- Home

- »

- Electronic & Electrical

- »

-

LED Table Lamps Market Size, Share & Growth Report, 2030GVR Report cover

![LED Table Lamps Market Size, Share & Trends Report]()

LED Table Lamps Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Decorative Lamps, Reading Lamps), By Application (Commercial, Residential), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-618-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

LED Table Lamps Market Size & Trends

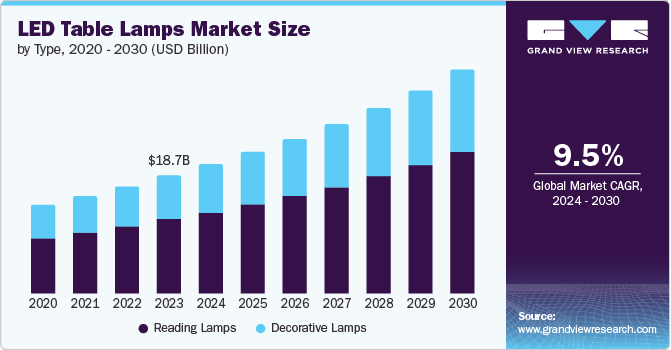

The global LED table lamps market size was valued at USD 18.74 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030. The Light Emitting Diode (LED) market is growing due to increasing focus on energy efficiency and rising technology and investment in innovation. Furthermore, the rising per capita income, increasing standard of living and rapid urbanization is leading to a rise in demand for energy efficient products. Moreover, the rising consumer demand for LED table lamps due to its features and designs such as adjustable color and brightness levels along with the popularity of enhancing home decor is anticipated to drive the market growth.

The rising adoption of LED table lamps due to increasing focus on saving energy and being more environmentally friendly, is likely to stimulate market growth. LED lamps are known for their less energy consumption, than incandescent lamps, long lasting, and appealing to eco-conscious consumers who want to cut down on their energy use and costs. LED table lamps are commonly used while studying and at work desks as these lamps offer greater durability and emits less heat and minimal UV radiations making them gentle for eyes and promoting a healthier environment.

The increasing trend of smart homes is driving the growth of LED table lamps that are practical and stylish in modern homes and workplaces. Advances like Bluetooth control and voice recognition systems have sparked new trends in LED table lamps. Moreover, advancement in technology such as integration of Internet of Things (IoT) with LED table lamps have gained traction allowing users to adjust and control the lighting intensity. Moreover, the increasing focus towards sustainable and eco-friendly energy usage is driving the LED table lamps market as it consumes 80% less energy than incandescent lights and are 100% recyclable, making a safer and more environmentally friendly choice.

Type Insights

The decorative lamps segment dominated the market and accounted for a share of 62.7% in 2023. This high percentage can be attributed to increasing urbanization and rising per capita income in emerging countries like India and China. The growing emphasis on home decor and its visual appearance of interior design has augmented the demand for decorative lamps. Furthermore, LED lamps consume 80% less energy compared to incandescent lamps and bulbs which translates to substantial cost and energy savings.

The reading lamps segment is expected to witness a substantial share of revenue during the forecast period. Reading LED table lamps offers focused and adjustable lights, according to consumers need and it’s perfect for reading, studying or working as it can make the light brighter or dimmer. Moreover, LED table lamps emit less UV rays making safer for eyes and maintains healthier environment.

Application Insights

The commercial segment accounted for the largest market revenue share of 63.8% in 2023, owing to rapid urbanization and more visual appeal attracting customers in commercial facilities. LED table lamps are an alternative solution and are used as an energy efficient lighting solution. Moreover, commercial LED table lamps comes in a wide variety of styles that reflects the versatility in design and provides an aesthetics ambience & visual to commercial spaces such as restaurants, offices, and malls to attract the customers.

The residential segment is expected to register the fastest CAGR of 5.7% during the forecast period. In household and residential sectors, LED table lamps come in variety of styles, designs, size and colors allowing customers to match their home décor needs. Moreover, the innovation in LED lamp table technology such as remote-control adjustable brightness and color, wall mounted lamps, making them suitable for various tasks. Moreover, LED table lamps are energy efficient and reduces electricity costs.

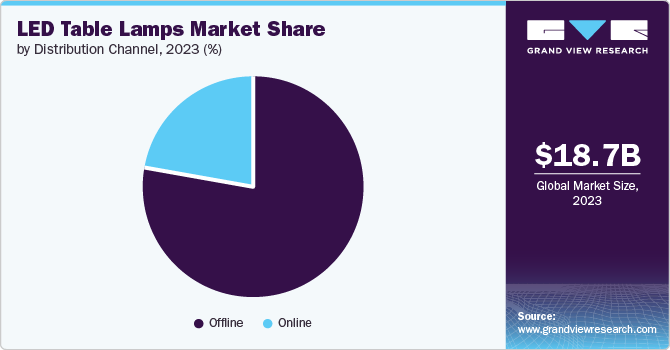

Distribution Channel Insights

The offline segment dominated the market in 2023. The growth can be attributed to a rise in specialty stores shopping, as these stores focus solely on types of products like electronic appliances, homes goods and LED table lamps. Moreover, the presence of skilled and knowledgeable staff in stores is a greater advantage as consumers seeking LED table lamps can benefit from their expertise. Furthermore, offline stores allow customers to interact with products before making purchase decisions. This fosters a sense of confidence and trust in the product, enhancing overall experience.

The online segment is projected to grow at the fastest CAGR of 10.0% during the forecast period, owing to the growing trend of online shopping and availability of a wide variety of items. For instance, there are 2.71 billion buyers buying from online platforms in 2024, an increase of 2.7% from previous years. Moreover, the fair and affordable prices offered by e-commerce platforms encourage people to shop online.

Regional Insights

North America LED table lamps held a significant market share in 2023 owing to advancements in technology and rising demand for advanced lamps. Furthermore, the increasing awareness among citizens about environmental awareness is driving the consumer preference for LED table lamps.

U.S. LED Table Lamps Market Trends

The U.S. LED table lamps market dominated the North America market in 2023 owing to the growing consumer demand for energy efficiency products and healthier environment. LED lamps consume 80% less energy and provide gentle care to your eyes. The country is hub to several industries such as hospitality, institutes, healthcare, film industry, etc. which demands LED table lamps due to their versatility in design and features which makes suitable for various tasks.

Europe LED Table Lamps Market Trends

Europe LED table lamps market is anticipated to witness significant market revenue share during the forecast period. The increasing growth of e-commerce shopping in the region is likely to propel the growth. The increasing electricity cost and rising environmental pollution in the region is fueling the demand for cost and energy efficient LED table lamps market. Moreover, the technological integration and innovation in LED table lamps such as voice control table lamps, is pushing the region growth.

The UK LED table lamps market accounted largest share in the Europe market in 2023. The growth can be attributed to an increase in adoption of cost-efficient and environmentally friendly LED table lamps. The government initiatives for clean energy projects and reducing the greenhouse gas emission to zero by 2050 are contributing to the growth.

The LED table lamp market in Germany is expected to grow rapidly during the forecast period owing to advancements in technology and rise in online shopping. The country is known for its versatility in designs. The rising concern for the environment and increasing electricity bill is paving the growth of LED table lamps market.

Asia Pacific LED Table Lamps Market Trends

Asia Pacific LED table lamps market dominated the market with a revenue share of 38.0% in 2023 and is anticipated to witness the fastest CAGR during the forecast period, owing to rising urbanization, increasing per capita income and hub to strong manufacturing sector. The rising popularity of smart homes in emerging countries like India, China and Indonesia is likely to propel the market growth.

The China LED table lamp market held a substantial share in 2023. China is hub to some of largest manufactures across the globe and is the world’s largest manufacturer of LED products.

The LED table lamps market in India is expected to witness significant growth during the forecast period, owing to the rising disposable income and rapid urbanization. Moreover, the country’s initiative to lower the carbon footprint by end of 2070 is also fueling the growth as these lamps consume less energy and lasts longer.

Key LED Table Lamps Company Insights

Some of the key companies in the LED table lamps market include: Koninklijke Philips N.V.; Panasonic Corporation; OSRAM GmbH; Eaton Corporation PLC; Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

OSRAM GmbH offers innovative and sustainable lighting solutions. The company serves its customer worldwide and offers lamps, semiconductors, electronic control gears, luminaires, and light management systems.

Key LED Table Lamps Companies:

The following are the leading companies in the LED table lamps market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- OSRAM GmbH

- Cree Inc.

- Zumtobel Group AG

- Acuity Brands Lighting Inc.

- General Electric Company

- Hubbell Incorporated

- Eaton Corporation PLC

- Panasonic Corporation

- Flos S.p.A.

Recent Developments

-

In August 2023, Utopia launched an ambiance enhancing range of LED table lamps. The lamps are cordless and are suitable for a hospitality environment as they are dust resistant.

-

In November 2022, Signify (Philips Lighting) launched Philips Smart LED Hero and Philips Smart LED Squire in India. They are portable smart lamps and are available on various online platforms in India.

LED Table Lamps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.4 billion

Revenue forecast in 2030

USD 35.3 billion

Growth Rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia & New Zealand, South Korea, Brazil, South Africa, Saudi Arabia.

Key companies profiled

Koninklijke Philips N.V.; OSRAM GmbH; Cree Inc.; Zumtobel Group AG; Acuity Brands Lighting Inc.; General Electric Company; Hubbell Incorporated; Eaton Corporation PLC; Panasonic Corporation; Flos S.p.A.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global LED Table Lamps Market Report Segmentation

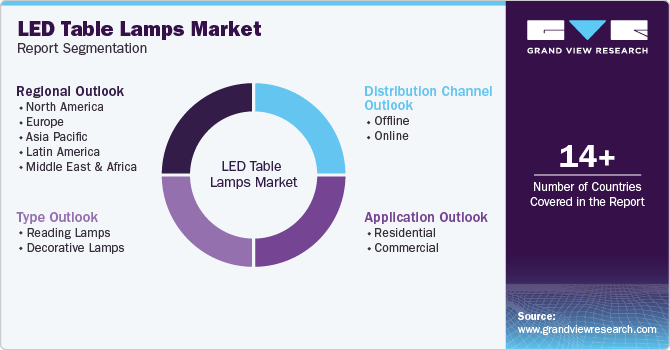

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global LED table lamps market report based on type, application, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reading Lamps

-

Decorative Lamps

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.