- Home

- »

- Advanced Interior Materials

- »

-

Lithium Foil Market Size, Share And Trends Report, 2030GVR Report cover

![Lithium Foil Market Size, Share & Trends Report]()

Lithium Foil Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (2N, 3N, 4N, 5N), By End-use (Electronics, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-266-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Lithium Foil Market Summary

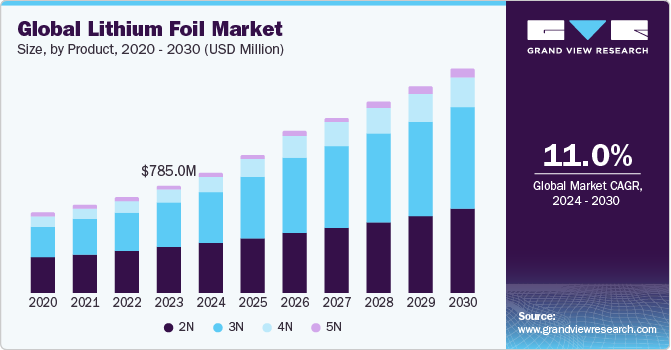

The global lithium foil market size was estimated at USD 785.0 million in 2023 and is projected to reach USD 1.63 billion by 2030, growing at a CAGR of 11.0% from 2024 to 2030. The product finds primary application in energy storage systems (ESS) as an anode material in solid-state and semi-solid batteries.

Key Market Trends & Insights

- The lithium foil market in Asia Pacific held the largest revenue share of about 51% of the global market in 2023.

- The China lithium foil market held about 40.0% of the revenue share of the Asia Pacific market in 2023.

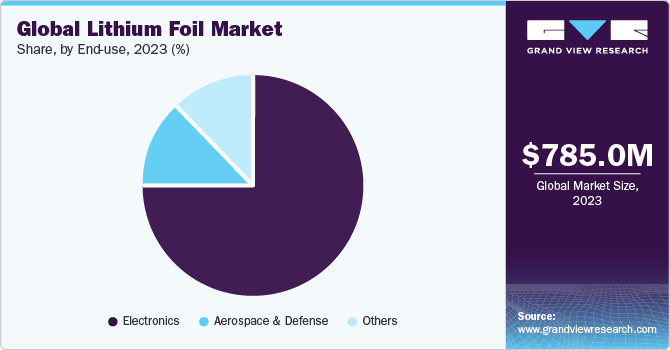

- By end-use, the electronics segment held the largest revenue share of about 77% in 2023 of the global market.

- By product, the 2N segment (purity of 99.0%) held the largest revenue share of about 46% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 785.0 Million

- 2030 Projected Market Size: USD 1.63 Billion

- CAGR (2024-2030): 11.0%

- Asia Pacific: Largest market in 2023

Hence, the electronics and aerospace industries are anticipated to boost demand during the forecast period. Considering the growth in end-use segments, various companies have invested in R&D to promote the licensing and adoption of the product in various industries. For instance, in July 2023, Asahi Kasei Corporation, a Japanese company engaged in chemicals and material science, announced that it has begun licensing its technology for the design and production of lithium-ion (Li-ion) capacitors that use lithium foil based on its proprietary technology.

Lithium foil is produced through extrusion and subsequent rolling of slabs. Lithium slabs are produced via the electrolytic refining process of extracting and purifying metal from lithium sulfate. During electrolysis, a direct electric current is passed through a solution of lithium sulfate. After that, the lithium ions migrate to the cathode, where they gain electrons and become metal atoms, forming a layer of lithium metal on the cathode.

These slabs are rolled into sheets, which are then further processed into thin foil of thickness around 0.6 to 2mm. Currently, a lot of R&D is underway to make lithium foil more cost-effective and stable for use in the fastest-growing segment for Li metal - the Li-ion battery for electric vehicles (EVs).

Lithium foil is gaining traction, and a lot of R&D is being conducted for its usage in energy storage systems (ESS). The current hindrance to its usage is that lithium produces dendrites, which reduces battery safety and life. Therefore, various tests are being conducted to eliminate this concern. For instance, researchers at Monash University have claimed to solve this issue by blocking harmful chemicals and stabilizing lithium in their discovery of a new battery design using nanopower polymer coated lithium foil anode. This discovery was published in a Q4 2023 article, stating the new design can hold five times the energy capacity compared to a Li-ion battery at half its cost.

Market Concentration & Characteristics

Li-ion batteries have a wide application scope and are deployed in electronics & transportation, as well as ESS. Existing applications of Li-ion batteries include smartphones, wearables, tablets & laptops, buses, forklifts, golf carts, power tools, and portable & stationary energy storage. Among the aforementioned applications, the usage of Li-ion batteries in EVs is expected to grow at the fastest rate owing to the proliferation in sales of EVs.

Increasing investments in EV manufacturing globally are expected to influence market growth over the forecast period positively. The year 2023 witnessed many automotive manufacturers, such as Tesla, Honda, Volkswagen, and Maruti Suzuki, investing in EV plants. For instance, in November 2023, Tesla signed an agreement with the Government of India to set up an EV plant in two years. Meanwhile, it is currently looking at sourcing auto parts and batteries from the country. Similarly, in April 2023, Volkswagen announced its plans to set up an EV plant in Aurangabad, Maharashtra, to commence production by 2026 - 2027.

The market is at a high stage of growth, with an accelerated pace. It is fairly consolidated and is characterized by the presence of integrated players who own lithium mines in strategic locations. These players cater to global demand, and the level of competition is high.

The market is characterized by a high degree of innovation to optimize the manufacturing process and to obtain high-purity lithium foil with a quality finish. Players have invested heavily in R&D to optimize the usage of lithium in high-growth end-use segments such as electric vehicles. Manufacturers have been focusing on developing and innovating new products by improving their production process.

The market observed moderate levels of mergers and acquisitions (M&A) activity owing to stringent regulations concerning mining rights and heavy competition. Players in this industry generally have resorted to backward or forward integration as their growth strategy.

The market is also subject to high levels of regulatory scrutiny. Various regulatory authorities worldwide provide standards and guidelines for proper safety measures and waste disposal mechanisms. End-user concentration is a significant factor in the market, and to minimize logistics costs, manufacturers are located in close vicinity to automotive manufacturing hubs to work hands-on with their customers.

End-use Insights

In terms of end-use, the electronics segment held the largest revenue share of about 77% in 2023 of the global market. In electronics, it is used in high-energy lithium primary and secondary battery anode material. It is one of the core materials of solid-state batteries and semi-solid batteries. Lithium foil is also a crucial component in Li-ion batteries, which are widely used in portable electronic devices like smartphones, laptops, and cameras.

Ongoing R&D within the Li-ion battery value chain is anticipated to improve lithium foil usage in the forecast period. For instance, in July 2023, Nexperia introduced a new set of Integrated Chips (ICs) that have been designed to boost the non-rechargeable lithium coin batteries by up to 10 times. This is anticipated to boost the usage of lithium foils within batteries used in low-power Internet of Things (IoTs) and other portable electronic applications.

The aerospace & defense segment is anticipated to exhibit a CAGR of around 9% over the forecast period. Lithium foil is used in thermal batteries, which are designed to provide a burst of power for a short duration. These batteries find applications in missiles, torpedoes, and other defense systems where a high output of power is required for a brief period. Lithium alloy (Cu-Li) foil can also be used in specialized welding applications, particularly in the aerospace industry.

Product Insights

In terms of product, the 2N segment (purity of 99.0%) held the largest revenue share of about 46% in 2023 of the global market. This trend is anticipated to continue over the forecast period. Lithium foil is used in the production of Li-ion batteries, which are further utilized in industrial equipment for energy storage. It requires Li metal foils of thickness ≤20μm having an area capacity of less than 4mAhcm−2. This pairs with Li metal oxide cathodes of 3 to 4mAhcm−2. However, the production of Li foil of this thickness is challenging and requires new technology - which is in the R&D phase.

The product is also used in synthetic chemistry, and in organic synthetic processes, where a strong reducing agent is required. It may also be used in the production of special glasses and ceramics.

3N accounted for a revenue share of about 40% in 2023. This type of lithium foil is used as an anode in button batteries and is wound in a cylindrical manner to achieve a greater surface area. Button batteries power many electronic items, such as computer motherboards, LED lights, and backup power supplies.

It is also used to improve the stability of solar cells, especially in experimental photovoltaic devices. It is also used in advanced thermal systems because of its excellent heat transfer properties. It is also used in electronic devices in the medical industry - in glucometers, hearing aids, and some thermometers.

Regional Insights

North America lithium foil market accounted for a revenue share of about 20.3% in 2023. It is anticipated to be driven by the increasing demand for energy storage systems.

U.S. Lithium Foil Market Trends

The lithium foil market in the U.S. accounted for about 81.5% of the region's demand in 2023. Growing demand from solid-state batteries is anticipated to boost demand over the forecast period.

Europe Lithium Foil Market Trends

The lithium foil market in Europe accounted for the second-highest global revenue share of about 28% in 2023. It is anticipated to be driven by R&D investments in battery technology by major electronics manufacturers.

The Germany lithium foil market held 43.6% of revenue share in Europe market in 2023. Rising investments in solid-state batteries owing to the aerospace & defense industry are expected to propel demand in the country.

Asia Pacific Lithium Foil Market Trends

The lithium foil market in Asia Pacific held the largest revenue share of about 51% of the global market in 2023. Key developments in the battery segment are anticipated to increase product development and applications over the forecast period.

The China lithium foil market heldabout 40.0% of the revenue share of the Asia Pacific market in 2023. The rising demand for lithium foil from electronics manufacturers is anticipated to augment market growth.

The India lithium foil market held a revenue share of about 9.0% in 2023 of Asia Pacific market. The continued demand for the product from the electronics segment makes the country a key market.

Central & South America Lithium Foil Market Trends

Electronic gadgets such as smartphones and laptops that consume lithium foil are mainly imported. However, the growing interest in the production of solid-state batteries is likely to boost demand.

The lithium foil market in Brazil accounted for about 74% in 2023. The growing interest in the production of solid-state batteries that consume the product is expected to boost demand over the forecast period.

Middle East & Africa Lithium Foil Market Trends

The lithium foil market in the Middle East & Africa is investing in boosting its economy and divesting from an oil-based economy. Governments are focusing their efforts on building the metals value chain within their country to attract Foreign Direct Investors (FDIs).

The Saudi Arabia lithium foil market held a revenue share of over 12.0% in 2023. The market is in a growth stage as the country develops its metal industry as part of its Vision 2030 goal to diversify from an oil-based economy.

Key Lithium Foil Company Insights

The landscape is very competitive and dynamic since it encases one of the fastest-growing segments as its key application-rechargeable ESS. Key players have devised strategies such as expanding market share, investing in R&D, and undertaking mergers and acquisitions. Key developments by players in the value chain have direct and positive implications for major companies.

Market players compete against product quality and reliability in terms of supply, customer service, and diversity in product portfolio. Furthermore, key end-users are investing in expanding their capacity, which offers exciting opportunities for the market. For instance, in January 2024, South Korean-based SK signed a technology license agreement worth USD 30 million with U.S.-based Solid Power to grow the development of solid-state batteries, a key application of lithium foil.

Some of the key players operating in the market include Albemarle, Ganfeng Lithium Co., Ltd., and Mineral Resources.

-

Albemarle’s lithium segment is engaged in the development of lithium-based materials, which cater to a wide range of industries. The segment manufactures lithium metal (foils, rods, powders, and anodes), salts, lithium sulfide, and LiBOB, a high-performance battery additive. In addition, the segment offers technical services such as handling of reactive lithium products and customer recycling services for lithium-containing by-products that are obtained from synthesis with organolithium products, lithium metal, and other reagents.

-

Ganfeng Lithium Co., Ltd. serves a wide category of industries including EVs, pharmaceuticals, chemicals, energy storage, and 3C (Computer, Communication, and Consumer Electronics) products. The company’s portfolio includes lithium compounds, metals & alloys, organo lithium compounds and rubidium & cesium compounds.

Nanoshel, China Energy Lithium Co., Ltd, and Honjo Metal Co., Ltd. are some of the emerging market participants.

-

Nanoshel LLC, a U.S.-based manufacturer, produces 3N lithium foil with thicknesses of 0.1-0.2mm and widths of 60 mm for the battery industry.

-

China Energy Lithium Co., Ltd is a Chinese player involved in the research, development, and production of lithium battery electrode materials and related products, such as foils and powder.

-

Honjo Metal Co., Ltd. is a Japanese manufacturer of lithium foil, mainly for the EV industry.

Key Lithium Foil Companies:

The following are the leading companies in the lithium foil market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- AMERICAN ELEMENTS

- China Energy Lithium Co., Ltd

- Ganfeng Lithium Co., Ltd

- Honjo Metal Co., Ltd.

- Nanoshel LLC

- Thermo Fisher Scientific, Inc.

Recent Developments

-

In September 2023, Gotion High-tech Co Ltd., a Chinese battery manufacturer, announced its plans to build a lithium battery manufacturing plant in Manteno, Illinois, U.S., for an investment value of USD 2 billion.

-

In September 2023, the Office of the Assistant Secretary for Industrial Base Policy signed an agreement with Albemarle for the latter’s lithium mining and production expansion plans. The agreement, worth USD 90 million, was signed through the Manufacturing Capability Expansion and Investment Prioritization (MCEIP) office. Albemarle plans to reopen its Kings Mountain, N.C. mine between 2025 and 2030, which will help increase the domestic production of lithium.

-

In June 2023, Samsung SDI received its carbon footprint labels from Carbon Trust in its effort to develop more sustainable products. It is expected to continue investing in technology to make lithium foil increasingly adaptable in electronics in battery applications.

-

In April 2023, the South Korean government announced a joint cooperation with three of the world’s largest battery manufacturers (Samsung SDI, LG Energy Solution Ltd, SK On) to invest Won 20 trillion (~USD 15.1 billion) in developing advanced battery technologies, including solid-state batteries, by 2030.

Lithium Foil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 878.7 million

Revenue forecast in 2030

USD 1.63 billion

Growth rate

CAGR of 11.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and volume in tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, company profiles, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country Scope

U.S.; UK; Germany; France; China; Japan; India; South Korea; Brazil; Saudi Arabia

Key companies profiled

Albemarle Corporation; AMERICAN ELEMENTS; China Energy Lithium Co., Ltd; Ganfeng Lithium Co., Ltd; Merck KGaA; Nanoshel LLC; The Honjo Chemical Corporation; Thermo Fisher Scientific, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lithium Foil Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in product and end-use segments from 2020 to 2030. For this study, Grand View Research has segmented the global lithium foil market report based on product, end-use, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

2N

-

3N

-

4N

-

5N

-

-

End-use Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

Electronics

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global lithium foil market was estimated at USD 785.0 million in 2023 and is expected to reach USD 878.7 million in 2024.

b. The lithium foil market is anticipated to grow at a compound annual growth rate of 11.0% from 2024 to 2030 to reach USD 1.63 billion by 2030.

b. Based on product, 2N held the largest revenue share of around 46% in 2023 owing to the increasing demand for ESS in the electronics end use segment.

b. Some of the key players are Albemarle Corporation, AMERICAN ELEMENTS, China Energy Lithium Co., Ltd, Ganfeng Lithium Co., Ltd, Merck KGaA, Nanoshel LLC, The Honjo Chemical Corporation, Thermo Fisher Scientific, Inc., and UACJ Foil Corporation, among others.

b. The growing demand for energy storage systems in electronics, aerospace & defence industries is anticipated to drive the lithium foil market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.