines for cancer. myNEO used their biological databases & bioinformatics integrated with ML to identify & validate specific target areas to create strong immune responses. Similarly, in April 2023, IBM and Moderma collaborated to use generative AI along with quantum computing to develop advanced mRNA technology, which would be used in discovery & development of vaccines. Thus, these collaborations between organizations for vaccine discoveries & development are anticipated to drive the growth of the computational biology market in the coming years.

Service Insights

Based on service, software platforms segment accounted for the largest market share of 39.06% in 2022 and is expected to expand at the fastest CAGR from 2023 to 2030. Software platforms in computational biology typically encompass a wide range of tools and technologies, including bioinformatics software, data analysis platforms, modeling, and simulation software, etc. These tools are essential for the management and analysis of large volumes of biological data, such as genomics, proteomics, and structural biology data. Furthermore, increasing demand for personalized medicines and growing drug discovery & development are some of the major factors boosting the segment growth. For instance, in May 2023, Genialis, a company specializing in computational precision medicine, announced the launch of Genialis Expressions version 3.0. The software is designed to expedite the process of discovering translational and clinical biomarkers, shedding light on complicated biological mechanisms for novel disease treatment approaches. Thus, the rising demand for computational technology in personalized medicine and drug development is anticipated to fuel the market growth of the segment from 2023 to 2030.

The infrastructure & hardware segment is expected to grow at a significant CAGR of 12.22% from 2023 to 2030. Computational biology often requires access to high-performance computing resources to perform complex simulations and data analysis tasks. The demand for more powerful hardware infrastructure services to support these computations is expected to increase as computational biology research becomes better. Moreover, in February 2021, Rescale, a startup headquartered in California, that focuses on advancing scientific and engineering simulation through its software platform and hardware infrastructure, has secured USD 50 million in funding. Thus, the growing investments in various organizations are anticipated to boost the segment growth over the period.

Application Insights

Based on application, clinical trials held the maximum market share of 26.84% in 2022. This can be attributed to the surging demand for drug discovery & development, target identification & validation, and personalized medicines. Moreover, with the increasing availability of patient data, including genomics and electronic health records, computational biology is used to analyze and interpret these patients’ data for undertaking informed clinical trial decisions. In September 2023, OSE Immunotherapeutics SA announced a peer-reviewed study in the Annals of Oncology regarding the Phase 3 clinical trial known as Atalante-1. This trial evaluated the T-cell epitope tumor vaccine Tedopi as a monotherapy in individuals with advanced HLA-A2 positive or metastatic NSCLC, specifically in the third-line treatment setting for NSCLC cases showing secondary resistance to immune checkpoint inhibitors (ICI). Thus, these factors are anticipated to propel the growth of the segment over the forecast period.

The computational genomics segment is expected to expand at the fastest CAGR of 15.99% from 2023 to 2030. Computational genomics is a field that focuses on the analysis and interpretation of genomic data using computational methods and tools. The rising incidence of cancer has propelled the growth of innovative treatments, consequently driving the demand for computational genomics in oncology research. According to World Cancer Research Fund International, approximately 18.1 million cases of cancer were reported globally in 2020, with 9.3 million occurring in males and 8.8 million in females. Furthermore, in January 2023, the personalized cancer vaccine developed by Evaxion Biotech received fast-track designation (FTD) from the FDA in combination with Keytruda for individuals diagnosed with metastatic melanoma (MM). Hence, the segment is expected to grow exponentially over the forecast period.

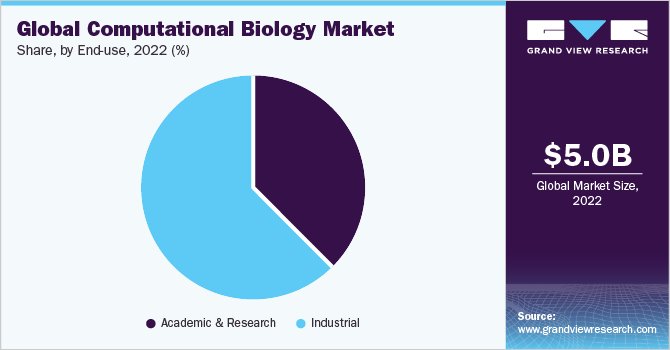

End-use Insights

The industrial segment accounted for the largest market share of 62.10% in 2022. The expanding awareness of artificial methods in computational biology, which enhance the advanced visualization and analysis of biological structures, is a key driver for the growth of the industrial segment. With an increasing demand to gain deeper insights into the metabolic interactions of therapeutic substances within the pharmaceutical & biotechnology sectors, companies are anticipated to increase the usage of advanced technologies like machine learning and artificial intelligence. Thereby, expected to accelerate the progress in drug research & development, helping in substantial innovations within the domain.

Academic & research is expected to grow at the fastest CAGR from 2023 to 2030. This can be attributed to the substantial need for computational software to enhance genome analysis within the rising research and development activities conducted in various research organizations. Furthermore, the increase in collaborative efforts and investments between public and private entities to launch new research institutes is expected to accelerate the expansion of this segment.

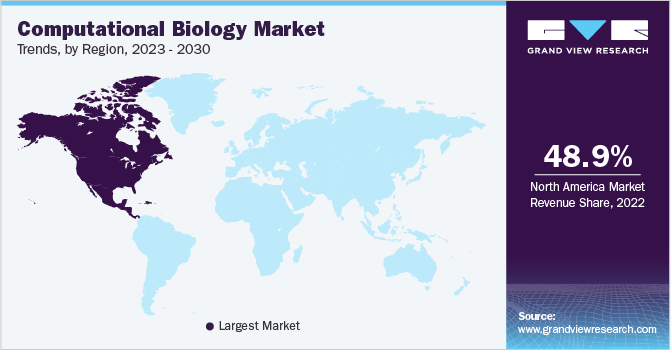

Regional Insights

North America held the largest share of 48.93% of the global market in 2022. The dominant market share is primarily due to the robust U.S. biotechnology and biopharmaceutical industry, increasing demand for computational biology in research & academic institutions for various drug discovery & development, and other factors. Moreover, the presence of major companies & organizations is anticipated to impel the adoption of advanced computational biology for various applications. In addition, significant investment in health technology is projected to drive the need to improve patient outcomes, hence, propelling the growth of the market. Thus, continuous advancements in computational biology coupled with affordable adoption of artificial intelligence, and growing investments solidify the U.S. as the world's most lucrative market.

The Asia Pacific market is anticipated to expand at a significant CAGR of 15.65% from 2023 to 2030. This trend is mainly due to rapid growth in the region’s biopharmaceutical sectors, including China and India, which leads to rising investments in healthcare IT & life science sectors. Furthermore, the rising emergence of startups focusing on bioinformatics is anticipated to accelerate the growth of the market in the region. For instance, in April 2022, an India-based AI startup Algorithmic Biologics, was planning to build a molecular computing algorithm to collect and analyze biological data which includes RNA, DNA, and various other proteins. In addition, rising government investments in better healthcare IT are propelling market growth. Hence, such government initiatives, growing R&D services, and emerging startups are anticipated to increase the adoption of computational biology in the Asia Pacific region.

Key Companies & Market Share Insights

Key market players are involved in extensive R&D for developing cost-efficient and technologically advanced products. Several strategies, such as new product launches and mergers & acquisitions are being undertaken by these players to expand their market presence which is expected to create significant growth opportunities over the forecast period. For instance, in February 2023, Accenture invested in Ocean Genomics, which is a U.S.-based technology & AI company that focuses on advanced computational platforms. This investment is expected to assist biotechnology companies in the discovery & development of personalized medicines. Such strategic initiatives by organizations are anticipated to propel the growth of the market over the forecast period. Some of the key players operating in the global computational biology market include:

-

DNAnexus, Inc.

-

Illumina, Inc.

-

Thermo Fisher Scientific, Inc.

-

Schrodinger, Inc.

-

Compugen

-

Aganitha AI Inc.

-

Genedata AG

-

QIAGEN

-

Simulations Plus, Inc.

-

Fios Genomics

Computational Biology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.57 billion

Revenue forecast in 2030

USD 13.25 billion

Growth rate

CAGR of 13.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DNAnexus, Inc.; Illumina, Inc.; Thermo Fisher Scientific, Inc.; Schrodinger, Inc.; Compugen, Aganitha AI Inc.; Genedata AG; QIAGEN; Simulations Plus, Inc.; Fios Genomics.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

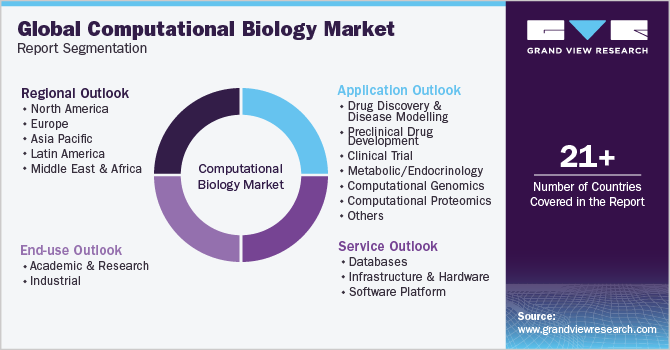

Global Computational Biology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global computational biology market based on service, application, end-use, and region:

-

Service Outlook (Revenue, USD Million; 2018 - 2030)

-

Databases

-

Infrastructure & Hardware

-

Software Platform

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Drug Discovery & Disease Modelling

-

Target Identification

-

Target Validation

-

Lead Discovery

-

Lead optimization

-

-

Preclinical Drug Development

-

Pharmacokinetics

-

Pharmacodynamics

-

-

Clinical Trial

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Computational Genomics

-

Computational Proteomics

-

Others

-

-

End-use Outlook (Revenue, USD Million; 2018 - 2030)

-

Academic & Research

-

Industrial

-

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global computational biology market size was estimated at USD 5.05 billion in 2022 and is expected to reach USD 5.57 billion in 2023.

b. The global computational biology market is expected to grow at a compound annual growth rate of 13.17% from 2023 to 2030 to reach USD 13.25 billion by 2030.

b. The promise of computational biology techniques to reduce the time and cost of drug development is expected to enhance their adoption in drug discovery programs. This has opened new opportunities for the growth of the computational biology market.

b. Key factors that are driving the market growth include the availability of enhanced computational tools, government funding & research, and rise in contract research services.

b. Some key players operating in the computational biology market include DNAnexus, Inc.; Illumina, Inc.; Thermo Fisher Scientific, Inc.; Schrodinger, Inc.; Compugen; Aganitha AI Inc.; Genedata AG; QIAGEN; Simulations Plus, Inc.; Fios Genomics

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.