- Home

- »

- Advanced Interior Materials

- »

-

Light Tower Market Size And Share, Industry Report, 2033GVR Report cover

![Light Tower Market Size, Share & Trends Report]()

Light Tower Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Power Source (Electric, Fossil Fuel, Solar), By Lifting Method, By Lamps Type, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-653-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Light Tower Market Summary

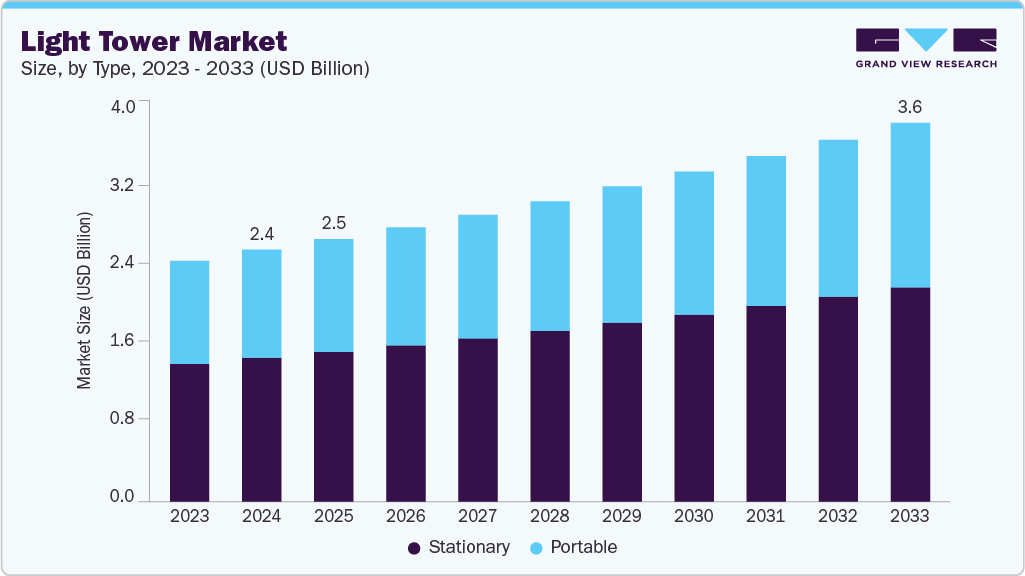

The global light tower market size was estimated at USD 2,393.3 million in 2024 and is projected to reach USD 3,597.3 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The global light tower industry is primarily driven by the surge in construction and infrastructure development activities worldwide.

Key Market Trends & Insights

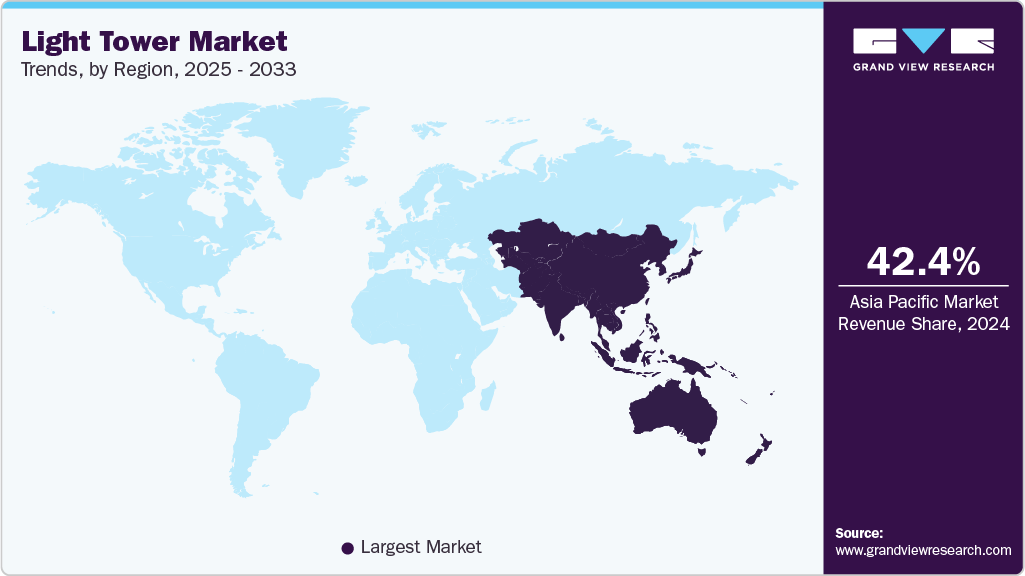

- Asia Pacific dominated the light tower market with the largest revenue share of 42.4% in 2024.

- The light tower market in China is expected to grow at a substantial CAGR of 6.2% from 2025 to 2033.

- By type, portable segment is expected to grow at a considerable CAGR of 4.8% from 2025 to 2033 in terms of revenue.

- By power source, the solar segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

- By lamps type, the LED segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 2,393.3 Million

- 2033 Projected Market Size: USD 3,597.3 Million

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

With increasing urbanization and government investments in public infrastructure, the demand for portable lighting solutions has grown significantly. In addition, the expansion of mining and oil & gas industries in remote areas fuels the need for efficient lighting solutions. These sectors operate in challenging terrains where fixed lighting is impractical, making a mobile tower essential. Growing emphasis on worker safety and uninterrupted operations further supports market demand. Advancements in LED and solar technologies are also enhancing efficiency and reducing operational costs.

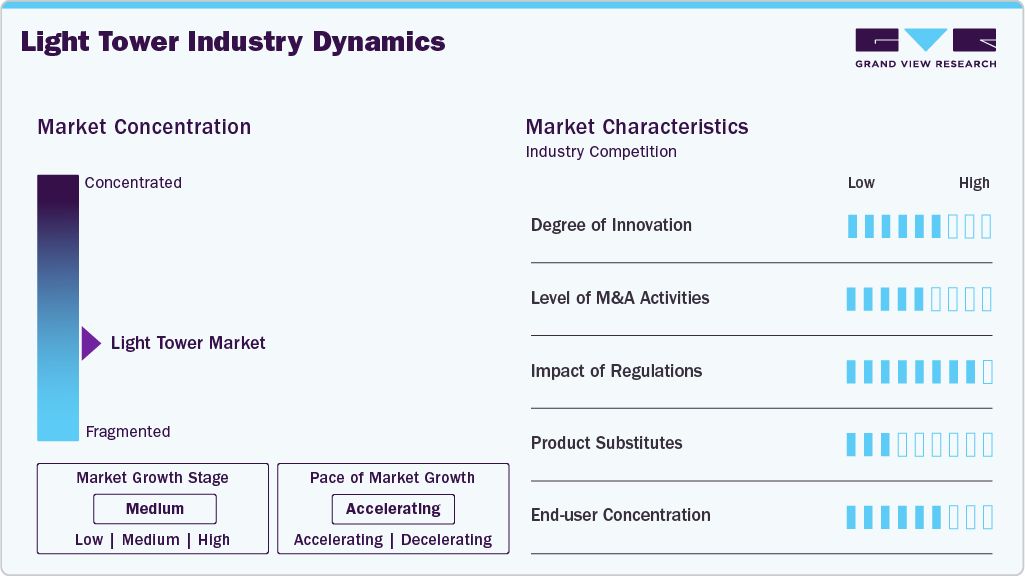

Market Concentration & Characteristics

The global light tower industry is moderately fragmented, with several regional and international players competing for market share. Key companies focus on innovation, product differentiation, and partnerships to strengthen their presence. While a few large players hold significant shares, numerous smaller firms serve niche regional markets. This competitive environment encourages continuous product development and pricing strategies.

The global light tower industry is witnessing continuous innovation, particularly in lighting and power technologies. Manufacturers are increasingly developing LED-based and solar-powered towers to meet sustainability goals. These innovations help reduce fuel consumption, emissions, and maintenance requirements. Integration of smart controls and remote monitoring systems is also gaining traction to improve operational efficiency.

The market shows moderate M&A activity as key players seek to strengthen their global presence. Companies are acquiring regional manufacturers to expand distribution networks and product portfolios. These mergers often provide access to new technologies and customer bases. The trend supports market consolidation and enhances competitiveness among leading firms.

Regulatory frameworks focused on emissions, fuel usage, and noise control are shaping the development of the light tower. Governments and environmental bodies are enforcing stricter standards, especially for diesel-powered units. This is encouraging the shift toward hybrid and solar-powered alternatives. Compliance with these regulations drives innovation but also increases production and operational costs.

Drivers, Opportunities & Restraints

The global light tower industry is driven by the growing demand from the construction, mining, and oil & gas industries. These sectors often operate in remote or low-light areas, requiring reliable illumination solutions. Increasing infrastructure development projects worldwide further boost demand. Technological advancements, such as LED and solar-powered towers, are also enhancing product efficiency and appeal.

There is a rising opportunity in the adoption of eco-friendly and energy-efficient light towers. Emerging markets in Asia-Pacific and Africa offer strong growth potential due to rapid urbanization and industrialization. The integration of smart features like remote monitoring is creating new value-added offerings. In addition, increased use in disaster response, events, and public safety applications provides further market expansion.

High upfront costs for advanced light towers can deter small and medium-sized buyers. Fuel dependency in conventional models leads to high operational costs and environmental concerns. Fluctuating prices of raw materials also pose challenges for manufacturers. Furthermore, strict regulatory standards across regions may increase compliance burdens and limit product flexibility.

Power Source Insights

The fossil fuel-powered segment led the market with the largest revenue share of 53.8% in 2024, due to its high power output and reliability in remote areas. They are widely used in construction, mining, and oil & gas sectors where grid access is limited. These towers offer long runtime and are preferred for heavy-duty, large-scale operations. Their robust design and established infrastructure support continued widespread adoption.

The solar-powered segment is anticipated to grow at the fastest CAGR during the forecast period, driven by rising environmental concerns and stricter emission regulations. They offer sustainable and cost-effective lighting solutions with minimal operational costs. Advancements in solar panel efficiency and battery storage have improved their performance and reliability. Increasing demand for green alternatives across construction and emergency services fuels their rapid adoption.

Type Insights

The stationary light tower segment led the market with the largest revenue share of 57.1% in 2024, owing to its widespread use in long-term, large-scale industrial and infrastructure projects. They offer higher power capacity and are ideal for fixed-site operations such as construction zones and mining fields. Their durability and ability to operate continuously make them a preferred choice for demanding environments. These systems are typically integrated with powerful lighting and robust fuel sources, ensuring reliability.

The portable segment is anticipated to grow at the fastest CAGR during the forecast period, owing to its flexibility and ease of deployment. They are highly suitable for temporary use in events, emergency response, road maintenance, and remote work sites. Lightweight designs and advancements in battery and solar technologies have improved their efficiency and mobility. The growing need for mobile and quick-setup lighting solutions is accelerating their demand across multiple sectors.

Lifting Method Insights

The hydraulic segment led the market with the largest revenue share of 63.0% in 2024, due to demand for convenience, safety, and efficiency in large-scale applications. They enable quick and effortless mast extension, reducing labor and setup time significantly. These systems are ideal for heavy-duty operations in mining, oil & gas, and infrastructure projects. As users shift toward automation and operator safety, hydraulic systems are increasingly replacing manual alternatives.

The manual lifting segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its cost-effectiveness and simple operation. They are widely used in small to medium-scale projects where heavy lifting power is not essential. These systems are preferred in developing regions with budget constraints and limited access to advanced equipment. Their low maintenance requirements and easy setup make them a popular choice for general lighting needs.

Lamps Type Insights

The LED lamps segment led the market with the largest revenue share of 57.5% in 2024,owing to their superior energy efficiency, long lifespan, and low maintenance needs. They offer instant illumination, better durability, and significantly lower operating costs than traditional lamps. Increasing focus on sustainability and emission reduction is accelerating the shift toward LED-based towers. As prices decline and performance improves, LED adoption continues to rise across all major industries.

The metal halide lamps segment is anticipated to grow at the fastest CAGR during the forecast period, driven by its high-intensity illumination and suitability for large outdoor areas. They are widely used in construction sites, mining operations, and sports events where powerful lighting is essential. Their relatively lower initial cost compared to LED systems also supports continued usage. Despite competition from newer technologies, their strong lighting performance maintains high demand.

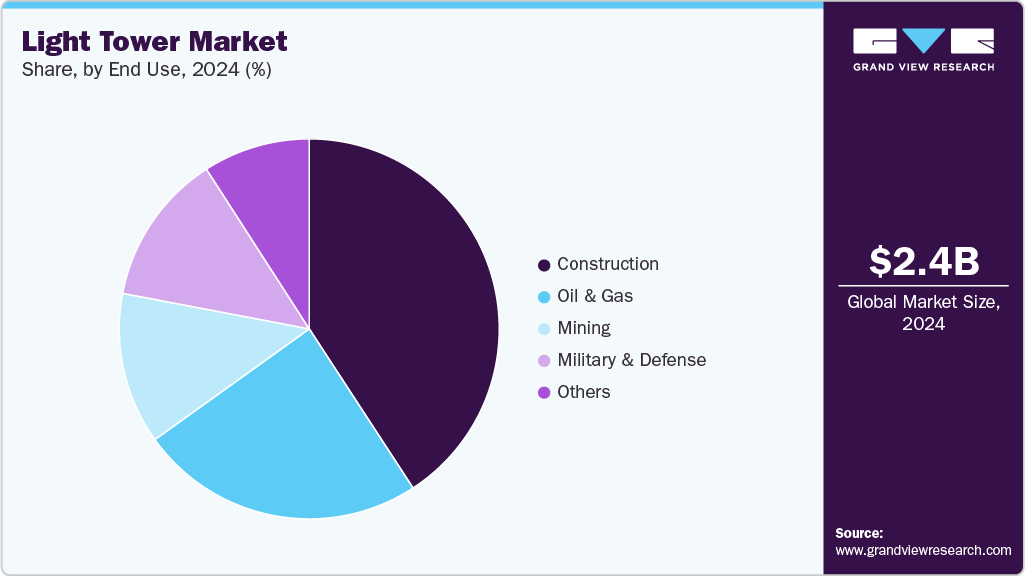

End Use Insights

The construction segment led the market with the largest revenue share of 40.8% in 2024, due to its consistent demand for reliable lighting at job sites. Projects often run into night hours or take place in remote areas, requiring strong illumination for safety and productivity. Light towers are essential for road construction, infrastructure development, and building projects. Rapid urbanization and government infrastructure initiatives globally continue to fuel this demand.

The military & defense sector is anticipated to grow at the fastest CAGR during the forecast period, due to increasing demand for portable and durable lighting in tactical and field operations. Light towers are essential for night-time visibility, security checkpoints, and emergency response in remote or combat zones. Advancements in hybrid and silent-operating towers are aligning with modern military needs. Rising global defense budgets and border security initiatives are further accelerating adoption.

Regional Insights

The light tower market in North America is anticipated to grow at the fastest CAGR of 3.6% during the forecast period, by applications requiring high-performance lighting across construction, oil & gas, and infrastructure sectors. The U.S. continues to invest heavily in energy and public works, supporting market dominance. Growth is accelerating in areas adopting energy-efficient and low-maintenance lighting technologies. Government incentives and stricter emission standards are also fueling the shift toward modern, sustainable solutions.

U.S. Light Tower Market Trends

The light tower market in the U.S. is experiencing strong growth due to its extensive construction activities, energy infrastructure upgrades, and military operations. Continued investments in oil & gas exploration, particularly in shale basins, increased demand for reliable lighting. Adoption of energy-efficient technologies like LED and solar-powered towers is rising rapidly. Federal infrastructure programs and disaster preparedness initiatives also contribute to sustained market expansion.

The Mexico light tower market is witnessing growth driven by increasing industrialization and the expansion of transportation and energy projects. Road and highway construction programs are particularly creating demand for portable and efficient lighting equipment. Rising foreign investments in infrastructure and energy are also fueling the market. In addition, growth in event-based and public safety applications is contributing to higher light tower deployment.

Asia Pacific Light Tower Market Trends

Asia Pacific dominates the light tower market with the largest revenue share of 42.4% in 2024, due to large-scale development initiatives, including transportation, mining, and urban expansion. Countries like China and India continue to deploy lighting solutions across fast-paced construction and rural electrification efforts. The market is growing quickly in technologies offering flexibility and mobility to meet the needs of dynamic work environments. Affordability and innovation are key factors supporting this regional surge.

The light tower market in China is growing rapidly due to massive infrastructure development, including highways, railways, and urban expansion. The government’s focus on large-scale industrial zones and mining operations drives consistent demand for lighting equipment. Increasing adoption of advanced technologies is improving energy efficiency and reducing operating costs. In addition, construction activities linked to economic recovery are further accelerating market growth.

The India light tower market is witnessing strong growth in light tower demand due to rising construction in rural and urban areas. Government programs such as Smart Cities and highway expansion are creating a need for portable lighting solutions. Growth in the mining, energy, and infrastructure sectors is also contributing to increased adoption. The push toward solar power and energy-efficient lighting aligns with national sustainability goals and reduces reliance on diesel.

Europe Light Tower Market Trends

The light tower market in Europe remains strong in projects involving long-term urban infrastructure and industrial modernization. Demand is steady in areas emphasizing efficiency and regulatory compliance. Rapid growth is observed in technologies aligned with sustainability goals and renewable integration. Environmental policies across the EU are pushing industries to adopt greener and quieter mobile lighting options.

The Germany light tower market is experiencing market growth due to its ongoing infrastructure modernization and public transport development. The country's focus on energy efficiency has accelerated the shift toward LED and hybrid light towers. Construction of renewable energy facilities and industrial zones further drives demand. Strong regulatory support for low-emission technologies is also encouraging faster adoption of sustainable lighting solutions.

The light tower market in the UK is growing due to increased infrastructure spending, particularly in the transportation and housing sectors. Government initiatives focused on clean energy and green construction are boosting the demand for advanced lighting equipment. Events, emergency response, and night-time utility work are expanding the use of mobile towers. In addition, rising preference for environmentally friendly and low-noise lighting technologies supports long-term market growth.

Latin America Light Tower Market Trends

The light tower market in Latin America is anticipated to grow at the fastest CAGR during the forecast period. The region is driven by strong demand from extractive industries and expanding infrastructure networks. Countries like Brazil are seeing stable usage patterns due to mining operations and utility construction. Fast growth is seen in solutions that offer automation, faster setup, and improved safety. Increasing government and private investments are further propelling the market forward.

The Brazil light tower market is growing due to strong demand from the mining and construction sectors across the country. Ongoing development of roads, airports, and energy infrastructure is driving the need for portable lighting solutions. Remote operations in resource-rich regions rely heavily on durable and high-performance light towers. In addition, rising government and private investments in infrastructure projects continue to boost market growth.

Middle East & Africa Light Tower Market Trends

The light tower market in the Middle East & Africa is anticipated to grow at a significant CAGR during the forecast period. High-intensity demand from large-scale industrial and energy projects supports market leadership in this region. Countries such as Saudi Arabia are investing in mega-projects and remote infrastructure that require durable lighting. The market is growing rapidly in alternatives that reduce fuel dependency and can operate in off-grid or harsh conditions. Sustainability targets and cost-efficiency are influencing newer adoption trends across this region.

The Saudi Arabia light tower market is experiencing strong growth driven by large-scale projects such as NEOM and Vision 2030 development goals. Extensive oil & gas operations in remote desert regions require reliable and durable lighting solutions. The country is also investing heavily in infrastructure, housing, and transport, supporting demand for light towers. Rising focus on safety, efficiency, and emission reduction is encouraging the adoption of modern lighting technologies

Key Light Tower Company Insights

Some of the key players operating in the market include Allmand Bros., Inc., PowerLink, MITSUBISHI HEAVY INDUSTRIES, LTD.

-

Allmand Bros., Inc. is a specialist in durable, heavy-duty light towers designed for construction, mining, and oilfield operations, with models offering advanced LED lighting and long fuel runtime. In addition to light towers, the company also manufactures mobile generators and portable heaters, providing complete job site power and climate solutions. Its products are engineered for extreme environments, prioritizing ruggedness, reliability, and minimal maintenance. Allmand also integrates telematics for remote equipment monitoring and performance tracking. The company supports its offerings with strong aftermarket service and parts availability across North America.

-

PowerLink designs and manufactures a diverse range of energy solutions, including light towers, diesel and gas generators, hybrid energy systems, and acoustic enclosures. Its light towers are widely used in telecom, construction, and disaster recovery, featuring solar and hybrid options for fuel savings and environmental compliance. PowerLink’s generator lineup spans from residential backup units to industrial-grade systems supporting hospitals, data centers, and remote infrastructure. The company emphasizes modular design and remote control integration for improved operational efficiency. It serves a global customer base with manufacturing and service hubs in the UK, China, and the Middle East.

Key Light Tower Companies:

The following are the leading companies in the light tower market. These companies collectively hold the largest market share and dictate industry trends.

- Allmand Bros., Inc.

- PowerLink

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Atlas Copco

- Caterpillar.

- Sigma Search Lights Limited

- Chicago Pneumatic

- Doosan Bobcat.

- Generac Power Systems, Inc.

- HIMOINSA

- Progress Solar Solutions

- Maxar Technologies

- The Will Burt Company

- TRIME s.r.l.

- PR Industrial Srl Unipersonale

- Wacker Neuson SE

Recent Developments

-

In January 2024,Generac Mobile introduced the GLT Series, a new line of mobile lighting towers designed for improved performance and sustainability. These towers feature compact designs, enhanced fuel efficiency, and low noise emissions, making them suitable for urban and sensitive environments. The GLT Series offers both diesel and hybrid models with optional LED lighting technology. This launch reflects Generac's commitment to innovation and environmentally conscious equipment solutions.

-

In December 2023,Atlas Copco launched its first hybrid light tower, the HiLight HVT 500, combining battery and diesel technologies. The model is designed to reduce fuel consumption by up to 70% and cut CO₂ emissions significantly. It operates silently during battery mode, making it ideal for urban and noise-sensitive environments. This launch aligns with the company’s commitment to offering more sustainable and energy-efficient equipment solutions.

Light Tower Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,492.6 million

Revenue forecast in 2033

USD 3,597.3 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power source, lifting method, lamps type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Allmand Bros., Inc.; PowerLink; MITSUBISHI HEAVY INDUSTRIES, LTD.; Atlas Copco; Caterpillar.; Sigma Search Lights Limited; Chicago Pneumatic; Doosan Bobcat.; Generac Power Systems, Inc.; HIMOINSA; Progress Solar Solutions; The Will Burt Company; TRIME s.r.l.; PR Industrial Srl Unipersonale; Wacker Neuson SE.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Light Tower Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global light tower market report based on type, power source, lifting method, lamps type, end use, and region

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Stationary

-

Portable

-

-

Power Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Fossil Fuel

-

Solar

-

-

Lifting Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Manual

-

Hydraulic

-

-

Lamps Type Outlook (Revenue, USD Million, 2021 - 2033)

-

LED

-

Metal Halide

-

Halogen

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Oil & Gas

-

Minning

-

Military & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global light tower market size was estimated at USD 2,393.3 million in 2024 and is expected to be USD 2,492.6 million in 2025.

b. The global light tower market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 3,597.3 million by 2033.

b. Asia Pacific dominated the market with a 42.4% share in 2024, driven by large-scale infrastructure projects, urban expansion, and rural electrification in countries like China and India. Rapid construction activity and demand for flexible, mobile lighting solutions are fueling growth.

b. Some of the key players operating in the global light tower market include Allmand Bros., Inc.; PowerLink; MITSUBISHI HEAVY INDUSTRIES, LTD.; Atlas Copco; Caterpillar.; Sigma Search Lights Limited; Chicago Pneumatic; Doosan Bobcat.; Generac Power Systems, Inc.; HIMOINSA; Progress Solar Solutions; The Will Burt Company; TRIME s.r.l.; PR Industrial Srl Unipersonale; Wacker Neuson SE.

b. The global light tower market is driven by rising construction, mining, and oil & gas activities across remote and large-scale sites. Increasing demand for energy-efficient, mobile, and environmentally friendly lighting solutions further fuels market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.