- Home

- »

- Medical Imaging

- »

-

Latin America Medical Imaging Market, Industry Report 2030GVR Report cover

![Latin America Medical Imaging Market Size, Share & Trends Report]()

Latin America Medical Imaging Market Size, Share & Trends Analysis Report By Product (Computed Tomography, Ultrasound), By End-use (Hospitals, Diagnostic Imaging Centers), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-236-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

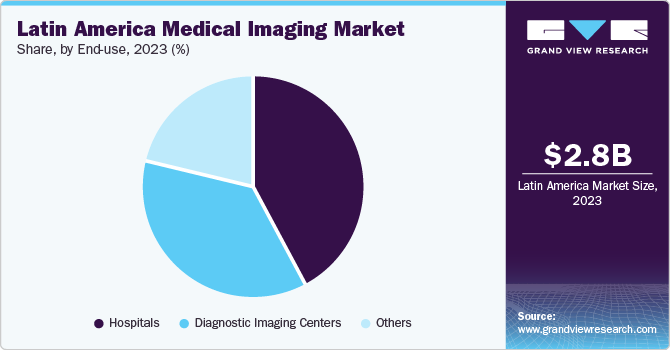

The Latin America medical imaging market size was estimated at USD 2.79 billion in 2023 and is projected to grow at a CAGR of 4.7% from 2024 to 2030. The market growth can be attributed to an increasing prevalence of chronic & lifestyle diseases, a growing geriatric population, advancements in imaging technology, government initiatives for healthcare infrastructure development, and rising healthcare expenditure. According to the National Confederation of Health (CNSaúde) and the Brazilian Federation of Hospitals (FBH), 62% of Brazil's 7,191 hospitals are privately owned. As of 2022, there are 427,097 hospital beds, 710 health insurance providers, 546,000 physicians, 402,000 dentists, and 90,900 drug stores in Brazil.

Other factors driving industry growth include high demand for early detection tools, advancements in technology to improve the turnaround time, government initiatives to increase investment & reimbursement, and expansion of new facilities in developing nations by market players. Latin America is witnessing a rise in the prevalence of chronic diseases, such as cancer, cardiovascular diseases, and diabetes. This has led to an increased demand for medical imaging systems, as these diseases often require regular imaging for monitoring and diagnosis. Medical imaging plays a crucial role in the early detection, diagnosis, and treatment of these chronic conditions.

According to the datasheet from the PRB created as part of the IDEA project, cardiovascular disease, diabetes, most cancers, and chronic respiratory diseases are estimated to account for about 81% of deaths in Latin America and the Caribbean by 2030. The growing geriatric population with a higher percentage of people aged 60 years and above, which is more susceptible to chronic diseases and requires more frequent medical imaging services for early detection & diagnosis, also supports market growth. According to the ECLAC - United Nations report titled "Ageing in Latin America and the Caribbean," the percentage of elderly people in the population is expected to rise to 25.1% by 2050.

This is 2.1 times higher than in 2022 because of the rapid aging process. Technological advancements in medical imaging have led to the development of innovative devices and systems with higher resolution, better image quality, and reduced radiation exposure. These improvements have made medical imaging more accessible and attractive to both healthcare providers and patients, driving market growth. For instance, in December 2023, GE HealthCare launched a new 1.5T wide-bore MRI system that utilizes AI and deep learning for faster and more precise scans. A rise in healthcare expenditure in the country is a significant driver of industry growth.

As governments and private healthcare providers allocate more resources to improve healthcare infrastructure and services, there is a growing need for advanced diagnostic tools, such as medical imaging equipment. As per the International Trade Administration, Brazil spends USD 161 billion, equivalent to 9.47% of its GDP, on healthcare, making it the largest healthcare market in Latin America.

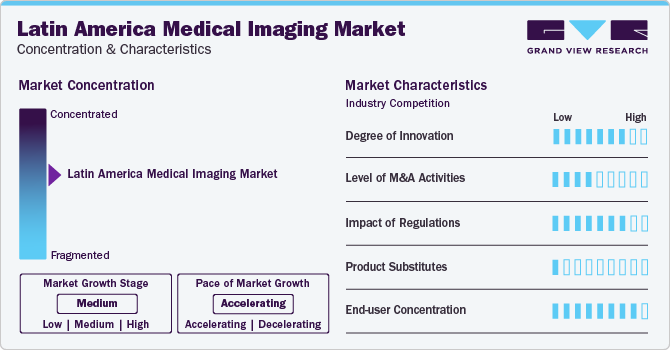

Market Concentration & Characteristics

Market growth stage is medium, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. The Latin American medical imaging market has seen the introduction of various new and advanced technologies in recent years. For instance, there has been a growing adoption of artificial intelligence (AI) and machine learning (ML) algorithms in medical imaging, and the use of mobile devices and cloud-based solutions in medical imaging.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the players. The level of mergers and acquisitions in the market has been steadily increasing over the past few years. Many companies are looking to expand their services and reach new markets through strategic acquisitions or mergers with other companies. For instance, in February 2023, GE HealthCare signed an agreement to acquire Caption Health, a company that develops AI-enabled ultrasound guidance software.

The medical imaging market is also subject to increasing regulatory scrutiny. This is due to concerns regarding patient safety and the need to maintain high-quality control standards in the production, distribution, and use of medical imaging equipment. Government agencies across various regions in Latin America, such as the National Health Surveillance Agency in Brazil and the Federal Commission for the Protection against Sanitary Risk in Mexico, regulate the market.

There are a limited number of direct product substitutes for medical imaging. Due to the unique design, functionality, and regulatory requirements, high capital investments, proprietary technologies, standardization and interoperability challenges, and clinical expertise scarcity medical imaging devices have limited direct product substitutes.

End-user concentration is a significant factor in this market. Since several end-user industries are driving the demand for medical imaging, the level of end-user concentration is high. The end-users include public & private healthcare providers, including hospitals, clinics, diagnostic centers, and research institutions.

Product Insights

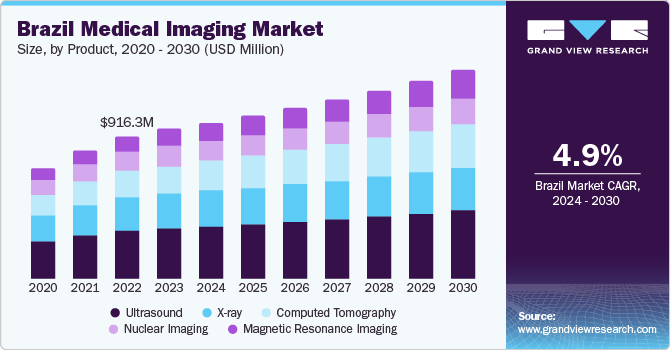

The ultrasound segment dominated the market and accounted for a share of 32.4% in 2023. This high percentage can be attributed to technological advancements, increasing burden of chronic diseases, the rising geriatric population, cost considerations, its applications in point-of-care, and the integration of AI. For instance, in November 2023, Siemens Healthineers AG launched the Acuson Maple1, a robust, adaptable, and cost-effective ultrasound system. It is lightweight, portable, and battery-operated, suitable for various clinical environments, such as emerging markets, outpatient centers, small hospitals, urgent care centers, and private practices.

Furthermore, improving healthcare infrastructure and healthcare programs are expected to increase the rate of diagnosis of patients, leading to a rise in the volume of ultrasonography examinations and bolstering the demand for ultrasound devices. For instance, The Brazilian federal government has introduced the new Mais Médicos para o Brazil [More Doctors for Brazil] program, aiming to provide more than 15,000 new positions for doctors in 2023. The program seeks to give preference to physicians trained in Brazil, with an investment of USD 143.4 million allocated for 2023.

The computed tomography segment is expected to register the fastest CAGR from 2024 to 2030. Continuous advancements in CT technology have led to the development of more sophisticated and efficient CT scanners. These modern scanners offer higher image quality, faster scanning times, lower radiation doses, and improved patient comfort. Healthcare providers in Latin America are increasingly adopting these advanced CT systems to enhance patient care and outcomes, leading to an increased demand for these systems. For instance, in May 2023, Koninklijke Philips N.V. launched the new Philips CT 3500, a high-throughput CT system to cater to high-volume screening programs and routine radiology requirements.

End-use Insights

The hospitals segment accounted for the largest revenue share in 2023. Rising demand for advanced imaging modalities and integration of surgical suits with imaging technologies are some of the factors driving the segment growth. Hospitals prioritize patient care and diagnostic accuracy, making high-quality medical imaging essential for accurate diagnosis and treatment planning. Advanced imaging modalities enable healthcare providers to obtain detailed images for precise diagnosis of various medical conditions. In January 2023, Lunit Inc. announced that it has signed a software license agreement with São Paulo's Hospital Israelita Albert Einstein in Brazil to offer its AI-powered chest x-ray solution for three years, ending in 2025.

The diagnostic imaging centers segment is expected to register the fastest CAGR from 2024 to 2030. One of the primary factors driving the segment growth includes the continuous evolution and advancement of imaging technologies. Furthermore, diagnostic imaging centers often offer cost-effective and efficient diagnostic solutions compared to traditional hospital-based imaging services. This factor particularly appeals to healthcare providers looking to optimize resources and streamline patient care. In addition, the convenience of scheduling appointments quickly and receiving prompt results contributes to the preference for diagnostic imaging centers, leading to an increased demand for imaging centers.

Country Insights

The Brazil medical imaging marketdominated the global industry in 2023 with a share of 32.8% and is expected to witness the fastest CAGR from 2024 to 2030. This can be attributed to the increasing prevalence of chronic diseases, growing healthcare infrastructure, and rapid advancements in technologies. Furthermore, The Brazilan market is being driven by rapid technological advancements in imaging modalities, such as MRI, CT scans, ultrasound, and X-ray systems. These advancements have led to improved imaging quality, faster scan times, enhanced diagnostic accuracy, and increased patient comfort, thereby driving the demand for these advanced imaging technologies in the country. In October 2022, SyntheticMR's quantitative imaging software solution, SyMRI MSK, received regulatory approval in Brazil, allowing it to be sold and distributed in this market.

Mexico Medical Imaging Market Trends

The medical imaging market in Mexico is expected to grow significantly over the forecast period. The market drivers of the market in Mexico are multifaceted and interconnected, encompassing technological advancements, increasing healthcare demand, government initiatives, and private sector investments. In addition, Mexico has emerged as a popular location for medical tourism, drawing patients from across the globe in search of cost-effective healthcare services, including medical imaging procedures. Medical tourism boosts patient volumes and revenue streams for healthcare providers, driving the growth of medical imaging techniques.

Argentina Medical Imaging Market Trends

The Argentina medical imaging market held a considerable share in 2023 owing to the increasing prevalence of chronic diseases necessitating diagnostic imaging, growing investments in healthcare infrastructure, rising demand for early disease detection, a growing aging population requiring more medical imaging services, and technological advancements leading to improved diagnostic capabilities. For instance, in July 2023, FUJIFILM Corporation broadened its range of point-of-care ultrasound (POCUS) products by unveiling the new Sonosite ST system to enhance procedural workflows.

Key Latin America Medical Imaging Company Insights

Some of the key players operating in the market include GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORP., Samsung Healthcare, and FUJIFILM Corporation.

-

GE HealthCare, a subsidiary of General Electric Company, is a global medical imaging equipment and solutions provider. In Latin America, GE HealthCare has a significant presence in the medical imaging market, offering a wide range of products and services to healthcare providers across the country. The company’s portfolio includes diagnostic imaging equipment, such as computed tomography (CT), magnetic resonance imaging (MRI), X-ray, mammography, and ultrasound systems

-

Siemens Healthineers AG is a medical technology company that offers a wide range of products and services in medical imaging. It has established a strong presence in Latin America with offices, distribution centers, and service facilities across the country. The company works closely with healthcare providers in Brazil, Mexico, Argentina, and Chile to deliver cutting-edge medical imaging technologies, including advanced MRI systems, CT scanners, X-ray machines, ultrasound devices, and molecular imaging solutions

CurveBeam AI, Ltd.; Carestream Health; Hitachi Ltd.; Agfa-Gevaert HealthCare; and SHIMADZU CORPORATION are some of the other market participants in the Latin America medical imaging market.

CurveBeam AI, Ltd. is dedicated to offering cutting-edge diagnostic imaging solutions focusing on orthopedics and bone health. Their offerings integrate artificial intelligence (AI) and deep learning AI (DLAI) capabilities to enhance diagnostic precision and mitigate the risk of fragility fractures. The company was established in 2022 following the merger of CurveBeam, LLC and StraxCorp Pty Ltd.

-

Carestream Health is a global provider of innovative digital radiography (DR) and computed radiography (CR) systems. Carestream Health’s medical imaging portfolio encompasses digital radiography systems, CT scanners, MRI systems, ultrasound machines, and PACS solutions. The company has a strong network of distributors and partners to reach healthcare facilities in Brazil, Mexico, Argentina, Colombia, Chile, and others.

Key Latin America Medical Imaging Companies:

- GE HealthCare

- Siemens Healthineers

- Koninklijke Kentalis

- Canon EMEA Medical Systems Corp.

- FUJIFILM Corporation

- Samsung Healthcare

- CurveBeam AI, Ltd.

- Carestream Health

- Hitachi Ltd.

- Agfa-Gevaert HealthCare

- Shimadzu Corp.

- ESAOTE SPA

- Shenzhen Mindray Bio-Medical Electronics Co.

- Neusoft Medical Systems Enlitic, Inc.

Recent Developments

-

In January 2024, Canon Medical Systems Corporation and Olympus Corporation announced a collaboration on Endoscopic Ultrasound Systems. The diagnostic ultrasound systems will be developed by Canon Medical, while Olympus will handle marketing and sales.

-

In January 2024, GE HealthCare acquired MIM Software. The company aims to utilize MIM Software's digital workflow capabilities and imaging analytics in diverse care areas to expedite innovation and distinguish its solutions for the global benefit of patients and healthcare systems

-

In October 2023, GE HealthCare entered into a USD 44 million agreement with the Biomedical Advanced Research and Development Authority (BARDA) to create ultrasound technology enhanced with AI. This technology aims to assist clinicians in diagnosing and treating traumatic injuries, as well as bolster national readiness for mass casualty incidents

-

In September 2023, Siemens Healthineers AG, during the annual congress of the European Society of Breast Imaging, unveiled the Mammomat B. brilliance, an innovative mammography system featuring wide-angle tomosynthesis. This advanced technology involves the tube rotating around the breast at an extensive 50° angle, which is currently the widest angle offered in the market

-

In November 2023, Siemens Healthineers AG announced the launch of a new Dual Source CT scanner designed to be more accessible for rural and smaller facilities and outpatient diagnostic centers

Latin America Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.91 billion

Revenue forecast in 2030

USD 3.84 billion

Growth rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

Latin America

Country scope

Brazil; Mexico; Argentina

Key companies profiled

GE HealthCare; Siemens Healthineers; Koninklijke Kentalis; Canon EMEA Medical Systems Corp.; FUJIFILM Corp.; Samsung Healthcare; CurveBeam AI, Ltd.; Carestream Health; Hitachi Ltd.; Agfa-Gevaert HealthCare ; Shimadzu Corp.; ESAOTE SPA; Shenzhen Mindray Bio-Medical Electronics Co.; Neusoft Medical Systems Enlitic, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Latin America Medical Imaging Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Latin America medical imaging market report based on product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

By Modality

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

-

Magnetic Resonance Imaging

-

By Architecture

-

Closed System

-

Open System

-

-

-

Ultrasound

-

By Portability

-

Handheld

-

Compact

-

Cart/Trolley-based

-

-

-

Computed Tomography

-

By Technology

-

High-end Slice

-

Mid-end Slice

-

Low-end Slice

-

Cone beam CT

-

-

-

Nuclear Imaging

-

By Product

-

SPECT

-

PET

-

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Brazil

-

Mexico

-

Argentina

-

Rest of Latin America

-

Frequently Asked Questions About This Report

b. The Latin America medical imaging market size was estimated at USD 2.79 billion in 2023 and is expected to reach USD 2.91 billion in 2024

b. The Latin America medical imaging market is expected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030 to reach USD 3.84 billion by 2030

b. In terms of market share, ultrasound dominated the technology segment, with the largest market share of 32.4% in 2023. This high share is attributable to technological advancements, point-of-care applications, and AI integration

b. GE HealthCare; Siemens Healthineers AG; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION, Samsung Healthcare, and FUJIFILM Corporation.

b. Key factors driving the market growth include the rising prevalence of chronic diseases, increasing government initiatives for healthcare infrastructure, technological advancement, and the rising geriatric population

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."