- Home

- »

- Advanced Interior Materials

- »

-

Lithium Extraction Market Size, Share, Industry Report, 2033GVR Report cover

![Lithium Extraction Market Size, Share & Trends Report]()

Lithium Extraction Market (2026 - 2033) Size, Share & Trends Analysis Report, By Resource Type (Brines, Spodumene, Others), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-853-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Extraction Market Summary

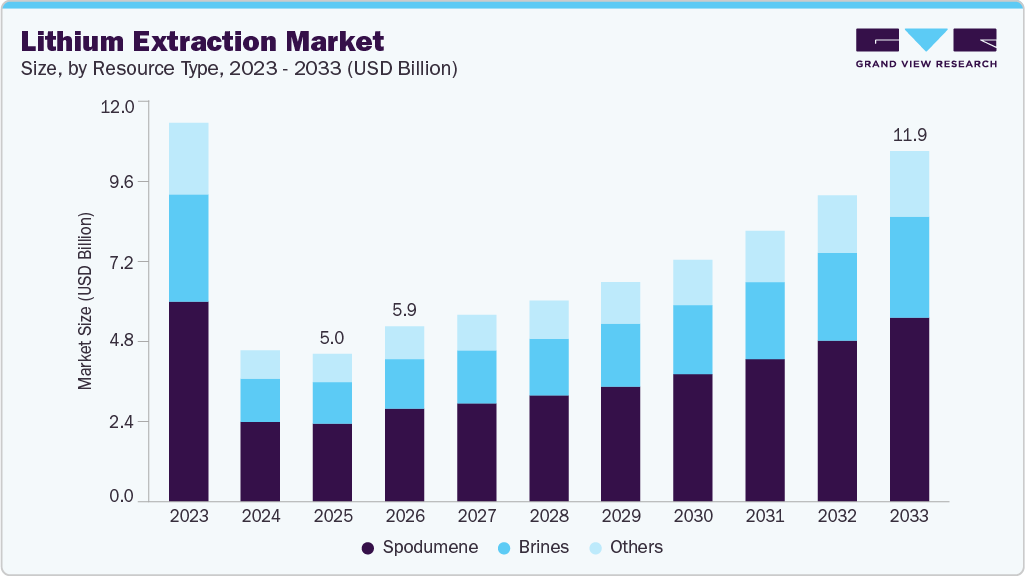

The global lithium extraction market size was estimated at USD 5.04 billion in 2025 and is projected to reach USD 11.94 billion by 2033, at a CAGR of 10.4% from 2026 to 2033. The market is experiencing robust growth driven by sustained expansion in lithium-ion battery manufacturing for electric vehicles (EVs), grid-scale energy storage systems, and consumer electronics.

Key Market Trends & Insights

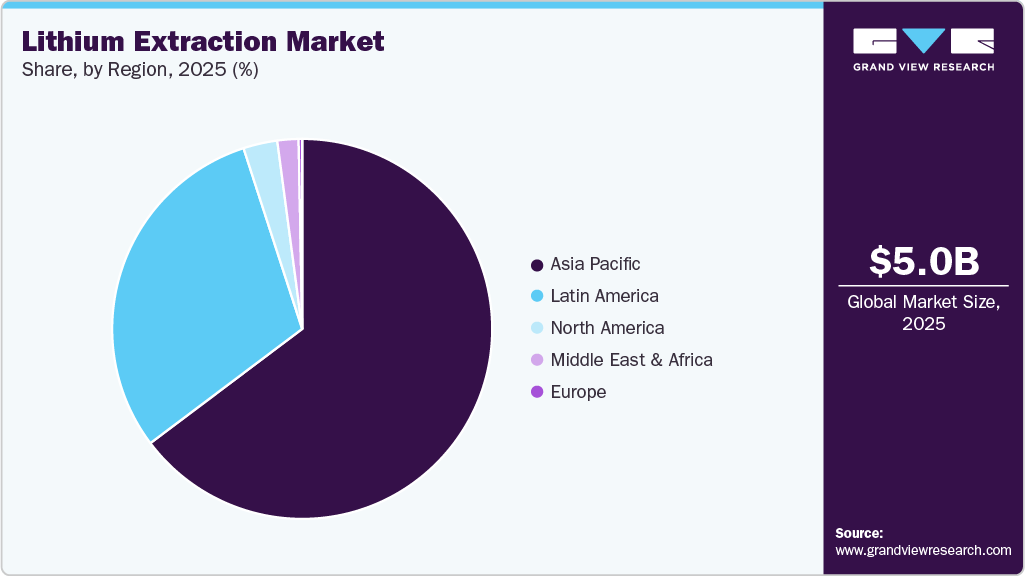

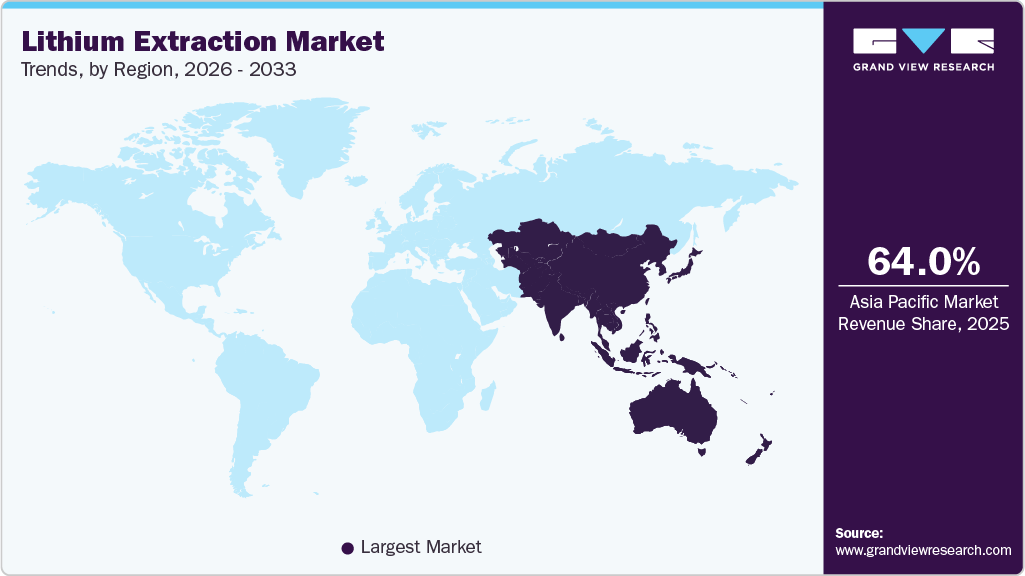

- Asia Pacific dominated the lithium extraction market with the largest market revenue share of over 64.0% in 2025.

- The North America lithium extraction market is expected to grow at a substantial CAGR of 12.1% from 2026 to 2033.

- The lithium extraction market is expected to grow at a substantial CAGR of 10.4% from 2026 to 2033.

- By resource type, the spodumene segment accounted for the largest market revenue share of over 52.0% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 5.04 Billion

- 2033 Projected Market Size: USD 11.94 Billion

- CAGR (2026-2033): 10.4%

- Asia Pacific: Largest market in 2025

Increasing penetration of EVs across major automotive markets, coupled with large-scale renewable energy integration, continues to strengthen long-term lithium demand fundamentals. Technological advancement is increasingly reshaping the lithium extraction market, with strong momentum toward higher-efficiency and faster-recovery processes. While conventional hard rock mining and solar evaporation ponds continue to account for a significant share of global production, emerging Direct Lithium Extraction (DLE) technologies are gaining commercial traction. DLE methods, including adsorption, ion exchange, membrane separation, and electrochemical extraction, enable lithium recovery in hours or days compared to 12-24 months required for traditional brine evaporation. These technologies improve recovery rates, enhance selectivity for lithium ions in complex brine chemistries, and reduce dependency on large land-intensive evaporation ponds. As battery manufacturers increasingly demand consistent, high-purity lithium hydroxide and lithium carbonate for advanced chemistries, process optimization and digital monitoring are becoming critical differentiators for extraction companies.

Sustainability considerations are now central to project development and capital allocation within the lithium extraction industry. Water stewardship, carbon footprint reduction, and land-use optimization are key evaluation parameters for regulators, investors, and downstream OEMs. Compared to conventional evaporation-based extraction, DLE technologies significantly reduce freshwater consumption and the risk of brine depletion, particularly in environmentally sensitive regions such as the Lithium Triangle in South America. In addition, integrating renewable energy sources such as geothermal-powered lithium extraction further lowers lifecycle emissions. ESG-driven procurement strategies from automotive and battery manufacturers are compelling upstream producers to adopt lower-impact extraction methods, implement brine reinjection systems, and improve traceability across the lithium value chain.

Drivers, Opportunities & Restraints

The lithium extraction market is primarily driven by accelerating global demand for battery-grade lithium to support electric vehicles and energy storage systems. Governments are actively strengthening domestic supply chains to reduce reliance on imports and secure critical minerals. For instance, on 11 February 2026, the French government announced a USD 59.32 million investment in a lithium mining project led by Imerys in central France, reinforcing Europe’s strategy to expand domestic extraction capacity. Similarly, on 11 February 2026, Zijin Mining Group confirmed plans to begin lithium production from the Manono deposit in the Democratic Republic of Congo in June 2026, marking the country’s first lithium output and underscoring continued global supply expansion to meet EV battery demand.

Significant opportunities arise from technological innovation and the geographic diversification of extraction projects, particularly through direct lithium extraction (DLE) from unconventional sources such as oilfield brines. In February 2026, Select Water Solutions and LibertyStream Infrastructure Partners announced a definitive agreement to develop commercial lithium carbonate production units in Texas, with the first 1,000-tonne facility targeted for commissioning by December 2026. Additionally, in February 2026, Chile updated a lithium development contract between Codelco and Rio Tinto at the Salar de Maricunga, highlighting expanding public-private collaboration in South America’s lithium-rich regions.

Despite strong long-term fundamentals, the lithium extraction market faces restraints related to cost competitiveness, price volatility, and operational challenges. High processing costs outside China have pressured margins, particularly for downstream conversion facilities. In February 2026, Albemarle Corporation announced the mothballing of part of its Kemerton lithium hydroxide plant in Western Australia and workforce reductions, citing significantly higher processing costs than those in Chinese operations. This development illustrates how elevated capital expenditure, operating costs, and lithium price fluctuations can delay projects and impact profitability across the extraction value chain.

Resource Type Insights

By resource type, the spodumene segment accounted for the largest market revenue share of over 52.0% in 2025. Spodumene-based lithium extraction currently accounts for the largest revenue share in 2025, primarily due to Australia’s dominant hard-rock mining output and established export supply chains to China and other processing hubs. Hard rock spodumene deposits offer relatively faster project development timelines compared to brine operations and provide consistent lithium grades, making them highly attractive during periods of supply tightness. Moreover, the scalability of open-pit mining and growing investments in conversion facilities have reinforced spodumene’s strong commercial position in meeting near-term EV battery demand.

Brine resources are projected to register the fastest CAGR over the forecast period, driven by expanding development in South America’s “Lithium Triangle” (Chile, Argentina, Bolivia) and increasing adoption of direct lithium extraction (DLE) technologies. Brine operations typically offer lower operating costs and reduced carbon intensity when optimized, enhancing long-term competitiveness. With technological advancements improving recovery rates and reducing concerns about water usage, brine-based lithium production is expected to accelerate as global producers prioritize cost efficiency and sustainability in sourcing battery materials.

Regional Insights

North America's Lithium Extraction Market Trends

North America is strengthening its position in the market through policy-driven investments, resource diversification, and expansion of domestic processing capacity. The region is prioritizing supply chain security through its critical mineral strategies, encouraging the development of brine-based and hard-rock lithium projects. Increasing collaboration between extraction companies and battery manufacturers, along with financial incentives under clean energy legislation, is accelerating project pipelines. In addition, the commercialization of Direct Lithium Extraction (DLE) technologies in oilfield brines and geothermal resources is enhancing regional competitiveness while aligning with ESG compliance standards.

U.S. Lithium Extraction Market Trends

The U.S. market is witnessing strategic expansion aimed at reducing dependence on imports from South America and China. Federal funding programs, Department of Energy grants, and Inflation Reduction Act incentives are supporting new mining and refining projects. Domestic initiatives include lithium extraction from geothermal brines in California’s Salton Sea and from produced water in Texas’s Permian Basin, reflecting technological innovation in the utilization of unconventional resources. The U.S. is also focusing on integrated value chains linking extraction, refining, and battery cell manufacturing to enhance supply security and long-term price stability.

Europe Lithium Extraction Market Trends

Europe’s market is driven by aggressive EV adoption targets and the European Green Deal's push to expand battery manufacturing. Countries such as France, Portugal, and Portugal are actively developing domestic hard rock and geothermal lithium projects to reduce reliance on imports. Regulatory frameworks emphasizing environmental compliance, water management, and carbon reduction are shaping project execution. Strategic public investments and partnerships between mining firms and automotive OEMs are accelerating early-stage developments, although permitting timelines and community opposition remain key constraints.

Asia Pacific Lithium Extraction Market Trends

Asia Pacific dominated the lithium extraction market with the largest market revenue share of over 64.0% in 2025. Asia Pacific dominates global lithium production, led by Australia (hard rock spodumene mining) and China (refining and chemical processing capacity). Australia remains the largest supplier of spodumene concentrate, while China controls a significant share of global lithium conversion and battery-grade chemical production. Regional growth is supported by strong EV manufacturing ecosystems, particularly in China, South Korea, and Japan. However, market dynamics are influenced by lithium price volatility and capacity rationalization efforts in response to cyclical demand fluctuations.

Latin America Lithium Extraction Market Trends

Latin America, particularly the “Lithium Triangle” comprising Chile, Argentina, and Bolivia, holds some of the world’s largest lithium brine reserves. The region’s extraction activities are primarily brine-based, leveraging solar evaporation in salt flats such as the Salar de Atacama. Governments are increasingly restructuring regulatory frameworks to attract foreign investment while retaining greater state participation in strategic resources. Water usage concerns, indigenous community engagement, and evolving royalty regimes are critical factors influencing project timelines and capital inflows.

Middle East & Africa Lithium Extraction Market Trends

The Middle East & Africa region is emerging as a developing lithium extraction hub, supported by new hard-rock discoveries in countries such as Zimbabwe and by expanding exploration activity in Namibia and Mali. African spodumene projects are attracting Chinese and Western investments to diversify global supply. In the Middle East, interest in lithium extraction from oilfield brines is gradually increasing, leveraging existing hydrocarbon infrastructure. While the region offers resource potential and cost advantages, infrastructure gaps, geopolitical risks, and regulatory uncertainty remain key challenges impacting large-scale commercialization.

Key Lithium Extraction Company Insights

Some of the key players operating in the market include Albemarle Corporation, SQM, and others

-

Albemarle Corporation is a U.S.-based specialty chemicals company and one of the world’s largest lithium producers, founded in 1994 following a spin-off from Ethyl Corporation. The company operates large-scale lithium extraction assets across Chile, Australia, and the United States. Albemarle specializes in the production of battery-grade lithium carbonate and lithium hydroxide, supplying major EV battery manufacturers and automotive OEMs globally. With integrated mining and conversion capabilities, the company plays a strategic role in strengthening Western lithium supply chains and advancing lower-carbon extraction technologies.

-

SQM is a Chile-based lithium and specialty chemicals producer founded in 1968, with large-scale commercial lithium production centered in the Salar de Atacama. The company primarily utilizes brine extraction methods, leveraging high lithium concentrations and favorable solar evaporation conditions in northern Chile. SQM produces lithium carbonate and lithium hydroxide for global battery manufacturers and has long-term supply agreements with major EV and cathode producers. As one of the lowest-cost brine operators globally, SQM plays a pivotal role in Latin America’s lithium supply landscape while increasingly investing in sustainability and water management initiatives.

-

Ganfeng Lithium is a China-based vertically integrated lithium producer founded in 2000, with operations spanning mining, refining, and battery manufacturing. The company holds interests in brine- and hard-rock lithium assets in Argentina, Australia, China, and other regions, ensuring diversified sourcing of raw materials. Ganfeng produces lithium carbonate, lithium hydroxide, and specialty lithium compounds for EV batteries, energy storage systems, and consumer electronics. Through strategic investments and long-term offtake agreements, the company has established itself as a critical supplier within the global lithium-ion battery value chain, supporting China’s dominant position in battery material processing.

Key Lithium Extraction Companies:

The following key companies have been profiled for this study on the lithium extraction market.

- Albemarle Corporation

- Arcadium Lithium

- Ganfeng Lithium

- IGO Limited

- Lithium Americas Corp.

- Mineral Resources Limited

- Pilbara Minerals

- SQM (Sociedad Química y Minera de Chile)

- Tianqi Lithium

- Zijin Mining Group

Recent Developments

-

In February 2026, Albemarle Corporation announced that it would mothball part of its Kemerton lithium hydroxide processing facility in Western Australia due to elevated operating costs and market pricing pressures. The company also confirmed workforce reductions at the site, reflecting ongoing cost optimization measures amid lithium price volatility and weaker near-term margins in the refining segment.

-

In February 2026, Zijin Mining Group announced plans to commence lithium production in June 2026 from the Manono project in the Democratic Republic of Congo. This development marks Congo’s first lithium output and strengthens Zijin’s international battery metals portfolio as global producers accelerate new supply to meet EV-driven demand growth.

-

In February 2026, Imerys confirmed that the French government would invest USD 59.32 million in support of its lithium mining project in the Allier region of central France. The state-backed funding aims to accelerate domestic lithium extraction capacity and reinforce Europe’s strategic autonomy in critical battery raw materials.

Lithium Extraction Market Report Scope

Report Attribute

Details

Market definition

The lithium extraction market represents the annual revenue generated from upstream extraction of lithium-bearing resources (such as brines, spodumene, and lepidolite), with production volumes standardized and expressed in lithium carbonate equivalent (LCE) terms.

Market size value in 2026

USD 5.97 billion

Revenue forecast in 2033

USD 11.94 billion

Growth rate

CAGR of 10.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Resource type and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Portugal; China; Australia; Brazil; Chile; Bolivia; Argentina; Namibia; Zimbabwe

Key companies profiled

Albemarle Corporation; Arcadium Lithium; Ganfeng Lithium; IGO Limited; Lithium Americas Corp.; Mineral Resources Limited; Pilbara Minerals; SQM; Tianqi Lithium; Zijin Mining Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Extraction Market Report Segmentation

This report forecasts country revenue growth and analyzes the latest trends in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the lithium extraction market report based on resource type and region.

-

Resource Type Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Brines

-

Spodumene

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Portugal

-

-

Asia Pacific

-

China

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

Bolivia

-

-

Middle East & Africa

-

Namibia

-

Zimbabwe

-

-

Frequently Asked Questions About This Report

b. The global lithium extraction market size was estimated at USD 5.04 billion in 2025 and is expected to reach USD 5.97 billion in 2026.

b. The global lithium extraction market is expected to grow at a compound annual growth rate of 10.4% from 2026 to 2033 to reach USD 11.94 billion by 2033.

b. By resource type, the spodumene segment accounted for the largest market share, over 52.0% in 2025.

b. Some key players in the lithium extraction market include Albemarle Corporation, Arcadium Lithium, Ganfeng Lithium, IGO Limited, Lithium Americas Corp., Mineral Resources Limited, Pilbara Minerals, SQM, Tianqi Lithium, Zijin Mining Group, and others.

b. The key driver of the lithium extraction market is the rising demand for lithium-ion batteries used in electric vehicles (EVs) and large-scale energy storage systems. Rapid electrification of transport and expansion of renewable power infrastructure are significantly accelerating global lithium consumption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.