- Home

- »

- Plastics, Polymers & Resins

- »

-

Liquid Crystal Polymer Market Size, Industry Report, 2033GVR Report cover

![Liquid Crystal Polymer Market Size, Share & Trends Report]()

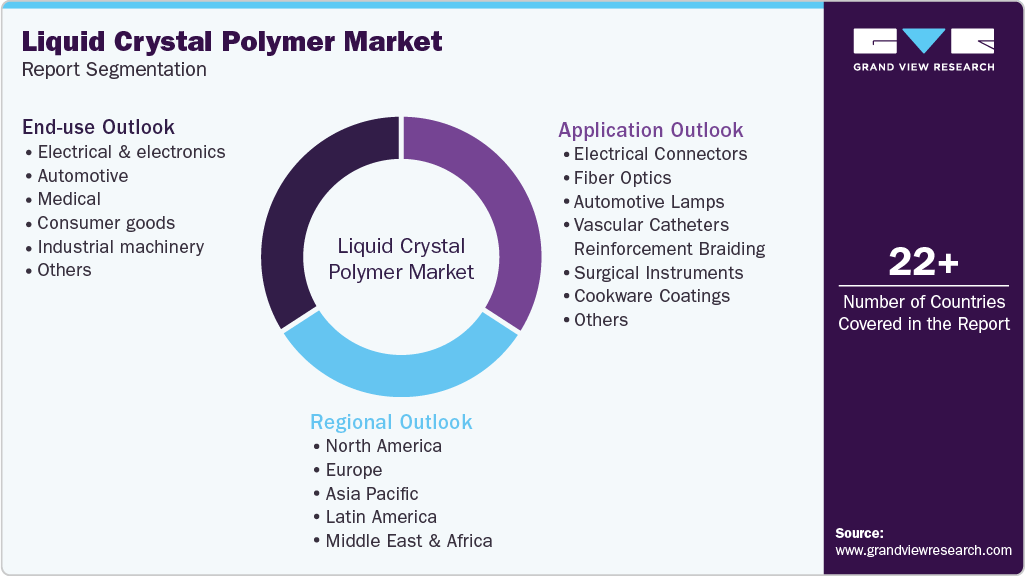

Liquid Crystal Polymer Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Electrical Connectors, Fiber Optics, Automotive Lamps, Vascular Catheters Reinforcement Braiding, Surgical Instruments), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-332-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Liquid Crystal Polymer Market Summary

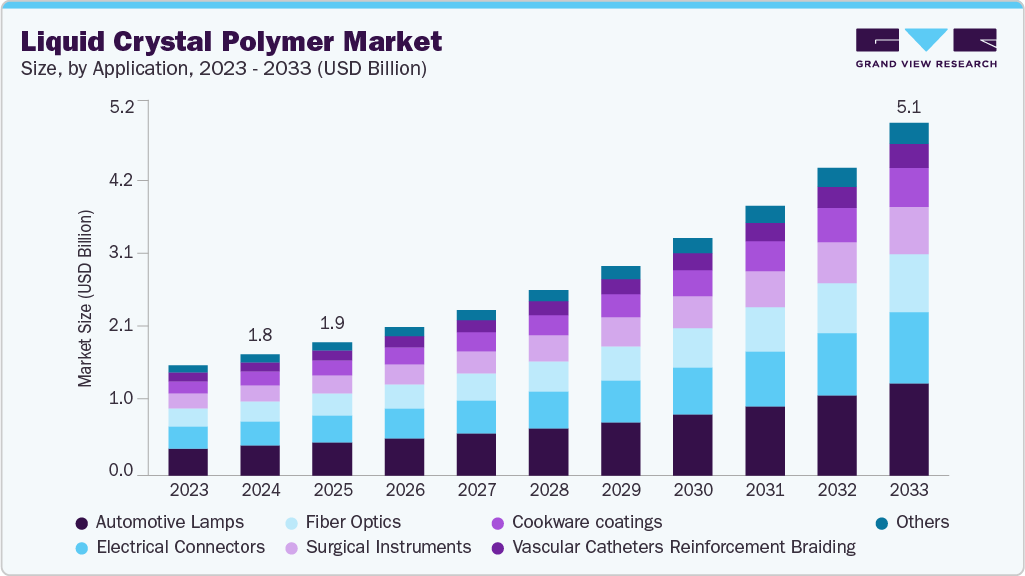

The global liquid crystal polymer market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 5.11 billion by 2033, growing at a CAGR of 12.9% from 2025 to 2033. The increasing demand for LCP from industries including medical, electrical & electronics, automotive, and others is expected to drive the market growth over the forecast period, owing to the benefits offered by the polymer.

Key Market Trends & Insights

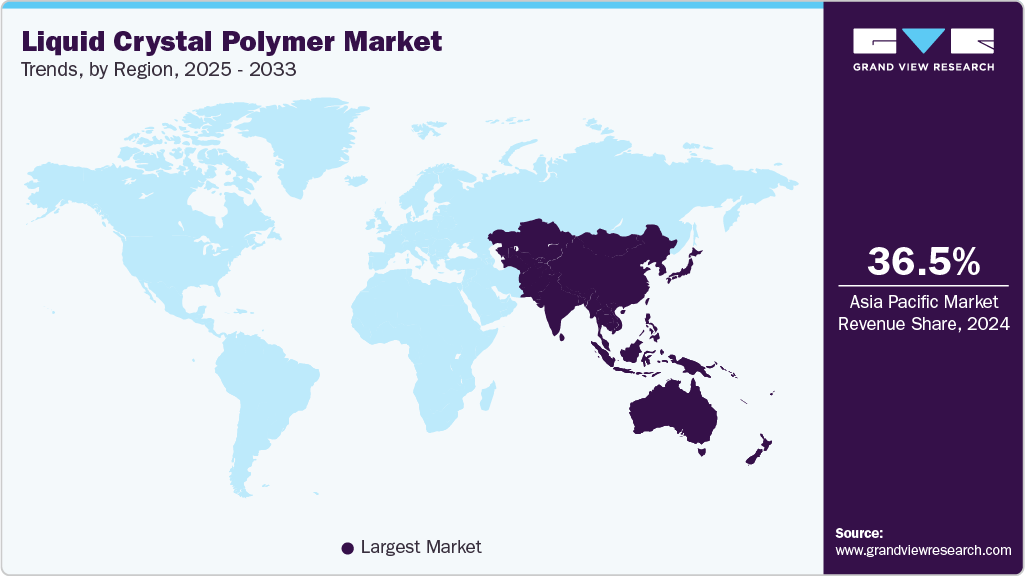

- Asia Pacific dominated the liquid crystal polymer industry with the largest revenue share of 36.48% in 2024.

- The liquid crystal polymer industry in China is expected to grow at a substantial CAGR of 14.1% from 2025 to 2033.

- By application, the automotive lamps segment is expected to grow at a considerable CAGR of 13.5% from 2025 to 2033 in terms of revenue.

- By end use, the electrical & electronics segment is expected to grow at a considerable CAGR of 13.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 5.11 Billion

- CAGR (2025-2033): 12.9%

- Asia Pacific: Largest market in 2024

LCP is an engineering plastic that offers enhanced strength, impact endurance, resistant to a wide range of chemicals, flame retardant, and maintenance of end-use structure, and offers a low coefficient of thermal expansion (CTE), which can be adjusted, and flows well through thin walls. Miniaturization and high-frequency integration are reshaping LCP demand. As electronic assemblies push into smaller form factors and higher microwave and millimeter wave bands, designers favor materials that deliver stable dielectric performance and tight dimensional control in thin walls and fine features. This is driving a steady shift from commodity resins to LCPs for connector housings, antenna substrates, and flexible interconnects where signal integrity and thermal reliability matter. Manufacturers are therefore orienting product portfolios toward films and grades tailored for RF and compact, high-density parts.

Drivers, Opportunities & Restraints

System-level requirements in 5G, automotive electrification, and dense consumer electronics are a direct demand engine for LCP. These sectors require materials that combine low loss at high frequencies, rapid molding cycle times, and sustained mechanical properties at elevated temperatures. LCPs meet that profile and are being specified more often for connectors, board-level components, and sensor housings that must perform across harsh environments. As OEMs prioritize reliability and miniaturization, LCP uptake at the component level becomes a procurement and design preference rather than an optional premium.

The most attractive commercial opportunity is downstream integration of LCP into new system architectures: flexible circuits, antenna-in-package solutions, and precision molded parts for electric vehicles and medical devices. Film and laminate variants unlock applications in wearable and aerospace electronics where weight, form factor, and high-frequency performance converge. There is also room for value capture through co-developed compound grades, service-level offerings around design for anisotropy, and localized compounding closer to key electronics clusters to reduce lead times and improve cost competitiveness.

Adoption is constrained by economics and processing complexity. LCPs are manufactured and processed at a premium cost relative to commodity thermoplastics, and they require tight mold control and specialized processing knowledge to manage flow-induced anisotropy and dimensional behavior. Volatile feedstock and energy costs, together with intermittent supply chain bottlenecks for specialty grades, raise the total cost of ownership and slow adoption among cost-sensitive manufacturers. Until price parity improves or supply becomes more predictable, some buyers will default to lower cost alternatives or hybrid designs that limit LCP penetration.

Market Concentration & Characteristics

The growth stage of the liquid crystal polymer industry is high, and the pace is accelerating. The market exhibits slight consolidation, with key players dominating the industry landscape. Major companies such as Solvay, Celanese Corporation, Sumitomo Chemical Company, Toray Industries, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the LCP market is moving from incremental resin tweaks to system-level advances that pair material science with processing and sustainability. Suppliers are launching biomass balance grades and specialty films that preserve LCP performance while lowering lifecycle carbon intensity, and makers are investing in tailored film laminates and compound grades for antenna in package, flexible interconnects, and ultra-thin, high-frequency substrates. Investment in local polymerization and co-development is shortening design cycles and letting material suppliers offer solution bundles rather than raw resin alone. These shifts turn LCP from a component material into an enabler for higher-value system architectures.

Regulatory dynamics are raising the bar on data, traceability, and circularity for high-performance polymers, and that is reshaping commercial behavior in the LCP supply chain. Updated U.S. TSCA review rules and rising scrutiny around new chemicals mean more up-front testing and longer qualification timelines for novel grades, while the EU Chemicals Strategy and REACH workstreams push producers toward safer chemistries, better disclosure, and circular solutions. Policy moves to secure critical chemicals and to address plastics pollution are creating both compliance cost pressure and strategic incentives for local capacity, certified green feedstocks, and investment in advanced recycling. Companies that anticipate tighter data requirements and embed regulatory compliance into product design will enjoy faster market access and lower program risk.

Application Insights

The automotive lamps segment dominated the market in terms of revenue, accounting for a market share of 24.67% in 2024, and is anticipated to grow at a 13.5% CAGR over the forecast period. LCP can operate at high temperatures in applications including connectors, lighting, and sensors. The increased automotive electrification also requires LCP’s for utilization in solenoids, connectors, and sensors. Combining thermal performance with electrical properties LCP enables significant copper slot fill in motor applications that enhance motor performance. In addition, LCP can function at 240°C while offering enhanced dimensional stability and avoiding outgassing in lighting systems.

The electrical connectors segment is anticipated to grow at a significant CAGR of 13.2% through the forecast period. The relentless push for smaller, higher pin count connectors is forcing designers to demand materials that support precision molding, tight dimensional tolerances, and stable performance under thermal cycling. LCP’s flow behavior and dimensional control let molders create very fine features and thin insulators while maintaining dielectric integrity, enabling high density board-to-board and cable connectors. That capability shortens cycle times and reduces rework risk, making LCP a preferred engineered resin for next-generation connector families. Contract manufacturers with molding expertise in LCP enjoy a procurement advantage with system OEMs.

End Use Insights

Electrical and electronics dominated the market in terms of revenue, accounting for a market share of 26.15% in 2024, and is anticipated to grow at a 13.5% CAGR over the forecast period. Miniaturization and downsizing of electronic components for their utilization in new emerging applications are expected to drive the market demand over the forecast period.

LCP is an aromatic liquid crystal polyester polymer with a stiff polymer chain structure. Owing to its unique molecular structure, it has enhanced vibration absorption characteristics, good chemical & heat resistance, self-reinforcing effect, low dielectric properties, small linear expansion rate, enhanced extinguishing, and others. It is an ideal material for utilization in antenna substrates, housings, and flexible printed circuits (FPCs), mainly attributed to its high dielectric performance and low moisture absorption.

The medical segment is expected to expand at a substantial CAGR of 13.2% over the forecast period. Medical device designers increasingly require materials that enable miniaturization, survive repeated sterilization cycles, and meet stringent biocompatibility expectations for long-term use. LCP grades designed for medical applications offer low moisture uptake, chemical resistance, and dimensional stability that support small, thin-walled housings, catheter braids, and implantable packaging where predictable behavior under sterilization is essential. These properties open opportunities in diagnostic instruments, drug delivery systems, and certain implantable electronics where metal components are being replaced to lower weight and simplify manufacturing. Companies that validate medical-grade LCPs and provide regulatory support alongside engineering services can accelerate adoption across device OEMs.

Regional Insights

The Asia Pacific liquid crystal polymer industry emerged as the largest regional market and accounted for a 36.48% revenue share in 2024 and is expected to grow at the fastest CAGR of 13.3% over the projected period. The rapid expansion of electronics manufacturing and a dense ecosystem of contract manufacturers and OEMs make the Asia Pacific the growth engine for LCP. The region’s strong handset, server, and consumer electronics production lines demand materials that support ultra-thin walls, embedded antennas, and high-speed signal paths, creating a steady pull for LCP films and molded parts. Local compounders and film producers that invest in proximity to major electronics clusters can capture share by reducing lead times and offering grade customization for high-volume assembly processes.

China Liquid Crystal Polymer Market Trends

The liquid crystal polymer industry in China has gained an impetus from acceleration in IC design, 5G infrastructure rollouts, and vehicle electrification, creating focused, high-volume demand for LCP in connectors, RF modules, and precision molded components. As domestic OEMs and module makers push for tighter integration and cost optimization, they specify materials that enable finer pitch connectors and reliable mmWave performance, providing a clear commercial runway for LCPs. Regional players that partner with local module makers and offer tailored LCP compounds for China’s fast product cycles tend to secure the largest specification wins.

North America Liquid Crystal Polymer Market Trends

The North America liquid crystal polymer industry is likely to provide promising opportunities as network densification and edge compute expansion become central demand engines for LCP in the region. Service providers and telecom equipment vendors are investing in small cells, active antenna systems, and higher frequency RF modules that require low-loss substrates and precision molded connector housings. At the same time, data center upgrades and advanced server architectures increase demand for thin, thermally stable interconnects where LCP films and molded parts outperform many commodity plastics. Suppliers that combine fast local supply with engineering support for high-frequency design are therefore winning specification-led contracts.

U.S. Liquid Crystal Polymer Market Trends

The liquid crystal polymer industry in the U.S. is well-positioned to grow robustly on the back of advanced manufacturing, strong semiconductor and aerospace clusters, and OEMs’ emphasis on reliability push. The U.S. system integrators are specifying LCP for next-generation board-level components, RF packages, and powertrain modules as automotive electrification and defense electronics tighten material performance requirements. Domestic sourcing priorities and qualification cycles by large OEMs favor suppliers that offer validated grades, application engineering, and shorter qualification lead times. This structural preference for proven, high-performance materials accelerates LCP penetration across strategic industrial programs.

Europe Liquid Crystal Polymer Market Trends

The liquid crystal polymer industry in Europe is anticipated to grow in the wake of automotive electrification and stringent sustainability and chemical regulations. OEMs designing electric powertrains, high voltage connectors, and compact lighting systems require polymers that tolerate high temperatures and repeated thermal cycles, while regulators push for safer chemistries and fuller life cycle disclosure. This regulatory backdrop makes qualifying LCP grades with transparent supply chains and lower lifecycle impact a competitive advantage, especially for suppliers who can align product data with EU compliance expectations.

Key Liquid Crystal Polymer Company Insights

The industry is highly competitive, with several key players dominating the landscape. Major companies include Solvay, Celanese Corporation, Sumitomo Chemical Company, and Toray Industries, Inc., among others. The market for liquid crystal polymer is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability.

Key Liquid Crystal Polymer Companies:

The following are the leading companies in the liquid crystal polymer market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Celanese Corporation

- Sumitomo Chemical Company

- TORAY INDUSTRIES, INC.

- UENO FINE CHEMICALS INDUSTRY, LTD.

- RTP Company

- Zeus Company Inc.

- Chang Chung Group

- Polyplastics Co.

- Daken Chem

Recent Developments

-

In June 2025, Sumitomo Chemical Co. developed a new mass production technology for liquid crystal polymer (LCP) made from biomass-based monomers.

-

In September 2024, Polyplastics launched LAPEROS bG-LCP, a liquid crystal polymer using biomass-derived raw materials through a mass balance approach. This new LCP maintained the same manufacturing process and properties as conventional products, but reduced CO2 emissions and increased renewable content ratios.

Liquid Crystal Polymer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.93 billion

Revenue forecast in 2033

USD 5.11 billion

Growth rate

CAGR of 12.9% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Solvay; Celanese Corporation; Sumitomo Chemical Company; Toray Industries, Inc.; Ueno Fine Chemicals Industry, Ltd.; RTP Company; Zeus Company Inc.; Chang Chung Group; Polyplastics Co.; Daken Chem

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Liquid Crystal Polymer Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the liquid crystal polymer market report on the basis of application, end use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrical connectors

-

Fiber optics

-

Automotive lamps

-

Vascular catheters reinforcement braiding

-

Surgical instruments

-

Cookware coatings

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Electrical & electronics

-

Automotive

-

Medical

-

Consumer goods

-

Industrial machinery

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.