- Home

- »

- Clothing, Footwear & Accessories

- »

-

Leather Footwear Market Size, Industry Report, 2033GVR Report cover

![Leather Footwear Market Size, Share & Trends Report]()

Leather Footwear Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Male, Female), By Distribution Channel (Online, Offline), By Region (Middle East & Africa, North America, Latin America), And Segment Forecasts

- Report ID: GVR-3-68038-170-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Leather Footwear Market Summary

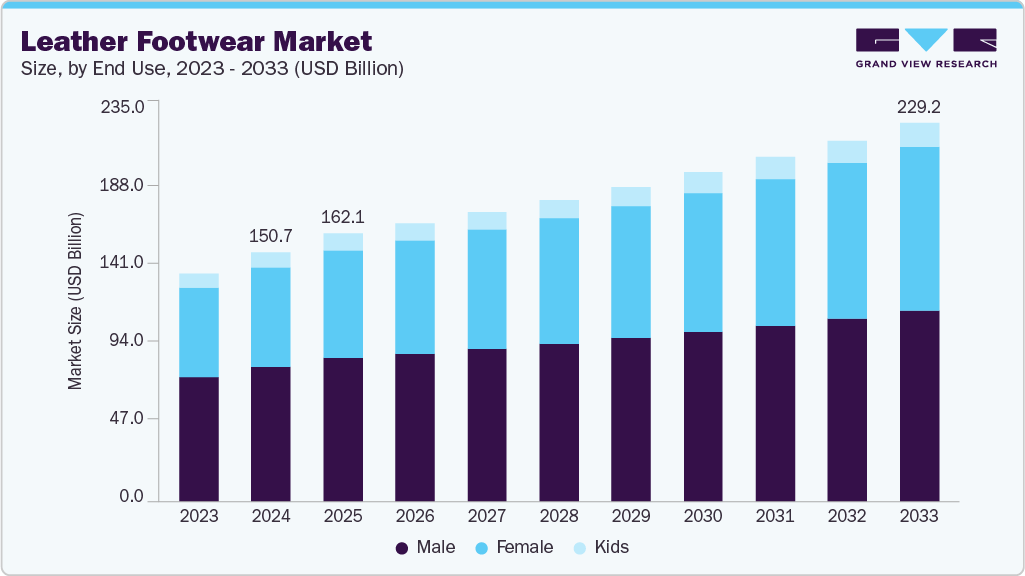

The global leather footwear market size was valued at USD 150.7 billion in 2024 and is expected to reach USD 229.1 billion by 2033, growing at a CAGR of 4.4% from 2025 to 2033. The industry is being driven by rising disposable incomes, changing fashion trends, and increasing demand for premium and durable footwear. Additionally, urbanization and growing awareness of high-quality end uses are encouraging consumers to invest in stylish leather shoes.

Key Market Trends & Insights

- Asia Pacific held the largest share of the leather footwear market in 2024, accounting for 53.9% share.

- The Middle East & Africa leather footwear market is experiencing significant growth, with a projected CAGR of 5.5%.

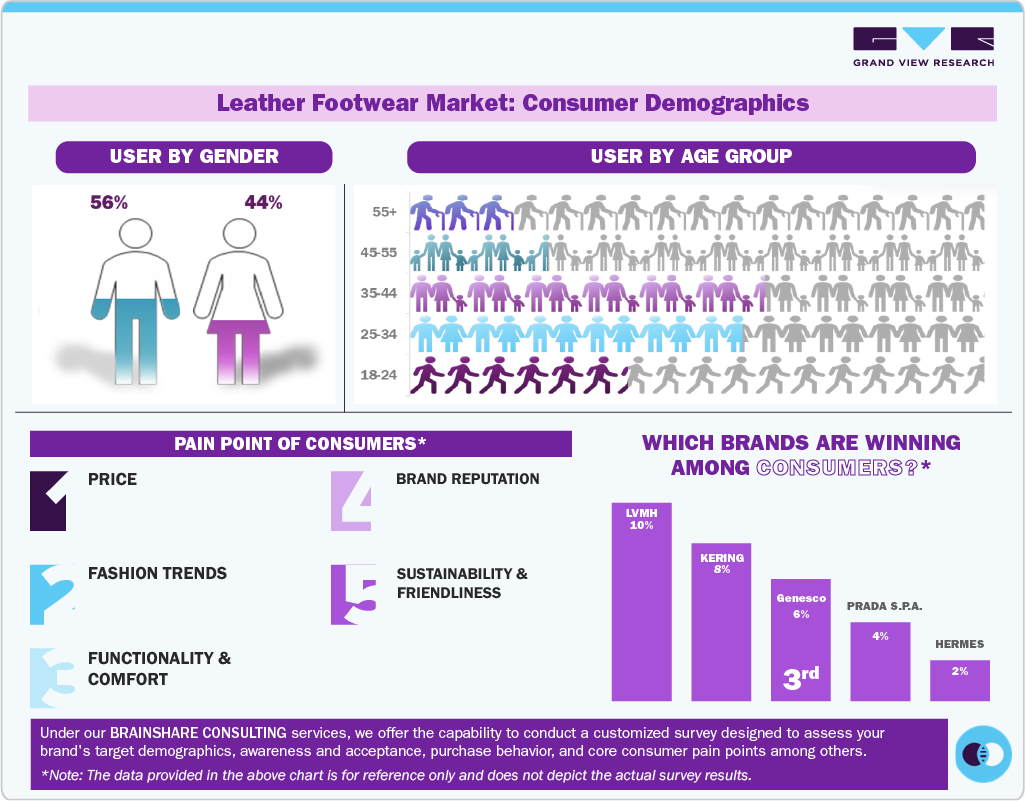

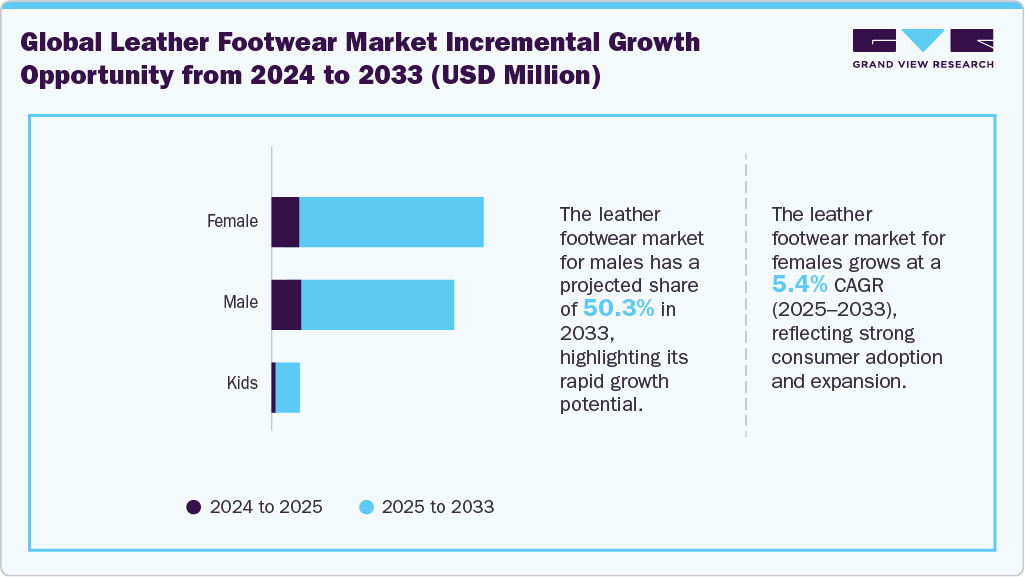

- By end use, the leather footwear market for males held the largest share of 54.1% in 2024.

- The market for females is experiencing significant growth, with a projected CAGR of 5.4%.

- Based on distribution channel, the offline segment led the market and accounted for a share of 73.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 150.7 Billion

- 2033 Projected Market Size: USD 229.1 Billion

- CAGR (2025-2033): 4.4%

- Asia Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

The industry is being driven by rising disposable incomes, changing fashion trends, and increasing demand for premium and durable footwear. Additionally, urbanization and growing awareness of high-quality end uses are encouraging consumers to invest in stylish leather shoes. The industry is picking up speed globally, driven largely by rising demand in emerging markets. As the middle class expands in these regions, more consumers are on the lookout for shoes that combine style with long-lasting quality. Increased travel and tourism are also fueling demand, with many shoppers preferring footwear that can adapt to different occasions and environments.

In cities, especially, seasonal fashion trends continue to impact what people buy. On top of that, celebrity partnerships and the influence of social media are playing a big part in guiding consumer choices. For instance, in October 2023, Gucci launched a new campaign for the Horsebit 1953 loafer to mark its 70th anniversary, featuring actors Paul Mescal and Xiao Zhan. They’re shown in classic iterations of the loafer styled with a mix of elegant, relaxed looks, shot under creative direction by Sabato De Sarno.

The rising influence of Western lifestyles in developing countries is significantly boosting demand for leather footwear. Increased participation in formal and corporate work environments is also driving the need for polished, professional shoes. Improved logistics and supply chains have made global distribution more efficient, supporting market expansion. Additionally, growing investments by major brands in physical retail spaces are enhancing consumer access and experience.

End Use Insights

The industry among males accounted for the largest share of 54.1% of the revenue in 2024. The male leather footwear market is seeing strong growth due to increasing interest in personal style and appearance among men. Demand for formal and semi-formal shoes is rising, especially with more men entering professional fields. The popularity of premium and designer brands among male consumers is also a key driver. Additionally, better awareness of end use longevity and comfort is influencing purchasing decisions. In February 2022, LIBERTYZENO introduced a new range of Easter shoe collection for men, in sixteen different designs, including Oxford, Derby, and Lace Up.

The market among females is projected to grow at the fastest CAGR of 5.4% from 2025 to 2033. The female leather footwear market is expanding rapidly, driven by a growing preference for versatile styles that blend fashion with function. Women are increasingly seeking high-quality shoes that offer both comfort and elegance for daily wear. The rise of women in the workforce has also boosted demand for stylish professional footwear. Seasonal collections and exclusive designer collaborations continue to attract fashion-conscious buyers. Social media influencers and online fashion platforms further amplify trends, encouraging more frequent purchases. For instance, in March 2024, Lee Cooper introduced a footwear line for females, including casual sneakers, slip-on sandals, and heels in bright color hues in patent leather & in neutral tones.

Distribution Channel Insights

The market through offline channels accounted for the largest share of around 73.4% of the global revenue in 2024. Offline distribution channels remain crucial for the leather footwear market due to the personalized shopping experience they offer. Many customers prefer trying on shoes in-store to ensure proper fit and comfort before purchasing. Established retail networks and brand-owned stores provide easy access to a wide range of end uses. Additionally, trusted local retailers often build strong relationships with consumers, encouraging repeat visits. Seasonal sales and in-store promotions further boost foot traffic and drive sales.

The market through online channels is projected to grow at a significant CAGR of 7.3% from 2025 to 2033. The online distribution channel for the leather footwear market primarily involves e-commerce platforms such as Amazon, eBay, and specialized footwear websites. Brands often set up their own direct-to-consumer (D2C) websites to control the customer experience and showcase their latest collections. Social media platforms such as Instagram and Facebook play a significant role in driving traffic and sales through targeted advertising. Collaborations with online marketplaces and influencers also boost visibility and reach. Additionally, mobile apps dedicated to fashion and footwear have become an essential tool for both consumers and retailers. In August 2025, Dr. Martens launched the Adrian Loafer campaign featuring social-media creator Nailea Devora showcasing the Adrian Tassel Rub-Off Loafer in Arcadia leather. Available in four colorways, including character-building Silver Arcadia, the campaign blended nostalgic silhouettes with influencer-driven marketing and material innovation.

Regional Insights

North America leather footwear market is fueled by strong consumer preference for high-quality craftsmanship and brand heritage. A growing focus on sustainable and ethically sourced materials is influencing purchasing habits. The presence of major fashion hubs and trade shows supports end use innovation and marketing. Increasing urbanization drives demand for both casual and formal footwear. Additionally, collaborations between footwear brands and sports or entertainment industries boost market visibility.

U.S. Leather Footwear Market Trends

The leather footwear market in the U.S. held the largest market share with 95.4% of the region’s total revenue. In the U.S., the rise of athleisure culture has expanded opportunities for leather sneakers and hybrid footwear styles. Consumers’ willingness to spend on premium, comfortable end uses supports market growth. Evolving fashion trends emphasizing individuality and customization also play a key role. The rise of direct-to-consumer brands is changing how leather footwear is marketed and sold. Moreover, environmental awareness encourages brands to adopt eco-friendly end-of-use methods, attracting conscious buyers.

Europe Leather Footwear Market Trends

The leather footwear market in Europe held a 28.8% market share in 2024. Europe’s market is largely driven by its rich history of artisanal shoemaking and luxury brands that emphasize tradition and quality. Increasing demand for handcrafted and limited-edition end uses reflects consumers’ appreciation for uniqueness. The growth of tourism supports sales in key cities known for fashion and leather goods. Regulations promoting sustainable practices also influence standards. Meanwhile, expanding online retail channels continue to enhance accessibility across diverse markets.

Italy leather footwear market held the largest market share of 20.2% in the European market. Italy remains a key player due to its world-renowned expertise in leather craftsmanship and design excellence. The domestic and international demand for iconic Italian brands strengthens the market. A strong culture of luxury and high fashion encourages consumers to invest in exclusive footwear. The industry benefits from local raw material availability and skilled labor. Seasonal fashion events like Milan Fashion Week also provide significant promotional platforms.

Asia Pacific Leather Footwear Market Trends

The leather footwear market in Asia Pacific accounted for a share of 53.9% in 2024. The Asia Pacific market is expanding rapidly thanks to increasing disposable incomes and urban lifestyles in countries like China and India. Growing awareness of global fashion trends via social media influences consumer preferences. E-commerce growth in the region is making international brands more accessible. Young consumers’ appetite for trendy and branded footwear fuels market demand. Additionally, rising participation of females in the workforce supports the demand for stylish yet practical options.

Middle East & Africa Leather Footwear Market Trends

The leather footwear market in the Middle East & Africa is projected to grow at a significant CAGR of 5.5% from 2025 to 2033. In the Middle East and Africa, the leather footwear market benefits from high demand for luxury and status-symbol end uses. Increasing investments in retail infrastructure and shopping malls improve market accessibility. The region’s hot climate drives demand for breathable yet durable leather footwear. Cultural events and festivals often spur seasonal sales boosts. Furthermore, expanding tourism contributes to growing interest in premium brands and exclusive designs.

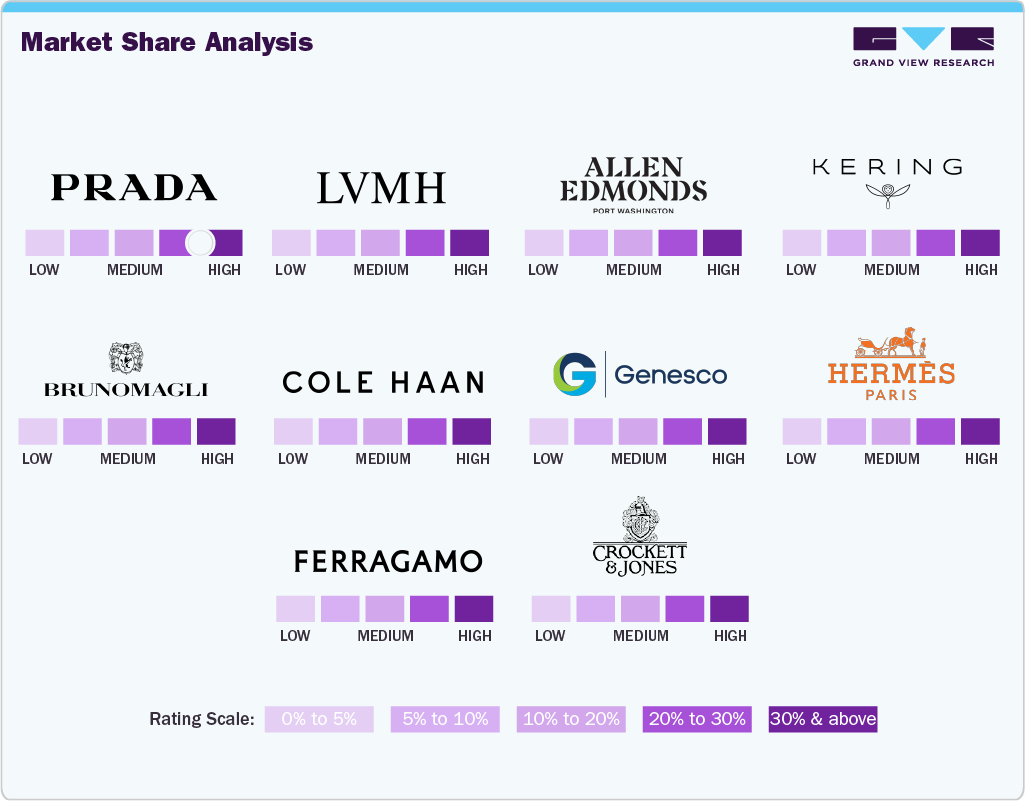

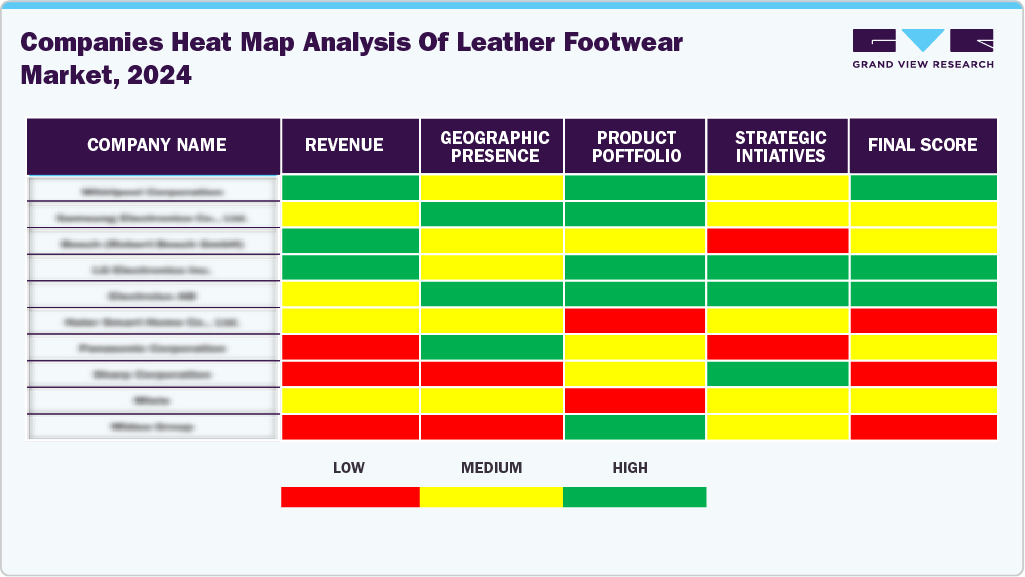

Key Leather Footwear Companies Insights

Key players operating in the leather footwear market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Leather Footwear Companies:

The following are the leading companies in the leather footwear market. These companies collectively hold the largest market share and dictate industry trends.

- PRADA S.P.A.

- LVMH

- Allen Edmonds Corporation.

- KERING

- Bruno Magli

- Cole Haan

- Genesco

- Hermès

- Salvatore Ferragamo S.P.A.

- Crockett & Jones.

Recent Developments

-

In June 2025, LeMieux unveiled its first-ever leather riding boots after a two-year development process. The collection included premium all-leather field boots with ergonomic design, YKK zips, elastic gussets and grip soles, plus junior and zip paddock variants for riders of all levels.

-

In June 2025, Prada acquired a 10% equity stake in the Rino Mastrotto Leather Group by transferring ownership of two tanneries, Conceria Superior and Tannerie Limoges, and making a cash investment. This move bolstered Prada’s strategic influence over leather production and deepened its partnership with a trusted Italian supplier renowned for quality, innovation, and sustainability.

Leather Footwear Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 162.08 billion

Revenue forecast in 2033

USD 229.1 billion

Growth rate (revenue)

CAGR of 4.4% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (revenue) units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, region

Regional scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Japan; India; Brazil; Mexico; Nigeria; South Africa

Key companies profiled

PRADA S.P.A.; LVMH; Allen Edmonds Corporation.; KERING; Bruno Magli; Cole Haan; Genesco; Hermès; Salvatore Ferragamo S.P.A.; Crockett & Jones

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

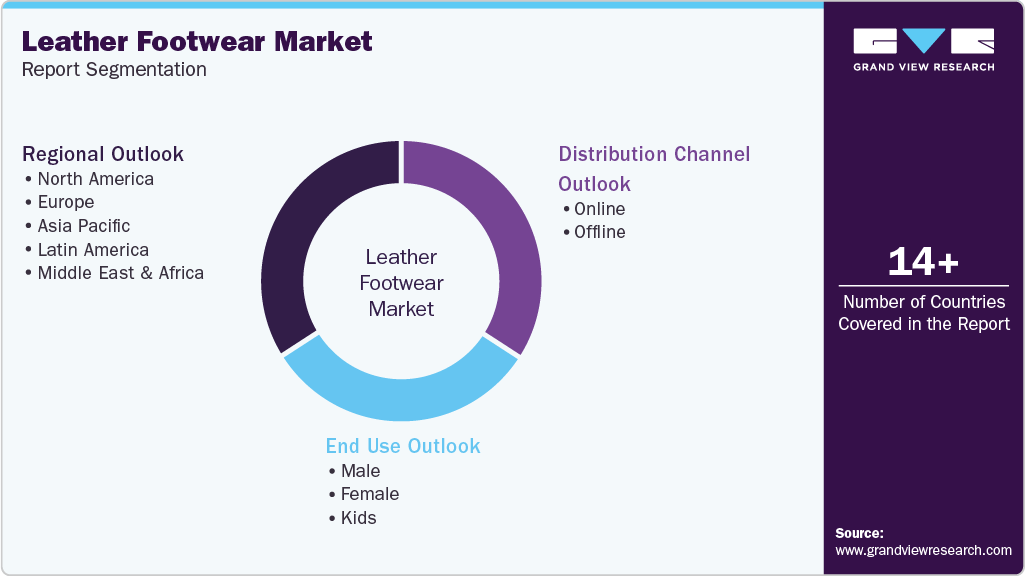

Global Leather Footwear Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global leather footwear market report on the basis of end use, distribution channel, and region:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Male

-

Female

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Nigeria

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global leather footwear market size was estimated at USD 150.72 billion in 2024 and is expected to reach USD 162.08 billion in 2025.

b. The global leather footwear market is expected to grow at a compound annual growth rate (CAGR) of 4.4 % from 2025 to 2033 to reach USD 229.15 billion by 2033.

b. The leather footwear market among males accounted for the largest share of 54.1% of the revenue in 2024. The male leather footwear market is seeing strong growth due to increasing interest in personal style and appearance among men

b. Some key players operating in the leather footwear market include PRADA S.P.A., LVMH, Allen Edmonds Corporation, KERING, Bruno Magli, Cole Haan, Genesco, Hermès, Salvatore Ferragamo S.P.A., and Crockett & Jones.

b. Key factors driving growth in the leather footwear market include rising consumer demand for premium, durable products, increased interest in fashion and personal style, growing adoption of formal and semi-formal shoes by professionals, and the expansion of online retail channels offering greater accessibility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.