- Home

- »

- Next Generation Technologies

- »

-

Legal AI Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Legal AI Market Size, Share & Trends Report]()

Legal AI Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Technology (Natural Language Processing Technology, Machine Learning And Deep Learning Technology), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-111-1

- Number of Report Pages: 162

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Legal AI Market Size & Trends

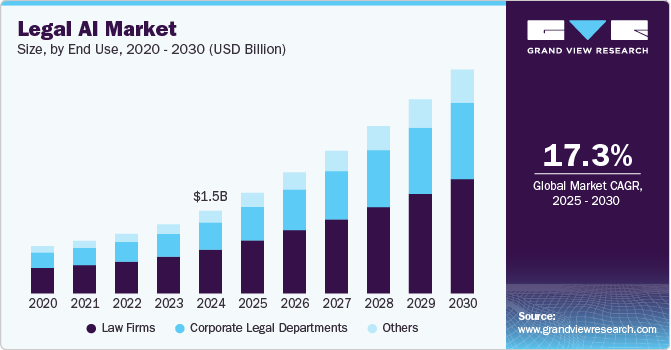

The global legal AI market size was valued at USD 1.45 billion in 2024 and is projected to grow at a CAGR of 17.3% from 2025 to 2030. The growth of the industry can be attributed to the upsurge in demand for automation in legal applications such as eDiscovery, case prediction, regulatory compliance, and contract review and management, among others. Law firms and legal departments face the challenge of managing large volumes of data and documents. However, the emergence of artificial intelligence (AI)-based approaches helped legal firms, legal departments, and governments to streamline tasks such as contract review, legal research, due diligence, and document analysis.

AI-powered chatbots are transforming the legal industry by streamlining communication, enhancing efficiency, and making legal services more accessible. Legal AI chatbots leverage advanced technologies like Natural Language Processing (NLP), machine learning, and predictive analytics to perform a variety of tasks for law firms, corporate legal departments, and clients. Some significant factors, such as the growing need for Faster responses and improved engagement through chatbots, the increasing need to reduce the need for manual labor in client intake, research, and routine inquiries, and the ability to handle a wide range of legal tasks improving the significant of legal AI chatbots, thereby supporting the growth of legal AI industry.

A robust regulatory framework significantly boosts the demand for legal AI solutions. It helps to ensure robust compliance and mitigate legal risks. Legal AI platforms help legal teams track and interpret these regulations, ensuring businesses remain compliant without overburdening internal resources. A stable regulatory framework encourages investment in AI research and development by reducing uncertainty. Industries with stringent regulatory requirements, such as finance, healthcare, and pharmaceuticals, may be compelled to adopt AI solutions to meet compliance obligations. Thus, the increasing availability of regulatory frameworks across the countries is also improving the significance of legal AI solutions, thereby supporting the growth of the legal AI industry.

Another significant trend in the legal AI industry is technological advancements in legal AI platforms. Modern Legal AI platforms are leveraging cutting-edge innovations such as AI, NLP, and ML to streamline processes, improve accuracy, and enhance decision-making across various legal functions. AI-powered tools can automate routine tasks like document review, contract analysis, and legal research, freeing up lawyers' time for more strategic and complex work. Furthermore, AI helps to quickly sift through vast amounts of legal data, identify relevant precedents, and generate concise summaries, significantly speeding up research and analysis processes. AI algorithms can efficiently review large volumes of documents, accurately identifying key information and potential issues, reducing the time and cost associated with manual review. Thus, the growing focus on technological advancements in AI is further stimulating the growth of the legal AI industry.

The growth of this market is driven by factors such as the increased adoption of automated solutions in legal firms and the growing demand for AI tools. AI-powered platforms help to analyze large volumes of legal documents, identifying relevant clauses, inconsistencies, and risks with greater accuracy than manual review. In the last few years, different tools leveraging Natural Language Processing (NLP) have allowed legal professionals to quickly retrieve case law, statutes, and precedents, saving hours of research time. AI tools provide insights into potential case outcomes by analyzing historical data, enabling better preparation and strategic decision-making. Thus, the growing adoption of AI tools and the increasing popularity of AI-based tools is fueling the growth of the legal AI industry.

Component Insights

The solutions segment accounted for the largest market share in 2024 driven by the increased adoption of legal AI software for handling the legal department's work, growing demand for AI-based software solutions to automate and accelerate the routine, repetitive aspects of legal practices. Further, the advent of innovative software solutions with features such as data analytics, machine learning, predictive modeling, and automation is also improving the demand for legal AI solutions, thereby supporting the growth of this segment.

The services segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the rising need for software integration and consulting services, the increasing need for regular upgrades and maintenance, and the growing need for support services to ensure its effective implementation and utilization.

Application Insights

The legal research segment dominated the market in 2024, owing to the growing adoption of AI-powered NLP tools to understand and interpret complex legal language, making it easier to find relevant case law, statutes, and regulations, and the rising need to analyze vast amounts of legal data to predict case outcomes, identify potential risks, and optimize legal strategies. AI-powered chatbots and virtual assistants can provide personalized legal advice to clients, answering questions and providing guidance. AI can automate many time-consuming tasks, reducing the need for manual labor and lowering costs. Further, AI can quickly review and analyze large volumes of legal documents, such as contracts, discovery materials, and regulatory filings, to extract key information and identify potential issues.

The legal chatbots segment is expected to witness the fastest CAGR from 2025 to 2030, driven by the growing adoption of legal chatbots by law firms, technological advancements in legal chatbots, and growing focus by companies on innovations. Chatbots can answer basic legal questions and collect initial client information around the clock, improving accessibility. They can guide clients through a structured intake process, ensuring all necessary information is gathered accurately and quickly. By using AI, chatbots can tailor their responses to individual client needs, building rapport and trust.

End Use Insights

The law firms segment dominated the market in 2024, owing to increased spending on AI technology by law firms. The AI's ability to process and analyze vast amounts of legal data with speed and accuracy has proven immensely valuable to law firms, leading to their substantial growth in the market. In addition, the demand for AI in law firms is driven by its benefits, such as improved efficiency, cost-effectiveness, enhanced decision-making, and better client service.

The corporate legal department's segment is expected to witness notable growth from 2025 to 2030. This growth is driven by several factors, including an increasing demand for legal AI solutions for contract review and lifecycle management, which encompass organizing, tracking, and negotiating contracts. Additionally, there is a rising need to analyze data from legal publications, social media, and client feedback to gain insights into market trends and competitive intelligence. Furthermore, there is a growing necessity to provide insights into litigation trends, case strategies, and judicial behaviors.

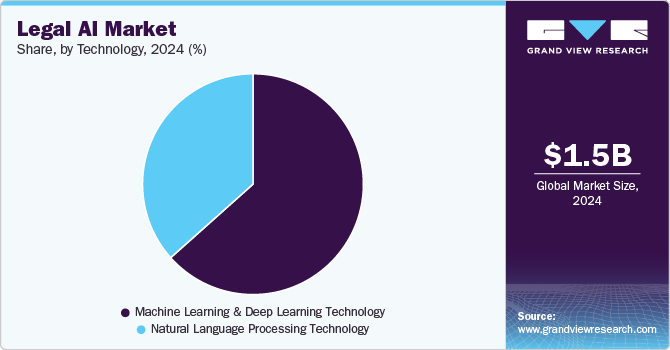

Technology Insights

The machine learning and deep learning technology segment accounted for the largest market share of over 63% in 2024, owing to rising adoption of ML and DL to develop sophisticated algorithms that can analyze large volumes of legal data, extract insights, and automate various legal processes. ML algorithms have analyzed many legal documents, including case law, statutes, and regulations. Increased use of ML technology in legal research platforms has further boosted the growth of this segment. In legal research, ML enables advanced search capabilities and context-based analysis, enabling lawyers to access relevant legal information and improve their research efficiency efficiently.

The natural language processing technology segment is expected to witness the fastest CAGR of 17% from 2025 to 2030, driven by the rising need to automate repetitive tasks, freeing up lawyers to focus on complex legal issues, increasing focus to reduce human error by automating document analysis and understanding, and growing need to speed up research, analysis, and document generation. Furthermore, NLP algorithms can quickly scan lengthy legal documents and generate concise summaries, saving lawyers valuable time. NLP can analyze large volumes of documents during mergers and acquisitions, helping identify red flags and potential liabilities.

Regional Insights

North America legal AI market dominated the global industry with a revenue share of over 46% in 2024, driven by increasing need for efficiency and cost-effectiveness in legal operations, the growing volume of legal data, and advancements in artificial intelligence and natural language processing technologies. With the rising demand for improved efficiency and productivity in the legal process, the region's law firms and legal departments are pressured to handle large volumes of data, documents, and research tasks. AI solutions have helped legal firms in the region to automate and streamline various aspects of legal work, such as contract analysis, legal research, document review, and due diligence; leveraging AI technologies, legal professionals can save time, reduce errors, and enhance overall productivity.

U.S. Legal AI Market Trends

The legal AI market in the U.S. held a dominant position in 2024. The market growth is fueled by the growing need for legal AI solutions by law firms and corporate legal departments, the growing adoption of legal AI solutions for contract analysis, legal research, document review, and predictive analytics, rapidly growing End Uses in the legal AI market, growing demand for legal AI solutions such as chatbots, and increasing adoption of cloud-based legal AI solutions.

Europe Legal AI Market Trends

The legal AI market in Europe is expected to grow at a considerable CAGR of 17% from 2025 to 2030, driven by technological advancements in artificial intelligence, machine learning, and natural language processing technologies. The legal landscape in Europe involves intricate laws, regulations, and compliance requirements across different jurisdictions. The region's law firms and legal departments are under increasing pressure to enhance operational efficiency and reduce costs. The AI tools helped law firms in the region to automate repetitive tasks, such as document review, contract analysis, and legal research, saving time and resources for legal professionals.

The U.K. legal AI market is expected to grow rapidly in the coming years. In the U.K. legal AI’s demand is rising due to the growing acceptance of legal AI solutions for document drafting and automation, increasing proliferation of AI-powered tools for legal research and e-discovery solutions, increasing adoption of AI tools for the improved mental well-being of legal professionals, and growing need to improve productivity and work quality in law firms.

The legal AI market in Germany held a substantial market share in 2024, driven by growing demand for legal AI tools owing to strict data privacy regulations such as GDPR, increasing deployments of AI-powered search engines, and the growing need to automate the review of large volumes of documents. Furthermore, the collaboration between law firms, tech companies, and academic institutions is driving innovation in this market.

Asia Pacific Legal AI Market Trends

The legal AI market in Asia Pacific is anticipated to grow at a CAGR of 20% during the forecast period. This growth is attributed to factors such as a supportive regulatory environment and a strong focus on digital transformation, growing deployments of legal AI tools, growing legal tech ecosystem with a focus on AI-powered solutions for contract analysis and e-discovery applications, and rapid applications of legal AI solutions into contract review and intellectual property analysis.

Japan legal AI market is expected to grow rapidly in the coming years due to increasing focus on prioritizing ethical considerations and data privacy, growing use of legal AI tools for contract analysis, legal research, and e-discovery applications, notable government initiatives for developing a comprehensive regulatory framework for AI, and collaboration between law firms, tech companies, and academic institutions.

The legal AI market in China held a substantial market share in 2024. The growth is attributed to the significant potential for generative AI to revolutionize legal tasks like drafting documents and providing legal advice, and stringent regulations regarding data privacy and security, which can impact the adoption of AI tools that rely on large datasets. Chinese courts have mandated the use of AI in judicial practices, aiming to achieve a higher level of digital justice. This includes implementing AI-powered systems for various tasks such as case analysis, document review, and decision-making. Law firms and legal departments in China are increasingly using AI tools for tasks like contract review, legal research, and due diligence.

Key Legal AI Company Insights

Some of the key players operating in the market include IBM Corporation and Thomson Reuters Corporation among others.

-

IBM Corporation is a provider of legal AI solutions and services. The company operates through four segments: Software, Consulting, Infrastructure, and Financing. Legal AI solutions are offered through the Software segment, which includes capabilities designed to simplify data consumption via data fabric and data management, optimize lifecycle management, and enhance predictive accuracy through business analytics. IBM's data and AI capabilities help create sustainable, resilient businesses and enable intelligent management of enterprise assets and supply chains with a focus on environmental intelligence. Its product offering includes solutions such as Watson Discovery, Contract Lifecycle Management Solutions, and LegalMation.

-

Thomson Reuters Corporation is a provider of legal AI solutions & services. The company also provides information, software, and services for tax and accounting professionals, including CFOs, CPAs, and governments. The company provides information, software, and services for legal professionals, including law firms, corporate legal departments, and governments. Its offerings combine advanced software and insights designed to equip these professionals with the necessary data, intelligence, and solutions for making informed decisions. The company operates through five reportable customer segments, namely Legal Professionals, Corporates, Tax & Accounting Professionals, Reuters News, and Global Print. The Legal Professionals segment of the company offers research and workflow products that emphasize user-friendly legal research powered by cutting-edge technologies such as generative AI, along with integrated legal workflow solutions that bring together content, tools, and analytics.

Casetext Inc. and Luminance Technologies Ltd. are some of the emerging participants in the legal AI market.

-

Casetext Inc. is a provider of legal AI solutions. The company is a leading legal technology company that leverages advanced artificial intelligence to revolutionize legal research and analysis. The company provides its legal AI solutions to different sectors, such as solo and smaller firms, big firms, in-house, litigators, transactional attorneys, and tax professionals. Its product offerings include AI-Powered Legal Research, Document Analysis and Summarization, Predictive Coding, Citation Analysis, and CoCounsel.

-

Luminance Technologies Ltd. is a provider of legal AI solutions. The company operates a leading AI platform specifically designed for legal professionals. Utilizing a unique legal Large Language Model (LLM), Luminance’s AI analyzes and comprehends legal documents in various languages. Currently, Luminance is employed by more than 700 organizations globally, which includes all the Big Four consulting firms, over a quarter of the top 100 law firms in the world, and international companies such as Koch, Inc., Hitachi, Liberty Mutual Insurance Company, and Avianca. Luminance’s AI enhances the capabilities of lawyers in over 70 countries, ranging from large conglomerates to small law practices.

Key Legal AI Companies:

The following are the leading companies in the legal AI market. These companies collectively hold the largest market share and dictate industry trends.

- Casetext Inc.

- CosmoLex Cloud, LLC

- Docusign, Inc.

- Everlaw, Inc.

- Filevine, Inc.

- IBM Corporation

- Icertis, Inc.

- Knovos LLC

- LegalSifter

- LexisNexis

- Luminance Technologies Ltd.

- LAWYAW (Mystacks, Inc.)

- Neota Logic Inc.

- Open Text Corporation

- Practice Insight Pty Ltd (WiseTime)

- Themis Solutions Inc. (Clio)

- Thomson Reuters Corporation

- TimeSolv Corporation

- Veritone, Inc.

Recent Developments

-

In September 2024, Wolters Kluwer N.V. announced the launch of new generative AI (GenAI) functionalities for VitalLaw, its intuitive legal research platform. VitalLaw AI merges advanced technology with Wolters Kluwer's extensive expertise in 25 practice areas, such as securities, privacy, tax labor, and employment, to enhance client outcomes.

-

In July 2024, LexisNexis announced the commercial release of Nexis+ AI, which features cutting-edge generative AI capabilities aimed at enhancing and expediting corporate research, intelligence collection, and business decision-making processes.

-

In February 2024, Thomson Reuters Corporation launched CoCounsel Core, Legal GenAI Assistant, in Canada and Australia. The CoCounsel Core delivers generative AI skills tailored to accelerate, streamline, and improve legal workflows.

Legal AI Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.75 billion

Revenue forecast in 2030

USD 3.90 billion

Growth Rate

CAGR of 17.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end use, regional

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Australia, Japan, India, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

Casetext Inc., CosmoLex Cloud, LLC, Docusign, Inc., Everlaw, Inc., Filevine, Inc., IBM Corporation, Icertis, Inc., Knovos LLC, LegalSifter, LexisNexis, Luminance Technologies Ltd., LAWYAW (Mystacks, Inc.), Neota Logic Inc., Open Text Corporation, Practice Insight Pty Ltd (WiseTime), Themis Solutions Inc. (Clio), Thomson Reuters Corporation, TimeSolv Corporation, Veritone, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Legal AI Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global legal AI market report based on component, technology, application, end use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Cloud-based

-

On-Premises

-

-

Services

-

Consulting Services

-

Support Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Language Processing Technology

-

Machine Learning and Deep Learning Technology

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

E-Discovery

-

Legal Research

-

Analytics

-

Compliance and Regulatory Monitoring

-

Document Drafting and Review

-

Contract Management

-

Legal Chatbots

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Law Firms

-

Corporate Legal Departments

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global legal AI market size was estimated at USD 1.45 billion in 2024 and is expected to reach USD 1.75 billion in 2025.

b. The global legal AI market is expected to grow at a compound annual growth rate of 17.3% from 2025 to 2030 to reach USD 3.90 billion by 2030.

b. Based on region, the North America segment dominated the market in 2024 with a share of over 46%. The segment growth is attributed to the increasing need for efficiency and cost-effectiveness in legal operations.

b. The key players in this industry are Casetext Inc., CosmoLEx Cloud LLC, DpcuSign Inc., Everlaw Inc., Filevine Inc., IBM Corporation, Icertis Inc., Knovos LLC, and others.

b. Key factors driving the growth of the legal AI market include increased demand for automation in eDiscovery, case prediction, regulatory compliance, and contract review and management among with increasing adoption of AI in legal industry to reduce the amount taken for legal case preparation.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."