- Home

- »

- Sensors & Controls

- »

-

Lighting Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Lighting Market Size, Share & Trends Report]()

Lighting Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (CFL, Fluorescent Lighting), By Application (Indoor lighting, Smart Lighting), By Distribution Channel (Online, Offline), By End Use (Residential, Commercial), And Segment Forecasts

- Report ID: GVR-4-68040-521-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Lighting Market Summary

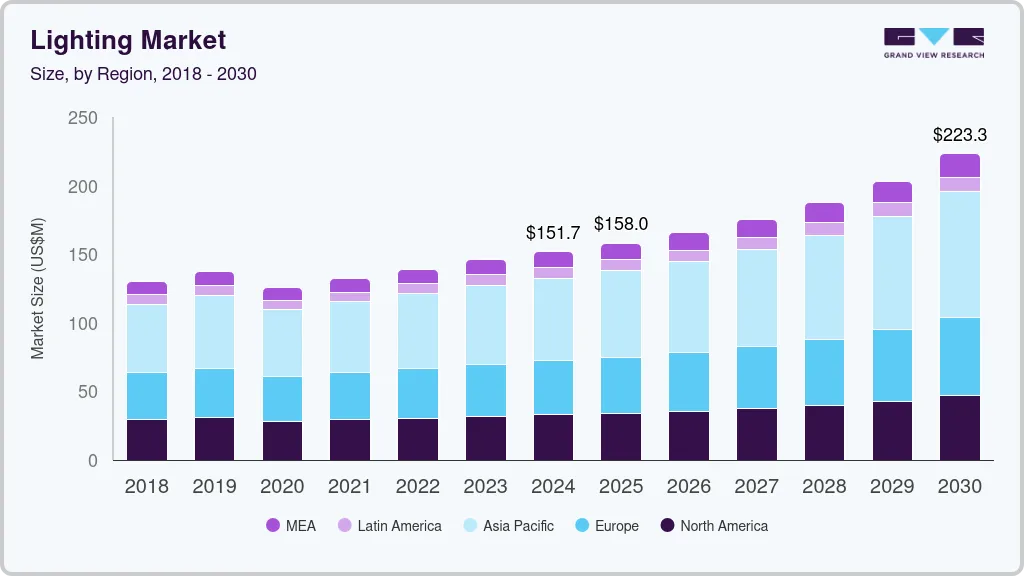

The global lighting market size was estimated at USD 151.7 billion in 2024 and is projected to reach USD 223.3 billion by 2030, growing at a CAGR of 7.2% from 2025 to 2030. The global lighting market is experiencing steady growth, driven by increasing demand for energy-efficient solutions, urbanization, and smart lighting technologies.

Key Market Trends & Insights

- North America lighting industry accounted for a revenue share of over 21% of the lighting industry in 2024.

- The lighting industry in the U.S. is expected to grow significantly from 2025 to 2030.

- By type, the LED lighting segment accounted for a revenue share of over 58% in 2024.

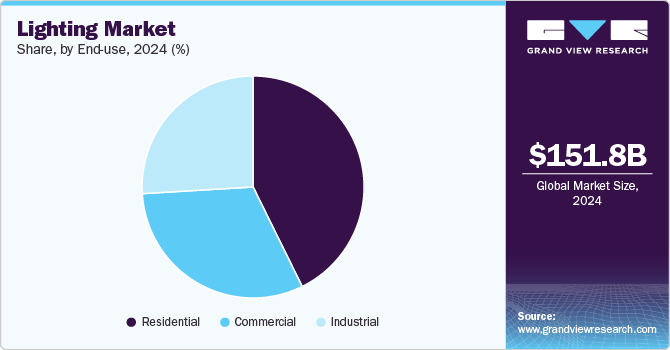

- By, end use, the residential segment accounted for the largest revenue share of over 42% in 2024.

- By distribution channel, the offline segment accounted for the largest revenue share of over 65% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 151.7 Billion

- 2030 Projected Market Size: USD 223.3 Billion

- CAGR (2025-2030): 7.2%

- North America: Largest market in 2024

Traditional lighting solutions, such as incandescent and halogen bulbs, are being phased out in favor of LED lighting, which dominates the market due to its superior energy efficiency, longer lifespan, and cost-effectiveness. Government regulations promoting energy conservation and sustainability are also accelerating the adoption of LEDs and smart lighting systems in residential, commercial, and industrial spaces. The rise of smart cities, infrastructure development, and Internet of Things (IoT)-enabled lighting solutions is shaping the future of industry.

Smart lighting systems integrated with IoT, AI, and automation are revolutionizing the lighting industry by enabling remote control, adaptive lighting, and energy optimization. These systems allow users to adjust brightness, color temperature, and schedules via mobile apps or voice assistants, improving convenience and efficiency. AI-driven automation helps optimize energy use by adjusting lighting based on occupancy and daylight availability. Additionally, the rapid expansion of commercial and residential construction projects, particularly in urban areas, is driving demand for modern lighting solutions. Smart lighting is becoming a key feature in smart homes, offices, and cities, enhancing energy savings, security, and user experience while supporting global sustainability initiatives and energy efficiency goals.

The proliferation of low-quality and counterfeit LED products undermines market reliability and consumer trust, as these products often fail to meet safety and efficiency standards. Additionally, environmental concerns regarding the disposal and recycling of lighting products, particularly CFLs and fluorescent Halogen containing mercury, pose significant regulatory challenges. Governments and industry players are focusing on strict quality control measures and eco-friendly disposal regulations to mitigate risks, ensuring sustainable lighting solutions, and reducing hazardous waste impacts on the environment.

The future of the lighting industryt is expected to be shaped by technological advancements, energy efficiency regulations, and smart lighting adoption. Smart and connected lighting solutions, integrated with AI and IoT, will drive innovation, allowing automated lighting control based on occupancy, daylight levels, and energy-saving preferences. Human-centric lighting (HCL), which adjusts color temperature and intensity to enhance productivity and well-being, is gaining popularity in workplaces, healthcare, and residential spaces.

Type Insights

The LED lighting segment accounted for a revenue share of over 58% in 2024. The growing adoption of smart homes, smart offices, and smart cities is significantly boosting demand for connected LED lighting systems. IoT-enabled LED lighting provides users with remote control, automation, and energy optimization, allowing seamless integration with mobile apps and voice assistants. Additionally, the declining cost of LED bulbs and fixtures has made them more affordable for both consumers and businesses. Mass production, advancements in semiconductor technology, and economies of scale have driven prices down, accelerating LED adoption. As LED lighting becomes more accessible and cost-effective, its role in energy-efficient and smart lighting solutions continues to expand across residential, commercial, and industrial sectors.

The HID segment is anticipated to register a CAGR of 7.6% during the forecast period. HID lighting is widely used in outdoor and industrial applications due to its high-intensity output and long lifespan. It is a preferred choice for streetlights, parking lots, stadium floodlights, and airports, ensuring consistent illumination. In industrial settings, including warehouses and manufacturing plants, HID lighting supports large-scale illumination, enhancing safety, visibility, and operational efficiency, especially in harsh and demanding environments.

Application Insights

The indoor lighting segment accounted for the largest revenue share in 2024. As urban populations continue to grow, there is a significant increase in the construction of residential, commercial, and office buildings, all of which require modern indoor lighting solutions. This trend is particularly pronounced in emerging economies, where rapid urbanization is driving the demand for high-quality, energy-efficient indoor lighting. The need for enhanced lighting in new developments, combined with the growing focus on sustainability and smart technologies, is accelerating the adoption of innovative indoor lighting solutions in these regions.

The smart lighting segment is expected to grow at a significant rate during the forecast period. The rising popularity of home automation systems and voice-controlled devices is significantly boosting the demand for smart lighting. These systems can easily integrate with smart thermostats, security systems, and other devices, providing a unified, customizable, and energy-efficient environment. The ability to control lighting alongside other home functions enhances convenience and energy savings, making it a key feature in modern smart homes. This growing trend is driving greater adoption of smart lighting solutions across residential spaces.

Distribution Channel Insights

The offline segment accounted for the largest revenue share of over 65% in 2024. Leading lighting brands are increasing their presence in retail outlets and specialty stores, making their products more accessible to consumers. The availability of lighting in home improvement stores, lighting showrooms, and electronics outlets has significantly contributed to the growth of the offline segment. Additionally, many consumers prefer purchasing from established offline retailers because they trust the product quality, reliability, and customer service these stores offer. Offline stores are often seen as providing superior after-sales support, including warranty services and return policies, which consumers value. This consumer trust and the convenience of in-person shopping continue to fuel the demand for lighting purchases.

The online segment is anticipated to grow at a CAGR of 8.5% during the forecast period. The online segment offers consumers a wider product selection than physical stores, providing access to designer Halogen, niche eco-friendly options, and smart lighting solutions. This expanded variety allows consumers to find exactly what they are looking for. Additionally, price comparison tools and the ability to read reviews help consumers make informed decisions. With discounts, seasonal offers, and flash sales, online shoppers are often attracted to better pricing and promotions, further boosting demand for lighting products.

End Use Insights

The residential segment accounted for the largest revenue share of over 42% in 2024. The demand for smart lighting in smart homes is growing rapidly as homeowners seek IoT-enabled lighting systems that provide remote control, automation, and energy optimization. Integration with voice assistants like Alexa and Google Assistant makes these systems more customizable, user-friendly, and efficient. At the same time, there is a rising focus on aesthetic lighting, where homeowners are using lighting to enhance the design and ambiance of their living spaces. This trend has driven demand for decorative fixtures, color-changing LEDs, and human-centric lighting solutions that adjust to the time of day, promoting better mood, productivity, and wellbeing, while contributing to the overall aesthetic appeal of the home.

The commercial segment is expected to grow at a significant CAGR during the forecast period. The development of smart cities is driving demand for intelligent lighting systems in commercial spaces. Public areas, retail, and municipal buildings are incorporating smart streetlights, connected lighting networks, and energy-efficient solutions, making the commercial segment a key area for innovation and adoption. Similarly, commercial spaces are increasingly using lighting not only for functional purposes but also as a design element. Decorative fixtures, ambient lighting, and accent lighting are in demand in retail stores, hotels, restaurants, and entertainment venues, enhancing the customer experience while meeting lighting needs.

Regional Insights

North America lighting industry accounted for a revenue share of over 21% of the lighting industry in 2024. The introduction of smart lighting solutions, which enables remote operation, automated processes, and energy usage monitoring via mobile applications or additional connected gadgets, has boosted the growth of the North America LED lighting market. Furthermore, the proliferation of the Internet of Things (IoT) and LED lighting integration has created new opportunities for lighting system customization and energy efficiency.

U.S. Lighting Market Trends

The lighting industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. is experiencing rapid adoption of smart lighting solutions, driven by the growing demand for connected homes and smart cities. The integration of IoT, voice assistants like Alexa and Google Assistant, and energy-efficient technologies is making smart lighting systems highly appealing to both consumers and businesses, increasing the demand for advanced lighting options.

Europe Lighting Market Trends

The Europe lighting market is anticipated to register a CAGR of 6.8% from 2025 to 2030. Europe has some of the most stringent energy efficiency regulations globally, with the European Union (EU) leading the way in promoting sustainable lighting solutions. Policies such as the EU Ecodesign Directive and Energy Performance of Buildings Directive encourage the use of LED lighting and other energy-efficient technologies, driving significant demand for green lighting solutions across residential, commercial, and industrial sectors.

The lighting industry in the UK is expected to grow rapidly in the coming years. The UK is seeing a significant rise in the adoption of smart lighting systems driven by the growing trend of smart homes and smart cities. Integration with IoT, AI, and automation allows for remote control, adaptive lighting, and energy optimization, making lighting solutions more efficient and user-friendly. This trend is especially strong in urban areas, where infrastructure upgrades are necessary.

The Germany lighting market held a substantial market share in 2024. Many businesses in Germany are upgrading their existing lighting systems to more energy-efficient solutions. Industrial, warehouse, and commercial sectors are increasingly adopting LEDs for large-scale illumination needs due to their low energy consumption, high brightness, and long-life span. These upgrades are helping organizations reduce energy costs and comply with environmental regulations, contributing to market growth.

Asia Pacific Lighting Market Trends

The lighting market in the Asia Pacific is growing significantly at a CAGR of over 7.0% from 2025 to 2030. The Asia Pacific region is experiencing massive urbanization, with an increasing number of people moving to cities and new urban centers. This urban growth is driving the demand for modern lighting solutions for residential, commercial, and public infrastructure. Smart street lighting, energy-efficient solutions, and smart city initiatives are becoming essential in new developments, further fueling the demand for advanced lighting technologies.

The China lighting industry held a substantial revenue share in 2024. China is one of the world's largest producers and exporters of lighting products, particularly LEDs. The country’s advanced manufacturing capabilities and established supply chain allow for the efficient production of lighting products at competitive prices. This has enabled Chinese lighting manufacturers to cater to both domestic and international markets, further supporting the growth of the lighting sector.

The lighting industry in Japan held a substantial revenue share in 2024. The growth of the Japanese lighting market can be attributed to the launching of LED lighting solutions by Japanese companies, which help reduce the cost of the LED lighting solution. For instance, in June 2023, ENDO Lighting Corporation, a Japanese lighting solution provider, introduced Synca. Synca Lights offer multi-functional solutions for commercial and residential spaces.

India lighting industry is growing rapidly due to India’s rapid urbanization, with increasing construction activities in residential, commercial, and industrial sectors, is a major growth driver for the lighting market. As cities expand and new infrastructures like smart cities emerge, the demand for modern lighting solutions, including smart lighting and energy-efficient LEDs, is growing.

Key Lighting Company Insights

The key market players in the global lighting industry include Acuity Brands, Inc., Signify Holding, OSRAM GmbH, Eaton Corporation, Cree Lighting, Nichia Corporation, GE Lighting, Seoul Semiconductor Co., Ltd., Everlight Electronics Co., Ltd., Hubbell Incorporated, Zumtobel Group, Siteco GmbH, Panasonic Holdings Corporation, Havells India Ltd, and Toshiba Lighting. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Lighting Companies:

The following are the leading companies in the lighting market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Brands, Inc.

- Signify Holding

- OSRAM GmbH

- Eaton Corporation

- Cree Lighting

- Nichia Corporation

- GE Lighting

- Seoul Semiconductor Co., Ltd.

- Everlight Electronics Co., Ltd.

- Hubbell Incorporated

- Zumtobel Group

- Siteco GmbH

- Panasonic Holdings Corporation

- Havells India Ltd

- Toshiba Lighting.

Recent Developments

-

In December 2024, Zumtobel Group AG announced the acquisition of a UK-based LED lighting company, AC/DC. This strategic move enhances Zumtobel's position in the lighting market by expanding its portfolio with advanced LED lighting solutions. AC/DC specializes in high-quality, energy-efficient LED products, which aligns with Zumtobel’s focus on sustainable and innovative lighting technologies. The acquisition aims to leverage AC/DC's expertise to offer more diverse and energy-efficient lighting options to meet the growing demand in both residential and commercial sectors.

-

In April 2024, Signify Holding introduced ultra-efficient and 3D-printed lighting innovations to support energy-efficient and sustainable workspaces. The new products significantly reduce energy consumption and carbon footprint while maintaining high performance. With 3D printing technology, Signify enhances circular economic efforts by reducing waste and material usage. These innovations align with global sustainability goals, helping businesses transition to eco-friendly lighting solutions for greener, more efficient workplaces.

-

In February 2024, Panasonic Holdings Corporation expanded its lighting business by inaugurating a new facility in Daman, India. This strategic move is aimed at strengthening its presence in the lighting market, focusing on energy-efficient solutions. The facility will enhance Panasonic's manufacturing capacity, enabling the company to meet the growing demand for innovative and sustainable lighting products. The expansion aligns with the company's commitment to environmental sustainability and serves as a step forward in advancing its lighting technologies in the Indian market.

Lighting Market Report Scope

Report Attribute

Details

Market size in 2025

USD 158.0 billion

Market Size forecast in 2030

USD 223.3 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Signify Holding; OSRAM GmbH; Eaton Corporation; Cree Lighting; Nichia Corporation; GE Lighting; Seoul Semiconductor Co., Ltd.; Everlight Electronics Co., Ltd.; Hubbell Incorporated; Zumtobel Group; Siteco GmbH; Panasonic Holdings Corporation; Havells India Ltd; Toshiba Lighting

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lighting Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lighting market report based on type, application, distribution channel, end use, and region.

-

Lighting Type Outlook (Market Size, USD Million, 2018 - 2030)

-

CFL

-

Fluorescent Lighting

-

Halogen

-

HID

-

Incandescent

-

LED Lighting

-

-

Lighting Application Outlook (Market Size, USD Million, 2018 - 2030)

-

Indoor Lighting

-

Outdoor Lighting

-

Smart Lighting

-

-

Lighting Distribution Channel Outlook (Market Size, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Lighting End Use Outlook (Market Size, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

Lighting Regional Outlook (Market Size, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lighting market size was estimated at USD 151.75 billion in 2024 and is expected to reach USD 158.0 billion in 2025.

b. The global lighting market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 223.3 billion by 2030.

b. The offline segment accounted for the largest market share of over 65% in 2024. Leading lighting brands are increasing their presence in retail outlets and specialty stores, making their products more accessible to consumers. The availability of lighting in home improvement stores, lighting showrooms, and electronics outlets has significantly contributed to the growth of the offline segment.

b. The key market players in the global lighting market include Acuity Brands, Inc., Signify Holding, OSRAM GmbH, Eaton Corporation, Cree Lighting, Nichia Corporation, GE Lighting, Seoul Semiconductor Co., Ltd., Everlight Electronics Co., Ltd., Hubbell Incorporated, Zumtobel Group, Siteco GmbH, Panasonic Holdings Corporation, Havells India Ltd, and Toshiba Lighting.

b. The global lighting market is experiencing steady growth, driven by increasing demand for energy-efficient solutions, urbanization, and smart lighting technologies. Traditional lighting solutions, such as incandescent and halogen bulbs, are being phased out in favor of LED lighting, which dominates the market due to its superior energy efficiency, longer lifespan, and cost-effectiveness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.