- Home

- »

- Medical Devices

- »

-

Latin America Energy-based Aesthetic Devices Market Report, 2033GVR Report cover

![Latin America Energy-based Aesthetic Devices Market Size, Share & Trends Report]()

Latin America Energy-based Aesthetic Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Collagen, PMMA Microspheres), By Application (Wrinkle Correction, Lip Augmentation), By End Use (MedSpas, Hospitals), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-785-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Latin America Energy-based Aesthetic Devices Market Summary

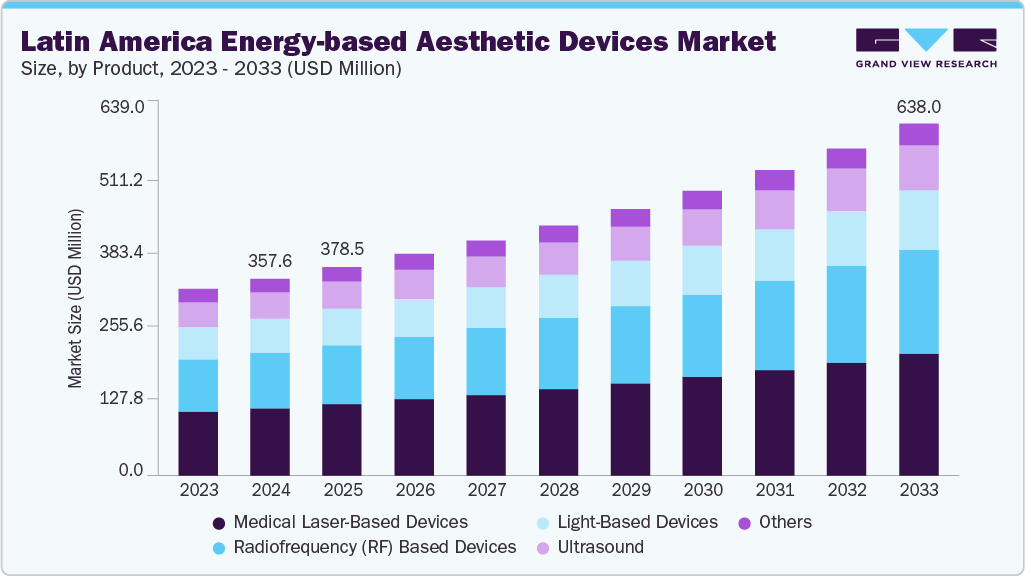

The Latin America energy-based aesthetic devices market size was valued at USD 357.6 million in 2024 and is projected to reach USD 638.0 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. This growth can be attributed to the rising demand for non-invasive cosmetic procedures, the country’s booming medical tourism sector, and expanding clinic infrastructure. Furthermore, the growing awareness among younger demographics and an influx of international patients seeking high-quality yet cost-competitive treatments.

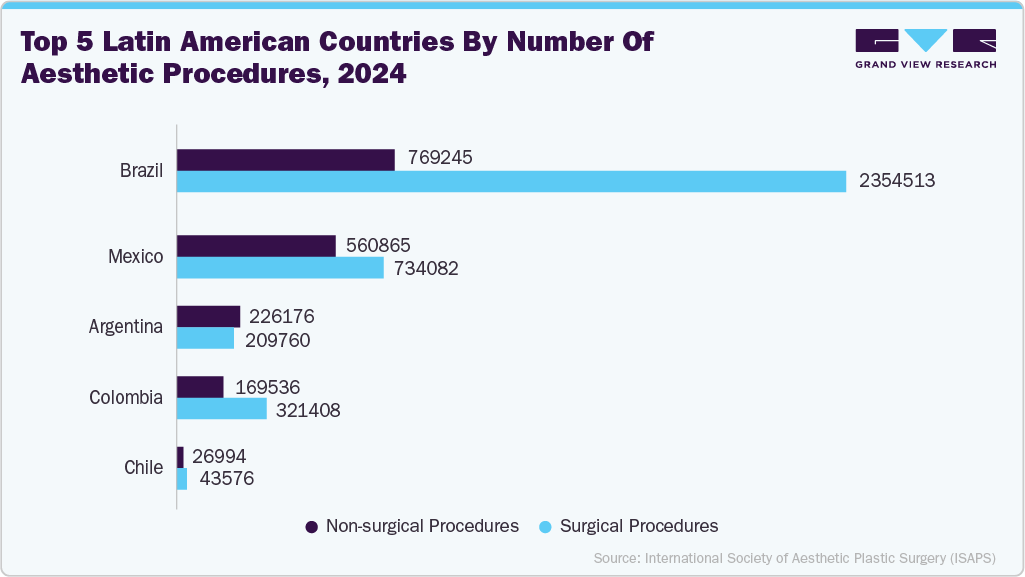

High procedural volume in aesthetic medicine is one of the major defining characteristics of Latin America, particularly Brazil, which consistently ranks among the top global markets for cosmetic procedures. In 2024, according to the International Society of Aesthetic Plastic Surgery (ISAPS), Brazil performed more surgical and non-surgical cosmetic procedures annually than nearly any other country, surpassing the U.S.in some years. Non-surgical treatments such as laser skin resurfacing, body contouring, and radiofrequency-based procedures account for a growing share of this volume, reflecting strong consumer demand for minimally invasive options. Neighboring countries like Colombia, Argentina, and Chile also see high procedure counts relative to population size, fueled by well-developed urban healthcare ecosystems.

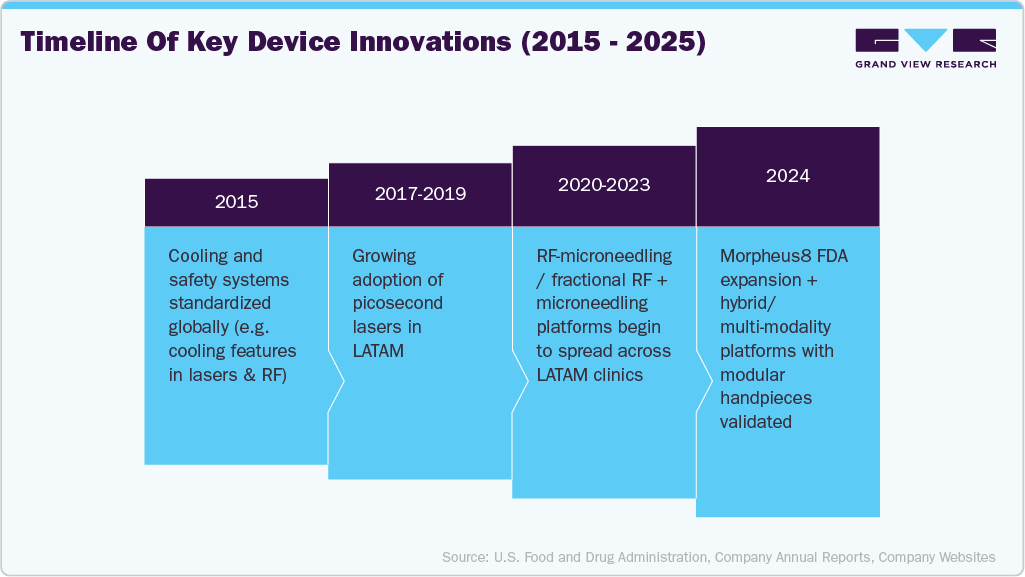

Energy-based aesthetic device technologies have recently made substantial strides globally and are increasingly relevant to Latin America. Innovations in radiofrequency (RF) microneedling, combined with RF-ultrasound platforms, picosecond lasers, and enhanced cooling systems, enable safer, more effective, and lower-downtime treatments. Though many of these devices are developed in the U.S., Europe, or East Asia, their adoption is driven in Latin America by clinics targeting safety, patient satisfaction, and differentiation in competitive urban markets.

The growing adoption of medical tourism and aesthetic treatments in Latin America is reshaping the region's healthcare landscape. Countries like Mexico, Brazil, Colombia, and Argentina have become prominent destinations for individuals seeking high-quality, cost-effective medical services. This trend is driven by several factors, including advanced medical infrastructure, skilled healthcare professionals, and competitive pricing compared to North America and Europe.

Latin America’s medical tourism industry is rapidly expanding, fueled by lower costs, high-quality services, and various treatment options. Recent data from a local medical tourism website shows that Mexico attracts over 1.2 million medical tourists yearly. Meanwhile, Costa Rica has recently experienced a 400% growth in medical tourism. Compared to the U.S., patients can save between 40-70% on procedures like laser treatments, body contouring, and skin tightening, making the region very appealing to international visitors. This growth is supported by state-of-the-art clinics, skilled healthcare professionals, and the integration of medical and travel services, solidifying Latin America’s reputation as a top choice for affordable and excellent medical and aesthetic care.

Table 1 Top Clinics & Hospitals in Latin America for Energy-Based Aesthetic Treatments

Country

City

Clinic/Hospital

Specialty

Mexico

Mexico City

Hospital Velmar

Laser hair removal, acne treatment, skin resurfacing

Guadalajara

Rejuvenate Clinic PV

Comprehensive aesthetic services, including energy-based treatments

Brazil

São Paulo

Clínica Leger

Body contouring, skin tightening, laser therapies

Rio de Janeiro

Clínica Ivo Pitanguy

Renowned for advanced laser and RF-based aesthetic procedures

Colombia

Medellín

Mery Álvarez Clinic

Facial and body treatments using state-of-the-art energy-based devices

Cali

Dcorpus International

Specializes in non-invasive body contouring and skin rejuvenation

Argentina

Buenos Aires

Clínica Dermatoestética

Offers a range of laser and RF treatments for skin rejuvenation and tightening

Chile

Santiago

Clínica Alemana

Provides advanced laser therapies for various aesthetic concerns

Dominican Republic

Santo Domingo

C Lina Esthetic & Spa by Dra. Carmelina Cerda

Venus Legacy for wrinkle reduction, skin tightening, and cellulite reduction

Santiago

Dr. Javier Baez Angles Plastic Surgery

Non-surgical body contouring and skin rejuvenation

Costa Rica

Heredia

CSI Salud Integral

Advanced laser therapies, including Fotona laser treatments

Panama

Panama City

Southern Skin & Electrology

Laser hair removal and Emerald™ Laser Body Sculpting

Source: Bookimed, Skin Solutionz, Universal Medical Travel, Minneapolis Liposuction Specialty Clinic

Technological advancements in energy-based devices have also appealed to young consumers. Innovations such as improved efficacy, reduced treatment times, and minimal downtime have enhanced the overall patient experience, making these procedures more attractive to the youth demographic. Additionally, the customization of treatments to address specific skin types and concerns has further personalized the appeal of these devices.

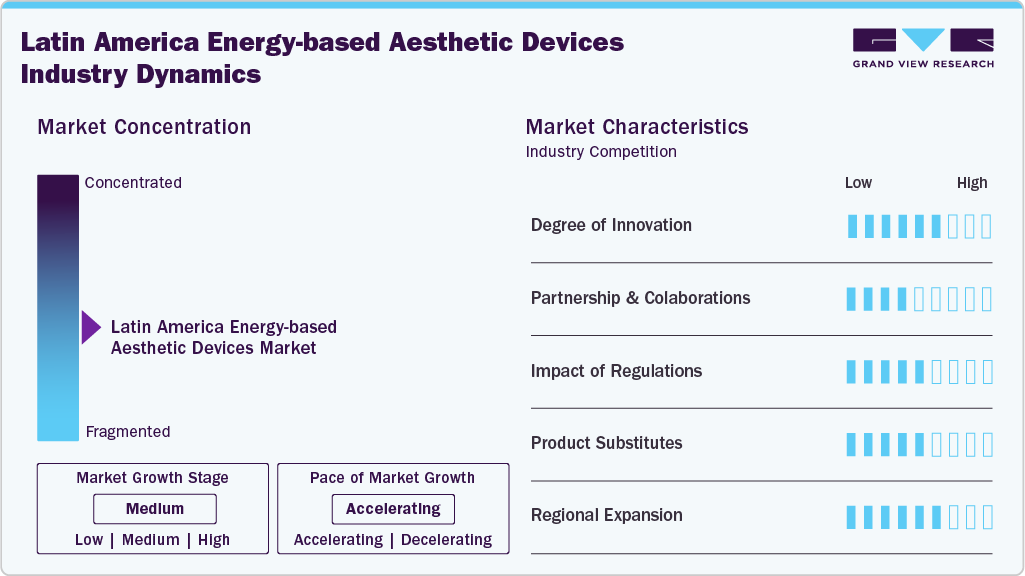

Market Concentration & Characteristics

The Latin America energy-based aesthetic devices industry is moderately concentrated, with a mix of global and regional players competing for market share. Key companies drive innovation through advanced technologies such as lasers, radiofrequency, and ultrasound-based systems. The market is characterized by growing demand for non-invasive and minimally invasive procedures, particularly for body contouring, skin tightening, and hair removal. Urban centers in countries like Brazil and Mexico lead adoption, supported by expanding medical tourism and rising disposable incomes. Strategic partnerships, distributor networks, and regulatory alignment further shape competition, while technological advancements and consumer awareness continue to accelerate industry growth.

The Latin America energy-based aesthetic devices industry is undergoing rapid innovation, particularly in RF-based skin tightening. Technologies like TriPollar enable pain-free, cooling-free treatments for body contouring, cellulite reduction, and wrinkle smoothing, offering long-lasting results without surgery or downtime. These RF systems complement ultrasound platforms, enhancing treatment versatility. Upcoming hybrid technologies, such as the geneO+ platform launching in Colombia, integrate OxyGeneo, Ultrasound, and TriPollar RF for simultaneous skin nourishment, tightening, and rejuvenation. This reflects the region’s strong shift toward multifunctional, efficient, and patient-friendly aesthetic solutions. Experts such as Julieta Spada, MD, note that:

“Latin America is an eclectic region, but what we all have in common is an appreciation for natural beauty and a balance between face and body. We are very physically expressive, and confidence in our bodies allows us to express ourselves freely.”

The Latin America energy-based aesthetic devices industry is witnessing an active wave of mergers and acquisitions as companies aim to expand portfolios and strengthen their global presence. In March 2025, Mattos Filho advised Medsystems on acquiring shares of Tarvos Holding, which oversees VYDENCE Medical’s investments. Though the deal value remains undisclosed, it marks a strategic consolidation in the sector. Fialdini Advogados represented the sellers, while Miguel Neto Advogados managed deal structuring and negotiations, ensuring smooth execution. Such transactions highlight growing investor interest and competitive positioning in Latin America’s rapidly evolving energy-based aesthetic devices industry.

Regulations play a critical role in shaping the Latin America energy-based aesthetic devices industry by ensuring product safety, efficacy, and quality. National health authorities such as Agência Nacional de Vigilância Sanitária and Comisión Federal para la Protección contra Riesgos Sanitarios enforce strict guidelines for device registration, clinical validation, and marketing authorization. These regulations enhance consumer trust and encourage responsible market growth. Compliance requirements also drive manufacturers to invest in quality control, certifications, and post-market surveillance. While regulatory variations across countries can slow product launches, harmonization efforts and streamlined approval pathways are improving regional market access and fostering innovation.

In July 2025, CLASSYS achieved a key milestone in the Latin America energy-based aesthetic devices industry with Volnewmer receiving regulatory approval from Comisión Federal para la Protección contra Riesgos Sanitarios in Mexico. This clearance allows the company to introduce its advanced monopolar RF platform for aesthetic treatments, expanding access to innovative, non-invasive procedures across the region. The approval strengthens CLASSYS’s competitive position, supporting its strategic growth and market penetration in Latin America while enhancing treatment options for clinics and medspas seeking cutting-edge RF technologies.

The Latin America energy-based aesthetic devices industry is witnessing strategic regional expansion, exemplified by Merz Aesthetics. In August 2025, Merz Aesthetics Latam celebrated the first anniversary of its São Paulo office, enhancing its footprint across Brazil, Argentina, Colombia, Mexico, and ten additional markets. The office employs over 40 regional staff and hosts the Merz Hauz innovation hub, supporting product development and market initiatives. Latin America now contributes approximately 15% of Merz’s global revenue, underscoring the region’s growing importance. This expansion reflects the industry’s focus on strengthening local presence, fostering innovation, and capturing increasing demand for energy-based aesthetic devices.

Product Insights

In 2024, medical laser-based devices dominated the Latin America energy-based aesthetic devices market, driven by rising disposable incomes, medical tourism, and greater access to minimally invasive treatments. These lasers are widely used for skin rejuvenation, hair removal, scar revision, vascular lesions, and gynecology, complemented by RF, ultrasound, and hybrid technologies for body contouring and lifting. Key players include Cutera, Cynosure, Lumenis, Syneron Candela, InMode, Fotona, Jeisys Medical Inc., CLASSYS, Merz Aesthetics, and others. In 2025, Jeisys launched its RF system DENSITY and ultrasound device LinearZ in Mexico, while Fotona expanded LA&HA training centers in Bogotá and Mexico City, strengthening clinical education and market adoption.

The Radiofrequency (RF) based devices segment is expected to register the fastest CAGR in the Latin America energy-based aesthetic devices market, driven by growing demand for non-invasive skin rejuvenation and aesthetic treatments. Key players include Lumenis, Cutera, Cynosure, Solta Medical, Jeisys Medical Inc., CLASSYS, Merz Aesthetics, Syneron Candela, Alma Lasers, and Ibramed. Candela introduced its Matrix RF microneedling system in Mexico, offering precise collagen stimulation for wrinkles, while South Korea’s HIRONIC launched its New Doublo 2.0 combining RF and HIFU, certified by Argentina’s ANMAT. Expanding middle-class awareness and international investment are boosting RF adoption across the region.

Application Insights

In 2024, skin tightening led the Latin America energy-based aesthetic devices market, driven by growing demand for noninvasive facial and body treatments. Microfocused ultrasound with visualization (MFU-V; Ulthera System) has gained prominence, delivering precise ultrasound energy guided by real-time imaging. A meta-analysis of 29 Latin American studies reported 84% patient satisfaction and significant improvements in skin firmness and laxity. Beyond the face, MFU-V is increasingly applied to arms and abdomen, addressing post-pregnancy and weight-related laxity. Clinical results show noticeable improvements within three to six months, lasting up to 18 months, with histological evidence confirming collagen regeneration, reinforcing its popularity in the region.

The skin rejuvenation segment is expected to register the fastest CAGR in Latin America’s energy-based aesthetic devices market, driven by rising demand for noninvasive, technology-driven treatments across Brazil, Peru, Chile, and Costa Rica. Training programs like Empire Medical Training’s 3-Day Facial Harmonization Masterclass in Lima, November 2025, are enhancing practitioner skills in hands-on, advanced rejuvenation techniques. Device innovations by Legolaser Group and local clinics such as Dr. Cárdenas Medical Aesthetic Center leverage lasers, RF, HIFU, and injectable therapies for effective, long-lasting results. Brazil’s centers further integrate ultrasound and global technologies, reinforcing the region as a hub for advanced facial rejuvenation.

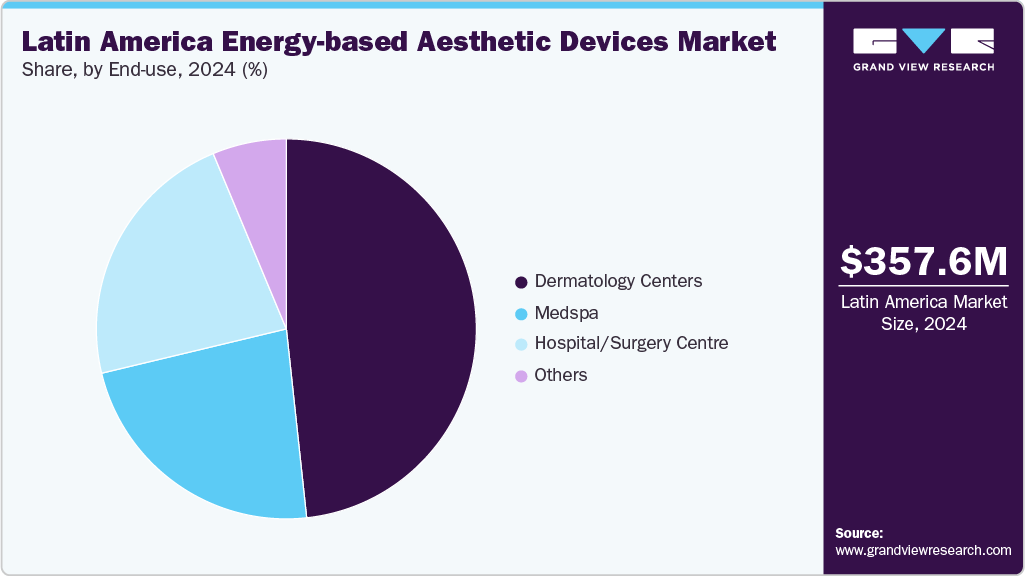

End Use Insights

In 2024, the Dermatology Centers segment led the Latin America energy-based aesthetic devices market, driven by growing adoption of advanced technologies for diverse skin concerns. Clinics use lasers, IPL, and hybrid devices to provide safe, effective, and customized treatments for Fitzpatrick III-V skin types. For example, Cali Laser Center in Colombia employs the 532 nm Sub Pulsed Laser for facial melasma, achieving 90.9% improvement in one to two sessions without post-inflammatory hyperpigmentation. In Mexico, dermatology centers like Puebla and VIDA Wellness utilize Erbium-YAG, CO₂, fractional, Fotona, and Alma hybrid lasers for skin rejuvenation, resurfacing, hair removal, and body contouring with minimal downtime.

The MedSpa segment is projected to register the fastest CAGR in Latin America’s energy-based aesthetic devices market, driven by rising demand for non-invasive, technology-driven treatments. MedSpas blend luxury spa experiences with clinically advanced procedures, employing trained professionals skilled in lasers, RF, ultrasound, and HIFU. Common services include laser hair removal, Fractional CO₂ and Fraxel resurfacing for wrinkles, hyperpigmentation, and scars, as well as HIFU and RF-based skin tightening. Body treatments utilize Liposonix, BodyTite, and Endolift, often complemented by injectables like Botox and hyaluronic acid. Clinics in Colombia and Tijuana attract local and international clients with high-quality, minimally invasive aesthetic solutions.

Country Insights

The Mexican energy-based aesthetic devices market is expanding rapidly, supported by strong demand for non-invasive treatments, growing medical tourism, and recent regulatory reforms that enhance device accessibility. In January 2023, Sofwave Medical Ltd. received COFEPRIS approval for its SUPERB technology, a non-invasive ultrasound-based skin tightening system. This milestone signaled Mexico’s openness to advanced energy-based solutions and strengthened Sofwave’s regional footprint. The device, approved by Mexico’s Federal Commission for the Protection from Sanitary Risks, is now available across hospitals, dermatology clinics, and med-spas meeting rising demand for youth-enhancing, non-surgical procedures.

Brazil Energy-based Aesthetic Devices Market Trends

The Brazilian energy-based aesthetic devices market is witnessing robust growth driven by strategic government investments and international collaborations that enhance healthcare and aesthetic technology adoption. In August 2025, the Brazilian Government announced an investment of USD 480 million to procure over 10,000 medical devices for basic care and surgical procedures. This initiative, as reported by TV BRICS, underscores the nation’s commitment to improving healthcare infrastructure while supporting domestic manufacturing. Among the listed equipment are low-power therapeutic lasers, ophthalmic lasers, electrocoagulation systems, and rigid video endoscopy systems all of which contribute to the growing energy-based aesthetic ecosystem.

Argentina Energy-based Aesthetic Devices Market Trends

The energy-based aesthetic devices market in Argentina is witnessing robust growth, driven by rising consumer demand for non-invasive cosmetic procedures and advancements in laser and radiofrequency technologies. Increasing awareness of aesthetic treatments and the desire for minimally invasive solutions have contributed to widespread adoption of devices for hair removal, skin rejuvenation, body contouring, and tattoo removal.

Chile Energy-based Aesthetic Devices Market Trends

The energy-based aesthetic devices market in Chile is experiencing significant growth, driven by technological innovation, rising consumer demand for non-invasive treatments, and strengthened regulatory frameworks. In 2025, Legolaser Group International marked a milestone in Chile with its participation at the Academy Summit Chile 2025, represented by its local distributor, Integrakin. This event brought together top professionals and industry leaders from across Latin America, providing a platform to showcase Legolaser’s advanced technologies. Their Musa CO2 Fractional Ultra Pulsed Laser, for example, offers versatile applications in dermatology, surgery, and gynecology, delivering precise results with reduced recovery times.

Colombia Energy-based Aesthetic Devices Market Trends

Colombia’s energy-based aesthetic devices market is witnessing robust growth, fueled by rapid technological innovation, growing consumer awareness of non-invasive cosmetic treatments, and increasing demand from both domestic clients and international medical tourists. The country’s strong healthcare infrastructure and skilled professionals enhance its position as a leading hub for advanced aesthetic procedures in Latin America.

Dominican Republic Energy-based Aesthetic Devices Market Trends

The Dominican Republic’s energy-based aesthetic devices market is witnessing rapid growth, fueled by its transformation into Latin America’s emerging medtech hub. Once known for tourism and agriculture, the country has strategically diversified its economy to become the region’s third-largest exporter of medical devices, reaching a record USD 2.25 billion in exports in 2024. This expansion is supported by strong nearshoring trends, tax incentives, and a rapidly developing manufacturing infrastructure catering to global medtech firms.

Panama Energy-based Aesthetic Devices Market Trends

The Panama’s energy-based aesthetic devices market is witnessing rapid growth, driven by the growing demand for minimally invasive cosmetic treatments. According to Dr. Jorge Cardenas Roldan (June 2025), the country has become a popular destination for international patients seeking affordable, high-quality cosmetic care, including Botox, dermal fillers, laser treatments, chemical peels, and body contouring. Panama’s appeal lies in its combination of modern clinics, internationally trained practitioners, and competitive pricing, making it a preferred choice over North America and Europe.

Costa Rica Energy-based Aesthetic Devices Market Trends

The Costa Rica’s energy-based aesthetic devices market is growing rapidly, fueled by the country’s thriving medical device sector, now Latin America’s second-largest exporter. Strategic planning, stable governance, and foreign investment have fostered a robust ecosystem for advanced healthcare technologies, including lasers, RF, and ultrasound systems. Since 1985, over 100 companies, including Boston Scientific, Medtronic, Abbott, Baxter, and LuxotticaEssilor, have established operations, contributing to exports reaching USD 4 billion by 2020 and 43% of total national exports in 2024. Skilled labor, advanced infrastructure, free trade incentives, and sustainability initiatives drive growth, despite challenges like high labor costs and shipping expenses.

Key Latin America Energy-based Aesthetic Devices Company Insights

Market players are involved in implementing strategic initiatives to hold a prominent share in the market. One key area of focus is continuous innovation through product launches and upgrades. Companies regularly introduce new Latin America energy-based aesthetic devices systems and technologies that offer enhanced capabilities in sensitivity, and data analysis.

Key Latin America Energy-based Aesthetic Devices Companies:

- Solta Medical

- InMode

- Sinclair

- Syneron Candela

- Lumenis

- Cutera Inc.

- Cynosure

- Fotona

- Jeisys Medical Inc.

- CLASSYS

- Merz Aesthetics

- Sofwave Medical

- VYDENCE Medical

- Sveltia

- ADSS

- Soupelli

- HMG Laser

- Laser Smile

Recent Developments

-

In October 2025, Classys Inc. announced the official launch of its Ultraformer MPT in Mexico, with a symposium at Hyatt Regency. The event will showcase the advanced aesthetic technology, featuring lectures and insights, marking a key milestone for Classys in expanding its presence in the Mexican aesthetics market.

-

In January 2023, Sofwave Medical announced COFEPRIS approval in Mexico for its SUPERB Technology, marking entry into the country’s growing aesthetic device market. Driven by medical tourism, rising demand for minimally invasive treatments, and broad clinical availability, Mexico ranks sixth globally in non-surgical skin tightening procedures.

“Gaining market approval for Sofwave TM from Mexican regulators is yet another important milestone attributed to Sofwave’s commercial expansion strategy”. “The tailwinds associated with Mexico’s growing aesthetic medical device market which is growing at more than 8% annually is expected to benefit our anticipated brand launch. Additionally, as we have done in other markets, we look forward to replicating our

positive results: demonstrating superior results, safety and return on investment of

the Sofwave device platform to both physicians and medi-spa owners alike.”

-Louis Scafuri, Sofwave’s Chief Executive Office

Latin America Energy-based Aesthetic Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 378.5 million

Revenue forecast in 2033

USD 638.0 million

Growth rate

CAGR of 6.7% from 2025 to 2033

Actual period

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use

Regional scope

Latin America

Country scope

Mexico; Brazil; Argentina; Chile; Colombia; Dominican Republic; Panama; Costa Rica

Key companies profiled

Solta Medical; InMode; Sinclair; Syneron Candela; Lumenis; Cutera, Inc.; Cynosure; Fotona; Jeisys Medical Inc.; CLASSYS; Merz Aesthetics; Sofwave Medical; VYDENCE Medical; Sveltia; ADSS; Soupelli; HMG Laser; Laser Smile.

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Energy-based Aesthetic Devices Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the Latin America energy-based aesthetic devices market on the basis of product, application, end use and country:

-

Product Outlook (Revenue, USD Million, 2021-2033)

-

Medical Laser-Based Devices

-

Light-Based Devices

-

Radiofrequency (RF) Based Devices

-

Ultrasound

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021-2033)

-

Skin Tightening

-

Skin Rejuvenation

-

Skin Resurfacing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021-2033)

-

Hospital/Surgery Centre

-

Medspa

-

Dermatology Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2021-2033)

-

Brazil

-

Mexico

-

Argentina

-

Chile

-

Colombia

-

Dominican Republic

-

Panama

-

Costa Rica

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.