- Home

- »

- Biotechnology

- »

-

Live Cell Encapsulation Market Trends Analysis Report, 2030GVR Report cover

![Live Cell Encapsulation Market Size, Share & Trends Report]()

Live Cell Encapsulation Market (2023 - 2030) Size, Share & Trends Analysis Report By Polymer Type (Natural, Synthetic), By Application (Drug Delivery, Cell Transplantation), By Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-035-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

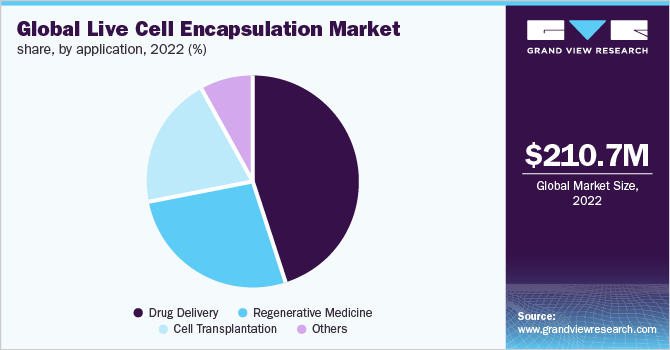

The global live cell encapsulation market size was valued at USD 210.7 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 3.97% by 2030. Live cell encapsulation is a process that involves encasing living cells within a protective material or structure. This technology can revolutionize many areas of research and medicine, allowing for the safe and controlled delivery of cells and cell-based therapies. One of the key advantages of live cell encapsulation is that it allows for the controlled release of cells or bioactive molecules. It is particularly useful in cell-based therapies, where the goal is to deliver therapeutic cells to a specific location in the body while protecting from the host's immune system.

For example, live cell encapsulation is used to provide insulin-producing cells to patients with diabetes, and it is also used to deliver cells that produce dopamine to patients with Parkinson’s disease. The sudden outbreak of COVID-19 led to a rise in research and development activities to design drugs and vaccines using novel technologies, such as encapsulation. According to an article published in Molecular Therapy, researchers developed highly effective small-interfering RNA therapeutics against SARS-CoV-2 infection using a novel lipid nanoparticle delivery system (LNP). The COVID-19 vaccine developed by both Moderna and Pfizer vaccines (mRNA-1273 and BNT162b2, respectively) contains an mRNA encoding the spike protein encapsulated in an LNP delivery vehicle.

Furthermore, the COVID-19 infection led to an increase in research studies on chronic or acute organ damage caused by the virus. Tissue engineering strategies including live cell encapsulation techniques are used to treat the damages. For instance, live cell encapsulation is used to increase cell viability and proliferation rate to treat liver damage. Hence, the COVID-19 pandemic had a positive impact on the market due to the increased uptake of encapsulation technology for COVID-19-related research. Rising public-private funding & investments in cell and gene therapies are expected to drive the live cell encapsulation market during the forecast years.

For instance, in September 2022, Arsenal Biosciences received series B funding of USD 220 million to grow its pipeline of therapeutic candidates and expand its cell therapy research activities for solid tumor malignancies. In addition, according to Creative Biolabs, 2073 cancer cell therapies in the global pipeline were active as of April 2021, an increase 0f 572 over the update in 2020. In comparison with 2019 and 2020, 48% growth was recorded in cell therapies, which increased by 23% in 2021. Such an increase in active cell therapies in the global pipeline is anticipated to boost the applications of live cell encapsulation techniques, thereby driving industry growth during the forecast years.

Moreover, the growing prevalence of target diseases is boosting the demand for replacing diseased or damaged tissues. The need for tissue grafts is exceeding the supply hence, regenerative medicine is rapidly expanding to cope with the demand. For instance, hydrogel encapsulation provides a 3D environment for cells that allow the maintenance of normal cells to produce similar tissues found in the body. In addition, live encapsulation offers a different and better path in tissue engineering to overcome the rejection of transplanted tissues. Hence, the increasing adoption of live cell encapsulation in regenerative medicine is fueling industry growth.

Live cell encapsulation is the most useful technology in the treatment of neurological disorders. It allows continuous and long-lasting release of the desired therapeutic product, next to the affected tissues without crossing the blood-brain barrier. For instance, NTCELL is an alginate-coated capsule that contains clusters of neonatal porcine choroid plexus cells. NTCELL functions as a biological factory generating growth factors to promote CNS development and restore disease-induced nerve degeneration. Furthermore, the technology has proven to be a suitable treatment strategy for different kinds of diseases, such as heart failure, anemia, diabetes, and cancer.

Thus, the growing significance of live cell encapsulation for therapeutic purposes is anticipated to boost industry growth during the study period. Furthermore, technological advancements and novel product launches by key players are projected to offer lucrative opportunities for the market. For instance, in November 2022, BIO INX introduced Hydrobio INX N400, the first commercially available bioresin that enables live cell encapsulation with high-resolution biofabrication. Similarly, ViaCyte, Inc. developed two breakthrough technological advances in regenerative medicine platforms. The Encaptra system for cell encapsulation & implantation and stem cell-derived cell replacement therapies address various human disorders and diseases that can potentially be treated by replacing malfunctioning or lost cells.

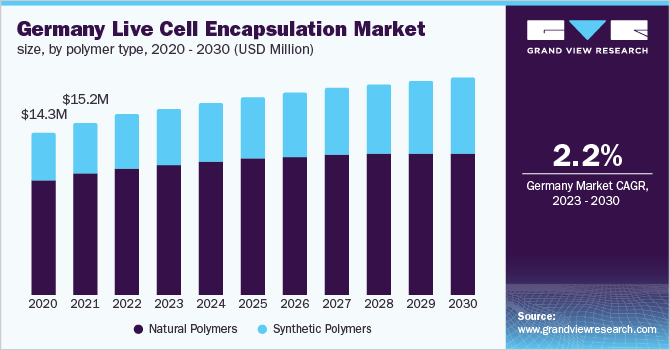

Polymer Type Insights

The natural polymers segment held the largest share of 69.80% in 2022. Natural polymers are the key choice for encapsulation. Natural polymers are macromolecules of large molecular weight derived from nature and are chosen due to their biodegradability, low toxicity, biocompatibility, renewability, and flexibility to modification. Being of natural origins, such as microorganisms, animals, and plants, they are able to interact with cells and tissues presenting some properties the body identifies with and as a result do not treat them as foreign bodies. Hence, natural polymers, such as lipids, proteins, and polysaccharides, have been employed as an encapsulation for encapsulating hydrophobic or hydrophilic active ingredients, which may be in solid, liquid, or gaseous states for transport and delivery to the required sites.

Such capabilities of natural polymers are boosting segment growth. The synthetic polymers segment is anticipated to grow at the fastest CAGR during the forecast years. Synthetic polymers, such as covalently cross-linked polyacrylates and PEG, have many advantages including greater chemical and mechanical stability, reduced nonspecific binding, tunable properties, ease of modification, and increased reproducibility due to the minimized batch-to-batch variation. As a result, synthetic polymers are a promising means to achieve future live cell encapsulation as immunoisolated cell therapies are gradually emerging into the clinical arena.

Method Insights

The microencapsulation segment held the largest share of 64.17% in 2022. The microencapsulation technique is the formulation procedure of encapsulating a bioactive substance in a particle size that is 1-1000 μm in diameter for the purpose of sustained and controlled delivery as well as protection of the encapsulated bioactive compound from the surrounding environment. In therapeutic delivery, microencapsulation has several applications in the treatment of diseases, such as tuberculosis, cancer, diabetes, rheumatoid arthritis, and respiratory tract infection. For instance, islets of Langerhans, are microencapsulated and implanted in the body for long-term treatment of diabetes or other disease requiring organ transplantation.

Thus, therapeutic applications of the microencapsulation method are driving segment growth. The nanoencapsulation segment is projected to grow at the highest CAGR during the forecast period. The nanoencapsulation technology is majorly used in designing effective drug delivery systems since the delivery of encapsulated diagnostic/ therapeutic agents depends on the size of the nanoparticle. Compared with the microencapsulation method, nanoencapsulation has greater performance, which can boost passive/active targeting of bioactive agents to the site of action, increase drug solubility, improve bioavailability, and delay or control drug release. Hence, advantages associated with nanoencapsulation are expected to fuel segment growth.

Application Insights

The drug delivery segment captured the highest revenue share of 44.60% in 2022. Live cell encapsulation technology is used in the manufacturing of capsules, tablets, and parenteral dosage forms for effective drug delivery. Controllable drug delivery has great potential in many diseases with a deteriorative progression. Advantages of controlled drug delivery by live cell encapsulation, such as enhanced therapeutic effects, lowered drug dose, reduced cytotoxicity, improved patient convenience, and compliance are driving the segment. Furthermore, the regenerative medicine segment is anticipated to grow at a rapid CAGR over the forecast period.

Regenerative medicine is a novel scientific discipline that employs stem cells as a cell-based therapy for restoring or regenerating damaged tissues or organs. Stem cell encapsulation can offer various benefits in regenerative medicine including, improved cell viability, differentiation, and proliferation. Several industry players are implementing strategies to support regenerative medicine. For instance, over 2023, Invetech will deliver three GMP encapsulation devices to support TreeFrog’s in-house and partnered cell therapy programs in regenerative medicine and immuno-oncology. Such initiatives are expected to drive the segment during the projected timeframe.

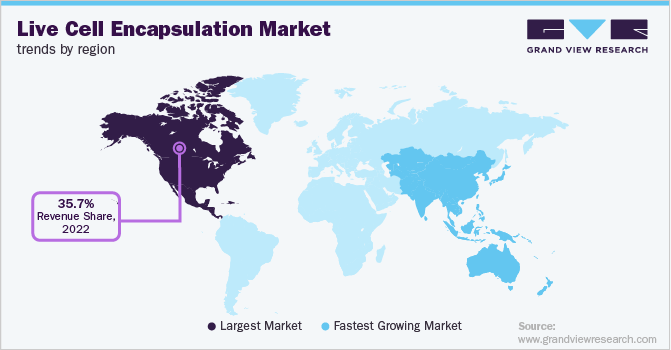

Regional Insights

North America held the largest share of 35.71% of the overall revenue in 2022. This large share can be attributed to increased funding for private companies, favorable regulations, and government assistance. The region majorly focuses on research being done in the area of drug discovery, thereby propelling industry growth. The presence of innovators and key operating players has resulted in higher penetrations of the products in the region. For instance, in February 2021, ViaCyte, Inc. announced the initiation of phase 2 clinical study of encapsulated cell therapy to treat type 1 diabetes patients.

Such initiatives are anticipated to improve the company’s industry position in the North America region. The Asia Pacific region is projected to grow at the fastest CAGR from 2023 to 2030. The rapid growth can be attributed to the developments in the biotechnology and pharmaceutical industries of emerging economies, such as India and China. This region's profitable expansion is also attributed to ongoing government support for developing the pharmaceutical sector in developing countries. Moreover, ongoing research in the fields of cancer & infectious illnesses, such as COVID-19, is expected to drive significant growth for the live cell encapsulation market in the region.

Key Companies & Market Share Insights

The industry is growing at a rapid pace due to several strategic initiatives implemented by the operating players involved. For instance, Nanoscribe and BIO INX expanded their partnership with the launch of novel biocompatible high-resolution bioink HYDROBIO INX for live cell encapsulation. Some of the prominent companies involved in the global live cell encapsulation market include:

-

AUSTRIANOVA

-

Merck KGaA

-

Sphere Fluidics Ltd.

-

ViaCyte, Inc.

-

Blacktrace Holdings Ltd. (Dolomite Microfluidics)

-

BIO INX

-

Living Cell Technologies Ltd.

-

Sigilon Therapeutics, Inc.

-

Isogen

-

Diatranz Otsuka Ltd.

Live Cell Encapsulation Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 218.2 million

Revenue forecast in 2030

USD 286.5 million

Growth rate

CAGR of 3.97% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Polymer type, method, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AUSTRIANOVA; Merck KGaA; Sphere Fluidics Limited; ViaCyte, Inc.; Blacktrace Holdings Ltd (Dolomite Microfluidics); BIO INX; Living Cell Technologies Limited; Sigilon Therapeutics, Inc.; Isogen; Diatranz Otsuka Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

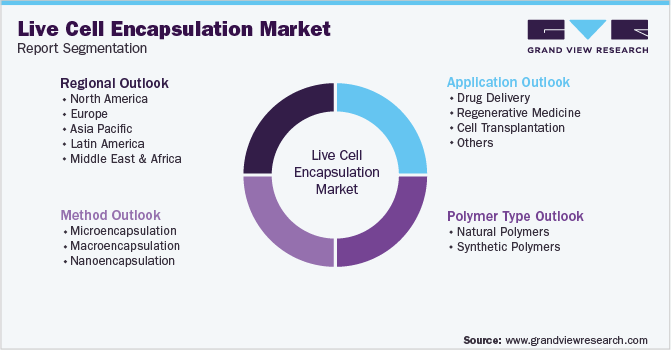

Global Live Cell Encapsulation Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global live cell encapsulation market report based on polymer type, method, application, and region:

-

Polymer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Polymers

-

Alginate

-

Chitosan

-

Cellulose

-

Others

-

-

Synthetic Polymers

-

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Microencapsulation

-

Macroencapsulation

-

Nanoencapsulation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Delivery

-

Regenerative Medicine

-

Cell Transplantation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global live cell encapsulation market size was estimated at USD 210.7 million in 2022 and is expected to reach USD 218.2 million in 2023.

b. The global live cell encapsulation market is expected to grow at a compound annual growth rate of 3.97% from 2023 to 2030 to reach USD 286.5 million by 2030.

b. North America dominated the live cell encapsulation market with a share of 35.71% in 2022. This is attributable to the to increase in funding for private companies, favorable regulations, and government assistance in the region.

b. Some key players operating in the live cell encapsulation market include AUSTRIANOVA; Merck KGaA; Sphere Fluidics Limited; ViaCyte, Inc.; Blacktrace Holdings Ltd (Dolomite Microfluidics); BIO INX; Living Cell Technologies Limited; Sigilon Therapeutics, Inc.; Isogen; Diatranz Otsuka Ltd

b. Increasing adoption of live cell encapsulation in regenerative medicine, rising public-private investments in cellular and gene therapies, and the growing significance of live cell encapsulation for therapeutic purposes are key factors driving the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.