- Home

- »

- Advanced Interior Materials

- »

-

Lifting Equipment Market Size, Share, Industry Report, 2033GVR Report cover

![Lifting Equipment Market Size, Share & Trends Report]()

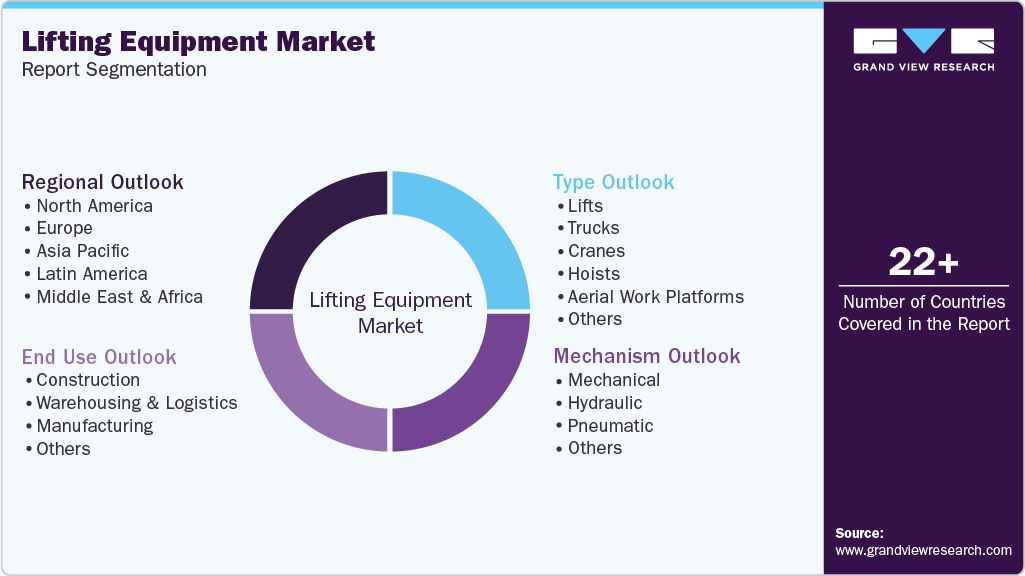

Lifting Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Lifts, Trucks, Cranes, Hoists, Aerial Work Platforms), By Mechanism (Mechanical, Hydraulic, Pneumatic), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-834-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lifting Equipment Market Summary

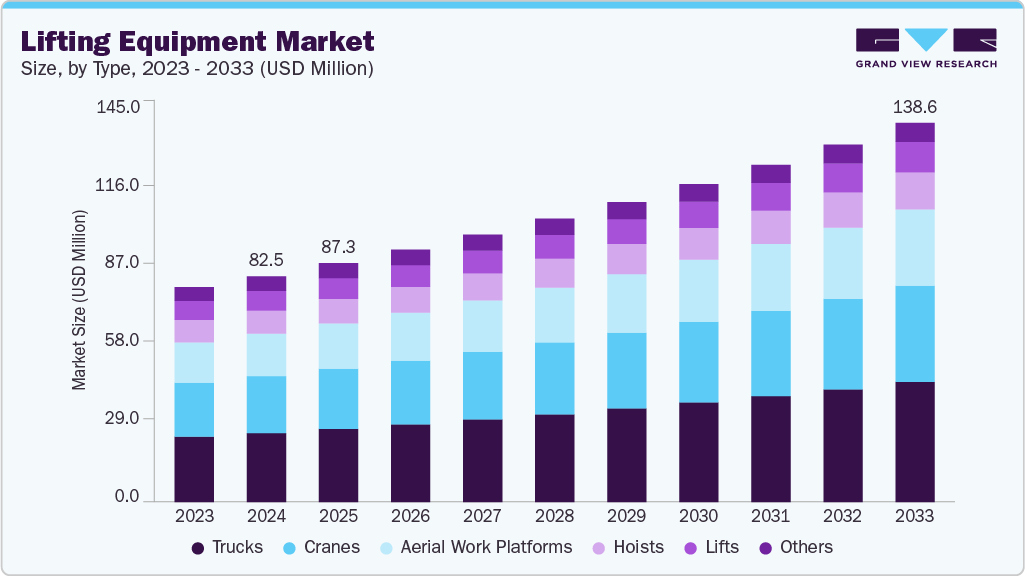

The global lifting equipment market size was estimated at USD 82.5 million in 2024 and is projected to reach USD 138.6 million by 2033, growing at a CAGR of 6.0% from 2025 to 2033. Rapid urbanization and increasing infrastructure development are significantly driving the growth of the lifting equipment industry.

Key Market Trends & Insights

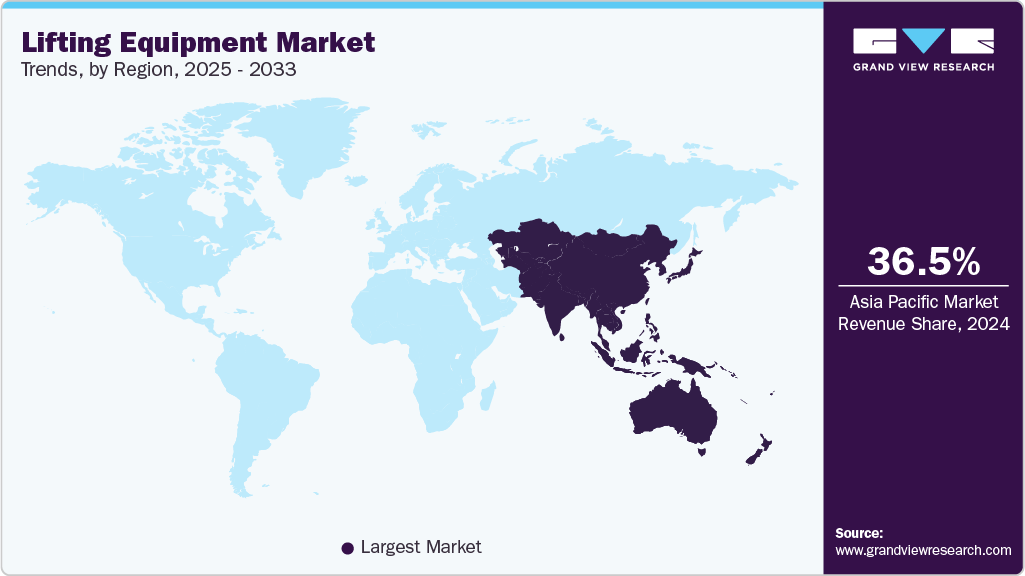

- Asia Pacific dominated the lifting equipment market with the largest revenue share of 36.5% in 2024.

- The lifting equipment market in China accounted for the largest market revenue share in 2024.

- By type, the aerial work platforms segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033.

- By mechanism, the pneumatic segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033.

- By end use, the warehousing & logistics segment is expected to grow at the fastest CAGR of 6.5% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 82.5 Million

- 2033 Projected Market Size: USD 138.6 Million

- CAGR (2025-2033): 6.0%

- Asia Pacific: Largest market in 2024

Expansion in construction, mining, oil & gas, and manufacturing sectors is creating strong demand for efficient material handling solutions. Cranes, hoists, and forklifts play a critical role in handling heavy loads across complex project sites.

The growing focus on workplace safety and operational efficiency is further fueling market expansion. Strict safety regulations are encouraging industries to shift from manual handling to mechanized lifting systems. Modern equipment reduces workplace injuries while improving precision and load control. This emphasis on safer and more productive operations is boosting overall demand for lifting equipment.

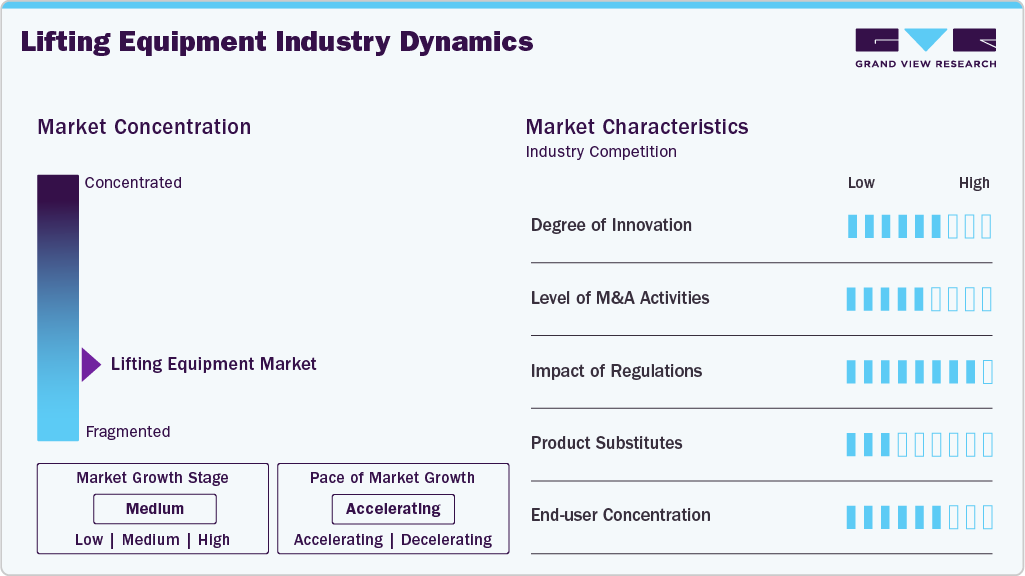

Market Concentration & Characteristics

The lifting equipment industry is largely fragmented, with the presence of numerous global, regional, and local manufacturers competing across different equipment categories and price ranges. While a few major players hold strong positions in premium and large-scale lifting solutions, a wide base of smaller companies serves niche applications and regional demand. This diversity leads to intense competition, frequent product differentiation, and price sensitivity across end-use sectors. Continuous innovation and customized equipment offerings further reinforce the fragmented structure of the market.

The lifting equipment industry demonstrates a high level of innovation driven by automation and smart technology integration. Manufacturers are introducing IoT-enabled systems, remote monitoring, and predictive maintenance features to improve performance. Energy-efficient designs and lightweight materials are also reshaping equipment efficiency and durability. Continuous R&D investment supports the development of safer and more precise lifting solutions.

Strict safety standards and compliance requirements strongly influence product design and operational practices in this lifting equipment industry. Regulatory bodies enforce guidelines related to load capacity, operator safety, and equipment inspection protocols. These regulations compel manufacturers to adopt advanced safety mechanisms and certified components. As a result, compliance-driven upgrades contribute to higher product reliability and market standardization.

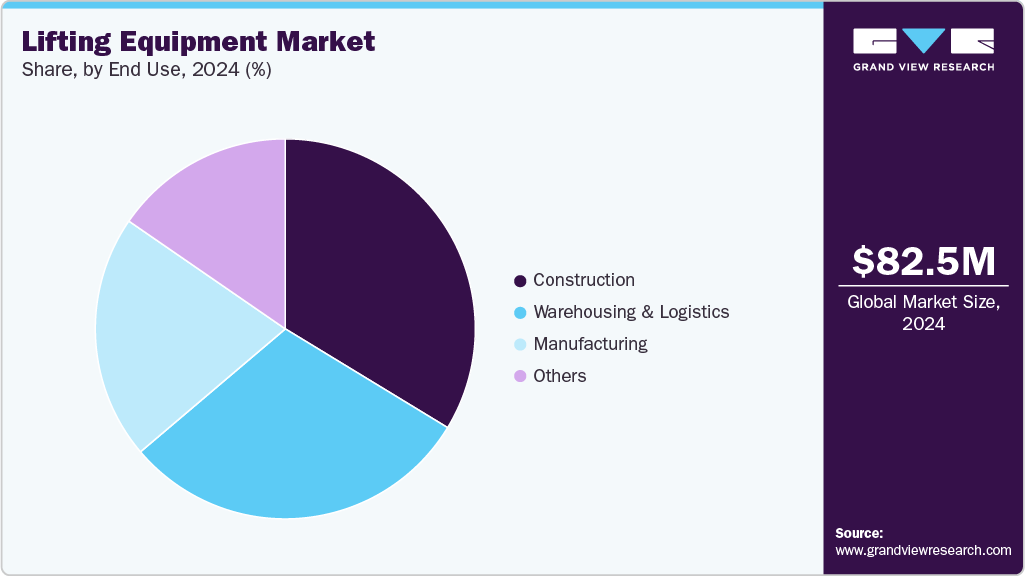

End user demand is moderately diversified across construction, logistics, manufacturing, and industrial sectors. Large infrastructure and industrial projects account for significant equipment consumption. However, small and medium enterprises also contribute steadily to market demand. This balanced distribution prevents excessive dependence on a single industry segment.

Drivers, Opportunities & Restraints

The lifting equipment industry is primarily driven by rapid infrastructure development, industrial expansion, and rising construction activity across urban regions. Increasing mechanization in material handling to improve efficiency and reduce manual labor dependency is accelerating equipment adoption. Growing demand from logistics hubs and warehouses for faster load movement further supports market growth. Technological advancements such as automated and smart lifting systems are strengthening overall equipment performance.

Expanding smart cities projects and large-scale transportation infrastructure create strong growth opportunities for advanced lifting solutions. The integration of IoT, telematics, and predictive maintenance features allows manufacturers to offer value-added systems. Rising investments in renewable energy projects also increase demand for specialized heavy-lifting equipment. Emerging markets are opening new avenues for affordable and customized lifting solutions.

High initial capital investment and maintenance costs limit the adoption of lifting equipment among small enterprises. Fluctuating raw material prices impact manufacturing costs and reduce profit margins for suppliers. Strict safety regulations and compliance requirements can increase operational complexity for end users. In addition, a shortage of skilled operators affects efficient equipment utilization.

Type Insights

The trucks segment led the market with the largest revenue share of 30.5% in 2024, due to their versatility in handling heavy loads across construction sites and industrial facilities. Their ability to perform both lifting and transportation functions improves operational efficiency and reduces equipment dependency. High demand from warehousing, ports, and logistics centers further strengthens their market leadership. Continuous upgrades in load capacity and maneuverability enhance their widespread adoption.

Aerial work platforms segment is expected to grow at the fastest CAGR of 6.7% from 2025 to 2033, due to rising demand for safe access solutions in high-rise construction and maintenance activities. Increasing emphasis on worker safety and compliance with height-related regulations is driving their adoption. Growth in infrastructure renovation and utility installation projects is also boosting their usage. Technological advancements such as electric and hybrid platforms are further accelerating market expansion.

Mechanism Insights

The mechanical lifting segment led the market with the largest revenue share of 48.5% in 2024, due to their simplicity, durability, and cost-effective performance in heavy-duty applications. These mechanisms are widely used in construction and industrial environments where consistent load handling is required. Their low maintenance needs and long operational life make them a preferred choice for continuous operations. Strong reliability under extreme working conditions further supports their widespread adoption.

The pneumatic segment is expected to grow at the fastest CAGR of 6.9% from 2025 to 2033, due to their efficiency in precision handling and lightweight load applications. The increasing use of automated production lines and controlled industrial environments is driving demand for these products. These systems offer smoother operation and reduced risk of overheating compared to conventional mechanisms. Growing focus on energy-efficient and clean operation technologies is accelerating their market growth.

End Use Insights

The construction segment led the market with the largest revenue share of 33.7% in 2024, due to its extensive use in infrastructure development, commercial buildings, and residential projects. Heavy machinery is essential for material movement, structural assembly, and on-site operational efficiency. Large-scale urban development and government-funded construction projects continue to drive demand. Consistent requirement for cranes, hoists, and lifting trucks supports its dominant position.

The warehousing & logistics segment is expected to grow at a fastest CAGR of 6.5% from 2025 to 2033 in terms of revenue, driven by the rapid expansion of e-commerce and distribution networks. The increased demand for efficient material handling and quick order fulfillment is driving the adoption of equipment. Automation of warehouses and high-density storage facilities further requires advanced lifting systems. This growing focus on optimized supply chains is accelerating segment growth.

Regional Insights

The lifting equipment market in North America is anticipated to experience at a steady CAGR of 5.5% during the forecast period, driven by the modernization of construction practices and increasing automation in material handling. The replacement of aging infrastructure is increasing the need for advanced lifting systems. Strong demand from warehousing and e-commerce distribution centers supports market expansion. Technological adoption and safety compliance upgrades also contribute to regional growth.

U.S. Lifting Equipment Market Trends

The lifting equipment market in the U.S. dominates the North American market due to strong construction activity and advanced industrial infrastructure. High demand from logistics, manufacturing, and large-scale commercial projects drives continuous use of equipment. The rapid adoption of automated and smart lifting technologies enhances operational efficiency across various sectors. Ongoing investments in infrastructure modernization further reinforce its market leadership.

The Canada lifting equipment market is emerging as a significant market, driven by increasing infrastructure development and urban expansion projects. Rising activity in mining, energy, and industrial construction is boosting demand for lifting solutions. Growth in warehousing and transportation networks is also driving the adoption of equipment. Government investment in public infrastructure continues to strengthen market expansion.

Europe Lifting Equipment Market Trends

The lifting equipment market in Europe is growing due to increased focus on workplace safety and sustainable construction practices. Ongoing renovation of commercial and industrial buildings is boosting equipment utilization. Adoption of energy-efficient and low-emission lifting solutions is gaining momentum. Strong regulatory frameworks encourage the use of technologically advanced equipment.

The Germany lifting equipment market is growing rapidly, driven by its strong industrial base and advanced manufacturing sector. High demand from automotive, construction, and heavy engineering industries supports consistent equipment utilization. The country’s focus on precision engineering and automation accelerates the adoption of advanced lifting systems. Continuous investments in infrastructure and modernization further reinforce its leading position.

The lifting equipment market in UK is experiencing steady growth, driven by expanding construction and infrastructure redevelopment projects. Rising activity in warehousing and logistics, driven by e-commerce growth, is boosting equipment demand. Increased focus on workplace safety and compliance is encouraging modern equipment upgrades. Government-backed infrastructure investments are further supporting market expansion.

Asia Pacific Lifting Equipment Market Trends

Asia Pacific dominates the global lifting equipment market with the largest revenue share of 36.5% in 2024, due to rapid industrialization and large-scale infrastructure construction. The expansion of urban projects, metro rail development, and smart city initiatives is increasing equipment demand. Strong manufacturing activities and growing logistics networks further reinforce market dominance. Continuous government investment in transportation and commercial infrastructure supports sustained growth.

The lifting equipment market in China accounted for the largest market revenue share in 2024, due to extensive infrastructure development and large-scale industrial expansion. Massive investments in high-speed rail, smart cities, and commercial construction drive continuous demand for equipment. Strong manufacturing capacity and rapid urbanization further strengthen market leadership. Ongoing government-backed development projects sustain high adoption of lifting systems.

The India lifting equipment market is emerging as a rapidly growing market, supported by increasing construction activity and expanding industrial sectors. Increased focus on infrastructure development, including highways, metros, and industrial corridors, is boosting demand. Growth in warehousing and logistics driven by e-commerce is accelerating equipment usage. Continuous government initiatives and foreign investments are strengthening market expansion.

Middle East & Africa Lifting Equipment Market Trends

The lifting equipment market in Middle East & Africa is experiencing growth due to significant infrastructure investments and ongoing urban development projects. Demand from the oil & gas, construction, and logistics sectors is increasing equipment usage. Expansion of ports, airports, and commercial complexes supports market growth. Government-backed development programs continue to enhance regional demand.

The Saudi Arabia lifting equipment market is experiencing strong growth, driven by large-scale infrastructure and mega construction projects under Vision 2030. The rapid development of commercial complexes, transport networks, and industrial zones is increasing the demand for advanced lifting solutions. Expansion in oil & gas facilities and the development of new logistics hubs further support equipment adoption. Rising investments in smart cities and urban development continue to accelerate market growth.

Latin America Lifting Equipment Market Trends

The lifting equipment market in Latin America is experiencing gradual growth supported by expanding mining, construction, and industrial development activities. Infrastructure improvement projects are increasing the demand for reliable lifting machinery. Rising urbanization and industrial expansion are driving the mechanization of material handling. Improved investment flow is strengthening market penetration across the region.

The Brazil lifting equipment market is witnessing steady growth, driven by expanding construction and infrastructure development activities. Increased investment in transport networks, ports, and industrial facilities is boosting demand for lifting solutions. Growth in the mining and manufacturing sectors further supports the adoption of equipment. Urban expansion and the rise of commercial projects continue to strengthen market momentum.

Key Lifting Equipment Company Insights

Some of the key players operating in the market include Liebherr, Komatsu, and Terex.

-

Liebherr specializes in high-capacity crawler and mobile cranes engineered for complex heavy-lift operations in infrastructure and energy projects. Its equipment is designed with advanced stability control and precise load management systems for demanding site conditions. The company’s cranes are extensively used in wind turbine installation and large modular construction assembly. Liebherr integrates intelligent monitoring tools to optimize equipment performance and reduce downtime. Continuous focus on automation and engineering refinement enhances lifting accuracy and operational safety.

-

Komatsu provides lifting equipment tailored for heavy-duty construction and mining environments requiring high durability. Its machines are designed to perform reliably under extreme load and challenging terrain conditions. The company integrates lifting functions with large-scale earthmoving and site preparation operations. Fuel-efficient systems and low-emission technologies improve operational sustainability. Advanced control mechanisms support precise load handling and improved job site productivity.

Key Lifting Equipment Companies:

The following are the leading companies in the lifting equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Terex

- Cargotec

- Demag Cranes & Components

- JASO Industrial Cranes

- Komatsu

- Konecranes

- Liebherr

- Mammoet

- Manitowoc Company

- Palfinger

- SANY

- Sarens

- Sennebogen

- Shanghai Zhenhua Heavy Industries (ZPMC)

- Tadano

Recent Developments

-

In November 2025,Potain has introduced the MCR 505 J25 luffing-jib tower crane, designed for efficient operation on congested construction sites. The crane boasts high lifting performance, even at extended jib lengths, making it well-suited for complex urban projects. Its compact slewing radius allows easier maneuverability in limited spaces. Enhanced control systems improve load precision and overall operational efficiency.

-

In August 2025, SANY introduced an innovative 50-ton energy-storage reach stacker designed specifically for handling large battery containers in industrial environments. The equipment features a high-capacity, swappable battery system that supports extended working hours with reduced emissions. Its advanced energy recovery technology improves efficiency by minimizing power loss during operation. This launch highlights SANY’s focus on sustainable and high-performance material handling solutions for modern infrastructure demands.

Lifting Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 87.3 million

Revenue forecast in 2033

USD 138.6 million

Growth rate

CAGR of 6.0% from 2024 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, mechanism, end use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Terex; Cargotec; Demag Cranes & Components; JASO Industrial Cranes; Komatsu; Konecranes; Liebherr; Mammoet; Manitowoc Company; Palfinger; SANY; Sarens; Sennebogen; Shanghai Zhenhua Heavy Industries (ZPMC); Tadano

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lifting Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global lifting equipment market report based on type,mechanism, end use, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lifts

-

Trucks

-

Cranes

-

Hoists

-

Aerial Work Platforms

-

Others

-

-

Mechanism Outlook (Revenue, USD Million, 2021 - 2033)

-

Mechanical

-

Hydraulic

-

Pneumatic

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Warehousing & Logistics

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lifting equipment market size was estimated at USD 82.5 million in 2024 and is expected to be USD 87.3 million in 2025.

b. The global lifting equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2033 to reach USD 138.6 million by 2033.

b. Asia Pacific dominates the global market and accounting for 36.5% share in 2024, due to rapid industrialization and large-scale infrastructure construction. Expanding urban projects, metro rail development, and smart city initiatives are increasing equipment demand. Strong manufacturing activities and growing logistics networks further reinforce market dominance.

b. Some of the key players operating in the global lifting equipment market include Terex; Konecranes; SANY; Demag Cranes & Components; Palfinger; Liebherr; Tadano; Shanghai Zhenhua Heavy Industries (ZPMC); Mammoet; Komatsu; Sarens; Cargotec; JASO Industrial Cranes; Manitowoc Company; Sennebogen.

b. The global lifting equipment market is driven by rapid infrastructure development and increasing construction activity worldwide. Growing demand for efficient material handling in logistics and industrial sectors is further boosting equipment adoption. Technological advancements in automation and safety systems are also enhancing operational efficiency and supporting market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.