- Home

- »

- Clothing, Footwear & Accessories

- »

-

Leather Footwear Market Size, Share & Growth Report, 2030GVR Report cover

![Leather Footwear Market Size, Share & Trends Report]()

Leather Footwear Market Size, Share & Trends Analysis Report By End-use (Male, Female, Kids), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-170-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Leather Footwear Market Size & Trends

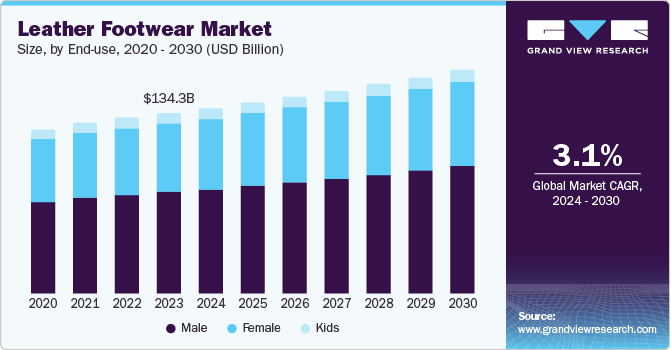

The global leather footwear market size was valued at USD 134.35 billion in 2023 and is projected to grow at a CAGR of 3.1% from 2024 to 2030. The growth is due to increasing disposable income among consumers, shifting fashion trends, growing working class population and flourishing e-commerce sector. Leather shoes are durable and provide an elegant look making it popular among various consumers. The breathable features of real leather which can cool down the feet and avoid unwanted odors are also driving the growth of the product in the market.

Leather footwear market is closely aligned with consumer spending on fashion accessories. Rapid growth in the spending on fashion accessories due to the growing influence of social media is driving the market. Recent changes in consumer shopping trends and increasing propensity toward buying high-end and designer shoes are estimated to trigger the growth. Demand for trendy, fancy, and comfortable footwear is driving the demand.

Leather shoes are widely accepted as a premium product. Introduction of new products by numerous brands has been driving the market growth. High adoption of the products even in areas with relatively warmer climates is anticipated to drive growth. As the demand for flexible and lightweight products is growing at a rapid rate, numerous innovations and technological advancements help surge the product demand. Leather footwear has high durability and stand strong even in heavy duty work along with casual, designer shoes and can be used for both indoor and outdoor applications, making it more popular among consumers.

Availability of counterfeit footwear made from synthetic leather developed by local manufactures is restraining the growth. Growing alternatives like synthetic and vegan leather are also likely to pose a challenge for growth. Leather footwear costs more on average than any other type of footwear which act as a major restrain in the cost centric countries. Consumers sensitive to animal slaughtering and aware regarding animal ethics and rights are also hindering the growth.

End Use Insights

The male segment accounted for a share of 56.4% in 2023. This is due to the increasing number of fashion-conscious men who are ready to spend in high-quality leather footwear for both formal and casual occasions. Furthermore, the leather shoes are durable and comfortable which make them a preferred choice among men looking for long-lasting footwear. Leather shoes are perceived as a symbol of sophistication, style, and status, driving men to choose leather footwear over synthetic. Growing awareness regarding physical appearance among men along with evolving fashion trends is also expected to drive the demand. Millennials and Generation Z are boosting the demand owing to increasing adoption of online purchasing of fashion accessories. Growing influence of advertising campaigns by big brands that feature popular male personalities is expected to result in an increasing product demand among the young generation. Tailor-made leather shoes is a trend expected to further fuel the growth.

The female segment is projected to witness a CAGR of 3.1% over the forecast period. he drop in purchase of heeled shoes is anticipated to affect the segment growth. Increasing number of working women is driving the demand for women’s leather footwear. Rising spending on high ankle length shoes, reptile and animal skin, suede ballerinas, pumps, boots, casual town shoes, sandals, and flip-flops is driving the segment. Trends in women fashion often emphasize the significance of footwear as an important accessory that complements their outfits. The high quality and craftsmanship associated with leather footwear make them popular choice among women who value both style and durability in their footwear. Moreover, the versatility of leather shoes allows women to switch very easily from day to night looks, making them a versatile option for different occasions. Leather footwear comes in wide range of designs, styles and colors that cater to diverse preferences of female consumers.

Distribution Channel Insights

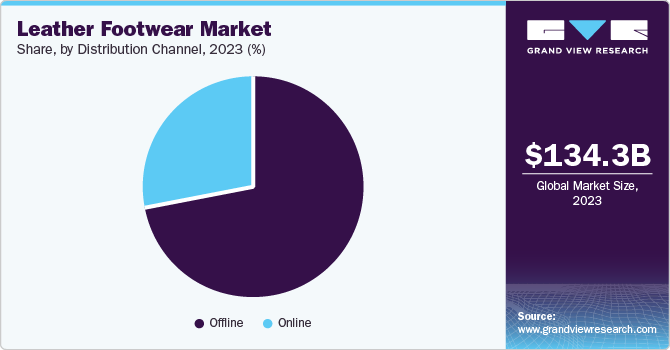

The offline segment dominated the market with a share of 72.0% in 2023. The offline distribution channels, such as shoe boutiques, department stores, specialty shoe shops, and supermarkets, continue to be essential for the leather footwear market. The increasing popularity of offline channels is due in part to the physical experience of buying leather shoes. Consumers often like to try on footwear before making a purchase to make sure the proper fit and comfort. Furthermore, physical stores offer personalized customer assistance and the opportunity for immediate satisfaction, which online channels may not always provide.

The online segment is projected to grow at the fastest CAGR of 3.5% over the forecast period. The convenience of shopping online, along with a wider range of options and competitive prices, has led many consumers to purchase leather footwear online. Furthermore, technological advancements have improved the online shopping experience by offering virtual try-on tools, customer reviews, detailed product descriptions, and easy return policies. The increasing usage of smartphones and internet access globally has also contributed to the rise of online sales in the leather footwear market.

Regional Insights

North America leather footwear market accounted for a significant revenue share in 2023. It is expected to grow rapidly in the coming years due to the rising disposable income levels among consumers. As the economy strengthens and people’s purchasing power increases, they are more likely to invest in high-quality products such as leather footwear. Furthermore, the fashion trends in North America often favor leather footwear due to its style, durable nature and versatility.

U.S. Leather Footwear Market Trends

The leather footwear market in the U.S. dominated the North American leather footwear market with a share of 89.4% in 2023. It is attributed to increasing awareness among consumers about sustainability and ethical sourcing practices. Leather shoes are seen as a more sustainable choice compared to synthetic ones, as they are biodegradable and have longer lifespan with proper care. Moreover, the U.S. market places a high value on craftsmanship and quality, which complements the characteristics of leather footwear.

Europe Leather Footwear Market Trends

Europe leather footwear market dominated the leather footwear market in 2023 with a revenue share of 30.4%, owing to the fashion preferences of European consumers who seek stylish and trendy options.

The Germany leather footwear market held a substantial market share in 2023. This is due to preferring quality and craftsmanship that comes with leather footwear. German consumers prioritize durability and high quality materials when making purchasing decisions, which makes leather an attractive choice for its longevity and classy appeal.

Asia Pacific Leather Footwear Market Trends

The Asia Pacific market is anticipated to witness significant growth in the coming years owing to growing economies, rising number of low-middle class, rapid expansion of international footwear chains, and growing working-class population. High internet penetration and a rapid rise in online sales are expected to further fuel the regional market. For men leather footwear formal shoes, ankle-high boots with slim lasts, sturdy lace-up boots, rounded Chelsea, and robust biker boots were the prominent products in the region.

The India leather footwear market held a substantial share due to several factors including India’s young demographic profile, along with a rising fashion awareness among consumers, and influence of social media.

Key Leather Footwear Company Insights

Some of the key companies in the leather footwear market include PRADA S.P.A.; LVMH; Allen Edmonds Corporation.; KERING; and others. Vendors in the market are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

PRADA S.P.A. is an Italian luxury fashion company that specializes in manufacturing and designing high-end leather goods, ready-to-wear apparel and footwear under various brands.

Key Leather Footwear Companies:

The following are the leading companies in the leather footwear market. These companies collectively hold the largest market share and dictate industry trends.

- PRADA S.P.A.

- LVMH

- Allen Edmonds Corporation.

- KERING

- Bruno Magli

- Cole Haan

- Genesco

- Hermès

- Salvatore Ferragamo S.P.A.

- Crockett & Jones

View a comprehensive list of companies in the Leather Footwear Market

Recent Developments

-

In June 2024, EGOSS announced a range of revolutionary Zero Gravity leather sneakers. This range offers unmatched footwear experience and fuses high-quality lining & soles, leather, with timeless designs. & modern technologies.

-

In February 2024, Thomas Crick made its debut in India and unveiled leather footwear for men. The brand showcased pieces such as the Dixon Black Casual Boots, Boyice Tan Monk Shoe and Addison Tan Chelsea Boots.

Leather Footwear Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 138.29 billion

Revenue forecast in 2030

USD 166.28 billion

Growth rate

CAGR of 3.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil and Nigeria, South Africa

Key companies profiled

PRADA S.P.A.; LVMH; Allen Edmonds Corporation. ; KERING; Bruno Magli; Cole Haan; Genesco; Hermès; Salvatore Ferragamo S.P.A.; Crockett & Jones

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs.

Global Leather Footwear Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global leather footwear market report based on end use, distribution channel, and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

-

MEA

-

Nigeria

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."